TIDM4BB

11 May 2022

4basebio plc

("4basebio", the "Company" or the "Group")

Final Results, Notice of AGM and Related Party Transaction

The Board of 4basebio plc is pleased to report the results for the financial

year ended 31 December 2022.

The annual report and accounts together with a notice of the Company's annual

general meeting, which is to be held on 14 June 2023 at 9:00am in the offices

of 4basebio plc are expected to be uploaded to the Company's website and posted

to shareholders shortly.

The annual general meeting will be followed by a presentation from the Company

through the Investor Meet Company platform on 16 June 2023 at 10am. Investors

can sign up to Investor Meet Company for free and register interest here:

https://www.investormeetcompany.com/4basebio-plc/register-investor.

The Company further advises that, on 10 May 2023, it amended the terms of its

loan facility with 2Invest AG, a significant shareholder, which it entered into

on 2 November 2020. Further details of the related party transaction are

included below.

* First commercial revenues from DNA

* First commercial revenues from HermesT non-viral vectors

* Clean rooms for manufacture of GMP DNA commissioned

* Six novel patent filings between January 2022 and February 2023

* Continued growth with headcount increasing to 61 staff from 33 at the

beginning of the year

4basebio plc is a Cambridge UK based AIM-quoted holding and service company for

the 4basebio group of companies ("the Group"), which includes manufacturing and

research and development subsidiaries across Cambridge, UK and Madrid, Spain.

4basebio is engaged in the research and development, manufacture and

commercialisation of synthetic DNA and RNA products and targeted non-viral

vector solutions. With its first revenues from these activities during 2022,

the Group is now focussed on the scaling of its commercial activities across a

range of gene therapy and vaccine applications, with a particular focus on mRNA

and AAV markets.

The Group is able to offer its customers application specific solutions; it

also continues to invest in research and development activities to further

develop its technology platforms and expand its product offering.

Dr Heikki Lanckriet, CEO and CSO for 4basebio, said: "2022 has been a very

exciting year for 4basebio, with the first commercial revenues from its

synthetic DNA and HermesT platforms, completion of its manufacturing clean

rooms, filing of fresh intellectual property and the overall growth is size and

capabilities of the group. The group will continue to develop its platforms

and is now also focussed on its commercial development with increasing revenue

a key objective."

For further enquiries, please contact:

4basebio plc +44 (0)12 2396 7943

Heikki Lanckriet, CEO

+44 (0)20 7213 0880

Cairn Financial Advisers LLP (Nominated

Adviser)

Jo Turner / Sandy Jamieson

finnCap Ltd (Broker)

Geoff Nash/Richard Chambers/Charlotte +44 (0)20 7220 0500

Sutcliffe

Lionsgate Communications (Media Enquiries)

Jonathan Charles +44 (0)77 91892509

Chairman's statement

Performance

During the course of 2022, 4basebio made significant progress in the

commercialisation of its platform technologies and the strengthening of the

Group's research and development, manufacturing and business development

capabilities.

4basebio secured commercial validation of its technologies through first

revenues of both its synthetic DNA and HermesT non-viral vectors, an important

step on which it continues to build.

Alongside that, the Group commissioned its manufacturing clean rooms, offering

seven manufacturing suites with an overall capacity of three hundred customer

batches per year, and able to manufacture at GMP grade ("good manufacturing

practice").

The continued commercial development of the business is naturally a key

objective. Alongside this, the Board considers there to be significant

intrinsic value in the Group's intellectual property and it remains a key focus

with continued investment in its platforms. To that end, six new patent

applications were filed during between January 2022 and February 2023, with

further filings expected in 2023. The Group also appointed a Director of

Intellectual Property to focus on this aspect.

With the objectives outlined above, the Group continued to invest during 2022

with a resultant net loss for the year of £5.2 million. As in 2021,

recruitment was a key priority both in research and development and

manufacturing teams and with overall headcount of 61 at year end. The Group

continues to recruit into roles within commercial, research and development and

manufacturing.

4basebio will be loss making during 2023 and the Group will utilise its loan

facility with 2Invest AG, a major shareholder and former parent company, to

fund activities. Immediately, prior to year end, 4basebio drew down an initial

?2million from this loan facility and it will continue to draw down further

tranches in 2023.

Strategy

4basebio's principal objective is to become a leading provider of synthetic DNA

and RNA products and non-viral delivery technology for the cell and gene

therapy and vaccines markets. In order to achieve this, the Group is focussed

on differentiating its product and technology solutions from existing

alternatives.

This differentiation is achieved by developing novel, highly flexible and

widely applicable platform technologies which in turn provide optimised

products and solutions for individual customers.

4basebio's payload and delivery platform technologies are synergistic and

enable offering of integrated services to customers, as appropriate, by

incorporation of client specific nucleic acid payloads in delivery solutions

tailored to client needs. Consequently, the Group offers a wide range of

solutions for customers depending on their application needs. 4basebio seeks to

establish early development stage relationships with its customers. The Group

anticipates that early revenues will be derived from selling research grade and

HQ grade synthetic DNA products used in early stage therapy discovery and

preclinical development.

