false

0000842518

0000842518

2023-11-30

2023-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 8-K/A

Amendment No. 1

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 30, 2023

EVANS BANCORP, INC.

(Exact name of the registrant as specified in

its charter)

| New York |

001-35021 |

16-1332767 |

|

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

| 6460 Main Street |

|

|

| Williamsville, New York |

|

14221 |

| (Address of principal executive offices) |

|

(Zip Code) |

(716) 926-2000

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (See General Instruction A.2.

below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4c) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.50 per share |

|

EVBN |

|

NYSE American |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Explanatory Note

This Amendment No. 1 to

Current Report on Form 8-K/A (the “Form 8-K/A”) amends and supplements the Current Report on Form 8-K filed by Evans Bancorp,

Inc. (the “Company”) with the Securities and Exchange Commission on December 1, 2023 (the “Initial Filing”) to

include the pro forma financial information required by Item 9.01(b) and to include the additional exhibits related thereto under Item

9.01(d) of this Form 8-K/A.

| Item 9.01 | Financial Statements and Exhibits. |

(b) Pro

Forma Financial Information.

As disclosed in the Initial Filing, on November

30, 2023, the Company completed the sale (the “Transaction”) of its insurance subsidiary, The Evans Agency, LLC, to Arthur

J. Gallagher & Co. and Arthur J. Gallagher Risk Management Services, LLC. The Transaction is described in more detail in the

Initial Filing and in the Company’s Current Report on Form 8-K filed with the Securities and Exchange Commission on November 9,

2023.

Item 9.01 of the Initial Filing stated that the

Company anticipated filing, on or before December 6, 2023, an amendment to the Initial Filing that would include unaudited pro forma condensed

financial statements and accompanying explanatory notes giving effect to the Transaction, as required under Item 9.01 of Form 8-K.

By this Form 8-K/A, the Company is amending the

Initial Filing to file as Exhibit 99.1 and incorporate herein by reference an unaudited pro forma condensed balance sheet that gives effect

to the Transaction as if it had occurred on September 30, 2023, and unaudited pro forma condensed income statements for the nine months

ended September 30, 2023 and the year ended December 31, 2022, in each case giving effect to the Transaction as if it had occurred on

January 1, 2022.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Evans Bancorp, Inc. |

| |

|

|

| December 6, 2023 |

By: |

/s/ David

J. Nasca |

| |

|

Name: David J. Nasca |

| |

|

Title: President and Chief Executive Officer |

Exhibit 99.1

UNAUDITED

PRO FORMA CONDENSED FINANCIAL INFORMATION

The following unaudited

pro forma condensed financial information reflects the statements of income for the nine months ended September 30, 2023 and for the

year ended December 31, 2022 as if the sale of substantially all of the assets (the “Asset Sale”) of The Evans Agency, LLC

(“TEA”) to Arthur J. Gallagher & Co. and Arthur J. Gallagher Risk Management Services, LLC (collectively, “Gallagher”)

had occurred on January 1, 2022. The unaudited pro forma condensed balance sheet as of September 30, 2023, assumes that the Asset Sale

occurred as of September 30, 2023. The unaudited pro forma condensed financial information should be read together with the Company’s

historical consolidated financial statements and accompanying notes and Management’s Discussion and Analysis of Financial Condition

and Results of Operations included in its annual report on Form 10-K for the fiscal year ended December 31, 2022, and in its quarterly

report on Form 10-Q for the nine months ended September 30, 2023.

The unaudited pro

forma condensed financial information is presented based on information currently available, is intended for informational purposes,

is not intended to represent what the Company’s consolidated statements of income and balance sheet actually would have been had

the Asset Sale occurred on the dates indicated above and do not reflect all actions that may be undertaken by the Company after the Asset

Sale. In addition, the unaudited pro forma condensed financial information is not necessarily indicative of the Company’s results

of operations and financial position for any future period.

The “Historical

Evans Bancorp, Inc.” column in the unaudited pro forma condensed financial information reflects the Company’s historical

consolidated financial information for the periods presented and does not reflect any adjustments related to the Asset Sale and related

transactions.

The information

in the “Pro Forma Adjustments” column in the unaudited pro forma condensed statements of income was derived from the Company’s

consolidated financial information and related accounting records for the nine months ended September 30, 2023 and fiscal year ended

December 31, 2022 and reflects the removal of substantially all of the historical operating results of TEA. Pro forma adjustments do

not reflect what TEA’s results of operations would have been on a stand-alone basis, and are not necessarily indicative of future

results of operations.

The information

in the “Pro Forma Adjustments” column in the unaudited pro forma condensed financial information was based on available information

and assumptions that the Company’s management believes are reasonable, that reflect the impacts of events directly attributable

to the Asset Sale and related transactions that are factually supportable, and for purposes of the consolidated statements of operations,

are expected to have a continuing impact on the Company. The pro forma adjustments do not reflect future events that may occur after

the Asset Sale, including potential selling, general and administrative dis-synergies and the expected charges, the expected realization

of any cost savings and other synergies, or the usage of the expected cash distribution received from Gallagher in connection with the

Asset Sale.

