Alliance Trust PLC - Interim Results

Alliance Trust PLC (‘the

Company’)

LEI: 213800SZZD4E2IOZ9W55

25 July 2024

Strong Investment Returns

Results for the six months ended 30 June 2024

| |

Six months to 30 June 2024 |

Year to 31 December 2023 |

Change |

| Share Price |

1,212.0p |

1,112.0p |

9.0% |

| Net Asset Value

(NAV) per Share |

1,273.9p |

1,175.1p |

8.4% |

| NAV Total

Return |

9.5% |

21.6% |

|

| Share Price Total

Return |

10.2% |

20.2% |

|

| |

|

|

|

| MSCI ACWI |

12.2% |

15.3% |

|

| |

|

|

|

| Discount to NAV

at period end |

-4.9% |

-5.4% |

|

Key Points

- NAV Total Return of 9.5% and Share

Price Total Return of 10.2% vs 12.2% for MSCI ACWI.

- Discount remains stable and is

markedly narrower than the Association of Investment Companies’

Global Sector average.

- Second interim dividend of 6.62p

declared, the total of the first two interim dividends declared for

2024 is 13.24p (2023: 12.52p), representing an increase of 5.8% on

the same payments for 2023.

- Combination with Witan Investment

Trust to be approved by shareholders.

Dean Buckley, Chair of Alliance Trust

PLC, commented:

"It has been an eventful period. Returns have been strong and we

have announced the Company's intention to combine with Witan

Investment Trust plc to create Alliance Witan PLC.”

About Alliance Trust PLC

Alliance Trust aims to be a core investment that beats inflation

over the long term through a combination of capital growth and a

rising dividend. The Company invests in listed, global equities

across a wide range of different sectors and industries to achieve

its objective. Our investment manager, Willis Towers Watson, blends

the top stock selections of some of the world’s best active

managers into a single diversified portfolio designed to outperform

the market while carefully managing risk and volatility. Alliance

Trust is an AIC Dividend Hero with 57 consecutive years of rising

dividends.

https://www.alliancetrust.co.uk

| For more

information, please contact: |

|

|

| Mark Atkinson,

Senior Director – Client Management, Wealth & Retail |

|

Sarah

Gibbons-Cook |

| Willis Towers

Watson |

|

Quill PR |

| Tel: 07918

724303 |

|

Tel: 020 7466

5050 / sarah@quillpr.com |

Interim Report for the six months ended

30 June 2024 (unaudited)

Our Performance - Financial Highlights

as at 30 June 2024

|

Share Price |

Net Asset Value (‘NAV’) Per Share |

|

|

|

|

1,212.0p |

1,273.9p |

|

|

|

|

Share Price Total

Return1 |

NAV Total Return1 |

|

|

|

|

+10.2% |

+9.5% |

|

|

|

|

Discount to NAV1 |

First Two Interim Dividends for

20242 |

|

|

|

|

-4.9% |

13.24p |

|

|

|

1. Alternative Performance Measure.

2. Total dividends declared in the period.

NAV Per Share including income with debt at fair value.

NAV Total Return based on NAV including income with debt at fair

value and after all costs.

Source: Morningstar and Juniper Partners Limited

(‘Juniper’).

Chair’s Statement

I am pleased to present the Interim Report for

the six months ended 30 June 2024. It has been an eventful period.

Returns have been strong and we have announced the Company’s

intention to combine with Witan Investment Trust plc (‘Witan’) to

create Alliance Witan PLC.

Many of you will already have seen the details

of the proposed transaction on the London Stock Exchange’s

regulatory news service or in the media. If not, you can find the

full announcement setting out the proposed terms on the Company’s

website at www.alliancetrust.co.uk.

The proposed transaction will not lead to any

change in Alliance Trust’s successful investment strategy, just a

larger pool of assets for the Company’s Investment Manager, Towers

Watson Investment Management Limited (referred to as `Willis Towers

Watson’ or `WTW’), to manage in the same way that it currently

manages the existing portfolio. This will result in economies of

scale, meaning lower ongoing charges for shareholders, and a higher

profile for the Company which will hopefully attract additional

interest from potential investors. A significant contribution from

WTW will ensure that none of the transaction costs fall on Alliance

Trust shareholders.

The proposed combination does, of course, need

approval from both sets of shareholders. We will soon be publishing

further documentation relating to the proposed transaction for you

to consider, to be followed by a General Meeting, expected to be

held in Dundee in late September/ early October, when you will have

the chance to vote on the proposed combination. You will, of

course, be able to vote your shares in advance and attend virtually

as per our Annual General Meeting earlier in the year. Further

details will be available on the Company’s website In due

course.

In the meantime, if you have any questions, I

can be contacted via the Company’s shareholder e-mail address:

investor@alliancetrust.co.uk.

Investment Performance

The Company produced very strong investment returns for the six

months ended 30 June 2024, with a Net Asset Value (‘NAV’) Total

Return of 9.5%. Over this particular six-month period, we

underperformed our benchmark index, the MSCI All Country World

Index (‘MSCI ACWI’), which returned 12.2% over the same period.

