TIDMBBSN

RNS Number : 2906M

Brave Bison Group PLC

13 September 2023

The information contained within this announcement is deemed by

the Company to constitute inside information pursuant to Article 7

of EU Regulation 596/2014 as it forms part of UK domestic law by

virtue of the European Union (Withdrawal) Act 2018 as amended. Upon

the publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

13 September 2023

Brave Bison Group plc

("Brave Bison" or the "Company", together with its subsidiaries

"the Group")

Interim Results

Performance in-line with Board expectations despite challenging

environment

Brave Bison, the digital advertising and technology services

company, today reports its unaudited interim results for the six

months ended 30 June 2023.

Commenting on the results, Oliver Green, Executive Chairman,

said:

"We are pleased to report a period of stable profitability

despite a difficult macro-economic backdrop. The core Brave Bison

business has performed in-line with our expectations, and the

turnaround of SocialChain is showing encouraging progress with a

number of recent customer wins including national brands such as

Asda, The Army and Holland & Barrett"

Financial Highlights

Unaudited H1 2023 H1 2022 Change

---------------------------------- ---------- --------- -------

Revenue GBP16.9m GBP14.7m +15%

Gross Profit / Net Revenue GBP10.0m GBP8.2m +23%

Adj. EBITDA (1) GBP1.9m GBP1.6m +20%

---------------------------------- ---------- --------- -------

Adj. Profit Before Tax (2) GBP1.5m GBP1.3m +14%

---------------------------------- ---------- --------- -------

Adj. PBT Per Share 0.12p 0.12p +0%

Profit Before Tax (GBP0.2m) GBP1.0m (124%)

Cash GBP4.5m GBP5.4m (17%)

Net Cash excl. Lease Liabilities GBP4.3m GBP4.8m (14%)

================================== ========== ========= =======

Small apparent errors due to rounding

(1) Adj. EBITDA is defined as earnings before interest,

taxation, depreciation and amortisation, and after adding back

acquisition costs, restructuring costs and share-based payments.

Under IFRS16 most of the costs associated with the Company's

property leases are classified as depreciation and interest,

therefore Adj. EBITDA is stated before deducting these costs.

(2) Adj. Profit Before Tax is stated after adding back

acquisition costs, restructuring costs, impairments, amortisation

of acquired intangibles and share-based payments, and is after the

deduction of costs associated with property leases.

-- Adj. EBITDA of GBP1.9m (H1 2022: GBP1.6m) and Adj. Profit

Before Tax of GBP1.5m (H1 2022: GBP1.3m), both in-line with

expectations

-- Double-digit growth in revenue and gross profit / net revenue

to GBP16.9m (H1 2022: GBP14.7m) and GBP10.0m (H1 2022: GBP8.2m)

respectively

-- Statutory loss before tax of GBP0.2m (H1 2022: profit of

GBP1.0m) after incurring GBP1.4m (H1 2022: GBP0.1m) in exceptional

costs associated with the acquisition and integration of

SocialChain and simultaneous GBP4.8m share placing in February

2023

-- Net cash of GBP4.3m (H1 2022: GBP4.8m, H2 2022: GBP6.2m)

excluding lease liabilities, a cash outflow of GBP1.9m (H1 2022:

GBP0.1m inflow) during the period due to the acquisition of

SocialChain which was funded in-part by balance sheet cash

-- Gross cash of GBP4.5m (H1 2022: GBP5.4m, H2 2022: GBP6.5m).

Brave Bison has now repaid all outstanding loans and deferred

consideration, with the exception of GBP0.2m worth of

Government-backed COVID relief loans with favourable interest rates

and long-dated maturities. As at 30 June 2023, the Company's

revolving credit facilities were undrawn

-- Adjusted earnings per share for the period of 0.12p (H1 2022:

