TIDMINSE

RNS Number : 1127A

Inspired PLC

22 May 2023

22 May 2023

Inspired PLC

("Inspired" or the "Company" or the "Group")

Deed of Variation - Ignite Energy LTD

Maximising our Optimisation Services opportunities

Inspired (AIM: INSE), a leading technology enabled service

provider supporting businesses in their drive to net-zero and

controlling energy costs, announces that it has entered into a deed

of variation (the "Deed") to the share purchase agreement dated 9

July 2020 (the "SPA") between the Company and vendors of Ignite

Energy LTD ("Ignite") being Benjamin Higgins, David Higgins,

Vanessa Higgins and Ethan Higgins (the "Vendors").

Summary

-- Over the past year the Group's Optimisation Services Division

has gained significant traction and this agreement is designed to

further incentivise the Ignite Vendors for the long term so they

can continue to add substantial value to the Group.

-- The Deed provides the opportunity for the Vendors to secure

up to GBP9.25 million of additional earn out consideration (the

"Additional Contingent Consideration") subject to challenging

performance thresholds.

-- To secure the entire Additional Contingent Consideration,

Ignite will be required to deliver year on year EBITDA growth in

excess of Group management's current expectations from FY24 until

H1 2027 and generate cumulative EBITDA (before deduction of central

overheads) of c.GBP64.1 million including in excess of GBP20.4

million of EBITDA (before deduction of central overheads) in FY26.

[1]

-- The Additional Contingent Consideration is entirely

self-funding and payment is subject to an 80% cash conversion

hurdle, to ensure alignment to the Group's focus on cash

generation.

Mark Dickinson, CEO of Inspired PLC commented : "The

Optimisation Division delivered significant growth in FY22, driven

by an increase in demand as the ongoing energy crisis sharpened

clients' focus on the economics of investment in energy reductions,

combined with the drive for delivering net-zero. With national

Covid restrictions behind us we are able to deliver on-site

services once again, a material factor which is driving strong

demand for our Optimisation Services. Now is the right time to

incentivise the Ignite Vendors to deliver for the long term for

Inspired PLC."

Background to and rationale for the Deed

The Company announced the acquisition of the outstanding 60% of

Ignite on 10 July 2020 pursuant to the SPA (the "Ignite

Acquisition"). The consideration paid by the Company for the Ignite

Acquisition was an initial consideration of GBP11.0 million and

further performance related consideration of up to a maximum of

GBP19.0 million in cash and shares in the Company ("Original

Earn-out Consideration"), dependent on the achievement of certain

financial performance criteria for the period to 31 December 2023

("Earn-out Period"). To date, GBP6.0 million of the GBP19.0 million

of the Original Earn-out Consideration has been paid in cash.

The Deed, alongside the final payments due and potentially

payable under the SPA, increases the maximum contingent

consideration which could currently still be payable to GBP22.5

million [2] should the Vendors achieve the challenging performance

thresholds set. The maximum Earn-out Consideration that could be

earned by the Vendors in relation to FY23 EBITDA performance

(before deduction of central overheads), to be paid in cash and

shares, totals GBP5.2 million. In respect of FY22 EBITDA

performance, GBP2.6 million in shares remains due to the Vendors

under the Original Earn-Out Consideration and these will be issued

shortly. The table in the Appendix sets out the current status of

the Original Earn-out Consideration.

As outlined in the Company's FY22 results, there is a

substantial growth opportunity for Optimisation Services,

underpinned by a strong current pipeline and growing d emand for

solutions to deliver net-zero and reduce costs, accelerated further

by the current energy crisis. The Board believes that the Vendors

are highly talented individuals and have a strong track record of

growing the Ignite business. The Board has therefore concluded it

is appropriate to enter into the Deed in order to maximise the

current opportunity. This Deed will re-incentivise the Vendors, as

management recognise that the Vendors have only had one full year

of the three to demonstrate the full scale of the opportunity due

to Covid-19 disruption.

The payment of the Additional Contingent Consideration is

conditional upon the achievement of challenging financial

performance targets relating to the growth of EBITDA in Ignite

(before deduction of central overheads) against the prior year's

performance and is subject to an 80 per cent cash conversion

hurdle. The H1 2027 element is designed to ensure the Vendors are

incentivised to build a strong pipeline to underpin sustained

growth into 2027 and beyond.

