TIDMFIF

RNS Number : 7406T

Finsbury Food Group PLC

16 November 2023

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION

FOR IMMEDIATE RELEASE

16 November 2023

RECOMMED ACQUISITION

of

FINSBURY FOOD GROUP PLC ("FINSBURY")

by

FRISBEE BIDCO LIMITED ("BIDCO")

to be effected by means of a scheme of arrangement

under Part 26 of the Companies Act 2006

SCHEME OF ARRANGEMENT BECOMES EFFECTIVE

On 20 September 2023, the boards of directors of Finsbury and

Bidco announced that they had reached agreement on the terms of a

recommended offer to be made by Bidco for the entire issued and to

be issued ordinary share capital of Finsbury (other than the

Finsbury Shares held by funds managed by DBAY) (the " Acquisition

"). The Acquisition is being effected by means of a

Court-sanctioned scheme of arrangement under Part 26 of the

Companies Act 2006 (the " Scheme ").

On 14 November 2023, Finsbury announced that the Court had

sanctioned the Scheme to effect the Acquisition.

Finsbury is pleased to announce that the Scheme has now become

Effective in accordance with its terms, following delivery of the

Court Order to the Registrar of Companies earlier today and the

entire issued share capital of Finsbury is now owned or controlled

by Bidco. The Acquisition has therefore completed.

Settlement of Consideration

Under the terms of the Scheme, subject to any valid election for

the Alternative Offer, holders of Scheme Shares on the register of

members of Finsbury at the Scheme Record Time, being 6.00 p.m.

(London time) on 15 November 2023, will be entitled to receive 110

pence for every Scheme Share held. Cheques will be dispatched to

Scheme Shareholders holding Scheme Shares in certificated form and

the CREST accounts of Scheme Shareholders holding Scheme Shares in

uncertificated form will be credited, and/or certificates issued in

respect of the Alternative Offer, in each case within 14 days of

today's date.

Suspension and cancellation of listing and trading

Dealings in Finsbury Shares were suspended with effect from 7.30

a.m. (London time) today. Applications have been made to the London

Stock Exchange in relation to the cancellation of the admission to

trading of Finsbury Shares on the AIM market of the London Stock

Exchange, which is expected to take place at 7.00 a.m. (London

time) on 17 November 2023.

Board Changes

As the Scheme has now become Effective, Finsbury announces that

Peter Baker, Bob Beveridge, Raymond Duignan and Marnie Millard have

tendered their resignations as directors of Finsbury and will step

down from the Board of Finsbury effective from today's date.

Dealing Disclosures

The Company is no longer in an "Offer Period" as defined in the

Code and accordingly the dealing disclosure requirements previously

notified to investors no longer apply.

Capitalised terms used in this announcement shall, unless

otherwise defined, have the same meanings as set out in the Scheme

Document, a copy of which is available, subject to certain

restrictions relating to persons in Restricted Jurisdictions, on

Finsbury's website at:

https://finsburyfoods.co.uk/investor-relations/offer.

Enquiries

Finsbury Tel: +44 (0)29 2035 7500

John Duffy

Steve Boyd

Oppenheimer (Financial adviser under Rule 3 of the Code to Finsbury) Tel: +44 (0)20 7220 1900

James Murray

Anthony Sills

Panmure Gordon (Nomad and corporate broker to Finsbury) Tel: +44 (0)20 7886 2500

Dominic Morley

Atholl Tweedie

Rupert Dearden

Alma (PR adviser to Finsbury) Tel: +44 (0)20 3405 0205

Rebecca Sanders-Hewett E-mail: finsbury@almastrategic.com

Sam Modlin

CMS Cameron McKenna Nabarro Olswang LLP is providing legal

advice to Finsbury.

IMPORTANT NOTICES

Oppenheimer Europe Limited ("Oppenheimer"), which is authorised

and regulated in the United Kingdom by the FCA, is acting

exclusively as financial adviser under Rule 3 of the Code to

Finsbury in connection with the matters set out herein and for no

one else and will not be responsible to anyone other than Finsbury

for providing the protections afforded to its clients or for

providing advice in relation to the matters set out in this

announcement. Neither Oppenheimer nor any of its affiliates owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Oppenheimer in

connection with this announcement, any statement contained herein,

the Acquisition or otherwise.

Panmure Gordon (UK) Limited ("Panmure Gordon"), which is

authorised and regulated by the FCA in the United Kingdom, is

acting exclusively for Finsbury and for no one else in connection

with the subject matter of this announcement and will not be

responsible to anyone other than Finsbury for providing the

protections afforded to its clients or for providing advice in

connection with the subject matter of this announcement.

