Altisource Asset Management Corporation Announces Departure of CEO

30 Agosto 2023 - 7:00AM

Business Wire

Company Moves Forward with Restructure of

Lending Operations

Altisource Asset Management Corporation (“AAMC” or the

“Company”) (NYSE American: AAMC) announces the resignation of Chief

Executive Officer, Jason Kopcak.

“We remain committed to the mortgage space,” said Chairman of

the Board Ricardo Byrd. “As the Board considers potential

replacements, we have appointed Danya Sawyer, Chief Operating

Officer of Alternative Lending Group, the Company’s principal

operating subsidiary, to serve as Interim CEO of AAMC.”

Significant Progress on Cost Cutting Initiatives and

Enhancing Liquidity

As announced during the Company’s recent Earnings Call, the

Board mandated a comprehensive review of the Company’s mortgage

platform to improve the performance of the business. This review

involved assessments of operational efficiency and capacity issues,

opportunities for cost reductions, strategies for improving

liquidity, among other initiatives, all with a view toward

enhancing financial performance. While improvements continue, this

review is now completed. The Company has already made significant

progress in reducing costs and streamlining operations, including

the following (all amounts disclosed below are as of August 25,

2023):

- An across-the-board employee right-sizing, considerably

reducing annual payroll costs

- Shuttering the Tampa facility and absorbing functions

previously undertaken at that location into operating

subsidiaries

- Aggressively reducing expenditures for third-party professional

services

- Reducing reliance on short-term lines of credit

- Cash and cash equivalents at the company are currently $16.5

million

- Credit lines have been reduced to $20.2 million

- The current loan portfolio consists of $37.1 million in unpaid

principal balance

“Our restructuring and cost reduction efforts are well

underway,” Chairman Byrd explained. “These are pivotal steps

forward which we believe will facilitate a sustainable mortgage

operation.”

About AAMC

AAMC acquires, originates and manages mortgage loans,

mortgage-backed securities and equity investments in underserved

markets. Additional information is available at

www.altisourceamc.com.

AAMC works to employ capital light operating strategies that

have historically been implemented across a variety of industry

sectors ranging from REIT management and title insurance and

reinsurance to private loan acquisition, origination and

disposition. AAMC is committed to an investment philosophy of

opportunistic deployment of capital in new ventures that we believe

will be accretive to shareholder value. We are likewise committed,

as a matter of core corporate values, to exemplary environmental,

social and governance principles.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, regarding management’s beliefs, estimates, projections,

anticipations, and assumptions with respect to, among other things,

the Company’s financial results, margins, employee costs, future

operations, business plans including its ability to sell loans and

obtain funding, and investment strategies as well as industry and

market conditions. These statements may be identified by words such

as “anticipate,” “intend,” “expect,” “may,” “could,” “should,”

“would,” “plan,” “estimate,” “target,” “seek,” “believe,” and other

expressions or words of similar meaning. We caution that

forward-looking statements are qualified by the existence of

certain risks and uncertainties that could cause actual results and

events to differ materially from what is contemplated by the

forward-looking statements. Factors that could cause our actual

results to differ materially from these forward-looking statements

may include, without limitation, our ability to develop our

businesses, and to make them successful or sustain the performance

of any such businesses; our ability to purchase, originate, and

sell loans, our ability to obtain funding, market and industry

conditions, particularly with respect to industry margins for loan

products we may purchase, originate, or sell as well as the current

inflationary economic and market conditions and rising interest

rate environment; our ability to hire employees and the hiring of

such employees; developments in the litigation regarding our

redemption obligations under the Certificate of Designations of our

Series A Convertible Preferred Stock; and other risks and

uncertainties detailed in the “Risk Factors” and other sections

described from time to time in the Company’s current and future

filings with the Securities and Exchange Commission. The foregoing

list of factors should not be construed as exhaustive.

The statements made in this press release are current as of the

date of this press release only. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements or any other information contained herein, whether as a

result of new information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230830113382/en/

Charles Frischer T: +1-813-474-9047 E:

charles.frischer@altisourceamc.com

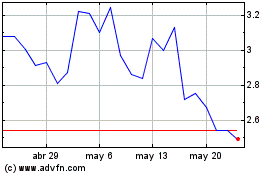

Altisource Asset Managem... (AMEX:AAMC)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

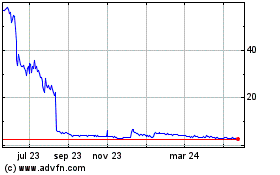

Altisource Asset Managem... (AMEX:AAMC)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024