TIDMABDP

RNS Number : 0996R

AB Dynamics PLC

04 March 2021

4 March 2021

AB Dynamics plc

("AB Dynamics", the "Company" or the "Group")

Acquisition of Vadotech Group

AB Dynamics (AIM: ABDP), the designer, manufacturer and supplier

of advanced testing systems and measurement products to the global

automotive market, is pleased to announce that, after thorough due

diligence, it has completed the acquisition of Vadotech Pte Ltd and

Zynit Pte Ltd (collectively "Vadotech Group") for total cash

consideration of up to EUR26.0 million (the "Acquisition").

Founded in 1997 and with 140 employees, the Vadotech Group is a

leading supplier of testing services in the Asia Pacific region,

headquartered in Singapore with key operations in China, Germany

and Japan. Vadotech Group provides comprehensive automotive testing

services including evaluations of ADAS systems, infotainment,

connectivity, electric vehicle performance and charging and other

associated functions. The business has long standing relationships

with German automotive OEMs, providing vehicle testing services to

local operations, underpinned by long term customer framework

agreements. Their primary operation is based in Beijing, China

where they have a 60,000ft(2) testing centre with a wide range of

testing capabilities.

Rationale for the Acquisition

The Acquisition supports a number of the Group's stated

strategic priorities including:

-- Expanding the Company's international footprint by providing

a sales and technical facility in the strategically important

Chinese market;

-- Establishing a new Asia Pacific divisional operating hub in

Singapore to manage the territory, drive additional cross selling

of Group products in the region and identify and deliver further

strategically important growth initiatives;

-- Further increasing the Group's visibility of future revenue

as Vadotech Group sales are supported by long term customer

framework agreements;

-- Increasing the range of services provided by the Group to

include full vehicle assessments including quality assurance

testing and support to new vehicle R&D programmes;

-- Establishing an electric vehicle and e-mobility technology training centre in Germany; and

-- Opportunity to replicate the Vadotech Group business model in

other territories such as Europe and the USA

Financial Considerations

The Acquisition has been completed on a cash free, debt free

basis for an initial cash consideration of EUR17.0 million, funded

from the Company's existing cash resources. Two further conditional

cash payments of up to EUR3.0 million and EUR6.0 million are

subject to certain performance criteria being achieved for the year

ended 31 December 2020 and the year ending 31 December 2021,

respectively. The Vadotech Group is being acquired from its two

shareholders, Mr Frank Beuler and Mr Sebastian Rupprecht. Mr

Rupprecht will continue with the business as Managing Director and

Mr Beuler will continue to support the business for an initial

transition period.

The Vadotech Group has a strong record of profitable, and cash

generative growth. Based on unaudited accounts, in the year ended

31 December 2020 Vadotech Group generated sales revenue of EUR14.2

million (2019: EUR14.5 million), earnings before interest, tax,

depreciation and amortisation ('EBITDA') of EUR4.0 million (2019:

EUR4.7 million) and adjusted operating profit of EUR3.7 million

(2019: EUR4.2 million). Net assets at 31 December 2020 were EUR4.1

million.

The Acquisition provides a significantly larger physical

presence for AB Dynamics in Asia Pacific and the Group will invest

approximately GBP1.0 million in the integration to establish a

strong regional hub for the wider business. The Board expects that

the Acquisition will be modestly earnings enhancing in the current

year, with a more significant contribution in the first full year

and beyond.

Current trading and financial position

Trading conditions for the Group were as anticipated through the

latter part of the first half, with performance for the six months

ended 28 February 2021 in line with the Board's expectations. With

continued recovery from the disruption to customer testing

operations arising from the pandemic across the Group's major

territories, the Board remains confident in the Group's prospects

for the year. Cash generation has also continued to be positive,

with net cash at 28 February 2021 of GBP33.0 million (29 February

2020: GBP34.2 million, 31 August 2020: GBP30.0 million).

Dr James Routh, Chief Executive Officer, said:

"The Acquisition of Vadotech Group supports the Group's

strategic initiatives by broadening the scope of the Group's

product and services offering, further expanding our reach into new

strategically important territories and increasing the range of

testing services, which in turn increases visibility of future

revenue.

"Vadotech Group has an outstanding reputation for providing

excellence in full vehicle testing services to its German OEM

customer base and we look forward to expanding this further, both

within existing territories and into new attractive markets.

"We expect the Acquisition, together with the establishment of

the Asia Pacific divisional operating hub, to provide us with an

excellent platform for further growth and we are pleased to welcome

the Vadotech Group team to AB Dynamics."

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) ("MAR") prior to its release as part

of this announcement and is disclosed in accordance with the

Company's obligations under Article 17 of those Regulations.

The person responsible for arranging the release of this

information is Felicity Jackson, Company Secretary.

Enquiries:

AB Dynamics plc 01225 860 200

Dr James Routh, Chief Executive

Officer

Sarah Matthews-DeMers, Chief Financial

Officer

Peel Hunt LLP 0207 418 8900

Mike Bell

Ed Allsopp

Tulchan Communications 0207 353 4200

James Macey White

Matt Low

Laura Marshall

Appendix

Vadotech Pte Ltd is a service provider to Zynit Pte Ltd which

has the relationship with the end customer. The 31 December 2020

results of the acquired sub-groups are as follows:

EUR'm Zynit Pte Vadotech Pte Vadotech Group

Ltd Ltd

Revenue 12.9 1.3 14.2

---------- ------------- ---------------

Adjusted operating profit 4.2 (0.5) 3.7

---------- ------------- ---------------

Net assets 3.2 0.8 4.1

---------- ------------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFLFSAVAIVIIL

(END) Dow Jones Newswires

March 04, 2021 02:00 ET (07:00 GMT)

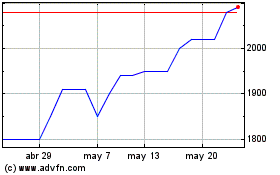

AB Dynamics (AQSE:ABDP.GB)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

AB Dynamics (AQSE:ABDP.GB)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025