TIDMCBOX

RNS Number : 2987T

Cake Box Holdings PLC

14 November 2023

Cake Box Holdings plc

("Cake Box", "the Company" or "the Group")

Unaudited Half Year Results for the six months ended 30

September 2023

Increase in revenues, profits, dividends and cash

Confident outlook, supported by investments in future growth

platforms

Cake Box Holdings plc, the specialist retailer of fresh cream

cakes, today announces its half-year results for the six months

ended 30 September 2023.

Sukh Chamdal, Chief Executive Officer, commented

"We have performed well in the first half of the year,

generating strong growth across key financial metrics and making

further progress on our strategy. We achieved double digit

increases in profits, cash and dividends, as raw material and input

costs stabilised, and we started to benefit from the recent

investments we have made in the business to drive growth.

As outlined in our recent Capital Markets Event, our new website

has increased online sales and improved customer experience and

loyalty, while brand awareness continues to increase as a result of

the success of our marketing campaigns (including national radio)

and multi-channel expansion.

Our franchise proposition remains attractive with nine new

franchise stores opening over the period and a strong pipeline of

future openings. We continue to engage with property consultants to

identify target growth areas, which will help us reach our

400-store target over the medium term. We are also excited to

launch our new Cake Box identity in the second half of the year,

which will broaden the appeal of our brand to new customers and

demographics, amplifying the opportunity for new store

openings.

While we are mindful of the ongoing macro-economic uncertainty,

customer demand remains robust, demonstrating Cake Box's enduring

appeal. We enter the second half with momentum and are on track to

deliver full year performance in line with market expectations. The

Board remains confident in the Company's long-term prospects,

underpinned by our ambitious growth strategy, the attractiveness of

the brand and focused investment programme."

Financial Highlights

Half year Change*

ended Half year %

30 September ended

2023 30 September 2022

Revenue GBP18.0m GBP16.8m 6.8%

-------------- ------------------- --------

Gross profit GBP8.9m GBP8.0m 11.0%

-------------- ------------------- --------

EBITDA** GBP3.1m GBP2.8m 10.4%

-------------- ------------------- --------

Pre-tax profit GBP2.4m GBP2.0m 18.0%

-------------- ------------------- --------

Net cash GBP5.9m GBP4.2m 41.8%

-------------- ------------------- --------

Cash at Bank GBP7.1m GBP5.5m 30.6%

-------------- ------------------- --------

Earnings per share 4.45p 3.72p 19.6%

-------------- ------------------- --------

Interim dividend 2.90p 2.625p 10.5%

-------------- ------------------- --------

*Change % is calculated on the figures included in consolidated

statement of comprehensive income and consolidated statement of

financial position

**EBITDA is calculated as operating profit before depreciation

and amortisation

-- Group revenues up 6.8% to GBP18.0m (H1 FY23: GBP16.8m).

o Driven by increased volumes from 20 stores opened in the prior

year and 9 new stores opened in the six months to 30(th) September

2023

-- The trading momentum for franchise store sales improved from

the second half of the prior year, with like-for-like sales growth

of 6.2% for the six months ended 30 September 2023.

-- Gross margins increased to 49.6% (H1 FY23:47.7%) due to the

partial easing of input cost increases and enhanced yield benefits

achieved in the distribution centres.

-- Continued balance sheet strength with net cash increasing to GBP5.9m (H1 FY23: GBP4.2m).

-- Interim dividend up 10.5% to 2.9p per share reflecting the

Group's progressive dividend policy and continued strong cash

generation.

Operational highlights

-- Franchise stores in operation increased to 214 as at 30

September 2023 (30 September 2022: 196).

-- Nine new franchise stores added in the period (H1 FY23: 11

new franchise stores), entering new geographies such as Liverpool,

Cambridge and Cheadle.

-- Successful investments in growth platform, including:

o New website launched in June 2023

o Launch of our new CRM system in May 2023

o GBP2m co-funded annual marketing fund agreed with our

franchisees, to drive sales growth, raise brand awareness, broaden

the customer base and evolve the brand

-- Continued innovation for growth through new product development.

o Summer launch of new premium Mango range proved very

popular

-- Effectively managing cost pressures, particularly through established supplier relationships.