Further information

This announcement is for information purposes only and is not

intended to and does not constitute, or form any part of, an offer

to sell or subscribe for or any invitation to purchase or subscribe

for any securities or the solicitation of any vote or approval in

any jurisdiction pursuant to the Acquisition or otherwise. Each

Finsbury Shareholder is urged to consult its independent

professional adviser immediately regarding the tax consequences to

it (or its beneficial owners) of the Acquisition.

This announcement does not constitute a prospectus or prospectus

equivalent document.

Overseas shareholders

The release, publication or distribution of this announcement

in, into or from jurisdictions other than the United Kingdom may be

restricted by the laws of those jurisdictions and therefore any

persons who are subject to the laws of any jurisdiction other than

the United Kingdom into whose possession this announcement comes

should inform themselves about, and observe, such restrictions. Any

failure to comply with any such restrictions may constitute a

violation of the securities laws of any such jurisdiction. To the

fullest extent permitted by applicable law, the companies and

persons involved in the Acquisition disclaim any responsibility or

liability for the violation of such restrictions by any person.

This announcement has been prepared for the purpose of complying

with the laws of England and Wales, the Market Abuse Regulation,

the AIM Rules and the Code and the information disclosed may not be

the same as that which would have been disclosed if this

announcement had been prepared in accordance with the laws of

jurisdictions outside of England and Wales. Nothing in this

announcement should be relied on for any other purpose.

Additional information for US investors

The Acquisition relates to the shares of a UK company and is

being made by means of a scheme of arrangement provided for under

the laws of England and Wales. A transaction effected by means of a

scheme of arrangement is not subject to the proxy solicitation or

tender offer rules under the Exchange Act of 1934, as amended (the

"Exchange Act") and is exempt from the registration requirements of

the Securities Act of 1933, as amended (the "Securities Act").

Accordingly, the Acquisition will be subject to disclosure

requirements and practices applicable in the UK to schemes of

arrangement under the laws of England and Wales, which are

different from the disclosure and other requirements applicable to

a US tender offer.

Neither the SEC, nor any US securities commission has approved

or disapproved of any offer of securities referred to in, or

commented upon the adequacy or completeness of any of the

information contained in this announcement or the Scheme Document.

Any representation to the contrary is a criminal offence in the

United States.

Financial information relating to Finsbury included in the

Scheme Document has been prepared in accordance with accounting

standards applicable in the United Kingdom. As a result, such

financial information may not be comparable to financial

information of US companies or companies whose financial statements

are prepared in accordance with generally accepted accounting

principles in the United States.

It may be difficult for US holders of Finsbury Shares to enforce

their rights and any claims they may have arising under US Federal

securities laws in connection with the Acquisition, since Finsbury

is organised under the laws of a country other than the United

States, and some or all of its officers and directors may be

residents of countries other than the United States, and most of

the assets of Finsbury are located outside of the United States. US

holders of Finsbury Shares may not be able to sue a non-US company

or its officers or directors in a non-US court for violations of US

Federal securities laws. Further, it may be difficult to compel a

non-US company and its affiliates to subject themselves to a US

court's jurisdiction or judgment.

Publication on a website and availability of hard copies

In accordance with Rule 26.1 of the Code, a copy of this

announcement will be made available, subject to certain

restrictions relating to persons resident in Restricted

Jurisdictions, free of charge on Finsbury's website at

https://finsburyfoods.co.uk/investor-relations/offer. Neither the

contents of this website nor the content of any other website

accessible from hyperlinks on such website is incorporated into, or

forms part of, this announcement.

In accordance with Rule 30.3 of the Code, Finsbury Shareholders

and persons with information rights may request a hard copy of this

announcement free of charge, by writing to Link Group, Corporate

Actions, Central Square, 29 Wellington Street, Leeds, LS1 4DL,

United Kingdom or by calling Link Group on +44 (0) 371 664 0321.

Calls are charged at the standard geographic rate and will vary by

provider. Calls outside the United Kingdom will be charged at the

applicable international rate. The helpline is open between 9:00

a.m. - 5:30 p.m., Monday to Friday excluding public holidays in

England and Wales. Please note that Link Group cannot provide any

financial, legal or tax advice and calls may be recorded and

monitored for security and training purposes.

24.2. (d)(i)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

SOAEAKFKFEXDFFA

(END) Dow Jones Newswires

November 16, 2023 11:12 ET (16:12 GMT)

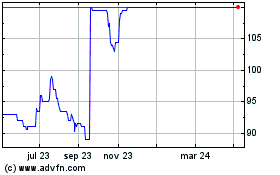

Finsbury Food (LSE:FIF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Finsbury Food (LSE:FIF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024