TIDMKR1

29 June 2023

KR1 Plc

("KR1", the "Company ")

Audited final results for the twelve months ended 31 December 2022

KR1 plc, a leading digital asset investment company, is pleased to announce its

audited results for the twelve-month period ended 31 December 2022 ("FY22").

Financial

Highlights

* Net assets of £70.0 million down 62.2% (FY21 £185.0 million)

* NAV per share of 39.47p, a reduction of 67.8% (FY21 122.68p)

* Income from digital assets of £20.2 million, 3.6% lower (FY21 £21.0

million)

Strategic Highlights

* Consistent income from staking in 'Proof-of-Stake' network, as well as

other crypto-native strategies such as rewards from parachains and

lockdrops; aiming to strengthen staking activities further.

* Optimising our corporate structure, following recent initiatives such as

the unaudited monthly NAV updates, the previous appointment of new auditors

and the appointment of a new independent non-executive director.

Investment Highlights

* Continued progress developing our high-quality long-only portfolio of

innovative, diversified digital assets with continued investment activity

into attractive opportunities (Anoma, Code&State and Hydra Ventures since

year-end).

* Strong momentum for portfolio projects such as Lido and Rocket Pool

following Ethereum's 'Proof-of-Stake' upgrade.

* Well positioned within the modular blockchain space through the Company's

seed investment in Celestia (formerly LazyLedger), a pluggable consensus

and data availability layer.

* Decentralised Finance ("DeFi") continues to be the primary driver of

blockchain adoption and remains an important investment focus.

Markets Outlook

* Most recently, the crypto ecosystem has found stability, even witnessing

some sustained positivity following the return of investor confidence after

last years' events.

* Despite the still seemingly uncertain macroeconomic conditions, we remain

confident in the growth opportunity of the underlying technology and our

high quality portfolio.

George McDonaugh and Keld van Schreven, Managing Directors of KR1 plc,

commented:

"Whilst the Company's NAV has been impacted by a turbulent year for the crypto

market due to multiple crises, KR1 has shown remarkable resilience throughout.

Our continued focus on building a high quality long-only portfolio of

innovative digital assets enabled us to deliver consistent income from our

portfolio. We have also strengthened the Company with key internal and external

appointments and improved reporting transparency with the long-desired

publication of our unaudited monthly NAV updates. KR1 is well placed to capture

an ever-growing inflow of innovative projects seeking investment and deploying

capital through a disciplined investment approach."

Chairman's Report

We are pleased to present the Annual Report and Audited Financial Statements of

the Company for the twelve months ended 31 December 2022.

At 31 December 2022, the net asset value of KR1 plc ("the Company") was 39.47

pence per share as compared with 122.68 pence per share a year earlier. The net

asset value of the Company at 31 December 2022 was £70,006,184, as compared

with £185,030,165 a year earlier. Moreover, the Company reported a loss for the

year of £145,211,303 (2021: profit £143,663,018).

On behalf of the Board of Directors, I thank all Shareholders for their

support.

Sincerely yours,

Rhys Davies

Chairman

28 June 2023

Managing Directors' Report

The cyclical nature of the digital asset economy is once again fully evident:

Throughout the financial year, the crypto ecosystem saw the unravelling of

multiple crises, starting with the Luna and Terra implosion earlier in the

year, the subsequent blowups of formerly major entities in the space and,

ultimately, the demise of FTX and Alameda Research and their affiliated

operations. Following the momentous bull market cycle previous to that, 2022

saw investor confidence plummet and an exit of participants and liquidity from

the digital asset sector. As market cycle history repeats itself, the previous

year and recent partial recovery serves once again as a strong reminder that

with such extreme cyclical volatility, complex trading, loans and leverage are

a dangerous mix of unnecessary risks when investing in this asset class.

As shown in the Company's financial statements and despite the turmoils in the

crypto ecosystem, especially in the latter part of the financial year, the

Company's Net Asset Value stood at £70,006,184 (2021: £185,030,165) at the year

end, which resulted in a Net Asset Value per Ordinary Share of 39.47p (2021:

122.68p) at the year end. While the portfolio suffered from the decrease of

crypto assets prices across the board, we are continuing to build a high

quality 'long-only' portfolio of innovative digital assets. This strategy has

allowed the Company to ride out and benefit materially from the market cycles

that we have experienced to date. We believe the structure of KR1 as a publicly

listed permanent capital vehicle and its approach to investments creates a

resilient model which puts the Company in a leading position to take advantage

of crypto's exceptional growth potential going forward.

Throughout the year the Company generated a total Income from Digital Assets of

£20,204,355 (2021: £20,959,934) for the financial year. We are particularly

pleased with the consistency of this income, which is driven primarily by the

Company's staking activities and the rewards received from participation in

parachain auctions. These activities have very efficient underlying economics,

especially when compared to the capital-intensive Bitcoin mining businesses.

