RNS Number:5225E

Accsys Technologies PLC

14 June 2006

14th June 2006

Accsys Technologies PLC

("Accsys" or "the Company")

PRELIMINARY RESULTS

FOR THE 12 MONTHS ENDED 31 MARCH 2006 (audited)

Highlights

* Establishment of Accsys Technologies and completion of the acquisition

of Accsys Chemicals

* Admission to AiM and completion of Euro27 million financing

* First license option agreements signed in UK and Middle East,

generating first license revenues ahead of expectations

* Strong test results on 'Accoya', the Company's 'new wood species' brand,

with product endorsements from the world's number one coatings supplier,

Akzo Nobel Sikkens, who announced product guarantees for up to thirty years

* Arnhem facility on track for completion in the fourth quarter of 2006

* Euro27 million of financial resources

* Business development progress in wood fibre and styrene applications

Willy Paterson-Brown, Chairman, said: "We are very pleased with the progress

that we are making on all fronts. I am confident that Accsys will continue on

its path to making a significant impact on the building materials industry

worldwide, offering manufacturers and consumers better performing, more

sustainable products through advancing technology."

For further information:

Accsys Technologies PLC Collins Stewart Ltd. Parkgreen

Communications

Willy Paterson-Brown, Chairman Michael O'Brien, Analyst Ana Ribeiro

+ 44 20 7598 4040 +44 20 7523 8000 +44 20 7493 3713

CHAIRMAN'S STATEMENT

Accsys Technologies was successfully listed on the AiM market of the London

Stock Exchange in October 2005, raising Euro27 million before expenses. This has

provided the Company with an excellent foundation for the continued development

of its technologies and our market launch prior to commercial start-up, which is

expected this year. The response of the investment community and the stock

market confirmed the validity of the Company's strategy and reflected the broad

interest of corporations and individuals in technologies which offer cost and

environmental benefits to basic industries.

The past year saw enormous strides in Accsys Technologies' development, with

particular emphasis on its Titan Wood subsidiary as planned. A new product

brand was created and launched, customer and licensee development proceeded

apace, product and process development continued positively and plant

construction, including the acquisition of a new, larger site, moved forward.

The Company expects to complete its wood acetylation production facility in the

fourth quarter of 2006, with revenue from initial sales anticipated soon after.

During the past year staffing levels were increased and management and reporting

systems transformed in readiness for full commercial production. Development

efforts for other applications, notably wood fibre and styrene also continued,

with discussions presently underway with several of the leading global companies

in each field about how best to exploit each technology. Considering these

activities, together with the stock market flotation, it is fair to say that

2005-6 was a busy, productive and successful year for our Company.

The directors do not intend to pay a dividend until the Company has established

strong cash flow and reported satisfactory profitability.

The Company has completed the restructuring reported at the interim stage, and

now has direct ownership of the subsidiaries likely to generate future licence

income which should enable the distribution of future earnings.

Willy Paterson-Brown

Executive Chairman

FINANCIAL INFORMATION

Basis of Preparation

The consolidated financial statements incorporate the financial statements of

Accsys Technologies PLC and all its subsidiary undertakings throughout the year

ended 31 March 2006, using the merger method of accounting as the acquisition of

Accsys Chemicals PLC meets the criteria of a group reconstruction.

In the Group financial statements, merged subsidiary undertakings are treated as

if they had always been a member of the Group. The results of such a subsidiary

are included for the whole period in the year it joins the Group. The

corresponding figures for the previous year include its results for that period,

the assets and liabilities at the previous balance sheet date and the shares

issued by the Company as consideration as if they had always been in issue. Any

difference between the nominal value of the shares acquired by the Company and

those issued by the Company to acquire them is taken to a merger reserve.

The financial information set out below does not constitute the company's

statutory accounts within the meaning of section 240 of the Companies Act 1985.

The financial information for the year ended 31 March 2005 is derived from the

statutory accounts of Accsys Chemicals PLC, the former parent company of the

group, for the year then ended as the company has applied merger accounting in

accounting for the business combination. The financial information for the year

ended 31 March 2006 is extracted from the company's statutory accounts for the

year then ended. The statutory accounts of Accsys Chemicals PLC for 2005 have

been delivered to the Registrar of Companies and those for Accsys Technologies

PLC for 2006 will be delivered following the company's annual general meeting.

The auditors have reported on those accounts; their reports were unqualified and

did not contain statements under the Companies Act 1985, s 237(2) or (3).

Consolidated profit and loss account

Note 2006 2006 2005 2005

Euro'000 Euro'000 Euro'000 Euro'000

Turnover 80 -

Administrative expenses

General administrative expenses (5,860) (2,965)

Impairment of tangible and

intangible fixed assets - (24,514)

_________ __________

(5,860) (27,479)

_______ _______

Operating loss (5,780) (27,479)

Interest receivable and similar income 782 18

_______ _______

Loss on ordinary activities before

and after taxation (4,998) (27,461)

Minority interest - 841

_______ _______

Loss for the year (4,998) (26,620)

======= =======

Basic and diluted loss per share 6 Euro(0.04) Euro(0.43)

Consolidated statement of total recognised gains and losses

Note 2006 2005

Euro'000 Euro'000

Loss for the year (4,998) (26,620)

Exchange translation differences on consolidation and conversion to

Euro

- (1,095)

_______ _______

Total recognised gains and losses for the year (4,998) (27,715)

======= =======

All amounts relate to continuing activities.

