TIDMIMM

RNS Number : 2513B

Immupharma PLC

30 September 2022

RNS: RELEASE | 30 SEPTEMBER 2022

ImmuPharma PLC

("ImmuPharma" or the "Company")

INTERIM RESULTS

for the six months ended 30 June 2022

ImmuPharma PLC (LSE:IMM) , ("ImmuPharma" or the "Company"), the

specialist drug discovery and development company, is pleased to

announce its interim results for the six months ended 30 June 2022

(the "Period").

Key Highlights (including post Period review)

Financials

-- Financial performance in line with expectations over the Period

o Loss for the Period of GBP1.7m (30 June 2021: GBP3.7m)

o Research and development expenses of GBP1.0m (30 June 2021:

GBP1.1m)

o Administrative expenses of GBP0.6m (30 June 2021: GBP0.9m)

o Share based expense of GBP0.1m (30 June 2021: GBP0.3m)

o Cash balance of GBP0.2m as at 30 June 2022 (31 December 2021:

GBP1.6m)

o Derivative financial asset of GBP0.6m as at 30 June 2022 (31

December 2021: GBP0.9m)

o Incanthera financial asset of GBP0.6m (GBP1.2m at 31 December

2021) and warrants financial asset of GBPNil (GBP0.2m at 31

December 2021)

o Basic and diluted loss per share of 0.58p (30 June 2021:

1.46p)

o Reorganisation of share capital structure in June 2022

o Successful fundraising in August 2022 raising GBP2.04m

(gross), including Lanstead subscription, placement and broker

option

o Total proceeds of GBP0.3m from exercise of share options by L1

Capital in August 2022 and in September 2022

'Autoimmunity': Lupuzor(TM) ("P140")

-- P140 Pharmokinetic ("PK") study successfully completed with

key endpoints met. P140 was safe and well tolerated across all

doses and in all subjects

-- FDA Type C written response received on 14 September 2022:

The FDA response was detailed and included significant guidance on

next steps for the clinical programme. This included advice on the

dosing regime and on study protocol that can be amended to improve

the regulatory outcome

-- The Company is currently reviewing the written response with

Avion and will make a further notification in due course

-- An adaptive Phase 2/3 clinical study protocol of P140 in CIDP

is being finalised for IND submission. Commercial partnering

discussions ongoing

'Anti-Infection'

-- BioAMB - further pre-clinical studies are in preparation

-- BioCin - further pre-clinical studies are in preparation

New website launched: www.immupharma.co.uk

Commenting on the statement and outlook, Tim McCarthy, CEO and

Chairman, said :

"The last six months have been pivotal for the Company,

positively concluding the PK study of Lupuzor(TM) ("P140") . Post

the recent written response from the FDA, in respect to the

Lupuzor(TM) Phase 3 protocol, we continue to have positive

discussions with our partner, Avion, on the way forward.

The new fundraising, supported by existing and new shareholders,

allows us to further invest in the other parts of our product

portfolio, whilst being focused on preserving cash where

required.

Moving forward, we remain focused on creating a robust and

successful Company that, with a diversity of assets, will build

future value for our shareholders.

The Board would like to take this opportunity to thank its

shareholders for their continued patience and support, as well as

its staff, corporate and scientific advisers and our partners

including, CNRS and Avion".

Market Abuse Regulation (MAR) Disclosure

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION

(WITHDRAWAL) ACT 2018, AS AMED. ON PUBLICATION OF THIS ANNOUNCEMENT

VIA A REGULATORY INFORMATION SERVICE, THIS INFORMATION IS

CONSIDERED TO BE IN THE PUBLIC DOMAIN.

For further information please contact:

ImmuPharma PLC (www.immupharma.co.uk) + 44 (0) 2072 062650

Tim McCarthy, Chief Executive Officer and Chairman

Lisa Baderoon, Head of Investor Relations + 44 (0) 7721 413496

SPARK Advisory Partners Limited (NOMAD)

Neil Baldwin +44 (0) 203 36 8 8974

Stanford Capital Partners (Joint Broker)

Patrick Claridge, John Howes +44 (0) 203 815 8880

SI Capital (Joint Broker)

Nick Emerson +44 (0) 1483 413500

A copy of the interim report is available on the Company's

website www.immupharma.co.uk

ImmuPharma plc

Chairman's Statement

INTERIM HIGHLIGHTS

The first half of 2022 up to the current date has seen a number

of key developments for ImmuPharma, including completion of

pharmacokinetic ("PK") study of Lupuzor(TM). In addition, in June

2022, our share capital structure has been reorganised and in

August 2022, we concluded a successful fundraising.

