- Solid business growth in the first quarter of 2024: revenue

up 7.4%

- All regions and business segments contributing to

growth

- Refinancing Plan well underway in the first quarter:

- AMF exemption obtained by Predica

- First tranche of asset disposals completed, raising

€268 million, more than quarter of the total disposal

plan

- In the Combined General Meeting of Shareholders of 26 March

2024, the capital increase was approved by a very large

majority

- 2024 objectives confirmed: organic revenue growth of

over 5% and stable EBITDA* in value

Regulatory News:

CLARIANE (Paris:CLARI):

In millions of euros –

First quarter 2023

First quarter 2024

Reported growth

Organic growth

Revenue**

1,218

1,308

+7.4%

+7.4%

France

535

579

+8.2%

+7.0%

Germany

283

304

+7.6%

+7.9%

Belgium/Netherlands

181

191

+5.7%

+8.1%

Italy

153

158

+3.5%

+4.3%

Spain/UK*

67

76

+13.2%

+13.6%

* Given the expected absence of

any contribution from real-estate development activities in 2024,

EBITDA excluding IFRS 16 and excluding expected disposals should

remain stable in value.

**The disposal of all of the

Group’s UK operations was completed on 9 April 2024. Accordingly,

the Group’s performance figures include UK revenue for the whole of

the first quarter of 2024.

Sophie Boissard, CEO of Clariane, said:

“The Group’s performance in the first quarter confirmed our

strong operational momentum over the recent period, across all of

our business segments and in all regions in which Clariane

operates. In particular, the Group’s average occupancy rate in its

Long-Term Care segment rose close to 90% in March 2024.

The Group Is prioritising more than ever the implementation of

the refinancing plan announced on 14 November 2023. A key milestone

was reached on 26 March, in our Combined General Meeting of

Shareholders, when 98% of votes were cast in favour of the capital

increase. We hope to meet the other prior requirements for carrying

out the capital increase – gaining regulatory approval in

particular – in the coming weeks. At the same time, after selling

certain real-estate assets in the Netherlands in the first quarter

along with all of our UK operations, we are continuing to make

progress with our disposal plan, with the aim of reducing our debt

and leverage.

2024 will therefore be an important transitional year for the

Group. The dedication of our staff members, along with good

momentum in our various business segments and geographies, means

that we can look ahead to the coming year with confidence. “

Important information

This press release does not constitute, and shall not be deemed

to constitute, an offer to the public, an offer to buy or the

solicitation of public interest in an offer to the public, nor

shall there be any sale of securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful absent

registration or approval under the securities laws of such state or

jurisdiction. The distribution of this document may be subject to

specific restrictions in certain countries. Persons into whose

possession this document comes are required to inform themselves

about and to observe any such potential local restrictions.

A prospectus relating to the capital increase will be submitted

by Clariane S.E. to the Autorité des Marchés Financiers for

approval prior to the effective launch of the capital increase.

All forward-looking statements included in this document are

valid only as of the date of this press release. Clariane S.E.

undertakes no obligation and assumes no responsibility to update

the information contained herein beyond the requirements of

applicable regulations.

In this press release, and unless indicated otherwise, all

changes are stated on a year-on-year basis (2024/2023), and at

constant scope and exchange rates.

The main alternative performance indicators (APIs), such as

EBITDA, EBIT, net debt and financial leverage, are defined in the

Universal Registration Document available on the company’s website

at www.clariane.com.

Clariane’s revenue in the first quarter of 2024 amounted to

€1,308 million, up 7.4% on a reported basis and at constant scope

and exchange rates.

Across the Group as a whole, the occupancy rate in the Long-Term

Care segment rose 1.9 points to 89.6% in the first quarter of

2024.

At 31 March 2024, the network consisted of 1,235 facilities as

opposed to 1,195 a year earlier, representing almost 92,000 beds

versus around 91,000 at 31 March 2023.

Reported revenue growth was supported by:

- Growth in business volumes, which had a net positive impact of

€47 million (higher occupancy rate in mature facilities, additional

capacity coming onstream);

- Price increases, which had a positive impact of €43 million,

particularly in France;

- A neutral effect from changes in scope.

