Bitcoin Spot ETF Will Bring $70 Billion In New Money To Trigger Price Rally – Glassnode

25 Noviembre 2023 - 11:40AM

NEWSBTC

Blockchain analytics firm Glassnode has estimated a substantial

influx of investor demand following the approval of Bitcoin Spot

ETF. The analysis indicates around $70 billion in new money flowing

into Bitcoin, potentially setting the stage for a BTC price

rally. Bitcoin Spot ETF Set To Ignite New Inflows Blockchain

data and intelligence provider, Glassnode has recently published

research insights on the potential impacts of Bitcoin Spot ETF

approvals on the price of Bitcoin and the broader crypto market.

The on-chain analytics company has predicted about $70.5 billion

flowing into Bitcoin from increased demand from institutional

investors. Related Reading: Crypto Fund Exits BLUR For Lido

And IMX—Endorsing DeFi? Glassnode bases its analysis on the

assumption that substantial portions of capital invested in the

stocks, bonds, and gold market might shift toward Bitcoin

investments. The blockchain analytics firm has stated that this

influx of new capital could have a huge effect on the Bitcoin

market, potentially driving its price to greater levels.

“Based on these assumptions, we estimate approximately $60.6

billion could flow into Bitcoin from the combined stock and bond

ETFs, and about $9.9 billion from the gold market, totaling around

$70.5 billion in potential new capital influx,” Glassnode

stated. It added: “This significant infusion of new capital

could have a considerable impact on Bitcoin’s market, potentially

driving up its price as it gains broader acceptance and becomes

integrated into more traditional investment portfolios.” Bitcoin

Futures And Altcoins Soar On BTC ETF Hype Glassnode has

extended its analysis to examine how Spot Bitcoin ETF applications

are influencing Chicago Mercantile Exchange (CME) Bitcoin futures

and various altcoins. The blockchain analytics firm has

stated that the recent crypto market recovery has been driven by

the surrounding anticipation of Spot Bitcoin ETF potential approval

by the United States Securities and Exchange Commission

(SEC). Bitcoin (BTC) is currently trading at $37.696. Chart:

TradingView.com “The market’s upward trajectory was largely driven

by the anticipation of Spot BTC ETF approvals, with market

movements significantly influenced by updates on filings from major

financial entities like Invesco and BlackRock,” Glassnode

stated. The on-chain analysis firm revealed that the growing

optimism in Spot Bitcoin ETFs has caused a notable increase in

Bitcoin futures on CME. According to the blockchain intelligence

provider, CME Bitcoin futures rose to an all-time high of 27.8%,

exceeding Binance for the first time since the start of the crypto

bear market. Various other altcoins like Ethereum and Solana

also experienced staggering price increases. Solana surged by

79.05%, and Ethereum’s price is presently above the $2000

mark. Related Reading: Bitcoin Price Rockets Past $38,000,

Hits Highest Peak Since May 2022 – Details The most notable

increase caused by the ongoing hype on Spot Bitcoin ETFs was seen

in Bitcoin. BTC surged above $37,000 as the optimism of regulator

approvals for the first Spot Bitcoin ETF spread.

Additionally, institutional engagement in open interest in Bitcoin

call options also rose by $4.3 billion, marking an 80% increase to

surpass $9.7 billion. These recent spikes in investor demand and

crypto prices have signaled a potential bullish trajectory for the

maturing crypto market. Featured image from Pexels

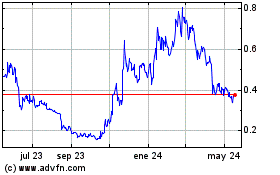

Blur (COIN:BLURUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

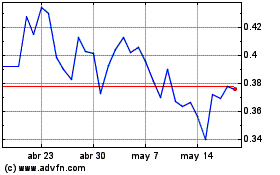

Blur (COIN:BLURUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024