Solana Plummets 17% As SOL Hits $118: Is a Break Below Inevitable?

05 Agosto 2024 - 7:00AM

NEWSBTC

Solana (SOL) is currently experiencing a significant decline,

dropping over 17% and reaching the critical $118 support level.

This sharp downturn has put considerable pressure on this key

level, raising concerns among traders and investors about the

possibility of a further breakdown. The $118 level has historically

been a stronghold for the cryptocurrency, but with the current

bearish sentiment in the market, its ability to hold is still being

determined. With the help of key technical indicators, this

article will provide an in-depth analysis of Solana’s current price

actions, assess the likelihood of breaking the $118 support, and

explore potential scenarios for SOL. As of the time of writing,

Solana has dropped by 17%, trading at approximately $119.78 in the

past 24 hours. Solana boasts a market capitalization exceeding $54

billion, which demonstrates a decrease of 18.45% and a trading

volume surpassing $9.4 billion, indicating an increase of 182.21%

in the past 24 hours. Technical Analysis: Indicators Pointing To A

Potential Break For Solana On the 4-hour chart, Solana has

demonstrated significant bearish momentum, with the price dropping

below the 100-day Simple Moving Average (SMA) and currently

attempting a break below the $118 support level. A successful

breach below this key level could lead to a further bearish move

for the cryptocurrency. The Relative Strength Index (RSI) on the

4-hour chart has dropped to 24.74%, which is considered to be an

oversold zone. This position of the RSI indicator signals that SOL

could extend its bearish move beyond $118. On the 1-day chart,

Solana has experienced increased selling pressure as the price

consistently forms bearish candlesticks. Specifically, this pattern

shows sellers are gaining control over the market, pushing the

price lower with each successive trading session. Also, the

formation of these bearish candlesticks, characterized by closing

prices lower than their opening prices, reflects a pattern of

sustained selling, which is often a sign of underlying weakness in

the asset. Finally, the 1-day RSI has also dropped below 50%, which

further supports the possibility of further price drop. This drop

suggests that bearish pressure is rising, as sellers are still

active and influential in the market. The fact that sellers are

still active implies that Solana will probably continue to decline.

Potential Scenarios: What Happens if $118 Fails? If Solana can

maintain its current bearish momentum and close below the $118

support level, it may continue to move downward to challenge the

$99.44 support level. When this level is breached, the digital

asset may experience further price loss toward the $79.24 support

range and possibly other ranges below. Conversely, should SOL’s

price close above the $118 support level, it will start to ascend

once more toward the $160 resistance point. Following a break above

this level, the crypto asset may see further price gain to

challenge the $170 resistance level and perhaps other levels above.

Featured image from Adobe Stock, chart from Tradingview.com

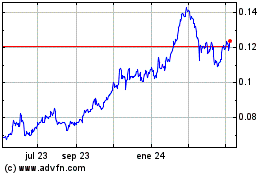

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

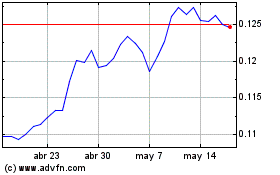

TRON (COIN:TRXUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024