TIDMCEY

RNS Number : 7037H

Centamin Egypt Limited

26 February 2010

CONSOLIDATED FINANCIAL REPORT

FOR THE HALF-YEAR ENDED

31 DECEMBER 2009

CONTENTS

DIRECTORS'

REPORT.........................................................................

................................................................... 1

AUDITOR'S INDEPENDENCE

DECLARATION....................................................................

................................. 1

INDEPENDENT REVIEW REPORT TO THE MEMBERS OF CENTAMIN EGYPT

LIMITED.................................. 4

DIRECTORS'

DECLARATION....................................................................

............................................................ 6

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME................................................. 7

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL

POSITION.......................................................... 8

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN

EQUITY........................................................... 1

CONDENSED CONSOLIDATED STATEMENT OF CASH

FLOWS....................................................................... 1

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL

STATEMENTS..................................................... 1

The Directors of Centamin Egypt Limited ("the Company") herewith submit the

financial report for the half-year ended 31 December 2009. In order to comply

with the provisions of the Corporations Act 2001, the Directors' Report is as

follows:

DIRECTORS

The names of the Directors and officers of the Company during or since the end

of the half-year are:

Mr Sami El-Raghy, Executive Chairman (resigned 31 December 2009)

Mr Josef El-Raghy, Managing Director/CEO

Mr Trevor Schultz, Executive Director of Operations

Mr Colin Cowden, Non Executive Director

Mr G Brian Speechly, Non Executive Director (resigned 31 December 2009)

Dr Thomas Elder, Non Executive Director

Mr H Stuart Bottomley, Non Executive Director

Professor G Robert T Bowker, Non Executive Director

Mr Marco Di Silvio, Chief Financial Officer

Mrs Heidi Brown, Company Secretary

PRINCIPAL ACTIVITIES

The principal activity of the consolidated entity during the course of the

financial year was the exploration for precious and base metals and the ongoing

development and construction work at the Sukari Gold Project in Egypt.

REVIEW OF OPERATIONS

The Company recorded a consolidated operating loss for the period of US$0.5M

compared with a consolidated operating loss of US$24.4M for the corresponding

period last year.

During the half-year the principal focus of the Company has been:

· Continuing mine development and completion of construction activities at

the Sukari Gold Project in Egypt;

· Upgrading the Sukari Mineral Resource to 10.29 Moz Measured and

Indicated, plus 3.4 Moz Inferred at a 0.5g/t cut off grade;

· Commencement of the underground Amun decline development;

· Corporately, successfully transitioning to the main board of the London

Stock Exchange.

In addition to the above activities, two members of the Centamin Board departed

at the end of December 2009. Mr Sami El-Raghy announced he would be stepping

down as the Chairman of Centamin and as a member of the Board at 31 December

2009 to pursue new personal endeavours and challenges. Sami has overseen a

successful transformation of the Company from a mining exploration company into

a significant gold producer. Mr Gordon Brian Speechly also stepped down from

the Board on 31 December 2009 due to other work commitments. Mr Speechly has

been a director of the Company since 15 August 2000. The Company is currently

pursuing the appointment of further appropriate board members.

The Company remains debt free, unhedged and able to aggressively pursue further

exploration and development activities, including the underground development of

the high grade Amun Deeps Zone.

Shareholders are referred to the Company's website (www.centamin.com) for

further details.

ROUNDING OFF OF AMOUNTS

The Company is a company of the kind referred to in ASIC Class Order 98/0100,

dated 10 July 1998, and in accordance with that Class Order amounts in the

Director's Report and the half-year Financial Report are rounded off to the

nearest thousand dollars, unless otherwise indicated.

AUDITOR'S INDEPENDENCE DECLARATION

The auditor's independence declaration is included on page 3 of the half-year

financial report.

Signed in accordance with a resolution of the directors made pursuant to s306(3)

of the Corporations Act 2001.

On behalf of the Directors

Colin Cowden

Director

Perth, 25 February 2010

+----------------------------------+

| The Board of Directors |

| Centamin Egypt Limited |

| 57 Kishorn Road |

| Mt Pleasant WA 6153 |

| |

+----------------------------------+

25 February 2010

Dear Board Members

Centamin Egypt Limited

In accordance with section 307C of the Corporations Act 2001, I am pleased to

provide the following declaration of independence to the directors of Centamin

Egypt Limited.

As lead audit partner for the review of the financial statements of Centamin

Egypt Limited for the half-year ended 31 December 2009, I declare that to the

best of my knowledge and belief, there have been no contraventions of:

(i) the auditor independence requirements of the Corporations Act 2001 in

relation to the review; and

(ii) any applicable code of professional conduct in relation to the review.

Yours sincerely

DELOITTE TOUCHE TOHMATSU

Ross Jerrard

Partner

Chartered Accountants

Independent Auditor's Review Report

to the members of Centamin Egypt Limited

We have reviewed the accompanying half-year financial report of Centamin Egypt

Limited, which comprises the condensed consolidated statement of financial

position as at 31 December 2009, and the condensed consolidated statement of

comprehensive income, the condensed consolidated statement of cash flows and the

condensed consolidated statement of changes in equity for the half-year ended on

that date, selected explanatory notes and the directors' declaration of the

consolidated entity comprising the company and the entities it controlled at the

end of the half-year or from time to time during the half-year as set out on

pages 6 to 17.

Directors' Responsibility for the Half-Year Financial Report

The directors of the company are responsible for the preparation and fair

presentation of the half-year financial report in accordance with Australian

Accounting Standards (including the Australian Accounting Interpretations) and

the Corporations Act 2001. This responsibility includes establishing and

maintaining internal control relevant to the preparation and fair presentation

of the half-year financial report that is free from material misstatement,

whether due to fraud or error; selecting and applying appropriate accounting

policies; and making accounting estimates that are reasonable in the

circumstances.

