UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE

ACT OF 1934

For the month

of November 2023

Commission File

Number: 001-41225

VIZSLA SILVER CORP.

(Registrant)

Suite 700, 1090 West Georgia

Street

Vancouver, British Columbia

V6E 3V7 Canada

(Address

of Principal Executive Offices)

Indicate by check mark whether the Registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

|

|

|

|

|

| |

|

|

|

VIZSLA SILVER CORP. |

| |

|

|

|

(Registrant) |

| |

|

|

|

| Date

November 27, 2023 |

|

|

|

By |

|

/s/ Michael Konnert |

| |

|

|

|

|

|

Michael Konnert |

| |

|

|

|

|

|

Chief Executive Officer |

EXHIBIT INDEX

EXHIBIT 99.1

VIZSLA SILVER REPORTS ADDITIONAL HIGH-GRADE INTERCEPTS

ON THE COPALA AND COPALA 2 STRUCTURES

VANCOUVER, BC, Nov. 27, 2023 /CNW/ - Vizsla Silver

Corp. (TSXV: VZLA) (NYSE: VZLA) (Frankfurt: 0G3) ("Vizsla" or the "Company") is pleased to report

new drill results from 22 expansion and infill holes targeting the Copala resource area at its 100%-owned, flagship Panuco silver-gold

project ("Panuco" or the "Project") located in Mexico. The reported results have successfully expanded

Copala mineralization by ~100m to the southeast and identified new vein splays situated in-between Copala and the high-grade Cristiano

structure.

Highlights

| • | CS-23-304 returned 1,722 grams per tonne (g/t) silver

equivalent (AgEq) over 2.80 metres true width (mTW) (1,366 g/t silver and 6.80 g/t gold) |

| • | Including 6,618 g/t AgEq over 0.55 mTW (5,320 g/t silver

and 25.20 g/t gold) |

| • | CS-23-300 returned 724 g/t AgEq over 3.10 mTW

(519 g/t silver and 3.57 g/t gold) |

| • | Including 1,749 g/t AgEq over 1.00 mTW (1,255 g/t silver

and 8.61 g/t gold) |

"Resource expansion drilling at Copala, both

to the north and southeast, continue to highlight a robust precious metals structure well beyond the January 2023 resource boundary,"

commented Michael Konnert, President & CEO. "New step out drilling has extended the total mineralized strike length of

Copala by approximately 100 metres to the south and it remains open in both directions. Additionally, drilling has confirmed the continuity

of the high-grade Copala 2 vein located between Tajitos and Copala main which now measures a total of 600 metres in mineralized strike.

Moving forward, we intend to continue infilling and expanding these high-grade zones with two drill rigs, in preparation for the updated

resource estimate planned for January 2024."

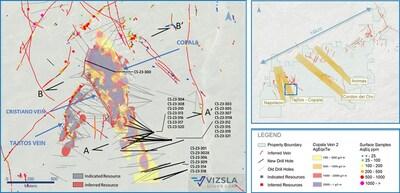

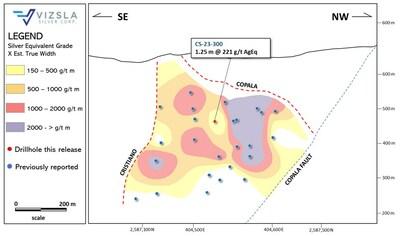

Figure 1: Plan map of recent drilling centered on

the Copala structure. (CNW Group/Vizsla Silver Corp.)

The precious metals dominant Copala Structure, located

in the western portion of the Panuco district, is situated ~800 m to the east of the Napoleon vein. Copala currently hosts Indicated Resources

of 51.1 Moz AgEq at 516 g/t AgEq and Inferred Resources of 55.4 Moz AgEq at 617 g/t AgEq within a broad envelope of vein-breccia interlayered

with host rock, up to 82 metres thick. Interpretations by Vizsla geologists indicate Copala has an average dip of ~46° to the east

(~35° in its northern sector and steepening to ~52° in the southern sector).