0.12p), in-line with Board expectations

Strategic Highlights

-- SocialChain was acquired in February 2023 and integrated with

Brave Bison Social & Influencer. The resulting SocialChain by

Brave Bison is one of the UK's leading social media advertising and

influencer marketing agencies. New business wins since completion

include Warner Bros., Asda, Pinterest, Purina, The Army, Holland

& Barrett and a national retailer under NDA

-- Brave Bison completed a GBP4.8m fundraising in February 2023

to fund the acquisition of SocialChain and provide further capital

for future acquisitions. The fundraising, initially targeting

GBP3.0m, was increased due to strong demand from institutional and

other investors and closed oversubscribed

-- Integration of SocialChain is materially complete with IT,

finance, HR, operations and marketing functions combined with Brave

Bison at the period end. Full systems integration is expected to be

materially complete by the end of 2023

-- As a result of the integration and tighter resource control,

headcount at SocialChain has reduced by 28% since completion of the

acquisition. Annualised cost savings of circa GBP1m have now been

realised

-- Brave Bison Media Network customers representing

approximately 65% of FY22 gross profit / net revenue have renewed

key contracts for between 24 and 36 months, including flagship

channels US Open, Ryder Cup, Link Up TV and PressPlay Media

-- New business wins at Brave Bison Performance and Brave Bison

Commerce include Markel Group, a global insurance company with

revenues in excess of $10bn, Alliance Automotive Group, a European

car parts distributor with revenues in excess of $3bn

-- Brave Bison Commerce awarded Best B2B Project at the MACH

Impact Awards for its world-first composable commerce architecture

delivery for MKM Building Supplies

-- Brave Bison total headcount as at 30 June 2023 of 238 (H1

2022: 156). Brave Bison staff now operate from in nine countries,

with hubs in London, Manchester and New York, as well as Bulgaria

and Egypt

Outlook

-- FY23 performance anticipated to be in-line Board

expectations, including net cash which is expected to exceed GBP6m

at year end

-- Trading in H2 is showing a meaningful improvement on H1,

driven by the positive impact from the SocialChain acquisition

& integration and healthy new business activity across Brave

Bison

Change of Name of Nominated Adviser

Brave Bison also announces that its Nominated Adviser has

changed its name to Cavendish Securities plc following completion

of its own corporate merger.

For further information please contact:

Brave Bison Group plc

Oliver Green, Chairman via Cavendish

Theo Green, Chief Growth Officer

Philippa Norridge, Chief Financial Officer

Cavendish Securities plc Tel: +44 (0)20 7397 8900

Nominated Adviser & Broker

Ben Jeynes

Dan Hodkinson

About Brave Bison

Brave Bison (AIM: BBSN) is a digital advertising and technology

services company, headquartered in London with a globally

distributed workforce in over nine countries. The Company provides

services to global brands and advertisers through four business

units.

Brave Bison Performance is a paid and organic media practice. It

plans and buys digital media on platforms like Google, Meta,

TikTok, Amazon and YouTube, as well as providing search engine

optimisation and digital PR services. Customers include New

Balance, Curry's and Asus.

SocialChain by Brave Bison is a social media advertising

practice. It creates content for social media platforms and works

with influencers to create and distribute marketing content. This

creative approach ensures that content is more native to the

platform it is on, allowing its customers to drive higher

engagement from audiences of all ages. Customers include KFC,

TikTok and General Mills.

Brave Bison Commerce is a digital commerce practice. It creates,

improves and maintains ecommerce websites and manages the customer

experience in a digital environment. This practice builds ecommerce

systems in a composable way - whereby different functions of a

website are provided by different software from different vendors.

Customers include MKM Building Supplies, Muller and Furniture

Village.

Brave Bison Media Network is a portfolio of channels across

YouTube, Facebook, Snapchat, TikTok and Instagram. These channels

generate hundreds of millions of monthly views, and the advertising

inventory from each channel is sold through online advertising

exchanges. Popular channels include The Hook, PGA Tour, US Open and

Link Up TV.

Chairman's Statement

The first half of 2023 has been dominated by the acquisition and

subsequent integration of SocialChain, a social media advertising

and influencer marketing agency, and our largest acquisition to

date. Brave Bison acquired SocialChain in February 2023 from a

distressed German corporate and the business has now been merged

into our existing social and influencer operations to form

SocialChain by Brave Bison.

SocialChain has an excellent market position and it is widely

viewed as one of the leading social media advertising and

influencer marketing agencies in the UK. This position stems from

strong brand recognition amongst social and brand marketers across

all industries. This recognition has three main drivers: firstly,

SocialChain's genesis (the business was founded by Dragon's Den

star Steven Bartlett), secondly, a very active marketing platform

underpinned by Social Minds, an award-winning podcast, and,

finally, an excellent roster of clients including global businesses

such as The Army, KFC and General Mills.

The Board believes that SocialChain, which was loss-making at

the time of acquisition, has the potential to become one of Brave

Bison's strongest brands. The business has been comprehensively

restructured, including property disposals, back office and systems

integration with Brave Bison and a reduction in headcount of 28%,

which is expected to result in an adjusted EBITDA SocialChain

profit for the current financial year.

Turnarounds always present challenges, but we are encouraged

with progress made to date. The integration of systems, operations

and ways of working with Brave Bison has happened quickly, and

resource is now being shared across the Company. Furthermore,

SocialChain by Brave Bison has been on an impressive new business

drive, winning in excess of GBP2m in annualised revenue, to be

delivered over this and the next financial year, from brands

including Holland & Barrett, The Army, Pinterest and Aer

Lingus. SocialChain's work for The Army will be supported by

additional work from our Brave Bison Performance business unit,

demonstrating clients' demand for a connected social and

performance marketing proposition and providing us with a strong

case study to win additional customers in this space.

Despite management focus on SocialChain in the period, the core

Brave Bison business has continued to perform in-line with our

expectations overall. Brave Bison Commerce has signed new

engagements with two large enterprise customers, Alliance

Automotive Group, a car parts distributer, and a retailer under

NDA. Fees are expected to exceed GBP1.3m in aggregate, on

programmes of work that will extend into the next financial year.

Some of this new revenue will be offset by customer losses as

budgets tighten, but we are comfortable that the proposition

remains strong and we will continue to win more market share. We

are particularly encouraged to see that Brave Bison Commerce won

Best B2B Project at the MACH Alliance Impact Awards, a prestigious

award for technology companies using composable development

architecture.

