The War Is Over!: Binance Announces FTX Buyout And The Market Recovers

08 Noviembre 2022 - 12:41PM

NEWSBTC

Did Binance just do what we think it did? The world’s biggest

cryptocurrency exchange by trading volume will likely buy one of

its biggest competitors. The market was in turmoil, the players

were in panic mode, but this news calmed the waters in a big way.

What’s next, though? Will Binance actually go through with the

buyout? Is the deal final? And what does this story says about

FTX’s business model? Were they fractional-reserving their way to

success? Let that sink in… pic.twitter.com/Whj50bR2Ey — wolf

(@ImNotTheWolf) November 8, 2022 Let’s analyze the official but not

abundant information out there and try to reach our own

conclusions. Related Reading: Users Flee FTX? Exchange Sees 47%

Drop In On-Chain Balance Sam Bankman-Fried Bends The Knee After a

whole morning of radio silence, the mind behind FTX and Alameda

Research finally spoke. In a Twitter thread that will live for the

ages, Sam Bankman-Fried was as vague as one can be. “We have come

to an agreement on a strategic transaction with Binance for

FTX.com,” he tweeted. Then, he announced that “our teams are

working on clearing out the withdrawal backlog as is. This will

clear out liquidity crunches; all assets will be covered 1:1.”

Wasn’t that supposed to be the case from the beginning,

though? 2) Our teams are working on clearing out the

withdrawal backlog as is. This will clear out liquidity crunches;

all assets will be covered 1:1. This is one of the main reasons

we’ve asked Binance to come in. It may take a bit to settle etc. —

we apologize for that. — SBF (@SBF_FTX) November 8, 2022 Then,

Bankman-Fried proceeded to effectively declare a winner. “A *huge*

thank you to CZ, Binance, and all of our supporters. This is a

user-centric development that benefits the entire industry,” he

tweeted about his new boss. “Binance has shown time and again that

they are committed to a more decentralized global economy while

working to improve industry relations with regulators. We are in

the best of hands.” 5) I know that there have been rumors in media

of conflict between our two exchanges, however Binance has shown

time and again that they are committed to a more decentralized

global economy while working to improve industry relations with

regulators. We are in the best of hands. — SBF (@SBF_FTX) November

8, 2022 Is the deal set in stone, though? According to River’s CEO

Alexander Leishman, “The DD on this deal is going to take forever.

Bankruptcy still on the table if Binance decides they don’t want to

touch it after digging deeper.” BNB price chart on FTX | Source:

BNB/USD on TradingView.com The Binance CEO Announces The Win

Allegedly, CZ knew what he was doing the whole time. After

distancing himself from the concept of war and saying Binance was

focused on building, today CZ really showed his true colors. “This

afternoon, FTX asked for our help. There is a significant liquidity

crunch. To protect users, we signed a non-binding LOI, intending to

fully acquire FTX.com and help cover the liquidity crunch,” he

humbly tweeted. There is a lot to cover and will take some

time. This is a highly dynamic situation, and we are assessing the

situation in real time. Binance has the discretion to pull out from

the deal at any time. We expect FTT to be highly volatile in the

coming days as things develop. — CZ 🔶 Binance (@cz_binance)

November 8, 2022 However, CZ is admitting to a liquidity crunch

that shouldn’t be there. And then, he clarifies that the deal isn’t

done yet. “There is a lot to cover and will take some time. This is

a highly dynamic situation, and we are assessing the situation in

real time. Binance has the discretion to pull out from the deal at

any time.” Related Reading: The Binance Vs. FTX War: Here Are The

Most Recent Stats & On-Chain Data Analyzing the little data we

have, DeFinace Capital’s Arthur Ox tweeted, “Given how little time

it took to close this deal. It’s likely Binance acquire FTX for

nominal/negligible amount and assume all the liabilities of FTX.”

And then, he gave advice, “if I am previous round investor of FTX,

I will probably start engaging litigation lawyer now.” The Future

For Binance And FTX The analysts are having a field day with this

story. Dylan LeClair, who’s been covering the ins and outs

from day one, recently tweeted that the resolution “confirms that

FTX is insolvent without a bailout from Binance” and that “Alameda

was speculating with user funds.” Those are severe accusations, but

he’s got some data to back them up. "Liquidity crunch" I

thought your deposits were backed 1:1?? Or was your "proprietary

trading desk" directionally trading using user funds. We could all

see the movements flooding back from Alameda wallets on-chain

yesterday as reserves got depleted. pic.twitter.com/f7Y3LsYsqq —

Dylan LeClair 🟠 (@DylanLeClair_) November 8, 2022 Questioning the

liquidity crunch, LeClair asks, “was your “proprietary trading

desk” directionally trading using user funds. We could all see the

movements flooding back from Alameda wallets on-chain yesterday as

reserves got depleted.” Taking it to the next level, economist Tuur

Demeester is concerned with the implications, “If Binance buys FTX

and hence takes over the claims of its depositors, it seems likely

that Binance then would also become (or remain) a fractional

reserve operation.” What a time to be alive. Featured Image by

Candice Seplow on Unsplash | Charts by TradingView

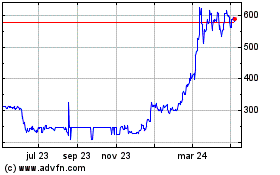

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

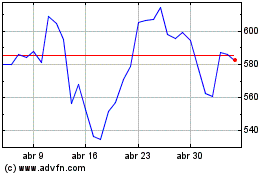

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024