TIDMCEY

RNS Number : 1625H

Centamin PLC

26 July 2023

26 July 2023

Centamin plc

("Centamin" or "the Company" or "the Group")

(LSE:CEY, TSX:CEE)

interim dividend declaration

for the six months ended 30 June 2023 ("H1 2023")

Consistent with the Company's stated commitment to shareholder

returns, the Centamin Board of Directors are pleased to declare an

interim dividend of 2.0 US cents per share (US$23 million), for the

six months ended 30 June 2023.

As per the dividend policy, this distribution is in line with

the commitment to return a minimum of 30% of Group free cash flow

before growth capital expenditure(1) to shareholders in cash

dividends. In consideration of the below factors, and reflecting

the Board's confidence, a total of 56% of H1 2023 Group free cash

flow before growth capex will be distributed to shareholders on 29

September 2023:

-- Centamin is in a financially robust position with US$161 million in cash and liquid assets

-- The US$150 million sustainability linked revolving credit

facility remains undrawn as a result of H1 2023 growth capex being

funded from cash flow

-- The gold price protection programme limits the revenue

downside risk below US$1,900/oz gold price

-- The Company is operationally and financially well positioned

for a stronger H2 2023, in line with plan

The interim dividend is calculated by the following:

30 June 2023

US$'000

---------------------------------------------------------- --------------------

Group free cash flow 19,362

----------------------------------------------------------- --------------------

Add back:

Growth capex financed from treasury[1] 21,818

Cash flow available for dividends 41,180

30% minimum distribution as per dividend policy (12,354)

----------------------------------------------------------- --------------------

Surplus cash flow for discretionary capital allocation[2] 28,826

Board interim dividend supplement (10,814)

Total interim dividend declared 23,168

----------------------------------------------------------- --------------------

Dividend Timetable ([3])

Below is the final dividend timetable for the London Stock

Exchange and Toronto Stock Exchange:

-- Ex-Dividend Date: 31 August 2023

-- Record Date: 1 September 2023

-- Last Date for Currency Elections: 4 September 2023

-- Payment Date: 29 September 2023

D ividend Currency Elections

The dividend will be paid on 29 September 2023, in US Dollars

("USD") with an option for shareholders to elect to receive the

dividend in Pounds Sterling ("GBP"). Currency elections should be

made no later than 4 September 2023 as per the instructions

detailed on the Company website ( www.centamin.com ). Payments in

GBP will be based on the USD/GBP exchange rate on 5 September 2023

and the rate applied will be published on the website

thereafter.

As a Jersey incorporated company, there is no requirement for

Centamin plc to make any withholding or deduction on account of

Jersey tax in respect of the dividend.

About Centamin

Centamin is an established gold producer, with a premium listing

on the London Stock Exchange and a secondary listing on the Toronto

Stock Exchange. Following a period of 'reset' including a

significant refresh of the Board and management team, the Company

is now entering a growth phase, balanced with stakeholder returns.

The Company's flagship asset is the Sukari Gold Mine ("Sukari"),

Egypt's largest and first modern gold mine, as well as one of the

world's largest producing mines. Since production began in 2009

Sukari has produced over 5 million ounces of gold, and today has

6.0Moz in gold Mineral Reserves. Through its large portfolio of

exploration assets in Egypt and Côte d'Ivoire, Centamin is

advancing an active pipeline of future growth prospects, including

the Doropo project in Côte d'Ivoire, and has over 3,000km(2) of

highly prospective exploration ground in Egypt's Nubian Shield.

Centamin practices responsible mining activities, recognising

its responsibility to deliver operational and financial performance

and create lasting mutual benefit for all stakeholders through good

corporate citizenship, including but not limited to in 2022,

achieving new safety records (8 million hours LTI-free),

commissioning of the largest hybrid solar farm for a gold mine

(Sukari 36MW(DC) solar plant), sustaining a 96% Egyptian workforce

and a 68% Egyptian supply chain at Sukari.

