Antipodean Currencies Rise As Asian Markets Traded Higher

09 Octubre 2024 - 9:41PM

RTTF2

The Antipodean currencies such as the Australia and the New

Zealand dollars strengthened against their major currencies in the

Asian session on Thursday, as traders remain optimistic about more

interest rate cuts by the U.S. Fed, and several other central

banks. The minutes from the U.S. Fed's September meeting showed

officials agreed to cut interest rates but were unsure how

aggressive to get.

Traders now look ahead to the release of U.S. consumer price and

producer price inflation data for more clarity on how aggressively

the Fed will lower rates in the coming months.

Markets speculate a rate cut of a 25 basis points (bps) by the

Federal Reserve (Fed) in November.

New York Fed President John Williams said on Tuesday that it

will be appropriate again for the central bank to reduce rates

'over time.' Separately, Fed Governor Adriana Kugler said there is

a case for more easing if inflation keeps easing. In the Asian

trading today, the Australian dollar rose to 3-day highs of 100.67

against the yen and 0.9232 against the Canadian dollar, from

Wednesday's closing quotes of 100.28 and 0.9209, respectively. If

the aussie extends its uptrend, it is likely to find resistance

around 102.00 against the yen and 0.94 against the loonie.

Against the U.S. dollar and the euro, the aussie edged up to

0.6737 and 1.6243 from yesterday's closing quotes of 0.6717 and

1.6281, respectively. The aussie may test resistance around 0.69

against the greenback and 1.60 against the euro.

The NZ dollar rose to a 3-day high of 91.06 against the yen,

from yesterday's closing value of 90.51. The kiwi may test

resistance around the 92.00 region.

Against the U.S. and the Australian dollars, the kiwi edged up

to 0.6093 and 1.1051 from Wednesday's closing quotes of 0.6063 and

1.1075, respectively. If the kiwi extends its uptrend, it is likely

to find resistance around 0.63 against the greenback and 1.08

against the aussie.

The kiwi climbed to 1.7957 against the euro, from yesterday's

closing value of 1.8036. On the upside, 1.75 is seen as the next

resistance level for the kiwi.

Looking ahead, the European Central Bank publishes the account

of the monetary policy meeting of the governing council held on

September 11 and 12, at 7:30 am ET. At the meeting, the bank had

lowered its key interest rates by 25 basis points.

In the New York session, U.S. CPI data for September and U.S.

weekly jobless claims data are slated for release.

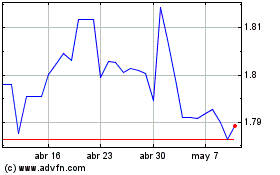

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Nov 2024 a Dic 2024

Euro vs NZD (FX:EURNZD)

Gráfica de Divisa

De Dic 2023 a Dic 2024