Auditor's Responsibility

Our responsibility is to express a conclusion on the half-year financial report

based on our review. We conducted our review in accordance with Auditing

Standard on Review Engagements ASRE 2410 Review of Interim and Other Financial

Reports Performed by the Independent Auditor of the Entity, in order to state

whether, on the basis of the procedures described, we have become aware of any

matter that makes us believe that the half-year financial report is not in

accordance with the Corporations Act 2001 including: giving a true and fair view

of Centamin Egypt Limited's financial position as at 31 December 2009 and its

performance for the half-year ended on that date; and complying with Accounting

Standard AASB 134 Interim Financial Reporting and the Corporations Regulations

2001. As the auditor of Centamin Egypt Limited, ASRE 2410 requires that we

comply with the ethical requirements relevant to the audit of the annual

financial report.

Auditor's Independence Declaration

In conducting our review, we have complied with the independence requirements of

the Corporations Act 2001.

Conclusion

Based on our review, which is not an audit, we have not become aware of any

matter that makes us believe that the half-year financial report of Centamin

Egypt Limited is not in accordance with the Corporations Act 2001, including:

(a) giving a true and fair view of the consolidated entity's financial position

as at 31 December 2009 and of its performance for the half-year ended on that

date; and

(b) complying with Accounting Standard AASB 134 Interim Financial Reporting and

the Corporations Regulations 2001.

DELOITTE TOUCHE TOHMATSU

Ross Jerrard

Partner

Chartered Accountants

Perth, 25 February 2009

The directors declare that:

a) In the directors' opinion, there are reasonable grounds to believe that

the company will be able to pay its debts as and when they become due and

payable; and

b) In the directors' opinion, the attached financial statements and notes

thereto are in accordance with the Corporations Act 2001, including compliance

with accounting standards and giving a true and fair view of the financial

position and performance of the consolidated entity.

Signed in accordance with a resolution of the directors made pursuant to s303(5)

of the Corporations Act 2001.

On behalf of the Directors

Colin Cowden

Director

Perth, 25 February 2010

+----------------------------------------------+----------+----------+

| FOR THE HALF YEAR ENDED 31 DECEMBER 2009 | |

+----------------------------------------------+---------------------+

| | Half Year Ended |

+----------------------------------------------+---------------------+

| | 31 December |

+----------------------------------------------+---------------------+

| | 2009 | 2008 |

+----------------------------------------------+----------+----------+

| | US$'000 | US$'000 |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Revenue - Note 4 | 450 | 2,106 |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Other income - Note 4 | 886 | 10 |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Corporate administration expenses | (2,352) | (914) |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Foreign exchange gain / (loss) | 2,595 | (25,204) |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Share based payments | (1,477) | (360) |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Other expenses | (644) | (72) |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Loss before income tax | (542) | (24,434) |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Tax (expense) / income | - | - |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Loss for the period | (542) | (24,434) |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Other Comprehensive Income | | |

+----------------------------------------------+----------+----------+

| Other Comprehensive Income for the period | - | - |

| (net of tax) | | |

+----------------------------------------------+----------+----------+

| Other Comprehensive Income for the period | - | - |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Total Comprehensive Income | (542) | (24,434) |

+----------------------------------------------+----------+----------+

| | | |

+----------------------------------------------+----------+----------+

| Earnings per share - Note 9 | | |

+----------------------------------------------+----------+----------+

| - Basic (cents per share) | (0.05) | (2.78) |

+----------------------------------------------+----------+----------+

| - Diluted (cents per share) | (0.05) | (2.78) |

+----------------------------------------------+----------+----------+

The above Condensed Consolidated Statement of Comprehensive Income

should be read in conjunction with the accompanying notes.

