Bitcoin Mining Revenue Surged 10% In August

01 Septiembre 2022 - 8:00PM

NEWSBTC

The first monthly gain since March, bitcoin mining revenue

increased 10% in August. Bitcoin Mining Revenue Soars Approximately

$657 million was earned by miners last month, according to

statistics gathered by The Block Research. In the most recent

update published on Wednesday, the difficulty of mining bitcoin

increased by 9.26% while the hash rate increased by more than 13%.

According to Kevin Zhang, senior vice president of mining strategy

at Foundry, which manages the Foundry USA mining pool, the increase

in hash rate is caused by “a combination of heat waves finally

subsiding (on a global level) and facilities slowly coming online,”

“There’s also the added kicker of the higher efficiency Bitmain S19

XP’s finally hitting the market as well!” Source: The Block Crypto

Data. Only a minor fraction of the pioneer crypto mining profits

($9.24 million) came from transaction fees, with the majority

($647.72 million) coming from the block reward subsidies.

Transaction costs for bitcoin decreased to 1.4% of overall revenue.

Ethereum miners generated $725 million in income in August, which

is 1.1 times more than bitcoin miners. Related Reading: Tug Of War

Between Bulls And Bears, Will Bitcoin Price Retest $19,000? Mining

Difficulty Surges The difficulty of mining bitcoin is rising.

According to data from BTC.com, the mining difficulty for the

largest cryptocurrency in the world increased by 9.26% during the

previous two weeks. The website’s analysis reveals that the

network’s mining difficulty is at its highest point since January,

reaching 30.97 trillion, with the hashrate currently averaging

around 230 exahashes per second (EH/s). Last month, Texas miners

stopped working in order to support the electrical system and save

energy during a heat wave. This action probably made Bitcoin easier

to mine. Weeks later, they turned back on, and as the level of

difficulty rises, miners may see their income decline as more

computer power (and energy) is required, but the price of Bitcoin

has remained stable. BTC/USD trades at $20k. Source: TradingView

According to TradingView data, the price of BTC was $20,060 at the

time of writing. It has been struggling for months to surpass the

$25,000 level and is down more than 70% from the record high of

$69,044 it reached in November. Related Reading: Bearish Indicator:

Bitcoin Short Exposure Surge To New All-Time High Featured image

from FT and chart from TradingView.com and The Block

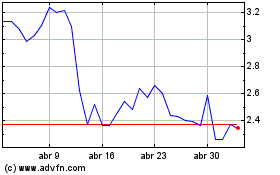

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Waves (COIN:WAVESUSD)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024

Real-Time news about Waves (Criptodivisas): 0 recent articles

Más de Waves Artículos de Noticias