Ongoing drilling at Copala has now traced mineralization

along ~1,770 metres of strike length and ~400 metres down dip. The recently completed batch of resource expansion drilling consisted of

21 holes drilled at ~50 m and ~100 m centres in the southern extent of Copala and one hole in the north, targeting both the main Copala

structure and the Copala 2 vein to the footwall. At Copala, hole CS-23-300 in the north, intercepted a broad mineralized structure (~30

mTW) consisting of two high grade zones enveloping a low grade stockwork zone carrying anomalous silver and gold grades throughout (see

cross section on figure 5). Results from seven step-out holes in the south show that the Copala structure gets steeper at depth (~70°)

and develops vein splays carrying significant silver and gold grades. The recently interpreted Copala 4 and FW Splay vein sit between

Cristiano and Copala, approximately 100 m and 50 m west of Copala, respectively. To date, drilling has traced Copala 4 approximately 300

m along strike and 400 m down dip whereas the FW Splay has been traced for ~350 m along strike and 250 m down dip. The vein splays strike

at 15° to 35° due northwest and dip at 60° to 70° to the east. These new splays, like Cristiano, are relatively narrow

compared to the main Copala structure, and host precious metals rich epithermal mineralization. The drilling completed in the southern

extent of Copala was designed to explore and/or infill the Copala structure. Due to geometry those holes could not efficiently test the

projection of the Cristiano vein, which remains an open target. Vizsla is preparing an exploration program for next year that will

consider additional exploration on the southern extent of Cristiano and the newly identified splays.

The Copala 2 vein sits at the footwall of the main

Copala structure and is bounded to the west by the Tajitos vein and to the east by the Copala Fault. The Vein strikes northeast, dips

to the southeast at approximately 48° and has been traced for ~330 metres along strike and ~290 metres down dip. Refer to the Company's

news releases dated July 13, 2023, and May 19, 2022, for previous drillhole results from Copala 2.

To date, Vizsla has completed ~89,800 m of its fully

funded 90,000 m 2023 drill program.

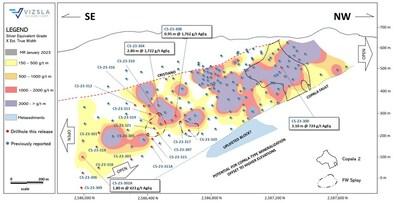

Figure 2: Inclined longitudinal section for Copala

structure with drillhole pierce points. The section is 1x along strike to 1.4x along the dip to compensate for the average 46-degree dip

of Copala. The black dash outlines represent Copala 2 in the north and the footwall vein (FW Splay) in the south. (CNW Group/Vizsla Silver

Corp.)

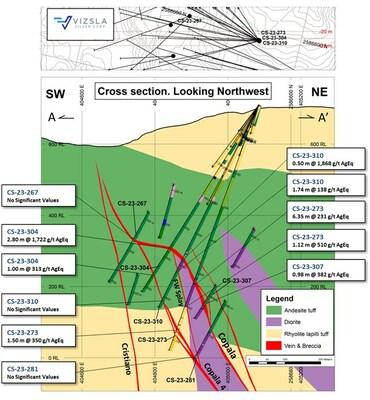

Figure 3: Cross section showing Copala structure,

FW Splay, Copala 4 and Cristiano veins with completed drilling. (CNW Group/Vizsla Silver Corp.)

Figure 4: Inclined longitudinal section for Copala

2 structure with drillhole pierce points. The section is 1x along strike to 1.18x along the dip to compensate for the average 48-degree

dip of Copala 2. (CNW Group/Vizsla Silver Corp.)

Figure 5: Cross section showing Copala, Copala 2 and

Tajitos veins with completed drilling. (CNW Group/Vizsla Silver Corp.)