+----------------------------------------+------------+-----------+

| AS AT 31 DECEMBER 2009 | | |

+----------------------------------------+------------+-----------+

| | 31 | 30 June |

| | December | 2009 |

| | 2009 | |

+----------------------------------------+------------+-----------+

| | US$'000 | US$'000 |

+----------------------------------------+------------+-----------+

| CURRENT ASSETS | | |

+----------------------------------------+------------+-----------+

| Cash and cash equivalents | 26,941 | 68,609 |

+----------------------------------------+------------+-----------+

| Trade and other receivables | 1,583 | 30 |

+----------------------------------------+------------+-----------+

| Inventories | 11,009 | 3,780 |

+----------------------------------------+------------+-----------+

| Other assets | 520 | 945 |

+----------------------------------------+------------+-----------+

| Total current assets | 40,053 | 73,364 |

+----------------------------------------+------------+-----------+

| | | |

+----------------------------------------+------------+-----------+

| NON-CURRENT ASSETS | | |

+----------------------------------------+------------+-----------+

| Plant and equipment | 56,960 | 59,879 |

+----------------------------------------+------------+-----------+

| Deferred tax assets | 4,104 | 4,104 |

+----------------------------------------+------------+-----------+

| Exploration, evaluation and | 342,893 | 269,075 |

| development expenditure - Note 5 | | |

+----------------------------------------+------------+-----------+

| Total non-current assets | 403,957 | 333,058 |

+----------------------------------------+------------+-----------+

| | | |

+----------------------------------------+------------+-----------+

| Total assets | 444,010 | 406,422 |

+----------------------------------------+------------+-----------+

| | | |

+----------------------------------------+------------+-----------+

| CURRENT LIABILITIES | | |

+----------------------------------------+------------+-----------+

| Trade and other payables | 8,407 | 7,454 |

+----------------------------------------+------------+-----------+

| Current tax liabilities | 444 | 444 |

+----------------------------------------+------------+-----------+

| Provisions | 1,325 | 606 |

+----------------------------------------+------------+-----------+

| Total current liabilities | 10,176 | 8,504 |

+----------------------------------------+------------+-----------+

| | | |

+----------------------------------------+------------+-----------+

| NON-CURRENT LIABILITIES | | |

+----------------------------------------+------------+-----------+

| Provisions | 2,307 | 1,736 |

+----------------------------------------+------------+-----------+

| Total non-current liabilities | 2,307 | 1,736 |

+----------------------------------------+------------+-----------+

| | | |

+----------------------------------------+------------+-----------+

| Total liabilities | 12,483 | 10,240 |

+----------------------------------------+------------+-----------+

| | | |

+----------------------------------------+------------+-----------+

| NET ASSETS | 431,527 | 396,182 |

+----------------------------------------+------------+-----------+

| | | |

+----------------------------------------+------------+-----------+

| EQUITY | | |

+----------------------------------------+------------+-----------+

| Issued Capital - Note 7 | 454,773 | 416,886 |

+----------------------------------------+------------+-----------+

| Reserves | 6,957 | 8,957 |

+----------------------------------------+------------+-----------+

| Accumulated losses | (30,203) | (29,661) |

+----------------------------------------+------------+-----------+

| TOTAL EQUITY | 431,527 | 396,182 |

+----------------------------------------+------------+-----------+

The above Condensed Consolidated Statement of Financial Position should be read

in conjunction with the accompanying notes.

+-----------------+---------+----------+---------+-------------+----------+

| FOR THE HALF YEAR ENDED 31 DECEMBER 2009 |

+-------------------------------------------------------------------------+

| | Issued | |Options |Accumulated | |

| | |Reserves |Reserve | Losses | Total |

| |Capital | US$'000 |US$'000 | US$'000 | US$'000 |

| |US$'000 | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| At 1 July 2008 | 352,948 | 2,295 | 5,273 | (7,559) | 352,957 |

+-----------------+---------+----------+---------+-------------+----------+

| Loss for the | - | - | - | (24,434) | (24,434) |

| period | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Total | - | - | - | (24,434) | (24,434) |

| Comprehensive | | | | | |

| Income for the | | | | | |

| period | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Share options | 811 | - | - | - | 811 |

| exercised | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Cost of share | - | - | 360 | - | 360 |

| based payments | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Transfer to | 334 | - | (334) | - | - |

| issued capital | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| At 31 December | 354,093 | 2,295 | 5,299 | (31,993) | 329,694 |

| 2008 | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| At 1 July 2009 | 416,886 | 2,295 | 6,662 | (29,661) | 396,182 |

+-----------------+---------+----------+---------+-------------+----------+

| Loss for the | - | - | - | (542) | (542) |

| period | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Total | | | | (542) | (542) |

| Comprehensive | | | | | |

| Income for the | | | | | |

| period | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Share options | 8,959 | - | - | - | 8,959 |

| exercised | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Cost of share | - | - | 1,477 | - | 1,477 |

| based payments | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| | 25,451 | - | - | - | 25,451 |

| Issue of shares | | | | | |

| under | | | | | |

| employee share | | | | | |

| option plan | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| Transfer to | 3,477 | - | (3,477) | - | - |

| issued capital | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

| At 31 December | 454,773 | 2,295 | 4,662 | (30,203) | 431,527 |

| 2009 | | | | | |

+-----------------+---------+----------+---------+-------------+----------+

The above Condensed Consolidated Statement of Changes in Equity

should be read in conjunction with the accompanying notes.

+----------------------------------------------+----------+------------+

| FOR THE HALF YEAR ENDED 31 DECEMBER 2009 | |

+----------------------------------------------+-----------------------+

| | Half Year Ended |

+----------------------------------------------+-----------------------+

| | 31 December |

+----------------------------------------------+-----------------------+

| | 2009 | 2008 |

+----------------------------------------------+----------+------------+

| | US$'000 | US$'000 |

+----------------------------------------------+----------+------------+

| CASH FLOWS FROM OPERATING ACTIVITIES | | |

+----------------------------------------------+----------+------------+

| Payments to suppliers and employees | (2,913) | (1,423) |

+----------------------------------------------+----------+------------+

| Payments for exploration | (6,198) | (5,142) |

+----------------------------------------------+----------+------------+

| Other income | - | 10 |

+----------------------------------------------+----------+------------+

| Net cash used in operating activities | (9,111) | (6,555) |

+----------------------------------------------+----------+------------+

| | | |

+----------------------------------------------+----------+------------+

| CASH FLOWS FROM INVESTING ACTIVITIES | | |

+----------------------------------------------+----------+------------+

| Payments for development | (70,656) | (48,166) |

+----------------------------------------------+----------+------------+

| Payments for plant & equipment | (3,131) | (7,743) |

+----------------------------------------------+----------+------------+

| Proceeds on sale of plant and equipment | 3,900 | - |

+----------------------------------------------+----------+------------+

| Interest received | 450 | 2,106 |

+----------------------------------------------+----------+------------+

| Net cash used in investing activities | (69,437) | (53,803) |

+----------------------------------------------+----------+------------+

| | | |

+----------------------------------------------+----------+------------+

| CASH FLOWS FROM FINANCING ACTIVITIES | | |

+----------------------------------------------+----------+------------+

| Proceeds from the issue of equity & | 34,410 | 811 |

| conversion of options | | |

+----------------------------------------------+----------+------------+

| Project finance due diligence | (1,343) | (1,573) |

+----------------------------------------------+----------+------------+

| Net cash generated by / (used in) financing | 33,067 | (762) |

| activities | | |

+----------------------------------------------+----------+------------+

| | | |

+----------------------------------------------+----------+------------+

| Net decrease in cash and cash equivalents | (45,481) | (61,120) |

+----------------------------------------------+----------+------------+

| | | |

+----------------------------------------------+----------+------------+

| Cash and cash equivalents at the beginning | 68,609 | 182,329 |

| of the financial period | | |

+----------------------------------------------+----------+------------+

| | | |

+----------------------------------------------+----------+------------+

| Effects of exchange rate changes on the | 3,813 | (23,704) |

| balance of cash held in foreign currencies | | |

+----------------------------------------------+----------+------------+

| | | |

+----------------------------------------------+----------+------------+

| Cash and cash equivalents at the end of the | 26,941 | 97,505 |

| financial period | | |

+----------------------------------------------+----------+------------+

The above Condensed Consolidated Statement of Cash Flows should be read in

conjunction with the accompanying notes.

