TIDMBAF

British & American Investment Trust PLC

Annual Financial Report

for the year ended 31 December 2022

Registered number: 00433137

Directors Registered office

David G Seligman (Chairman) Wessex House

Jonathan C Woolf (Managing Director) 1 Chesham Street

Dominic G Dreyfus (Non-executive and Chairman of the Audit Telephone: 020 7201

Committee until 7 February 2022) 3100

Alex Tamlyn (Non-executive, acting Chairman of the Audit Committee Registered in England

until 31 May 2022)

Julia Le Blan (Non-executive and Chair of the Audit Committee from No.00433137

1 June 2022)

27 April 2023

This is the Annual Financial Report as required to be published under DTR 4 of

the UKLA Listing Rules.

Financial Highlights

For the year ended 31 December 2022

2022 2021

Revenue Capital Total Revenue Capital Total

return return return return

£000 £000 £000 £000 £000 £000

Profit/(loss) before tax - 658 (277) 381 978 (810) 168

realised

Profit before tax - - 579 579 - 1,028 1,028

unrealised

__________ __________ __________ __________ __________ __________

Profit before tax - total 658 302 960 978 218 1,196

__________ __________ __________ __________ __________ __________

Earnings per £1 ordinary

share - basic and diluted 1.30p 1.21p 2.51p 2.66p 0.87p 3.53p

__________ __________ __________ __________ __________ __________

Net assets 7,091 6,727

__________ __________

Net assets per ordinary

share

- deducting preference

shares 20p 19p

at fully diluted net

asset value*

__________ __________

- diluted 20p 19p

__________ __________

Diluted net asset value per 22p

ordinary share at 21 April

2023

__________

Dividends declared or

proposed for the period:

per ordinary share

- interim paid 1.75p 3.5p

- final proposed 0.0p 0.0p

per preference share 1.75p 3.5p

*Basic net assets are calculated using a value of fully diluted net asset value

for the preference shares.

Chairman's Statement

I report our results for the year ended 31 December 2022.

Revenue

The return on the revenue account before tax amounted to £0.7 million (2021: £

1.0 million), a lower level than in the previous year due to a lower level of

dividends received from external investments. A slightly higher level of

dividend income was received from our subsidiary companies derived from gains

realised on our principal US investments for subsequent distribution as

dividends.

Gross revenues totalled £1.2 million (2021: £1.4 million). In addition, film

income of £107,000 (2021: £171,000) and property unit trust income of £1,000

(2021: £2,000) was received in our subsidiary companies. This reduction in

property income reflected the sale of one of our investments during the year.

In accordance with IFRS10, these income streams are not included within the

revenue figures noted above because consolidated financial statements are not

prepared.

The total return before tax amounted to a profit of £1.0 million (2021: £1.2

million profit), which comprised net revenue of £0.7 million, a realised loss

of £0.3 million and an unrealised gain of £0.6 million. The revenue return per

ordinary share was 1.3p (2021: 2.7p) on an undiluted basis.

Net Assets and Performance

Net assets at the year end were £7.1 million (2021: £6.7 million), an increase

of 5.4 percent after payment of £0.6 million in dividends to shareholders

during the year. This compares to an increase in the FTSE 100 index of 0.9

percent and to a decrease in the UK All Share index of 3.2 percent over the

period. On a total return basis, after adding back dividends paid during the

year, our net assets increased by 14.5 percent compared to increases of 4.7

percent and 0.3 percent in the FTSE 100 and UK All Share indices, respectively.

In this transitional year reflecting the end of the Covid pandemic disruption

and the initiation of interest rate rise programmes by many central banks, we

significantly out-performed these benchmarks both on a portfolio and a total

return basis while also returning cash via dividends to shareholders at well

above market yields. This was made possible by a significant gain in the value

of our largest US investment (Geron Corporation) particularly in the mid part

of the year in anticipation of important clinical trial results in the early

weeks of 2023. Geron's share price increased by 140 percent over this four

month period and by 100 percent over the year as a whole in US dollar terms. In

sterling terms, this overall increase was over 120 percent due to the strength

of the US dollar in 2022. This out-performance for the year was despite a

retrenchment of over 40 percent in the value of our other large US investment,

Lineage Cell Therapeutics Inc following gains of 100 percent in that stock over

the previous two years.

More generally, equity markets in the USA and UK saw an overall declining trend

from the higher levels of the previous year which had reflected the significant

bounce-back in markets after the initial shock of the Covid pandemic. The

developing realisation that the extended era of ultra low interest rates was

coming to an end and that a period of steadily and possibly aggressive interest

rates rises was in prospect to challenge strong inflationary pressures weighed

on the markets which traded in a narrow but declining trend over the year. The

US Federal Reserve, having been in the forefront of these interest rate moves,

gave rise to the substantial strength seen in the US dollar over the year.