Our underperformance against the index was

primarily attributable to market returns being highly concentrated

in a narrow group of artificial intelligence (‘AI’) related stocks.

This has made it difficult for active managers to outperform, but

WTW is confident that the portfolio is well positioned for

long-term returns versus the index. The Company’s Share Price Total

Return was 10.2%, marginally underperforming the average Share

Price Total Return of the Association of Investment Companies

(‘AIC’) Global Sector peer group of 10.7%.

A full analysis of the Company’s investment

performance can be found in the Investment Manager’s Report.

Discount Management

One of the Board’s strategic objectives is to

maintain a stable share price discount to NAV, and where

practicable, to facilitate our shares trading at close to NAV. The

Company’s average discount over the period was 4.8%, which compares

favourably to the average AIC Global Sector discount of 9.7%. As at

30 June 2024 the Company’s discount was 4.9%.

To support the stability of the share rating,

1,705,000 shares (equivalent to 0.6% of the number of shares in

issue at the start of the period) were bought back and placed in

Treasury during the six months to 30 June 2024. These shares held

in Treasury can be re-issued by the Company at a premium to

estimated NAV when there is market demand.

Second Interim Dividend

We have announced a second interim dividend for

2024 of 6.62p per share (2023: 6.34p). The total of the first two

interim dividends declared for 2024 is 13.24p (2023: 12.52p),

representing an increase of 5.8% on the same payments for 2023.

This level of dividend is well supported by the Company’s

investment strategy and its significant distributable reserves,

which stood at over £3.5 billion as at 30 June 2024.

Barring any unforeseen circumstances, it is

anticipated that the Company’s third and fourth interim dividends

will be at least equal to the first and second interim dividends.

This would result in a total dividend for the 2024 financial year

of at least 26.48p per share which, based on the Company’s share

price of 1,212.0p as at 30 June 2024, would represent an annual

dividend yield of 2.2% and a 5.1% increase over dividends paid for

the financial year ended 31 December 2023.

As shareholders may be aware, in the event that

the proposed combination with Witan proceeds as expected, it is the

intention of the Board to increase the third and fourth interim

dividends for the current financial year (which would each be paid

after completion of the combination) so that they are commensurate

with the interim dividend payments currently being paid to Witan

shareholders. Further information on this potential increase in

dividend, including illustrative figures by way of information, is

provided in the full transaction announcement made by the Company

on 26 June 2024.

Shareholder Engagement

I am delighted to let you know that we will be holding an investor

forum in London at WTW’s offices in Lime Street on Friday, 25

October 2024, when shareholders will be provided with an investment

update from WTW and will hear presentations from two of our stock

pickers. An on-line live feed will also be made available for

shareholders unable to attend in person. Shareholders wishing to

attend the investor forum in person or view the live feed will need

to pre-register. Further details of the investor forum and how to

register will be made available on the Company’s website in due

course.

The Company has invested in its brand and

website to improve communication with shareholders, raise the

profile of the Company and attract new investors to increase

shareholder returns. You may have noticed that we launched our

refreshed brand in May with a new website and an advertising

campaign. Having carefully studied investor feedback, we concluded

that, after a very volatile last few years, what we offer fits very

well with what many investors are looking for – a comfortable

balance between risk and return. So, we adapted our messaging and

the look and feel of our brand accordingly.

If you have not yet done so, I would encourage

you to subscribe to receive the quarterly newsletter, monthly

factsheet and other news and events.

Outlook

The economic and political outlook remains uncertain. This is

reflected in our modest net gearing of 4.6%. Although any faint

doubt about the result of the general election in the UK has been

removed, there is still the US presidential election to come, and

the global economy seems delicately balanced between faster or

slower growth. However, rather than attempting to second-guess

macroeconomic or political outcomes, our investment strategy will

continue to focus on a diversified but high conviction approach to

stock picking based on the fundamentals of individual businesses.

It will not always outperform the market in every discrete period,

particularly when the market is so concentrated, but we believe it

will continue to add significant value for shareholders in the long

run.

I look forward to meeting as many of you as

possible at the General Meeting in Dundee or the investor forum in

London.

Dean Buckley

Chair

25 July 2024

Investment Manager’s Report

Global equities continued to rise in the first

half of 2024, although investors’ hopes at the start of the year

for a rapid reduction in interest rates to boost equity valuations

and corporate profit margins were thwarted by the surprising

resilience of economic growth and the persistence of inflationary

pressures, including wage growth.

While market breadth continued to increase

regionally, the US still dominated, and returns by sector became

extremely concentrated in information technology as the half-year

progressed due to investors’ enthusiasm for AI. Indeed, almost a

quarter (23%) of the MSCI ACWI’s 12.2% advance came from just one

stock, NVIDIA, whose valuation rose by an astonishing 151% in six

months. NVIDIA’s cutting-edge chips are at the epicentre of the AI

boom and its surging stock price meant that it briefly overtook

Microsoft and Apple to become the world’s most valuable

company.

A Game of Two Quarters

It was a period of two distinct quarters for our

portfolio, with outperformance of the index in the first quarter

due to good stock selection across a variety of countries and

industries. But we underperformed in the second, largely because of

our underweight positions in NVIDIA, and Apple which rallied in the

second quarter after announcing new AI features for its phones.