Lupuzor(TM)

The Board is confident that there are a number of routes to

market for Lupuzor(TM), including corporate collaborations. Such a

collaboration was successfully completed at the end of November

2019, resulting in a signed exclusive Trademark, License and

Development Agreement with Avion Pharmaceuticals ("Avion") in the

US. Positive discussions with a number of potential commercial

partners for Lupuzor(TM) in key territories outside of the US are

continuing.

Lupuzor(TM) and Avion Pharmaceuticals | Background

On 28 November 2019, ImmuPharma and Avion signed an exclusive

Trademark, License and Development Agreement for Lupuzor(TM), with

Avion agreeing to fund a new international Phase 3 trial and

commercialising Lupuzor(TM) in the US.

There have been many meetings following this agreement with both

Avion and the FDA, which have been highlighted in numerous

announcements.

As part of these discussions, the FDA requested that Avion and

ImmuPharma develop and validate a bioanalytical assay in order to

confirm the unique pharmacokinetic ("PK") profile of Lupuzor(TM)/

P140, principally to demonstrate that P140 shows a positive result

within plasma at the subcutaneous level.

The P140 PK study was successfully completed, as announced on 13

April 2022, with all key endpoints requested by the FDA being met.

The key highlights from the study were summarised as below.

Subcutaneous injection of P140 (in both 200 microgram ("mcg")

and 800 mcg doses (note: 1mcg = 1 millionth of a gram) showed a

clear time and dose-related PK profile, which is detectable in the

blood of human volunteers and applicable for all potential clinical

dosing regiments of P140.

The final group of subjects completed dosing on 30 March 2022.

This was a group of subjects that received an intravenous injection

of a 800 mcg dose of P140, which showed successful measurement of

the absolute bioavailability of the drug (as a control). In line

with all human dosing to date, P140 was safe and well tolerated

across all doses and in all subjects.

Avion, our US partner, has been integral to the development,

initiation and successful conclusion of this PK study.

On 27 June 2022 Avion submitted, via a Type C Meeting, the

positive results from the Lupuzor(TM)/P140 PK study to the FDA.

The FDA response, reported on 14 September 2022 was detailed and

included significant guidance on next steps for the clinical

programme. This included advice on the dosing regime and on study

protocol that can be amended to improve the regulatory outcome.

The Company is currently reviewing the written response with

Avion and will make a further notification in due course.

Pipeline Overview

ImmuPharma's pipeline is focused on two core therapeutic

areas:

-- Autoimmunity & Inflammation

-- Anti-Infectives

Autoimmunity & Inflammation

The increasing knowledge of P140's mode of action and its

relevance to many autoimmune and inflammatory conditions provides a

depth of disease states for ImmuPharma and its partners to explore

in the near future. The therapeutic potential of P140 goes beyond

just lupus, with Chronic Inflammatory Demyelinating Polyneuropathy

("CIDP") being the next step. This expanding insight is

fundamentally driven by the excellent research partnership between

the Company and Prof. Sylviane Muller, inventor of P140 and

Emeritus Research Director CNRS, France. Key highlights within the

progression of the P140 platform are summarized below:

o Lupuzor(TM) (P140) - successfully completed PK study

o P140 - CIDP a neurological disorder targeting the body's

nerves. An adaptive Phase 2/3 clinical study protocol is being

finalised for IND submission

o P140 - Other indications. Further clinical applications based

on further preclinical investigation include asthma, Sjögrens

syndrome, irritable bowel disease, periodontitis and gout

o P140 - Second generation. 'ImmuPharma Biotech' has commenced

work to develop a pharmacologically improved version of P140, a

second-generation product that aims to further strengthen the IP

position and provide therapies with different improved

administration modalities, yet still maintaining P140 as the active

moiety

Anti-Infectives

The innovative peptide technology at ImmuPharma Biotech has been

a huge success and very recently has given rise to a number of

novel development programs, out of which we have identified two

core programs, in pre-clinical development; BioAMB and BioCin,

which we believe have the best commercial opportunity and speed to

market.

o BioAMB, a novel peptide-based drug that offers a potential

improvement on the limiting side effects and poor administration

regime of current Amphotericin-B ("AMB") formulations. AMB is one

of a last line of agents against serious and life-threatening

fungal infections caused by the aspergillus family of fungi

o BioCin, a novel peptide-based drug based on an existing potent

antibacterial used in high medical need cases and in many cases the

last line of defense. BioCin has the potential to offer improved

safety and/or administration benefits

Capital restructure

At the Annual General Meeting on 28 June 2022, the shareholders

approved the subdivision of the Company's ordinary share capital,

whereby each existing Ordinary Share with a nominal value of 10p

was subdivided into 1 new Ordinary Share of 1p and 1 Deferred Share

of 9p. The Deferred Shares have no significant rights attached to

them and carry no right to vote or to participate in distribution

of surplus assets and are not admitted to trading on the AIM market

of the London Stock Exchange plc. The Deferred Shares effectively

carry no value.