With significantly higher levels of interest rates now operating throughout the

developed world and prices having risen at their highest rates for a

generation, economic growth in 2022 has been subdued globally and is not

expected to resume for some time, although the fears of recession, particularly

in the UK and other European countries might not in the event materialise.

The second major influence in 2022 on global economic activity which

substantially affected equity markets was the war in Ukraine resulting from

Russia's unprovoked invasion of that country in February last year. This caused

severe disruption to international trade, energy prices and supply,

geopolitical relations and global security with the up-ending of the post-1945

international rules based system and undisguised nuclear threats by Russia.

The unprecedented economical, developmental and social effects of the war have

impacted not only of course Ukraine but all European and many other countries

throughout the World and indeed ultimately and strategically Russia itself. The

introduction of a comprehensive and hard-hitting sanctions regime on Russia has

resulted in a major re-ordering of international financial systems and flows,

the re-calibration of global energy markets and a re-examination of military

and strategic planning not seen since the end of the Cold War over 30 years

ago.

Dividend

In 2022, dividends of 1.75 pence per ordinary share and 1.75 pence per

preference share were paid as an interim payment during the year. This

represented a decrease of 50 percent for ordinary shareholders over the

previous year and a yield of approximately 9 percent on the ordinary share

price averaged over a period of 12 months.

It is our intention to pay an interim dividend this year as close as possible

in amount and on a similar timetable to the dividend paid in 2021, as and when

the profitable sales of investments permit. The position regarding these

investments is set out in more detail in the Managing Director's report below.

Recent events and outlook

A resolution to the unnecessary and bloody conflict in Ukraine is still not in

sight and the damage to the combatants and the World in general continues.

Against this background, we enter a more dangerous phase as Western and allied

democracies are forced to realign and confront those increasingly assertive and

in some cases nuclear-armed authoritarian nations which are seeking to

challenge a perceived to be weakening West. There can be no doubt that this

new era of insecurity and uncertainty now being played out on the global stage

can have no long term benefits to us or our planet as the risks of global

conflict increase and the implementation of the important and hard-won

provisions of the Global Climate Change Agreements (COP) to protect against the

long-term and damaging effects of global warming are delayed or rolled back.

All this inevitably introduces a great deal of uncertainty into financial

markets in both the short and medium terms which make the making of long-term

investment decisions particularly difficult. Consequently, we will continue to

limit our activities and major focus to our US biopharma investments which do

not tend to track general market movements and which we believe hold

significant investment promise as they progress ever closer towards

commercialisation of their ground-breaking and valuable technologies.

As at 21 April 2023, our net assets had increased to £7.7 million, an increase

of 8.6 percent since the beginning of the calendar year. This is equivalent to

22.0 pence per share (prior charges deducted at fully diluted value) and 22.0

pence per share on a diluted basis. Over the same period the FTSE 100 increased

6.2 percent and the All Share Index increased 5.5 percent.

David Seligman

27 April 2023

Managing Director's report

In the aftermath of the lengthy Covid pandemic and with the vicious and

globally disruptive war in Ukraine now continuing into a second year, the past

12 months have been characterised by a great deal of uncertainty, flux and

points of pivot in many of the major constituents of global financial and

investment markets.

Starting with interest rates, which are always the prime driver of movements in

markets, levels of economic growth in major world economies, equity and bond

markets, foreign exchange parities, inflation, cost of living, energy prices

and supply, geopolitics and even bank confidence have exhibited large swings

and disruption over the period, finding it extremely difficult to return to the

trends and greater certainties of the pre-Covid era.

At the interim stage last year, we focused comment on the interest rate

programmes being introduced by central banks, increasing rates from their

multi-year lows to confront the rapidly rising levels of inflation. These

inflation rises were initially the result of the unprecedented government

support schemes introduced during the Covid pandemic which had swollen

government debt levels and central bank balance sheets substantially. But then

the war in Ukraine further exacerbated inflation as the resulting international

sanctions regime against Russia disrupted supply chains, particularly in

relation to energy where prices increased dramatically.

However, despite some of the more extreme projections of inflation possibly

rising to levels of 20 percent being put forward by some analysts during the

year, we thought such levels would be unlikely as long as wage settlements did

not embed higher inflation into the system and that a relatively quick return

to more normal levels of inflation could be expected, particularly as the

higher energy costs related to the war began to drop out of the annual

calculation.