As customers progress their programs into the clinic, larger quantities of the

higher quality standard 'GMP product' will be required and in due course,

4basebio expects this will lead to significant GMP manufacturing batches. The

Group is therefore focussed on engaging with as many potential customers as

possible, recognising there may be a degree of attrition as individual clients

may be unable to progress their clinical development program.

Share Price

Consistent with 2021, the share price experienced some volatility during the

year. The directors believe this in part reflects the modest trading volumes

which consequently can have a relatively large impact on the price. During the

course of the year about 4% of shares in issue changed hands, with a typical

daily trading volume of 2,000 shares.

At year end, approximately 68% of the Company's shares were closely held

between the Company's two largest shareholders and Board directors. The Board

believes that a significant portion of the remaining shares is owned by long

term shareholders.

The share price opened the year at 615p, before it softened in the middle of

the year, reaching a closing price of 460p. From there it increased to 710p at

year end. The Board recognises that an increase in liquidity is desirable and

continues to consider how this might be achieved.

People and Culture

4basebio places great emphasis on creating a positive and supportive workplace

centred around its people and the science. Currently, over 75% of 4basebio's

workforce hold scientific degrees, with a third holding PhDs. This fosters an

environment focussed on problem solving, innovation and progress.

On behalf of the Board, I would like to extend our thanks to the whole team for

their dedication over the past year.

Tim McCarthy

Chairman

Consolidated statement of profit or loss and other comprehensive income

for the year ended 31 December 2022

[in £'000] 2022 2021

Revenues 268 338

Cost of goods sold (29) (69)

Gross profit 239 269

Sales and marketing expenses (245) (132)

Administration expenses (2,711) (1,725)

Operation expenses (928) 0

Research and non-capitalised development expenses (2,081) (1,622)

Other operating expenses (181) (400)

Other operating income 67 83

Loss from operations (5,840) (3,527)

Finance expense (89) (113)

Financial result (89) (113)

Loss before tax (5,929) (3,640)

Income tax income / (expense) 779 405

Loss for the year (5,150) (3,235)

Items that may be reclassified to the income statement in

subsequent periods

Exchange differences on translation of foreign 447 (608)

operations

Total comprehensive income (4,703) (3,843)

Loss per share

Basic and diluted (in £/share) (0.42) (0.26)

All of the loss for the year is from continuing operations.

Consolidated statement of financial position

31 December 2022

[in £ 2022 2021

'000]

Assets

Intangible assets 2,124 1,271

Property, plant and equipment 3,633 2,759

Other non-current assets 35 30

Non-current assets 5,792 4,060

Inventories 133 156

Trade receivables 54 46

Other current assets 1,359 854

Cash and cash equivalents 4,351 9,586

Current assets 5,897 10,642

Total assets 11,689 14,702

Liabilities

Financial liabilities (415) (432)

Trade payables (490) (353)

Other current liabilities (613) (738)

Current liabilities (1,518) (1,523)

Financial liabilities (2,935) (1,326)

Other liabilities (116) (158)

Non-current liabilities (3,051) (1,484)

Total liabilities (4,569) (3,007)

Net assets 7,120 11,695

Share capital 11,130 11,130

Share premium 706 706

Merger reserve 688 688

Capital reserve 13,307 13,179

Foreign exchange reserve 14 (433)

Profit and loss reserve (18,725) (13,575)

Total Equity 7,120 11,695

Consolidated statement of changes in equity

for the year ended 31 December 2022

[in £'000] Share Share Merger Capital Foreign Profit and Total equity

capital premium reserve reserve exchange loss reserve

reserve

Balance at 1 January 2022 11,130 706 688 13,179 (433) (13,575) 11,695

Loss for the year - - - - - (5,150) (5,150)

Foreign Exchange difference - - - - 447 - 447

arising on translation of

4basebio S.L.U.

Share based payments - - - 128 - - 128

Balance at 31 December 2022 11,130 706 688 13,307 14 (18,725) 7,120

[in £'000] Share Share Merger Capital Foreign Profit and Total equity

capital premium reserve reserve exchange loss reserve

Balance at 1 January 2021 11,130 706 688 13,099 175 (10,340) 15,458

Loss for the year - - - - - (3,235) (3,235)

Foreign Exchange difference - - - - (608) - (608)

arising on translation of

4basebio S.L.U.

Share based payments - - - 80 - - 80

Balance at 31 December 2021 11,130 706 688 13,179 (433) (13,575) 11,695

Consolidated statement of cash flows

for the year ended 31 December 2022

[in £'000] 2022 2021

Net loss for the period (5,150) (3,235)

Adjustments to reconcile net loss for the period to net

cashflows

Income taxes (779) (405)

Interest charge 89 113

Depreciation of property, plant and equipment 404 242

Amortisation and impairment of intangible assets 27 78

Other non-cash items 136 12

Working capital changes:

(Increase)/decrease in trade receivables and other current 140 (126)

assets

Increase/(decrease) in trade payables and other current (2) 615

liabilities

(Increase)/decrease in inventories 30 (34)

Tax receipt 401 -

Net Cash flows from operating activities (4,704) (2,740)

Investments in property, plant and equipment (1,155) (884)

Investments in capitalised development and intangible (786) (628)

assets

Cash flows from investing activities (1,941) (1,512)

Net receipt/(payment) of loans 1,412 (331)

Interest paid (93) (76)

Capital lease payments (75) (60)

Cash flows from financing activities 1,244 (467)

Net change in cash and cash equivalents (5,401) (4,719)

Exchange differences 166 (696)

Cash and cash equivalents at the beginning of the period 9,586 15,001

Cash and cash equivalents at the end of the period 4,351 9,586

Notes to the financial statements

1. General

4basebio plc (the "Company" or "4basebio") is registered in England and Wales

with company number 13519889.

