CentralNic Group PLC Transaction in Own Shares (1095A)

22 Mayo 2023 - 1:00AM

UK Regulatory

TIDMCNIC

RNS Number : 1095A

CentralNic Group PLC

22 May 2023

22 May 2023

CentralNic Group plc

("CentralNic" or the "Company")

Transaction in Own Shares

CentralNic Group plc (AIM: CNIC), the global internet company

that derives recurring revenue from privacy-safe, AI based

customer journeys that help online consumers make informed

choices, announces that on 19 May 2023 it purchased 268,037

ordinary shares of GBP0.001 each in the Company (the "Repurchased

Shares"), pursuant to the share buyback programme (the

"Buyback Programme") that was announced on 15 May 2023,

as follows (together the "Transaction"):

Date of purchase 19 May 2023

Number of ordinary shares purchased 268,037

Highest price paid per ordinary share 116 pence

Lowest price paid per ordinary share 116 pence

Volume weighted average price paid per

ordinary share 116 pence

Total Voting Rights

Following the Transaction, the issued share capital of

the Company remains unchanged at 288,660,084 and the Company

now holds 3,241,064 shares in treasury. The total voting

rights in the Company is now 285,419,020 which may be used

by shareholders as the denominator for the calculations

by which they will determine if they are required to notify

their interest in, or a change to their interest in, CentralNic

under the FCA's Disclosure Guidance and Transparency Rules.

The Company will make further announcements in due course

following the completion of any further purchases pursuant

to the Buyback Programme.

In accordance with Article 5(1)(b) of the Market Abuse

Regulation (EU) No 596/2014 details of the purchase of

its own ordinary shares by CentralNic, which were all executed

through the Company's broker, Zeus Capital Limited, are

set out below:

Schedule of Purchases:

Shares purchased: CentralNic Group plc (ISIN: GB00BCCW4X83)

Date of purchases: 19 May 2023

Aggregate information:

Aggregated Volume Volume-weighted average Venue

price (pence)

268,037 116 London Stock Exchange

Individual transactions:

Volume Price Time

268,037 116.00 pence 09:35

UK

CentralNic Group

plc +44 (0) 203 388 0600

Michael Riedl, Chief Executive Officer

William Green, Chief Financial Officer

Zeus (NOMAD and Joint Broker)

Nick Cowles / Jamie Peel / James Edis

(Investment Banking) +44 (0) 161 831 1512

Dominic King (Corporate Broking) +44 (0) 203 829 5000

Berenberg (Joint Broker) +44 (0) 203 207 7800

Mark Whitmore / Richard Andrews / Alix

Mecklenburg-Solodkoff

SEC Newgate (for Media) +44 (0) 203 757 6880

Bob Huxford / Alice Cho / Harry Handyside centralnic@secnewgate.co.uk

About CentralNic Group Plc

CentralNic is a leading global internet solutions company

that operates in two highly attractive markets: high-growth

digital advertising (Online Marketing segment) and domain

name management solutions (Online Presence segment). The

company's Online Marketing segment creates privacy-safe

and AI-generated online consumer journeys that convert

general interest online media users into confident high

conviction consumers through advertorial and review websites.

The Online Presence segment is a critical constituent of

the global online presence and productivity tool ecosystem,

where CentralNic serves as the primary distribution channel

for a wide range of digital products. The company's high-quality

earnings come from subscription recurring revenues in the

Online Presence segment and revenue share on rolling utility-style

contracts in the Online Marketing segment. The Online Marketing

market has a long-term average growth rate of +20%, making

it an attractive growth market. With a proven business

model, scalable technology, and a track record of delivering

accretive M&A, CentralNic has become a global consolidator.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

POSBFLFLXELBBBL

(END) Dow Jones Newswires

May 22, 2023 02:00 ET (06:00 GMT)

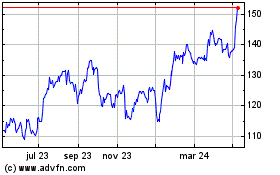

Team Internet (LSE:TIG)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

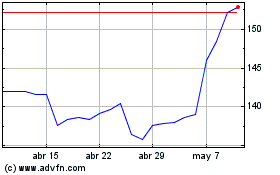

Team Internet (LSE:TIG)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024