TIDMAAU

RNS Number : 4653L

Ariana Resources PLC

06 September 2023

6 September 2023

AIM: AAU

WESTERN TETHYAN - SLIVOVA POSITIVE PEA

Ariana Resources plc ("Ariana" or "the Company"), the AIM-listed

mineral exploration and development company with gold mining

interests in Europe, is pleased to announce that Western Tethyan

Resources Ltd ("WTR"), of which 75% is held by Ariana, has

completed a Preliminary Economic Assessment ("PEA") on the Slivova

Gold Project ("Slivova" or "the Project") in Kosovo, reported in

accordance with CIM guidelines and disclosed under NI43-101

reporting requirements. WTR executed a definitive Earn-In Agreement

with Avrupa Minerals Ltd (TSX-V: AVU) on the Project, and can earn

up to 85% by spending EUR1.8 million ("Earn-in")* and up to 85% on

completion of a Feasibility Study among other technical and

parallel work.

Highlights:

-- Slivova provides a conceptual pre-tax Net Present Value

("NPV") at 8% discount rate of US$27 million , and an internal rate

of return ("IRR") of 29% at a gold price of US$1,835/oz(#) .

-- Capital expenditure is estimated at US$33.4 million and

sustaining capital requirements of US$9.4 million are

envisaged.

-- Average production of 13,000 ounces of gold per annum

projected over a seven-year mine life from a combined open-pit and

underground mining operation is estimated from the study.

-- Gold recovery by the Carbon-in-Leach ("CIL") method, with

recovery of gold at 92-94.5% Au (based on current testwork) and a

processing rate of 142,000 tonnes per annum is estimated from the

study.

* WTR of which Ariana owns 75%, has yet to establish a net

attributable interest under the Earn-in.

# The full PEA report can be accessed via:

https://avrupaminerals.com/wp-content/uploads/2023/08/Slivova-NI-43-101-Technical-Report-2023.pdf

To read a pdf version of this announcement, please click here:

http://www.rns-pdf.londonstockexchange.com/rns/4653L_1-2023-9-5.pdf

Dr. Kerim Sener, Managing Director, commented:

"This is an excellent outcome for the Slivova Gold Project,

demonstrating its potential economics and highlighting

opportunities to enhance the project in the longer term. The

broader exploration potential of the Slivova project area, in

particular the opportunity to define further mineralisation

down-plunge of the existing orebody, bodes well for further

economic upside. We are now looking to complete further work to

demonstrate this upside, via a phased exploration programme, which

will target the definition of additional resources and further

investigate various aspects of the proposed mine design and

processing route, among other technical matters, in addition to

project-level environmental and social studies."

Mentor Demi, Managing Director of WTR, added:

" The PEA prepared by Bara Consulting provides strong evidence

that the Slivova Gold Project has the potential to develop into a

profitable gold mine of modest size, even if no additional

resources are identified. By showcasing compelling economic

viability, it also provides the basis for commencing the next phase

of detailed exploration and techno-economic studies. In conjunction

with the pre-established infill resources drill program, WTR is

commencing a trenching program to enhance exploration in the areas

bordering the primary resource zone, specifically targeting

Dzemailj and Valijevishte. Throughout Q4, the company intends to

initiate the Environmental Base Line Study, the Social Impact

Assessment, and complete the planning for a drilling program, with

the actual drilling activities scheduled to commence in the first

quarter (Q1) of 2024."

Paul W. Kuhn, President and CEO of Avrupa Minerals, added:

" We are delighted about the progress made at the Slivova Gold

Project by Western Tethyan Resources and associated company Ariana.

In the past two months, the Mineral Resource Estimate has been

updated, and a positive Preliminary Economic Assessment has been

completed by our partners. We look forward to seeing more positive

results from the upcoming Q4 2023/Q1 2024 work fieldwork program,

including trenching and drilling, the Q4 2023 initiation of an

Environmental Baseline Study, and continued, strong and proactive

ESG work in the project area. "

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

Introduction

The Slivova Gold-Silver Project ("the Project") is located some

30 km southeast of Pristina, the capital of Kosovo. The Project was

acquired by AVU Kosova, a wholly owned subsidiary of Avrupa

Minerals ("Avrupa"), which was granted a seven-year exploration

licence for the Project in 2022. In May 2023, Western Tethyan

Resources Ltd ("Western Tethyan", "WTR" or "the Company") executed

an earn-in agreement with Avrupa, in which WTR can earn-in up to

85% of the project.