The unaudited pro

forma condensed financial information is provided for illustrative information purposes only. The unaudited pro forma condensed financial

information is not necessarily, and should not be assumed to be, an indication of the actual results that would have been achieved had

the Asset Sale been completed as of the dates indicated or that may be achieved in the future. The pro forma financial information has

been prepared by the Company in accordance with Regulation S-X Article 11, Pro Forma Financial Information, as amended by the final rule,

Amendments to Financial Disclosures About Acquired and Disposed Businesses, as adopted by the SEC on May 21, 2020.

The unaudited pro

forma condensed financial information also does not consider any potential effects of changes in market conditions on revenues, expense

efficiencies, asset dispositions, and share repurchases, among other factors. The pro forma adjustments have been made solely for the

purpose of providing the unaudited pro forma condensed financial information.

UNAUDITED PRO FORMA CONDENSED BALANCE SHEET

As of September 30, 2023

(in thousands)

| | |

Transaction

Accounting Adjustments | |

| | |

Historical

Evans

Bancorp, Inc. | | |

Pro forma

Adjustments | | |

Note 2 | | |

Pro forma

Condensed | |

| | |

| | | |

(in thousands) |

|

|

| | |

| | |

| Cash and due from banks | |

$ | 17,826 | | |

| 33,853 | | |

| B | | |

$ | 51,679 | |

| Interest-bearing deposit at banks | |

| 7,468 | | |

| - | | |

| | | |

| 7,468 | |

| Securities | |

| 336,630 | | |

| - | | |

| | | |

| 336,630 | |

| FHLB Stock | |

| 3,348 | | |

| - | | |

| | | |

| 3,348 | |

| FRB Stock | |

| 3,092 | | |

| - | | |

| | | |

| 3,092 | |

| Loans, net | |

| 1,682,554 | | |

| - | | |

| | | |

| 1,682,554 | |

| Premises and equipment | |

| 15,852 | | |

| (173 | ) | |

| A | | |

| 15,679 | |

| Goodwill and other intangibles, net | |

| 13,629 | | |

| (11,699 | ) | |

| A | | |

| 1,930 | |

| Bank owned life insurance | |

| 42,528 | | |

| - | | |

| | | |

| 42,528 | |

| Other assets | |

| 51,816 | | |

| (1,466 | ) | |

| A | | |

| 50,350 | |

| Total assets | |

$ | 2,174,743 | | |

$ | 20,515 | | |

| | | |

$ | 2,195,258 | |

| | |

| | | |

| | | |

| | | |

| | |

| Deposits | |

| 1,805,406 | | |

| - | | |

| | | |

| 1,805,406 | |

| Other borrowed funds | |

| 151,252 | | |

| - | | |

| | | |

| 151,252 | |

| Other liabilities | |

| 67,150 | | |

| 5,411 | | |

| C | | |

| 72,561 | |

| Total liabilities | |

$ | 2,023,808 | | |

$ | 5,411 | | |

| | | |

$ | 2,029,219 | |

| | |

| | | |

| | | |

| | | |

| | |

| Common stock | |

| 2,796 | | |

| - | | |

| | | |

| 2,796 | |

| Capital surplus | |

| 82,017 | | |

| - | | |

| | | |

| 82,017 | |

| Treasury Stock | |

| (3,656 | ) | |

| - | | |

| | | |

| (3,656 | ) |

| Retained earnings | |

| 128,468 | | |

| 15,104 | | |

| C | | |

| 143,572 | |

| Accumulated other comprehensive income, net of tax | |

| (58,690 | ) | |

| - | | |

| | | |

| (58,690 | ) |

| Total shareholders’ equity | |

$ | 150,935 | | |

$ | 15,104 | | |

| | | |

$ | 166,039 | |

| Total liabilities and shareholders’ equity | |

$ | 2,174,743 | | |

$ | 20,515 | | |

| | | |

$ | 2,195,258 | |

See the accompanying

Notes to the Unaudited Pro Forma Condensed Financial Information.

UNAUDITED PRO FORMA CONDENSED STATEMENT OF INCOME

For the Nine Months Ended September 30, 2023

| | |

Transaction Accounting Adjustments | |

| | |

Historical Evans

Bancorp, Inc | | |

Pro

forma

Adjustments

(Note 2A) | | |

Pro forma

Condensed | |

| | |

(in thousands) | |

| Net interest income | |

$ | 47,262 | | |

$ | - | | |

$ | 47,262 | |

| Provision for credit losses | |

| (264 | ) | |

| - | | |

| (264 | ) |

| Net interest income after provision

for credit losses | |

| 47,526 | | |

| - | | |

| 47,526 | |

| Insurance service and fees | |

| 8,648 | | |

| (8,250 | ) | |

| 398 | |

| Other non-interest income | |

| 5,723 | | |

| - | | |

| 5,723 | |

| Amortization expense | |

| 300 | | |

| (286 | ) | |

| 14 | |

| Other non-interest expense | |

| 42,782 | | |

| (5,471 | ) | |

| 37,311 | |

| Income before income taxes | |

| 18,815 | | |

| (2,493 | ) | |

| 16,322 | |

| Income tax provision | |

| 4,465 | | |

| (618 | ) | |

| 3,847 | |

| Net income | |

$ | 14,350 | | |

$ | (1,875 | ) | |

$ | 12,475 | |

See the accompanying

Notes to the Unaudited Pro Forma Condensed Financial Information.