| Drillhole |

From |

To |

Downhole

Length |

Estimated

True width |

Ag |

Au |

AgEq |

Vein |

|

|

| |

|

| (m) |

(m) |

(m) |

(m) |

(g/t) |

(g/t) |

(g/t) |

|

|

| CS-23-300 |

148.10 |

150.00 |

1.90 |

1.73 |

247 |

2.28 |

385 |

Copala |

|

|

| CS-23-300 |

180.00 |

183.40 |

3.40 |

3.10 |

519 |

3.57 |

724 |

Copala |

|

|

| Includes |

182.30 |

183.40 |

1.10 |

1.00 |

1,255 |

8.61 |

1,749 |

|

|

|

| CS-23-300 |

276.70 |

278.10 |

1.40 |

1.25 |

190 |

0.69 |

221 |

Copala 2 |

|

|

| CS-23-301 |

No significant values |

Copala |

|

|

| CS-23-302A |

667.90 |

669.95 |

2.05 |

1.80 |

355 |

1.41 |

423 |

Copala |

|

|

| CS-23-303 |

No significant values |

Copala |

|

|

| CS-23-304 |

468.00 |

471.30 |

3.30 |

2.80 |

1,366 |

6.80 |

1,722 |

Copala |

|

|

| Includes |

468.85 |

469.50 |

0.65 |

0.55 |

5,320 |

25.20 |

6,618 |

FW Splay |

|

|

| CS-23-304 |

No significant values |

FW Splay |

|

|

| CS-23-304 |

560.80 |

561.95 |

1.15 |

1.00 |

249 |

1.23 |

313 |

Copala 4 |

|

|

| CS-23-305 |

No significant values |

Copala |

|

|

| CS-23-305 |

660.00 |

661.00 |

1.00 |

0.63 |

341 |

1.09 |

387 |

FW Splay |

|

|

| CS-23-306 |

No significant values |

Copala |

|

|

| CS-23-307 |

608.10 |

609.25 |

1.15 |

0.98 |

287 |

1.72 |

382 |

Copala |

|

|

| CS-23-307 |

No significant values |

FW Splay |

|

|

| CS-23-308 |

531.40 |

532.40 |

1.00 |

0.95 |

387 |

20.00 |

1,762 |

Copala |

|

|

| CS-23-308 |

537.00 |

538.50 |

1.50 |

1.41 |

846 |

0.76 |

824 |

Copala |

|

|

| CS-23-309 |

No significant values |

Copala |

|

|

| CS-23-310 |

485.45 |

485.95 |

0.50 |

0.50 |

1,455 |

7.71 |

1,868 |

Copala |

|

|

| CS-23-310 |

517.75 |

520.50 |

2.75 |

1.74 |

89 |

0.81 |

138 |

FW Splay |

|

|

| CS-23-310 |

No significant values |

Copala 4 |

|

|

| CS-23-311A |

No significant values |

Copala |

|

|

| CS-23-312 |

No significant values |

Copala |

|

|

| CS-23-312 |

591.95 |

593.35 |

1.40 |

1.05 |

138 |

0.53 |

163 |

Cristiano |

|

|

| CS-23-313 |

485.50 |

486.00 |

0.50 |

0.45 |

442 |

2.14 |

553 |

Copala |

|

|

| CS-23-314 |

665.65 |

666.25 |

0.60 |

0.50 |

94 |

1.00 |

156 |

Copala |

|

|

| CS-23-315 |

No significant values |

Copala |

|

|

| CS-23-316 |

552.85 |

553.65 |

0.80 |

0.75 |

23 |

2.81 |

219 |

Copala |

|

|

| CS-23-317 |

No significant values |

Copala |

|

|

| CS-23-317 |

No significant values |

FW Splay |

|

|

| CS-23-318 |

748.55 |

750.95 |

2.40 |

1.95 |

205 |

0.86 |

247 |

Copala |

|

|

| CS-23-319 |

587.90 |

589.30 |

1.40 |

1.30 |

427 |

1.70 |

508 |

Copala |

|

|

| CS-23-319 |

606.40 |

606.75 |

0.35 |

0.27 |

626 |

3.61 |

824 |

FW Splay |

|

|

| CS-23-320 |

No significant values |

Copala |

|

|

| CS-23-320 |

661.15 |

663.50 |

2.35 |

1.30 |

479 |

2.28 |

596 |

FW Splay |

|

|

| CS-23-321 |

No significant values |

Copala |

|

|

| CS-23-321 |

654.00 |

655.50 |

1.50 |

0.99 |

631 |

6.29 |

1,018 |

FW Splay |

|

|

| Note: AgEq = Ag g/t x Ag rec. + (Au g/t x Au Rec x Au price/gram)/Ag price/gram. Metal price assumptions are $24.00/oz silver and $1,800/oz gold and metallurgical recoveries assumed are 91% for silver and 94% for gold. Gold and silver metallurgical recoveries used in this release are from metallurgical test results of the Copala vein (see press release dated August 16, 2023). |

Table 1: Downhole drill intersections from

the holes reported for Copala structure Copala 2, FW Splay and Copala 4 veins.

