TIDMPHC

RNS Number : 9591Y

Plant Health Care PLC

15 September 2020

RNS

15 September 2020

Plant Health Care plc

( " Plant Health Care", the " Group " and the " Company")

Interim Results 2020 and update on Current Trading

Plant Health Care(R) (AIM: PHC.L), a leading provider of novel

patent-protected biological products to global agriculture markets,

announces its unaudited interim results for the six months ended 30

June 2020.

Financial Highlights

- Revenue for the six months ended 30 June 2020 was $3.1 million (2019: $2.7 million).

- Cash operating expenses decreased 10% to $3.6 million (H1 2019: $4.0 million).

- Cash used in operations decreased 29% to $2.0 million (2019: $2.8 million).

- Adjusted LBITDA* improved to $1.8 million (2019: $2.4 million).

- In March of 2020, the Group raised $4.4 million (net of expenses).

- Cash reserves of $5.1 million at 30 June 2020 (2019: $1.4 million).

Operational Highlights

- Harpin revenue increased by 43% to $1.9 million.

o Revenue in the US increased 50% to $0.6 million, on-ground

sales into corn were almost double prior year.

o Sales to Brazil for sugar cane ($0.35 million) resumed, in Q2;

on-ground sales were nearly 2.5 times the prior year.

- Covid-19 has had only modest impact on the business to date but some uncertainty remains.

- The registration of PHC279 in Brazil has accelerated, with

launch now targeted in H2 2021. Registration in the US in now

expected in 2022.

- Scaling up of production of PHC279 is in hand.

Dr Christopher Richards, Chief Executive Officer, commented:

" The Company ' s robust revenue growth in the first half of

2020 demonstrates the merits of exposure to sustainable

agriculture, an essential industry moving to new, greener

technologies. Strong growth in the US reflects the excellent

support we are receiving from our major distribution partners and

the resulting wide market access. In Brazil, on-ground sales of

H2Copla are growing rapidly, in spite of the low price of

ethanol.

We expect to deliver continued revenue growth in the second half

of the year, while continuing to drive down the cash burn and move

towards building a sustainably profitable business. While we remain

optimistic about the market opportunity, the effects of Covid-19

have not yet played out around the world. We will maintain our

cautious stance on growth investments for the time being."

*LBITDA: loss before interest, tax, depreciation, amortisation,

shared-based payments and intercompany currency adjustments.

In this document, references to "the Company" are to Plant

Health Care plc. References to "Plant Health Care", "the Group",

"we" or "our" are to Plant Health Care plc and its subsidiaries and

lines of business, or any of them as the context may require. The

Plant Health Care name and logo, Myconate, and Innatus and other

names and marks appearing herein and on company literature are

trademarks or trade names of Plant Health Care. All other

third-party trademark rights are acknowledged.

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014

Plant Health Care plc

Chris Richards - Chief Executive Officer

Jeffrey Hovey - Chief Financial Officer +1 919 926 1600

Arden Partners plc - Nomad and Broker

John Llewellyn-Lloyd / Dan Gee-Summons +44 (0) 20 7614 5900

Company website: www.planthealthcare.com

Chief Executive Officer ' s statement

Introduction

Plant Health Care is at the heart of the movement towards

sustainable food production. Our core products are derived from

naturally occurring proteins, which stimulate plant growth. They

provide growers with higher yield and better quality crops, while

having much lower impact on the environment than conventional

agricultural chemicals.

The heart of our Commercial business is Harpin 𝜶

<BETA>, which offers remarkable benefits to farmers in a wide

range of crops. We have reached new agreements with major

distributors in large target crops over the last three years.

Resulting launches are starting to deliver increased on-ground

sales, which will bring more consistent, balanced and profitable

revenue growth.

In New Technology, PREtec is a novel, environmentally friendly

approach to growing crops more sustainably. PREtec peptides can be

thought of as 'vaccines for plants' - they stimulate the plants'

natural defence systems and result in improved crop yield and

quality. Research on PREtec started in 2012, with a cumulative

investment since then of more than $20 million. The Company is now

poised to launch the first products from a broad pipeline of PREtec

peptides, targeting markets which have a value of greater than $5

billion. The Company has developed a global scientific lead in the

use of peptides for agriculture, with the first patents now granted

in the US.

