TIDMITIM

RNS Number : 8925N

itim Group PLC

28 September 2023

28 September 2023

itim Group plc

("itim" or the "Company and with its subsidiaries the

Group")

Interim Results for the six months ended 30 June 2023

itim Group plc (AIM:ITIM) a SaaS based technology company that

enables store based retailers to optimise their businesses to

improve financial performance, is pleased to announce its unaudited

interim results for the 6 months ended 30 June 2023.

Financial Highlights

-- Group revenue of GBP7.4m (Half Year 2022 ("HY22"): GBP6.8m,

Full Year 2022("FY22"): GBP14.0m)

-- Booked Recurring Revenue of GBP6.4m (HY22: GBP5.6m, FY22:

GBP11.8m)

-- Recurring revenue percentage of Group revenue was 86% (HY22:

82%, FY22: 84%)

-- Annual recurring revenue ("ARR")(1) of GBP13.2m (HY22:

GBP12.6m, FY22: GBP13.2m)

-- Annual growth in ARR(1) 5% (HY22: GBP19%, FY22: 19%)

-- Adjusted EBITDA(2) (GBP0.2)m (HY22: GBP0.3m, FY22: GBP0.2m)

-- Adjusted EBITDA(2) margin (3)% (HY22: 5%, FY22: 2%)

-- (Loss)/profit before tax (GBP1.1)m (HY22: (GBP0.4)m, FY22:

(GBP1.3)m)

-- Cash GBP2.7m (HY22: GBP5.3m, FY22: GBP3.9m)

-- Earnings per share (3.02) pence (HY22: (1.20) pence, FY22:

(2.20) pence)

-- Adjusted Earnings per share(3) (3.02) pence (HY22: (1.06)

pence, FY22: (2.01) pence)

Full year numbers quoted above are audited and half year numbers

quoted above are unaudited

1. Annual recurring revenue

2. EBITDA has been adjusted to exclude share-based payment

charges, exceptional items, along with depreciation, amortisation,

interest and tax from the measure of profit.

3. The profit measure has been adjusted to exclude exceptional

items and share option charge

Enquiries:

Ali Athar, CEO

Itim Group plc Ian Hayes CFO 0207 598 7700

Katy Mitchell

WH Ireland (NOMAD & Harry Ansell

Broker) Darshan Patel 0207 220 1666

Graham Herring

IFC Advisory Florence Chandler 0207 3934 6630

ABOUT ITIM

itim was established in 1993 by its founder, and current Chief

Executive Officer, Ali Athar. itim was initially formed as a

consulting business, helping retailers effect operational

improvement. From 1999 the Company began to expand into the

provision of proprietary software solutions and by 2004 the Company

was focused exclusively on digital technology. itim has grown both

organically and through a series of acquisitions of small, legacy

retail software systems and associated applications which itim has

redeveloped to create a fully integrated end to end Omni-channel

platform.

CEO Statement

The Group is pleased to report an increase in revenue in the

period despite the well documented challenging market conditions

for retail companies.

Revenue for the six month period was GBP7.4m (HY22: GBP6.8m) an

increase of 9%, of which recurring revenues were GBP6.4m (HY22:

GBP5.6m) representing 86% of sales and underpinning future sales.

Adjusted EBITDA (EBITDA excluding share-based payment charges and

exceptional items) fell to a loss of GBP0.2m (HY22: GBP0.3m) as a

result of investment in R&D and in building and protecting our

staff base. Cash balances totalled GBP2.7m at the period end (FY22:

GBP5.3m) reflecting investment in anticipated product development.

Adjusted loss per share was 3.02p (HY22: loss 1.2p).

The wider retail market has remained challenging for most

operators however there are signs that omni channel retailers are

beginning to fare better than their peers. With this in mind, the

Group relaunched its consultancy business as a complement to its

technology offering and to enable our customers to gain the maximum

benefit from it.

The Group continues to benefit from its well established client

base with 80 customers resulting in strong recurring revenues.

Whilst new business remains a priority, the Group has significant

opportunity to upsell and cross sell within its customer base

enabling organic growth.

The Directors believe that the investment in the business over

the past two years has positioned itim for future growth, created

essential USPs in the market and broadened its offering with the

potential to increase revenues from new and existing customers.

As a result of this investment and in the Directors'

opinion:

1. itim is one of a few companies that can deliver a single

unified sales (commerce) platform to support omni-channel

retailers. Retailers no longer need to have separate platforms for

selling in stores (EPOS), or selling online (e-commerce), or

selling to B2B, or wholesale customers - itim can support all these

in one platform. This is seen as a significant USP for omni channel

retailing.

2. itim has enhanced its merchandising, stock management and

optimisation solutions, again to support retailers selling across

multiple channels. Numerous sales channels makes this much more

complex, which itim is well positioned to be able to address.