Franchise store highlights

-- Franchise store sales up 12.9% to GBP36.1m (H1 FY23 GBP31.8m).

-- Franchise total sales including kiosks up 10.7% to GBP38.5m (H1 FY23 GBP34.8m).

-- Franchisee online sales increased 15.1% to GBP7.7m (H1 FY23: GBP6.7m).

-- Number of multi-site franchisees increased to 46 (H1 FY23: 43).

Current trading and outlook

-- Trading has continued positively post the half year, with

total franchise sales 5.1% ahead in October 2023 compared with the

same period in the prior year and online sales increasing 12.8%

versus last year.

-- On track to deliver a full year performance in line with market expectations.

*Like-for-like: Stores trading for at least one full financial

year prior to 30 September 2023

Webcast recording

A recording of the results presentation webcast will be

available via the following link: https://brrmedia.news/CBOXHYR

For further information, please contact:

Cake Box Holdings plc Enquires via MHP

Sukh Chamdal, CEO

Michael Botha, CFO

Shore Capital (Broker and NOMAD) +44 (0) 20 7408 4090

Stephane Auton

Patrick Castle

Rachel Goldstein

Fiona Conroy (Corporate Broking)

Liberum (Joint Broker) +44 (0) 20 3100 2000

Edward Thomas

Dru Danford

MHP Communications (Financial PR) +44 (0) 7834 623818

Charlie Barker cakebox@mhpc.com

Robert Collett-Creedy

Hugo Harris

Operational and Financial Review

Strong first half performance

Our trading momentum continued through the first half of the

year, with revenue growth of 6.8% and an increase in total

franchise store sales of 12.9%, reflecting the strength of our

proposition and continued robust customer demand. Franchise store

like-for-like sales were up 6.2% (H1 FY23: down 1.6%) for the first

half of the new financial year, compared to 3.4% H2 FY23.

In June 2023, we launched our new website and at the same time

invested in expanding our marketing team, which has helped to

increase our online sales by 15.1% year on year. Our new website is

delivering a consistent increase in online sales month on month.

Our new site improves our position by giving our customers a better

user experience and in doing so, increases conversion rate and

customer loyalty. The site is data driven and automated to deliver

bespoke marketing campaigns to increase customer lifetime

value.

New product development once again played a vital role in our

strong trading performance, with the launch of our new premium

Mango range, proving very popular amongst our customers. The

release of new premium ranges continues to support our franchisee's

ability to grow their margins through pricing.

Strategic progress with franchisee funding and marketing

initiatives

During the period, we created a GBP2m co-funded annual marketing

fund with our franchisees to drive brand awareness, broaden the

customer base and evolve the brand. The fund will be utilised with

the aim of creating the leading multi-channel cake business in the

UK. A large proportion of the fund is being allocated for digital

and social media marketing, and we are making good progress as we

build on Cake Box's already strong 40% brand awareness. Both our

national radio advertising campaigns, which went live in September

2023, and our outdoor advertising have been favourably received by

our customers, driving increased demand.

Customer data is becoming central to our marketing strategy, and

we have experienced strong growth since launching our new CRM

system in May 2023. Our marketing database grew by 50%, from 200k

to 300k in the five months to 30 September 2023, while our new SMS

subscriptions went from zero to 80k in the same period. We expect

our database to significantly increase as the investments we have

made continue to deliver greater awareness and appeal.

Continued expansion in the franchise store estate

The confidence of our franchisees in our proposition continues

with the opening of a further nine franchise stores during the

period, despite the sharp rise in UK base interest rates. As a

result, the total number of stores at 30 September 2023 rose to 214

(H1 FY23: 196).

New locations added in the period include Liverpool, Cambridge

and Cheadle, where we have identified compelling growth

opportunities and anticipate strong customer demand.

