TIDMDEVO

RNS Number : 4422N

Devolver Digital, Inc.

25 September 2023

25 September 2023

The information contained within this announcement is deemed by

the company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014 as it forms part of the

domestic law of the United Kingdom by virtue of the European Union

(Withdrawal) Act 2018 (as amended) ("UK MAR"). Upon the publication

of this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

Devolver Digital, Inc.

("Devolver Digital", "Devolver" or the "Company", and the

Company together with all of its subsidiary undertakings "the

Group")

Unaudited results for the six months ended 30 June 2023

Healthy pipeline for new releases in Q4 2023 and 2024

On track for EBITDA break-even in 2023 and return to growth in

2024

Devolver Digital, an award-winning digital publisher and

developer of independent ("indie") video games, announces its

unaudited results for the six months ended 30 June 2023. All

figures relate to this period unless otherwise stated.

Prioritising quality to unlock long-term value

o As announced in the trading update on 3 (rd) August 2023, high

potential titles have been delayed to 2024 to ensure that they have

the time, effort and support to succeed.

o As a result, 1H 2023 was an unusually quiet release period

with only 4 new titles, of which only one was a major title, Terra

Nil (1H 2022: 7 title releases).

o As also previously announced, Devolver declined subscription

deal proposals that undervalued the titles' value and revenue

opportunities in 2023 and 2024, resulting in lower subscription

revenues.

o Back catalogue revenues were up 10%, accounting for 87% of

total revenues (1H 2022: 64%), reflecting the lower new title

contribution and the continued strong performance of Cult of the

Lamb.

o Average 79 Metacritic score for released titles year to date (76 average score for 1H 2023).

o Steady recovery at Good Shepherd; announced tie-up with Rebellion for 2000 AD IP.

Financial performance reflects unusually quiet 1H release

schedule, as expected

o As flagged, 1H 2023 financial performance has been impacted by

a quiet release schedule: revenues down 17%; Normalised Gross

Profit down 51%.

o As expected, Normalised Adjusted EBITDA loss of US$3.5m (1H 2022: US$6.8m profit).

o Statutory net loss of US$10.1m (1) (1H 2022: US$16.6m loss).

o Cash of US$64.8m at 30 June 2023 (1H 2022: US$74.2m),

following c.US$7.2m purchase of shares in the market for the

Employee Benefit Trust.

o Cost-saving initiatives underway to protect margin and strong net cash position.

Current trading and outlook

o Back catalogue continues to be driven by Cult of the Lamb post

1H 2023 period-end.

o Targeted marketing and the full return of physical gaming

events are expected to help drive engagement and maintain quality

for upcoming titles.

o 11 new titles expected in 2023, including nine titles

published directly by Devolver.

o Seven releases scheduled for 2H 2023 including major titles

Wizard With A Gun and The Talos Principle 2, as well as Gunbrella,

KarmaZoo and Hellboy: Web of Wyrd.

o On track to meet previous guidance of break-even profitability

in 2023, return to profitable growth in 2024 and acceleration in

2025.

o Healthy pipeline of more than 30 new titles due for release in the next three years.

Harry Miller, Executive Chairman of Devolver, said:

"The first half of 2023 was a reset for Devolver, with delays to

new releases as we prioritise the quality and long-term potential

of major titles scheduled for the second half of 2023 and 2024.

Devolver's DNA is to commit relatively low spend on high quality

titles that stand the test of time. We look forward to returning to

our normal cadence of releases in the rest of 2023 and 2024 with

big titles to come such as Wizard With A Gun and The Talos

Principle 2, as well as The Plucky Squire and Baby Steps.

As a result of our busy upcoming release schedule, steps to

improve our return from our back catalogue and active management of

our cost base, Devolver is on track to meet its previous guidance

of break-even EBITDA profitability in 2023, a return to profitable

growth in 2024 and then an acceleration in 2025."

About Devolver Digital

Devolver is an award-winning video games publisher in the indie

games space with a balanced portfolio of third-party and own-IP.

