TIDMMRO

RNS Number : 1760U

Melrose Industries PLC

31 March 2021

The 2020 Annual Report and Notice of Annual General Meeting

Melrose Industries PLC (the "Company") announces that its Annual

Report and financial statements for the year ended 31 December 2020

(the "Annual Report"), Notice of Annual General Meeting (the

"AGM"), and Form of Proxy for the AGM have each been sent to or

otherwise made available to shareholders and are available to view

or download from the Company's website at

https://www.melroseplc.net/investors/ .

The Company's AGM will be held at 11.00 a.m. on 6 May 2021 at

Leconfield House, Curzon Street, London W1J 5JA.

PLEASE NOTE OUR GUIDANCE SET OUT IN THE NOTICE OF AGM REGARDING

SHAREHOLDER ATTANCE AT THE AGM, IN LINE WITH UK GOVERNMENT GUIDANCE

AT THE TIME OF PUBLICATION, WHICH DOES NOT ALLOW US TO ALLOW

SHAREHOLDERS TO ATT THE AGM IN PERSON. WE RECOMM THAT ALL

SHAREHOLDERS COMPLETE AND RETURN A FORM OF PROXY, APPOINTING THE

CHAIRMAN OF THE AGM AS THEIR PROXY, AND TO SUBMIT ANY QUESTIONS

PRIOR TO THE MEETING USING THE SERVICE WE HAVE SET UP FOR THESE

PURPOSES.

The Company's preliminary results announcement on 4 March 2021

included, in addition to the preliminary financial results, the

text of the Chairman's statement, Chief Executive's review

(including the Divisional review) and Finance Director's review, in

each case as contained in the Annual Report.

The appendix to this announcement sets out the required

disclosures with regard to the Directors' responsibility statement,

the principal risks and uncertainties and related party

transactions, in each case as contained in the Annual Report.

Together, this information is provided in accordance with

Disclosure & Transparency Rule 6.3.5(2). This information is

not a substitute for reading the full Annual Report for the year

ended 31 December 2020.

The Company confirms that, in compliance with Listing Rule

9.6.1, an electronic copy of each of the Company's Annual Report

for the year ended 31 December 2020, Notice of AGM and Form of

Proxy for the AGM have been submitted to the National Storage

Mechanism, appointed by the Financial Conduct Authority, and will

be available shortly for inspection at www.morningstar.co.uk/uk/NSM

.

Enquiries:

Montfort Communications:

Nick Miles, +44 (0) 20 3514 0897

Charlotte McMullen, +44 (0) 7973 130 669 / +44 (0) 7921 881

800

APPIX

Directors' Responsibility Statement

We confirm that to the best of our knowledge:

-- the financial statements, prepared in accordance with the

relevant financial reporting framework, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole;

-- the Strategic Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face; and

-- the Annual Report and financial statements, taken as a whole,

are fair, balanced and understandable and provide the information

necessary for shareholders to assess the Company's performance,

business model and strategy.

Principal Risks and Uncertainties

This section outlines the principal risks and uncertainties that

may affect the Group and highlights the mitigating actions that are

being taken. This section is not intended to be an exhaustive list

of all the risks and uncertainties that may arise, nor is the order

of the content intended to be any indication of priority.

A risk management and internal controls framework is in place

within the Group, which is continually reviewed and adapted where

necessary to reflect the risk profile of the Group and to continue

to ensure that such risks and uncertainties can be identified and,

where possible, managed suitably. Each Group business unit

maintains a risk register which is aggregated into an interactive

data-driven dashboard reporting tool, to facilitate review by the

Melrose senior management team, the Audit Committee and the

Board.