Bara Consulting Limited ("Bara") was engaged by WTR to prepare a

Preliminary Economic Assessment ("PEA") for Slivova. The study

comprised the updated Mineral Resource Estimate (announced

separately on 17 July 2023) and mining and tailings management

assessments, which were used as inputs into a concept-level

techno-economic evaluation prepared in accordance with CIM

guidelines and disclosed in accordance with NI 43-101 reporting

requirements.

Project Location

The Slivova Project exploration licence is located along the

Vardar Trend, approximately 30 km (30 minutes by car) southeast of

Pristina, the capital city of Kosovo. Access to the Project is via

the Pristina-to-Gjilan, two-lane highway and then an unsealed road

beyond the village of Peshter.

There are four main exploration targets within the Slivova

licence: Peshter, Dzemail, Valjeviste, and Brus. The Peshter

prospect is further subdivided into three portions: the Main

Gossan, Gossan Extension, and the Sandstone Gossan. The Peshter

prospect is the main subject of the PEA, for which there is

material disclosure (Figure 1).

Figure 1: The Slivova deposit (Peshter Target), and its

associated license boundary.

Project Geology

Within the Slivova licence, two units are identified: the

calcareous unit and the non-calcareous greywacke unit. They are

moderately to steeply dipping, northwest striking, and beyond the

mineralised prospects, tend to be unaltered and weakly to

moderately oxidised.

Two types of intrusive dykes and sills were identified in the

mapping and drilling: hornblende-biotite porphyry dykes and stock

and a feldspar porphyry dyke. The dykes represent less than 3% of

the total rock volume within the Main Gossan, with the

hornblende-biotite porphyry representing 99.5% of the intrusive

rocks. Within the Gossan Extension, the hornblende-biotite porphyry

is represented by a greater volume of rock and may be a series of

northeast-trending dykes, or a larger stock.

Economic mineralisation in the Main Gossan and Gossan Extension

is concentrated in the calcareous pebble conglomerate and

calcareous sandstones. Mineralisation at Slivova is classified as a

distal, intrusive-related, stratiform, massive to disseminated

gold-silver-lead-zinc deposit. The principal minerals of economic

interest are gold with minor amounts of galena, sphalerite,

chalcopyrite and silver. The gangue mineral assemblage consists of

ilvaite(?), trace magnetite, arsenopyrite, pyrrhotite, marcasite,

pyrite, quartz and various carbonates. Trace elements include

arsenic, bismuth, chromium, manganese, nickel, and vanadium.

Mineral Resources

The Mineral Resource Estimate, as previously announced, has an

effective date of 22 June 2023. The Mineral Resource Estimate for

Slivova is reported in Table 1, which was completed on 14 July

2023, based on the block model shown in Figure 2. No estimates of

Mineral Reserves have been prepared. Mineral Resources are not

Mineral Reserves and do not have demonstrated economic viability.

The estimate of Mineral Resources may be materially affected by

environmental, permitting, legal, title, taxation, socio-political,

marketing, or other relevant issues. The Qualified Person is not

aware of any such issues at the time of writing.

Figure 2: Oblique view of the block model showing the estimated

gold grades. WGS84 Z34N.

Table 1: Estimated Mineral Resources for Slivova. Numbers are

rounded to an appropriate number of significant figures and as such

discrepancies may exist between individual values, products and

totals.

Category Tonnes Bulk Density AuEq Au Ag Au Ag

(g/t) (g/t) (g/t) (oz) (oz)

---------- ------------- ------- ------- ------- -------- ========

Total Mineral Resources (Gross to the Project)