In the event, while inflation did reach levels not seen for many decades, the

timely and sustained interest rate rises by central banks, particularly in the

USA, have served to stabilise inflation and the headline rates have now started

to reduce gradually, even though increases in most household cost of living

baskets remain well into double digits, continuing to drive demand for

substantial compensatory wage rises.

At this stage, it remains to be seen whether large wage settlements will embed

inflation levels at above policy levels for the longer term. However, as a

mitigating factor, the huge energy price rises seen last year as a result of

the war in Ukraine, with crude oil rising by 50 percent (following a 100

percent rise in the previous year as the world economy re-awakened from the

Covid pandemic) and natural gas prices rising by up to 300 percent as Russian

gas supplies were cut off, have now receded to substantially below pre-war

prices.

These lower prices will likely result in significant reductions in headline

inflation levels over the next few months. This expectation is also driving

governments, particularly in the UK and Europe, to stand firm and delay the

agreement of above inflation public sector wage settlements despite significant

industrial and public sector unrest until such time as the inflation background

looks more benign. In the meantime and in order to avoid embedding higher

inflation into the system, settlements have focused on one-off compensatory

catch-up payments rather than multi-year increases in general pay.

In the absence of clarity around inflation and given the uncertainty about the

duration and extent of central bank interest rate increase programmes,

financial markets inevitably performed poorly in 2022 with the post-Covid

recovery stalling and the major equity markets ended the year in negative

territory, as noted in the Chairman's statement above.

A more significant effect, however, was seen in the bond markets which suffered

their sharpest falls since 2008 as the higher interest rate environment

impacted prices significantly and large-scale government bond issuance

programmes were implemented to repair central bank balance sheets following

their multi-year quantitative easing programmes and to finance government

deficits. These drivers pushed up yields for all issuers, governmental and

corporate alike, and over all maturities.

In the UK in particular, this strain on the government bond market was

exacerbated by the ill-advised but thankfully short-lived policy errors of the

equally short-lived Truss government which in September attempted to introduce

un-costed and unfunded tax reductions at a time of high government debt and

financing needs, leading to meltdown in a particular part of the Gilt market in

relation to pension funds which required fast and significant Bank of England

intervention.

Since that time, bond market volatility and valuation issues derived from

interest rate increases have caused other significant areas of difficulty.

Notably, in relation to confidence in banks, particularly those with certain

vulnerabilities for example a record of poor management or repeated scandals

(such as Credit Suisse in Switzerland) or an underlying portfolio risk

management problem (such as Silicon Valley Bank in the USA). Even though very

large in size and considered solvent and ostensibly operating well within their

regulatory capital requirements, confidence in even these institutions

disappeared quickly over the last few months as deposits were withdrawn by

their customers and their share prices collapsed, precipitating further deposit

withdrawals and ultimately requiring rescues to be engineered by their

respective governments in order to preserve vital confidence in the wider

banking market.

This was a wholly unexpected and worrying development which prompts further and

more specific examination of the workings of banks within today's much more

dynamic and customer/investor empowered world where deposits can be withdrawn

or switched at the press of a button, even by smaller retail customers using

internet banking apps, or by professional funds taking advantage of a

speculative and self-fulfilling interplay between listed banks' stock market

values and confidence in their deposit bases.

It appears that, in addition to their loan portfolios, banks must now consider

concentration and quality of risk in their deposit bases, which have proved to

be more volatile and susceptible to adverse publicity than expected, if they

are to avoid the contagion which has been seen in recent months between falling

bank equity prices - likely exacerbated by professional short selling funds -

and deposit withdrawals, leading ultimately to failure or enforced rescue by

the authorities.

Further work is now also being undertaken by governments to re-assess the

strength and coverage of bank capital adequacy rules, which had for instance

been weakened in the USA in the case of banks not considered systemic during

the Trump administration, and was possibly a contributing factor in the Silicon

Valley Bank failure. An examination of the adequacy of state deposit guarantee

schemes is also now being called for in response to the new and systemic risks

to confidence in banks posed by the promulgation of misinformation via social

media and 24 hour reporting.

This recent unexpected vulnerability in the banking sector, taken together with

the undoubted pain which substantially higher rates have brought to companies,

home owners and indeed investors as wages fall in real terms, mortgage interest

payments double and the asset bubbles built up over years of ultra-low interest

rates collapse will now be giving central banks some moment of reflection in

relation to their continued programmes of interest rate rises and monetary

tightening. As reductions in inflation levels become more evident, central

banks will have to balance the risks of keeping inflation higher for longer

with the risks of possible long term damage to their economies if interest

rates are kept too high for too long.