Over the six-month period our portfolio

delivered a robust absolute NAV Total Return of 9.5% but lagged the

MSCI ACWI by 2.7%. Our Share Price Total Return was slightly higher

than the NAV Total Return at 10.2%, due to a narrowing of the

discount from 5.4% to 4.9%. The table below shows the detailed

contribution analysis.

|

Contribution to Return Six Months to 30 June

2024 |

% |

|

Benchmark Total Return |

12.2 |

|

|

Asset Allocation |

-0.9 |

|

|

Stock Selection |

-2.2 |

|

|

Gearing and Cash |

0.5 |

|

Investment Manager Impact |

-2.6 |

|

Portfolio Total Return |

9.7 |

|

Share Buybacks |

0.0 |

|

Fees/Expenses |

-0.3 |

|

NAV including Income, Debt at Par |

9.4 |

|

Change in Fair Value of Debt |

0.1 |

|

NAV including Income, Debt at Fair Value |

9.5 |

|

Change in Discount |

0.6 |

|

Share Price Total Return |

10.2 |

Source: Performance and attribution data sourced

from WTW, Juniper, MSCI, FactSet and Morningstar as at 30 June

2024. Percentages may not add due to rounding.

Against a highly concentrated index return, most

of our managers struggled to add value across the whole six months.

Although GQG Partners (‘GQG’) stood out as a stronger performer,

Sands Capital (‘Sands’) and Vulcan Value Partners were the only

other two who modestly boosted relative returns. The success of all

three managers was in large part attributable to strong returns

from their technology holdings, especially NVIDIA, which was held

by GQG and Sands. The other seven managers were handicapped by not

holding NVIDIA and by having overall underweight positions relative

to the index in giant tech companies. Our average portfolio weight

in NVIDIA was 2.2% versus 3% for the index.

There were, however, several cases of stock

selections which were costly over the six-month period.

For example, the share prices of Diageo, the UK

drinks giant, and Visa, the US digital payments business, both of

which are held by more than one manager, and therefore represent

two of our larger holdings, did not perform well, though our

managers continue to believe in their long-term prospects. Another

company to struggle was the airline Ryanair, which warned of softer

ticket pricing at the start of the holiday season, though

Metropolis Capital (‘Metropolis’), which owns the stock, says the

long-term outlook for fares and the business remains positive.

Vinci, the French infrastructure group, owned by Veritas Asset

Management (‘Veritas’), also fell sharply.

Vinci’s share price decline followed threats

from the French far-right National Rally party to nationalise

motorways, which is where its concessions are the biggest source of

profits. However, National Rally did not perform as well as

expected in the French general election, and Veritas says that

Vinci’s shares offer good value.

The detractors were partially offset by strong

performance from a wide range of our other holdings.

For example, we benefitted from:

- a 31% rise in Alphabet, which

continues to enjoy strong earnings growth and surprised investors

with a stock buyback and its first dividend;

- a 36% rise in Ebara, the Japanese

industrial group, which has exposure to semiconductor manufacturing

through its Precision Machinery Business;

- a 28% rise in Amazon.com, which

reported a 221% year-on-year rise in operating income as

advertising spend increased and the company’s web services division

benefitted from customers modernising their tech infrastructure and

addressing AI;

- a 41% rise in Novo Nordisk, the

Danish company which continues to excite investors with its

pioneering weight loss drugs; and

- a 57% increase in Hargreaves

Lansdown, the UK investment platform, which benefitted from a

takeover bid.

Although the geopolitical backdrop remains

turbulent, we believe that the biggest risk facing investors today

is the structure of the market index. The index we compare

ourselves to, MSCI ACWI, holds around 3,000 stocks, with an average

position size of 0.03%; but Microsoft, Apple, and NVIDIA each

represent around 4% of the index at the end of the six-month

period, more than 110x the average stock position size. Volatility

in companies that are so large in the index creates significant

distortions. When they move, the whole index moves with them.

Owning large overweight stakes in such companies

as their share prices rise might help short-term performance but we

believe it creates significant risks to long-term returns if

sentiment turns against them or they fail to deliver expected

profits. History shows that market concentration can persist for

long periods but ultimately ends with many market leaders falling

by the wayside. Remember Cisco, Intel and AOL, the fallen giants of

the internet revolution in the late 1990s. So, we are acutely aware

of the need to actively manage our exposures to achieve an

acceptable balance between risk and reward.

Long Term Benefits of AI are

Unclear

The stock market excitement around AI is understandable. It could

be a game-changing technology, with huge potential benefits for

productivity. But AI’s impact is still largely unknown. It is

perhaps worth noting that, in this high-tech gold rush, NVIDIA is

providing picks and shovels to other industries looking to improve

their efficiency. But the long-term revenues and profits of the

technology are yet to emerge. They could be in farming, healthcare,

financial services, or consumer service industries, for example,

rather than the technology industry itself. And for the AI

revolution to succeed, it also requires investment in the

background infrastructure, such as data centres and electricity

supply. We, therefore, prefer to spread our investments both within

technology and beyond.