Similarly, Brave Bison Performance is trading in-line with our

expectations. Despite challenging end markets, our consumer-focused

customers such as New Balance and Curry's have continued to spend.

Focus has shifted into conversion-led products that have repeatable

and predictable outcomes for our customers, and performance

marketing has proven to be the most resilient budget. In Q1 we

launched a new Marketplaces proposition that allows our customers

to simultaneously offer their products across a network of

third-party websites (Amazon, eBay, TikTok, Target+, OnBuy, Google

Shopping etc.). This has the potential to add incremental sales

within a short period of time and take up to date has been

encouraging. We were pleased to announce two significant new

business wins during the period: Markel, a global insurance

company, and Manual, a men's wellness company. Both customers have

scope to expand both services and markets, and we look forward to

collaborating into 2024.

The Brave Bison Media Network has experienced some volatility,

particularly on Snapchat where revenues are lower year-on-year.

Competition between publishers on the platform has increased

substantially and consequently the views across some of our

channels are lower, compounding the effects of an already subdued

advertising market. However, our YouTube network performed well

over the period. Our sports franchise, focussed on tennis and golf,

has grown well, and customers representing approximately 65% of

FY22 net revenue have now renewed their contracts of 24 to 36

months terms.

Financial Review

H1 2023 saw Brave Bison record another period of steady results

whilst also completing a major acquisition and integration. The

Company recorded revenues of GBP16.9m (H1 2022: GBP14.7m), gross

profit / net revenue of GBP10.0m (H1 2022: GBP8.2m) and Adj. PBT of

GBP1.5m (H1 2022: GBP1.3m), an increase of 16%.

Adjusted EBITDA Margin (Adj. EBITDA as a proportion of gross

profit / net revenue) was 18.9% compared to 19.2% in H1 2022. This

reduction is a consequence of the acquisition of SocialChain which

was loss making at the point of acquisition, and should improve in

future periods as a result of the cost savings and efficiencies

already realised.

Net cash at the period end was GBP4.3m (H1 2022: GBP4.8m, H2

2022: GBP6.2m). Cash outflows during the period were primarily

related to the initial cash outflows on the acquisition of

SocialChain and the associated working capital requirements for the

business over the following few months. We anticipate being

significantly cash generative in H2 2023 now that the restructuring

and integration costs have been incurred, with 2023 year-end cash

expected to exceed GBP6m.

Acquisition costs of GBP0.8m (H1 2022: GBP0.0m) and

restructuring costs of GBP0.6m (H1 2022: GBP0.1m) were recorded

during the period. Acquisition costs relate to professional fees

associated with the acquisition of SocialChain and the simultaneous

fundraising. Due to investor demand, the size of the fundraising

was increased from an initial GBP3.0m to GBP4.8m, resulting in

higher fees than originally anticipated. Restructuring costs relate

primarily to notice periods of duplicated employees, severance

payments, legal costs, property costs and duplicated IT costs

associated with the integration of SocialChain into Brave

Bison.

As detailed in the 2022 annual report, there are ongoing costs

recognised which are related to the amortisation of acquired

intangible assets and the impairment of brand names. During the

period the purchase price allocation exercise relating to the Best

Response Media Ltd (BRM) acquisition was completed, and the amount

allocated to the BRM brand name (GBP26k) was impaired following the

successful integration of this into the Brave Bison Commerce.

Share based payments relate to the value of share awards that

have been granted to employees of the Brave Bison. GBP0.2m (H1

2022: GBP0.2m) of this amount relates to the directors' LTIP, which

can only be redeemed in accordance with the terms outlined in the

Directors' Remuneration section of the 2022 Annual Report. The

earliest possible redemption date is December 2024, and redemption

is contingent on, inter alia, the Brave Bison share price exceeding

3.0 pence.

An analysis of the Adjusted Profit Before Tax is shown

below:

GBP'000 H1 FY23 H1 FY22

-------- --------

Adj. Profit Before Tax 1,522 1,331

-------------------------------------- -------- --------

Adjusting Items:

Acquisition Costs 810 40

Restructuring Costs 626 62

Amortisation of Acquired Intangibles 114 17

Impairment of Brand Name 26 0

Share Based Payments 190 187

Profit Before Tax (244) 1,025

--------

On behalf of the Board

Oliver Green

Chairman

13 September 2023

BRAVE BISON GROUP PLC

CONDENSED CONSOLIDATED INCOME STATEMENT AND CONSOLIDATED

STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2023

(unaudited) (unaudited) (audited)

6 months 6 months Year to

to to 31

30 June 30 June December

Note 2023 2022 2022

GBP000's GBP000's GBP000's

Revenue 3 16,902 14,742 31,652

Cost of sales (6,877) (6,559) (14,704)

----------------- ------------- ---------

Gross profit 10,025 8,183 16,948

Administration expenses (10,234) (7,108) (15,486)

----------------- ------------- ---------

Operating (loss)/profit (209) 1,075 1,462

Finance income 70 1 80

Finance costs (105) (51) (86)

----------------- ------------- ---------

(Loss)/profit before tax (244) 1,025 1,456

Analysed as

Adjusted EBITDA 1,893 1,571 3,020

Finance costs (105) (51) (86)