NOTE 1: STATEMENT OF SIGNIFICANT ACCOUNTING POLICIES

STATEMENT OF COMPLIANCE

The Half Year report is a general purpose financial report prepared in

accordance with the Corporations Act 2001 and AASB 134 'Interim Financial

Reporting'. Compliance with AASB 134 ensures compliance with International

Financial Reporting Standard IAS 34 'Interim Financial Reporting'. The Half

Year financial report does not include notes of the type normally included in an

annual financial report and should be read in conjunction with the most recent

annual financial report.

BASIS OF PREPARATION

This financial report is denominated in United States Dollars, which is the

functional currency of Centamin Egypt Limited. The Company is of a kind

referred to in ASIC Class Order 98/100 dated 10 July 1998 and in accordance with

that Class Order, all financial information presented in United States Dollars

has been rounded to the nearest thousand dollars, unless otherwise stated.

The financial report has been prepared on the basis of historical cost, except

for the revaluation of certain non-current assets and financial instruments.

Cost is based on the fair values of the consideration given in exchange for

assets.

In the application of A-IFRS, management is required to make judgments,

estimates and assumptions about carrying values of assets and liabilities that

are not readily apparent from other sources. The estimates and associated

assumptions are based on historical experience and various other factors that

are believed to be reasonable under the circumstances, the results of which form

the basis of making the judgments. Actual results may different from these

estimates. The estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the period in which

the estimate is revised if the revision affects only that period, or in the

period of the revision and future periods if the revision affects both current

and future periods.

Judgments made by management in the application of A-IFRS that have significant

effects on the financial statements and estimates with a significant risk of

material adjustments in the next year are disclosed, where applicable, in the

relevant notes to the financial statements.

Accounting policies are selected and applied in a manner which ensures that the

resulting financial information satisfies the concepts of relevance and

reliability, thereby ensuring that the substance of the underlying transactions

or other events is reported.

ADOPTION OF NEW AND REVISED ACCOUNTING STANDARDS

In the current period, the Company has adopted all of the new and revised

Standards and Interpretations issued by the Australian Accounting Standards

Board ("AASB") that are relevant to its operations and effective for annual

reporting periods beginning on or after 1 July 2009. The standards adopted are:

- AASB 3 : "Business Combinations"

- AASB 8 : "Operating Segments"

- AASB 2007-3 "Amendments to Australian Accounting Standards arising from AASB

8"

- AASB 101 : "Presentation of Financial Statements"

- AASB 127 : "Consolidated and Separate Financial Statements"

- AASB 2009-4: "Amendments to Australian Accounting Standards arising from the

Annual Improvements Project"

The adoption of these new and revised Standards and Interpretations has resulted

in some disclosure changes being made.

NOTE 2: SEGMENT REPORTING

The Consolidated Entity has adopted AASB 8 "Operating Segments" and AASB 2007-3

"Amendments to Australian Accounting Standards arising from AASB 8" with effect

from 1 January 2009. AASB 8 requires operating segments to be identified on the

basis of internal reports about components of the Group that are regularly

reviewed by the chief operating decision maker in order to allocate resources to

the segment and to assess its performance. In contrast, the predecessor standard

(AASB 114 "Segment Reporting") required an entity to identify two sets of

segments (business and geographical) using a risks and rewards approach, with

the entity's 'system of internal financial reporting to key management

personnel' serving as the only starting point for the identification of such

segments.

In the case of the Centamin Group, the adoption of AASB 8 has changed the

methodology used to identify segments however the reporting segments that are

disclosed in the financial report remain unchanged.

The Consolidated Entity is engaged in the business of exploration and mining of

precious and base metals only, which is characterised as one operating segment

only. As the consolidated Entity has only one operating segment, all the

necessary reporting disclosures are disclosed elsewhere in the notes to the

financial statements.

NOTE 3: EVENTS SUBSEQUENT TO BALANCE DATE

Other than as set out above, there has not risen in the interval between the end

of the financial year and the date of this report, any item, transaction or

event of a material and unusual nature likely in the opinion of the Directors of

the Company to affect significantly the operations of the company, the results

of those operations, or the state of affairs of the Company in subsequent

financial years.