Capital subscription

In August 2022, ImmuPharma completed a successful fundraising

totalling GBP2.04m (before expenses) through the issue of

40,818,182 new ordinary shares of 1p each in ImmuPharma, at a price

of 5p per ordinary share ("Issue Price").

The highlights of the August 2022 fundraising are outlined

below:

o Subscription for 20,000,000 new ordinary shares by Lanstead

Capital Investors L.P. "Lanstead" to raise GBP1 million (at 5p per

share)

o "Placing" of 1,818,182 new ordinary shares to raise GBP0.09

million at the price of 5p.

o "Broker Option" raised an additional GBP0.95 million, for 19

million shares at the price of 5p per share. Certain the Directors

(Tim McCarthy, Dr Tim Franklin, Lisa Baderoon) subscribed to

GBP0.1m in total in the Broker Option (GBP60,000, GBP20,000,

GBP20,000 respectively).

o 200,000 new ordinary shares ("Fee Shares") at an issue price

of 5p per share to SPARK Advisory Partners Limited, the Company's

nominated adviser, in lieu of fees.

Lanstead subscription

The GBP1 million gross proceeds of the Lanstead subscription

were followed by the Sharing Agreement with Lanstead for 100% of

these shares with a reference price of 6.6667p per share

("Benchmark Price"). The Sharing Agreement is for a 24 month period

and the Company will receive 24 equal monthly settlements, as

measured against Benchmark Price. The actual consideration is

variable depending upon ImmuPharma's share price, which needs to be

on average (over the 24 months of the sharing agreement) at or

above the Benchmark price for the Company to receive at least, or

more than, the gross subscription of GBP1 million.

For example, if on a monthly settlement date the calculated

"Measured Price" (average of twenty day ImmuPharma share VWAP)

exceeds the Benchmark Price by 10 per cent, the settlement on that

monthly settlement date will be 110 per cent of the amount due from

Lanstead on that date. If on the monthly settlement date the

calculated "Measured Price" is below the Benchmark Price by 10 per

cent, the settlement on the monthly settlement date will be 90 per

cent of the amount due on that date.

The Company also agreed to issue Lanstead 1,400,000 ordinary

shares in connection with entering into the Sharing Agreement

("Value Payment Shares").

Impact on L1/Lind arrangement

The 25,640,254 options in the Company, held equally by L1

Capital Global Opportunities Master Fund "L1" and Lind Global Macro

Fund, LP "Lind" issued on 11 June 2020, exercisable at any time up

to 10 June 2023, at 11p have been amended, as a result of the

August 2022 fundraising of issuing shares below 11p. The effect of

the current fundraising is to amend the exercise price of this

options from 11p to 5p and to increase the number of options held

by L1 and Lind from 25,640,254 to 56,408,558.

Warrants

In August 2022, Lanstead was issued 30,000,000 warrants (for 10

years term), with an exercise price of 5.5p per share in return for

foregoing the entitlement to increase the benchmark price by 50%

(from 14.6667p to 22p) in relation to the 2021 sharing agreement

(due to the amendment made to L1 and Lind option arrangements).

In August 2022, Stanford Capital Partners ("SCP"), the Company's

broker, was issued 2,000,000 warrants with an exercise price of 5p

per share for the period of 10 years, in lieu of fees.

In August 2022, SCP and SI Capital were issued 500,000 warrants

each, for a period of 10 years, in lieu of fees, as part of the

"Broker Option".

Exercise of options

On 24 August 2022, L1 has exercised options over 1,000,000 new

ordinary shares of 1p each at an exercise price of 5p per share,

for a consideration of GBP50,000.

On 30 August 2022, L1 has exercised options over 2,000,000 new

ordinary shares of 1p each at an exercise price of 5p per share,

for a consideration of GBP100,000.

On 7 September 2022, L1 has exercised options over 3,000,000 new

ordinary shares of 1p each at an exercise price of 5p per share,

for a consideration of GBP150,000.

Interest in Incanthera Plc

ImmuPharma has a 13.37% interest in Incanthera plc, which trades

on Aquis Stock Exchange ("AQSE") under the ticker (TIDM:INC).