Equity markets have recently begun to sense the approach of a potential pivot

point in interest rates and have shown some resilience since the sell-off in

the fourth quarter of 2022 following the mis-handled UK 'mini-budget' which had

repercussions in both the bond and equity markets, and despite moments of

uncertainty in the first quarter of 2023 when fears of a more widespread

contagion in banks persisted and temporarily depressed markets.

This equity market resilience has been further supported by the unexpectedly

firm economic performance of leading economies which so far have avoided

expectations of downturns by the end of 2022 and into 2023, remaining flat

instead. In the case of the USA, the economy grew by 2.5 percent in 2022 and

is expected to grow by 3.0 percent in the current year.

In the UK, an expected technical recession in the last quarter of 2022,

particularly in the aftermath of the mis-handled autumn mini-budget, did not

materialise and the government expects recession to be avoided in 2023 with

activity in retail, hospitality and construction continuing to perform better

than expected, despite the recently announced misgivings of the IMF which has

consistently under-estimated UK growth levels in recent years.

The reasons for this unexpected resilience in the UK economy could be partly

the result of the high levels of savings built up during the Covid years when

salaries were still being paid through government support schemes but not fully

utilised due to general inactivity associated with the pandemic lockdowns.

Since then, the sense of relief in the population at the end of the pandemic

has encouraged a burst of spending, particularly in hospitality and travel,

which has so far not been totally restrained by the sharply rising interest

rates and costs of living.

Geron Corporation

As noted in the Chairman's statement above, the value of our largest US

investment in Geron Corporation increased substantially in 2022, by 120 percent

in sterling terms, allowing our portfolio to outperform for the year as a

whole, as the stock price rose strongly in anticipation of important Phase 3

clinical trial results due in early 2023.

Those results were duly announced on 4th January and were as positive as the

market had been expecting, confirming in a larger patient population the

results of the prior Phase 2 trials which had showed significant and

unprecedented success in the treatment of Myelodysplastic Syndrome (MDS), a

serious haematological cancer disorder with no long-term cure requiring

lifetime and debilitating blood transfusions and leading ultimately to an early

death.

Immediately upon announcement of the news, Geron's share price rose by 67

percent from $2.40 to $4.00, building on the large gain already registered in

2022 as a whole. During the day, however, the share price steadily declined to

$3.12 on large volume of approximately 120 million shares, being 50 times

normal levels and representing around 30 percent of the total shares

outstanding. It was not until after market close on the same day, however,

that the company announced a previously unexpected and un-flagged secondary

share offering led by a new financier to the company, to be priced on a

book-building basis for new shares representing approximately 20 percent of the

market capitalisation of the company. On the next day, the stock price

decreased further to $2.48 on volume of 40 million shares and after market

close that day, the company announced that the secondary offering of over 90

million shares and warrants, including over-allotment shares, had been priced

at $2.45.

It seems quite extraordinary that price sensitive information of such

importance and of such potentially price negative effect could reasonably have

been withheld and not released at the same time as the good and price positive

news concerning the successful clinical trial results announced at the

beginning of the same day. The withholding of this price sensitive information

during the day's trading session had the effect of artificially inflating the

stock price in the absence of full publication of relevant information, leading

investors to purchase stock at prices based on incomplete information and

indeed giving those potential investors participating in the contemporaneous

but at that time unannounced secondary issue the opportunity to short stock

ahead of the pricing of the issue and thereby to profit from the exercise, at

the expense of existing investors.

It should be said that such activities, were they to have occurred in the UK,

could well have been in breach of the regulations relating to market abuse and

the Listing Rules of the London Stock Exchange. It is extraordinary and highly

damaging that such activities could be permitted under the rules of any

properly regulated stock exchange interested in protecting the interests of

investors trading on that exchange.

The correct approach would have been for the company either to make a full

announcement of the results and equity financing simultaneously in the normal

way to avoid a false market in its stock or to allow the stock price to find a

new and price-discovered level in the market after the release of the positive

results prior to proceeding with the financing at a later stage. Such financing

could then be based on a properly re-valued stock price. In this way, the

managers of the financing would have been required to do the job they were paid

for of finding new investors in the company at a fair price both to the company

and existing investors given all the circumstances and not to be able to take

advantage of a highly predictable yet false price movement in the market to the

financial detriment of the company and its investors.

Since these events in January, Geron's stock price fell further below the

secondary issue price by more than 20 percent and to well below its

pre-announcement level. It has also underperformed the Nasdaq and Biotechnology

indices by 35 percent and 45 percent, respectively, over this short period of

10 weeks. It would appear, therefore, that despite Geron's very promising

future prospects, as confirmed by the positive trial results announced in

January, investor confidence in the stock has again been badly shaken by these

damaging and investor-unfriendly market operations, which are similar to those

we have had cause to comment upon and criticise many times in the past.