Measured 835,000 2.9 4.3 4.2 15 113,000 402,000

=========== ========== ============= ======= ======= ======= ======== ========

Indicated 296,000 2.8 3.6 3.5 15 33,200 144,000

=========== ========== ============= ======= ======= ======= ======== ========

Meas

+ Ind 1,130,000 2.9 4.1 4.0 15 146,000 546,000

=========== ========== ============= ======= ======= ======= ======== ========

Inferred 250,000 2.8 3.7 3.7 13 30,000 100,000

----------- ---------- ------------- ------- ------- ------- -------- ========

Open Pit Resources Above 0.5g/t AuEq

Measured 110,000 2.9 3.2 3.2 14 11,200 48,300

=========== ========== ============= ======= ======= ======= ======== ========

Indicated 39,300 2.6 2.8 2.7 13 3,390 16,500

=========== ========== ============= ======= ======= ======= ======== ========

Meas

+ Ind 150,000 2.8 3.1 3.0 13 14,600 64,800

=========== ========== ============= ======= ======= ======= ======== ========

Inferred nil nil nil nil nil nil nil

----------- ---------- ------------- ------- ------- ------- -------- ========

Underground Resources Above 1.5g/t AuEq

Measured 725,000 2.9 4.4 4.4 15 102,000 354,000

=========== ========== ============= ======= ======= ======= ======== ========

Indicated 257,000 2.9 3.7 3.6 15 29,800 127,000

=========== ========== ============= ======= ======= ======= ======== ========

Meas

+ Ind 982,000 2.9 4.2 4.2 15 131,000 481,000

=========== ========== ============= ======= ======= ======= ======== ========

Inferred 250,000 2.8 3.7 3.7 13 30,000 100,000

----------- ---------- ------------- ------- ------- ------- -------- --------

Notes to the Mineral Resource Estimate (1-9):

1. The independent Qualified Person responsible for Mineral

Resource disclosure, as defined by NI 43-101, is Mr. Richard

Siddle, MSc, MAIG, of Addison Mining Services Ltd. The effective

date of the Mineral Resource Estimate is 22 June 2023.

2. Mineral Resources are not Mineral Reserves and do not have

demonstrated economic viability. There is no certainty that all or

any part of the Mineral Resource will be converted to Mineral

Reserves.

3. A gold equivalent (AuEq) grade was calculated for each block

using the formula AuEq = (Ag g/t x 0.05) + Au g/t. It is the

opinion of the Qualified Person that all elements included in the

Au Equivalent calculation have a reasonable prospect of being

recovered and sold, the calculation of the Au equivalent value

considers the relative recovery and payability of each element

(recovery by cyanide leaching of 93.4% for gold and 50% for silver

and 95% and 85% payability, respectively, as informed by

metallurgical test work completed to date) as well as the assumed

commodity prices.

4. Reasonable prospects of eventual economic extraction are

satisfied by the estimation of break-even cut-off grades for each

anticipated mining scenario (0.5g/t AuEq for open pit and 1.5g/t

AuEq for underground mining). These cut-off grades were used to

report the Mineral Resource. The cut-off grades were estimated on

the basis of the following assumptions: a gold price of US$1850/oz

(selected following consideration of (1, 2 and 3 year trailing

average LMBA gold price and LMBA 2023 average forecast gold price,

a silver price of US$20/oz, underground mining costs of US$43.7/t,

processing costs (including tailings disposal) of US$29.5/t and

G&A costs of US$3/ROMt.

5. Estimates in the above table have been rounded to three

significant figures for Measured and Indicated Resources and two

significant figures for Inferred Mineral Resources.

6. CIM Definition Standards for Mineral Resources have been followed.

7. The independent Qualified Person for Resources is not aware

of any additional known environmental, permitting, legal, title,

taxation, socio-political, marketing, or other relevant issues that

could materially affect the Mineral Resource Estimate.

8. The Mineral Resource figures set out above are quoted gross

with respect to the Project. WTR of which Ariana owns 75%, has yet

to establish a net attributable interest under the Earn-in and

accordingly, no separate net attributable figures are reported.

9. Western Tethyan Resources is the operator of Slivova.

Mine Design

A revised approach to the mining of Slivova involves a small

starter pit to access the outcropping mineralised gossan area,

followed by underground extraction of the gold resource below the

open pit at an appropriate extraction rate to suit the size and

grade of the deposit. Mine design involved a more detailed analysis

of the potential mining method and a mineable stope optimisation

exercise to fully assess and define the underground stoping

extents.