ImmuPharma also has 7,272,740 warrants options in Incanthera at

an exercise price of 9.5p, being the price at which new shares have

been issued in the Placing accompanying Incanthera's listing.

Please refer to Incanthera's website for further updates on the

company ( www.incanthera.com ).

Financial Review

ImmuPharma's cash balance at 30 June 2022 was GBP0.2 million

(GBP1.6 million at 31 December 2021, GBP4.2 million at 30 June

2021) with the decrease in the Period caused by the research and

development expenditure related to PK study. Financial asset

related to investment in Incanthera plc amounted to GBP0.6 million

(GBP1.2 million at 31 December 2021, GBP1.2 million at 30 June

2021) and warrants (recognized under financial asset) decreased to

GBPNil (GBP0.2 million at 31 December 2021 and GBP0.2 million at 30

June 2021). The decrease was due to the fair value loss on the

investment in shares in the Incanthera plc, following the decrease

in its share price to 6p at 30 June 2022 compared to 12.2p at 31

December 2021.

As a result of the Lanstead Sharing Agreements, the Company had

a derivative financial asset of GBP0.6 million at 30 June 2022

(GBP0.9 million at 31 December 2021, GBP0.2 million at 30 June

2021). The decrease was a result of the fair value calculation

performed at 30 June 2022, reflecting the decrease in ImmuPharma's

share price. Current tax asset amounted to GBP0.6 million at 30

June 2022 (GBP0.8 million at 31 December 2021, GBP0.2 million at 30

June 2021) and it's related to research and development tax credit

due. The convertible loans liability has been repaid in full in

2021, therefore it has a GBPNil balance (GBPNil at 31 December

2021, GBP0.7 million at 30 June 2021). Trade and other payables

liability decreased to GBP0.9 million at 30 June 2022 (GBP1.6

million at 31 December 2021, GBP1.1 million at 30 June 2021) and

was largely due to payments made for PK study related expenditures.

Basic and diluted loss per share were 0.58p and 0.58p respectively

(30 June 2021: 1.46p and 1.46p). In line with the Company's current

policy, no interim dividend is proposed.

Operating loss for the Period was GBP1.7 million (GBP3.1 million

for the six months ended 30 June 2021). Research and development

expenditure in the Period was GBP1 million (GBP1.1 million for the

six months ended 30 June 2021). Administrative expenses decreased

to GBP0.6 million during the Period (GBP0.9 million for the six

months ended 30 June 2021), largely due to savings made on

corporate reorganization. The share based expense amounted to

GBP0.1 million (GBP0.3 million for the six months ended 30 June

2021). Finance costs for the Period were GBP0.2 million (GBP0.9

million for the six months ended 30 June 2021). These arose largely

due to the calculation of fair value of the derivative financial

asset - "Lanstead Sharing Agreements", which resulted in a finance

loss of GBP0.2 million (GBP0.8 million of finance loss for the six

months ended 30 June 2021). The finance loss was significant for

the six months ended 30 June 2021, due to the impact of the

adjustment to the Lanstead Sharing Agreements' benchmark price from

13.33p to 20p. Finance income for the Period was GBP0.02 million

(GBP0.1 million for the six months ended 30 June 2021). It

primarily arose due to foreign exchange gain.

Given the stage of ImmuPharma's development, the fact that

losses have continued to be made is to be expected since there is

minimal revenue and business activity is concerned with significant

investment in the form of clinical development expenditure, in

addition to maintaining the infrastructure of the Company.

Current activities and outlook

The last six months have been pivotal for the Company,

positively concluding the PK study of Lupuzor(TM) ("P140") . Post

the recent written response from the FDA, in respect to the

Lupuzor(TM) Phase 3 protocol, we continue to have positive

discussions with our partner, Avion, on the way forward.

The new fundraising, supported by existing and new shareholders,

allows us to further invest in the other parts of our product

portfolio, whilst being focused on preserving cash where

required.

Moving forward, we remain focused on creating a robust and

successful Company that, with a diversity of assets, will build

future value for our shareholders.

The Board would like to take this opportunity to thank its

shareholders for their continued patience and support, as well as

its staff, corporate and scientific advisers and our partners

including, CNRS and Avion.