UNAUDITED PRO FORMA CONDENSED STATEMENT OF INCOME

For the Year Ended December 31, 2022

| | |

Transaction Accounting Adjustments | |

| | |

Historical Evans

Bancorp, Inc | | |

Pro

forma

Adjustments

(Note 2A) | | |

Pro forma

Condensed | |

| | |

(in thousands) | |

| Net interest income | |

$ | 72,955 | | |

$ | - | | |

$ | 72,955 | |

| Provision for credit losses | |

| 2,739 | | |

| - | | |

| 2,739 | |

| Net interest income after provision

for credit losses | |

| 70,216 | | |

| - | | |

| 70,216 | |

| Insurance service and fees | |

| 10,453 | | |

| (9,837 | ) | |

| 616 | |

| Other non-interest income | |

| 8,818 | | |

| - | | |

| 8,818 | |

| Amortization expense | |

| 400 | | |

| (381 | ) | |

| 19 | |

| Other non-interest expense | |

| 59,535 | | |

| (7,416 | ) | |

| 52,119 | |

| Income before income taxes | |

| 29,552 | | |

| (2,040 | ) | |

| 27,512 | |

| Income tax provision | |

| 7,163 | | |

| (527 | ) | |

| 6,636 | |

| Net income | |

$ | 22,389 | | |

$ | (1,513 | ) | |

$ | 20,876 | |

See the accompanying

Notes to the Unaudited Pro Forma Condensed Financial Information.

EVANS BANCORP,

INC.

NOTES TO UNAUDITED

CONDENSED FINANCIAL STATEMENTS

1. Basis of Presentation

The accompanying

unaudited pro forma condensed financial information and related notes were prepared in accordance with Article 11 of Regulation S-X.

The unaudited pro forma condensed statements of income for the nine months ended September 30, 2023 and the year ended December 31, 2022

separates substantially all of the operating results of TEA from the historical consolidated income statement of the Company, giving

effect to the Asset Sale as if it had been completed on January 1, 2022. The unaudited pro forma condensed balance sheet as of September

30, 2023 separates substantially all of the assets and certain liabilities of TEA from the historical consolidated balance sheet of the

Company, giving effect to the Asset Sale as if it had been completed on September 30, 2023.

The unaudited pro

forma condensed financial information and explanatory notes have been prepared to illustrate the effects of the Asset Sale. The unaudited

pro forma condensed financial information is presented for illustrative purposes only and does not necessarily indicate the financial

results of the company had the sale been completed on January 1, 2022, nor does it necessarily indicate the results of operations in

future periods or the future financial position of the Company.

2. Pro Forma Adjustments to the Unaudited

Condensed Balance Sheet and Income Statements

The unaudited condensed

pro forma statements of operations for the nine months ended September 30, 2023, and the year ended December 31, 2022 and the unaudited

pro forma condensed balance sheet as of September 30, 2023, include the following adjustments:

A. Reflects the sale of substantially

all of the assets and transfer of certain liabilities of TEA, including the associated results of operations.

B.

Reflects the receipt of net cash consideration which includes the following:

| | |

(in thousands) | |

| Gross purchase price pursuant to Asset Purchase Agreement | |

$ | 40,000 | |

| Transaction costs settled at closing | |

| (3,710 | ) |

| Working capital adjustment settled at closing | |

| (60 | ) |

| Net cash proceeds at closing | |

| 36,230 | |

| Fiduciary cash transferred to Gallagher | |

| (2,377 | ) |

| Adjusted net proceeds | |

$ | 33,853 | |

| C. |

Reflects the impact to the Company’s total shareholders’ equity from the estimated gain on sale, net of tax, of substantially all of the assets and transfer of certain liabilities of TEA to Gallagher. The tax effect was computed using the Company’s statutory tax rate of 26.5%. |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

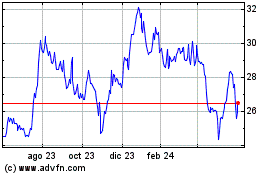

Evans Bancorp (AMEX:EVBN)

Gráfica de Acción Histórica

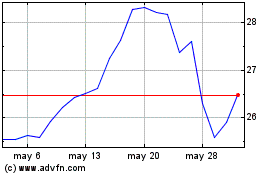

De Nov 2024 a Dic 2024

Evans Bancorp (AMEX:EVBN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024