Consolidated Balance Sheets

Note Group Group Company

2006 2005 2006

Euro'000 Euro'000 Euro'000

Fixed assets

Intangible assets 13,715 14,246 -

Tangible assets 10,693 2,842 -

Investments - - 11,383

_______ _______ _______

24,408 17,088 11,383

Current assets

Debtors 8,411 6,224 19,646

Other investments 15,513 - 15,513

Cash at bank 4,577 4,564 4,023

_______ _______ _______

28,501 10,788 39,182

Creditors: amounts falling due within

one year 1,984 1,922 23,666

_______ _______ _______

Net current assets 26,517 8,866 15,516

_______ _______ _______

Net assets 50,925 25,954 26,899

======= ========= =======

Capital and reserves

Called up share capital 1 1,473 1,203 1,473

Share premium account 25,504 - 25,504

Merger reserve 106,707 102,512 -

Profit and loss account (82,759) (77,761) (78)

_______ _______ _______

Shareholders' funds 2 50,925 25,954 26,899

======= ======= =======

The financial statements were approved by the Board and authorised for issue on

14 June 2006

Consolidated cash flow statement

Note 2006 2006 2005 2005

Euro'000 Euro'000 Euro'000 Euro'000

Net cash outflow from operating

activities 3 (4,468) (2,513)

Returns on investments and

servicing of finance

Interest received 269 18

Interest paid - -

_______ _______

Net cash inflow from

returns on investments and

servicing of finance 269 18

Capital expenditure and

financial investment

Purchase of tangible fixed assets (7,925) (2,210)

Sale of tangible fixed assets 53 -

_______ _______

(7,872) (2,210)

_______ _______

Cash outflow before use of

liquid resources and financing (12,071) (4,705)

Management of liquid resources

Increase in short term deposits (1,690) (5,616)

Increase in other investments (15,000) -

_______ _______

(16,690) (5,616)

Financing

Increase in loans - 1,434

Issue of share capital 27,000 11,773

Expenses of issue of share

capital (1,226) (565)

Shares issued by subsidiary 3,000 800

_______ _______

28,774 13,442

_______ _______

Increase in cash 13 3,121

======= ======

Notes to the financial information

1 Share capital

2006

Euro'000

Authorised equity share capital

200,000,000 ordinary shares of Euro0.01 each 2,000

1,000,000 deferred shares of 10p each 148

______

2,148

======

Allotted, called up and fully paid equity share capital

132,463,447 ordinary shares of Euro0.01 each 1,325

1,000,000 deferred shares of 10p each 148

______

1,473

======

2 Reconciliation of movements in shareholders' funds

2006 2005

Euro'000 Euro'000

Group

Loss for the year (4,998) (26,620)

Exchange translation differences on consolidation

and conversion to euro - (1,095)

Net proceeds from issue of shares 25,774 21,593

Shares issued by subsidiary 4,195 -

_______ _______

Net increase/(decrease) in shareholders' funds 24,971 (6,122)

Opening shareholders' funds 25,954 32,076

_______ _______

Closing shareholders' funds 50,925 25,954

======= =======

Notes to the financial information

3 Reconciliation of operating loss to net cash outflow from operating

activities

2006 2005

Euro'000 Euro'000

Operating loss (5,780) (27,479)

Depreciation of tangible fixed assets 21 838

Amortisation of intangible fixed assets 531 -

Impairment of intangible fixed assets - 24,514

(Increase) in debtors (497) (476)

Increase in creditors 1,257 90

_______ _______

(4,468) (2,513)

======= =======

4 Reconciliation of net cash inflow to movement in net funds/(debt)

2006 2005

Euro'000 Euro'000

Increase in cash in the year 13 3,121

Cash inflow from increase in debt and lease financing - (1,434)

_______ _______

Change in net funds resulting from cash flows 13 1,687

Shares issued in subsidiary in settlement of debt 1,195 3,000

Other non-cash movements - 150

Exchange differences - 115

_______ _______

Movement in net funds/(debt) in the year 1,208 4,952

Opening net funds/(debt) 3,369 (1,583)

_______ _______

Closing net funds 4,577 3,369

====== ======

Notes to the financial information

5 Analysis of net funds

At Other At

1 April Cash non-cash 30 March

2005 flow changes 2006

Euro'000 Euro'000 Euro'000 Euro'000

Cash in hand and at bank 4,564 13 - 4,577

Debt due within one year (1,195) - 1,195 -

_______ _______ _______ _______

Total 3,369 13 1,195 4,577

======= ======= ======= =======

6 Loss per Accsys Technologies PLC share

The loss per share shown below is calculated based upon the weighted average

number of Accsys Technologies PLC Ordinary shares in issue.

2006 2005

Weighted average number of Ordinary Shares in issue 116,975,026 61,596,033

Loss for the year Euro'000 (4,998) (26,620)

Loss per share Euro(0.04) Euro(0.43)

Since none of the Accsys Technologies PLC's potential Ordinary shares are

dilutive, there is no difference between basic and diluted loss per share.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GUUGCQUPQGQW

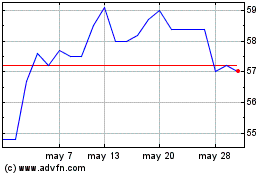

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024