As we move to launch the first of many PREtec products, we are

seeking regulatory approvals in Brazil and the USA. In parallel, we

are working to define routes to market and establish low cost

manufacture.

Our aim is to take the Group to cash positive quickly, while

investing to drive sales growth and launch the first products from

the PREtec platform. The Board expects to begin the monetisation of

PREtec intellectual property in 2022.

Commercial Products

Our Commercial business markets our proprietary products Harpin

𝜶 <BETA> and Myconate(R) worldwide through

distributors and also distributes complementary third-party

products alongside our own products in Mexico. Harpin-based

products are well established in certain niche markets, with more

recent expansion into large crops. We now have access to markets

covering more than 30 million hectares, with strong, committed

partners. Since their launch, our commercial products have taken

longer to gain predicted revenue growth; however, the Directors

believe that the foundations for steady growth in its products are

now in place.

During the first half of 2020, overall product sales were $3.1

million (H1 2019: $2.7 million). Sales of Harpin 𝜶

<BETA> increased by 43% (48% in constant currency) to $1.9

million. The gross margin increased to 59% (2019: 57%) due to the

increased sales of Harpin 𝜶 <BETA> and the

reduced proportion of third-party sales.

Sales in the US increased by 50% to $0.6m (H1 2019: $0.4

million), on demand from our major distribution partners for both

specialty crops and corn.

In US corn, the seed treatment product based on Harpin

𝜶 <BETA> results in the crop emerging from the

ground taller and more robustly than untreated corn. We understand

that on-ground sales were more than double those in 2019.

In specialty crops in the US, our partner Wilbur-Ellis is

promoting the Employ(R) Harpin 𝜶 <BETA> product

in many fruit and vegetable crops, where it improves yield and

quality. Thanks to Wilbur-Ellis's strong presence across the

nation, the product is now reaching more growers than before. We

understand that on-ground sales increased significantly compared

with 2019.

In Brazil, our partner Coplacana launched the H2Copla Harpin

𝜶 <BETA> product in 2018. Demonstration trials

over the last four years have shown a remarkable average yield

increase of more than 20%. On-ground sales of H2Copla in the first

half of 2020 were nearly 2.5 times those in the same period of

2019. Given the collapse of ethanol prices, this is an excellent

performance. Sales of Harpin 𝜶 <BETA> to

Coplacana resumed ($0.35m) as their inventory reduces.

Sales in EMEAA increased by 9% (12% in constant currency). In

the UK, sales into the UK amenity market were significantly

impacted by Covid-19 but sales into the potato market doubled from

2019 levels. Sales in Spain increased 29% (32% in constant

currency) through increased sales into the citrus and rice markets.

Sales through our Spanish subsidiary expanded into the citrus and

grape markets in Peru and Chile.

Sales in Mexico decreased by 14% (4% in local currency); reduced

domestic demand for fresh fruit and vegetables due to Covid-19

impacted sales. Sales of Harpin 𝜶 <BETA> were

$0.2 million (2019: $0.3 million); third party sales were $1.2

million (2019: $1.3 million).

In recent years, sales by Plant Health Care have not always been

well matched to on-ground sales and this has led to in-market

inventories which have obscured under-lying growth of sales to

growers. Closer relationships with our distribution partners are

now giving us much better visibility of on-ground sales. This will

drive supply chain efficiencies and should lead to more consistent

growth in our revenues.

New Technology

Plant Response Elicitor technology (PREtec)

PREtec is a platform technology, with the potential to generate

many products, offering a wide range of specific grower benefits.

These 'vaccines for plants' act by stimulating the plant's own

natural defence mechanisms. Inspired by natural proteins, these

peptides can be customised to target features such as growth

promotion, disease resistance or drought stress. Since 2012, our

research efforts have brought forward six lead products, from three

major platforms. The Innatus 3G platform targets growth and disease

resistance. The T-Rex 3G platform targets nematode defence, while

the Y-Max 3G platform delivers increase yield and growth. Our aim

over the next three years is to launch the first products from

these platforms, before investing further to expand the product

range. Development work continues with partners in the US and

Brazil, in parallel with seeking regulatory approvals.