FOR MORE INFORMATION please visit the website www.centamin.com

or contact:

Centamin plc FTI Consulting

Alexandra Barter-Carse, Head of Corporate Ben Brewerton / Sara Powell

Communications / Nick Hennis

investor@centaminplc.com +442037271000

centamin@fticonsulting.com

------------------------------------------- -----------------------------

Forward-looking Statements

This announcement (including information incorporated by

reference) contains "forward-looking statements" and

"forward-looking information" under applicable securities laws

(collectively, "forward-looking statements"), including statements

with respect to future financial or operating performance. Such

statements include "future-oriented financial information" or

"financial outlook" with respect to prospective financial

performance, financial position, EBITDA, cash flows and other

financial metrics that are based on assumptions about future

economic conditions and courses of action. Generally, these

forward-looking statements can be identified by the use of

forward-looking terminology such as "believes", "expects",

"expected", "budgeted", "forecasts" and "anticipates" and include

production outlook, operating schedules, production profiles,

expansion and expansion plans, efficiency gains, production and

cost guidance, capital expenditure outlook, exploration spend and

other mine plans. Although Centamin believes that the expectations

reflected in such forward-looking statements are reasonable,

Centamin can give no assurance that such expectations will prove to

be correct. Forward-looking statements are prospective in nature

and are not based on historical facts, but rather on current

expectations and projections of the management of Centamin about

future events and are therefore subject to known and unknown risks

and uncertainties which could cause actual results to differ

materially from the future results expressed or implied by the

forward-looking statements. In addition, there are a number of

factors that could cause actual results, performance, achievements

or developments to differ materially from those expressed or

implied by such forward-looking statements; the risks and

uncertainties associated with direct or indirect impacts of

COVID-19 or other pandemic, general business, economic,

competitive, political and social uncertainties; the results of

exploration activities and feasibility studies; assumptions in

economic evaluations which prove to be inaccurate; currency

fluctuations; changes in project parameters; future prices of gold

and other metals; possible variations of ore grade or recovery

rates; accidents, labour disputes and other risks of the mining

industry; climatic conditions; political instability; decisions and

regulatory changes enacted by governmental authorities; delays in

obtaining approvals or financing or completing development or

construction activities; and discovery of archaeological ruins.

Financial outlook and future-ordinated financial information

contained in this news release is based on assumptions about future

events, including economic conditions and proposed courses of

action, based on management's assessment of the relevant

information currently available. Readers are cautioned that any

such financial outlook or future-ordinated financial information

contained or referenced herein may not be appropriate and should

not be used for purposes other than those for which it is disclosed

herein. The Company and its management believe that the prospective

financial information has been prepared on a reasonable basis,

reflecting management's best estimates and judgments at the date

hereof, and represent, to the best of management's knowledge and

opinion, the Company's expected course of action. However, because

this information is highly subjective, it should not be relied on

as necessarily indicative of future results. There can be no

assurance that forward-looking statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information or

statements, particularly in light of the current economic climate

and the significant volatility, the risks and uncertainties

associated with the direct and indirect impacts of COVID-19.

Forward-looking statements contained herein are made as of the date

of this announcement and the Company disclaims any obligation to

update any forward-looking statement, whether as a result of new

information, future events or results or otherwise. Accordingly,

readers should not place undue reliance on forward-looking

statements.

LEI: 213800PDI9G7OUKLPV84

Company No: 109180

[1] Defined as Sukari growth capex funded from Treasury and

available for cost-recovery as per the Concession Agreement. The

FY23 estimated growth capex funded from treasury is US$53m

[2] Discretionary capital allocation options include future

project investment, portfolio optimisation, supplemental

shareholder returns

[3] The dates set out above are based on the Directors' current

expectations and may be subject to change. If any of the dates

should change, the revised dates will be announced by a regulatory

news announcement and will be available at www.centamin.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVNKPBDABKDQOB

(END) Dow Jones Newswires

July 26, 2023 02:01 ET (06:01 GMT)

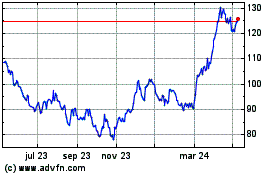

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

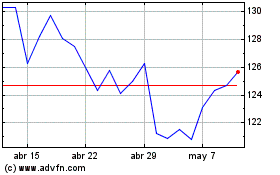

Centamin (LSE:CEY)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024