TIDMALL

RNS Number : 8892W

Atlantic Lithium Limited

14 December 2023

14 December 2023

A$7 million Equity Placing

to contribute to the funding of the Ewoyaa Lithium Project

Atlantic Lithium Limited (AIM: ALL, ASX: A11, OTCQX: ALLIF,

"Atlantic Lithium" or the "Company"), the African-focused lithium

exploration and development company targeting to deliver Ghana's

first lithium mine, is pleased to announce the launch of an

institutional placement ("Equity Placing") of new fully paid

ordinary shares of no par value each in the Company ("New Shares")

at an offer price of A$0.44 (equivalent to 23.35 pence) per New

Share ("Issue Price") .

Highlights of the Equity Placing

- The Equity Placing will be undertaken by an institutional

placement of New Shares to raise approximately A$7.0 million

(GBP3.7 million), utilising the Company's existing share

authorities, launching today . As part of the Equity Placing, the

Company reserves the ability to accept oversubscriptions for up to

A$2.0 million (GBP1.0 million).

- Proceeds from the Equity Placing will be used to contribute to

the funding of the Company's flagship Ewoyaa Lithium Project in

Ghana (the " Project") and provide additional working capital for

the Company .

- The Equity Placing will be undertaken at a fixed issue price

of A$0.44 (equivalent to 23.35 pence) per New Share, which, as at

the last trading day of 14 December 2023 on the ASX, represents

a:

o 10.2% discount to the last closing price of A$0.490; and

o 11.9% discount to the 5-day volume weight average price of

A$0.499 .

- Canaccord Genuity (Australia) Limited has been appointed as

Lead Manager ( " Lead Manager " ) in connection with the Equity

Placing . Wilsons Advisory & Stockbroking is acting as

Co-Manager ("Co-Manager " ).

Proposed Use of Proceeds

- Mining Lease requirements

o Expenditure associated with the Feldspar Definitive

Feasibility Study;

o Downstream Conversion Study to determine viability of

downstream lithium conversion in Ghana and related factors

required;

o Listing by introduction on the Ghana Stock Exchange .

- Project Expenditure

o EPA permitting process, land acquisition, relocation of

powerline and engineering works;

o Atlantic Lithium's share of the Project's overall development

expenditure is approximately US$38 million, which is expected to be

fully funded through (i) this Equity Placing (once completed), (ii)

the completion of the agreed, non-binding investment in the Company

from the Minerals Income Investment Fund of Ghana ("MIIF") and

(iii) the ongoing off-take financing process, due to complete in Q1

2024 .

- Exploration

o Additional extensional drilling announced over and above the

ongoing 2023 drilling programme .

- Working capital

o Working capital to ramp up the operational readiness team,

relevant production processes and systems and associated costs

.

Commenting, Neil Herbert, Executive Chairman of Atlantic

Lithium, said :

" Under Ewoyaa's current funding arrangements, which comprise

Piedmont's staged earn-in agreement, the agreed, non-binding Heads

of Terms with the Minerals Income Investment Fund of Ghana for its

investment in the Company and the process that is underway to

secure a partner for a portion of the available off-take, we are in

an excellent position to fully fund the Company's share of the

development expenditure for the Project.

"While we await the completion and receipt of the funds from

MIIF's investment, expected in Q1 2024, and the completion of the

offtake process in late Q1 2024, we are undertaking this

institutional placing in order to strengthen the Company's cash

balance, notably in light of recent takeover offers from the

Company's largest shareholder, Assore, and to ensure the

advancement of Project in line with the current development

schedule.

"Funds will be allocated towards advancing the activities agreed

under the grant of the Mining Lease and for further drilling

following the report of a 106m continuous pegmatite interval and

broad intersections of visible spodumene outside of the current

MRE. This drilling will contribute to the Company delivering an

upgraded Mineral Resource Estimate for the Project in Q3 2024.

"We look forward to the completion of the placing, which we

believe represents a major milestone towards fully de-risking the

funding of the Project. "

Background to the Equity Placing

On 29 June 2023, the Company published a Definitive Feasibility

Study of the Ewoyaa Project ("DFS") which highlighted economic

outcomes placing the Project as an industry-leading asset with a

steady state production rate of 365,000 tonnes per annum ("ktpa")

over a 12-year Life of Mine, an All-in Sustaining Cost of

US$675/tonne and an NPV(8) of US$1.3bn.