Launching the first PREtec products

Encouraging progress has been made during H1 2020 towards the

first product launches, which are expected to be in Brazil and the

USA. PHC279, an Innatus 3G peptide, is likely to be the first

product to be launched. Plans are advancing to achieve product

registrations, to secure distribution partners and to manufacture

for launch. The timing of product launches will depend on achieving

product registrations in the target markets, alongside establishing

distribution contracts and low-cost manufacturing. Securing

intellectual property in parallel will protect the value of the

business.

PHC279 - a revolutionary new seed treatment for ASR control

Brazil is the world's largest exporter of soybeans, with some 36

million hectares planted in 2019. One of the challenges of

producing soybeans in Brazil is Asian Soybean Rust (ASR), which can

be a devastating disease. Growers spent $2.1 billion in 2017 on

soybean fungicides in Brazil. With increasing regulatory scrutiny

of the safety of chemical fungicides, the use of biological

products such as PHC279 is growing rapidly: sales of biological

inputs and biopesticides for the soybean crop in Brazil totalled

US$200 million in the 2019-20 season, a 30% rise compared to the

previous season.

Similar to last year, PHC279 demonstrated strong performance

this season in field trials in Brazil as a soybean seed treatment.

Compared to a standard foliar fungicide programme alone, the

addition of a PHC279 seed treatment improved disease control by an

average of 8% to 14% across the rates evaluated and increased yield

by 3.6% to 5.1%, with some sites reporting increases in yield as

great as 27%.

These promising results support the launch of PHC279 as a truly

revolutionary biological seed treatment for ASR control. The

product has the potential both to reduce significantly the use of

toxic fungicides and to increase growers' productivity.

The Company submitted PHC279 for regulatory approval in Brazil

in October 2019 and it is progressing well through the process.

Assuming PHC279 receives regulatory approval, the Company is now

planning on launching PHC279 in soybeans in Q4 2021, one year

earlier than previously forecast. Discussions are underway to

market PHC279 through one or more distributors in Brazil.

PHC279 development in the USA

In June of this year, the EPA (the US Environmental Protection

Agency) approved the registration of the first PREtec peptide,

PHC398, as a biopesticide. This important milestone paves the way

for an accelerated, low cost path to registration of other PREtec

peptides. The EPA has now provided an initial review of the

Company's application for the registration of its next peptide,

PHC279, for disease control in a wide range of row crops and fruit

and vegetable crops. They requested some additional studies;

approval is now expected in mid-2022.

Together with potential distribution partners, we are evaluating

several products based on PHC279. T rials this season continue to

evaluate the potential of PHC279 in corn and vegetables. Last

season, when PHC279 was applied together with a leading chemical

fungicide, it significantly improved control of two key corn

diseases compared to the fungicide treatment alone, and yields were

increased by as much as 26 bushels per acre depending on

application timing. Given that 92 million acres of corn were

planted in the US in 2020, the economic opportunity for an

effective corn treatment is considerable.

Further PREtec products in development

While PHC279 is the most advanced peptide in development, other

peptides are also progressing towards launch. PHC949, from the

T-Rex 3G nematode control platform, continues to show strong

results in PHC's and partner's field trials in specialty and row

crops.

PHC404, another peptide from the Innatus 3G platform has shown

strong yield benefits in almond trees in California.

PHC414, from the Y-Max 3G platform, is showing promise as a

biostimulant, promoting yield and quality in a range of fruit and

vegetable crops. As episodes of severe drought and high

temperatures become more frequent across the globe, products such

as PHC414 that help plants manage abiotic stress are expected to

play an increasing role in sustaining agricultural production.

Manufacturing PREtec peptides

Scaling up of PHC279 manufacture at Penn State University has

been achieved during the first half of 2020. The promise of a low

cost of goods is being delivered. With the target of a Brazil

launch being brought forward by one year, initial launch quantities

of PHC279 will be produced at Penn State's facility. We are now

engaging with several potential toll manufacturers of PREtec

peptides and expect to have commercial scale production of PHC279

in place by 2022.