The Company is domiciled in England and the registered office of the Company is

25 Norman Way, Over, Cambridge CB24 5QE. 4basebio plc is the parent of a group

of companies (together, "the Group"). The Group focusses on life sciences and

in particular the development of synthetic DNA and nanoparticles suitable for

inclusion in, or delivery of, therapeutic payloads for gene therapies and gene

vaccines.

The Company trades on London Stock Exchange's AIM market, having been admitted

on 17 February 2021. The international securities number (ISIN) number for its

AIM traded shares is GB00BMCLYF79; its ticker symbol is 4bb.l.

The consolidated financial statements of 4basebio plc and its subsidiaries for

the year ended 31 December 2022 were authorised for issue in accordance with a

resolution of the directors on 10 May 2023.

2. Basis of preparation

The consolidated financial statements of 4basebio UK plc (or "the Group") for

the financial year ending 31 December 2022 have been prepared using UK adopted

international accounting standards.

The consolidated financial statements for 2022 and 2021 comprise the results of

4basebio plc, 4basebio S.L.U., 4basebio UK Limited and 4basebio Discovery

Limited for the whole year.

The above summary has been extracted from the report and financial statements

and, accordingly, references to notes and page numbers may be incorrect.

Shareholders are advised to read the full version of the report and financial

statements which will be available from the Company's website.

3. Going concern

The directors have, at the time of approving the financial statements, a

reasonable expectation, taking into account the unutilised existing loan

facility with 2Invest AG, a shareholder in 4basebio plc, referred to in note

22, that the Group has adequate resources to continue in operational existence

for at least 12 months from the date of approval of the financial statements.

Thus, they continue to adopt the going concern basis of accounting in preparing

the financial statements.

4. Earnings per share

2022 2021

Numerator [in £'000]

Result for the period (5,150) (3,235)

Denominator [number of shares]

Weighted average number of registered shares in

circulation (ordinary shares) for calculating 12,317,473 12,317,473

the undiluted earnings per share

Basic and diluted earnings per share (0.42) (0.26)

The calculation of the basic and diluted earnings per share for continuing

operations was based on the weighted average number of shares as determined

above. The numerator is defined as result after tax from continuing operations.

The average number of share options outstanding during the period was 642,878

(2021: 522,860) which have not been included in the calculation of the diluted

Earning per share because they would be anti-dilutive since the business is

loss making.

5. Approval of the financial statements

The financial statements were approved by the Board of directors and authorised

for issue on 10 May 2022.

Related Party Transaction

On 2 November 2020, the Company entered into a loan agreement with 2Invest AG

("2Invest") (formerly 4bb AG) pursuant to which the Company could draw down up

to ?25 million at any time prior to 31 October 2026. Details of the loan

agreement are included in the Company's admission document published on 12

February 2021.

On 10 May 2023, the loan facility was amended by reducing the available

facility by ?2 million in consideration for extending the repayment date. As a

result, the loan facility with 2Invest, which is denominated in Euros, is now

for up to ?23 million which can be drawn, with notice, at the discretion of

4basebio plc until 31 October 2026. Interest is charged at 5% per annum on all

loan amounts outstanding and compounds annually on all loan tranches

outstanding. The capital and interest are now due to be repaid in a single

payment on 31 October 2028. Early repayment is permitted. No other fees are

due under this facility.

As a result of 2Invest being a significant shareholder, the amendment of this

agreement constitutes a related party transaction pursuant to Rule 13 of the

AIM Rules for Companies. With the exception of Hansjörg Plaggemars, a director

of the Company and 2Invest, the directors of the Company, having consulted with

the Company's Nominated Adviser, Cairn Financial Advisers LLP, consider the

terms of the Transaction to be fair and reasonable insofar as the Company's

shareholders are concerned.

END

(END) Dow Jones Newswires

May 11, 2023 02:00 ET (06:00 GMT)

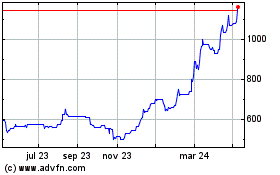

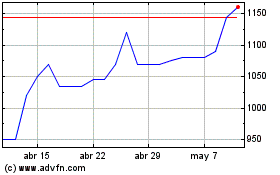

4basebio (LSE:4BB)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

4basebio (LSE:4BB)

Gráfica de Acción Histórica

De May 2023 a May 2024