To earn the entire Additional Contingent Consideration, under

the terms of the Deed, Ignite would be required to deliver year on

year EBITDA growth in excess of current management expectations

from FY24 to H127 and generate, as a minimum, in excess of GBP20.4

million of EBITDA before central overheads in FY26. This would

result in a cumulative EBITDA (before deduction of central

overheads) of c.GBP64.1 million between FY24 and H127. [1] The

Additional Contingent Consideration is structured to be entirely

self-funding given the criteria as set out in Table 1 below. As the

Additional Contingent Consideration is payable for year on year

EBITDA performance in excess of current management expectations,

the contingent consideration liability on the balance sheet in

relation to FY24 to H127 will remain unchanged at this time.

Summary of the key changes pursuant to the Deed

Further detail on the Additional Contingent Consideration is set

out below. All Additional Contingent Consideration will be settled

in cash and is subject to cash generation from operations of Ignite

being in excess of 80% of the EBITDA generated in each period

tested.

Table 1: Details of the Additional Contingent Consideration

Tranche Additional

Contingent

Consideration

Cash Test Period Criteria Minimum required See through

EBITDA before EBITDA multiple

central overheads ***

to maximise

Additional

Contingent

Consideration*

----------------- ------------- ---------------------- ------------------- -----------------

Tranche Up to a Financial GBP0.85 consideration c.GBP14.9m c.2.70x

1 maximum Year ending for every GBP1.00

of GBP2,337,500 31 December growth in EBITDA

2024 before deduction

of central overheads

in FY24 over FY23

----------------- ------------- ---------------------- ------------------- -----------------

Tranche Up to a Financial GBP0.85 consideration c.GBP17.7m c.2.45x

2 maximum Year ending for every GBP1.00

of GBP2,337,500 31 December growth in EBITDA

2025 before deduction

of central overheads

in FY25 over FY24

----------------- ------------- ---------------------- ------------------- -----------------

Tranche Up to a Financial GBP0.85 consideration c.GBP20.4m c.2.28x

3 maximum Year ending for every GBP1.00

of GBP2,337,500 31 December growth in EBITDA

2026 before deduction

of central overheads

in FY26 over FY25

----------------- ------------- ---------------------- ------------------- -----------------

Tranche Up to a 6 months Payable if EBITDA c.GBP22.4m**

4 maximum ending 30 before deduction

of GBP2,237,500 June 2027 of central overheads

2027 is 10% or

more higher than

the aggregate

of the Gross Margin

for the highest

two Quarters in

the year ending

31 December 2026.

----------------- ------------- ---------------------- ------------------- -----------------

Total Up to

a maximum

of GBP9,250,00

----------------- ------------- ---------------------- ------------------- -----------------

*Assumes that Ignite generates GBP12.1m in FY23 as per the

maximum Original Earnout Consideration for that year and achieves

the maximum Additional Contingent Consideration each year

previously.

**H1 2027 on a 12m proforma basis.

*** Calculated from the total consideration which could be

payable for Ignite and the maximum EBITDA before overheads as set

out in the table.

Note: A table which sets out the details of the Original

Earn-out Consideration, as already disclosed by the Company on 10

July 2020, and includes the current payment status, is set out in

the appendix to this announcement.

Management have agreed with the Vendors that the Additional

Contingent Consideration calculation excludes any EBITDA (before

deduction of central overheads) contribution from a major public

sector optimisation customer (the "Specific Optimisation Customer

"), who impacted the Group's aged trade receivables position in

FY21 and FY22.

Noting that the Deed contains an acknowledgement between the

parties that no Original Earn Out Consideration is due in relation

to FY21, which was in part due to the Specific Optimisation

Customer being an aged debtor, the Company has agreed a separate

incentivisation with the Vendors in relation to this customer. The

Vendors will have the opportunity to recover up to GBP2.75 million

of the earn out consideration foregone in relation to cash

collected and generated (rather than profit generation) from the

Specific Optimisation Customer from FY23 and up to an additional

GBP2.75 million in relation to additional revenue and cash

collected from FY24 to FY26.