1 - Key performance indicators for the first quarter of 2024 by

segment

In millions of euros

First quarter 2023

First quarter 2024

Reported growth

Organic growth

Revenue*

1,218

1,308

+7.4%

+7.4%

Long-Term Care*

759

802

+5.7%

+7.1%

Specialized Care*

322

337

+4.8%

+5.1%

Community Care

138

169

+22.3%

+14.4%

* All of the Group’s UK operations were

deconsolidated on 9 April 2024 following their disposal. The

Group’s first-quarter 2024 performance in this region therefore

includes UK figures for the whole of the period.

1.1 - Long-Term Care

The Long-Term Care segment, which accounted for 61.3% of

the Group’s business activity in the first quarter of 2024,

generated revenue of €802 million, up from €759 million in

the year-earlier period, representing reported growth of 5.7% and

organic growth of 7.1%.

That growth came from price increases aimed at offsetting

high-cost inflation in 2023, particularly in Germany, and from a

further rise in the occupancy rate, which averaged 89.6% in the

first quarter as opposed to 87.7% in the same period of 2023,

reflecting a return to normal operating conditions post-Covid and a

ramp-up in newly introduced capacity. In March 2024, the occupancy

rate in this segment was 90.2%.

1.2 - Specialized Care:

The Specialized Care segment generated €337 million of

revenue in the first quarter of 2024, 25.8% of the Group total,

equating to growth of 4.8% as reported and +5.1% in organic

terms.

In particular, this performance was driven by:

- The medical and rehabilitation care sub-segment: new technical

platforms came into service and new areas of specialist care were

developed, particularly in oncology and neurology;

- The mental health sub-segment: the integration of Grupo 5 in

Spain in 2023 has significantly strengthened the Group’s business

in this sector.

Revenue from outpatient activities (consultations and partial

hospitalisation) rose by more than 7.1% (around 7.3% on an organic

basis).

1.3 - Community Care

Revenue in the Community Care segment, whose brands

include Petits-fils and Ages & Vie in France, amounted to €169

million in the first quarter of 2024 (12.9% of the Group total),

representing growth of 22.3% as reported or 14.4% on an organic

basis.

2 - Performance by geographical zone

2.1 - France

In millions of euros

First quarter 2023

First quarter 2024

Reported growth

Organic growth

Revenue

535

579

+8.2%

+7.0%

In the first quarter, revenue growth in France was strong

(7.0% in organic terms) in all business segments.

- Organic revenue growth in the Long-Term Care segment was

6.4%. That increase reflects the impact of revised pricing and

higher volumes, with the average occupancy rate continuing to rise

gradually to 87.8% during the first quarter as opposed to 87.1% in

the first quarter of 2023 based on the network of operational

facilities. The occupancy rate was 87.8% in March 2024, up from

86.9% in March 2023.

- The Specialized Care segment achieved organic revenue

growth of 6.1% in the first quarter of 2024. Each sub-segment –

homecare, mental health and medical and rehabilitation care –

achieved significant growth during the period. Outpatient and

partial hospitalisation activities made a good contribution in all

facilities.

- Finally, the Community Care segment achieved strong

growth in the first quarter (revenue up 25.5% on an organic basis),

driven by robust demand for services such as those offered by Ages

& Vie and Petits-fils.

2.2 - Germany

In millions of euros

First quarter 2023

First quarter 2024

Reported growth

Organic growth

Revenue

283

304

+7.6%

+7.9%

Revenue in Germany rose sharply in the first quarter of

2024, driven mainly by price increases negotiated in 2023 with

local authorities. Operating conditions continued to be affected by

the very high inflation of the last two years, and price increases

negotiated in 2023 did not fully make up for that inflation.

However, the time lag between the impact of inflation and price

increases should be gradually eliminated in 2024 and 2025 by new

pricing measures currently being negotiated.

- Looking at individual business segments:

- The Long-Term Care segment posted organic growth of

7.2%, supported by price rises and an occupancy rate that rose from

86.9% in the first quarter of 2023 to 88.8% in the first quarter of

2024. The occupancy rate was 89.2% in March 2024, up from 86.4% in

March 2023.

- Revenue in the Community Care segment grew by 9.2% on an

organic basis.

2.3 - Benelux

In millions of euros

First quarter 2023

First quarter 2024

Reported growth

Organic growth

Revenue

181

191

+5.7%

+8.1%

Growth remained strong in the Benelux region, with

revenue rising by 8.1% on an organic basis in the first

three months of the year.

In Belgium, revenue totalled €154 million, up 5.7% on an organic

basis.