Finance income 70 1 80

Depreciation (336) (190) (382)

----------------- ------------- ---------

Adjusted profit before tax 1,522 1,331 2,632

Restructuring costs (626) (62) (62)

Acquisition costs (810) (40) (56)

Impairment charge (26) - (456)

Amortisation of acquired intangibles (114) (17) (215)

Equity settled share based payments (190) (187) (387)

----------------- ------------- ---------

(Loss)/profit before tax (244) 1,025 1,456

-------------------------------------------- ---- ----------------- ------------- ---------

Income tax credit/(charge) 17 (3) 624

----------------- ------------- ---------

(Loss)/profit attributable to equity

holders of the parent (227) 1,022 2,080

================= ============= =========

Statement of Comprehensive Income

(Loss)/profit for the period/year (227) 1,022 2,080

Items that may be reclassified subsequently

to profit or loss

Exchange (loss)/gain on translation

of foreign subsidiaries (10) 12 25

----------------- ------------- ---------

Total comprehensive (loss)/profit

for the period/year attributable

to owners of the parent (237) 1,034 2,105

================= ============= =========

Profit per share (basic and diluted)

Basic (loss)/profit per ordinary

share (pence) 5 (0.02p) 0.09p 0.19p

Diluted (loss)/profit per ordinary

share (pence) 5 (0.02p) 0.09p 0.18p

BRAVE BISON GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 June 2023

(unaudited) (unaudited) (audited)

At At At 31

30 June 30 June December

Note 2023 2022 2022

GBP000's GBP000's GBP000's

Non-current assets

Intangible assets 6 12,592 6,489 6,270

Property, plant and equipment 7 815 519 372

Deferred tax asset 48 135 48

----------- ----------- ---------

13,455 7,143 6,690

Current assets

Trade and other receivables 7,032 6,495 7,426

Cash and cash equivalents 4,453 5,370 6,485

----------- ----------- ---------

11,485 11,865 13,911

Current liabilities

Trade and other payables (8,468) (9,056) (9,310)

Bank Loans <1 year 12 (14) (108) (109)

Lease Liabilities 9 (270) (657) (393)

----------- ----------- ---------

(8,752) (9,821) (9,812)

Non-current liabilities

Lease Liabilities 9 (31) (57) -

Deferred tax liability (411) - (283)

Bank loan >1 year 12 (144) (254) (199)

Provisions for liabilities (877) (125) (285)

----------- ----------- ---------

(1,463) (436) (767)

Net assets 14,725 8,751 10,022

=========== =========== =========

Equity

Share capital 8 1,287 1,081 1,081

Share premium 89,095 84,551 84,551

Capital redemption reserve 6,660 6,660 6,660

Merger reserve (24,060) (24,060) (24,060)

Merger relief reserve 62,624 62,624 62,624

Retained deficit (121,038) (122,259) (121,001)

Translation reserve 157 154 167

----------- ----------- ---------

Total equity 14,725 8,751 10,022

=========== =========== =========

BRAVE BISON GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 June 2023

(unaudited) (unaudited) (audited)

6 months 6 months Year to

to to 31

30 June 30 June December

2023 2022 2022

GBP000's GBP000's GBP000's

Operating activities

(Loss)/profit before tax (244) 1,025 1,456

Adjustments:

Depreciation, amortisation and impairment 476 41 1,053

Finance income (70) (1) (80)

Finance costs 105 51 86

Share based payment charges 190 187 387

Decrease/(increase) in trade and other

receivables 1,478 244 (553)

(Decrease)/increase in trade and other

payables (3,104) (794) (721)

Tax received 265 - 84

----------- --------------- ---------

Cash (outflow)/inflow from operating

activities (904) 753 1,712

Investing activities

Acquisition of subsidiaries (4,756) (1,063) (1,174)

Net cash acquired on acquisition (27) 190 840

Purchase of property, plant and equipment (23) (30) (81)

Interest received 70 1 80

----------- --------------- ---------

Cash outflow from investing activities (4,736) (902) (335)

Cash flows from financing activities

Issue of share capital 4,750 - -

Interest paid (105) (8) (86)

Repayment of borrowings (628) (56) (108)

Repayment of lease liability (399) (308) (629)

----------- --------------- ---------

Cash inflow/(outflow) from financing

activities 3,618 (372) (823)

Net change in cash and cash equivalents (2,022) (520) 554

=========== =============== =========

Movement in net cash

Cash and cash equivalents, beginning

of period 6,485 5,906 5,906

(Decrease)/increase in cash and cash

equivalents (2,022) (520) 554

Movement in foreign exchange (10) (16) 25

Cash and cash equivalents, end of period 4,453 5,370 6,485

=========== =============== =========

BRAVE BISON GROUP PLC

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2023

Capital Merger

Share Share redemption Merger relief Translation Retained Total

capital premium reserve reserve reserve reserve deficit equity

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

At 1 January 2022

(audited) 1,081 84,551 6,660 (24,060) 62,624 142 (123,468) 7,530

Shares issued during the - - - -

period - - - -

Equity settled share based

payments - - - - - - 187 187

--------- -------- ----------- --------- --------- ------------- --------- --------