Key risk Description Mitigation Responsibility Risk Trend commentary Strategic

and impact trend priorities

Strategic risks

Acquisition The success Structured Executive Following Buy

of new of the Group's and appropriate management the acquisition Improve

businesses acquisition due diligence of GKN in

and strategy depends undertaken 2018, the

improvement on identifying on potential Group remains

strategies available new targets focused

and suitable where permitted principally

targets, obtaining and practicable. on improvement.

any consents Focus on The impact

or authorisations acquisition of COVID-19

required to targets that has interrupted

carry out have strong the timing

an acquisition, headline of some

and procuring fundamentals, improvement

the necessary high-quality plans, but

financing, products, these are

be this from and leading continuing

equity, debt market share at pace.

or a combination but which Although

of the two. are no large

In making underperforming acquisitions

acquisitions, their potential were made

there is a and ability in 2020, the

risk of unforeseen to generate Group

liabilities sustainable remains open

being later cash flows to potential

discovered and profit new

which were growth. opportunities.

not uncovered Hands-on role

or known at taken by

the time of executive

the due diligence Directors

process, particularly and other

in the context senior

of limited employees

access in of the Group.

public bids. Development

Further, as of strategic

per the Group's plans,

strategy to restructuring

buy and improve opportunities,

good but capital

underperforming expenditure,

manufacturing procurement

businesses, and working

once an acquisition capital

is completed, management.

there are Proper

risks that incentivisation

the Group of operational

will not succeed management

in driving teams to align

strategic with Melrose

operational strategy.

improvements

to achieve

the expected

post acquisition

trading results

or value which

were originally

anticipated,

that the acquired

products and

technologies

may not be

successful,

or that the

business may

require significantly

greater resources

and investment

than anticipated.

If anticipated

benefits are

not realised

or trading

by acquired

businesses

falls below

expectations,

it may be

necessary

to impair

the carrying

value of these

assets. The

Group's return

on shareholder

investment

may fall if

acquisition

hurdle rates

are not met.

The Group's

financial

performance

may suffer

from goodwill

or other

acquisition-related

impairment

charges, or

from the identification

of additional

liabilities

not known

at the time

of the acquisition.

------------------------ ----------------- --------------- -------- ----------------- -----------

Timing of In line with Directors Executive Although global Sell

disposals our strategy are experienced management M&A markets

and depending in judging continue to

where the and regularly experience

Group is within reviewing uncertainty,

the "Buy, the appropriate there remain

Improve, Sell" time in a opportunities

cycle, the business cycle for value

expected timing for a disposal realisation,

of any disposal to realise and a formal

of businesses maximum value sale process

is considered for has recently

as a principal shareholders. been commenced

risk which Each disposal for the Nortek

could have is assessed Air Management

a material on its merits, division.

impact on with a key The process

the Group focus on a remains highly

strategy and clean disposal. uncertain,

performance. but the

Further, due division's

to the Group's outstanding

global operations, recent

there may performance

be a significant will translate

impact on into a good

the timings outcome for

of disposals the businesses

due to political and our

and macro-economic shareholders.

factors. Some non-core

Depending businesses

on the timings were sold

of disposals or placed

and the nature under strategic

of the businesses' review during

operations, 2020. However,

there may management

be long-term continues

liabilities to remain

which could disciplined

be retained and there

by the Group is no obligation

following to sell before

a disposal. it is

Insufficient appropriate

allowance to do so.

for

such retained

liabilities

may affect

the Group's

financial

position.

------------------------ ----------------- --------------- -------- ----------------- -----------

Operational risks

Economic and The Group Regular Board Executive There were Buy

political operates, meetings and management unprecedented Improve

through manufacturing business review levels of Sell

and/or sales meetings were volatility

facilities, supplemented and uncertainty

in numerous by weekly during 2020

countries meetings of primarily

and is affected the Board as a result

by global and weekly of COVID-19.

economic conditions. cash management The Melrose

Businesses meetings during senior

are also affected the initial management

by government height of team continues

actions and the COVID-19 to actively

the willingness pandemic during engage with

of governments the second the business

to commit and third unit executive

substantial quarters of teams to track

resources. 2020. As the the potential

Current global initial impacts of

economic and disruption further

financial subsided in lockdowns

market conditions the third or tiered

have recently quarter, these restrictions

been characterised additional aimed at curbing

by high levels meetings moved the impact

of volatility to fortnightly, of COVID-19,

and uncertainty. whilst the as well as

There has Board continued the potential

been widespread to receive impacts of

disruption key financial Brexit and

to production information the possibility

and trading on a weekly of future

environments basis. The tariffs. The

caused by increased Melrose senior

the COVID-19 frequency management

pandemic, of meetings team engages

in particular at Board level actively with

a sharp market enabled the those who

decline in Board to discuss are working

the aerospace and increase on the relevant

sector due their monitoring impact

to global and oversight assessments

travel restrictions. of the impact and mitigation

Fluctuation of actions, and

in commodity macro-political reports the

prices, the events on material

potential the Group findings

for a significant on a regular to the Board.