A geotechnical review was undertaken to validate extraction

methods. Ore zones and host rocks are either non-calcareous or

calcareous sequences of altered sedimentary rocks with ore zone

strengths varying between 45 MPa and 50 Mpa. Mine design was

adapted to be flexible to varying competencies of host rock,

particularly in the contact areas.

The starter pit is designed to be mined from the top bench

downwards with ore being accessible and extracted immediately,

i.e., there is no requirement or need for any pre-stripping. It has

been assumed that this small open pit can be mined by local

contractors who have quarries within the vicinity of the proposed

mine at Slivova. The revised starter pit design is also situated

such that there is now no requirement for stream re-alignment where

the pit can be accessed for initial extraction via existing tracks

on the north side of the stream. Pit extents minimise the impact on

the surrounding countryside and local communities.

Due to the requirement for a 25 m crown pillar the bottom bench

was modified to a base of 865 mRL. Bench access was linked into the

existing tracks and roads on the site. This allows for easy access

to each bench for overburden and ore removal without the need for

any ramps. The access to the bottom bench is directly in from

topography, with pit operations ceasing after Year 1.

Underground access is envisaged as a portal developed directly

into the south valley wall, supporting mining typically by sublevel

open stoping, unless ore zone geometry dictates a step down to

cut-and-fill methods. Main sublevels are 20 m, with stoping

separated 25 m from the open pit bottom by a crown pillar which

will be mined by sublevel caving methods at the end of mine

life.

Mining is suggested to be via small teams of approximately 16

people per shift, using small diesel fleet appropriate for

production at between 300 t/day and 400 t/day. Mined material to be

trammed directly from underground operations through the portal to

the primary crusher tip located at the plant site on the saddle of

the southern ridge 500 m to the east.

Recovery Methods

Results of extensive characterisation and testing of the Slivova

ore by a range of methods suggest that treatment would be via

carbon-in-leach ("CIL") methods, delivering gold recovery of

92-94.5% and silver recovery of 19.8-22.5%. Some gold may be

extracted via gravity recovery methods. Nominal plant throughput

will be 142,000 tpa, with primary, secondary, and tertiary crushing

of the ore, followed by ball milling to 106 m m and leaching of the

ore by CIL methods. Loaded carbon is stripped, with electrowinning

and final EAF smelting of the dore to bullion on site.

Environmental

The environmental and social work completed to date is in line

with that required for the PEA based on the revised mining plan. No

environmental or social fatal flaws have been identified and Bara

is not aware of any environmental or social issue that would

prevent the project from proceeding to the PFS phase, during which

time various potential environmental risks would need to be

evaluated further.

Economic Analysis

The economic analysis presented here is preliminary in nature

and is based in part on Inferred Mineral Resources that are

considered too speculative geologically to have the economic

considerations applied to them that would enable them to be

categorised as Mineral Reserves. There is therefore no certainty

that the PEA presented here will be realised.

PEA level economic analysis is based on the production schedule

presented with capital and operating cost estimates for the Slivova

Project and other information as of July 2023. The discounted

cashflow analysis ("DCF") is presented in United States Dollars

(US$) in real money terms, free of escalation or inflation. Revenue

has been determined through application of the recovered troy

ounces produced by Slivova to the gold and silver prices as stated,

less payability.

Depreciation has been calculated on the assumption of that 100%

of capital expenditure may be deducted from profits in the year

that they are incurred (Deductibility Rate). It is assumed that all

capital expenditure is eligible for deduction. A discount rate of

8% has been used for the evaluation and no tax treatment has been

applied.

The conceptual DCF analysis shows the Project is economic with a

pre-tax NPV, at 8% discount rate of US$27 million, and an internal

rate of return ("IRR") of 29% with upfront capital requirements of

$33.4 million, and sustaining capital requirements of $9.4

million.

About Western Tethyan Resources

Western Tethyan Resources Ltd ("WTR") is a UK-registered,

mineral exploration and development company focused on South East

Europe. The company has a strategic alliance with Newmont

Corporation and Ariana Resources and is currently focused on

exploration for major copper-gold deposits in the Lecce Magmatic

Complex and Vardar Belt. The company is assessing several other

exploration project opportunities across Eastern Europe, targeting

major copper-gold deposits across the porphyry-epithermal

transition.