The total development expenditure for the Project is estimated

to be US$185 million, of which the Company's partner, Piedmont

Lithium, will sole fund the initial US$70 million, and 50%

thereafter. As previously disclosed, MIIF and the Company have

entered into a non-binding financing arrangement for US$32.9

million which is currently in the process of completing. Following

MIIF's investment, the Company's development expenditure

requirement for Ewoyaa equates to US$38 million.

In parallel, the Company is undertaking a process to seek an

off-take partner for a portion of the available off-take from

Ewoyaa, which is expected to provide upfront capital. This process

is expected to complete in Q1 2024. Together, the Equity Placing,

the off-take financing and MIIF's intended investment are expected

to fully fund the development expenditure for the Project and

provide additional capital for the Company to continue its

exploration plans for 2024 and broader corporate requirements.

Advisers

Canaccord Genuity (Australia) Limited is acting as Lead Manager

to the Equity Placement. Wilsons Advisory & Stockbroking is

acting as Co-Manager.

Expected Timetable of Principal Events

The times and dates set out below are subject to change and may

be adjusted by the Company in consultation with the Lead Manager.

In the event of any significant changes from the below expected

timetable, details of the new times and dates will be notified to

Company shareholders by an announcement on a Regulatory Information

Service.

AIM ASX

Announcement of the Equity Placing and 14 December 2023 15 December 2023

ASX Trading Halt

Announcement of results of the Equity 15 December 2023 15 December 2023

Placing

Trading Halt lifted and shares recommence - 18 December 2023

trading on ASX

Allotment and trading of new securities 22 December 2023 22 December 2023

under the placement

------------------------------------------ ----------------- -----------------

The timetable is subject to modification at the Lead Manager's

discretion.

Allotment and trading

Allotment for New Shares (ASX and AIM) and admission to trading

on AIM is expected to take place on or around 22 December 2023.

The New Shares will be issued fully paid and will rank pari

passu in all respects with the Company's existing Ordinary Shares,

including the right to receive all dividends and other

distributions declared, made or paid after the date of issue.

Additional Information

The content of this Announcement has not been approved by an

authorised person within the meaning of the Financial Services and

Markets Act 2000, as amended ("FSMA"). Reliance on this

Announcement for the purpose of engaging in any investment activity

may expose an individual to a significant risk of losing all of the

property or other assets invested. The price of shares and any

income expected from them may go down as well as up and investors

may not get back the full amount invested upon disposal of the

shares. Past performance is no guide to future performance, and

persons needing advice should consult an appropriate independent

financial adviser.

Nothing contained in this announcement constitutes investment,

legal, tax or other advice. You should seek appropriate

professional advice before making any investment decision.

No representation or warranty, express or implied, is or will be

made as to, or in relation to, and no responsibility or liability

is or will be accepted by the Company, the Lead Manager or the

Co-Manager, or by any of their affiliates or agents as to, or in

relation to, the accuracy or completeness of this Announcement or

any other written or oral information made available to or publicly

available to any interested party or its advisers, and any

liability therefore is expressly disclaimed.

No statement in this Announcement is intended to be a profit

forecast or estimate, and no statement in this Announcement should

be interpreted to mean that earnings per share of the Company for

the current or future financial years would necessarily match or

exceed the historical published earnings per share of the

Company.

The New Shares to be issued pursuant to the Placing will not be

admitted to trading on any stock exchange other than the ASX and

AIM.

Neither the content of the Company's website nor any website

accessible by hyperlinks on the Company's website is incorporated

in, or forms part of, this Announcement.

Disclaimer

The information contained within this announcement is deemed by

the company to constitute inside information as stipulated under

the market abuse regulation (EU) no. 596/2014 as it forms part of

UK domestic law pursuant to the European Union (withdrawal) Act

2018, as amended. Upon the publication of this announcement via a

regulatory information service, this information is considered to

be in the public domain.

This announcement and the information contained herein, is

restricted and is not for publication, release or distribution,

directly or indirectly, in whole or in part, in or into the United

States, Canada, Japan, the Republic of South Africa or New Zealand

or any other jurisdiction in which it would be unlawful to do

so.

This announcement is for information purposes only and does not

itself constitute an offer for sale or subscription of any

securities in the Company. This announcement does not constitute or

contain any invitation, solicitation, recommendation, offer or

advice to any person to subscribe for, otherwise acquire or dispose

of any securities of Atlantic Lithium Limited in any jurisdiction

in which any such offer or solicitation would be unlawful.