Transactions with owners - - - - - - 187 187

--------- -------- ----------- --------- --------- ------------- --------- --------

Other Comprehensive Income

Profit and total

comprehensive

income for the period - - - - - 12 1,022 1,034

--------- -------- ----------- --------- --------- ------------- --------- --------

At 30 June 2022

(unaudited) 1,081 84,551 6,660 (24,060) 62,624 154 (122,259) 8,751

--------- -------- ----------- --------- --------- ------------- --------- --------

At 1 January 2022

(audited) 1,081 84,551 6,660 (24,060) 62,624 142 (123,468) 7,530

Shares issued during the - - - -

year - - - -

Equity settled share based

payments - - - - - - 387 387

--------- -------- ----------- --------- --------- ------------- --------- --------

Transactions with owners - - - - - - 387 387

--------- -------- ----------- --------- --------- ------------- --------- --------

Other Comprehensive Income

Profit and total

comprehensive

income for the period - - - - - 25 2,080 2,105

--------- -------- ----------- --------- --------- ------------- --------- --------

At 31 December 2022

(audited) 1,081 84,551 6,660 (24,060) 62,624 167 (121,001) 10,022

--------- -------- ----------- --------- --------- ------------- --------- --------

At 1 January 2023

(audited) 1,081 84,551 6,660 (24,060) 62,624 167 (121,001) 10,022

Shares issued during the

period 206 4,544 - - - - - 4,750

Equity settled share based

payments - - - - - - 190 190

--------- -------- ----------- --------- --------- ------------- --------- --------

Transactions with owners 206 4,544 - - - - 190 4,940

--------- -------- ----------- --------- --------- ------------- --------- --------

Other Comprehensive Income

Loss and total

comprehensive income

for the period - - - - - (10) (227) (237)

--------- -------- ----------- --------- --------- ------------- --------- --------

At 30 June 2023

(unaudited) 1,287 89,095 6,660 (24,060) 62,624 157 (121,038) 14,725

--------- -------- ----------- --------- --------- ------------- --------- --------

BRAVE BISON GROUP PLC

NOTES TO THE UNAUDITED INTERIM FINANCIAL STATEMENTS

For the six months ended 30 June 2023

1 General information

The information for the year ended 31 December 2022 does not

constitute statutory accounts as defined in section 435 of the

Companies Act 2006. A copy of the statutory accounts has been

delivered to the Registrar of Companies. The auditors reported on

those accounts: their report was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under section 498 (2) or (3) of the Companies Act 2006.

The interim financial statements have not been audited or reviewed

by the Group's auditor.

2 Accounting policies

Basis of preparation

The annual financial statements of Brave Bison Group plc are

prepared in accordance with IFRS as adopted by the European Union.

The condensed set of financial statements included in this half

yearly report has been prepared in accordance with International

Accounting Standard 34 "Interim Financial Reporting", as adopted by

the European Union.

The interim statement has been prepared on a going concern

basis, which assumes that the Group will be able to meet its

liabilities for the foreseeable future. The Group is dependent for

its working capital requirements on cash generated from operations,

cash holdings and from equity markets. The cash holdings of the

Group at 30 June 2023 were GBP4.5 million.

The Directors have prepared detailed cash flow projections ("the

Projections") which are based on their current expectations of

trading prospects. The board forecasts that the Group will achieve

positive cash inflows in the second half of 2023 and 2024.

Accordingly, the Directors have concluded that it is appropriate to

continue to adopt the going concern basis in preparing these

financial statements. The Directors are confident that the Group's

forecasts are achievable, and are committed to taking any actions

available to them to ensure that any shortfall in forecast revenues

is mitigated by cost savings.

The Directors also continue to maintain rolling forecasts which

are regularly updated.

Significant accounting policies

The accounting policies applied by the Group in this condensed

set of consolidated financial statements are the same as those

applied by the Group in its consolidated financial statements as at

and for the year ended 31 December 2022.

Other pronouncements

Other accounting pronouncements which have become effective from

1 January 2023 and therefore have been adopted do not have a

significant impact on the Group's financial results or

position.

3 Segment reporting

The Group has identified three geographic areas (United Kingdom

& Europe, Asia Pacific and Rest of the world) and the

information is presented based on the customers' location.

Geographic reporting

The information is presented based on the customers'

location.

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

GBP000's GBP000's GBP000's

United Kingdom & Europe 14,844 12,857 28,493

Asia Pacific 212 122 311

Rest of the World 1,846 1,763 2,848

----------- ----------- ----------

Total Revenue 16,902 14,742 31,652

=========== =========== ==========

The Group identifies two revenue streams, advertising and fee

based services, which correspond to the Media Network and Digital

Advertising and Technology Services pillars respectively. The

analysis of revenue by each stream is detailed below.

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

Revenue GBP000's GBP000's GBP000's

Advertising 5,015 5,919 11,905

Fee based services 11,887 8,823 19,747

Total revenue 16,902 14,742 31,652

============== =========== ==========

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

Gross profit GBP000's GBP000's GBP000's

Advertising 1,313 1,436 2,945

Fee based services 8,712 6,747 14,003

Total gross profit 10,025 8,183 16,948

============== =========== ==========

Timing of revenue recognition

The following table includes revenue from contracts

disaggregated by the timing of recognition.