Investor confidence was then further undermined in February when senior

management sold significant numbers of shares upon the expiry of in-the-money

share options under the company's senior management share option programme,

giving a further poor signal to the market.

It is very disappointing to see that even at times of imminent success, Geron's

management and by extension its stock price fail to perform in line with what

the company's long-term investors reasonably deserve and can justifiably

expect. Notwithstanding this market-related disappointment, the value of

Geron's technology will we believe eventually be properly priced through a

transparent and un-adulterated price discovery process in the market and will

yield superior returns to its long term investors such as ourselves. We

believe this re-rating can be expected within a short time frame given the

end-point now successfully reached by Geron in this particular clinical trials

process, either emanating from a long-overdue corporate action within the

sector or upon gaining the anticipated official approval later this year of its

ground-breaking Imetelstat drug and commencement of commercial sales, for which

the company confirmed it had the necessary funding even before the recent

equity issue.

Short selling

Finally, given its relevance to the major holdings in our portfolio, it is

worth again drawing attention to what can be the very detrimental effects of

shorting on market transparency, corporate well-being and shareholder interests

in specific sectors of the market.

While many consider that shorting provides much needed liquidity to markets,

unless it is properly controlled and understood, which in many instances it

seems not to be, it can also have seriously negative and damaging effects on a

number of vital market sectors.

It will be recalled for instance that at the time of the financial crisis in

2008/9, regulators imposed co-ordinated bans on shorting bank stocks to limit

contagious bank runs and preserve confidence generally in the banking system.

The prescience of this move has been underlined in recent weeks in the case of

the bank failures/rescues described above where the interplay between the stock

prices of listed banks - likely further depressed at the time by shorting - and

the consequential mass withdrawals of their deposits, no doubt magnified by a

'rinse and repeat' effect, played a major part in these failures.

Shorting can have a similarly detrimental effect on certain other industries

requiring high levels of liquidity based primarily on confidence rather than

underlying financial worth. Biotechnology is such an industry, where companies

rely in their early stages of development on the injection of considerable

amounts of bank or equity finance for long periods of time to support their

multi-year development programmes with no underlying sales, income or tangible

assets during this period to support their valuations and share prices or to

secure their loans. It is therefore essentially financing based on an albeit

calculated hope of future success.

Short sellers know very well that these companies require substantial

injections of funds consistently over a long period of time and they therefore

become an easy target for unscrupulous market operators who are able to sell

down the stock to any desired level because of the lack of any verifiable value

basis, prior to being able to close such positions either sooner or later via

the company's next new stock issuance at a price lower than that at which they

had previously shorted and at little risk, therefore, to themselves. The fact

that in the majority of cases each new equity issuance in a series of equity

issuances over the years is generally struck at an ever declining price (a

function of the share dilution inherent in the process) provides validation of

this lucrative but pernicious business model for short sellers.

While it cannot be avoided that biotech and other similar long-development

technology companies are ultimately in the hands of those entities providing

them with finance, the uncontrolled ability of these providers to manipulate

the outcomes of these operations to their own financial advantage and limited

risk but to the disadvantage of the companies and their shareholders is very

damaging to the proper valuation and operation of these important business

going forward and eventually to the market in general. A review of these

practices and their operation in the public markets is therefore urgently

called for.

Jonathan Woolf

27 April 2023

Income statement

For the year ended 31 December 2022

2022 2021

Revenue Capital Total Revenue Capital Total

return return return return

£ 000 £ 000 £ 000 £ 000 £ 000 £ 000

Investment income (note 2) 1,156 - 1,156 1,439 - 1,439

Holding gains on investments 579 579 1,028 1,028

at fair value through profit - -

or loss

Losses on disposal of

investments at fair value - (294) (294) - (585) (585)

through profit or loss*

Foreign exchange gains/ (40) 277 237 (4) 22 18

(losses)

Expenses (424) (250) (674) (422) (243) (665)

________ ________ ________ ________ ________ ________

Profit before finance costs 692 312 1,004 1,013 222 1,235

and tax

Finance costs (34) (10) (44) (35) (4) (39)

________ ________ ________ ________ ________ ________

Profit before tax 658 302 960 978 218 1,196

Tax 16 - 16 36 - 36

________ ________ ________ ________ ________ ________

Profit for the year 674 302 976 1,014 218 1,232

________ ________ ________ ________ ________ ________

Earnings per share

Basic and diluted - ordinary 1.30p 1.21p 2.51p 2.66p 0.87p 3.53p

shares**

________ ________ ________ ________ ________ ________

The company does not have any income or expense that is not included in the

profit/(loss) for the year. Accordingly, the 'Profit for the year' is also the

'Total Comprehensive Income for the year' as defined in IAS 1 (revised) and no

separate Statement of Comprehensive Income has been presented.

