Solana Rockets Up 23% As Developments Spark Investor Interest

12 Agosto 2024 - 4:30AM

NEWSBTC

Although the market dipped today, Solana has found its way to spark

investor interest despite falling a few points in the past 24

hours. However, the token is still up nearly 22% in the past month,

going against the market’s general bearishness after last week’s

slip and slide. Related Reading: XRP Price Reaches Support:

Will It Trigger a Turnaround? Solana’s significant traction around

the world has garnered some attention in the institutional space,

leading to a development that might help SOL weather the bearish

storm ahead. But with the coming announcements of several macro

indicators, there might be trouble in the coming weeks.

Brazil Approves Solana ETF, Coming Ahead Of The USA The Comissão de

Valores Mobiliários (CVM), the Brazilian equivalent of the US

Securities and Exchange Commission, approved QR Asset’s Solana

exchange-traded fund (ETF) proposal on Wednesday becoming the first

ever Solana ETF in Latin America. This development surpasses the

United States as several Solana ETFs are still up for review by the

SEC. According to local sources, the ETF is still subject to

approval by B3, the company responsible for the country’s stock

exchange. Nonetheless, this is a huge win for Brazilian

crypto-enthusiasts as it solidifies the country’s position in the

international crypto scene. “This ETF reaffirms our

commitment to offering quality and diversification to Brazilian

investors. We are proud to be global pioneers in this segment,

consolidating Brazil’s position as a leading market for regulated

investments in crypto assets,” Theodoro Fleury, Manager and Chief

Investment Officer at QR Asset, said in an interview. SOL

Consolidation Phase Starts, Price To Stabilize On This Level

Regulatory hurdles are the thing that block Solana ETFs from

hitting the market. Although the SEC already pulled Solana’s name

from its legal action against Binance, Solana ETFs in the US are

still a long way ahead. But the market reacted spectacularly well

from the Brazilian Solana ETF announcement. Although short

term pain is relatively stingy, SOL’s position is quite healthy as

the $131-$147 price range remains to be the bulls’ chosen platform

for future upward movement. Meanwhile, World of Charts, a

well-known cryptocurrency analyst, has identified the presence of a

bullish pennant pattern. This pattern typically occurs after a

significant upward price movement and is characterized by

converging trendlines that resemble a symmetrical triangle. This

pattern indicates a temporary halt in the market before continuing

the current upward trend. ETF: Boon Or Bane? The ETF announcement

has definitely hurt the bears, which further reduced the

possibility of further downturn. Moving forward, investors and

traders should watch the broader market developments that may or

may not affect the token’s price movement. In this case, watching

how institutional entities grow in interest on Solana– and crypto

as a whole– is a great place to start. Related Reading: SUI

Leads Crypto Market With 78% Weekly Uptick: Here’s Why SOL’s

potential is in the long term with developments like this that may

take place weeks, or even months, after the initial announcement.

As of now, SOL is weathering the bearish storm well as the

consolidation phase opens the road toward $171 or even $186.

However, expect this consolidation phase to be short as the market

continues to experience moderate volatility in the short

term. Featured image from Marca, chart from TradingView

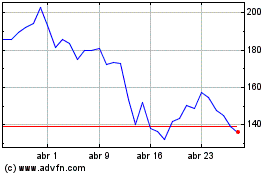

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Solana (COIN:SOLUSD)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024