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

GBP000's GBP000's GBP000's

Products and services transferred

at a point in time 5,025 5,959 11,968

Products and services transferred

over time 11,877 8,883 19,684

Total revenue 16,902 14,742 31,652

=========== =========== ==========

4 Restructuring

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

GBP000's GBP000's GBP000's

Restructuring costs 626 62 62

=============== =========== ==========

Restructuring costs in 2022 relate to corporate reorganisation

activities as a result of the acquisition of Greenlight and costs

associated with setup up a Bulgarian subsidiary and transferring

employees into this entity. Restructuring costs in 2023 relate to

corporate reorganisation activities as a result of the acquisition

of SocialChain.

5 Earnings per share

Both the basic and diluted earnings per share have been

calculated using the profit after tax attributable to shareholders

of Brave Bison Group plc as the numerator, i.e. no adjustments to

profits were necessary in 2022 or 2023. The calculation of the

basic earnings per share is based on the profit attributable to

ordinary shareholders divided by the weighted average number of

shares in issue during the year.

(audited)

(unaudited) (unaudited) 12 months

ended 31

6 months ended 6 months ended December

June 2023 June 2022 2022

Weighted average number

of ordinary shares 1,249,684,604 1,080,816,000 1,080,816,000

Dilution due to share options 73,926,266 62,376,266 62,176,266

Total weighted average number

of ordinary shares 1,323,610,870 1,143,192,266 1,142,992,266

Basic (loss)/profit per

ordinary share (pence) (0.02p) 0.09p 0.19p

============== ============== =============

Diluted (loss)/profit per

ordinary share (pence) (0.02p) 0.09p 0.18p

============== ============== =============

Adjusted basic profit per

ordinary share (pence) 0.12p 0.12p 0.24p

============== ============== =============

Adjusted diluted profit

per ordinary share (pence) 0.11p 0.12p 0.23p

============== ============== =============

(audited)

(unaudited) (unaudited) 12 months

ended 31

6 months ended 6 months ended December

June 2023 June 2022 2022

GBP000's GBP000's GBP000's

(Loss)/profit for the year

attributable to ordinary

shareholders (227) 1,022 2,080

Equity settled share based

payments 190 187 387

Restructuring costs 626 62 62

Acquisition costs 810 40 56

Impairment charge 26 - 456

Amortisation of acquired

intangibles 114 17 215

Tax (credit)/charge (17) 3 (624)

Adjusted operating profit

for the period attributable

to the equity shareholders 1,522 1,331 2,632

============== ============== =============

6 Intangible Assets

Online Channel Customer

Goodwill Content Technology Brands Relation-ships Total

GBP000's GBP000's GBP000's GBP000's GBP000's GBP000's

Cost

At 30 June 2022 41,469 2,034 5,213 273 19,332 68,321

Reallocation of

Goodwill (1,379) - - 456 1,360 437

-------- -------------- ---------- -------- --------------- --------

At 31 December

2022 40,090 2,034 5,213 729 20,692 68,758

-------- -------------- ---------- -------- --------------- --------

Additions 6,433 - - - - 6,433

Reallocation of

Goodwill (124) - - 26 127 29

-------- -------------- ---------- -------- --------------- --------

At 30 June 2023 46,399 2,034 5,213 755 20,819 75,220

-------- -------------- ---------- -------- --------------- --------

Amortisation and impairment

At 30 June 2022 35,075 1,941 5,213 273 19,332 61,834

Charge for the

period - 17 - - 181 198

Impairment charge - - - 456 - 456

At 31 December

2022 35,075 1,958 5,213 729 19,513 62,488

-------- -------------- ---------- -------- --------------- --------

Charge for the

period - 17 - - 97 114

Impairment charge - - - 26 - 26

-------- -------------- ---------- -------- --------------- --------

At 30 June 2023 35,075 1,975 5,213 755 19,610 62,628

-------- -------------- ---------- -------- --------------- --------

Net Book Value

At 30 June 2022 6,394 93 - - - 6,487

======== ============== ========== ======== =============== ========

At 31 December

2022 5,015 76 - - 1,179 6,270

======== ============== ========== ======== =============== ========

At 30 June 2023 11,324 59 - - 1,209 12,592

======== ============== ========== ======== =============== ========

7 Property, plant and equipment

Leasehold Fixtures

Right of Improvement Computer &

Use asset Equipment Fittings Total

GBP000's GBP000's GBP000's GBP000's GBP000's

Cost

At 30 June 2022 1,754 11 106 - 1,871

Additions - - 16 27 43

Acquisition of subsidiary - - 1 - 1

At 31 December 2022 1,754 11 123 27 1,915

Additions - - 23 - 23

Disposals (1,035) - (6) - (1,041)

Acquisition of subsidiary 313 268 175 - 756

---------- ------------ ---------- --------- --------

At 30 June 2023 1,032 279 315 27 1,653

---------- ------------ ---------- --------- --------

Depreciation and

impairment

At 30 June 2022 1,311 5 36 - 1,352

Charge for the period 167 3 19 2 191

Impairment charge - - - - -

At 31 December 2022 1,478 8 55 2 1,543

Charge for the period 254 25 53 4 336

Disposals (1,035) - (6) - (1,041)