Devolver has an emphasis on premium games and has published more

than 100 titles, with more than 30 titles in the pipeline scheduled

for release over the next three years. Devolver has in-house

studios developing first-party IP titles and a complementary

publishing brand. Devolver is registered in Wilmington, Delaware,

USA.

Notes:

(1) Including non-cash impact of US$3.9m of share-based payments.

Enquiries

Devolver Digital, Inc. ir@devolverdigital.com

Harry Miller, Executive Chairman

Douglas Morin, Chief Executive Officer

Daniel Widdicombe, Chief Financial Officer

+44 (0)20 3829

Zeus (Nominated Adviser and Sole Broker) 5000

Nick Cowles, Jamie Peel, Alexander Craig

(Investment Banking)

Ben Robertson (Equity Capital Markets)

FTI Consulting (Communications Adviser) devolver@fticonsulting.com

Jamie Ricketts / Dwight Burden / Valerija +44 (0)20 3727

Cymbal / Usama Ali 1000

OPERATING REVIEW

1H 2023 - fewer title releases than previous period

Devolver released 4 new titles in 1H 2023, including Devolver

Tumble Time, Sludge Life 2 and Terra Nil. Terra Nil was the only

major release in 1H 2023, and consequently revenue fell 17% in the

first half compared to 1H 2022 which had 7 title releases. As a

result, back catalogue accounted for an unusually high 87% of total

1H revenues in the period.

Despite the revenue decline there have been several positive

developments in 1H 2023, including our publishing subsidiary Good

Shepherd (GSE) posting a steady recovery following the

restructuring it underwent early in the year, on track to reach

EBITDA break-even by 4Q. GSE recently announced a ground-breaking

partnership with Rebellion (Sniper Elite) to develop and publish

video game adaptations based on stories from the beloved 2000 AD

universe, the home of Judge Dredd, Rogue Trooper, ABC Warrior and

more, as well as Rebellion's other comic IP, including Roy of the

Rovers and Battle Action. Separately, Cult of the Lamb back

catalogue sales have continued to out-perform expectations from the

start of 2023.

Several market events held in 1H 2023 have also added to the

excitement about our future releases for 2024 and 2025. Sony held

its PlayStation Showcase 2023 in May, featuring 36 games in total

including Devolver titles The Talos Principle 2, The Plucky Squire

and Neva . The Summer Games Fest 2023 included Devolver Direct, in

which several new titles were introduced or updated including Baby

Steps , Wizard with a Gun, The Talos Principle 2, and Human Fall

Flat 2 , the highly anticipated sequel to Human Fall Flat which

sold over 40 million copies worldwide since release in July 2016.

Devolver Direct enjoyed record viewership numbers and was included

in numerous broadcasts archived on YouTube with a combined 4.68

million views just one week post broadcast. Finally, Steam's Next

Fest saw the Wizard with a Gun demo post the 5 (th) highest number

of downloads by players out of over 1,000 demos featured in the

event. All these developments bode well for the outlook in 2024 and

beyond.

2022 hit release supports back catalogue

The August 2022 hit release Cult of The Lamb has provided strong

revenue momentum continuing into 1H 2023, the only 2022 release to

do so given that 1H 2022 releases did not perform as expected. The

contribution from Cult of The Lamb was the principal driver for a

10% increase in back catalogue revenues in 1H 2023 compared to the

previous year period. BAFTA-winning Inscryption, an October 2021

release, also continued to perform well in the first six months of

2023. Other back catalogue titles have seen weaker performance in

1H 2023 compared to 1H 2022. Devolver is working hard to stimulate

back catalogue sales through a combination of new ports, additional

DLC, strategic marketing and strategic pricing mechanisms.

Our back catalogue includes all titles released in or prior to

the last financial year (2022 or earlier). As of 31 December 2022,

the back catalogue consists of 109 titles, including numerous indie

cult classics, supporting highly diversified revenues.

Operating expense containment, selective co-funding on game

development

A group-wide exercise to reduce overall expenses is under way.

Rental expenses, out-sourced professional fees and other operating

and administration fees are all being optimised for efficiency with

continual assessment for cost savings. Separately, as part of the

directional move towards more participation in the live services

area, we will seek co-funding for larger titles where partners can

bring strategic value.