We now have 95 franchisees with 46 of them owning more than one

store, with these multi store franchisees operating a total of 165

sites out of the total 214 stores. We continue to identify growth

franchisees who are performing well and are ambitious, harnessing

their entrepreneurial skills and supporting them in taking on

additional sites.

Demand for new stores remains high, with 44 deposits held at the

end of the period. Of these 44 deposits, 20 are from existing

franchisees. As outlined at our recent Capital Markets Event, we

continue to engage with our property consultants and franchisees as

we identify new attractive target geographies to enhance

growth.

Gross margin improvement

During the half-year, we saw a reduction and stabilisation of

certain input costs, most noticeably in fuel and utility prices,

which will benefit both franchisees and our Group profitability.

This, coupled with the actions we have taken to improve efficiency

in the business, supported a rise in our gross margin to 49.6% and

an 18.0% increase in profit before tax.

Although our pricing strategy remains continually under review,

we have been mindful to not increase pricing to our franchisees and

likewise to their customers and maintain the value proposition,

during the current period of heightened cost-of-living

challenges.

Invested for growth opportunities

Since our IPO we have invested GBP7.7m, primarily on expanding

and enhancing our production, warehousing and distribution

capabilities. During that time, we have also focused on enhancing

our IT and e-commerce to capitalise on our significant growth

opportunities.

In addition, we have strengthened our management team, as well

as bolstering the teams within the business, who will all be

integral in delivering our strategy. These changes implemented

across the 2023 financial year and the first half of the current

year, have resulted in a planned increase in administration costs

in the period to GBP6.4m (H1 FY23: GBP5.9m).

Balance Sheet and cashflow

The Group's balance sheet remains strong, underpinned by the

highly cash generative nature of our business model. Cash at period

end was GBP7.1m, up 30.6% from the same point last year, which is

post paying a final dividend of GBP2.2m in August 2023. The Group's

net cash position increased, by 41.8% to GBP5.9m (H1 FY23:

GBP4.2m).

Dividends

In line with our progressive dividend policy which reflects our

cash generation, earnings progression and confidence in our

outlook, today we are declaring an interim dividend of 2.9 pence

per share representing an increase of 10.5% from last year. The

interim dividend will be paid on 15 December 2023 to those

shareholders on the register at the close of business on 24

November 2023. The ex-dividend date is therefore 23 November

2023.

Board update

On 30 October 2023, the Board was delighted to announce the

appointment of independent Non-Executive Director, Martin Blair as

Non-Executive Chairman of the Company. He replaced Nilesh ("Neil")

Sachdev who, after more than five years in the role, stepped down

from the Board on 31 October 2023 to concentrate on his growing

commitments outside of Cake Box.

Martin has a deep knowledge of Cake Box and its strategy, having

sat on the Board as an Independent Non-Executive Director and chair

of the Audit Committee, since the Company was admitted to trading

on the AIM market of the London Stock Exchange in June 2018.

As announced at the same time, another of the Company's

independent Non-Executive Directors, Adam Batty, was appointed to

the role of Senior Independent Director. The Board has initiated a

process to recruit a new independent Non-Executive Director to

chair the Audit Committee. A further announcement will be made in

this regard in due course. Until such time, Martin will continue to

chair the Audit Committee.

Outlook

The investments made in our business continue to make a positive

impact, with our marketing campaigns and improvements in digital,

increasing brand awareness and driving online sales growth. This

has supported ongoing trading momentum into H2 2024, with total

franchise sales 5.1% ahead in October 2023.

Our engagement with property consultants and franchisees to

identify target growth areas for new openings is progressing well

and we are confident of reaching our medium-term store estate

targets.

Cake Box's proposition continues to evolve, with an exciting

range of new products in development and the launch of our new

brand identity set for the second half, which will broaden the

appeal of the Cake Box brand.

Whilst we remain mindful of the ongoing macro-economic

challenges, consumer demand remains robust, and the Group's is on

track to deliver a full year performance in line with market

expectations. The Board remains confident in Cake Box's long term

growth potential, underpinned by its attractive customer and

franchisee proposition, strong balance sheet and ongoing investment

in the business.