+------------------------------------------------+---------+---------+

| | Half Year Ended |

| NOTE 4: REVENUE | |

+------------------------------------------------+-------------------+

| | 31 December |

+------------------------------------------------+-------------------+

| | 2009 | 2008 |

+------------------------------------------------+---------+---------+

| |US$'000 |US$'000 |

+------------------------------------------------+---------+---------+

| (a) Revenue | | |

+------------------------------------------------+---------+---------+

| Interest revenue | 450 | 2,106 |

+------------------------------------------------+---------+---------+

| | | |

+------------------------------------------------+---------+---------+

| (b) Other income | | |

+------------------------------------------------+---------+---------+

| Gain on sale of plant and equipment | 886 | - |

+------------------------------------------------+---------+---------+

| VAT refund | - | 10 |

+------------------------------------------------+---------+---------+

| | 1,336 | 2,116 |

+------------------------------------------------+---------+---------+

+------------------------------------------------+----------+---------+

| | Half Year Ended |

| NOTE 5: EXPLORATION, EVALUATION AND | |

| DEVELOPMENT EXPENDITURE | |

+------------------------------------------------+--------------------+

| | 31 | 30 |

| |December | June |

+------------------------------------------------+----------+---------+

| | 2009 | 2009 |

+------------------------------------------------+----------+---------+

| | US$'000 |US$'000 |

+------------------------------------------------+----------+---------+

| Exploration and evaluation phase expenditure - | | |

| At Cost (a) | | |

+------------------------------------------------+----------+---------+

| Balance at the beginning of the period | 26,698 | 21,511 |

+------------------------------------------------+----------+---------+

| Expenditure for the period | 4,968 | 5,187 |

+------------------------------------------------+----------+---------+

| Balance at the end of the period | 31,666 | 26,698 |

+------------------------------------------------+----------+---------+

| | | |

+------------------------------------------------+----------+---------+

| Development expenditure - At Cost (b) | | |

+------------------------------------------------+----------+---------+

| Balance at the beginning of the period | 242,377 | 169,433 |

+------------------------------------------------+----------+---------+

| Expenditure for the period | 68,850 | 72,944 |

+------------------------------------------------+----------+---------+

| Balance at the end of the period | 311,227 | 242,377 |

+------------------------------------------------+----------+---------+

| Net book value of exploration, evaluation and | 342,893 | 269,075 |

| development phase expenditure | | |

+------------------------------------------------+----------+---------+

+----------------------------------------------------------------------+

| |

| (a) Included within the cost amount of exploration evaluation and |

| development assets is $5,311,744 being the excess of consideration |

| over the net tangible assets acquired on the acquisition of Pharaoh |

| Gold Mines NL in January 1999. This amount has been treated as part |

| of the cost of exploration, evaluation and development. Management |

| believe that the recovery of these amounts will satisfactorily be |

| made through the exploitation of the project in due course. |

| |

+----------------------------------------------------------------------+

| (b) Development of the Sukari Gold Project commenced in March |

| 2007. Items of development phase expenditure relevant to the project |

| are being separately accounted for as development phase expenditure. |

+----------------------------------------------------------------------+

NOTE 6: CONTINGENT LIABILITIES

The Directors are not aware of any contingent liabilities as at the date of

these interim consolidated financial statements.

+--------------------------------------------------+-----------+----------+

| NOTE 7: ISSUED CAPITAL | Half Year Ended |

+--------------------------------------------------+----------------------+

| | 31 | 30 June |

| | December | |

+--------------------------------------------------+-----------+----------+

| | 2009 | 2009 |

+--------------------------------------------------+-----------+----------+

| | US$000 | US$000 |

+--------------------------------------------------+-----------+----------+

| Fully paid ordinary shares | | |

+--------------------------------------------------+-----------+----------+

| Balance at beginning of the period | 416,886 | 352,948 |

+--------------------------------------------------+-----------+----------+

| Issue of shares upon exercise of options and | 8,959 | 1,278 |

| warrants | | |

+--------------------------------------------------+-----------+----------+

| Transfer from share options reserve | 3,477 | 1,817 |

+--------------------------------------------------+-----------+----------+

| Other placements | 27,004 | 60,127 |

+--------------------------------------------------+-----------+----------+

| Share issue costs | (1,553) | (3,219) |

+--------------------------------------------------+-----------+----------+

| Tax effect on share issue costs | - | 3,935 |

+--------------------------------------------------+-----------+----------+

| Balance at end of the period | 454,773 | 416,886 |

+--------------------------------------------------+-----------+----------+

Changes to the then Corporations Law abolished the authorised capital and par

value concept in relation to share capital from 1 July 1998. Therefore, the

Company does not have a limited amount of authorised capital and issued shares

do not have a par value. Fully paid ordinary shares carry one vote per share

and carry the right to dividends.

Fully Paid Ordinary Shares

+--------------------------------------------------+---------------+----------+

| | Half Year Ended |

| | 31 December 2009 |

+--------------------------------------------------+--------------------------+

| | Number | US$000 |

+--------------------------------------------------+---------------+----------+

| Balance at beginning of the period | 991,940,623 | 416,886 |

+--------------------------------------------------+---------------+----------+

| Placements | 19,000,000 | 25,451 |

+--------------------------------------------------+---------------+----------+

| Issue of shares on exercise of options and | 9,713,855 | 8,959 |

| broker warrants | | |

+--------------------------------------------------+---------------+----------+

| Transfer from share options reserve | - | 3,477 |

+--------------------------------------------------+---------------+----------+

| Balance at end of the period | 1,020,654,478 | 454,773 |

+--------------------------------------------------+---------------+----------+

Share options granted under the employee share option plan

In accordance with the provisions of the employee share option plans, as at 31

December 2009, executives and employees had options over 6,090,000 ordinary

shares. The expiry dates of the granted options are detailed in Note 10. Share

options granted under the Employee Option Plan carry no rights to dividends and

no voting rights. Further details of the employee share option plan are

contained in Note 10 to the financial statements.

Share warrants on issue

As part of the Canadian listing process undertaken during the previous financial

year on the Toronto Stock Exchange ("TSX") the Company was required to issue to

its nominated share broker share warrants as part of the arrangement. Share

warrants are identical in nature to share options however they are

differentiated as such because the latter in Canada typically relates to options

issued to employees under employee share plans. As at 31 December 2009, there

were 3,603,855 broker warrants on issue over an equivalent number of ordinary

shares (all of which are vested). Further details of the share warrants are

contained in Note 10 to the financial statements.

NOTE 8: RELATED PARTY TRANSACTIONS

The related party transactions for the six months ended 31 December 2009 are

summarised below:

- Salaries, superannuation contributions, consulting and Directors fees

paid to Directors during the six months ended 31 December 2009 amounted to

A$653,499 (31 December 2008: A$712,006).