Investment Journey as Important as

Destination

We believe our more diverse positioning, across investment styles,

regions, industries, and stocks will serve shareholders well in the

long term. For investors in a core, long-term holding such as

Alliance Trust, the journey is just as important as the

destination, and we aim to provide investors with a much more

comfortable ride than a single-manager portfolio that is skewed

towards a country or sector, which is more likely to experience

higher peaks and lower troughs.

In our view, the portfolio is well positioned

with high quality companies in every sector of the market.

Although changes of government generally do not

make much difference to long-term stock market returns, they can

impact investor sentiment or sectors in the short term, as the

example of Vinci shows. So, with a new Labour government in the UK,

the possibility of a second Donald Trump term in the US, ongoing

wars in the Middle East and Ukraine, and no real clarity about the

future direction of global economic growth, the world remains a

fragile and uncertain place. More than ever, this emphasises the

importance of staying diversified and using skilled active managers

to exploit mispriced opportunities that arise out of the volatility

that we are likely to continue to see as the year progresses.

This diverse positioning across countries,

sectors and styles should serve us well in both a bullish scenario,

where growth picks up as inflation and interest rates come down and

stock market returns broaden out, and a bearish one, where

inflation and interest rates remain stubbornly high and cause a

slow slide into recession.

New Manager Appointed

The main change we made to portfolio positioning in the first half

of the year was the replacement of Jupiter Asset Management

(‘Jupiter’) with ARGA Investment Management (‘ARGA’). As mentioned

in our first-quarter newsletter, this change followed Ben

Whitmore’s decision to resign from Jupiter to set up his own

business. It was unrelated to performance. While we continue to

have high regard for Ben’s skill as an investor, his new business

arrangements represented potential risks and we will take time to

fully assess them. We decided to bring in a new manager with

similar value characteristics to ensure the portfolio remains

balanced across styles.

ARGA’s appointment brought several new holdings

into the portfolio, such as Alaska Air, Tapestry, Boliden, and

Société Générale. Alaska Air’s valuation has come under pressure

from the impending acquisition of Hawaiian Airlines, but ARGA says

Alaska Air has a strong balance sheet and the all-cash deal will

increase its market share at Honolulu International Airport from

10% to 40%. Tapestry is a global luxury brand company. ARGA expects

Tapestry to benefit from the recovery in revenue from Kate Spade,

which sells designer handbags, clothing and accessories. In

addition, Tapestry is in the process of completing the acquisition

of the global fashion group Capri Holdings, whose brands include

Versace, Jimmy Choo and Michael Kors. Boliden is a Swedish miner

which has been hit by a copper smelter fire and the closure of a

high-cost zinc mine, but ARGA says the company has plans to resolve

these temporary issues and hopes to receive a fire insurance

payment. Société Générale, the French bank, is expected to benefit

from its exposure to French retail network mergers, new cost

initiatives and lower regulatory costs.

In aggregate, stock turnover was 42% of the

portfolio. The largest purchases and sales undertaken by our

managers during the last six months are listed in the tables

below.

|

Top 10 largest net purchases – Six Months to 30 June

2024 |

% of Equity

Portfolio

purchased |

Net value

of stock

purchased

(£m) |

|

Synopsys |

1.4 |

49.0 |

|

Apple |

0.8 |

29.9 |

|

Coca Cola |

0.7 |

26.5 |

|

Philip Morris |

0.7 |

26.3 |

|

Diageo |

0.7 |

26.1 |

|

Skyworks Solutions |

0.7 |

24.7 |

|

Kerry Group |

0.6 |

22.3 |

|

Qualcomm |

0.6 |

21.5 |

|

Tencent Holdings |

0.6 |

21.1 |

|

Southern Company |

0.6 |

21.1 |

|

Top 10 largest net sales – Six Months to 30 June

2024 |

% of Equity

Portfolio

sold |

Net value

of stock

sold

(£m) |

|

NVIDIA |

1.4 |

52.2 |

|

Alphabet |

0.9 |

34.6 |

|

Adani Enterprises |

0.8 |

30.5 |

|

AIA Group |

0.7 |

28.4 |

|

Stericycle |

0.6 |

24.2 |

|

MercadoLibre |

0.6 |

24.1 |

|

Astrazeneca |

0.6 |

22.0 |

|

Molson Coors |

0.6 |

21.7 |

|

Glencore |

0.5 |

21.0 |

|

Microsoft |

0.5 |

20.3 |

Source: Juniper.

Further changes to portfolio positioning can be

expected in the second half of the year if shareholders approve the

combination with Witan. Up to that point, it will be business as

usual, with us actively managing our allocations to each stock

picker. However, the combination with Witan will give us the

opportunity to consider whether to change the manager line up. We

have two managers in common, GQG and Veritas, but Witan has other

managers that we rate highly, and we have always said that the

optimal number is between 8 and 12.

We will be using the services of a specialist

transition manager to combine the portfolios. It should be noted

too that there will be some less liquid holdings that come across

from Witan. These are high quality assets, and it would not make

sense in the short term to dispose of them. We are, therefore,

likely to continue holding them for some time until a sale looks

materially more attractive with proceeds being passed to the

managers in place at the time.