and prolonged basis, including The Melrose

global downturn national and senior

and uncertainty regional management

in the political lockdowns, team monitors

environment, material working key issues

may materially pattern changes, with the

and adversely PPE supplies divisional

affect the and management

Group's operational distribution, teams including

performance and the business the impact

and financial units' ongoing of geopolitical

condition, assessment uncertainty

and could of and/or on order books,

have a significant use of and cash generation,

impact on paying back legal and

the timing of national regulatory

of acquisitions support schemes threats and

and disposals. where deemed other key

These factors appropriate. operational

may also materially Regular and commercial

affect customers, monitoring indicators,

suppliers of order books, to ensure

and other cash the Group

parties with performance, and each of

which the cost control its businesses

Group does and other can respond

business. leading appropriately

Adverse economic indicators, to adverse

and financial to ensure trading

market conditions the Group conditions.

may cause and each of Tactics for

customers its businesses mitigating

to terminate could respond the potential

existing orders, quickly to impact of

to reduce adverse trading geopolitical

their purchases conditions. uncertainty

from the Group, This included include

or to be unable the identifying

to meet their identification cost reduction

obligations of cost and operational

to pay outstanding reduction efficiency

debts to the and efficiency measures.

Group. These measures. The Board

market conditions Bank financing notes that

may also cause is readily economic

our suppliers available uncertainty

to be unable to the Group can depress

to meet their from its business

commitments supportive valuations

to the Group banking and this may

or to change syndicate. increase the

the credit This support number of

terms they has proven potential

extend to to be available acquisition

the Group's to the Group opportunities

businesses. even during for Melrose.

Since the periods of

UK left the unprecedented

EU on 31 January turmoil that

2020, uncertainty was experienced

has continued in 2020 due

in the UK to the global

regarding pandemic.

the nature Assessment

and impact of and/or

of the UK's use of national

future trading support schemes

relationship where deemed

with the EU appropriate

and other in the context

international of COVID-19

trading partners disruption.

with which Short-term

the UK intends inventory

to establish buffers are

new terms regularly

on which to reviewed and

trade, and assessed to

what this minimise the

will mean impact of

for business further lockdown

and the UK restrictions

economy. The due to COVID-19,

impact of and the initial

the COVID-19 impact of

pandemic is Brexit on

a significant import costs

risk to the and tariffs

global economy. and border

Each of the disruption.

Group's businesses Sales from

and their the EU to

respective the UK within

production the GKN

and market Aerospace

geographies and GKN

are impacted Automotive

by the COVID-19 divisions

pandemic to are frequently

various extents, on ex-works

with the most terms and

common impacts therefore

across the a cost to

Group during customers.

2020 being This continued

the temporary to be reviewed

reduction during 2020

of manufacturing in light of

capacity and the then ongoing

reduced requirements Brexit

due to lockdown negotiations

measures and and the

international subsequent

travel restrictions. ongoing trading

The Board terms between

and the Melrose the UK and

senior management the EU.

team continue Strong customer

to regularly relationships

monitor the built on

impact of long-term

the pandemic partnerships

on the Group often with

with particular plants in

focus on the close proximity,

potential technical

for staff excellence

shortages, and quality.

production Planning for

delays and potential

supply chain discussions

disruption. in respect

A significant of increased

amount of tariff costs

the Group's that materialise

revenue is following

generated the final

from operations Brexit deal

located in between the

North America, UK and the

which during EU.

2020 continued The Group

to experience remains agile,

challenging diversified

tariffs relating and well

to the US/China positioned

trade war to deal with

and uncertainty any short-term

related to uncertainty

the US presidential in the UK.

election.

The US has

also required

close monitoring

related to

the expected

short to medium-term

impact of

potential

changes to

international

trading relationships

following

the conclusion

of a definitive

future trade

deal between

the UK and

the EU. The

Group's exposure

to such US

trade risk

factors is

inherently

mitigated

by its manufacturing

footprint

across the

UK and European-based

GKN Aerospace

and GKN Automotive

divisions.