We continue to advance the laboratory efficiency of production

of other peptides in our pipeline, as both granule and liquid

formulations. Scale-up work with Penn State on the next PREtec

peptides in the pipeline has been initiated.

Intellectual property

Plant Health Care has filed more than 50 patent applications

worldwide for its PREtec peptide technology since 2012. The first

of these patents has been granted by the US Patent and Trademark

Office (USPTO). Additional patents are expected to be granted prior

to the end of the year, providing protection for a large number of

PREtec peptides in a wide range of agricultural uses in key

countries around the world.

Summary of financial results

Financial highlights for the six months ended 30 June 2020, with

comparatives for the six months ended 30 June 2019, are set out

below:

2020 2019

$'000 $'000

Revenue 3,100 2,684

Gross profit 1,814 1,526

Research and development (1,366) (1,423)

Sales and marketing (1,268) (1,636)

Administrative * (3,374) (1,430)

-------------------------------- ---------- ----------

Total operating expenses (6,008) (4,489)

Operating loss (4,194) (2,963)

-------------------------------- ---------- ----------

Net finance income 181 142

Net loss for period before tax (4,013) (2,821)

-------------------------------- ---------- ----------

Cash operating expenses decreased $0.4 million to $3.6 million

(H1 2019: 4.0 million).

* Includes $2.0 million foreign exchange losses in non-US dollar

denominated inter-company funding (2019: $0.1 million) .

Revenue

Revenues for the six-month period ended 30 June 2020 were $3.1

million (H1 2019: $2.7 million) producing a gross profit of $1.8

million (H1 2019: $1.5 million) and the loss before tax was $4.0

million (H1 2019: $2.8 million). The gross profit margin was 59%

(H1 2019: 57%). Harpin revenue increased 43% (48% constant

currency) to $1.9 million (2019: 1.3 million). Revenues were higher

than prior year due to strong sales in the row and speciality crop

markets in North America and resumed sales into the Sugarcane

market in Brazil.

Cash operating expenses

Operating expenses, excluding non-cash items, decreased $0.4

million to $3.6 million (2019: $4.0 million) due to decreased

personnel costs in sales and marketing. Adjusted LBITDA improved

$0.6 million to $1.8 million (H1 2019: $2.4 million) primarily due

to increased gross margin and decreased Sales and Marketing

costs.

Operating expenses

Operating expenses increased by $1.5 million for the six-month

period to $6.0 million (2019: $4.5 million). This is primarily due

to a $2.0 million of currency loss primarily related to a Pound

Sterling loan with a subsidiary company (H1 2019: $0.1 million

currency loss).

Cash position and liquidity

As of 30 June 2020, the Group had cash and investments of $5.1

million. Cash and costs continue to be tightly controlled.

During H1 2020, cash outflows decreased 39% to $1.8 million (H1

2019: $2.9 million). The decrease was due mainly to reductions in

cash operating expenses, supported by the receipt of an unsecured

note in the amount of $0.3 million as part of the US Payroll

Protection Plan.

Net cash outflows from operating activities decreased 29% to

$2.0 million (H1 2019: $2.8 million). Included in the cash used in

operations is a decrease in the Group ' s inventory balance offset

by lower accounts payable balances. Adjusted LBITDA decreased $0.6

million to $1.8 million (H1 2019: $2.4 million).

Net cash flows from financing activities increased $4.9 million

(H1 2019: ($0.2 million)). The increase is due to the March 2020

equity raise of $4.4 million and the receipt of $0.3 million

through the US Payroll Protection Plan.

Principal Risks and Uncertainties

The principal risks and uncertainties facing the Group remain

broadly consistent with the Principal Risks and Uncertainties

reported in Plant Health Care ' s 31 December 2019 Annual Report.

In addition, since then, the Board have been monitoring and

mitigating the effects of the following international events on the

Group ' s business:

Covid-19

In March 2020, the World Health Organisation declared a global

pandemic due to the Covid-19 virus that has spread across the

globe, causing different governments and countries to enforce

restrictions on people movements, a stop to international travel,

and other precautionary measures. This has had a widespread impact

economically and a number of industries have been heavily impacted.