- The Long-Term Care segment posted organic growth of

4.9%, supported by an occupancy rate that rose from 89.5% in the

first quarter of 2023 to 91.6% in the first quarter of 2024, and by

regular price rises. In March 2024, the occupancy rate was 91.7%,

as opposed to 89.7% in March 2023.

- The Community Care segment – which accounts for just

over 7% of the Group’s revenue in Benelux – achieved rapid organic

growth of 16.7%.

In the Netherlands, revenue was €37 million in the first quarter

of 2024, up 19.6% on an organic basis.

The Group’s three Dutch business segments achieved firm growth

throughout the period.

- Long-Term Care revenue rose by 20.5%, supported by an

improvement in the occupancy rate to 74.4% on average over the

period as a whole versus 73.2% in the first quarter of 2023. This

reflects the rapid ramp-up of recently completed greenfield

facilities in favourable market conditions.

- Revenue in the Specialized Care segment, which accounted

for just over 2% of the total in the Netherlands, was stable during

the period (up 0.4%).

- The Community Care segment – which accounts for around

15% of the Group’s revenue in the Netherlands – achieved organic

revenue growth of 18.1%.

2.4 - Italy

In millions of euros

First quarter 2023

First quarter 2024

Reported growth

Organic growth

Revenue

153

158

+3.5%

+4.3%

Revenue in the Italian market rose by 4.3% on an organic

basis.

- Long-Term Care revenue grew by 7.9% on an organic basis,

supported by a high occupancy rate of 95.6% on average during the

period as a whole versus 92.2% in the first quarter of 2023. The

occupancy rate was 96.1% in March 2024 as opposed to 92.9% in March

2023.

- Revenue in the Specialized Care segment, which accounted

for around 46% of the total in Italy, was stable during the period

(up 0.4%).

- The Community Care segment – which made up around 7% of

the Group’s revenue in Italy – achieved organic revenue growth of

7.9%.

2.5 - Spain/UK*

In millions of euros

First quarter 2023

First quarter 2024

Reported growth

Organic growth

Revenue*

67

76

+13.2%

+13.6%

* The disposal of all of the Group’s UK operations was completed

on 9 April 2024. Accordingly, the Group’s performance figures

include UK revenue for the whole of the first quarter of 2024.

The region, as a whole, posted solid revenue growth of 13.6% on

an organic basis, supported by price rises and the ramp-up of

business levels in the UK.

In Spain, revenue totalled €59 million in the first quarter of

2024, up 11.0% on an organic basis.

- Revenue in the Long-Term Care segment – which

accounts for around 19% of revenue in Spain – rose by 9.1% on an

organic basis. This was supported by an average occupancy rate of

88.5% over the first quarter as a whole versus 83.8% in the first

quarter of 2023, and by a slight increase in prices. The occupancy

rate was 89.7% in March 2024 as opposed to 83.2% in March

2023.

- Specialized Care revenue grew 8.5% on an organic basis

and 7.9% as reported; the acquisition of Grupo 5 no longer had a

significant impact on the scope of consolidation since it was

integrated in the first quarter of 2023.

- The Community Care segment – which only accounts for

around 4% of the Group’s revenue in Spain – remained highly

volatile, with revenue growth of 111.3%.

In the United Kingdom, revenue totalled €17 million, up 23.7% on

an organic basis. This performance was driven by price rises, since

the average occupancy rate was stable at 84.9% over the first

quarter as a whole (85.8% in March 2024, 84.3% in March 2023). The

deal to sell the UK business closed on 9 April 2024, and so it will

be fully deconsolidated from that date.

3 - Update on the Refinancing Plan

The refinancing plan announced on 14 November 2023 was put in

place to deal with the liquidity difficulties presented at that

time and reiterated in the press release of 8 February 2024. These

risks are described in the notes to the 2023 financial statements,

which are available on the company’s website www.clariane.com.

As part of the Refinancing Plan announced on 14 November 2023,

the Company completed its first two stages in December

2023:

- Formation of the Gingko real-estate partnership, raising €140

million (see press release of 15 December 2023) followed by the

Juniper real-estate partnership, which raised €90 million (see

press release of 28 December 2023);

- Arrangement of a €200 million real-estate-backed bridge term

loan with Crédit Agricole Mutuel de Paris et d’Ile de France

(CADIF), LCL and Crédit Agricole Corporate and Investment Bank

(CACIB).