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE

SIX MONTHSED 30 SEPTEMBER 2023

-------------------------------------------------------------------------------------------

6 months to 6 months to 12 months to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

----- --------------- --------------- --------------

Note GBP GBP GBP

----- --------------- --------------- --------------

Revenue 2 17,960,580 16,822,209 34,800,941

Cost of Sales (9,047,974) (8,791,924) (17,626,671)

--------------- --------------- --------------

Gross profit 8,912,606 8,030,285 17,174,270

Administrative Expenses (6,454,032) (5,933,111) (11,595,228)

--------------- --------------- --------------

Operating Profit 2,458,574 2,097,174 5,579,042

Finance income 44,130 6,711 25,019

Finance expenses (107,593) (73,839) (160,494)

--------------- --------------- --------------

Profit before income tax 2,395,111 2,030,046 5,443,567

Income tax expense (615,344) (541,563) (1,206,896)

PROFIT AFTER INCOME TAX 1,779,767 1,488,483 4,236,671

OTHER COMPREHENSIVE INCOME

FOR THE PERIOD

Items that will not subsequently

be classified to profit or

loss

- Revaluation of freehold

property - - 187,665

-Deferred tax on revaluation

of freehold property - - (35,656)

Total other comprehensive

income for the period - - 152,009

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD 1,779,767 1,488,483 4,388,680

EARNINGS PER SHARE - pence

Basic 5 4.45 3.72 10.59

Diluted 5 4.45 3.72 10.59

----- --------------- --------------- --------------

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT

30 SEPTEMBER 2023

6 months 6 months 12 months

to to to

30 September 30 September 31 March

2022 -

2023 as restated 2023

(unaudited) (unaudited) (audited)

Note GBP GBP GBP

----- -------------------- -------------------- ------------------

ASSETS

Non-current assets

Intangible assets 480,924 107,273 399,186

Property, plant and equipment 11,095,006 10,973,813 11,267,783

Right-of-use assets 2,424,520 2,724,460 2,574,490

Other financial assets 562,931 595,314 508,532

14,563,381 14,400,860 14,749,991

Current Assets

Inventories 2,426,905 2,577,643 2,790,724

Trade and other receivables 2,188,484 2,962,332 2,683,621

Other financial assets 364,412 252,488 245,880

Cash and cash equivalents 7,135,660 5,464,364 7,353,583

12,115,461 11,256,827 13,073,808

TOTAL ASSETS 26,678,842 25,657,687 27,823,799

-------------------- -------------------- ------------------

EQUITY AND LIABILITIES

EQUITY

Issued share capital 4 400,000 400,000 400,000

Capital redemption reserve 40 40 40

Revaluation reserve 3,786,743 3,616,383 3,786,743

Retained earnings 13,132,338 12,209,822 13,552,572

EQUITY attributable to the owners

of the parent company 17,319,121 16,226,245 17,739,355

Current liabilities

Trade and other payables 3,116,420 2,996,742 3,766,413

Lease liabilities 275,224 213,963 270,117

Short-term borrowings 96,295 167,754 104,498

Current tax payable 401,736 749,834 294,262

Provisions 243,100 243,100 243,100

-------------------- -------------------- ------------------

4,132,775 4,371,393 4,678,390

-------------------- -------------------- ------------------

Non-current liabilities

Lease liabilities 2,290,940 2,617,568 2,429,838

Borrowings 1,092,082 1,101,223 1,132,292

Deferred tax liabilities 1,843,924 1,341,258 1,843,924

-------------------- -------------------- ------------------

5,226,946 5,060,049 5,406,054

-------------------- -------------------- ------------------

TOTAL LIABILITIES 9,359,721 9,431,442 10,084,444

-------------------- -------------------- ------------------

TOTAL EQUITY & LIABILITIES 26,678,842 25,657,687 27,823,799

-------------------- -------------------- ------------------

CAKE BOX

HOLDINGS PLC

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE SIX MONTHSED

30 SEPTEMBER 2023

Capital As restated

Share redemption Revaluation - Retained

capital reserve reserve earnings Total

GBP GBP GBP GBP GBP

---------------

At 1 April

2022 400,000 40 3,634,734 12,475,030 16,509,804

Adjustment to

asset lives* - - - 330,812 330,812

Deferred tax

on adjustment

to

asset lives - - - (62,854) (62,854)