Further, the

Group's businesses

operating

in North America

continue to

take regular

specific actions

to mitigate

the impact

of new relevant

North American

tariffs and

changes to

international

trading regulations

by engaging

with the relevant

authorities

prior to and

after any

such changes

are implemented.

Whilst the

long-term

impact of

Brexit, COVID-19,

and tariff

wars are not

isolated as

principal

risks to the

Group as a

whole, they

present potential

risks that

the business

units continue

to monitor

and assess

closely, particularly

in the context

of potential

changes to

travel and

working restrictions,

and the cross-border

trade and

regulatory

environments

in which the

business units

operate. The

Board continues

to assess

and review

the potential

impact of

these evolving

risks.

------------------------ ----------------- --------------- -------- ----------------- -----------

Commercial The Group The Group Executive The Melrose Improve

operates in continued management senior

competitive to actively management

markets throughout invest in team actively

the world research and engages with

and is diversified development the divisional

across a variety activities executive

of industries in 2020 to management

and production augment its teams to track,

and sales platforms monitor and

geographies. for future support

This provides product strategic

a degree of expansion, planning

Group-level quality activities

impact mitigation improvements, and impact

from the potential customer mitigation

commercial alignment assessments

challenges and achieving in respect

and market further of ongoing

disruptions production commercial

that face efficiencies. risks.

each of the Details about Particular

divisions. some of the focus is placed

However, the Group's research on certain

widespread and development GKN Aerospace

disruption activities and GKN

caused by are provided Automotive

COVID-19 has in the end markets

heightened Sustainability where

the Group's report on customer and/or

exposure to pages 58 to competitor

supply chain 87 of the concentration

and end-market 2020 Annual is high and

commercial Report. heavier reliance

risk. Health and is placed

Each division safety awareness on supply

is exposed initiatives chain efficiency

to particular and performance and programme

commercial enhancements partner

and market continued management.

risks, which to be The divisional

are primarily implemented CEOs report

accentuated in alignment material updates

where with directly to

customer/competitor regulation, members of

concentration market practice the Melrose

is high within and site-based senior

their respective risk assessments management

market segments. and team which

Melrose operates requirements. maintains

a decentralised In addition, a

control and in light of number of

management the COVID-19 contact points

structure pandemic, throughout

which empowers the the Group

divisional Group has to increase

management followed awareness.

teams to take government

full responsibility guidance on

for planning, hygiene and

mitigating, social

navigating distancing

and responding protocols,

to the specific and coordinated

commercial the sourcing

risks and of PPE globally

challenges to ensure

facing their no disruptions.

respective Since acquiring

businesses. GKN, the Melrose

The Melrose senior

senior management management

team monitors team has

the aggregated actively

impact of engaged with

such risks and supported

and provides the GKN

active support businesses'

and challenge divisional

to the divisional management

management executive

teams in fulfilling teams in

their responsibilities. identifying

Common commercial embedded

risk areas contractual

that potentially and business

affect a large conduct risks

proportion relating to

of the Group's key supply

businesses chain and

include those production

related to programme

production partners.

quality assurance, Those management

health and teams have

safety performance, continued

customer concentration to implement

and uncertainties and direct

related to a series of

future customer operational

demand, onerous change

customer and management

supplier contracts, programmes

the impact to mitigate

of increased the risks

competitive they have

pressures identified.

on the The Melrose

maintenance/improvement senior

of market management

share, potential team, in

disruptions collaboration

to supply with Ernst

chains and & Young,

increases continues

to the price to enhance

of raw materials, the Board

technological and Audit

innovation Committee's

and market visibility

disruption, of the Group's

and the performance Common

and management Commercial

of programme Risks through

partners ("Common the use of

Commercial the Group

Risks"). reporting

In 2020, Common dashboard

Commercial to aggregate

Risks increased and report

due to the numerous Common

impact of Commercial

the global Risks across

pandemic, each of the

which affected Group's

a number of divisions.

areas including Throughout

supply chains, the COVID-19

production pandemic,

scheduling, the rate and

factory closures, intensity

customer demand of business

rates, and unit reporting

freight. was

substantially

increased.