FINANCIAL REVIEW

Unaudited first half 2023 results to June 30 2023

The unaudited financial results included in this announcement

cover the Group's combined activities for the six months ended 30

(th) June 2023 (prepared in accordance with applicable

International Financial Reporting Standards, "IFRS").

Normalised Adjusted results

The following refers to Normalised Adjusted results, as

presented in the financial statements contained within this

release. Normalised Adjusted results exclude any one-time

exceptional items during the respective half-year periods.

Normalised EBITDA and Normalised Adjusted EBITDA results are not

intended to replace statutory results and are prepared to provide a

more comparable indication of the Group's core business performance

by removing the impact of certain items including exceptional items

(material and non-recurring), and other, non-trading, items that

are reported separately. These results have been presented to

provide users with additional information and analysis of the

Group's performance, consistent with how the Board monitors

results. Further details of adjustments are given in Notes 3 and 4

to the condensed financial statements contained within this

semi-annual results release.

P&L results and margins

Devolver Digital's first half 2023 performance was muted due to

a lower number of title releases (4) compared to the previous

period (7). Revenues of US$43.9 million fell 17% year-over-year.

Normalised gross profit was US$9.4 million, a decline of 51%

year-over-year. Normalised Adjusted EBITDA turned to a loss of

US$3.5 million from US$6.8 million profit in 1H 2022.

Normalised gross profit margin decreased to 21.4% in the first

half of 2023, down from 35.8% in the year-earlier period. Gross

margin was compressed due to the absence of first-party IP and

other new releases in recoup during the period, resulting in the

royalty pay-out mix being heavily weighted towards third party

titles in 1H 2023. This compares to 1H 2022 when new first-party IP

and other releases were cushioned while the titles were still in

recoup (before royalties are usually paid out).

Normalised Adjusted EBITDA margins were depressed at negative

7.9% in the first half of 2023, compared to positive margin of

12.9% the previous year. The compression in 1H 2023 gross profit

had a direct flow through effect to impact Normalised Adjusted

EBITDA, despite successfully containing cash operating expenses at

similar levels as the 1H of 2022.

Employee Benefit Trust (EBT)

Devolver established an Employee Benefit Trust (EBT) in May 2022

to facilitate stock option exercise by employees and contractors

who were awarded 2017 Stock Option plan stock options and stock

units vesting under the 2022 Long Term Incentive Plan (LTIP). The

EBT is a Jersey-incorporated Trust enabling option exercise and

share settlement off-market without impacting market liquidity.

Share purchases by the EBT are funded by way of a loan from

Devolver which can request settlement of the loan at any time in

future. The shares held by the EBT are consolidated within

Devolver's share capital balance.

Cash Balances

Cash holdings at end of June 2023 were US$64.8 million, a

reduction of US$14.7 million compared to end of 2022's level of

US$79.5 million. The reduction in cash balances during the period

was primarily due to: 1) lower operating cash generation in the

first half combined with the US$13.6 million ongoing investment in

game development during the period; 2) approximately US$7 million

provided to the EBT for the market purchase of c. 19m shares.

CURRENT TRADING OUTLOOK

As noted in our August 2023 update, expected performance for

2023 will be impacted by three key factors: delays to new title

releases, a reduction in revenue from subscription deals and

relative weakness from our back catalogue with the exception of a

few outperforming titles.

Our busy release schedule for Q4 2023 features major titles

Wizard with a Gun and The Talos Principle 2, among others. Waiting

until titles are ready has led to delays as we prioritise our

strategy to maximise the appeal and success of new titles by

increasing investment on development, quality control and

marketing. Giving our titles every chance to succeed is critical to

our long-term growth. As previously indicated, titles such as The

Plucky Squire, which has been tracking well with audiences, will

now be released in 2024 alongside other titles previously earmarked

for release in 2023 such as Anger Foot, Pepper Grinder and Stick It

to the Stickman.

After a period of strong growth in subscription deals in 2021

and 2022, we expect the trend of reduced revenues from subscription

deals to continue into 2024. We expect to continue to turn down

subscription deal proposals that undervalue the titles' value and

revenue opportunity in 2023 and 2024.