Since the close of the previous year, following the shock of the FTX panic and

its contagion, the crypto ecosystem has found stability, even witnessing some

sustained positivity more recently. While encouraging, it is not necessarily

indicative of an impending start of the bull market anytime soon with the macro

backdrop still threatening valuations of 'risk assets'. A seemingly overtly

hostile regulatory position of the current US administration towards digital

assets could also stifle adoption, suppress prices and continue to drive future

innovations out of the US, to nations more welcoming of the technology and its

potential benefits.

The recent partial US banking crisis reignited interest in Bitcoin's 'sound

money' narrative, however, Ethereum looks to potentially capture some of this

narrative following its successful upgrade to 'Proof-of-Stake' (ETH now being

termed 'ultra sound money' by respected voices in the Ethereum community).

Following the completion of Ethereum's upgrade, KR1 benefited from the

performance of Rocket Pool and Lido, both long-time seed investments since 2017

and 2020 respectively, that relate to Ethereum's staking ecosystem and were

placed firmly front and centre in the minds of the market after the successful

move.

In terms of technology, Ethereum remains the platform that sees by far the most

activity, currently still best expressed through the blossoming Decentralised

Finance ("DeFi") ecosystem, which will continue to become ever more relevant to

crypto's overall growth. There are also very exciting developments happening

within other layer-1 blockchain ecosystems. Cosmos has recently captured

attention as 'interchain security' shipped, which could benefit the ATOM token

economics while placing the Cosmos on a high-growth trajectory for hundreds of

new application specific chains to onboard. Likewise, the Polkadot ecosystem

continues to develop at a rapid pace, ranking at the top of developer activity

charts across the entire crypto landscape.

Throughout the past year and into this year we have continued to see strong

inflows of innovative projects seeking investment and have also seen portfolio

projects successfully go live and launch their products, such as Vega recently

with enabling trading for its alpha mainnet.

We are expecting further projects in the portfolio to come to market over the

next time period: A major one being Celestia (formerly LazyLedger), which

received investment from KR1 during its initial seed funding round a few years

ago and subsequently progressed on executing on their technical roadmap of

creating a modular blockchain architecture that solves the core scaling

problems of today's blockchains.

On the corporate side of the Company, the past year served as a great

opportunity to improve various internal structures and functions. The most

notable recent development of this being the introduction of our monthly

unaudited net asset value ("NAV") updates. These updates are currently

published on a monthly schedule as public announcements and detail not only the

relevant unaudited NAV and NAV per share, but also provide further insights

into the top holdings of the KR1 portfolio. This process has been a long time

in the making and we are thrilled to finally have the updates in production and

available to our shareholders. Another important milestone for the Company has

been the appointment of PKF Littlejohn LLP as the Company's new auditors. Their

expertise in the digital asset sector is highly suitable for KR1 and ensures

that the Company meets all its obligations as a publicly listed company in

terms of financial reporting and transparency. Last but not least, the Company

also welcomed Aeron Buchanan as a non-executive director. After gaining a

doctorate from Oxford University, Aeron was involved in several start-ups

before joining the Ethereum Foundation soon after it was founded and was

subsequently involved in the launch of Polkadot and the Web3 Foundation.

As we continue to move through 2023 and beyond, we will keep building a high

quality 'long-only' portfolio of innovative digital assets. As in previous

years, KR1 plc remains at the very heart of the crypto ecosystem, fully focused

and taking advantage of the disruption that this exciting technology will bring

to society.

George McDonaugh

Keld van Schreven

Managing Director & Co-Founder Managing

Director & Co-Founder

28 June 2023

Statement of Comprehensive Income

for the year ended 31 December 2022

2022 2021

Restated

Note £ £

Continuing operations

Income

Income from digital assets 8 20,204,355 20,959,934

Interest received 8 2,371 -

Direct costs 9 (444,194) (392,514)

Gross profit 19,762,532 20,567,420

Administrative expenses 9 (3,726,682) (32,778,173)

Gain on disposal of intangible assets 8 3,642,819 20,758,540

Movement in fair value of financial assets at fair 6 (183,932) (3,765,107)

value through profit and loss

Share options 9,16 (39,327) (13,810)

Operating profit 19,455,410 4,768,870

Taxation on profit 11 - -

Profit after taxation 19,455,410 4,768,870

Other comprehensive income:

Movement in fair value of intangible assets 13 (164,666,713) 138,894,148

Total other comprehensive income for the year (164,666,713) 138,894,148

Total comprehensive income attributable to the equity

holders of the Company (145,211,303) 143,663,018

Earnings per share attributable to the equity owners

of the company (pence):

Basic earnings per share 12 11.86 3.53

Diluted earnings per share 12 10.96 3.12

The notes contained in the Company's Annual Report form part of these financial

statements.