Craig Baker, Stuart Gray, Mark

Davis

Willis Towers Watson

Investment Manager

Responsible Investment

In the six months to 30 June 2024, EOS at

Federated Hermes engaged with 95 companies held in the portfolio on

a range of over 439 issues and objectives. Key areas of engagement

included board effectiveness, climate change, human and labour

rights, human capital, biodiversity, digital rights and AI. Over

the same period, the Company’s Stock Pickers cast 2,717 votes at

184 company meetings. They voted on all the proposals that could be

voted on in the period. The Company’s Stock Pickers voted against

management on 320 proposals and abstained on 38 proposals. Of the

votes exercised against company management, the most frequently

recurring themes were compensation and director election.

Task Force on Climate Related Financial

Disclosures (‘TCFD’)

The 2023 Product Level TCFD Report for the Company as prepared by

WTW is available in the AIFM Disclosures & Policies section of

the Company’s website www.alliancetrust.co.uk

Principal and Emerging

Risks

In common with other financial services organisations, the

Company’s business model results in inherent risks.

The Directors have carried out a robust

assessment of the principal and emerging risks facing the Company

and how these are continuously monitored and managed.

In pursuit of its strategic objectives, the

Company faces the following principal risks:

- Investment – Market, Investment Performance, Strategy and

Market Rating, Capital Structure and Financial

- Operational – Cybercrime, IT Systems Failure, Inadequacy of

Oversight and Controls, Climate Risk, and Ineffective Disaster

Recovery Planning.

- Legal and Regulatory Non‑Compliance

These risks, and the way in which they are

managed, are described in more detail within the How We Manage Our

Risks section on pages 31 to 34 of the Annual Report for the year

ended 31 December 2023, which is available on the Company’s website

at www.alliancetrust.co.uk. The Board believes these principal

risks and uncertainties are applicable to the remaining six months

of the financial year, as they were to the six months ended 30 June

2024.

Emerging risks facing the Company have largely

remained unchanged since those detailed in the Annual Report for

the year ended 31 December 2023, namely geopolitical tension,

governmental elections, global monetary policy, inflation and

interest rate pressures.

These emerging risks are considered by the Board

alongside its principal risks. The Board remains of the view that

active management of the concentrated ‘best ideas’ approach

employed by the Company will be able to take advantage of any

volatility as it creates opportunities. The Board believes that the

Company’s globally diversified multi-manager portfolio will be less

volatile and, hopefully, a more rewarding investment.

Related Party Transactions

There were no transactions with related parties during the six

months ended 30 June 2024 which had a material effect on the

results or the financial position of the Company.

Going Concern Statement

As at 30 June 2024, while there have been market changes over the

period, the Board does not consider that in relation to its ability

to continue as a going concern that there have been any significant

changes to these factors. The Directors, who have reviewed budgets,

forecasts and sensitivities, consider that the Company has adequate

financial resources to enable it to continue in operational

existence for the foreseeable future.

Accordingly, the Directors believe it is

appropriate to continue to adopt the going concern basis.

The factors impacting on going concern are set

out in detail in the Company’s Viability Statement on pages 54 and

55 of the Annual Report for the year ended 31 December 2023.

Factors considered included Financial Strength, Investment,

Liquidity, Dividends, Reserves, Discount, Significant Risks,

Borrowings, Reserves, Security and Operations.

Responsibility Statement

We confirm to the best of our knowledge

that:

- The condensed set of financial

statements which have been prepared in accordance with IAS 34

“Interim Financial Reporting” as adopted by the UK, give a true and

fair view of the assets, liabilities, financial position and profit

or loss of the Company as required by DTR 4.2.4 of the Disclosure,

Guidance and Transparency Rules;

- The interim management report

includes a fair review of the information required by:

(a) DTR 4.2.7R of the Disclosure

Guidance and Transparency Rules, being an indication of important

events that have occurred during the first six months of the

financial year and their impact on the condensed set of financial

statements, and a description of the principal risks and

uncertainties for the remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure Guidance and

Transparency Rules, being related party transactions that have

taken place in the first six months of the current financial year

and that have materially affected the financial position or

performance of the Company during that period, and any changes in

the related party transactions described in the Annual Report for

the year ended 31 December 2023 that could have a material effect

on the financial position or performance of the Company in the

first six months of the current financial year.

