China Retains Benchmark Lending Rates As Expected

19 Marzo 2023 - 7:46PM

RTTF2

China retained its benchmark lending rates for the seventh

straight month on Monday after a surprise reserve requirement ratio

reduction last week.

The People's Bank of China left its one-year loan prime rate, or

LPR, unchanged at 3.65 percent. Similarly, the five-year LPR, the

benchmark for mortgage rates, was maintained at 4.30 percent.

The last change in the LPR was in August 2022, when the

five-year rate was cut by 15 basis points and one-year rate by 5

basis points.

The LPR is fixed monthly based on the submission of 18 banks,

though Beijing has influence over the rate-setting. The LPR

replaced the central bank's traditional benchmark lending rate in

August 2019.

Markets anticipated the central bank to hold the LPR today as

the medium-term lending facility, or MLF, which acts as a guide to

the LPR, was kept unchanged last week.

The PBoC last week added CNY 481 billion liquidity into the

financial system via one-year MLF at an unchanged rate of 2.75

percent and injected CNY 104 billion through seven-day reverse repo

operations at an interest rate of 2.0 percent.

Last Friday, the PBoC decided to lower the reserve requirement

ratio for banks by 25 basis points for the first time this year to

support the nascent economic recovery and to ensure reasonable and

sufficient liquidity in the banking system.

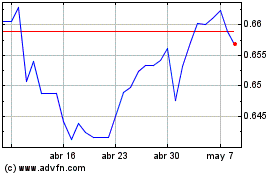

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Mar 2024 a Abr 2024

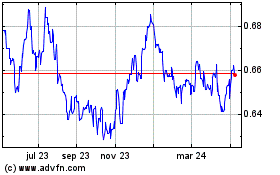

AUD vs US Dollar (FX:AUDUSD)

Gráfica de Divisa

De Abr 2023 a Abr 2024