This has resulted in impacts on certain industries and a more

general need to consider whether budgets and targets previously set

are realistic in light of these events

As described above, the Covid-19 pandemic to date has had

limited impact to our business. The Board remains optimistic that

the business is well positioned to be able to navigate through the

impact of Covid-19 due to the strength and flexibility of its

relationships with its distributors, its strong balance sheet and

its cash position.

Brexit

The United Kingdom ( ' UK ' ) formally left the European Union (

' EU ' ) on 30 January 2020. The period of time from when the UK

voted to exit the EU on 23 June 2016 and the formal process

initiated by the UK government to withdraw from the EU, or Brexit,

created volatility in the global financial markets. The UK now

enters a transition period, being an intermediary arrangement

covering matters like trade and border arrangements, citizens '

rights and jurisdiction on matters including dispute resolution,

taking account of The EU (Withdrawal Agreement) Act 2020, which

ratified the Withdrawal Agreement, as agreed between the UK and the

EU. The transition period is currently due to end on 31 December

2020 and ahead of this date, negotiations are ongoing to determine

and conclude a formal agreement between the UK and EU on the

aforementioned matters.

The UK currently represents some 3% of revenues for the Group

and is not a manufacturing centre. As the Group operates

subsidiaries in many countries, there are several channels

available to us to continue business with the same customers,

should the need arise, with little to no effect from Brexit

changes. As such, the Directors currently deem that the effects of

the UK ' s current transitional period outside the EU and the

impact of ongoing discussions with the EU will not have a

significant impact on the Group ' s operations. However, the

Directors and Senior Leadership Team are closely monitoring the

situation to be in a position to manage the risk of any volatility

in global financial markets and impact on global economic

performance due to Brexit.

Current trading and outlook

The Board remains confident about the prospects for building a

growing, profitable Commercial business, as sales of Harpin

𝜶 <BETA> continue to increase. We anticipate a

strong second half of 2020 and are confident of achieving material

revenue growth in 2020, despite macro-level market-driven

challenges.

Preparations for the first launches of PHC279 are progressing to

plan, with further PREtec peptides following. The medium-term

prospects for PREtec peptides, in markets worth more than $5

billion, are very exciting.

The Board has reviewed the Company ' s cash position and

concluded that we are able to achieve cash breakeven within

existing cash resources. The Board will take whatever steps are

necessary, including by reducing cash expenses, to achieve

that.

Dr. Christopher Richards

Chief Executive Officer

15 September 2020

Consolidated statement of comprehensive income

FOR THE SIX MONTHSED 30 JUNE 2020

Six months Six months

to 30 June to 30 June

2020 2019

(Unaudited) (Unaudited)

Note $'000 $'000

Revenue 3,100 2,684

Cost of sales (1,286) (1,158)

Gross profit 1,814 1,526

Research and development (1,366) (1,423)

Sales and marketing (1,268) (1,636)

Administrative expenses (3,374) (1,430)

------------------------------------- ----- ------------------- -----------------

Operating loss 4 (4,194) (2,963)

Finance income 193 160

Finance expense (12) (18)

------------------------------------- ----- ------------------- -----------------

Loss before tax (4,013) (2,821)

Income tax expense (14) (1)

Net loss for the period (4,027) (2,822)

------------------------------------- ----- ------------------- -----------------

Other comprehensive income:

Exchange difference on translation

of foreign operations 1,444 155

------------------------------------- -----

Total comprehensive loss for

the period (2,583) (2,667)

===================================== ===== =================== =================

Basic and diluted loss per

share 6 $(0.02) $(0.02)

===================================== ===== =================== =================

Consolidated statement of financial position

AT 30 JUNE 2020

30 June 31 December

2020 2019

(Unaudited) (Audited)

Note $'000 $'000

Assets

Non-current assets

Intangible assets 1,627 1,649

Property, plant and equipment 287 475

Right-of-use 257 416

Trade and other receivables 129 150

Total non-current assets 2,300 2,690

--------------------------------- ----- ------------------------ ------------------

Current assets

Inventories 3,284 2,960

Trade and other receivables 2,995 3,747

Investments 3 3,532 1,964

Cash and cash equivalents 1,581 457

--------------------------------- ----- ------------------------ ------------------

Total current assets 11,392 9,128

--------------------------------- ----- ------------------------ ------------------