Cautionary Statement about Forward-Looking Statements

This announcement contains certain "forward-looking statements"

including statements regarding our intent, belief, or current

expectations with respect to Atlantic's business and operations,

market conditions, results of operations and financial condition,

and risk management practices. The words "likely", "expect", "aim",

"should", "could", "may", "anticipate", "predict", "believe",

"plan", "forecast" and other similar expressions are intended to

identify forward-looking statements. Indications of, and guidance

on, future earnings, anticipated production, life of mine and

financial position and performance are also forward-looking

statements. These forward-looking statements involve known and

unknown risks, uncertainties and other factors that may cause

Atlantic's actual results, performance and achievements or industry

results to differ materially from any future results, performance

or achievements, or industry results, expressed or implied by these

forward-looking statements. Relevant factors may include (but are

not limited to) changes in commodity prices, foreign exchange

fluctuations and general economic conditions, increased costs and

demand for production inputs, the speculative nature of exploration

and project development, including the risks of obtaining necessary

licences and permits and diminishing quantities or grades of

reserves, political and social risks, changes to the regulatory

framework within which Atlantic operates or may in the future

operate, environmental conditions including extreme weather

conditions, recruitment and retention of personnel, industrial

relations issues and litigation.

Forward-looking statements are based on Atlantic's good faith

assumptions as to the financial, market, regulatory and other

relevant environments that will exist and affect Atlantic's

business and operations in the future. Atlantic does not give any

assurance that the assumptions will prove to be correct. There may

be other factors that could cause actual results or events not to

be as anticipated, and many events are beyond the reasonable

control of Atlantic. Readers are cautioned not to place undue

reliance on forward-looking statements, particularly in the current

economic climate with the significant volatility, uncertainty and

disruption. Forward-looking statements in this document speak only

at the date of issue. Except as required by applicable laws or

regulations, Atlantic does not undertake any obligation to publicly

update or revise any of the forward-looking statements or to advise

of any change in assumptions on which any such statement is based.

Except for statutory liability which cannot be excluded, each of

Atlantic, its officers, employees and advisors expressly disclaim

any responsibility for the accuracy or completeness of the material

contained in these forward-looking statements and excludes all

liability whatsoever (including in negligence) for any loss or

damage which may be suffered by any person as a consequence of any

information in forward-looking statements or any error or

omission.

Overseas investors

The New Shares have not been and will not be registered under

the U.S. Securities Act of 1933, as amended (the "Securities Act"

or with any securities regulatory authority of any state or other

jurisdiction of the United States and may not be offered, sold,

pledged, taken up, exercised, resold, renounced, transferred or

delivered, directly or indirectly, in or into the United States

absent registration under the Securities Act, except pursuant to an

exemption from, or in a transaction not subject to, the

registration requirements of the Securities Act and in compliance

with any applicable securities laws of any state or other

jurisdiction of the United States. The Placing Shares not been

approved, disapproved or recommended by the U.S. Securities and

Exchange Commission, any state securities commission in the United

States or any other U.S. regulatory authority, nor have any of the

foregoing authorities passed upon or endorsed the merits of the

offering of the Placing Shares. Subject to certain exceptions, the

securities referred to herein may not be offered or sold in the

United States, Canada, Japan, New Zealand, the Republic of South

Africa or to, or for the account or benefit of, any national,

resident or citizen of the United States, Canada, Japan, New

Zealand or the Republic of South Africa.

The relevant clearances have not been, nor will they be,

obtained from the securities commission of any province or

territory of Canada; no prospectus has been lodged with, or

registered by, the Financial Markets Authority of New Zealand or

the Japanese Ministry of Finance; the relevant clearances have not

been, and will not be, obtained from the South Africa Reserve Bank

or any other applicable body in the Republic of South Africa in

relation to the New Shares; and the New Shares have not been, and

nor will they be, registered under or offered in compliance with

the securities laws of any state, province or territory of Canada,

Japan, New Zealand or the Republic of South Africa. Accordingly,

the New Shares may not (unless an exemption under the relevant

securities laws is applicable) be offered, sold, resold or

delivered, directly or indirectly, in or into Canada, Japan, New

Zealand or the Republic of South Africa or any other jurisdiction

outside the United Kingdom or to, or for the account or benefit of

any national, resident or citizen of Japan, New Zealand or the

Republic of South Africa or to any investor located or resident in

Canada.