Back catalogue sales have been softer following the weaker

performance of three key title releases in 2022, except for Cult of

the Lamb and Inscryption which have continued to perform strongly,

and a weaker overall economic environment.

As previously indicated in August 2023, we expect Group

Normalised Adjusted EBITDA to be at least break-even in 2023,

before a return to growth in 2024 and an acceleration in 2025.

Our momentum, robust balance sheet with US$65m in cash at June

2023, deep pipeline and strong contribution from extensive back

catalogue all support our confidence of further progress in 2023

and in the future. We have a proven strategy that has delivered

success for the last 13 years. The Board believes that we are well

positioned for future success, and we look forward to reporting on

our progress in the year ahead.

Harry Miller

Chairman

Consolidated Statement of Profit or Loss

Unaudited Unaudited

6 months 6 months ended Year ended

ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

REVENUES

Revenues 43,877 53,003 134,565

TOTAL REVENUES 43,877 53,003 134,565

COST OF SALES

Royalty expense (22,167) (22,015) (61,448)

Development expense (2,878) (1,704) (3,856)

Marketing (3,354) (3,912) (9,148)

Amortisation of intangible

assets (5,150) (7,112) (14,788)

Impairment of intangible

assets (934) - (22,822)

TOTAL COST OF SALES (34,483) (34,743) (112,062)

GROSS PROFIT 9,394 18,260 22,503

ADMINISTRATIVE EXPENSES

Overhead expenses (12,612) (12,637) (25,523)

Stock compensation expense (3,905) (11,477) (19,621)

Amortisation of non-current

assets (1,863) (3,761) (5,292)

Impairment of non-current

assets - - (69,973)

TOTAL ADMINISTRATIVE EXPENSES (18,380) (27,875) (120,409)

Other (loss) / income (591) 5 (549)

OPERATING PROFIT/(LOSS) (9,577) (9,610) (98,455)

Interest income 897 26 364

Interest expense (198) - -

Foreign exchange gains

/ (losses) 239 (2,007) (673)

PRE-TAX PROFIT/(LOSS) (8,639) (11,591) (98,764)

Income tax (expense) /

credit (1,426) (5,019) 7,264

Profit/(Loss) for the

period (10,065) (16,610) (91,500)

Equity holders of the parent (10,042) (16,560) (91,475)

Non-Controlling Interests (23) (50) (25)

PROFIT/(LOSS) FOR THE

PERIOD (10,065) (16,610) (91,500)

Basic earnings per share

($) (0.023) (0.037) (0.206)

Diluted earnings per

share ($) (0.023) (0.037) (0.206)

6 months 6 months Year ended

ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

Non-IFRS measures

Adjusted EBITDA* (3,809) 5,627 (73,378)

Normalised Adjusted

EBITDA (3,469) 6,818 13,914

Normalised Adjusted

EBITDA excluding performance-related

impairments (2,535) 6,818 23,210

* Adjusted EBITDA is a non-IFRS measure and is defined as

earnings before interest, tax, depreciation, amortisation (but not

taking out amortisation of capitalised software development costs)

and share-based payment expenses.

Consolidated Statement of Comprehensive Income

Unaudited Unaudited

6 months 6 months Year ended

ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

Loss for the period (10,065) (16,610) (91,500)

Other comprehensive

income/(loss): Items

that will be reclassified

subsequently to profit

or loss

Exchange differences

on translation of foreign

operations 33 (964) (477)

Total comprehensive

income/(loss) for the

period (10,032) (17,574) (91,977)

Total comprehensive

income/(loss) is attributable

to:

Equity holders of the

parent (10,009) (17,524) (91,952)

Non-controlling interests (23) (50) (25)

---------- ---------- -----------

(10,032) (17,574) (91,977)