As regards the capital increase, the process is

continuing:

- The AMF has granted Predica, a subsidiary of the Crédit

Agricole Assurances Group and Clariane’s largest shareholder,

exemption from the requirement to file a draft tender offer (in the

event that Predica crosses the 30% threshold as a result of the

capital increase) based on Articles 234-8, 234-9(2) and 234-10 of

the AMF’s General Regulation (AMF decision no. 224C0227 of 8

February 2024).

Crédit Agricole Assurances, which holds 24.7% of the share

capital and voting rights via Predica, has undertaken to subscribe,

subject to the fulfilment of the Conditions Precedent and market

standard conditions for this type of transaction, (i) by

irrevocable entitlement in proportion to its equity stake by

exercising all the preferential subscription rights it will receive

and (ii) by using its entitlement subject to reduction in a cash

subscription amount equal to the difference between €200 million

and the total amount of its subscription by irrevocable

entitlement.

The Company has also received expressions of interest from banks

to underwrite, subject to conditions precedent, the remainder of

the capital increase, i.e. up to a maximum of €100 million.

- The adoption by Clariane’s shareholders of the resolutions

relating to the €300 million capital increase in the 26 March 2024

Combined General Meeting of Shareholders is a further step towards

its completion, scheduled for late June 2024 or September

2024.

The transaction remains subject to the fulfilment of the

following conditions precedent:

- Authorisation from the relevant competition authorities for

Crédit Agricole Assurances’ possible acquisition of control over

Clariane in the event that Crédit Agricole Assurances’ subscription

to the Capital Increase leads to such an acquisition of

control;

- An amendment to the terms and conditions of the OCEANE bonds

maturing in 2027 (0.875% – FR0013489739) in order to prevent early

redemption from being triggered in the event that Crédit Agricole

Assurances acquires control over Clariane through the capital

increase;

- Submission by the independent appraiser appointed by the

Company’s Board of Directors of a fairness opinion confirming the

fairness of the terms and conditions of the capital increase and

the related agreements, including the underwriting

commitments;

- Approval of the prospectus for the capital increase by the

AMF.

It should be noted that the capital increase will provide for

shareholders’ preferential subscription rights to be maintained so

that shareholders can subscribe to it in order to maintain their

stake while taking advantage of the discount. Otherwise,

shareholders who do not wish to exercise their preferential

subscription rights will be subject to significant dilution, which

may be offset in whole or in part by the sale of their preferential

subscription rights.

Lastly, the Company points out that the capital increase is an

essential condition of its plan to strengthen its financial

position and that if it is not carried out, the Company would be

obliged to place itself under appropriate protection in order to

renegotiate its debt with its creditors.

As regards the asset disposal programme, intended in

particular to refocus the Group’s business geographically and to

raise around €1 billion of gross disposal proceeds, the

Group has so far sold:

- Its 50% stake in a real-estate portfolio in the Netherlands to

its partner Aedifica for a total agreed sale value of around €25

million;

- All of its business activities and assets in the United

Kingdom, via an OpCo/PropCo deal, to Elevation Specialized Care

Property, a UK real-estate investment fund specialising in

retirement homes and Specialized Care facilities and managed by

Elevation Advisors LLP, resulting in gross disposal proceeds of

£207 million (around €243 million). The assets sold were part of

the Juniper real-estate partnership signed with Predica (see press

release of 28 December 2023). Details of this transaction, and

particularly the Group’s plans for using the proceeds, are

described in the press release relating to the disposal, published

on 28 February 2024. It should be noted that the net proceeds from

the disposal of this business will contribute to the repayment of

approximately €150 million of the Group’s outstanding debt, but

will not have a significant impact on leverage.

With the sale of its business in the United Kingdom and six

real-estate assets in the Netherlands announced on 5 February 2024,

the Group has already completed over a quarter of the asset

disposal programme in the first three months of 2024. It is

actively pursuing that programme and several deals are in the

pipeline, particularly in Benelux.

On 4 April, Clariane also confirmed that it had held an

information meeting with members of the Central Workforce Relations

and Economic Committee, in accordance with applicable French

regulations, about the possible disposal of its hospital home care

and home nursing services business in France. The Group currently

has eight specialist hospital home care facilities and three home

nursing services agencies in France, which employ 309 people

(full-time equivalent). In 2023, this business generated just over

€46 million of revenue. As of the date of the present press

release, the Group had not received any firm offer to acquire this

business.

4 - Outlook for 2024

In 2024, the Group will continue to focus on improving its

performance in a balanced way and on maintaining a high level of

quality in all its activities, in line with its “At your side”

corporate project.

