The Crypto Bulls Are Back: Digital Asset Inflows Cross $103 Million In One Week

26 Diciembre 2023 - 4:00PM

NEWSBTC

Inflows into crypto investment funds have resumed after a brief

hiatus two weeks ago, as evidenced by CoinShares’s latest analysis.

According to James Butterfill, Head of Research at CoinShares,

digital assets saw a net inflow of $103 million last week, as the

wider crypto industry went through a few days of bullish sentiment.

This is particularly exciting, as it signaled a change from the net

outflows in digital asset investment funds witnessed two weeks

ago. Crypto Fund Inflows Surge To $103 Million Crypto asset

investment funds witnessed a minor net outflow of $16 million two

weeks ago, bringing an end to 11 consecutive weeks of inflows since

September. However, according to a social media post by Butterfill,

these investment funds attracted a $103 million net inflow last

week. As expected, Bitcoin, again, led the charge, attracting 85%

of the total inflow. Bitcoin saw an inflow of $87 million last

week, bringing its total net inflow this year to $1.758

billion. Related Reading: Harmony To See Redemption? Analyst

Predicts Meteoric 650% Rise For ONE Token Ethereum led the altcoin

market with a net inflow of $7.9 million, bringing its total net

inflow this year to $23 million. Solana followed suit with a $6

million net inflow. At the time of writing, Solana’s total inflow

this year stands at $162 million, reflecting the better sentiment

Solana has seen with institutional investors this year. On

the other hand, Litecoin and Avalanche investment products were the

only ones registering a net outflow during the week, with $0.4

million and $2.6 million respectively. In terms of geographical

location, Germany had the most inflows with $41.6 million, Canada

with $25.8 million, USA with $20.4 million, and Switzerland with

$15 million. On the other hand, Sweden had a net outflow of $8.7

million. Total assets under management now stand at $52

billion, representing 31% of the entire crypto market cap of $1.65

trillion. Most of this is traded in the United States, with

US-based investment funds holding $37.8 billion worth of assets

under management. US$103m inflows in digital assets last week, no

report on Monday. Merry Christmas! pic.twitter.com/xAVzCrPPkQ —

James Butterfill (@jbutterfill) December 23, 2023 Total market cap

rises above $1.6 trillion | Source: Crypto Total Market Cap on

Tradingview.com State Of The Market Investment in digital asset

funds is largely tied to the sentiment among the spot market

prices. As a result, the net inflows last week were a mirror of the

price surge led by Bitcoin, with the crypto crossing over $44,000

multiple times during the week. Bitcoin has since corrected and is

now trading at $42,390. Related Reading: Crypto Analyst Predicts

XRP Price Will Hit $1.33 ‘Pretty Fast’ Ethereum’s lead in the

altcoin market has been overshadowed by Solana since October. The

crypto is up by 53% in a 7-day timeframe, hitting a yearly high of

$124.92 on Christmas day. At the time of writing, Solana is trading

at $114. Featured image from Business Insider, chart

from Tradingview.com

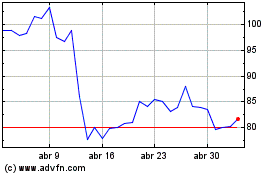

Litecoin (COIN:LTCUSD)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Litecoin (COIN:LTCUSD)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024