TIDMDEVO

RNS Number : 3008Z

Devolver Digital, Inc.

12 May 2023

12 May 2023

Devolver Digital, Inc.

("Devolver Digital", "Devolver" or the "Company", and the

Company together with all of its subsidiary undertakings "the

Devolver Group", or "Group")

Treasury Share Admission and Update

Devolver Digital, an award-winning digital publisher and

developer of independent ("indie") video games, announces that it

has applied for the admission to trading on AIM ("Admission") of

34,668,475 shares of common stock, $0.0001 par value each

("Shares"), which the Company holds in treasury (the "Treasury

Shares"). The Company is applying for Admission of the Treasury

Shares in order to facilitate the exercise of options and to reduce

the administrative burden in satisfying LTIP and other awards. The

Company may also use the Treasury Shares for other corporate

purposes at its discretion.

The Admission of the Treasury Shares will not increase the total

voting rights outstanding in the Company. It is expected that

Admission will become effective on or around 16 May 2023.

As announced on 11 May 2022, the Company may transfer Treasury

Shares to satisfy the exercise of options under the 2017 Equity

Incentive Plan. The Company has also previously utilised Treasury

Shares to satisfy 2022 LTIP Awards. A complete table of Treasury

Share transfers is set out below:

Date Number of Number of Number of Number of

Treasury Shares Treasury Shares Treasury Shares Shares in

Prior to Transfer Transferred held by the Issue and

by the Company Company Following Outstanding

to Satisfy the Transfer Following

the Exercise the Transfer

of Options

or LTIP Awards

19/05/2022 37,244,200 679,271 36,564,929 442,935,987

------------------- ----------------- ------------------- --------------

09/06/2022 36,564,929 430,362 36,134,567 443,366,349

------------------- ----------------- ------------------- --------------

01/09/2022 36,134,567 175,000 35,959,567 443,541,349

------------------- ----------------- ------------------- --------------

08/09/2022 35,959,567 110,833 35,848,734 443,652,182

------------------- ----------------- ------------------- --------------

13/10/2022 35,848,734 144,900 35,703,834 443,797,082

------------------- ----------------- ------------------- --------------

20/10/2022 35,703,834 9,513 35,694,321 443,806,595

------------------- ----------------- ------------------- --------------

03/11/2022 35,694,321 81,667 35,612,654 443,888,262

------------------- ----------------- ------------------- --------------

08/12/2022 35,612,654 18,990 35,593,664 443,907,252

------------------- ----------------- ------------------- --------------

15/12/2022 35,593,664 200,000 35,393,664 444,107,252

------------------- ----------------- ------------------- --------------

16/12/2022 35,393,664 455,058 34,938,606 444,562,310

------------------- ----------------- ------------------- --------------

23/12/2022* 34,938,606 166,840 34,771,766 444,729,150

------------------- ----------------- ------------------- --------------

12/01/2023 34,771,766 11,666 34,760,100 444,740,816

------------------- ----------------- ------------------- --------------

26/01/2023 34,760,100 91,625 34,668,475 444,832,441

------------------- ----------------- ------------------- --------------

*previously described as "new" common shares in the announcement

published on 16(th) December 2022, these shares were not newly

issued and were a transfer of treasury shares

Following the transfer of 2,575,725 treasury shares that are

outlined in the table above, the Company holds 34,668,475 shares in

treasury.

Any future transfer of Treasury Shares will be announced without

delay.

Following Admission, the Company's issued and outstanding share

capital is unchanged and comprises 444,832,441 Shares (excluding

Shares held in treasury) and this number may be used by

shareholders in the Company as the denominator for the calculations

by which they will determine if they are required to notify their

interest in, or a change in their interest in, the share capital of

the Company under the FCA's Disclosure Guidance and Transparency

Rules.

Enquiries :

Devolver Digital, Inc. ir@devolverdigital.com

Harry Miller, Executive Chairman

Douglas Morin, Chief Executive Officer

Daniel Widdicombe, Chief Financial Officer

Zeus (Nominated Adviser and Sole Broker) +44 (0)20 3829 5000

Nick Cowles, Jamie Peel, Matt Hogg (Investment

Banking)

Ben Robertson (Equity Capital Markets)

FTI Consulting devolver@fticonsulting.com

Jamie Ricketts / Dwight Burden / Valerija

Cymbal / Usama Ali +44 (0)20 3727 1000

Devolver Digital overview

Devolver Digital is an award-winning video games publisher in

the indie games space with a balanced portfolio of third-party and

own-IP. The Company has an emphasis on premium games and has a back

catalogue of over 100 titles, with more than 30 new titles in the

pipeline. Through acquisitions, Devolver now has its own-IP

franchises, in-house studios developing first-party IP and two

publishing brands. The Company is registered in Wilmington,

Delaware, USA.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUUSUROVUVAAR

(END) Dow Jones Newswires

May 12, 2023 10:00 ET (14:00 GMT)

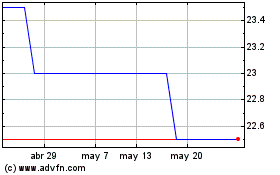

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025