Defying The Crypto Crash: Liquid Staking’s $20 Billion Rise Amid Market Uncertainty

05 Septiembre 2023 - 7:00PM

NEWSBTC

The crypto market has witnessed several fluctuations, but specific

sectors’ resilience within this domain remains attractive.

Recently, despite a noticeable dip in the broader crypto market,

one area seems poised to touch its peak, demonstrating the

potential and adaptability within the crypto ecosystem, per a

report. Liquid staking, a sector that facilitates rewards for

token pledges supporting blockchain operations, shows signs of

resurgence. This re-emergence occurs despite an overarching

downturn in crypto assets. Related Reading: Lido (LDO) Price Inks

Gains Alongside TVL Rise – What Traders Should Expect Recovery Amid

Crypto Crisis According to Bloomberg, citing data from DefiLlama,

there is a roughly 292% surge in assets secured in liquid staking

services, reaching a monumental $20 billion from a low in June

2022. This ascent is all the more significant considering the

broader crypto slump during that period. Bloomberg noted a recovery

in liquid staking’s position as “the titan of decentralized finance

(DeFi).” Thanks to blockchain-based automated software, this crypto

framework enables individuals to trade, borrow, and lend without

intermediaries. Notably, once the crown jewel of DeFi applications,

liquid staking has overtaken lending. Protocols specialized in

liquid staking, such as Lido and Rocket Pool, witnessed their

zenith in April of the previous year. They amassed assets slightly

exceeding $21 billion. However, this momentum was disrupted by the

destabilization of TerraUSD, leading to a massive $2 trillion

setback in the crypto market. Despite the gloomy overtones in the

crypto sector, where major tokens and a majority of DeFi services

are yet to recover from the blows of 2021 and 2022, liquid staking

stands out, showcasing a comeback, as seen in the chart below.

Global Regulatory Stance On Staking Liquid staking plays a pivotal

role, especially in the Ethereum blockchain. It offers a mechanism

where users can stake their tokens and, in return, receive a liquid

token representing their staked amount. This process allows users

to participate in securing the network while maintaining liquidity.

Simply put, they can earn staking rewards without locking up their

assets, ensuring flexibility and maximizing potential gains. Kunal

Goel, a research analyst at Messari, parallels these services to

“the on-chain equivalent of government bonds.” The analyst

elaborates that while these aren’t devoid of risks, they exude a

comparatively lower risk profile and, thus far, have remained

untainted by hacks or exploits. This resurgence in liquid staking

doesn’t go unnoticed and has been juxtaposed with regulatory

decisions concerning crypto globally. The US, for instance, has

intensified its regulatory lens on the crypto sector, especially on

staking products. Related Reading: Rocket Pool (RPL) On 4-Day

Bullish Streak After Shapella, Can It Make A Fifth? Such measures

prompted key players like Kraken and Bitstamp to halt their

regional staking products. Richard Galvin, co-founder at DACM,

noted: The regulatory crackdown around staking products offered by

centralized exchanges has definitely helped liquid staking.

Featured image from iStock, Chart from TradingView

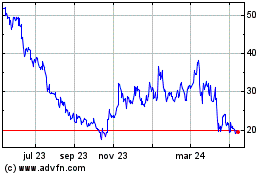

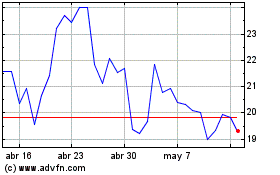

Rocket Pool (COIN:RPLUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Rocket Pool (COIN:RPLUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024