Consolidated Statement of Financial Position

Unaudited Unaudited

6 months 6 months Year

ended ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

NON-CURRENT ASSETS

Goodwill 19,416 66,820 19,153

Intellectual property 24,734 49,640 25,782

Software development

costs 47,622 52,960 40,136

Total intangibles 91,772 169,420 85,071

Tangible assets 91 237 174

Employee loans 456 537 995

Deferred tax assets 10,598 - 10,088

TOTAL NON-CURRENT ASSETS 102,917 170,194 96,328

CURRENT ASSETS

Accounts receivable 12,173 19,452 16,813

Employee loans 406 - -

Cash at bank and in hand 64,761 74,176 79,493

Prepaid income tax 3,905 4,705 2,185

TOTAL CURRENT ASSETS 81,245 98,333 98,491

TOTAL ASSETS 184,162 268,527 194,819

CURRENT LIABILITIES

Trade and other payables 17,699 13,956 19,149

Deferred revenue 2,402 5,047 2,091

Current tax payable 4,158 - 262

TOTAL CURRENT LIABILITIES 24,259 19,003 21,502

NON-CURRENT LIABILITIES

Deferred tax liabilities 1,046 9,316 1,045

Long-term liabilities - 1,567 -

TOTAL NON-CURRENT LIABILITIES 1,046 10,883 1,045

TOTAL LIABILITIES 25,305 29,886 22,547

CAPITAL AND RESERVES

Share capital 45 44 45

Share premium 146,062 120,061 146,044

Retained Earnings 49,966 120,942 56,259

Translation reserve -

OCI (2,234) (2,433) (2,267)

Capital Redemption Reserve (34,857) - (27,707)

CAPITAL AND RESERVES

TO OWNERS 158,982 238,614 172,374

Non-controlling interest (125) 27 (102)

TOTAL EQUITY 158,857 238,641 172,272

TOTAL EQUITY AND LIABILITIES 184,162 268,527 194,819

Consolidated Statement of Changes in Equity

Capital Total Non-

Share Share Redemption Translation Retained Devolver controlling Total

capital premium Reserve Reserve earnings equity interest equity

US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at

1 January 2022 44 121,588 - (986) 126,184 246,830 (77) 246,753

Prior year

adjustment - - - - (159) (159) 154 (5)

Loss for the

period - - - - (16,560) (16,560) (50) (16,610)

Currency

translation

differences - - - (1,447) - (1,447) - (1,447)

Transactions

with owners

in their capacity

as owners:

Exercise of

share options

via EBT - (1,527) - - - (1,527) - (1,527)

Share-based

payments - - - - 11,477 11,477 - 11,477

Total transactions

with owners - (1,527) - - 11,477 9,950 - 9,950

Balance at

30 June 2022 44 120,061 - (2,433) 120,942 238,614 27 238,641

Balance at

1 January 2022 44 121,588 - (986) 126,184 246,830 (77) 246,753

Loss for the

period - - - - (91,475) (91,475) (25) (91,500)

Currency

translation

differences - - - (1,281) - (1,281) - (1,281)

Other movements - 383 - - (1) 382 - 382

Transactions

with owners

in their capacity

as owners

Issue of shares - 165 - - - 165 - 165

Exercise of

share options 1 630 - - - 631 - 631

Reclassification

of treasury

shares b/f - 25,837 (25,837) - - - - -

Treasury share

repurchase - - (2,500) - (2,500) - (2,500)

Share-based

payments - - - - 19,622 19,622 - 19,622

Transfers - (2,559) 630 - 1,929 - - -

Total transactions

with owners 1 24,073 (27,707) - 21,551 17,918 - 17,918

Balance at

31 December

2022 45 146,044 (27,707) (2,267) 56,259 172,374 (102) 172,272

Balance at 1

January

2023 45 146,044 (27,707) (2,267) 56,259 172,374 (102) 172,272

Loss for the

period - - - - (10,042) (10,042) (23) (10,065)

Currency

translation

differences - - - 33 - 33 - 33

Transactions

with

owners in

their

capacity as

owners

Share buyback

transactions - - (7,150) - - (7,150) - (7,150)

Exercise of

share

options - 18 - - - 18 - 18

Share-based

payments

charge - - - - 3,905 3,905 - 3,905

Share-based

payments

recycle of

charge - - - - (156) (156) - (156)