At 1 April

2022 - as

restated 400,000 40 3,634,734 12,742,988 16,777,762

Total

comprehensive

income for

the period - - - 1,488,483 1,488,483

Transfer of

excess

depreciation

on revalued

assets - - (18,351) 18,351 -

Dividends paid - - - (2,040,000) (2,040,000)

At 30

September

2022 400,000 40 3,616,383 12,209,822 16,226,245

Total

comprehensive

income - - - 2,748,188 2,748,188

Revaluation of

freehold

property - - 187,665 - 187,665

Deferred tax

on

revaluation

of

freehold

property - - (35,656) - (35,656)

Tax rate

changes - - - (337,088) (337,088)

Transfer of

excess

depreciation

on revalued

assets - - 18,351 (18,351) -

Dividends paid - - - (1,050,000) (1,050,000)

At 31 March

2023 400,000 40 3,786,743 13,552,571 17,739,354

Total

comprehensive

income - - - 1,779,767 1,779,767

Dividends paid - - - (2,200,000) (2,200,000)

At 30

September

2023 400,000 40 3,786,743 13,132,338 17,319,121

---------------

* During the prior financial year, the Directors reviewed the fixed assets

category and made adjustments to change the asset lives of various assets

and determined that some assets were still being used by the business

despite being almost fully depreciated.

--------------------------------------------------------------------------------------------------------------------------- --------------------------

CAKE BOX HOLDINGS PLC

UNAUDITED CONSOLIDATED CASH FLOW STATEMENT FOR THE SIX MONTHSED 30 SEPTEMBER 2023

6 months 6 months 12 months

to to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP GBP GBP

--------------- ------------

Cash flows from operating activities

Profit before income tax 2,395,111 2,030,046 5,443,567

Adjusted for:

Depreciation 421,366 520,309 777,571

Depreciation of right-of-use assets 149,970 149,970 299,940

Amortisation of intangible assets 53,504 26,035 54,110

Profit on disposal of tangible fixed

assets - (34,204) (50,733)

Decrease/(Increase) in inventories 363,819 (108,722) (321,803)

Decrease/(Increase) in trade and other

receivables 495,137 (409,123) (360,950)

(Increase)/decrease in other financial

assets (172,932) 219,804 263,307

(Decrease)/Increase in trade and other

payables (649,993) 335,371 1,105,042

Increase in provision - - 280,425

Share based payment provision - - -

Finance income (44,130) (6,711) (25,019)

Finance expense 151,723 73,839 160,494

--------------- ------------

Cash generated from operations 3,163,575 2,796,614 7,625,951

Taxation paid (507,876) (350,100) (1,341,087)

--------------- ------------

Net cash inflow from operating activities 2,655,699 2,446,514 6,284,864

Cash flows from investing activities

Proceeds from sale of property, plant

and equipment - 34,204 61,003

Purchase of property, plant and equipment (383,825) (1,267,412) (1,961,233)

Finance income 44,130 6,711 25,019

--------------- ------------

Net cash flows from investing activities (339,695) (1,226,497) (1,875,211)

--------------- ------------

Cash flows from financing activities

Repayment of finance leases (133,792) (128,618) (260,192)

Repayment of borrowings (48,412) (84,754) (116,942)

Dividends paid (2,200,000) (2,040,000) (3,090,000)

Finance expense (151,723) (73,839) (160,494)

--------------- ------------

Net cash flows from financing activities (2,533,927) (2,327,211) (3,627,628)