Signed on behalf of the Board

Dean Buckley

Chair

25 July 2024

Financial Statements

Condensed Income Statement (unaudited) for the period

ended 30 June 2024

|

|

6 months to 30 June 2024 |

6 months to 30 June 2023 |

Year to

31 December 2023 (audited) |

|

|

£000 |

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income |

35,554 |

320 |

35,874 |

42,102 |

– |

42,102 |

69,591 |

1,678 |

71,269 |

|

| Gain on

investments held at fair value through profit or loss |

– |

298,729 |

298,729 |

– |

289,726 |

289,726 |

– |

578,715 |

578,715 |

|

|

Profit/(loss) on fair value of debt |

– |

8,627 |

8,627 |

– |

2,765 |

2,765 |

– |

(11,371) |

(11,371) |

|

|

Total |

35,554 |

307,676 |

343,230 |

42,102 |

292,491 |

334,593 |

69,591 |

569,022 |

638,613 |

|

|

Investment management fees |

(2,786) |

(6,435) |

(9,221) |

(2,451) |

(5,438) |

(7,889) |

(5,074) |

(11,228) |

(16,302) |

|

| Administrative

expenses |

(1,786) |

(121) |

(1,907) |

(1,239) |

(200) |

(1,439) |

(2,558) |

(344) |

(2,902) |

|

| Finance

costs |

(1,376) |

(4,127) |

(5,503) |

(1,063) |

(3,190) |

(4,253) |

(2,380) |

(7,141) |

(9,521) |

|

|

Foreign exchange losses |

– |

(1,580) |

(1,580) |

– |

(3,284) |

(3,284) |

– |

(3,737) |

(3,737) |

|

|

Profit before tax |

29,606 |

295,413 |

325,019 |

37,349 |

280,379 |

317,728 |

59,579 |

546,572 |

606,151 |

|

|

Taxation |

(2,872) |

(5,933) |

(8,805) |

(3,323) |

(185) |

(3,508) |

(6,231) |

(251) |

(6,482) |

|

|

Profit for the period/year |

26,734 |

289,480 |

316,214 |

34,026 |

280,194 |

314,220 |

53,348 |

546,321 |

599,669 |

|

|

All profit for the period/year is attributable to equity

holders. |

Earnings per share attributable to

equity holders |

9.42 |

101.99 |

111.41 |

11.71 |

96.41 |

108.12 |

18.55 |

189.98 |

208.53 |

|

The Company does not have any other

comprehensive income and hence profit for the period/year, as

disclosed above, is the same as the Company’s total comprehensive

income.

Condensed Statement of Changes in Equity

(unaudited) for the period ended 30 June 2024

| |

|

|

Distributable reserves |

|

|

£000 |

Share

capital |

Capital

redemption

reserve |

Realised capital

reserve |

Unrealised capital reserve |

Revenue

reserve |

Total distributable reserves |

Total

|

|

Balance at 1 January 2023 |

7,314 |

11,684 |

2,669,933 |

103,754 |

102,334 |

2,876,021 |

2,895,019 |

| Total

Comprehensive income: |

|

|

|

|

|

|

|

| Profit for the

year |

– |

– |

75,430 |

470,891 |

53,348 |

599,669 |

599,669 |

|

Transactions with owners, recorded directly to

equity: |

|

|

|

|

|

|

|

| Ordinary

dividends paid |

– |

– |

– |

– |

(71,378) |

(71,378) |

(71,378) |

| Unclaimed

dividends returned |

– |

– |

– |

– |

14 |

14 |

14 |

|

Own shares purchased |

(208) |

208 |

(86,636) |

– |

– |

(86,636) |

(86,636) |

Balance at 31 December

2023 (audited) |

7,106 |

11,892 |

2,658,727 |

574,645 |

84,318 |

3,317,690 |

3,336,688 |

Balance at 1 January 2023 |

7,314 |

11,684 |

2,669,933 |

103,754 |

102,334 |

2,876,021 |

2,895,019 |

| Total

Comprehensive income: |

|

|

|

|

|

|

|

| Profit for the

period |

– |

– |

42,673 |

237,521 |

34,026 |

314,220 |

314,220 |

|

Transactions with owners, recorded directly to

equity: |

|

|

|

|

|

|

|

| Ordinary

dividends paid |

– |

– |

– |

– |

(35,347) |

(35,347) |

(35,347) |

|

Own shares purchased |

(143) |

143 |

(57,287) |

– |

– |

(57,287) |

(57,287) |

|

Balance at 30 June 2023 |

7,171 |

11,827 |

2,655,319 |

341,275 |

101,013 |

3,097,607 |

3,116,605 |

|

|

|

|

|

|

|

|

|

| Balance at 1

January 2024 |

7,106 |

11,892 |

2,658,727 |

574,645 |

84,318 |

3,317,690 |

3,336,688 |

| Total

Comprehensive income: |

|

|

|

|

|

|

|

| Profit for the

period |

– |

– |

254,730 |

34,750 |

26,734 |

316,214 |

316,214 |

|

Transactions with owners, recorded directly to

equity: |

|

|

|

|

|

|

|

| Ordinary

dividends paid |

– |

– |

– |

– |

(36,802) |

(36,802) |

(36,802) |

| Unclaimed

dividends returned |

– |

– |

– |

– |

9 |

9 |

9 |

|

Own shares purchased |

– |

– |

(20,427) |

– |

– |

(20,427) |

(20,427) |

|

Balance at 30 June 2024 |

7,106 |

11,892 |

2,893,030 |

609,395 |

74,259 |

3,576,684 |

3,595,682 |

The £609.4m of Unrealised capital reserve

(£341.3m at 30 June 2023 and £574.6m at 31 December 2023) arising

on the revaluation of investments is subject to fair value

movements and may not be readily realisable at short notice. As

such it may not be entirely distributable. The Unrealised capital

reserve includes unrealised gains on the fixed rate loans of £14.1m

(£19.6m as at 30 June 2023 and £5.5m at 31 December 2023) which are

not distributable.