Statement of Financial Position

for the year ended 31 December 2022

2022 2021 1 January

Restated 2021

Note £ £ Restated

£

Assets

Non-current assets

Intangible assets 13 3,270,856 26,307,014 667,029

Intangible assets receivable 13,14 3,795 163,888 -

Total non-current assets 3,274,651 26,470,902 667,029

Current assets

Intangible assets 13 57,669,180 177,560,034 40,406,173

Intangible assets receivable 13,14 1,774,020 3,755,494 -

Financial assets at fair value through 6 8,067,895 6,026,270 720,586

profit and loss

Cash and cash equivalents 634,163 3,488,421 332,535

Trade and other receivables 14 125,570 103,305 31,034

Total current assets 68,270,828 190,933,524 41,490,328

Total assets 71,545,479 217,404,426 42,157,357

Equity and liabilities

Current liabilities

Trade and other payables 15 1,539,295 32,374,261 4,290,882

Total current liabilities 1,539,295 32,374,261 4,290,882

Net assets 70,006,184 185,030,165 37,866,475

Equity

Share capital 16 808,756 758,320 720,076

Share premium 17 36,602,619 6,505,061 3,056,443

Revaluation reserve 17 6,716,815 171,383,528 32,489,380

Option reserve 16 149,852 110,524 252,630

Retained reserves 17 25,728,142 6,272,732 1,347,946

Total equity 70,006,184 185,030,165 37,866,475

Total equity and liabilities 71,545,479 217,404,426 42,157,357

The notes contained in the Company's Annual Report form part of these financial

statements.

Statement of Cash Flows

for the year ended 31 December 2022

2022 2021

Restated

£ £

Cash flows from operating activities

Profit / loss after tax for the financial year 19,455,410 4,768,870

Other Comprehensive Income (164,666,713) 138,894,148

Adjustments for:

Movement in fair value of intangible assets 164,666,713 (138,894,148)

Gain on disposal of intangible assets (3,642,819) (20,758,540)

Non-cash income from digital assets (20,204,355) (20,959,934)

Other non-cash transactions 270,344 392,410

Forex Exchange Loss 36,072 17,354

Movement in fair value of financial assets 183,932 3,765,107

at fair value through profit and loss

Share option issue 39,327 13,810

(Increase) in debtors (22,266) (72,271)

(Decrease) /increase in creditors (30,834,966) 28,083,379

Net cash (outflow)/inflow from operating activities (34,719,321) (4,749,815)

Cash flows from investing activities

Sales of investments 6,249,761 21,325,335

Purchases of investments (4,496,617) (16,902,952)

Net cash inflow from investing activities 1,753,144 4,422,383

Cash flows from financing activities

Proceeds from issue of ordinary shares 30,147,991 3,500,672

Net cash generated by financing activities 30,147,991 3,500,672

Net (decrease)/increase in cash (2,818,186) 3,173,240

Cash at the beginning of the year 3,488,421 332,535

Effect of exchange fluctuations on cash (36,072) (17,354)

Cash as at 31 December 634,163 3,488,421

Represented by:

Cash at bank 634,163 3,163,061

Cash held on trading platforms - 325,360

634,163 3,488,421

Non-cash transactions consist of expenses paid and investments purchased using

digital assets and cryptocurrency assets.

The notes contained in the Company's Annual Report form part of these financial

statements.

The financial statements were approved by the Board of Directors on 28 June

2023 and were signed on its behalf by:

George McDonaugh Keld van

Schreven

Director

Director

The financial information set out in this announcement does not constitute

statutory accounts. This financial information has been extracted from the

audited full accounts of the Company for the year ended 31 December 2022. The

Company does not declare a dividend for the period.

The full Annual Report of the Company will be available on the Company's

website: www.KR1.io.

The Directors of the Company accept responsibility for the contents of this

announcement.

For further information please contact:

KR1 PLC +44 (0)1624 630 630

George McDonaugh

Keld van Schreven

Peterhouse Capital Limited (AQSE Corporate

Adviser) +44 (0)20 7469 0930

Mark Anwyl

FTI Consulting (PR Adviser)

Ed Berry +44 (0)7711 387 085

Maxime Lopes KR1@fticonsulting.com

Lynn Begany

About KR1 plc

KR1 plc is a leading digital asset investment company supporting early-stage

decentralised and open source blockchain projects. Founded in 2016 and publicly

traded in London on the AQSE Growth Market (KR1:AQSE), KR1 has one of the

longest and most successful track records of investment in the digital assets

space by investing in decentralised platforms and protocols that are emerging

to form new financial and internet infrastructures.

www.KR1.io

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation EU 596/2014 as it forms part of retained EU law (as

defined in the European Union (Withdrawal) Act 2018).

END

(END) Dow Jones Newswires

June 29, 2023 02:01 ET (06:01 GMT)

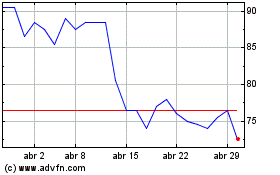

KR1 (AQSE:KR1)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

KR1 (AQSE:KR1)

Gráfica de Acción Histórica

De May 2023 a May 2024