--------------- ------------

Net increase in cash and cash equivalents (217,923) (1,107,194) 782,025

Cash and cash equivalents brought forward 7,353,583 6,571,558 6,571,558

--------------- ------------

Cash and cash equivalents carried forward 7,135,660 5,464,364 7,353,583

=============== =============== ============

CAKE BOX HOLDINGS PLC

NOTES TO THE INTERIM ACCOUNTS

FOR THE SIX MONTHS ENDED 30 SEPTEMBER 2023

1.Notes to the Interim Report

Basis of preparation

The consolidated half-yearly financial statements do not

constitute statutory accounts within the meaning of Section 434 of

the Companies Act 2006. The statutory accounts for the year ended

31 March 2023 have been filed with the Registrar of Companies at

Companies House. The auditor's report on the statutory accounts for

the year ended 31 March 2023 was unqualified, did not include any

matters to which the auditor drew attention by way of emphasis and

did not contain any statements under Section 498 (2) or (3) of the

Companies Act 2006.

The published financial statements for the year ended 31 March

2023 were prepared in accordance with the recognition and

measurement principles of UK adopted International Financial

Reporting Standards ("UK adopted IFRS") that are expected to be

applied in the preparation of the next annual report.

The consolidated annual financial statements of Cake Box

Holdings Plc for the year ended 31 March 2024 will be prepared in

accordance with IFRS. Accordingly, these interim financial

statements have been prepared using accounting policies consistent

with those which will be adopted by the Group in the financial

statements for the year ended 31 March 2024, but do not contain all

the information necessary for full compliance with IFRS.

The consolidated half-yearly financial statements for the six

months to 30 September 2023 have not been audited or reviewed by

auditors.

The consolidated half-yearly financial statements have been

prepared under the going concern assumption and historical cost

convention as modified by fair value for property, plant and

equipment.

Basis of consolidation

The Group consolidated half-yearly financial statements

consolidates the company and its subsidiaries. All intra-group

transactions, balances, income and expenses are eliminated on

consolidation.

2.Segment reporting

Components reported to the chief operating decision maker, the

board of directors, are not separately identifiable. The Group

makes varied sales to its customers, but none are a separately

identifiable component. The following information is disclosed:

6 months 6 months 12 months

to to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP GBP GBP

------------------------- ------------------------

Sales of sponge 7,385,751 6,170,612 13,631,930

Sales of food 3,151,169 2,930,966 5,870,607

Sales of fresh cream 2,083,960 1,761,069 3,976,694

Sales of other goods 3,700,104 3,686,104 7,454,354

Online sales commission 546,021 487,168 1,001,192

Franchise packages 969,055 1,786,290 2,866,164

Marketing Levy 124,520 - -

17,960,580 16,822,209 34,800,941

3.Dividends

6 months to 6 months to 12 months to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP GBP GBP

--------------- --------------

Dividends paid 2,200,000 2,040,000 3,090,000

--------------- --------------

4.Share Capital

6 months 12 months

to 6 months to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

GBP GBP GBP

-------------------------------- -----------------------

40,000,000 Ordinary Shares

of GBP0.01 400,000 400,000 400,000

-------------------------------- -----------------------

5.Earnings per share

The basic earnings per share is calculated by dividing the

earnings attributable to equity shareholders by the weighted

average number of shares in issue. In calculating the diluted

earnings per share, share options outstanding have been taken into

account where the impact of these is dilutive.

6 months 12 months

to 6 months to to

30 September 30 September 31 March

2023 2022 2023

(unaudited) (unaudited) (audited)

Pence Pence Pence

------------------------------------ --------------------------

Basic earnings

per share 4.45 3.72 10.59

Diluted earnings

per

share 4.45 3.72 10.59

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR VXLFFXFLFFBZ

(END) Dow Jones Newswires

November 14, 2023 02:00 ET (07:00 GMT)

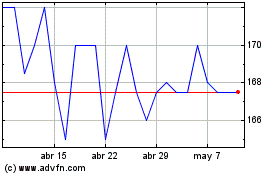

Cake Box (LSE:CBOX)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Cake Box (LSE:CBOX)

Gráfica de Acción Histórica

De May 2023 a May 2024