| Drillhole |

Easting |

Northing |

Elevation |

Azimuth |

Dip |

Depth |

| CS-23-300 |

404,674 |

2,587,217 |

533 |

290.0 |

-35.0 |

411.0 |

| CS-23-301 |

405,260 |

2,586,248 |

666 |

253.1 |

-60.2 |

648.0 |

| CS-23-302A |

405,440 |

2,586,177 |

637 |

253.3 |

-58.0 |

717.0 |

| CS-23-303 |

405,399 |

2,586,492 |

633 |

251.7 |

-59.7 |

810.0 |

| CS-23-304 |

405,081 |

2,586,569 |

714 |

260.6 |

-57.3 |

618.0 |

| CS-23-305 |

405,275 |

2,586,500 |

678 |

267.1 |

-56.7 |

738.0 |

| CS-23-306 |

405,440 |

2,586,177 |

637 |

251.2 |

-65.4 |

857.8 |

| CS-23-307 |

405,273 |

2,586,490 |

680 |

277.8 |

-56.9 |

677.4 |

| CS-23-308 |

405,086 |

2,586,574 |

696 |

284.3 |

-61.9 |

652.0 |

| CS-23-309 |

405,441 |

2,586,177 |

637 |

250.0 |

-72.0 |

885.0 |

| CS-23-310 |

405,086 |

2,586,574 |

696 |

259.8 |

-63.3 |

633.0 |

| CS-23-311A |

405,276 |

2,586,489 |

677 |

271.5 |

-63.0 |

798.0 |

| CS-23-312 |

405,119 |

2,586,386 |

646 |

268.7 |

-51.8 |

622.5 |

| CS-23-313 |

405,086 |

2,586,573 |

709 |

245.8 |

-62.6 |

624.0 |

| CS-23-314 |

405,411 |

2,586,260 |

639 |

254.9 |

-55.7 |

750.0 |

| CS-23-315 |

405,276 |

2,586,490 |

677 |

271.0 |

-60.0 |

777.0 |

| CS-23-316 |

405,086 |

2,586,573 |

710 |

242.2 |

-54.0 |

676.5 |

| CS-23-317 |

405,086 |

2,586,572 |

710 |

293.8 |

-64.0 |

666.0 |

| CS-23-318 |

405,412 |

2,586,261 |

641 |

255.0 |

-62.5 |

809.0 |

| CS-23-319 |

405,276 |

2,586,490 |

637 |

268.9 |

-51.1 |

730.5 |

| CS-23-320 |

405,086 |

2,586,573 |

709 |

303.4 |

-64.9 |

723.0 |

| CS-23-321 |

405,276 |

2,586,490 |

677 |

274.0 |

-53.7 |

718.5 |

Table 2: Drillhole details for the reported

drillholes. Coordinates in WGS84, Zone 13.

About the Panuco project

The newly consolidated Panuco silver-gold project

is an emerging high-grade discovery located in southern Sinaloa, Mexico, near the city of Mazatlán. The 7,189.5-hectare, past producing

district benefits from over 86 kilometres of total vein extent, 35 kilometres of underground mines, roads, power, and permits.

The district contains intermediate to low sulfidation

epithermal silver and gold deposits related to siliceous volcanism and crustal extension in the Oligocene and Miocene. Host rocks are

mainly continental volcanic rocks correlated to the Tarahumara Formation.

The Panuco Project hosts an estimated in-situ indicated

mineral resource of 104.8 Moz AgEq and an in-situ inferred resource of 114.1 Moz AgEq. An updated NI 43-101 technical report titled "Technical

Report on the Mineral Resource Estimate Update for the Panuco Ag-Au-Pb-Zn Project, Sinaloa State, Mexico" was filed on SEDAR on March

10, 2023, with an effective date of January 19, 2023 was prepared by Allan Armitage, Ph.D., P.Geo., Ben Eggers, MAIG, P.Geo.

and Yann Camus, P.Eng. of SGS Geological Services.

About Vizsla Silver

Vizsla Silver is a Canadian mineral exploration and

development company headquartered in Vancouver, BC, focused on advancing its flagship, 100%-owned Panuco silver-gold project located in

Sinaloa, Mexico. To date, Vizsla has completed over 310,000 metres of drilling at Panuco leading to the discovery of several new high-grade

veins. For 2023, Vizsla has budgeted +90,000 metres of resource/discovery-based drilling designed to upgrade and expand the mineral resource,

as well as test other high priority targets across the district.

Quality Assurance / Quality Control

Drill core and rock samples were shipped to ALS Limited

in Zacatecas, Zacatecas, Mexico and in North Vancouver, Canada for sample preparation and for analysis at the ALS laboratory in North

Vancouver. The ALS Zacatecas and North Vancouver facilities are ISO 9001 and ISO/IEC 17025 certified. Silver and base metals were

analyzed using a four-acid digestion with an ICP finish and gold was assayed by 30-gram fire assay with atomic absorption ("AA")

spectroscopy finish. Over limit analyses for silver, lead and zinc were re-assayed using an ore-grade four-acid digestion with AA finish.