Related Party Transaction

The Vendors are directors of Ignite which is a wholly owned

subsidiary of the Company and therefore are deemed to be related

parties of the Company under the AIM Rules for Companies ("AIM

Rules"). Accordingly, the entering into the Deed by the Company

with the Vendors constitutes a related party transaction under the

AIM Rules (the "Related Party Transaction"). The directors of the

Company consider, having consulted with S hore Capital and

Corporate Limited ("Shore Capital"), the Company's nominated

adviser, that the terms of the Related Party Transaction are fair

and reasonable insofar as shareholders of the Company are

concerned.

Enquiries please contact:

Inspired PLC www.inspiredplc.co.uk

Mark Dickinson, Chief Executive Officer +44 (0) 1772 689250

Paul Connor, Chief Financial Officer

David Cockshott, Chief Commercial Officer

Shore Capital (Nominated Adviser and

Joint Broker)

Patrick Castle

James Thomas

Rachel Goldstein +44 (0) 20 7408 4090

Liberum (Joint Broker)

Edward Mansfield

Will Hall +44 (0) 20 3100 2000

Alma PR +44 (0) 20 3405 0205

Justine James inspired@almapr.co.uk

Hannah Campbell

Will Ellis Hancock

Appendix - Original Earn-Out Consideration schedule in

accordance with the SPA

Tranche Earn-out

Consideration

Cash Contingent Test Period Criteria Current status

Consideration

Shares*

------------------- ------------------- ---------------- ----------------------- -----------------

Tranche GBP3,400,000 Nil From Completion Payable on delivery Paid in FY2022

1 to Financial of GBP5.22m of

Year ending EBITDA before

31 December deduction for

2023 central overheads.

------------------- ------------------- ---------------- ----------------------- -----------------

Tranche Up to GBP2,600,000 Up to GBP2,600,000 Financial GBP1.50 consideration Nothing paid

2 Year ending for every GBP1.00 due to Covid

31 December growth in EBITDA impact and

2021 before deduction reflecting

of central overheads an outstanding

FY21 over FY19. aged debtor

Therefore, full who is a major

earn out payable public sector

on delivery of Optimisation

GBP8.9m of EBITDA client.

before deduction

of central overheads.

------------------- ------------------- ---------------- ----------------------- -----------------

Tranche Up to GBP2,600,000 Up to GBP2,600,000 Financial GBP1.50 consideration Cash element

3 Year ending for every GBP1.00 paid in respect

31 December growth in EBITDA of FY22.Share

2022 before deduction element to

of central overheads be issued

of FY22 over FY21. imminently.

------------------- ------------------- ---------------- ----------------------- -----------------

Tranche Up to GBP2,600,000 Up to GBP2,600,000 Financial GBP1.50 consideration To be determined

4 Year ending for every GBP1.00

31 December growth in EBITDA

2023 before deduction

of central overheads

of FY23 over FY22.

------------------- ------------------- ---------------- ----------------------- -----------------

Total Up to Up to GBP7,800,000

GBP11,200,000

------------------- ------------------- ---------------- ----------------------- -----------------

[1] Assumes that Ignite generates GBP12.1m of EBITDA (before

deduction of central overheads) in FY23 as per the maximum Original

Earn-Out Consideration for that year and achieves the minimum

EBITDA (before deduction of central overheads) to secure the

maximum Additional Contingent Consideration between FY24 and H127

as per the criteria in Table 1.

[2] Consisting of: (1) Up to GBP9.25m of Additional Contingent

Consideration (on the terms as set out in Table 1); (2) the GBP2.6m

of shares in respect of FY22, which are due to be issued shortly;

(3) Up to GBP5.2m in respect of FY23 from the Original Earn Out

Consideration; and (4) Up to c.GBP5.5m in respect of the Specific

Optimisation Customer (as set out below).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEANSFAFDDEFA

(END) Dow Jones Newswires

May 22, 2023 02:00 ET (06:00 GMT)

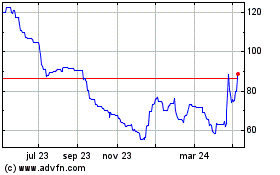

Inspired (LSE:INSE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

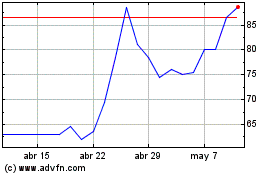

Inspired (LSE:INSE)

Gráfica de Acción Histórica

De May 2023 a May 2024