Total assets 13,692 11,818

--------------------------------- ----- ------------------------ ------------------

Liabilities

Current liabilities

Trade and other payables 1,134 1,406

Short term lease liabilities 195 353

Short-term borrowings 448 -

Total current liabilities 1,777 1,759

--------------------------------- ----- ------------------------ ------------------

Non-current liabilities

Long term lease liabilities 83 107

Total non-current liabilities 83 107

--------------------------------- ----- ------------------------ ------------------

Total liabilities 1,860 1,866

--------------------------------- ----- ------------------------ ------------------

Total net assets 11,832 9,952

================================= ===== ======================== ==================

Capital and reserves

attributable to owners

of the Company

Share capital 3,605 3,030

Share premium 92,520 88,647

Foreign exchange reserve 1,383 (61)

Retained earnings (85,676) (81,664)

--------------------------------- -----

Total equity 11,832 9,952

================================= ===== ======================== ==================

Consolidated statement of cash flows

FOR THE SIX MONTHSED 30 JUNE 2020

Six months ended Six months ended

30 June 30 June

2020 2019

(Unaudited) (Unaudited)

$'000 $'000

Cash flows from operating activities

Loss for the year (4,029) (2,822)

Adjustments for:

Depreciation of property, plant

and equipment 168 179

Depreciation of right-of-use assets 161 166

Amortisation of intangibles 22 22

Share-based payment expense 16 54

Finance income (126) (160)

Finance expense 11 18

Foreign exchange on intercompany 1,460 155

Decrease in trade and other receivables 903 811

Gain on disposal of fixed assets - (16)

Increase in inventories (324) (476)

Decrease in trade and other payables (273) (735)

Net cash used in operating activities (2,011) (2,804)

------------------------------------------ ----------------- -----------------

Investing activities

Purchase of property, plant and

equipment (2) (56)

Sale of property, plant and equipment - 42

Finance income 67 200

Purchase of investments (2,733) (19)

Sale of investments 1,098 1,085

------------------------------------------ ----------------- -----------------

Net cash (used)/provided by investing

activities (1,570) 1,252

------------------------------------------ ----------------- -----------------

Financing activities

Finance expense (2) (2)

Lease payments (190) (186)

Issue of ordinary share capital 4,449 -

Proceeds from unsecured loan 448 -

------------------------------------------ ----------------- -----------------

Net cash provided/(used) by financing

activities 4,705 (188)

------------------------------------------ ----------------- -----------------

Net increase/(decrease) in cash

and cash equivalents 1,124 (1,740)

Effects of exchange rate changes

on cash

and cash equivalents - (29)

Cash and cash equivalents at beginning

of period 457 2,459

------------------------------------------ ----------------- -----------------

Cash and cash equivalents at end

of period 1,581 690

========================================== ================= =================

Notes to the unaudited financial information

1 General information

Plant Health Care plc is a company incorporated and domiciled in

England. The unaudited interim financial information of the Group

for the six months ended 30 June 2020 comprise the Company and its

subsidiaries (together referred to as the "Group").

The Board of Directors approved this interim report on 15

September 2020.

2 Basis of preparation and accounting policies

These interim consolidated financial statements have been

prepared using accounting policies based on International Financial

Reporting Standards (IFRS and IFRIC Interpretations) issued by the

International Accounting Standards Board (IASB) as adopted for use

in the EU. They do not include all disclosures that would otherwise

be required in a complete set of financial statements and should be

read in conjunction with the 31 December 2019 Annual Report. The

financial information for the half years ended 30 June 2020 and 30

June 2019 does not constitute statutory accounts within the meaning

of Section 434 (3) of the Companies Act 2006 and both periods are

unaudited.

The annual financial statements of Plant Health Care Plc ('the

Group') are prepared in accordance with IFRS as adopted by the

European Union. The statutory Annual Report and Financial

Statements for 2019 have been filed with the Registrar of

Companies. The Independent Auditors' Report on the Annual Report

and Financial Statements for the year ended 31 December 2019 was

unqualified, did draw attention to a matter by way of emphasis,

being going concern and did not contain a statement under 498(2) or

498(3) of the Companies Act 2006.