This ensured

business unit

management

and the Melrose

senior

management

team had timely

access to

detailed and

accurate

information

on the trading

performance

of the Group,

which enabled

informed and

quick

decision-making.

------------------------ ----------------- --------------- -------- ----------------- -----------

Loss of key The success Succession Executive Succession Buy

management of the Group planning within management planning remains Improve

and is built upon the Group a core focus Sell

capabilities strong management is coordinated for the

teams. As via the Nomination

a result, Nomination Committee

the loss of Committee and the Board.

key personnel in conjunction Reviewing

could have with the Board the succession

a significant and includes planning

impact on all Directors arrangements

performance, and senior of the Board

at least for Melrose as a whole,

a time. The employees. together with

loss of key In line with a review of

personnel the Group's the Melrose

or the failure decentralised senior

to plan adequately structure, management

for succession each divisional team, will

or develop CEO, in remain an

new talent consultation area of

may impact with the Chief particular

the reputation Executive, focus in 2021,

of the Group is responsible as well as

or lead to for the maintaining

a disruption appointment oversight

in the leadership of their of business

of the business. respective unit succession

Competition executive planning.

for personnel team members,

is intense with

and the Group disclosure

may not be to the

successful Nomination

in attracting Committee

or retaining via the Melrose

qualified senior

personnel, management

particularly team.

engineering The Company

professionals. recognises

that, as with

most businesses,

particularly

those operating

within a

technical

field,

appointments

are dependent

on Directors

and employees

with particular

managerial,

engineering

or technical

skills.

Appropriate

remuneration

packages and

long-term

incentive

arrangements

are

offered in

an effort

to attract

and retain

such

individuals.

------------------------ ----------------- --------------- -------- ----------------- -----------

Compliance and ethical risks

Legal, Considering Regular Executive Each business Improve

regulatory the breadth, monitoring management has a fully

and scale and of legal and developed

environmental complexity regulatory legal function,

of the Group, matters at headed by

there is a both a Group their respective

risk that and business General Counsel

the Group unit level. reporting

may not always Consultation to their

be in complete with external executive

compliance advisors where management

with laws, necessary. team, and

regulations Group-wide are properly

or permits. standard and staffed and

The Group enhanced supported

could be held application by external

responsible to trade advisors where

for liabilities authorisation necessary

and consequences procedures or helpful

arising from are in place to ensure

(i) past or and regularly ongoing

future environmental reviewed against compliance

damage, including the in the

potentially ever-changing jurisdictions

significant global trade in which they

remedial costs; compliance operate across

(ii) employee landscape, the globe.

matters including supported This is

liability by access augmented

for employee to external by central

accidents trade compliance oversight

in the workplace legal and from the Melrose

or regulatory legal team

consequences specialists and robust

of environmental and electronic annual reviews.

liabilities, counterparty The Board

which may screening reviews its

be susceptible systems. assessment

to class action Our businesses of the Group's

law suits, are validated material

particularly and certified sustainability

but not exclusively in respect issues annually,

with respect of quality and is currently

to Group businesses management, establishing

operating environmental a Group internal

in North America; management sustainability

(iii) restrictions and health reporting

arising from and safety and performance

economic sanctions, with the function to

export controls appropriate support the

and customs, bodies including business units.

which can ISO and BS During the

result in OHSAS, where coming year,

fines, criminal relevant to the Board

penalties, their with the support

adverse publicity, operations. of the Melrose

payment of The Group's senior

back duties businesses management

and suspension are either team will

or revocation already publish an

of the Group's compliant assessment

import or with or working of how Melrose

export towards timely and its

privileges; compliance businesses

and (iv) product with new and are mitigating

liability upcoming climate change

claims, which standards. risks aligned

can result This includes with the

in significant Group businesses recommendations

total liability that are of the Task

or remedial currently Force on

costs, particularly certified Climate-related

for products to BS OHSAS Financial

supplied to 18001 and Disclosures

large are actively (TCFD), and

volume global driving towards setting targets

production full transition in line with

programmes to ISO the UN

spanning multiple 45001:2018. Sustainable

years, for With Melrose Development

example in support, each Goals.

the aerospace business invests

and automotive in and

industries, implements

or to consumer appropriate

end markets, systems and

for example processes

in the air to manage

management their impact

industry. on the

There can environment,

also be no and continually

assurance reviews these

that any provisions in line with

for expected evolving

environmental expected

liabilities practices.

and remediation The executive

costs will management

adequately team of each

cover these business

liabilities regularly

or costs. reviews any

The Group significant

operates in climate-related

highly regulated issues, risks

sectors, which and

has been accentuated opportunities

by the GKN related to

acquisition. the business.