The total column of this statement represents the Income Statement, prepared in

accordance with IFRS. The supplementary revenue return and capital return

columns are both prepared under guidance published by the Association of

Investment Companies. All items in the above statement derive from continuing

operations.

All profit and total comprehensive income is attributable to the equity holders

of the company.

*Losses on disposal of investments at fair value through profit or loss include

Gains on sales of £9,000 (2021 - £270,000 losses) and Losses on provision for

liabilities and charges of £303,000 (2021 - £315,000 losses).

**Calculated in accordance with International Accounting Standard 33 'Earnings

per Share'. Conversion of the preference shares will have an antidilutive

effect. Upon conversion of the preference shares to ordinary shares the

anti-diluted earnings per share would be 1.93p (2021 - 2.90p) (revenue return).

Statement of changes in equity

For the year ended 31 December 2022

Share Capital Retained Total

capital reserve earnings

£ 000 £ 000 £ 000 £ 000

Balance at 31 December 2020 35,000 (28,448) 168 6,720

Changes in equity for 2021

Profit for the period - 218 1,014 1,232

Ordinary dividend paid (note 4) - - (875) (875)

Preference dividend paid (note 4) - - (350) (350)

________ ________ ________ ________

Balance at 31 December 2021 35,000 (28,230) (43) 6,727

Changes in equity for 2022

Profit for the period - 302 674 976

Ordinary dividend paid (note 4) - - (437) (437)

Preference dividend paid (note 4) - - (175) (175)

________ ________ ________ ________

Balance at 31 December 2022 35,000 (27,928) 19 7,091

________ ________ ________ ________

Registered number: 00433137

Balance Sheet

At 31 December 2022

2022 2021

£ 000 £ 000

Non-current assets

Investments - at fair value through profit or 5,600 6,124

loss

Investment in subsidiaries - at fair value 7,712 6,707

through profit or loss

__________ __________

13,312 12,831

Current assets

Receivables 442 535

Cash and cash equivalents 45 83

__________ __________

487 618

__________ __________

Total assets 13,799 13,449

__________ __________

Current liabilities

Trade and other payables 1,794 2,129

Bank credit facility 1,018 619

__________ __________

(2,812) (2,748)

__________ __________

Total assets less current liabilities 10,987 10,701

__________ __________

Non - current liabilities (3,896) (3,974)

__________ __________

Net assets 7,091 6,727

__________ __________

Equity attributable to equity holders

Ordinary share capital 25,000 25,000

Convertible preference share capital 10,000 10,000

Capital reserve (27,928) (28,230)

Retained revenue earnings 19 (43)

__________ __________

Total equity 7,091 6,727

__________ __________

Approved: 27 April 2023

Cash flow statement

For the year ended 31 December 2022

Year ended Year ended

2022 2021

£ 000 £ 000

Cash flows from operating activities

Profit before tax 960 1,196

Adjustments for:

Gains on investments (285) (443)

Dividends in specie - (78)

Proceeds on disposal of investments at fair 548 1,708

value through profit and loss

Purchases of investments at fair value through (441) (1,610)

profit and loss

Finance costs 44 39

__________ __________

Operating cash flows before movements in working 826 812

capital

Decrease in receivables 109 551

Decrease in payables (1,351) (549)

__________ __________

Net cash from operating activities before (416) 814

interest

Interest paid (21) (7)

__________ __________

Net cash from operating activities (437) 807

Cash flows from financing activities

Dividends paid on ordinary shares - (875)

Dividends paid on preference shares - (175)

__________ __________

Net cash used in financing activities - (1,050)

__________ __________

Net decrease in cash and cash equivalents (437) (243)

Cash and cash equivalents at beginning of year

(536) (293)

__________ __________

Cash and cash equivalents at end of year

(973) (536)

__________ __________

Purchases and sales of investments are considered to be operating activities of

the company, given its purpose, rather than investing activities. Cash and cash

equivalents at year end shows net movement on the bank facility.

1 Basis of preparation and going concern

The financial information set out above contains the financial information of

the company for the year ended 31 December 2022. The company has prepared its

financial statements under IFRS. The financial statements have been prepared on

a going concern basis adopting the historical cost convention except for the

measurement at fair value of investments, derivative financial instruments and

subsidiaries.