For further information on Western Tethyan Resources you are

invited to visit the Company's website at

www.westerntethyanresources.com

About Avrupa Minerals Ltd

Avrupa Minerals Ltd. is a growth-oriented junior exploration and

development company directed to discovery of mineral deposits,

using a hybrid prospect generator business model. The company holds

one 100%-owned license in Portugal, the Alvalade VMS Project,

presently optioned to Sandfire MATSA in an earn-in joint venture

agreement. The company now holds one 100%-owned exploration license

covering the Slivova gold prospect in Kosovo and is actively

advancing four prospects in central Finland through the recently

announced acquisition of Akkerman Finland Oy. Avrupa focuses its

project generation work in politically stable and prospective

regions of Europe, presently including Portugal, Finland and

Kosovo. The company continues to seek and develop other

opportunities around Europe.

Contacts:

Ariana Resources plc Tel: +44 (0) 20 7407 3616

Michael de Villiers, Chairman

Kerim Sener, Managing Director

Beaumont Cornish Limited (Nominated Tel: +44 (0) 20 7628 3396

Adviser)

Roland Cornish / Felicity Geidt

Panmure Gordon (UK) Limited (Joint Tel: +44 (0) 20 7886 2500

Broker)

John Prior / Hugh Rich / Atholl

Tweedie

WHIreland Limited (Joint Broker) Tel: +44 (0) 207 2201666

Harry Ansell / Katy Mitchell / George

Krokos Tel: +44 (0) 7983 521 488

Yellow Jersey PR Limited (Financial

PR)

Dom Barretto / Shivantha Thambirajah arianaresources@yellowjerseypr.com

/

Bessie Elliot

Editors' Note:

The independent Qualified Person for the disclosure of the

Preliminary Economic Assessment as defined by NI 43-101 is Dr.

Andrew Bamber, BSc, MASc, PhD, P.Eng. of Bara Consulting Limited.

Dr. Bamber has reviewed and approved the scientific and technical

content of this news release, in the form and context in which it

appears. Dr. Bamber completed a site visit to the project on 15

February 2023 and inspected the property, core samples and visited

locations relevant to the project including the gossan outcrop and

potential access road, process plant and tailings sites within the

licence area.

About Ariana Resources:

Ariana is an AIM-listed mineral exploration and development

company with an exceptional track-record of creating value for its

shareholders through its interests in active mining projects and

investments in exploration companies. Its current interests include

gold production in Turkey and copper-gold exploration and

development projects in Cyprus and Kosovo.

The Company holds 23.5% interest in Zenit Madencilik San. ve

Tic. A.S. a joint venture with Ozaltin Holding A.S. and Proccea

Construction Co. in Turkey which contains a depleted total of c.

2.1 million ounces of gold and other metals (as at February 2022).

The joint venture comprises the Kiziltepe Mine and the Tavsan and

Salinbas projects.

The Kiziltepe Gold-Silver Mine is located in western Turkey and

contains a depleted JORC Measured, Indicated and Inferred Resource

of 222,000 ounces gold and 3.8 million ounces silver (as at

February 2022). The mine has been in pro table production since

2017 and is expected to produce at a rate of c.20,000 ounces of

gold per annum to at least the mid-2020s. A Net Smelter Return

("NSR") royalty of 2.5% on production is being paid to

Franco-Nevada Corporation.

The Tavsan Gold Mine is located in western Turkey and contains a

JORC Measured, Indicated and Inferred Resource of 307,000 ounces

gold and 1.1 million ounces silver (as at November 2022). Following

the approval of its Environmental Impact Assessment and associated

permitting, Tavsan is being developed as the second gold mining

operation in Turkey. Construction progress is temporarily suspended

pending the outcome of a local court decision pertaining to the

EIA. A NSR royalty of up to 2% on future production is payable to

Sandstorm Gold.

The Salinbas Gold Project is located in north-eastern Turkey and

contains a JORC Measured, Indicated and Inferred Resource of 1.5

million ounces of gold (as at July 2020). It is located within the

multi-million ounce Artvin Gold eld, which contains the "Hot Gold

Corridor" comprising several signi cant gold- copper projects

including the 4 million ounce Hot Maden project, which lies 16km to

the south of Salinbas. A NSR royalty of up to 2% on future

production is payable to Eldorado Gold Corporation.