No public offer or prospectus

No public offering of the New Shares is being made in the United

States, Australia, the United Kingdom or elsewhere. This

announcement is for information purposes and is not a prospectus,

product disclosure statement or any other offering document under

Australian law or the law of any other jurisdiction (and will not

be lodged with the Australian Securities and Investments Commission

("ASIC") or any foreign regulator).

All offers of the New Shares will be made in the European

Economic Area or the United Kingdom pursuant to an exemption from

the requirement to produce a prospectus under Regulation (EU)

2017/1129 of the European Parliament and Council of 14 June 2017

and any relevant implementing measures in any Member State of the

European Economic Area (the "EU Prospectus Regulation"), or

pursuant to the UK version of the EU Prospectus Regulation, which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended (the "UK Prospectus Regulation") (as the case may

be).

No prospectus will be made available in connection with the

matters contained in this Announcement and no such prospectus is

required (in accordance with the EU Prospectus Regulation or the UK

Prospectus Regulation, as the case may be) to be published.

This Announcement is being distributed to persons in the United

Kingdom only in circumstances in which section 21(1) of the FSMA

does not apply.

This Announcement is for information purposes only and is

directed only at persons who are: (a) persons in Australia to whom

an offer of securities may be made without a disclosure document

(as defined in the Australian Corporations Act 2001 (Cth)

("Corporations Act") on the basis that such persons are exempt from

the disclosure requirements of Part 6D.2 in accordance with Section

708(8) or 708(11) of the Corporations Act; (b) persons in Member

States (of the European Economic Area) who are Qualified Investors

(as defined in the EU Prospectus Regulation); and (c) in the United

Kingdom, Qualified Investors (as defined in the UK Prospectus

Regulation) who are persons who (i) have professional experience in

matters relating to investments falling within the definition of

"investment professionals" in article 19(5) of the Financial

Services and Markets Act 2000 (Financial Promotion) Order 2005, as

amended (the "Order"); (ii) are persons falling within article

49(2)(a) to (d) ("high net worth companies, unincorporated

associations, etc") of the Order; or (iii) are persons to whom it

may otherwise be lawfully communicated; (all such persons together

being referred to as relevant persons").

This Announcement must not be acted on or relied on by persons

who are not relevant persons. Persons distributing this

Announcement must satisfy themselves that it is lawful to do so.

Any investment or investment activity to which this Announcement is

available only to relevant persons and will be engaged in only with

relevant persons.

For any further information, please contact:

Atlantic Lithium Limited

Neil Herbert (Executive Chairman)

Amanda Harsas (Finance Director and Company Secretary)

www.atlanticlithium.com.au

IR@atlanticlithium.com.au

Tel: +61 2 8072 0640

SP Angel Corporate Finance Yellow Jersey PR Limited Canaccord Genuity Limited

LLP Charles Goodwin Financial Adviser:

Nominated Adviser Bessie Elliot Raj Khatri (UK) /

Jeff Keating atlantic@yellowjerseypr.com Duncan St John, Christian

Charlie Bouverat Tel: +44 (0)20 3004 Calabrese (Australia)

Tel: +44 (0)20 3470 9512

0470 Corporate Broking:

James Asensio, Harry

Rees

Tel: +44 (0) 20 7523

4500

============================== ============================= =============================

Notes to Editors:

About Atlantic Lithium

www.atlanticlithium.com.au

Atlantic Lithium is an AIM and ASX-listed lithium company

advancing a portfolio of lithium projects in Ghana and Côte

d'Ivoire through to production.

The Company's flagship project, the Ewoyaa Project in Ghana, is

a significant lithium spodumene pegmatite discovery on track to

become Ghana's first lithium-producing mine.

The Definitive Feasibility Study for the Project indicates the

production of 3.6Mt of spodumene concentrate over a 12-year mine

life, making it one of the top 10 largest spodumene concentrate

mines in the world.

The Project, which was awarded a Mining Lease in October 2023,

is being developed under a funding agreement with Piedmont Lithium

Inc.

Atlantic Lithium holds 509km(2) and 774km(2) of tenure across

Ghana and Côte d'Ivoire respectively, comprising significantly

under-explored, highly prospective licences.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFZMMZVDMGFZM

(END) Dow Jones Newswires

December 14, 2023 11:45 ET (16:45 GMT)

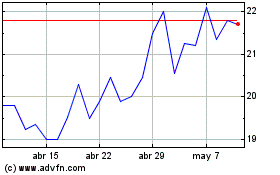

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Atlantic Lithium (LSE:ALL)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025