- Mr S El-Raghy and Mr J El-Raghy are Directors and shareholders of

El-Raghy Kriewaldt Pty Ltd ("ELK"), which provides office premises to the

Company in Australia. All dealings with ELK are in the ordinary course of

business and on normal terms and conditions. Rent paid to ELK during the six

months ended 31 December 2009 amounted to A$32,983 (31 December 2008: A$30,916).

- Mr S El-Raghy provides office premises to the Company in Alexandria,

Egypt. All dealings are in the ordinary course of business and on normal terms

and conditions. Rent paid during the six months ended 31 December 2009 amounted

to GBP 3,900 (31 December 2008: GBP 3,900).

- Mr C Cowden, a non-executive director, is also a director and

shareholder of Cowden Limited, which provides insurance broking services to the

Company. All dealings with Cowden Limited are on normal terms and conditions.

Cowden Limited was paid A$53,239 during the six months ended 31 December 2009

(31 December 2008: A$45,810). In addition, amounts of A$359,969 (31 December

2008: A$283,507) were paid to Cowden Limited to be passed on to underwriters

for premiums during the six months ended 31 December 2009.

An amount of US$150,000 included in non-current liabilities of the condensed

consolidated statement of financial position as at 31 December 2009 represents

an unsecured loan payable after commencement of commercial production at the

Sukari project to Egyptian Mineral Commodities, a company which Mr S El-Raghy

has a financial interest in. This transaction was entered into by the Company on

27 September 2001.

NOTE 9: EARNINGS PER SHARE

Basic earnings per share are calculated using the weighted average number of

shares outstanding. Diluted earnings per share are calculated using the treasury

stock method. In order to determine diluted earnings per share, the treasury

stock method assumes that any proceeds from the exercise of dilutive stock

options and warrants would be used to repurchase common shares at the average

market price during the period, with the incremental number of shares being

included in the denominator of the diluted earnings per share calculation. The

diluted earnings per share calculation exclude any potential conversion of

options and warrants that would increase earnings per share.

The weighted average number of ordinary shares used in the calculation of basic

earnings per share is 996,405,084 (31 December 2008: 878,655,576). The weighted

average number of ordinary shares used in the calculation of diluted earnings

per share is 996,405,084 (31 December 2008: 878,655,576). The earnings used in

the calculation of basic and diluted earnings per share is a loss of US$541,683

(31 December 2008: US$24,434,381).

NOTE 10: SHARE BASED PAYMENTS

The consolidated entity has an Employee Option Plan in place for executives and

employees.

Options are issued to key management personnel under the Employee Option Plan

2006 (previously the Employee Option Plan 2002) as part of their remuneration.

Options are offered to key management personnel at the discretion of the

Directors, having regard, among other things, to the length of service with the

consolidated entity, the past and potential contribution of the person to the

consolidated entity and in some cases, performance.

Each employee share option converts into one ordinary share of the Company on

exercise. The options carry neither rights to dividends nor voting rights.

Options vest over a period of 12 months, with 50% vesting and exercisable after

six months and the other 50% vesting and exercisable after 12 months of issue.

All options are issued with a term of three years. At the discretion of the

Directors part or all of the options issued to an executive or employee may be

subject to performance based hurdles. No performance based hurdles have been

applied for issues granted to date.

In addition, Series 5 options were issued to three employees outside of the

Employee Option Plan on 31 October 2005. Details of those options were:

- 2,500,000 of those options were subject to performance based hurdles.

Due to the cessation of employment by the employee to whom the options were

issued they lapsed in May 2007.

- 1,000,000 of those options vest and are exercisable over a period of two

years, with 50% vesting and exercisable after 12 months and the other 50%

vesting and exercisable after 24 months of issue. These options have a term of 5

years. To date, 650,000 options have been exercised.

- 750,000 of those options vest and are exercisable immediately. These

have a term of 5 years. To date, 250,000 options have been exercised.

In addition to the above:

- 1,630,150 options (Series 18) were issued pursuant with the agreement with

Macquarie Bank Limited to provide a corporate loan facility of up to US$25

million (as announced on 02 April 2009). Those options are exercisable any time

on or before 31 December 2012. No Series 18 options have been exercised at the

date of this report.

- 1,000,000 options (Series 20) were issued pursuant with the agreement with

Ambrian Partners Limited and Investec Bank Plc to provide advisory services

associated with the main board of the London Stock Exchange. Those options are

exercisable any time on or before 28 November 2010. No Series 20 options have

been exercised at the date of this report.

The following reconciles the outstanding share options granted under the

Employee Option Plan, and other share based payment arrangements, at the

beginning and end of the financial year:

+------------------------------------------------------------+-------------+

| | Half |

| | Year |

| | Ended |

| | 31 |

| | December |

| | 2009 |

+------------------------------------------------------------+-------------+

| | Number |

| | of |

| | options |

+------------------------------------------------------------+-------------+

| | |

+------------------------------------------------------------+-------------+

| Balance at beginning of the period (a) | 11,305,150 |

+------------------------------------------------------------+-------------+

| Granted during the period (b) | 1,350,000 |

+------------------------------------------------------------+-------------+

| Exercised during the period (c) | (2,960,000) |

+------------------------------------------------------------+-------------+

| Forfeited, expired or lapsed during the period (d) | (125,000) |

+------------------------------------------------------------+-------------+

| Balance at the end of the period (e) | 9,570,150 |

+------------------------------------------------------------+-------------+

| Exercisable at the end of the period | 9,220,150 |

+------------------------------------------------------------+-------------+

a) Balance at the beginning of the period

+--------------------+------------+---------+-----------+----------+--------+

| Options series | Number | Grant | Expiry / | Exercise | Fair |

| | | date | | price | value |

| | | | Exercise | A$ | at |

| | | | Date | | grant |

| | | | | | date |

| | | | | | A$ |

+--------------------+------------+---------+-----------+----------+--------+

| Series 5 | 1,050,000 | 31 Oct | 31 Oct | 0.3500 | 0.1753 |

| | | 2005 | 2010 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 9 | 690,000 | 31 Jan | 31 Jan | 0.7106 | 0.3518 |