Condensed Balance Sheet (unaudited) as at 30 June

2024

|

£000 |

30 June 2024 |

30 June 2023 |

31 December 2023 (audited) |

|

Non-current assets |

|

|

|

|

Investments held at fair value through profit or loss |

3,750,562 |

3,254,091 |

3,482,329 |

|

|

3,750,562 |

3,254,091 |

3,482,329 |

|

Current assets |

|

|

|

| Outstanding

settlements and other receivables |

14,716 |

11,721 |

9,321 |

|

Cash and cash equivalents |

115,546 |

63,702 |

84,974 |

|

|

130,262 |

75,423 |

94,295 |

|

Total assets |

3,880,824 |

3,329,514 |

3,576,624 |

|

|

|

|

|

|

Current liabilities |

|

|

|

| Outstanding

settlements and other payables |

(14,983) |

(9,033) |

(9,792) |

|

Bank loans |

(45,716) |

(63,500) |

– |

|

|

(60,699) |

(72,533) |

(9,792) |

| Total

assets less current liabilities |

3,820,125 |

3,256,981 |

3,566,832 |

| |

|

|

|

|

Non-current liabilities |

|

|

|

| Fixed rate

loan notes held at fair value |

(206,517) |

(140,376) |

(215,144) |

| Bank

loans |

(15,000) |

– |

(15,000) |

|

Deferred tax provision |

(2,926) |

– |

– |

|

|

(224,443) |

(140,376) |

(230,144) |

|

Net assets |

3,595,682 |

3,116,605 |

3,336,688 |

|

Equity |

|

|

|

| Share

capital |

7,106 |

7,171 |

7,106 |

| Capital

redemption reserve |

11,892 |

11,827 |

11,892 |

| Capital

reserve |

3,502,425 |

2,996,594 |

3,233,372 |

|

Revenue reserve |

74,259 |

101,013 |

84,318 |

|

Total equity |

3,595,682 |

3,116,605 |

3,336,688 |

|

|

|

|

|

| All net assets

are attributable to equity holders. |

|

|

|

|

|

|

|

|

|

Net asset value per ordinary share attributable to equity

holders (£) |

12.74 |

10.87 |

11.75 |

Condensed Cash Flow Statement

(unaudited) for the period ended 30 June 2024

|

£000 |

6 months to

30 June 2024 |

6 months to

30 June 2023 |

Year to

31 December 2023

(audited) |

|

Cash flows from operating activities |

|

|

|

| Profit before

tax |

325,019 |

317,728 |

606,151 |

| Adjustments

for: |

|

|

|

| Gains on

investments |

(298,729) |

(289,726) |

(578,715) |

| (Gains)/losses

on fair value of debt |

(8,627) |

(2,765) |

11,371 |

| Foreign

exchange losses |

1,580 |

3,284 |

3,737 |

|

Finance costs |

5,503 |

4,253 |

9,521 |

|

Operating cash flows before movements in working capital |

24,746 |

32,774 |

52,065 |

|

Decrease/(increase) in receivables |

837 |

(913) |

1,599 |

|

Increase/(decrease) in payables |

94 |

(1,303) |

(36) |

|

Net cash inflow from operating activities before tax |

25,677 |

30,558 |

53,628 |

|

Taxes paid |

(6,221) |

(3,713) |

(6,654) |

|

Net cash inflow from operating activities |

19,456 |

26,845 |

46,974 |

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

| Proceeds on

disposal of investments |

2,270,716 |

791,489 |

1,600,165 |

|

Purchases of investments |

(2,244,807) |

(743,307) |

(1,489,643) |

|

Net cash inflow from investing activities |

25,909 |

48,182 |

110,522 |

|

Net cash inflow before financing |

45,365 |

75,027 |

157,496 |

|

|

|

|

|

| Cash

flows from financing activities |

|

|

|

| Dividends paid

– equity |

(36,802) |

(35,347) |

(71,378) |

| Unclaimed

dividends returned |

9 |

– |

14 |

| Purchase of own

shares |

(16,801) |

(56,654) |

(88,060) |

| Repayment of

bank debt |

(59,000) |

– |

(63,500) |

| Drawdown of

bank debt |

104,874 |

– |

15,000 |

| Issue of loan

notes |

– |

– |

60,632 |

|

Finance costs paid |

(5,335) |

(4,904) |

(10,357) |

|

Net cash outflow from financing activities |

(13,055) |

(96,905) |

(157,649) |

|

|

|

|

|

| Net

increase/(decrease) in cash and cash equivalents |

32,310 |

(21,878) |

(153) |

| Cash and cash

equivalents at beginning of period/year |

84,974 |

88,864 |

88,864 |

|

Effect of foreign exchange rate changes |

(1,738) |

(3,284) |

(3,737) |

|

Cash and cash equivalents at the end of

period/year |

115,546 |

63,702 |

84,974 |

Notes to the Financial

Statements

- General

information

The information contained in this Interim Report

for the period ended 30 June 2024 does not constitute statutory

accounts as defined in section 434 of the Companies Act 2006. A

copy of the statutory accounts for the year ended 31 December 2023

has been delivered to the Registrar of Companies. The auditor’s

report on those financial statements was prepared under s495 and

s496 of the Companies Act 2006. The Interim Report was not

qualified, did not contain an emphasis of matter paragraph and did

not contain statements under section 498(2) or (3) of the Companies

Act.