The Group has applied the same accounting policies and methods

of computation in its interim consolidated financial statements as

in its 31 December 2019 annual financial statements, except for

those that relate to new standards and interpretations effective

for the first time for periods beginning on (or after) 1 January

2020 and will be adopted in the 2020 financial statements. There

are deemed to be no new and amended standards and/or

interpretations that will apply for the first time in the next

annual financial statements that are expected to have a material

impact on the Group.

Going Concern

In March 2020, the World Health Organisation declared a global

pandemic due to the Covid-19 virus that has spread across the

globe, causing different governments and countries to enforce

restrictions on people movements, a stop to international travel,

and other precautionary measures. This has had a widespread impact

economically and a number of industries have been heavily impacted.

This has resulted in supply chain disruption in certain industries,

uncertainty over cash collection from certain suppliers, and a more

general need to consider whether budgets and targets previously set

are realistic in light of these events.

In carrying out the going concern assessment, the Directors have

considered a number of scenarios, taking account of the possible

impacts of the pandemic, in relation to revenue forecasts for the

next 12 months. An analysis was performed to reflect a variety of

possible cash flow scenarios where the Group had significantly

reduced revenues for the twelve months following the date of this

Interim Report. A material downside scenario assumed that current

agreed contractual minimum revenues will be maintained over the

period and no new contract revenues. In such a scenario, the Group

has identified cost reductions which could be implemented, to help

mitigate the impact on cash outflows.

As such, the Directors have concluded that taking account of the

Group's contractually secured working capital at the date of this

report, there exists a material uncertainly which may cast doubt as

to the Groups ability to continue as a going concern. However,

given working capital options available, including the Group's

track record of raising funding when required, the Directors

believe the Group will continue as a going concern for the

foreseeable future. The interim financial statements do not include

the adjustments that would be required if the Group were unable to

continue as a going concern

3 Investments

Investments comprise short-term investments in notes and bonds

having investment grade ratings. These assets are actively managed

and evaluated by key management personnel on a fair value basis in

accordance with a documented investment strategy. They are carried

at fair value as determined by quoted prices on active markets,

with changes in fair values recognised through profit and loss.

4 Operating loss

Six months to Six months to

30 June 30 June

2020 2019

(unaudited) (unaudited)

$'000 $'000

Operating loss is stated after

charging:

Depreciation 329 345

Amortisation 22 22

Share-based payment expense 16 54

Foreign exchange loss 2,045 80

================================ ================== ==============

5 Segment information

The Group views, manages and operates its business according to

geographical segments. Revenue is generated from the sale of

agricultural products across all geographies.

Six months to 30 June 2020 (unaudited)

Rest Total New

Americas Mexico of World Elimination Commercial Technology Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Revenue*

Proprietary

product

sales 975 230 737 - 1,942 - 1,942

Third-party

product

sales - 1,154 4 - 1,158 - 1,158

Inter-segmental

product sales 353 - 46 (399) - - -

Total revenue 1,328 1,384 787 (399) 3,100 - 3,100

--------- ------- ----------- ------------ ----------- ----------- --------

Group

consolidated

revenue 1,328 1,384 787 (399) 3,100 - 3,100

--------- ------- ----------- ------------ ----------- ----------- --------

Cost of sales (655) (721) (309) 399 (1,286) - (1,286)

Research and

development - - - - - (1,089) (1,089)

Sales and

marketing (689) (290) (289) - (1,268) - (1,268)

Administration (395) (186) (87) - (668) (96) (764)

Non-cash

expenses:

Depreciation (47) (35) (7) - (89) (240) (329)

Amortisation (19) - (3) - (22) - (22)

Share-based

payment - - - - - (11) (11)

--------- ------- ----------- ------------ ----------- ----------- --------

Segment

operating

(loss)/profit (477) 152 92 - (233) (1,436) (1,669)

Corporate

expenses

**

Wages and

professional

fees (518)

Administration

*** (2,007)

Operating loss (4,194)

Finance income 193

Finance expense (12)

--------- ------- ----------- ------------ ----------- ----------- --------

Loss before tax (4,013)

--------- ------- ----------- ------------ ----------- ----------- --------

* Revenue from one customer within the Mexico segment totalled

$508,000 or 16% of Group revenues.