Total

transactions

with owners - 18 (7,150) - 3,749 (3,383) - (3,383)

Balance at 30

June

2023 45 146,062 (34,857) (2,234) 49,966 158,982 (125) 158,857

Statement of Cash Flows

Unaudited Unaudited

6 months 6 months Year ended

ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

Operating activities

Cash inflow / (outflow)

from operations (7,367) (14,759) (100,780)

Amortisation, depreciation

and impairments 7,947 10,873 112,376

Share based payments 3,905 11,477 19,621

Interest payable 198 - -

Net taxation payable (361) - (2,062)

Net cashflow from

operating activities 4,322 7,591 29,155

Investing activities

Purchase of intangible

assets (600) - -

Investment in software

development (12,570) (15,631) (32,641)

Purchase of tangible

assets - (5) (66)

Net cashflow from

investing activities (13,170) (15,636) (32,707)

Financing activities

Net change in borrowings/

others - (510) -

Share capital issuance

including option

exercise 18 (1,527) 795

Share repurchase

transactions (7,150) - (2,514)

Interest received 893 26 362

Interest paid - - (2)

Net cashflow from (1,359

financing activities (6,239) (2,011) )

Net cashflow (15,087) (10,056) (4,911)

At 1 January / 1

July 79,493 86,239 86,239

FX 355 (2,007) (1,835)

Closing cash 64,761 74,176 79,493

Note 1: Basis of preparation and consolidation

These condensed financial statements have been prepared in

accordance with the recognition and measurement requirements of

International Accounting Standard 34 Interim Financial Reporting.

In the opinion of management, all adjustments (consisting of normal

recurring accruals) considered necessary for fair presentation have

been included. The condensed consolidated financial statements as

at and for the six months ended June 30, 2023 have been prepared on

the same basis as the audited annual financial statements.

In May 2022 Devolver established an Employee Benefit Trust (EBT)

to facilitate settlement of employee stock options granted under

the 2017 Stock Option Plan and stock awards granted under the 2022

Long Term Incentive Plan. The EBT is a Jersey-based Trust and the

Trustees act to the benefit of the employees. The accounting

treatment determined that Devolver controls the EBT and must

consolidate the EBT within its consolidated financial

statements.

Most transactions eliminate upon consolidation, with the

exception of the purchase by the EBT of Devolver shares from

employees and shares issued to employees who are exercising options

out of the Capital Redemption Reserve. These are recognised at cost

as "Issued shares held within the Group". These shares are included

within the Capital Redemption Reserve, a separate reserve within

equity. The Devolver shares held by the EBT are not revalued. When

the EBT sells the shares to a third party, any gains or losses are

recognised directly in equity.

Operating results for the six months ended 30 June 2023 are not

necessarily indicative of the results that may be expected for the

year ending 31 December 2023. For further information, refer to the

consolidated financial statements and footnotes thereto included in

the Group's annual report for the year ended 31 December 2022.

The Directors are confident that the Group will remain cash

positive and will have sufficient funds to continue to meet its

liabilities as they fall due for a period of at least 12 months

from the date of this first half 2023 announcement and have

therefore prepared this unaudited semi-annual announcement on a

going concern basis.

Tax charged within 6 months ended 30 June 2023 has been

calculated by applying the effective rate of tax which is expected

to apply to the Group for the year ending 31 December 2022 as

required by IAS 34 'Interim Financial Reporting'. The effective

rate of (16.2)% varies from the statutory rate of 21% due to: a)

permanent book to tax differences related to stock compensation

deductions for foreign entities, which is not deductible for US

income taxes, and; b) US State tax liabilities.

The financial presentation in this release should be read in

conjunction with the notes to the consolidated financial statements

as at and for the first half ended 30 June 2023, as contained

within this release.

These preliminary unaudited financial statements were approved

by the Board of Directors on 24 September 2023.

