Cardano Rides The ETF Wave: Inflows Surge To $1.1 Million – Details

02 Abril 2024 - 4:37AM

NEWSBTC

Cardano (ADA) has recently emerged as a focal point of investor

attention, experiencing both a surge in inflows and mounting

concerns over its performance. According to the latest data from

CoinShares, Cardano-centric investment products witnessed a

staggering $1.1 million influx over the past week, marking a

notable reversal from the $3.7 million outflows recorded just a

week prior. Related Reading: Investor Alert: Ethereum Q2 Potential

Promises Double-Digit Gains – Analyst Cardano Sees Massive Inflows

This sudden influx catapults Cardano to the forefront of investor

interest in similar products, reflecting a growing prominence for

the cryptocurrency within the crypto investment landscape. Despite

experiencing a reduction in positions in March, fresh data suggests

a positive trajectory for Cardano by the end of the month, hinting

at resilience amidst market fluctuations. A recovery for Bitcoin

ETFs, with US$862m inflows last week pic.twitter.com/D1OWUSdGIU —

James Butterfill (@jbutterfill) April 1, 2024 The resurgence of

investor interest in Bitcoin ETFs has also contributed to a broader

increase in crypto investment activity, with total crypto

investment inflows since the beginning of the year surpassing $13

billion. Bitcoin ETFs absorbed the majority of these inflows,

totaling $12 billion, indicating robust investor confidence in the

leading cryptocurrency. Source: Coinshares Amidst these

developments, speculation looms regarding the possibility of a

Cardano ETF. While Cardano’s ability to attract investment amid a

competitive market landscape underscores its growing prominence,

the prospect of a Cardano ETF remains speculative, particularly

given the ongoing situation with Ethereum. However, as capital

continues to flow into ADA-oriented investment products, Cardano’s

position on the financial markets is likely to strengthen,

positioning it as a notable contender in the ongoing crypto ETF

boom. ADA market cap currently at $21 billion. Chart:

TradingView.com ADA Tells A Different Narrative Despite the

positive inflows, concerns linger over Cardano’s recent performance

compared to other assets. ADA has seen sluggish performance, with

losses of 3.50% and only 6.40% gains year-to-date, according to

CoinMarketCap. Analysis reveals a drop in the percentage of ADA’s

total supply in profit, from 80% to 75%, indicating a trend of

selling activity and raising concerns about ADA’s trajectory amidst

bullish market trends. Related Reading: XRP And XLM Blast:

Analyst’s 20X Rally Projection To ‘Melt Faces’ Furthermore, there’s

a notable decrease in the number of wallets holding substantial

amounts of ADA, signaling a shift in investor behavior. This

decrease could potentially reflect a lack of confidence in ADA’s

future prospects or a desire among investors to reallocate their

assets to other cryptocurrencies or investment vehicles. The

juxtaposition of increased investor interest and concerns over

performance paints a nuanced picture of Cardano’s current standing

in the cryptocurrency market. While the surge in inflows highlights

growing investor confidence and recognition of Cardano’s potential,

the challenges posed by sluggish performance and shifting investor

sentiments underscore the need for vigilance among ADA investors.

Featured image from Jeremy Bishop/Unsplash, chart from TradingView

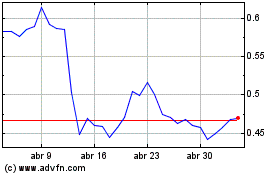

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

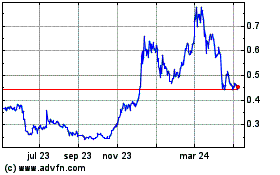

Cardano (COIN:ADAUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024