Revenue from one customer within the America's segment totalled

$365,000 or 12% of Group revenues.

** These amounts represent public company expenses for which

there is no reasonable basis by which to

allocate the amounts across the Group's segments.

*** Includes net share-based payments expense of $5,000

attributed to corporate employees who are not affiliated with any

of the Commercial or New technology segments. Includes $2.0 million

foreign exchange losses in non-US dollar denominated inter-company

funding.

Six months to 30 June 2019 (unaudited)

Rest Total New

Americas Mexico of World Elimination Commercial Technology Total

$'000 $'000 $'000 $'000 $'000 $'000 $'000

Revenue*

Proprietary

product

sales 380 288 678 - 1,346 - 1,346

Third-party

product

sales 21 1,317 - - 1,338 - 1,338

Inter-segmental

product sales 330 - 236 (566) - - -

Total revenue 731 1,605 914 (566) 2,684 - 2,684

--------- ------- ----------- ------------ ----------- ----------- --------

Group

consolidated

revenue 731 1,605 914 (566) 2,684 - 2,684

--------- ------- ----------- ------------ ----------- ----------- --------

Cost of sales (477) (814) (433) 566 (1,158) - (1,158)

Research and

development - - - - - (1,095) (1,095)

Sales and

marketing (782) (412) (443) - (1,637) - (1,637)

Administration (328) (129) (76) - (533) (110) (643)

Non-cash

expenses:

Depreciation (46) (27) (4) - (77) (268) (345)

Amortisation (19) - (3) - (22) - (22)

Share-based

payment - - (2) - (2) (37) (39)

--------- ------- ----------- ------------ ----------- ----------- --------

Segment

operating

(loss)/profit (921) 223 (47) - (745) (1,510) (2,255)

Corporate

expenses

**

Wages and

professional

fees (611)

Administration

*** (98)

Operating loss (2,964)

Finance income 160

Finance expense (18)

--------- ------- ----------- ------------ ----------- ----------- --------

Loss before tax (2,822)

--------- ------- ----------- ------------ ----------- ----------- --------

* Revenue from one customer within the Mexico segment totalled

$525,000 or 20% of Group revenues.

** These amounts represent public company expenses for which

there is no reasonable basis by which to

allocate the amounts across the Group's segments.

*** Includes net share-based payments expense of $15,000

attributed to corporate employees who are not affiliated with any

of the Commercial or New technology segments. Includes $0.1 million

foreign exchange losses in non-US dollar denominated inter-company

funding.

6 Loss per share

Basic loss per ordinary share has been calculated on the basis

of the loss for the period of $4,027,000 (loss for the six months

ended 30 June 2019: $2,822,000) and the weighted average number of

shares in issue during the period of 238,510,886 (six months ended

30 June 2019: 172,822,881).

The weighted average number of shares used in the above

calculation is the same as for total basic loss per ordinary share.

Instruments that could potentially dilute basic earnings per share

in the future have been considered but were not included in the

calculation of diluted earnings per share because they are

anti-dilutive for the periods presented. This is due to the Group

incurring losses on continuing operations for the period.

7 Cautionary statement

This document contains certain forward-looking statements

relating to Plant health Care plc ('the Group'). The Group

considers any statements that are not historical facts as

"forward-looking statements". They relate to events and trends that

are subject to risk and uncertainty that may cause actual results

and the financial performance of the Group to differ materially

from those contained in any forward-looking statement. These

statements are made by the directors in good faith based on

information available to them and such statements should be treated

with caution due to the inherent uncertainties, including both

economic and business risk factors, underlying any such

forward-looking information .

Copies of this report and all other announcements made by Plant

Health Care plc are available on the Company's website at

www.planthealthcare.com/for-investors.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFITASISLII

(END) Dow Jones Newswires

September 15, 2020 02:00 ET (06:00 GMT)

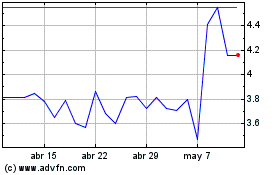

Plant Health Care (LSE:PHC)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Plant Health Care (LSE:PHC)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024