In addition, These reviews

new legislation, consider the

regulations level of

or certification climate-related

requirements risk that

may require the business

additional is prepared

expense, restrict to take in

commercial pursuit of

flexibility its business

and business strategy and

strategies the

or effectiveness

introduce of management

additional controls in

liabilities place to

for the Group mitigate

or the Directors. climate-related

For example, risk. Any

the Group's identified

operations risks are

are subject discussed

to anti-bribery with the Melrose

and anti-corruption, senior

anti-money management

laundering, team and

competition, escalated

anti-trust to the Board

and where necessary.

trade compliance In line with

laws and regulations. our

Failure to decentralised

comply with model, our

certain regulations businesses

may result have frameworks

in significant in place for

financial identifying

penalties, principal

debarment risks and

from opportunities

government appropriate

contracts to their

and/or reputational business

damage, and and

may impact stakeholders,

our business which include

strategy. climate-related

We purchase risks. Each

businesses business takes

that are an appropriately

underperforming tailored

their potential approach

with respect to

to their financial, climate-related

operational initiatives

and sustainability that suits

performance. their

Inherent in requirements,

the nature and operational

of the manufacturing and market

businesses environments,

we acquire as well as

is that they reflecting

often operate their maturity

in industries in this area

that are the at the time

hardest to of becoming

decarbonise. part of the

Group sustainability Group.

performance The Board

and ratings sets a leading

will fluctuate example in

during our sustainability,

investment and holds

cycle as we each business

acquire new and their

businesses management

in need of teams

improvement, accountable

and sell businesses for their

that we have progress,

improved. and provides

them with

a platform

to absorb

the Group's

best practices,

to accelerate

their and

others'

progress.

The Melrose

senior

management

team works

with the

businesses'

executive

teams, to

set meaningful

sustainability

targets,

alongside

financial

metrics, and

Melrose provides

the investment

to achieve

them. The

businesses

subsequently

identify,

monitor, and

manage the

specific

environmental

risks that

affect their

operating

and market

environments.

The Board

with the support

of the Melrose

senior

management

team reviews

the annual

reports on

energy usage

and greenhouse

gas emissions

within each

business,

and provides

support and

investment

to drive

improvements

within their

operations

through more

efficient

use of

electricity,

fuel and heat,

including

by increasing

the proportion

of renewable

energy where

commercially

viable, and

by implementing

other

climate-positive

actions such

as sustainable

transport

initiatives

for employees.

The Board

with the support

of the Melrose

senior

management

team spends

time listening

to the Group's

key stakeholders

to enable

informed

strategic

decisions

and to deliver

on their needs.

A robust control

framework

is in place,

underpinned

by comprehensive

corporate

governance

and compliance

procedures

at both a

Group and

business unit

level, including

utilisation

of third party

verification

providers.

Where possible

and practicable,

due diligence

processes

during the

acquisition

stage seek

to identify

legal,

regulatory

and

environmental

risks. At

the business

unit level,

controls are

in place to

prevent such

risks from

crystallising.

Any

environmental

risks that

crystallise

are subject

to mitigation

by specialist

consultants

engaged for

this purpose.

External

consultants

assist the

Group in

complying

with new and

emerging

environmental

regulations.

Insurance

cover mitigates

certain levels

of risk and

the Group's

insurers are

instructed

to carry out

external audits

of specified

areas of legal

and compliance

risk including

health and

safety.