Note 2: Earnings Per Share

6 months 6 months Year ended

ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

Profit/(Loss) attributable

to the owners of the company (10,042) (16,560) (91,475)

Weighted average number

of shares 444,818,506 442,464,268 443,090,183

Basic earnings per share

($) (0.023) (0.037) (0.206)

Profit/(Loss) attributable

to the owners of the company (10,042) (16,560) (91,474)

Weighted average number

of shares 444,818,506 442,464,268 443,090,183

Dilutive effect of share - - -

options

------------ ------------ ------------

Weighted average number

of diluted shares 444,818,506 442,464,268 443,090,183

Diluted earnings per

share ($) (0.023) (0.037) (0.206)

Note 3: Normalised Adjusted Results*

6 months 6 months Year ended

ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

Revenue

Reported Revenue 43,877 53,003 134,565

Reported Revenue growth -17.2% 14.1% 37.1%

Gross Profit

Reported Gross Profit 9,394 18,260 22,503

Reported Gross Profit

margin 21.4% 34.5% 16.7%

Normalised Gross Profit

adjustment - 721 23,829

Normalised Gross Profit 9,394 18,981 46,332

Normalised Gross Profit

margin 21.4% 35.8% 34.4%

Adjusted EBITDA

Reported Adjusted EBITDA (3,809) 5,627 (73,378)

Reported Adjusted EBITDA

margin -8.7% 10.6% (54.5%)

Normalised Adjusted

EBITDA adjustment 340 1,191 87,292

Normalised Adjusted

EBITDA (3,469) 6,818 13,914

Normalised Adjusted

EBITDA margin -7.9% 12.9% 10.3%

* Normalised Adjusted EBITDA makes the following adjustments: it

excludes 1) stock compensation (share-based payment) expenses and

revaluation of contingent consideration; 2) one-time expenses and

other non-recurring items; 3) amortisation of IP (but does not

exclude amortisation of capitalised software development costs),

and 4) impairment.

Note 4: Reconciliations to Adjusted EBITDA

6 months 6 months Year ended

ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

Operating Profit/(Loss) (9,577) (9,610) (98,455)

Share-based payment expenses 3,905 11,477 19,621

Amortisation and depreciation

of non-current assets 1,863 3,761 5,456

Adjusted EBITDA (3,809) 5,627 (73,378)

6 months 6 months Year ended

ended ended

30-Jun-23 30-Jun-22 31-Dec-22

US$'000 US$'000 US$'000

Adjusted EBITDA (3,809) 5,627 (73,378)

Net Exceptional income from

IP disposal & sale of publishing

rights - - (214)

Non-recurring, one-time

expenses 340 470 1,616

Impairments & others - 721 85,890

---------- ---------- -----------

Normalised Adjusted EBITDA (3,469) 6,818 13,914

Performance-related impairments 934 - 9,296

Normalised Adjusted EBITDA

excluding performance related

impairments (2,535) 6,818 23,210

Note 5: Intangible Assets

Intangible Assets Goodwill Intellectual Software Total

Property Development

US$'000 US$'000 US$'000 US$'000

Cost

As at 1 January 2022 66,820 59,817 61,396 188,033

Additions - - 32,641 32,641

As at 31 December 2022 66,820 59,817 94,037 220,674

Additions 263 815 13,570 14,648

As at 30 June 2023 67,083 60,632 107,607 235,322

Amortisation and impairment

As at 1 January 2022 - 6,435 16,955 23,390

Amortisation charge for

the period - 5,293 14,788 20,081

Impairment 47,667 22,307 22,158 92,132

As at 31 December 2022 47,667 34,035 53,901 135,603

Amortisation charge for

the period - 1,863 5,150 7,013

Impairment - - 934 934

As at 30 June 2023 47,667 35,898 59,985 143,550

Carrying amount

As at 1 January 2022 66,820 53,382 44,441 164,643

As at 31 December 2022 19,153 25,782 40,136 85,071

As at 30 June 2023 19,416 24,734 47,622 91,772

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEEESLEDSELU

(END) Dow Jones Newswires

September 25, 2023 02:00 ET (06:00 GMT)

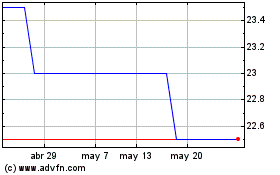

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025