Tim McCarthy

Chairman & Chief Executive Officer

ImmuPharma plc

CONSOLIDATED INCOME STATEMENT

FOR THE PERIODED 30 JUNE 2022

Unaudited Audited Unaudited

6 months Year ended 6 months

ended 31 December ended

Note 30 June 2021 30 June

2022 2021

restated*

GBP GBP GBP

Continuing operations

Revenue - 118,350 23,531

Research and development

expenses (1,042,917) (3,650,400) (1,054,875)

Administrative expenses (555,600) (1,011,398) (913,516)

Exceptional items 6 - (1,427,084) (846,792)

Share based expense (70,994) (616,423) (288,826)

Operating loss (1,669,511) (6,586,955) (3,080,478)

Finance costs 4 (176,665) (2,354,872) (904,549)

Finance income 16,364 1,107 95,225

Loss before taxation (1,829,812) (8,940,720) (3,889,802)

Tax 166,024 766,815 229,919

Loss for the period (1,663,788) (8,173,905) (3,659,883)

Attributable to:

Equity holders of the parent

company (1,663,788) (8,173,905) (3,659,883)

Loss per ordinary share

Basic and diluted 2 (0.58)p (3.25)p (1.46)p

* The presentation of the income statement for the comparative

period ended 30 June 2021 has been restated to show exceptional

items as a separate line, consistent with the presentation for the

full year income statement for the year ended 31 December 2021.

ImmuPharma plc

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 30 JUNE 2022

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Loss for the financial period (1,663,788) (8,173,905) (3,659,883)

Other comprehensive income

Items that will not be reclassified

subsequently to profit or loss:

Fair value loss on investment (614,068) (584,355) (555,633)

Fair value loss on warrants (206,411) (418,068) (395,640)

Total items that will not be

reclassified subsequently to

profit or loss (820,479) (1,002,423) (951,273)

Items that may be reclassified

subsequently to profit or loss:

Exchange differences on translation

of foreign operations 16,350 (36,177) (20,357)

Total items that may be reclassified

subsequently to profit or loss 16,350 (36,177) (20,357)

Other comprehensive loss for

the period (804,129) (1,038,600) (971,630)

Total comprehensive loss for

the period (2,467,917) (9,212,505) (4,631,513)

ImmuPharma plc

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2022

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Non-current assets

Intangible assets 471,534 477,553 495,736

Property, plant and equipment 330,835 352,996 369,700

Financial asset 595,355 1,415,835 1,466,985

Derivative financial asset 4 196,488 405,489 -

Total non-current assets 1,594,212 2,651,873 2,332,421

Current assets

Trade and other receivables 114,450 427,199 129,850

Cash and cash equivalents 170,922 1,649,374 4,248,412

Current tax asset 595,205 761,188 211,180

Derivative financial asset 4 400,306 508,167 160,436

Total current assets 1,280,883 3,345,928 4,749,878

Current liabilities

Financial liabilities -

borrowings (230) (700) (914)

Trade and other payables (858,291) (1,583,604) (1,113,465)

Convertible loans - - (655,811)

Total current liabilities (858,521) (1,584,304) (1,770,190)

Net current assets 422,362 1,761,624 2,979,688

Net assets 2,016,574 4,413,497 5,312,109

EQUITY

Ordinary shares 5 2,849,849 28,498,494 25,022,130

Deferred shares 5 25,648,645 - -

Share premium 27,237,329 27,237,329 27,237,329

Merger reserve 106,148 106,148 106,148

Other reserves 5,240,503 5,153,159 3,524,005

Retained earnings (59,065,900) (56,581,633) (50,577,503)

Total equity 2,016,574 4,413,497 5,312,109

ImmuPharma plc

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2022

Other

reserves

Other -

Other Other reserves Convertible Other

reserves reserves -Share option reserves

Share Merger - - based reserve - Retained

Ordinary Deferred premium Reserve Acquisition Translation payment GBP Warrant Earning Total

shares shares GBP GBP Reserve Reserve reserve reserve GBPs Equity

GBP GBP GBP GBP GBP GBP GBP

At 1 January

2021 25,022,130 - 27,237,329 106,148 (3,541,203) (1,308,480) 8,073,596 31,623 - (45,966,347) 9,654,796

Loss for the

financial

period - - - - - - - - (3,659,883) (3,659,883)

Exchange

differences - - - - - (20,357) - - - (20,537)

Share based

payments - - - - - - 288,826 - - 288,826

Equity - - - - - - - - - -

component

of

convertible

loan notes

Fair value

loss

on

investments - - - - - - - - (555,633) (555,633)

Fair value

loss

on warrants - - - - - - - - (395,640) (395,640)

At 30 June

2021

unaudited 25,022,130 - 27,237,329 106,148 (3,541,203) (1,328,837) 8,362,422 31,623 - (50,577,503) 5,312,109

At 1 January

2021 25,022,130 - 27,237,329 106,148 (3,541,203) (1,308,480) 8,073,596 31,623 - (45,966,347) 9,654,796

