U.S. Stock Futures Tick Lower Ahead of Consumer Data

30 Abril 2021 - 3:08AM

Noticias Dow Jones

U.S. stock futures edged down on Friday, ahead of fresh data on

American consumers including income, spending and sentiment.

S&P 500 futures declined 0.2% and futures tied to the Dow

Jones Industrial Average slipped 0.1%. Changes in equity futures

don't necessarily predict moves after the markets open.

In Europe, the Stoxx Europe 600 added 0.2% in morning trade as

gains in communication services and information technology sectors

were balanced by losses in financials and materials sectors.

Euronext fell 8.3%.

The U.K.'s FTSE 100 rose 0.2%. Other regional indexes in Europe

also mostly climbed as France's CAC 40 climbed 0.2%, the U.K.'s

FTSE 250 gained 0.2% and Germany's DAX climbed 0.3%.

The euro and the British pound dropped 0.1% against the U.S.

dollar. Meanwhile, the Swiss franc was mostly flat against the

dollar, with 1 franc buying $1.10.

In commodities, Brent crude was down 0.3% to $67.83 a barrel.

Gold was up 0.1% to $1,770.00 a troy ounce.

The German 10-year bund yield declined to minus 0.201% and the

yield on 10-year gilts fell to 0.829%. The yield on 10-year U.S.

Treasury edged up to 1.642% from 1.639%. Bond prices and yields

move in opposite directions.

Stocks in Asia mostly fell as Hong Kong's Hang Seng was lower

1.6%, Japan's Nikkei 225 index shed 0.8%, and China's benchmark

Shanghai Composite lost 0.8%.

An

artificial-intelligence tool

was used in creating this article.

(END) Dow Jones Newswires

April 30, 2021 03:53 ET (07:53 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

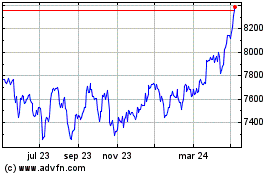

FTSE 100

Gráfica de índice

De Abr 2024 a May 2024

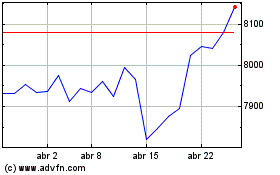

FTSE 100

Gráfica de índice

De May 2023 a May 2024