Heineken N.V. reports 2024 half year results

Amsterdam, 29 July 2024 – Heineken N.V.

(EURONEXT: HEIA; OTCQX: HEINY) announces:

- Revenue €17,823 million

- Net revenue (beia)

6.0% organic growth; per hectolitre 4.3%

- Beer volume organic

growth 2.1%; Heineken® volume 9.2% growth

- Operating profit

€1,542 million; operating profit (beia) organic growth 12.5%

- Diluted EPS (beia)

€2.15; up 5.9%

- Outlook for the

full year updated: operating profit (beia) expected to grow

organically in the range of 4% to 8%.

Dolf van den Brink, CEO and Chairman of the Executive

Board, commented:

"We delivered a solid first half of the year, organically

growing net revenue (beia) 6% and operating profit (beia) 12.5%.

The Americas region stood out, as portfolio mix and major ongoing

saving initiatives resulted in a strong operating profit

improvement, notably in Brazil and Mexico. APAC returned to growth,

led by India and with the Vietnamese beer market stabilizing. We

are actively navigating volatility in Africa. In Europe we gained

market share in the majority of our markets and beer volume was

slightly up compared to last year despite poor weather in June.

Our EverGreen strategy continues to shape our business. Premium

beer volume grew 5%, led by the Heineken® brand, up 9%.

Heineken® was proud to receive a record 22 awards from

the Cannes Lions Festival. We consolidated leadership in the Low

& No-alcohol category, with Heineken® 0.0 up 14%. We are firmly

on-track to deliver €0.5 billion gross savings for 2024, enabling

us to invest in growing the category and in building strong

brands.

In the second half, we will materially step-up investment in

market and sales expenditures, with notable increases in key

markets. We update our full year outlook to grow operating profit

(beia) organically in the range of 4% to 8%, reflecting our

confidence in delivery and commitment to invest behind growth and

to future-proof our business.”

|

IFRS Measures |

€ million |

|

Total growth |

|

BEIA Measures |

€ million |

Organic

growth2 |

| Revenue |

17,823 |

|

2.2% |

|

Revenue

(beia) |

17,812 |

5.9% |

| Net revenue |

14,824 |

|

2.1% |

|

Net revenue

(beia) |

14,814 |

6.0% |

| Operating profit |

1,542 |

|

-4.3% |

|

Operating

profit (beia) |

2,079 |

12.5% |

| |

|

|

|

|

Operating

profit (beia) margin |

14.0% |

|

| Net profit* |

-95 |

|

|

|

Net profit

(beia) |

1,204 |

4.4% |

| Diluted EPS (in €)* |

-0.17 |

|

|

|

Diluted EPS

(beia) (in €) |

2.15 |

5.9% |

| *Includes non-cash

impairments of €1,050 million in accordance with IFRS (IAS 28 and

36). For more details go to pages 5, 14 and 29. |

|

Free

operating cash flow |

655 |

|

|

|

Net debt / EBITDA (beia)3 |

2.4x |

|

1 Consolidated figures are used throughout this report, unless

otherwise stated. Please refer to the Glossary for an explanation

of non-GAAP measures and other terms.

Page 12 includes a reconciliation versus IFRS metrics. These

non-GAAP measures are included in internal management reports that

are reviewed by the Executive Board of

HEINEKEN, as management believes that this measurement is the most

relevant in evaluating the results and in performance

management.

2 Organic growth shown, except for Diluted EPS (beia), which is

total growth.

3 Includes acquisitions and excludes disposals on a 12 month

pro-forma basis.

Our EverGreen strategy is a multi-year journey, and we are

pleased with the solid progress in the first half of 2024. While

several key emerging markets had to navigate a volatile

macroeconomic environment, overall, we achieved more balanced,

volume- and value-led revenue growth, and good operating leverage.

We also continue to deliver against our premiumisation, digital and

sustainability ambitions, funded by gross savings and productivity

gains.

We continue to expect variable costs to increase organically by

a low-single-digit on a per-hectolitre basis. While we expect to

benefit from lower commodity and energy prices compared to 2023,

this is more than offset by local input cost inflation and currency

devaluations, particularly in Africa. We also expect higher than

historical average wage inflation.

Across the company, our markets and functions realized more than

€300 million of gross savings in the first half. We have clear line

of sight on our cost saving initiatives and are therefore confident

to achieve our c.€500 million ambition for 2024, ahead of our

medium-term commitment of €400 million per year.

We are reinvesting a larger proportion of these savings into

marketing and sales. In the second half, we will materially step-up

investment in our brands focused on our greatest opportunities for

long-term sustainable growth. Notable increases will be in Mexico,

Brazil, Vietnam, India, and South Africa.

At the same time, volatility remains a reality. Consumer

confidence and economic sentiment in developed markets remain below

their historical average. In the Africa & Middle East region

there is a risk of material currency devaluation in Ethiopia and

hyperinflation in Nigeria and Egypt. We are confident we are able

to adapt, yet this continues to bring some short-term

uncertainty.

Reflecting our confidence in delivery and commitment to invest

behind growth and in future-proofing our business, we update our

full year outlook to grow operating profit (beia) organically in

the range of 4% to 8%.

For the full year of 2024, we further expect:

- An effective

interest rate (beia) of around 3.5% (2023: 3.4%).