The information for the year ended 31 December 2022 is an extract from the

statutory accounts to that date. Statutory company accounts for 2021, which

were prepared under IFRS as adopted by the UK, have been delivered to the

registrar of companies and company statutory accounts for 2022, prepared under

IFRS as adopted by the UK, will be delivered in due course.

The auditors have reported on the 31 December 2022 year end accounts and their

report was unqualified and did not include references to any matters to which

the auditors drew attention by way of emphasis without qualifying their reports

and did not contain statements under section 498(2) or (3) of the Companies Act

2006.

The directors, having made enquiries, consider that the company has adequate

financial resources to enable it to continue in operational existence for the

foreseeable future. Accordingly, the directors believe that it is appropriate

to continue to adopt the going concern basis in preparing the company's

accounts.

2 Income

2022 2021

£ 000 £ 000

Income from investments

UK dividends 89 391

Dividend from subsidiary 1,001 907

_________ _________

1,090 1,298

Other income 66 71

Other - 70

_________ __________

Total income 1,156 1,439

_________ __________

Total income comprises:

Dividends 1,090 1,298

Other interest 66 141

_________ __________

1,156 1,439

_________ __________

Dividends from investments

Listed investments 89 391

Unlisted investments 1,001 907

_________ __________

1,090 1,298

_________ __________

During the year the company received a dividend of £1,001,000 (2021 - £907,000)

from a subsidiary which was generated from gains made on the realisation of

investments held by that company. As a result of the receipt of this dividend a

corresponding reduction was recognised in the value of the investment in the

subsidiary company.

Of the £1,090,000 (2021 - £1,298,000) dividends received, £nil (2021 - £

204,000) related to special and other dividends received from investee

companies that were bought after the dividend announcement. There was a

corresponding capital loss of £nil (2021 - £249,000), on these investments.

During the year the company recognised £317,000 of a foreign exchange gain on

the loan of $3,526,000 to a subsidiary. As a result of this gain, the

corresponding movement was recognised in the value of the investment in the

subsidiary company.

Under IFRS 10 the income analysis is for the parent company only rather than

that of the consolidated group. Thus, film revenues of £107,000 (2021 - £

171,000) received by the subsidiary British & American Films Limited and

property unit trust income of £1,000 (2021 - £2,000) received by the subsidiary

BritAm Investments Limited are shown separately in this paragraph.

3 Earnings per ordinary share

The calculation of the basic (after deduction of preference dividend) and

diluted earnings per share is based on the following data:

2022 2021

Revenue Capital Total Revenue Capital Total

return return return return

£ 000 £ 000 £ 000 £ 000 £ 000 £ 000

Earnings:

Basic and 324 302 626 664 218 882

diluted

Basic revenue, capital and total return per ordinary share is based on the net

revenue, capital and total return for the period after tax and after deduction

of dividends in respect of preference shares and on 25 million (2021: 25

million) ordinary shares in issue.

The diluted revenue, capital and total return is based on the net revenue,

capital and total return for the period after tax and on 35 million (2021: 35

million) ordinary and preference shares in issue.

*Calculated in accordance with International Accounting Standard 33 'Earnings

per Share'. Conversion of the preference shares will have an antidilutive

effect. Upon conversion of the preference shares to ordinary shares the

anti-diluted earnings per share would be 1.93p (2021 - 2.90p) (revenue return).

4 Dividends

2022 2021

£ 000 £ 000

Amounts recognised as distributions to equity

holders in the period

Dividends on ordinary shares:

Final dividend for the year ended 31 December 2021

of 0.0p - -

(2020: 0.0p) per share

First interim dividend for the year ended 31

December 2022 of 1.75p 437 675

(2021: 2.7p) per share

Second interim dividend for the year ended 31

December 2022 of 0.0p - 200

(2021: 0.8p) per share

__________ __________

437 875

__________ __________

Proposed final dividend for the year ended 31

December 2022 of 0.0p (2021: 0.0p) per share - -

__________ __________

Dividends on 3.5% cumulative convertible

preference shares:

Preference dividend for the 6 months ended 31

December 2021 of 0.00p (2020: 0.00p) per share - -

Preference dividend for the 6 months ended 30 June

2022 of 0.0p (2021: 1.75p) per share - 175

Preference dividend for the 6 months ended 31

December 2022 of 1.75p (2021: 1.75p) per share 175 175

__________ __________

175 350

__________ __________

We have set out below the total dividend payable in respect of the financial

year, which is the basis on which the retention requirements of Section 1158 of

the Corporation Tax Act 2010 are considered.