| | | 2007 | 2010 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 10 | 2,060,000 | 24 May | 24 May | 1.0500 | 0.4661 |

| | | 2007 | 2010 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 12 | 250,000 | 15 Oct | 15 Oct | 1.4034 | 0.4002 |

| | | 2007 | 2010 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 13 | 3,500,000 | 16 Apr | 16 Apr | 1.7022 | 0.4015 |

| | | 2008 | 2011 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 14 | 250,000 | 25 Aug | 25 Aug | 1.1999 | 0.3070 |

| | | 2008 | 2011 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 15 | 750,000 | 28 Oct | 28 Oct | 0.7033 | 0.1964 |

| | | 2008 | 2011 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 16 | 125,000 | 28 Nov | 28 Nov | 0.6750 | 0.3676 |

| | | 2008 | 2011 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 17 | 1,000,000 | 19 Dec | 19 Dec | 1.0000 | 0.3568 |

| | | 2008 | 2011 | | |

+--------------------+------------+---------+-----------+----------+--------+

| Series 18 | 1,630,150 | 15 Apr | 31 Dec | 1.2000 | 0.4326 |

| | | 2009 | 2012 | | |

+--------------------+------------+---------+-----------+----------+--------+

| | 11,305,150 | | | | |

+--------------------+------------+---------+-----------+----------+--------+

b) Granted during the period

+---------------------+-----------+---------+------------+----------+----------+

| Options series | Number | Grant | Expiry / | Exercise | Fair |

| | | date | Exercise | price | value at |

| | | | Date | A$ | grant |

| | | | | | date |

| | | | | | A$ |

+---------------------+-----------+---------+------------+----------+----------+

| Series 19 | 350,000 | 06 Aug | 06 Aug | 1.8658 | 0.7960 |

| | | 2009 | 2012 | | |

+---------------------+-----------+---------+------------+----------+----------+

| Series 20 | 1,000,000 | 28 Nov | 28 Nov | 1.5000 | 0.9258 |

| | | 2009 | 2010 | | |

+---------------------+-----------+---------+------------+----------+----------+

| | 1,350,000 | | | | |

+---------------------+-----------+---------+------------+----------+----------+

c) Exercised during the period

+----------------------------------------+-----------+----------+----------+

| Options series | Number | Exercise | Share |

| | exercised | Date | price at |

| | | | exercise |

| | | | date |

| | | | A$ |

+----------------------------------------+-----------+----------+----------+

| Series 5 | 200,000 | 4 Aug | 1.8250 |

| | | 2009 | |

+----------------------------------------+-----------+----------+----------+

| Series 9 | 25,000 | 01 Jul | 1.7500 |

| | 190,000 | 2009 | 1.8000 |

| | 100,000 | 02 Jul | 1.7200 |

| | 40,000 | 2009 | 1.7250 |

| | 50,000 | 06 Jul | 1.6550 |

| | 100,000 | 2009 | 1.6600 |

| | 45,000 | 07 Jul | 1.8800 |

| | 50,000 | 2009 | 1.8300 |

| | | 08 Jul | |

| | | 2009 | |

| | | 13 Jul | |

| | | 2009 | |

| | | 20 Jul | |

| | | 2009 | |

| | | 22 Jul | |

| | | 2009 | |

+----------------------------------------+-----------+----------+----------+

| Series 10 | 10,000 | 02 Jul | 1.8000 |

| | 30,000 | 2009 | 1.7250 |

| | 130,000 | 07 Jul | 1.6550 |

| | 200,000 | 2009 | 1.8800 |

| | 300,000 | 08 Jul | 1.8000 |

| | 500,000 | 2009 | 1.9200 |

| | 790,000 | 20 Jul | 2.0400 |

| | 100,000 | 2009 | 2.3600 |

| | | 11 Aug | |

| | | 2009 | |

| | | 17 Sep | |

| | | 2009 | |

| | | 15 Oct | |

| | | 2009 | |

| | | 16 Nov | |

| | | 2009 | |

+----------------------------------------+-----------+----------+----------+

| Series 13 | 70,000 | 13 Nov | 2.3500 |

| | 30,000 | 2009 | 2.4600 |

| | | 02 Dec | |

| | | 2009 | |

+----------------------------------------+-----------+----------+----------+

| | 2,960,000 | | |

+----------------------------------------+-----------+----------+----------+

d) Forfeited, expired or lapsed during the period

+----------------------------------------+-----------+----------+----------+

| Options series | Number | Forfeit | Share |

| | forfeited | date | price at |

| | | | forfeit |

| | | | date |

| | | | A$ |

+----------------------------------------+-----------+----------+----------+

| Series 16 | 125,000 | 09 Sep | 1.8850 |

| | | 2009 | |

+----------------------------------------+-----------+----------+----------+

| | 125,000 | | |

+----------------------------------------+-----------+----------+----------+

e) Balance at the end of the period

+-------------------+-----------+---------+-----------+----------+--------+

| Options series | Number | Grant | Expiry / | Exercise | Fair |

| | | date | Exercise | price | value |

| | | | Date | A$ | at |

| | | | | | grant |

| | | | | | date |

| | | | | | A$ |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 5 | 850,000 | 31 Oct | 31 Oct | 0.3500 | 0.1753 |

| | | 2005 | 2010 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 9 | 90,000 | 31 Jan | 31 Jan | 0.7106 | 0.3518 |

| | | 2007 | 2010 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 12 | 250,000 | 15 Oct | 15 Oct | 1.4034 | 0.4002 |