Loss for the

financial

year - - - - - - - - (8,173,905) (8,173,905)

Exchange

differences - - - - (36,177) - - - (36,177)

Share based

payments - - - - - - 616,423 - - 616,423

Settlement

of

convertible

loans

reserves (31,623) 31,623 -

New issue of

equity

capital 3,476,364 - 322,727 - - - - - (1,349,000) 2,450,091

Cost of new

issue of

equity

capital - - (322,727) - - - - - (121,581) (444,308)

Fair value

loss

o n

investments - - - - - - - - (584,355) (584,355)

Fair value

loss

on warrants - - - - - - - - (418,068) (418,068)

Issue of

warrants - 1,349,000 - 1,349,000

At 31

December

2021 & 1

January

2022

audited 28,498,494 - 27,237,329 106,148 (3,541,203) (1,344,657) 8,690,019 - 1,349,000 (56,581,633) 4,413,497

Loss for the

financial

period - - - - - - - - - (1,663,788) (1,663,788)

Exchange

differences - - - - - 16,350 - - - 16,350

Share split (25,648,645) 25,648,645 -

Share based

payments - - - - - - 70,994 - - - 70,994

Fair value

loss

on

investments - - - - - - - - - (614,068) (614,068)

Fair value

loss

on warrants - - - - - - - - - (206,411) (206,411)

At 30 June

2022

unaudited 2,849,849 25,648,645 27,237,329 106,148 (3,541,203) (1,328,307) 8,761,013 - 1,349,000 (59,065,900) 2,016,574

ImmuPharma plc

CONSOLIDATED STATEMENT OF CASHFLOWS

FOR THE PERIODED 30 JUNE 2022

Note Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Cash flows from operating

activities

Cash used in operations 3 (1,966,598) (5,222,446) (2,068,937)

Tax received 343,246 392,217 390,418

Interest paid (922) (2,943) (1,444)

Net cash used in operating

activities (1,624,274) (4,833,172) (1,679,963)

Investing activities

Purchase of property,

plant and equipment - (50,934) (48,014)

Purchase of intangibles - - (4,756)

Interest received 63 651 215

Net cash (used in)/generated

from investing activities 63 (50,283) (52,555)

Financing activities

Decrease in bank overdraft - (211) 5

New loans/(loan repayments) (470) (6,028) (5,751)

Settlements from Sharing

Agreement 143,273 328,495 261,116

Gross proceeds from issue - 3,550,000 -

of new share capital

Share capital issue costs - (132,350) -

Funds deferred per Sharing - (2,200,000) -

Agreement

Interest paid on convertible - (121,120) -

loan notes

Convertible loan notes repaid - (716,739) -

Net cash generated from financing

activities 142,803 702,047 255,370

Net (decrease) in cash and

cash equivalents (1,481,408) (4,181,408) (1,477,148)

Cash and cash equivalents

at start of period 1,649,374 5,862,057 5,862,057

Effects of exchange rates

on cash and

cash equivalents 2,956 (31,275) (136,497)

Cash and cash equivalents

at end of period 170,922 1,649,374 4,248,412

ImmuPharma plc

NOTES TO THE CONSOLIDATED INTERIM ACCOUNTS FOR THE PERIODED 30

JUNE 2022

1 ACCOUNTING POLICIES

Basis of preparation

The interim financial information in this report has been

prepared using accounting policies consistent with IFRS as adopted

by the United Kingdom. IFRS is subject to amendment and

interpretation by the International Accounting Standards Board

(IASB) and the IFRS Interpretations Committee and there is an

ongoing process of review and endorsement by the UK Endorsement

Board. The financial information has been prepared on the basis of

IFRS expected to be adopted by the United Kingdom and applicable as

at 31 December 2022. The Group has chosen not to adopt IAS 34

"Interim Financial Statements" in preparing the interim financial

information.

The accounting policies applied are consistent with those that

were applied to the financial statements for the year ended 31

December 2021.

Non-Statutory accounts

The financial information set out in this interim report does

not constitute the Group's statutory accounts, within the meaning

of Section 434 of the Companies Act 2006. The statutory accounts

for the year ended 31 December 2021 have been filed with Registrar

of Companies. The auditors reported on those accounts; their report

was unqualified, did not contain a statement under either Section

498 (2) or Section 498 (3) of the Companies Act 2006 but did

include emphasis of matter paragraph relating to the carrying value

of Parent Company's investment in subsidiaries and receivables due

from group undertakings, and a reference to which the auditor drew

attention by way of emphasis without qualifying their report in

respect of going concern.