Dividends proposed for the period

2022 2021

£ 000 £ 000

Dividends on ordinary shares:

First interim dividend for the year ended 31

December 2022 of 1.75p 437 675

(2021: 2.7p) per share

Second interim dividend for the year ended 31

December 2022 of 0.0p - 200

(2021: 0.8p) per share

Proposed final dividend for the year ended 31

December 2022 of 0.0p (2021: 0.0p) per share - -

__________ __________

437 875

__________ __________

Dividends on 3.5% cumulative convertible

preference shares:

Preference dividend for the 6 months ended 30 June

2022 of 0.00p (2021: 1.75p) per share - 175

Preference dividend for the 6 months ended 31

December 2022 of 1.75p (2021: 1.75p) per share 175 175

__________ __________

175 350

__________ __________

The non-payment in December 2019, December 2020 and June 2022 of the dividend

of 1.75 pence per share on the 3.5% cumulative convertible preference shares,

consequent upon the non-payment of a final dividend on the Ordinary shares for

the year ended 31 December 2019, for the year ended 31 December 2020 and for

the period ended 30 June 2022, has resulted in arrears of £525,000 on the 3.5%

cumulative convertible preference shares. These arrears will become payable in

the event that the ordinary shares receive, in any financial year, a dividend

on par value in excess of 3.5%.

Interim dividend declared for the year ended 31 December 2022 of 1.75 pence per

ordinary share was paid on 22 December 2022 to shareholders on the register at

9 December 2022. A preference dividend of 1.75 pence was paid to preference

shareholders on the same date.

5 Net asset values

Net asset

value per share

2022 2021

Ordinary shares £ £

Diluted 0.20 0.19

Undiluted 0.20 0.19

Net assets

attributable

2022 2021

£ 000 £ 000

Total net assets 7,091 6,727

Less convertible preference shares at (2,026) (1,922)

fully diluted value

__________ __________

Net assets attributable to ordinary 5,065 4,805

shareholders

__________ __________

The undiluted and diluted net asset values per £1 ordinary share are based on

net assets at the year end and 25 million (undiluted) ordinary and 35 million

(diluted) ordinary and preference shares in issue.

Principal risks and uncertainties

The principal risks facing the company relate to its investment activities and

include market risk (other price risk, interest rate risk and currency risk),

liquidity risk and credit risk. The other principal risks to the company are

loss of investment trust status and operational risk. These will be explained

in more detail in the notes to the 2022 Annual Report and Accounts, but remain

unchanged from those published in the 2021 Annual Report and Accounts.

Related party transactions

The company rents its offices from Romulus Films Limited, and is also charged

for its office overheads.

The salaries and pensions of the company's employees, except for the

non-executive directors and one employee are paid by Remus Films Limited and

Romulus Films Limited and are recharged to the company.

During the year the company did not enter into any investment transactions with

British & American Films Limited (2021 - £772,000 sale) or BritAm Investments

Limited (2021 - £711,000 purchase).

At 31 December 2022 £4,132,163 (2021 - £4,084,909) was owed by British &

American Films Limited to Romulus Films Limited under an existing loan

agreement.

There have been no other related party transactions during the period, which

have materially affected the financial position or performance of the company.

Capital Structure

The company's capital comprises £35,000,000 (2021 - £35,000,000) being

25,000,000 ordinary shares of £1 (2021 - 25,000,000) and 10,000,000 non-voting

convertible preference shares of £1 each (2021 - 10,000,000). The rights

attaching to the shares will be explained in more detail in the notes to the

2022 Annual Report and Accounts, but remain unchanged from those published in

the 2021 Annual Report and Accounts.

Directors' responsibility statement

The directors are responsible for preparing the financial statements in

accordance with applicable law and regulations. The directors confirm that to

the best of their knowledge the financial statements prepared in accordance

with the applicable set of accounting standards, give a true and fair view of

the assets, liabilities, financial position and the (loss)/profit of the

company and that the Chairman's Statement, Managing Director's Report and the

Directors' report include a fair review of the information required by rules

4.1.8R to 4.2.11R of the FSA's Disclosure and Transparency Rules, together with

a description of the principal risks and uncertainties that the company faces.

Annual General Meeting

This year's Annual General Meeting has been convened for Thursday 29 June 2023

at 12.15pm at Wessex House, 1 Chesham Street, London SW1X 8ND.

END

(END) Dow Jones Newswires

April 28, 2023 04:53 ET (08:53 GMT)

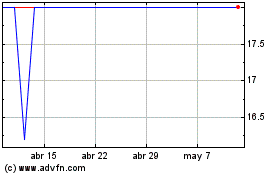

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

British & American Inves... (LSE:BAF)

Gráfica de Acción Histórica

De May 2023 a May 2024