| | | 2007 | 2010 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 13 | 3,400,000 | 16 Apr | 16 Apr | 1.7022 | 0.4015 |

| | | 2008 | 2011 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 14 | 250,000 | 25 Aug | 25 Aug | 1.1999 | 0.3070 |

| | | 2008 | 2011 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 15 | 750,000 | 28 Oct | 28 Oct | 0.7033 | 0.1964 |

| | | 2008 | 2011 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 17 | 1,000,000 | 19 Dec | 19 Dec | 1.0000 | 0.3568 |

| | | 2008 | 2011 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 18 | 1,630,150 | 15 Apr | 31 Dec | 1.2000 | 0.4326 |

| | | 2009 | 2012 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 19 | 350,000 | 06 Aug | 06 Aug | 1.8658 | 0.7960 |

| | | 2009 | 2012 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| Series 20 | 1,000,000 | 28 Nov | 28 Nov | 1.5000 | 0.9258 |

| | | 2009 | 2010 | | |

+-------------------+-----------+---------+-----------+----------+--------+

| | 9,570,150 | | | | |

+-------------------+-----------+---------+-----------+----------+--------+

NOTE 11: SHARE WARRANTS

a) Balance at the start of the period

The following share warrants were in existence during the current reporting

period:-

+--------------------+-----------+--------+----------+----------+----------+

| Broker Warrants | Number | Grant | Expiry |Exercise | Fair |

| series | | date | / | price |value at |

| | | |Exercise | C$ | grant |

| | | | Date | | date |

| | | | | | A$ |

+--------------------+-----------+--------+----------+----------+----------+

| Series 4 | 4,770,720 |10 Jan | 23 Nov | 1.2000 | 0.3782 |

| | | 2008 | 2009 | | |

+--------------------+-----------+--------+----------+----------+----------+

| Series 5 | 4,636,990 |10 Feb | 10 Feb | 0.6500 | 0.4288 |

| | | 2009 | 2011 | | |

+--------------------+-----------+--------+----------+----------+----------+

| | 9,407,710 | | | | |

+--------------------+-----------+--------+----------+----------+----------+

b) Exercised during the period

+----------------------------------------+-----------+----------+----------+

| Warrants series | Number | Exercise | Share |

| | exercised | Date | price at |

| | | | exercise |

| | | | date |

| | | | A$ |

+----------------------------------------+-----------+----------+----------+

| Series 4 | 329,280 | 06 Jul | 1.7200 |

| | 500,000 | 2009 | 1.8400 |

| | 500,000 | 28 Jul | 1.9000 |

| | 500,000 | 2009 | 1.9450 |

| | 500,000 | 04 Sep | 1.8500 |

| | 500,000 | 2009 | 1.8700 |

| | 500,000 | 15 Sep | 2.0900 |

| | 453,040 | 2009 | 2.3400 |

| | 988,400 | 23 Sep | 2.3700 |

| | | 2009 | |

| | | 07 Oct | |

| | | 2009 | |

| | | 23 Oct | |

| | | 2009 | |

| | | 26 Oct | |

| | | 2009 | |

| | | 23 Nov | |

| | | 2009 | |

+----------------------------------------+-----------+----------+----------+

| Series 5 | 1,983,135 | 28 Oct | 2.3100 |

| | | 2009 | |

+----------------------------------------+-----------+----------+----------+

| | 6,753,855 | | |

+----------------------------------------+-----------+----------+----------+

c) Issued during the period

+------------------------+---------+---------+---------+----------+---------+

| Warrants series | Number | Grant | Expiry | Exercise | Fair |

| | | date | Date | price | value |

| | | | | C$ | at |

| | | | | | grant |

| | | | | | date |

| | | | | | A$ |

+------------------------+---------+---------+---------+----------+---------+

| Series 6 | 788,437 | 16 Jul | 16 Jul | 1.5600 | 0.6601 |

| | | 2009 | 2011 | | |

+------------------------+---------+---------+---------+----------+---------+

| Series 7 | 161,563 | 26 Aug | 26 Aug | 1.5200 | 0.5895 |

| | | 2009 | 2011 | | |

+------------------------+---------+---------+---------+----------+---------+

| | 950,000 | | | | |

+------------------------+---------+---------+---------+----------+---------+

d) Balance at the end of the period

+-----------------------+-----------+---------+----------+----------+----------+

| Warrant series | Number | Grant | Expiry / | Exercise | Fair |

| | | date | Exercise | price | value at |

| | | | Date | C$ | grant |

| | | | | | date |

| | | | | | A$ |

+-----------------------+-----------+---------+----------+----------+----------+

| Series 5 | 2,653,855 | 10 Feb | 10 Feb | 0.6500 | 0.4288 |

| | | 2009 | 2011 | | |

+-----------------------+-----------+---------+----------+----------+----------+

| Series 6 | 788,437 | 16 Jul | 16 Jul | 1.5600 | 0.6601 |

| | | 2009 | 2011 | | |

+-----------------------+-----------+---------+----------+----------+----------+

| Series 7 | 161,563 | 26 Aug | 26 Aug | 1.5200 | 0.5895 |

| | | 2009 | 2011 | | |

+-----------------------+-----------+---------+----------+----------+----------+

| | 3,603,855 | | | | |

+-----------------------+-----------+---------+----------+----------+----------+

Share warrants are specific to the Company's listing on the TSX and retain the

same characteristics as share options but are referred to separately under the

TSX listing rules.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LLFEEFDIEFII

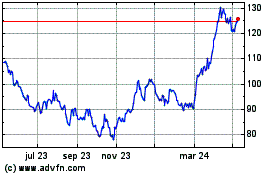

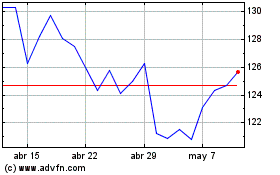

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024