------------------------ ----------------- --------------- -------- ----------------- -----------

Information Information Management Executive Information Improve

security and security and work with management security and

cyber threats cyber threats the leaders cyber threats

to our systems of each business are an

are an and external increasing

increasing security priority across

priority across consultants all industries.

all industries to assess The COVID-19

and remain the Group's pandemic has

a key increased increased

UK Government exposure to online traffic,

agenda item. cyber security reduced physical

Like many risk and to contact, and

businesses, ensure created

Melrose recognises appropriate additional

that the Group mitigation new threats

may have a measures are to all of

potential in place for our businesses

exposure in the Group. requiring

this area. During 2020, increased

Potential Melrose attention.

exposure to continued Cyber security

such risks to monitor breaches of

remains high and enhance the Group's

due to the its IT systems

scale, complexity information could result

and public-facing security in the

nature of strategy misappropriation

the Group. and risk-based of confidential

In addition, governance information

Melrose recognises framework belonging

that the inherent with all to it or its

security threat businesses customers,

is considered within the suppliers

highest in Group. The or employees.

GKN Aerospace framework In response

where data follows the to the increased

is held in UK Government's sophistication

relation to recommended of information

civil aerospace steps on cyber security and

technology security. cyber threats,

and controlled This strategic the Group

military contracts. management has worked,

approach has and continues

delivered to work, with

risk profiling external

capabilities security

by business companies

and the to monitor,

enablement improve and

of mitigation refine its

plans to be Group-wide

developed strategy to

for each aid the

business prevention,

to reduce identification

their exposure and mitigation

to cyber risk. of any present

The progress and future

of each business threats.

is measured

against the

information

security

strategy

and is monitored

on a quarterly

basis.

Data is also

externally

reviewed

quarterly

by Ernst &

Young, who

will be

augmenting

their review

in 2021 with

a mix of virtual

and

onsite assurance

visits.

------------------------ ----------------- --------------- -------- ----------------- -----------

Financial risks

Foreign Due to the The Group Executive Group results Buy

exchange global nature policy is management are reported Improve

of operations to protect in Sterling Sell

and volatility against the but a large

in the foreign majority of proportion

exchange market, foreign of its revenues

exchange rate exchange risk are denominated

fluctuations which affects in currencies

have, and cash, by hedging other than

could continue such risks Sterling,

to have, a with primarily

material impact financial US Dollar

on the reported instruments. and Euro.

results of The businesses Sensitivity

the Group. are protected to the key

The Group against being currency pairs

is exposed over-hedged, is shown in

to three types due to short the Finance

of currency to medium-term Director's

risk: transaction reductions review on

risk; translation in forecasts, pages 36 to

risk; and as the 42 of the

the risk that percentage 2020 Annual

when a business of hedges Report.

that is predominantly compared to

based in a forecast foreign

foreign currency exchange

is sold, it exposures

is sold in tapers over

that foreign future periods.

currency. Protection

The Group's against specific

reported results transaction

will fluctuate risks is taken

as average by the Board

exchange rates on a

change. The case-by-case

Group's reported basis.

net assets

will fluctuate

as the year-end

exchange rate

changes.

------------------------ ----------------- --------------- -------- ----------------- -----------

Pensions Any shortfall The Group's Executive Although the Buy

in the Group's key funded management risks are Improve

defined benefit UK defined well understood, Sell

pension schemes benefit pension the deficit

may require plans are significantly

additional closed to reduced and

funding. As new entrants funding plans

at 31 December and future for the GKN

2020, the service accrual. Schemes having

Group's pension Long-term already been

schemes had funding agreed with

an aggregate arrangements the Trustees,

deficit, on are agreed the size of

an accounting with the the gross

basis, of Trustees liabilities

GBP838 million and reviewed as a proportion

(2019: GBP1,121 following of the Group's

million). completion net assets

Changes in of actuarial remains

discount rates, valuations. significant.

inflation, Active During the

asset values engagement period, gross

or mortality with the liabilities

assumptions Trustees increased

could lead on pension as a result

to a materially plan asset of changes

higher deficit. allocations in financial

For example, and strategies. conditions.