Ariana owns 100% of Australia-registered Asgard Metals Fund

("Asgard"), as part of the Company's proprietary Project Catalyst

Strategy. The Fund is focused on investments in high-value

potential, discovery-stage mineral exploration companies located

across the Eastern Hemisphere and within easy reach of Ariana's

operational hubs in Australia, Turkey and the UK.

Ariana owns 75% of UK-registered Western Tethyan Resources Ltd

("WTR"), which operates across south-eastern Europe and is based in

Pristina, Republic of Kosovo. The company is targeting its

exploration on major copper-gold deposits across the

porphyry-epithermal transition. WTR is being funded through a

ve-year Alliance Agreement with Newmont Corporation

(www.newmont.com) and is separately earning-in to 85% of the

Slivova Gold Project.

Ariana owns 58% of UK-registered Venus Minerals Ltd ("Venus")

which is focused on the exploration and development of copper-gold

assets in Cyprus which contain a combined JORC Indicated and

Inferred Resource of 17Mt @ 0.45% to 1.10% copper (excluding

additional gold, silver and zinc.

Panmure Gordon (UK) Limited and WH Ireland Limited are brokers

to the Company and Beaumont Cornish Limited is the Company's

Nominated Adviser.

For further information on Ariana, you are invited to visit the

Company's website at www.arianaresources.com .

Glossary of Technical Terms:

"Ag" chemical symbol for silver;

"Au" chemical symbol for gold;

"AuEq" gold equivalent;

"CIM" Canadian Institute of Mining, Metallurgy and

Petroleum;

"cut-off grade" the lowest grade, or quality, of mineralised

material that qualifies as economically mineable and available in a

given deposit. May be defined on the basis of economic evaluation,

or on physical or chemical attributes that define an acceptable

product specification;

"g/t" grams per tonne;

"Indicated Resource" a part of a mineral resource for which

tonnage, densities, shape, physical characteristics, grade and

mineral content can be estimated with a reasonable level of

confidence. It is based on exploration, sampling and testing

information gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes. The

locations are too widely or inappropriately spaced to confirm

geological and/or grade continuity but are spaced closely enough

for continuity to be assumed;

"Inferred Resource" a part of a mineral resource for which

tonnage, grade and mineral content can be estimated with a low

level of confidence. It is inferred from geological evidence and

has assumed, but not verified, geological and/or grade continuity.

It is based on information gathered through appropriate techniques

from locations such as outcrops, trenches, pits, workings and drill

holes that may be limited or of uncertain quality and

reliability;

"Inverse Distance Weighted Squared" or "IDWS" or "ID2" a

conventional mathematical method used to calculate the attributes

of mineral resources. Near sample points provide a greater

weighting than samples further away for any given resource

block;

"JORC" the Joint Ore Reserves Committee;

"JORC 2012" is the current edition of the JORC Code, which was

published in 2012. After a transition period, the 2012 Edition came

into mandatory operation in Australasia from 1 December 2013;

"m" Metres;

"Measured Resource" a part of a Mineral Resource for which

tonnage, densities, shape, physical characteristics, grade and

mineral content can be estimated with a high level of confidence.

It is based on detailed and reliable exploration, sampling and

testing information gathered through appropriate techniques from

locations such as outcrops, trenches, pits, workings and

drillholes. The locations are spaced closely enough to confirm

geological and grade continuity;

"mIK" Median Indicator Kriging;

"MRE" Mineral Resource Estimate;

"Mt" million tonnes;

"NI 43-101" the Canadian National Instrument 43-101. This is the

national instrument for the Standards of Disclosure for Mineral

Projects within Canada or reported on the TSX (Toronto Stock

Exchange);

"oz" Troy ounces;

"ROMt" run of mill tonnes;

"SE" standard error statistic;

"t/m(3) " tonnes per cubic metre.

Ends.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPUAPBUPWGAA

(END) Dow Jones Newswires

September 06, 2023 02:00 ET (06:00 GMT)

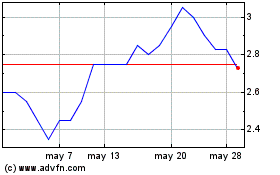

Ariana (AQSE:AAU.GB)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Ariana (AQSE:AAU.GB)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025