Clariane expects organic revenue growth to remain above 5%,

supported by a steady increase in business volumes and ongoing

price adjustments.

Given the expected absence of any contribution from real-estate

development activities in 2024, EBITDA excluding IFRS 16 and

excluding expected disposals should remain stable in value.

As regards non-financial indicators and adjusted for changes in

scope resulting from the disposal plan, Clariane has set

quantitative targets for the 19 indicators on its new CSR roadmap.

In particular, it is aiming to:

- Maintain a net promoter score (NPS) of at least 40 among

residents/patients and families;

- Continue having more than 7,000 staff members undertaking

training courses leading to qualifications, in line with its

purpose-driven commitments;

- Reduce its lost-time accident frequency rate by at least a

further 8 points;

- Implement a low-carbon energy trajectory compatible with the

Paris Agreements and validated by the Science Based Target

initiative (SBTi).

These targets will be adjusted to take into account changes in

scope resulting from the disposal plan.

In line with the refinancing plan presented on 14 November, the

Group has prioritised improving cash flow generation and

controlling debt levels. In terms of expenditure, the Group will

maintain its maintenance spending at a normal level, which should

be around €100 million. Growth investments are expected to average

around €200 million in 2024 and 2025, much less than in 2023.

Finally, the Group is aiming to reduce its leverage ratio to

below 3.0x and its LTV to 55% by the end of 2025. The speed with

which the Group reduces its debt and gearing in 2024 will be

closely related to pace at which the Refinancing Plan announced on

14 November 2023 is implemented, through the €1 billion disposal

programme and the completion of the planned capital increase.

As the leverage ratio was greater than 3.5x at 31 December 2023,

the Group reiterates that it will not pay a dividend in respect

of 2023, in accordance with the terms of its unsecured

syndicated loan agreement.

Finally, the Group will present its medium-term plan to

the market on 21 May 2024.

5 - In relation to the present press release, the Group will

hold:

- A conference call in English at 3.00pm CEST on 26 April

2024

You can take part in the conference call by

- calling one of the following numbers:

- Paris: +33 (0)1 70 37 71 66

- UK: +44 (0)33 0551 0200

- US: +1 786 697 3501

- You can watch the live webcast here.

A playback of the conference call will be available here.

The presentation used in the conference call will be available

on Clariane’s website (www.clariane.com) from 12pm (CET).

6 - Forthcoming events

- The Group will present its medium-term plan to the market on 21

May 2024

About Clariane

Clariane is the leading European community for care in times of

vulnerability. It has operations in seven countries: Belgium,

France, Germany, Italy, the Netherlands, Spain and the United

Kingdom.

Relying on their diverse expertise, each year the Group’s 67,000

professionals provide services to over 800,000 patients and

residents in three main areas of activity: long-term care nursing

home (Korian, Seniors Residencias, Berkley, etc.), specialized care

facilities and services (Inicea, Ita, Grupo 5, Lebenswert, etc.),

and alternative living solutions (Petits-fils, Les essentiels, Ages

et Vie, etc.).I

In June 2023, Clariane became a purpose-driven company and added

to its bylaws a new corporate purpose, common to all its

activities: “To take care of each person’s humanity in times of

vulnerability”.

Clariane has been listed on Euronext Paris Section A since

November 2006 and is included in the following indices: SBF 120,

CAC Health Care, CAC Mid 60, CAC Mid & Small and MSCI Global

Small Cap

Euronext ticker: CLARI - ISIN: FR0010386334

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425793988/en/

Investor contacts Stéphane Bisseuil Head of

Investor Relations +33 (0) 6 58 60 68 69

stephane.bisseuil@clariane.com

Press contacts Matthieu Desplats Head of Press

Relations 06 58 09 01 61 matthieu.desplats@clariane.com

Julie Mary Press Officer 06 59 72 50 69

julie.mary@clariane.com

Florian Bachelet Press Officer 06 79 86 78 23

florian.bachelet@clariane.com

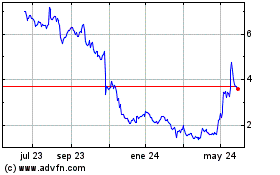

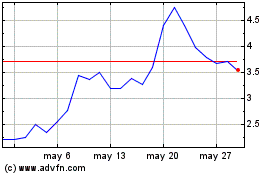

Clariane (EU:CLARI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Clariane (EU:CLARI)

Gráfica de Acción Histórica

De May 2023 a May 2024