the cost of During the The increase

a buy-out year the GKN was offset

on a discontinued Schemes 1-4 by increases

basis uses appointed in scheme

more conservative a fiduciary assets arising

assumptions manager which from the return

and is likely will allow on investments

to be significantly more timely and group

higher than decisions contributions

the accounting to be made of GBP111

deficit. Alternatively, on million. As

if the plans changing a result of

are managed investments the deficit

on an ongoing as circumstances reduction

basis, there require. Also, during the

is a risk investments period, the

that the plans' can be spread Trustees took

assets, such across more action to

as investments asset classes better hedge

in equity which will risks associated

and debt securities, reduce risk. with movements

will not be in inflation

sufficient and interest

to cover the rates, and

value of the to reduce

retirement investment

benefits to risk.

be provided Accordingly,

under the the volatility

plans. The risk to the

implications Group is

of a higher reduced.

pension deficit

include a

direct impact

on valuation,

implied credit

rating and

potential

additional

funding requirements

at subsequent

triennial

reviews. In

the event

of a major

disposal that

generates

significant

cash proceeds

which are

returned to

the shareholders,

the Group

may be required

to make additional

cash payments

to the plans

or provide

additional

security.

------------------------ ----------------- --------------- -------- ----------------- -----------

Liquidity The ability To ensure Executive Whilst the Buy

to raise debt it has management Group maintains Improve

or to refinance comprehensive strong cash

existing borrowings and timely controls and

in the bank visibility forecasting

or capital of the liquidity processes,

markets is position, in light of

dependent the Group the COVID-19

on market conducts monthly pandemic,

conditions reviews of management

and the proper its cash have

functioning forecast, driven a

of financial which are redoubling

markets. As in turn revised of efforts

set out in quarterly. throughout

more detail The Group the Group

in the Finance operates cash to increase

Director's management visibility

review on mechanisms, and certainty

pages 36 to including of cash flow

42 of the cash pooling information,

2020 Annual across the robustness

Report, the Group and of cash

Group has maintenance controls,

term loans of revolving and cash-saving

of US$960 credit initiatives.

million and facilities These have

GBP100 million to mitigate been very

and revolving the risk of successful

credit facilities any liquidity and combined

comprising issues. with the

US$2.0 billion, The Group negotiation

EUR0.5 billion gained agreement of covenant

and GBP1.1 from its lenders waivers with

billion. to a three-year our supportive

In addition, extension, banking

the GKN net at the Group's syndicate,

debt at acquisition option to the Group

included capital be built into is satisfied

market borrowings its that it has

across three multi-currency adequate

unsecured term loan resources

bonds that denominated available

totalled GBP1.1 GBP100 million to meet its

billion. Two and US$960 liabilities.

of these bonds million,

- totalling exercisable

GBP750 million at any time

- remain outstanding prior to 1

as at 31 December April 2021

2020 and further that would

detail is extend the

provided in maturity date

the Finance of the loan

Director's to 30 April

review on 2024. Since

pages 36 to the end of

42 of the the

2020 Annual current

Report. reporting

The sudden period, this

and material option has

impact of been exercised.

COVID-19 in The Group

2020 has brought operates a

cash management conservative

into sharp level of

focus. In headroom

line with across its

the Group's financing

strategy, covenants

investment which is

is made in designed

the businesses to avoid the

(capital expenditure need for any

and restructuring unplanned

actions) and refinancing.

there is a As a result

requirement of COVID-19

to assess the Group's

liquidity banking

and headroom syndicate

when new businesses agreed to

are acquired. amend its

financial

covenants

during the

year, covering

the periods

up to and

including

31 December

2022, which

provides

significant

headroom over

the existing

covenants.

------------------------ ----------------- --------------- -------- ----------------- -----------

Related party transactions

Except for transactions with associates (see Note 29 to the 2020

Annual Report on page 191), no other related party had material

transactions or loans with the Company over the last two financial

years.

-- END --

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSUAASRARUOOAR

(END) Dow Jones Newswires

March 31, 2021 11:30 ET (15:30 GMT)

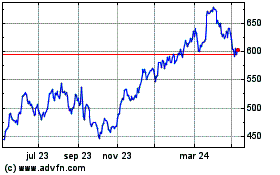

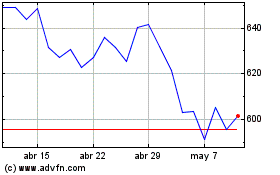

Melrose Industries (LSE:MRO)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Melrose Industries (LSE:MRO)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024