Control samples comprising certified reference samples,

duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance

/ quality control protocol.

Qualified Person

In accordance with NI 43-101, Martin Dupuis, P.Geo.,

COO, is the Qualified Person for the Company and has reviewed and approved the technical and scientific content of this news release.

Information Concerning Estimates of Mineral Resources

The scientific and technical information in this news

release was prepared in accordance with NI 43-101 which differs significantly from the requirements of the U.S. Securities and Exchange

Commission (the "SEC"). The terms "measured mineral resource", "indicated mineral resource" and "inferred

mineral resource" used herein are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum

Standards (the "CIM Definition Standards"), which definitions have been adopted by NI 43-101. Accordingly, information contained

herein providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public

by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder.

You are cautioned not to assume that any part or all

of mineral resources will ever be converted into reserves. Pursuant to CIM Definition Standards, "inferred mineral resources"

are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence

and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral

resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve.

However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with

continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility

studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically

or legally mineable. Disclosure of "contained ounces" in a resource is permitted disclosure under Canadian regulations; however,

the SEC normally only permits issuers to report mineralization that does not constitute "reserves" by SEC standards as in place

tonnage and grade without reference to unit measures.

Canadian standards, including the CIM Definition Standards

and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining

disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the "SEC Modernization

Rules"), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace

the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization

Rules, the SEC now recognizes estimates of "measured mineral resources", "indicated mineral resources" and "inferred

mineral resources". Information regarding mineral resources contained or referenced herein may not be comparable to similar information

made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be "substantially

similar" to the CIM Definition Standards, readers are cautioned that there are differences between the SEC Modernization Rules and

the CIM Definitions Standards. Accordingly, there is no assurance any mineral resources that the Company may report as "measured

mineral resources", "indicated mineral resources" and "inferred mineral resources" under NI 43-101 would be the

same had the Company prepared the resource estimates under the standards adopted under the SEC Modernization Rules.

Website: www.vizslasilvercorp.ca

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy

of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward-Looking

Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward-looking

information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe",

"estimate", "expect", "target", "plan", "forecast", "may", "would",

"could", "schedule" and similar words or expressions, identify forward-looking

statements or information. These forward-looking statements or information relate

to, among other things: the exploration, development, and production at Panuco, including plans for resource/discovery-based drilling,

designed to upgrade, and expand the maiden resource as well as test other high priority targets across the district.

Forward-looking

statements and forward-looking information relating to any future mineral production,

liquidity, enhanced value and capital markets profile of Vizsla Silver, future growth potential for Vizsla Silver and its business, and

future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based

on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes

are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other

things, the price of silver, gold, and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and

development; the estimated costs of development of exploration projects; Vizsla Silver's ability to operate in a safe and effective manner

and its ability to obtain financing on reasonable terms.

These statements reflect Vizsla Silver's respective

current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered

reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and

contingencies. Many factors, both known and unknown, could cause actual results, performance, or achievements to be materially different

from the results, performance or achievements that are or may be expressed or implied by such forward-looking

statements or forward-looking information and Vizsla Silver has made assumptions and estimates based on or related to many of these factors.

Such factors include, without limitation: the Company's dependence on one mineral project; precious metals price volatility; risks associated

with the conduct of the Company's mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on

the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain

insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate

sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining

projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects;

contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health

and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic

and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities;

employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the

Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks

of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers;

lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors"

in Vizsla Silver's management discussion and analysis. Readers are cautioned against attributing undue certainty to forward-looking

statements or forward-looking information. Although Vizsla Silver has attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Vizsla Silver

does not intend, and does not assume any obligation, to update these forward-looking

statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting

such statements or information, other than as required by applicable law.

SOURCE Vizsla Silver Corp.

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/November2023/27/c4040.html

%CIK: 0001796073

For further information: to sign-up to the mailing list, please contact:

Michael Konnert, President and Chief Executive Officer, Tel: (604) 364-2215, Email: info@vizslasilver.ca

CO: Vizsla Silver Corp.

CNW 08:00e 27-NOV-23

Vizsla Silver (AMEX:VZLA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Vizsla Silver (AMEX:VZLA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025