The interim financial results are unaudited and

have not been reviewed by the Company’s auditors. They should not

be taken as a guide to the full year.

2. Accounting policies

Basis of preparation

These condensed interim financial statements for the six months to

30 June 2024 have been prepared in accordance with IAS 34 ‘Interim

financial reporting’ and also in accordance with the measurement

and recognition principles of UK adopted international accounting

standards (‘IASs’) but are not the Company’s statutory accounts.

They include comparators extracted from the Company’s statutory

accounts but do not include all of the information required for

full annual financial statements and should be read in conjunction

with the 2023 Annual Report, which were prepared in accordance with

the requirements of the Companies Act 2006 and in accordance with

UK-adopted international accounting standards. Those accounts have

been reported on by the Company’s auditors and delivered to the

Registrar of Companies. The report of the auditor was (i)

unqualified, (ii) did not include a reference to any matters to

which the auditor drew attention by way of emphasis without

qualifying their report and (iii) did not contain a statement under

section 498(2) or (3) of the Companies Act 2006.

The Association of Investment Companies (‘AIC’)

issued a Statement of Recommended Practice: Financial Statements of

Investment Companies (‘SORP’) in July 2022. The Directors have

sought to prepare the financial statements in accordance with the

AIC SORP where the recommendations are consistent with IFRS. The

Company qualifies as an investment entity.

Going concern

The Directors having assessed the principal and emerging risks of

the Company have, at the time of approving the financial

statements, a reasonable expectation that the Company has adequate

resources to continue in operational existence for at least 12

months from date of approval. The Company’s assets, the majority of

which are investments in quoted equity securities and are readily

realisable, significantly exceed its liabilities. They therefore

continue to adopt the going concern basis of accounting in

preparing the financial statements. The Company’s business

activities, together with the factors likely to affect its future

development and performance are set out in the Strategic Report of

the Annual Report for the financial year ended 31 December

2023.

Segmental reporting

The Company has identified a single operating segment, the

investment trust, which aims to maximise shareholders returns. As

such no segmental information has been included in these financial

statements.

Application of accounting

policies

The same accounting policies, presentations and methods of

computation are followed in these financial statements as were

applied in the Company’s annual audited financial statements for

the financial year ended 31 December 2023.

3. Income

|

£000 |

6 months to

30 June 2024 |

6 months to

30 June 2023 |

Year to

31 December 2023 |

|

Revenue: |

|

|

|

|

Income from investments |

|

|

|

| Listed dividends

– UK |

4,651 |

6,527 |

12,836 |

|

Listed dividends – Overseas |

30,083 |

35,059 |

55,761 |

|

|

34,734 |

41,586 |

68,597 |

|

Other income |

|

|

|

| Other

interest |

798 |

515 |

987 |

|

Other income |

22 |

1 |

7 |

|

|

820 |

516 |

994 |

|

Total allocated to revenue |

35,554 |

42,102 |

69,591 |

|

Capital: |

|

|

|

| Income

from investments |

|

|

|

| Listed dividends

– UK |

23 |

– |

– |

|

Listed dividends – Overseas |

297 |

– |

1,678 |

|

Total allocated to capital |

320 |

– |

1,678 |

|

Total income |

35,874 |

42,102 |

71,269 |

4. Investment management fees

The fee includes £8,580,000 for investment

management services, which is allocated 25% to revenue and 75% to

capital, and £641,000 for distribution services, which is recorded

directly to revenue.

5. Dividends paid

£000 |

6 months to

30 June 2024 |

6 months to

30 June 2023 |

Year to 31

December 2023 |

|

2022 fourth interim dividend of 6.00p per share |

– |

17,498 |

17,498 |

| 2023 first

interim dividend of 6.18p per share |

– |

17,849 |

17,849 |

| 2023 second

interim dividend of 6.34p per share |

– |

– |

18,028 |

| 2023 third

interim dividend of 6.34p per share |

– |

– |

18,003 |

| 2023 fourth

interim dividend of 6.34p per share |

18,003 |

– |

– |

|

2024 first interim dividend of 6.62p per share |

18,799 |

– |

– |

|

Total |

36,802 |

35,347 |

71,378 |

Availability of Interim

Report

The Interim Report will shortly be available to

view on the Company's website at www.alliancetrust.co.uk

A copy of the Interim Report will shortly be

submitted to the Financial Conduct Authority’s National Storage

Mechanism and will be available for inspection at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

[END]

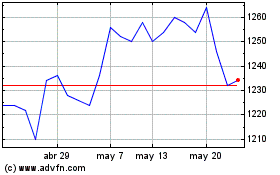

Alliance (LSE:ATST)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Alliance (LSE:ATST)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024