Copies of this statement will be available on the Company's

website - www.immupharma.co.uk.

2 LOSS PER SHARE

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Loss

Loss for the purposes of basic

and diluted loss per share

being net loss attributable

to equity shareholders (1,663,788) (8,173,905) (3,659,883)

Number of shares

Weighted average number of

ordinary shares for the purposes

of basic loss per share 284,984,933 251,164,361 250,221,297

Basic loss per share (0.58)p (3.25)p (1.46)p

Diluted loss per share (0.58)p (3.25)p (1.46)p

There is no difference between basic loss per share and diluted

loss per share as the share options and warrants are anti-dilutive.

Deferred shares are excluded from the loss per share calculation as

they have no attributable earnings.

3 CASH USED IN OPERATIONS

Unaudited Audited Unaudited

6 months Year 6 months

ended ended ended

30 June 31 December 30 June

2022 2021 2021

GBP GBP GBP

Operating loss (1,669,511) (6,586,955) (3,080,478)

Depreciation & amortisation 37,212 114,119 86,639

Share based payments 70,994 616,423 288,826

Decrease/(increase) in trade

& other receivables 312,749 (265,201) 29,964

Increase/(decrease) in trade

& other payables (725,313) 896,798 511,100

Gain on foreign exchange 7,271 2,370 95,012

Cash used in operations (1,966,598) (5,222,446) (2,068,937)

4 Derivative Financial Asset

As part of the placement completed in June 2019, the Company

issued 26,565,200 new ordinary shares to Lanstead Capital

Investors L.P. ("Lanstead") at a price of 10p per share

for an aggregate subscription price of GBP2.66m before expenses.

In the placement completed in March 2020, the Company issued

13,000,000 new ordinary shares to Lanstead at a price of

10p per share to raise GBP1.3m gross. In December 2021,

the Company issued 20,000,000 new ordinary shares to Lanstead

at a price of 11p per share to raise GBP2.2m before expenses.

All Subscriptions proceeds were pledged under the Sharing

Agreement, under which Lanstead made and will continue to

make, subject to the terms and conditions of that Sharing

Agreement, monthly settlements to the Company that are subject

to adjustment upwards or downwards depending on the Company's

share price performance.

In December 2021 the Company also issued 1,400,000 new ordinary

shares to Lanstead as value payments in connection with

the Share Subscription and the Sharing Agreement. Monthly

settlements under the Sharing Agreement from June 2019 completed

in September 2021. The settlements from remaining agreements

(March 2020 and December 2021) will continue until 2024,

completing in July 2022 and March 2024 respectively.

At the end of the accounting period the amount receivable

has been adjusted to fair value based upon the share price

of the Company at that date. Any change in the fair value

of the derivative financial asset is reflected in the income

statement. As at 30 June 2022, the Company completed a calculation

of fair value of the derivative financial asset that resulted

in a finance loss of GBP175,742 (GBP769,570 at 30 June 2021),

which was recorded in the income statement. The restatement

to fair value will be calculated at the end of each accounting

period during the course of the Sharing Agreement and will

vary according to the Company's share price performance.

5 Issued share capital

Allotted, called 30 June 31 December 30 June 2022 31 December

up and fully paid 2022 2021 No. GBP 2021 GBP

Ordinary Shares No.

At start of period

of GBP0.10 each

Split to deferred 284,984,933 250,221,297 28,498,494 25,022,130

shares of GBP0.09

each - - (25,648,645) -

Shares issued

in the period - - - -

At end of period

of GBP0.01 each 284,984,933 250,221,297 2,849,849 25,022,130

-------------- -------------- --------------- -------------

Allotted, called 30 June 31 December 30 June 2022 31 December

up and fully paid 2022 2021 No. GBP 2021 GBP

Deferred Shares No.

At start of period

Split from Ordinary - - - -

Shares of GBP0.09 284,984,933 - 25,648,645 -

each

At end of period

of GBP0.09 each 284,984,933 - 25,648,645 -

-------------- ------------- -------------- -------------

Capital restructure

At Annual General Meeting on 28 June 2022 the shareholders

approved the subdivision of the Company's ordinary share capital,

whereby each existing Ordinary Share with a nominal value of 10p

was subdivided into 1 new Ordinary Share of 1p and 1 Deferred Share

of 9p. The Deferred Shares have no significant rights attached to

them and carry no right to vote or to participate in distribution

of surplus assets and are not admitted to trading on the AIM market

of the London Stock Exchange plc. The Deferred Shares effectively

carry no value.