At 30 June 2023 697 33 102 6 838

Net Book Value

At 30 June 2022 443 6 70 - 519

========== ============ ========== ========= ========

At 31 December 2022 276 3 68 25 372

========== ============ ========== ========= ========

At 30 June 2023 335 246 213 21 815

========== ============ ========== ========= ========

Included in the net carrying amount of property, plant and

equipment are right-of-use assets as follows:

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

GBP000's GBP000's GBP000's

Right-of-use-asset 335 443 276

----------- ----------- ----------

Total right-of-use asset 335 443 276

=========== =========== ==========

8 Share capital

Ordinary share capital At 30 June 2023

Number GBP000's

Ordinary shares of GBP0.001 1,287,337,739 1,287

Total ordinary share capital of the

Company 1,287

========

Rights attributable to ordinary shares

The holders of ordinary shares are entitled to receive notice of

and attend and vote at any general meeting of the Company.

9 Leases

Lease liabilities are presented in the statement of financial

position as follows:

(unaudited) (unaudited) (audited)

At At At 31

30 June 30 June December

2023 2022 2022

GBP000's GBP000's GBP000's

Current 270 657 393

Non-current 31 57 -

----------- ----------- ---------

301 714 393

=========== =========== =========

The Group acquired four office leases with the acquisition of

SocialChain which expire in June 2024. With the exception of

short-term leases and leases of low-value underlying assets, each

lease is reflected on the balance sheet as a right-of-use asset and

a corresponding lease liability.

The table below describes the nature of the Group's leasing

activities by type of right-of-use asset recognised on the

statement of financial position:

No. of right-of-use Range of remaining Average remaining No. of leases No. of leases

assets leased term lease term with extension with termination

options options

Office building 6 0.5 - 1 year 0.75 years - -

The lease liabilities are secured by the related underlying

assets. Future minimum lease payments at 30 June 2023 were as

follows:

Within one One to two Total

year years

GBP000's GBP000's GBP000's

Lease payments 301 - 301

Finance charges (11) - (11)

---------- ---------- --------

Net present values 290 - 290

========== ========== ========

The Group does not have any liabilities for short term

leases.

At 30 June 2023 the Group had not committed to any leases which

had not yet commenced excluding those recognised as a lease

liability.

10 Financial Instruments

(unaudited) (unaudited) (audited)

Categories of financial instruments As at 30 As at 30 As at 31

June June December

2023 2022 2022

GBP000's GBP000's GBP000's

Financial assets at amortised

cost

Trade and other receivables 6,291 6,154 6,167

Cash and bank balances 4,453 5,370 6,485

----------- ----------- ---------

10,744 11,524 12,652

=========== =========== =========

Financial liabilities at amortised

cost

Trade and other payables 7,184 7,862 8,067

Lease liabilities 301 714 393

----------- ----------- ---------

7,485 8,576 8,460

=========== =========== =========

Brave Bison categorises all financial assets and liabilities as

level 1 for fair value purposes which means they are valued using

quoted prices (unadjusted) in active markets for identical assets

or liabilities.

11 Contingent liabilities

There were no contingent liabilities at 30 June 2023 (30 June

2022 and 31 December 2022: None).

12 Bank Loans

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

GBP000's GBP000's GBP000's

Loan <1 year 14 108 109

Loan >1 year 144 254 199

----------- ----------- ----------

158 362 308

=========== =========== ==========

The Group has a Bounce Back Loan Agreement which is due to be

fully repaid in 2026. The repayment amount and timing of each

instalment is based on a fixed interest rate of 2.5% payable on the

outstanding principal amount of the loan and applicable until the

final repayment date. This loan is unsecured. The Group had a

Coronavirus Business Interruption Loan ("CBIL") which was acquired

as part of the Greenlight acquisition which was due to be fully

repaid in 2026. The repayment amount and timing of each instalment

was based on a fixed interest rate of 4.35% per annum payable on

the outstanding principal amount of the loan and applicable until

the final repayment date. During the period, the Group repaid the

CBIL in full. The Group continues to have a GBP3m revolving credit

facility (RCF) with Barclays Bank plc. The RCF is a 3 year facility

with an interest margin of 2.75% over Base Rate. The RCF was

partially drawn (GBP1.5 million) at the time of the SocialChain

acquisition but was repaid in full before the end of the period.

The Group also has a U.S. Small Business Administration loan which

was acquired as part of the SocialChain acquisition which is due to

be fully repaid in 2050. The repayment amount and timing of each

instalment was based on a fixed interest rate of 3.75% per annum

payable on the outstanding principal amount of the loan and

applicable until the final repayment date.