- As indicated at our

earlier outlook statement, other net finance expenses will increase

compared to 2023. This is driven primarily by the impact from

significant devaluations and hard currency scarcity in key emerging

markets. We made progress in reducing hard currency exposures and

are on track with the rights issue in Nigerian Breweries Ltd. If

current conditions prevail, we expect more stable other net

financing expenses in the second half of the year.

- We have updated our

view on the average effective tax rate (beia), and now expect this

to land at around 28% (2023: 26.8%), an improvement relative to the

previous guidance of 29%, including further insights into Brazil's

2024 tax law changes.

Given the factors above, we revise the expected organic net

profit (beia) growth to be more closely in line with the expected

operating profit (beia) growth.

Finally, we continue to expect investments in capital

expenditure related to property, plant and equipment and intangible

assets to be below 9% of net revenue (beia) (2023: 8.8%).

|

|

Media |

|

Investors |

| |

Joris

Evers |

|

Tristan van

Strien |

| |

Director of Global

Communication |

|

Director of Investor

Relations |

| |

E-mail:

pressoffice@heineken.com |

|

Mark Matthews / Chris

Steyn |

| |

Tel: +31-20-5239355 |

|

Investor Relations Manager /

Senior Analyst |

| |

|

|

E-mail:

investors@heineken.com |

| |

|

|

Tel: +31-20-5239590 |

HEINEKEN will host an analyst and investor conference call in

relation to its 2024 Half Year results today at 14:00 CET/ 13:00

BST. The call will be audio cast live via the company’s website:

www.theheinekencompany.com. An audio replay service will also be

made available after the conference call at the above web address.

Analysts and investors can dial-in using the following telephone

numbers:

United Kingdom (Local): 020 3936 2999

Netherlands (Local): 085 888 7233

USA: 1 646 787 9445

For the full list of dial in numbers, please refer to the

following link: Global Dial-In Numbers

Participation password for all countries: 939700

Editorial information:

HEINEKEN is the world's most international brewer. It is the

leading developer and marketer of premium and non-alcoholic beer

and cider brands. Led by the Heineken® brand, the Group has a

portfolio of more than 350 international, regional, local and

specialty beers and ciders. With HEINEKEN’s over 90,000 employees,

we brew the joy of true togetherness to inspire a better world. Our

dream is to shape the future of beer and beyond to win the hearts

of consumers. We are committed to innovation, long-term brand

investment, disciplined sales execution and focused cost

management. Through "Brew a Better World", sustainability is

embedded in the business. HEINEKEN has a well-balanced geographic

footprint with leadership positions in both developed and

developing markets. We operate breweries, malteries, cider plants

and other production facilities in more than 70 countries. Most

recent information is available on our Company's website and follow

us on LinkedIn, Twitter and Instagram.

Market Abuse Regulation

This press release may contain price-sensitive information within

the meaning of Article 7(1) of the EU Market Abuse Regulation.

Disclaimer:

This press release contains forward-looking statements based on

current expectations and assumptions with regard to the financial

position and results of HEINEKEN’s activities, anticipated

developments and other factors. All statements other than

statements of historical facts are, or may be deemed to be,

forward-looking statements. Forward-looking statements also

include, but are not limited to, statements and information in

HEINEKEN’s non-financial reporting, such as HEINEKEN’s emission

reduction and other climate change related matters (including

actions, potential impacts and risks associated therewith). These

forward-looking statements are identified by use of terms and

phrases such as “aim”, “ambition”, “anticipate”, “believe”,

“could”, “estimate”, “expect”, “goals”, “intend”, “may”,

“milestones”, “objectives”, “outlook”, “plan”, “probably”,

“project”, “risks”, “schedule”, “seek”, “should”, “target”, “will”

and similar terms and phrases. These forward-looking statements,

while based on management's current expectations and assumptions,

are not guarantees of future performance since they are subject to

numerous assumptions, known and unknown risks and uncertainties,

which may change over time, that could cause actual results to

differ materially from those expressed or implied in the

forward-looking statements. Many of these risks and uncertainties

relate to factors that are beyond HEINEKEN’s ability to control or

estimate precisely, such as but not limited to future market and

economic conditions, the behaviour of other market participants,

changes in consumer preferences, the ability to successfully

integrate acquired businesses and achieve anticipated synergies,

costs of raw materials and other goods and services, interest-rate

and exchange-rate fluctuations, changes in tax rates, changes in

law, environmental and physical risks, change in pension costs, the

actions of government regulators and weather conditions. These and

other risk factors are detailed in HEINEKEN’s publicly filed annual

reports. You are cautioned not to place undue reliance on these

forward-looking statements, which speak only of the date of this

press release. HEINEKEN assumes no duty to and does not undertake

any obligation to update these forward-looking statements contained

in this press release. Market share estimates contained in this

press release are based on external sources, such as specialised

research institutes, in combination with management estimates.

HEINEKEN undertakes no responsibility for the accuracy or

completeness of such external sources.

Attachment

- Please click here to download the full press release.

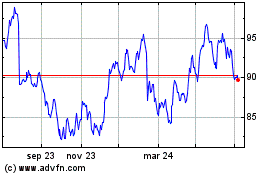

Heineken (EU:HEIA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

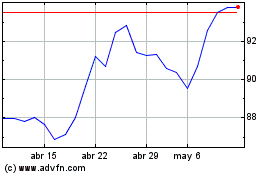

Heineken (EU:HEIA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024