6. Exceptional items

There were no exceptional items in the Period (GBP1.4 million at

31 December 2021, GBP0.8 million at 30 June 2021). Exceptional

items related to termination benefit packages paid out in 2021.

7. Subsequent events

In August 2022 ImmuPharma secured successful fundraising

totalling to GBP2.04m (before expenses) through the issue of

40,818,182 new ordinary shares of 1p each in ImmuPharma at a price

of 5p per ordinary share ("Issue Price").

The highlights of the August 2022 fundraising are outlined

below:

o -Subscription for 20,000,000 new ordinary shares by Lanstead

Capital Investors L.P. "Lanstead" to raise GBP1 million (at 5p per

share).

o -"Placing" of 1,818,182 new ordinary shares to raise GBP0.09

million at the price of 5p.

o -"Broker Option" raised an additional GBP0.95 million, for 19

million shares at the price of 5p per share. Certain of the

Directors (Tim McCarthy, Dr Tim Franklin, Lisa Baderoon) subscribed

GBP0.1m in total in the Broker Option (GBP60,000, GBP20,000,

GBP20,000 respectively).

o -200,000 new ordinary shares ("Fee Shares") at an issue price

of 5p per share to SPARK Advisory Partners Limited, the Company's

nominated adviser, in lieu of fees.

Lanstead subscription

The GBP1 million gross proceeds of the Lanstead subscription was

followed by the Sharing Agreement with Lanstead for 100% of these

shares with a reference price of 6.6667p per share ("Benchmark

Price"). The Sharing Agreement is for a 24 month period and the

Company will receive 24 equal monthly settlements, as measured

against Benchmark Price. The actual consideration is variable

depending upon ImmuPharma's share price, which needs to be on

average (over the 24 months of the sharing agreement) at or above

the Benchmark price for the Company to receive at least, or more

than, the gross subscription of GBP1 million.

For example, if on a monthly settlement date the calculated

"Measured Price" (average of twenty day ImmuPharma share VWAP)

exceeds the Benchmark Price by 10 per cent, the settlement on that

monthly settlement date will be 110 per cent of the amount due from

Lanstead on that date. If on the monthly settlement date the

calculated "Measured Price" is below the Benchmark Price by 10 per

cent, the settlement on the monthly settlement date will be 90 per

cent of the amount due on that date.

The Company also agreed to issue Lanstead 1,400,000 ordinary

shares in connection with entering into the Sharing Agreement

("Value Payment Shares").

Impact on L1/Lind arrangement

The 25,640,254 options in the Company, held equally by L1 and

Lind, (issued in June 2020) exercisable at any time up to 10 June

2023, at 11p have been amended, as a result of the August 2022

fundraising of issuing shares below 11p. The effect of the current

fundraising is to amend the exercise price of these options from

11p to 5p and to increase the number of options held by L1 and Lind

from 25,640,254 to 56,408,558.

Warrants

In August 2022, Lanstead was issued 30,000,000 warrants (for 10

years term), with an exercise price of 5.5p per share in return for

foregoing the entitlement to increase the benchmark price by 50%

(from 14.6667p to 22p) in relation to the 2021 sharing agreement

(due to the amendment made to L1 and Lind option arrangements).

In August 2022, Stanford Capital Partners "SCP"- the Company's

broker was issued 2,000,000 warrants with an exercise price of 5p

per share for the period of 10 years, in lieu of fees.

In August 2022, SCP and SI Capital were issued 500,000 warrants

each, for the period of 10 years, in lieu of fees, as part of the

"Broker Option".

Exercise of options

On 24 August 2022, L1 has exercised options over 1,000,000 new

ordinary shares of 1p each at an exercise price of 5p per share,

for a consideration of GBP50,000.

On 30 August 2022, L1 has exercised options over 2,000,000 new

ordinary shares of 1p each at an exercise price of 5p per share,

for a consideration of GBP100,000.

On 7 September 2022, L1 has exercised options over 3,000,000 new

ordinary shares of 1p each at an exercise price of 5p per share,

for a consideration of GBP150,000.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UKAWRUBUKUAR

(END) Dow Jones Newswires

September 30, 2022 02:00 ET (06:00 GMT)

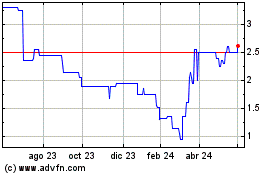

Immupharma (AQSE:IMM.GB)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

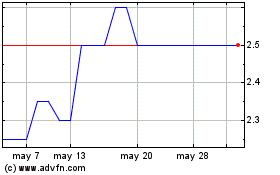

Immupharma (AQSE:IMM.GB)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024