13 Transactions with Directors and other related parties

Transactions with associates during the year were:

(audited)

(unaudited) (unaudited) 12 months

6 months 6 months ended 31

ended ended December

June 2023 June 2022 2022

GBP000's GBP000's GBP000's

Amounts charged to Tangent Marketing

Services Limited by Brave Bison

Recharge for HR related salary 16 20 36

Recharge for IT related salary 15 15 33

Recharge for support staff salary 8 4 13

Charge for property related costs 41 55 107

Recharge for IT related costs 5 - -

Charge for client related work 7 20 43

Recharge of other staff costs 7 - 8

------------ ----------- ----------

99 114 240

------------ ----------- ----------

Amounts charged to Brave Bison

by Tangent Marketing Services

Limited

Recharge for IT related salary - - 3

Charge for client related work 67 - 9

------------ ----------- ----------

67 - 12

------------ ----------- ----------

Amounts charged to The Printed

Group Limited by Brave Bison

Charge for client related work 35 - -

Recharge for property related

costs 26 - 50

------------ ----------- ----------

61 - 50

------------ ----------- ----------

(unaudited) (unaudited) (audited)

6 months 6 months

to to Year to 31

30 June December

30 June 2023 2022 2022

GBP000's GBP000's GBP000's

Amounts owed to Tangent Marketing

Services Limited - - 17

Amounts owed by Tangent Marketing

Services Limited 18 24 68

Amounts owed by The Printed Group

Limited 22 - 20

Tangent Marketing Services Limited is a related party by virtue

of its directors and shareholders, which include Oliver Green and

Theodore Green. The Printed Group Limited is a related party by

virtue of its directors and shareholders which include Oliver Green

and Theodore Green. Oliver Green and Theodore Green are both

directors of and shareholders in Brave Bison.

All of the above transactions were conducted at arms length, and

in accordance with the Group's related party policy which requires

approval by the Independent Directors.

There are no related party transactions with any family members

of the Directors.

14 Acquisitions

On 3 February 2023, the Company acquired the entire issued share

capital of Social Chain Limited. This was partially funded by way

of an oversubscribed vendor placing to raise GBP4.75 million.

SocialChain is one of the UK's leading social media and

influencer marketing agencies. It was founded in 2014 by Dragon's

Den entrepreneur Steven Bartlett and works with global brands such

as Amazon, TikTok, KFC and Apple Beats to create social media

advertising campaigns and perform influencer marketing services.

SocialChain has offices in Manchester, New York and London.

The provisional fair value of the assets acquired and

liabilities assumed were as follows:

Fair value

Book value adjustments Fair value

GBP000's GBP000's GBP000's

Goodwill 6,432 - 6,432

Tangible Assets 756 - 756

Trade and other receivables 1,349 - 1,349

Cash and cash equivalents (27) - (27)

Current Liabilities (3,161) - (3,161)

Non-current liabilities (479) - (479)

Deferred tax (115) - (115)

---------- ------------ ----------

4,756 - 4,756

========== ============ ==========

The consideration for the acquisition is as follows:

GBP000's

Initial cash consideration 4,767

Completion accounts adjustment (11)

--------

4,756

========

The condensed consolidated Statement of Comprehensive Income

includes GBP0.8 million of acquisition costs.

The fair value of the financial assets includes trade and other

receivables with a fair value of GBP1.5 million and a gross

contractual value of GBP1.5 million. The best estimate at

acquisition date of the contractual cash flows not to be collected

is GBP0.0 million. The goodwill represents the acquired accumulated

workforce and the synergies expected from integrating SocialChain

into the Group's existing business. The Group has carried out an

interim fair value adjustment exercise and will be completing a

full exercise within the one year measurement period from the date

of the acquisition in accordance with IFRS3, and alongside the

completion of the integration. At the interim valuation stage the

Group has not been able to reliably estimate the fair value of

acquired intangibles and therefore the excess of consideration over

fair value of other identifiable assets and liabilities has been

allocated to goodwill. Once the full valuation exercise has been

completed additional intangible assets may be recognised separately

from goodwill.

Social Chain Limited contributed GBP3.6 million revenue and

added a GBP0.1 million loss to the Group's loss for the period

between the date of acquisition and the reporting date.

During the period, the Group carried out a full fair value

adjustment exercise in relation to the acquisition of Best Response

Media Limited on 28(th) April 2022. As a result intangible assets

have been identified in relation to the Best Response trade name

and the customer relationships, and amounts allocated to goodwill

at the interim valuation have been reallocated to these intangible

assets.

The revised fair value of the assets acquired and liabilities

assumed was as follows:

Fair value

Interim valuation adjustments Fair value

GBP000's GBP000's GBP000's

Goodwill 239 (124) 115

Brands - 26 26

Customer relationships - 127 127

Tangible Assets 1 - 1

Trade and other receivables 237 - 237

Cash and cash equivalents 840 - 840

Current Liabilities (143) - (143)

Deferred Tax - (29) (29)

- -

----------------- ------------ ----------

1,174 - 1,174

================= ============ ==========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EXLBFXKLFBBX

(END) Dow Jones Newswires

September 13, 2023 02:00 ET (06:00 GMT)

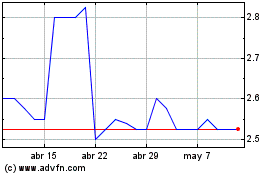

Brave Bison (LSE:BBSN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Brave Bison (LSE:BBSN)

Gráfica de Acción Histórica

De May 2023 a May 2024