Cardano (ADA): Green Shoots Emerge – Is A 30% Price Growth Next?

09 Febrero 2024 - 2:00AM

NEWSBTC

Cardano (ADA), the eighth largest cryptocurrency by market

capitalization, is experiencing a surge of excitement among

investors. A 10% price increase within the past 24 hours has

fuelled optimism, further amplified by crypto analyst Ali

Martinez’s prediction of a potential 32% jump to $0.68. Martinez’s

prediction is based on both technical analysis and recent positive

price movements. Related Reading: Boom! Bitcoin Barrels Past

$46,000, Eyes $50K As Bullish Sentiment Returns Cardano: No More

Downtrend – For Now One key technical indicator identified by

Martinez is the descending triangle pattern on the daily chart.

This pattern often foreshadows the end of a downtrend, offering

hope for Cardano’s future trajectory. However, for the bullish

scenario to materialize, Cardano needs to maintain its price above

$0.53, acting as a crucial support level. #Cardano shows signs of a

descending triangle formation on its daily chart. A sustained daily

close above $0.53 could lead to the start of a 32% rally,

potentially pushing $ADA up to $0.68! pic.twitter.com/DoizuVPiRI —

Ali (@ali_charts) February 8, 2024 Adding to the positive

sentiment, Cardano’s recent performance has been stellar,

outperforming its top 10 cryptocurrency peers. While Bitcoin (BTC)

saw a 2.48% increase, Ethereum (ETH) gained 3.15%, and Binance Coin

(BNB) climbed 4.04%, Cardano managed a noteworthy 10% surge. This

impressive performance was accompanied by a staggering 121%

increase in trading volume within a single day, reaching 599.29

million. Such a significant rise in volume suggests strong buyer

interest and potentially indicates a shift in momentum. However,

not everyone is fully convinced about Cardano’s upward trajectory.

The Social Dominance metric, which measures the relative amount of

discussion surrounding a cryptocurrency compared to the overall

crypto market, has dropped to nearly 0.60%. Cardano currently

trading at $0.5359 on the daily chart: TradingView.com ADA’s

Potential Growth Faces Challenges This could imply that ADA might

not have reached its local peak yet, suggesting room for further

growth. Additionally, the Cumulative Value Delta (CVD), a measure

of buying and selling pressure, remains negative, indicating the

presence of aggressive sellers who could pose a challenge to the

predicted price increase. Despite these potential headwinds,

another key metric offers encouragement. Open Interest (OI), which

reflects the total amount of outstanding contracts in futures

markets, has seen a significant increase. This suggests that buyers

are positioning themselves for further price appreciation,

potentially indicating their confidence in Cardano’s future.

Source: Coinalyze Related Reading: Bitcoin Nears $45,000 Level In

Historic Price Surge Following Spot ETF Debut Furthermore, NewsBTC

highlights Cardano’s ongoing development activity with numerous

projects in the pipeline. The Alonzo hard fork, which enabled smart

contracts on the Cardano blockchain, is considered a significant

milestone that could attract developers and drive future adoption,

potentially impacting the value of ADA tokens. While it’s still too

early to definitively say whether Cardano will reach the predicted

$0.68, the recent upswing, technical indicators, and strong buyer

interest suggest a potential breakout. However, investors should

exercise caution, as the cryptocurrency market remains volatile and

susceptible to sudden shifts. Featured image from Adobe Stock,

chart from TradingView

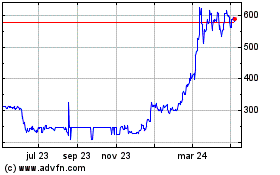

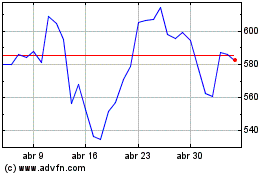

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Binance Coin (COIN:BNBUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024