3. itim is a market leader in Price and Promotions optimisation

helping retailers increase cash generation, by either reducing the

markdowns and discounts they give away or improving recoveries from

suppliers through its advanced invoice matching, supplier funding

tracking and a supplier payments platform.

4. itim is a leader in improving digital supplier collaboration

through a series of portal applications built on its Electronic

Data Interchange history. This is coming to the fore due to the

rise in marketplaces.

The Board is resolutely focused on profitability and creating

shareholder value and is taking the necessary steps to reduce

investment in product, driving services revenues and returning the

business to cash generation. Whilst this will impact the rate of

subscription revenue growth it should result in higher margins and

increased profitability.

Finally, I would like to thank our employees and our partners

for the continued support they give to this business and the

commitment and faith they show that we will be a successful

business.

Consolidated Statement of Comprehensive Income

for the half-year ended 30 June 2023

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2022

2023 2022

Unaudited Unaudited Audited

Notes GBP000 GBP000 GBP000

Continuing operations

Revenue 7,425 6,784 14,034

Cost of sales (5,514) (4,588) (9,538)

-------------- -------------- ---------------------

Gross profit 1,911 2,196 4.496

Administrative expenses (2,108) (1,860) (4,285)

-------------- -------------- ---------------------

EBITDA (197) 336 211

Amortisation of intangible assets (574) (443) (889)

Share option charge - (45) (58)

Depreciation (23) (20) (42)

Depreciation of leased assets (275) (184) (452)

-------------- -------------- ---------------------

Loss from operations (1,069) (356) (1,230)

Other interest - right of use

assets (21) (21) (45)

Loss before taxation (1,090) (377) (1,275)

Taxation 149 2 589

-------------- -------------- ---------------------

Loss for the period/year (941) (375) (686)

Other comprehensive income

Exchange differences on retranslation

of foreign operations (77) 51 124

Total comprehensive income

for the period/year net of tax (1,018) (324) (562)

============== ============== =====================

Earnings per share

Basic 2 (3.02p) (1.20p) (2.20)p

Diluted 2 (3.02p) (1.20p) (2.20)p

-------------- -------------- ---------------------

Consolidated Statement of Financial Position

as at 30 June 2023

As at As at As at

30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Non-current assets

Intangible assets 10,349 9,233 10,069

Plant and equipment 586 508 721

Right-of-use assets 380 581 442

Deferred tax 83 4 164

----------- -------------- -----------

11,398 10,326 11,396

Current assets

Trade and other receivables 4,537 3,512 4,603

Cash and cash equivalents 2,697 5,295 3,922

----------- -------------- -----------

7,234 8,807 8,525

Total assets 18,632 19,133 19,921

----------- -------------- -----------

Current liabilities

Trade and other payables (5,673) (4,866) (5,776)

Right-of-use liability (214) (288) (297)

(5,887) (5,154) (6,073)

Non-current liabilities

Trade and other payables due

in more than one year (444) (355) (540)

Right-of-use liability (209) (359) (201)

Deferred tax (633) (563) (630)

(1,286) (1,277) (1,371)

Total liabilities (7,173) (6,431) (7,444)

----------- -------------- -----------

Net Assets 11,459 12,702 12,477

=========== ============== ===========

Capital and reserves

Called up share capital 1,561 1,561 1,561

Share premium account 7,398 7,398 7,398

Share options reserve 513 500 513

Capital redemption reserve 1,103 1,103 1,103

Foreign exchange reserve 73 77 150

Retained profit/(loss) 811 2,063 1,752

----------- -------------- -----------

Shareholders' funds 11,459 12,702 12,477

=========== ============== ===========

Consolidated Statement of Cash Flow

for the half-year ended 30 June 2023

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2022

2023 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Cash flows from operating

activities

Profit after taxation (941) (375) (686)

Adjustments for:

Taxation (149) (3) (589)

Share option charge - 45 58

Other interest on leases 21 21 45

Amortisation and depreciation 872 647 1,383

Cash flows from operations

before working capital changes (197) 335 211

Movement in trade and other

receivables 305 337 (384)

Movement in trade and other

payables (59) (383) 371

-------------- -------------- -------------

Cash generated from operations 49 289 198

Corporation tax (23) (42) 280

-------------- -------------- -------------

Net cash flow from operating

activities 26 247 478

Cash flow from investing

activities

Capital expenditure on intangible

assets (906) (907) (2,140)

Purchase of plant and equipment (24) (28) (49)

Net cash flow from investing

activities (930) (935) (2,189)

Cash flow from financing

activities

Interest repayments (16) - -

Payment of lease liabilities (266) (194) (438)

Loan issued (18) - (140)

Net cash flow from financing

activities (300) (194) (578)

Net decrease in cash and

cash equivalents (1,204) (882) (2,289)

============== ============== =============

Cash and cash equivalents

at beginning of year 3,922 6,172 6,172

Exchange (losses)/gains on

cash and cash equivalents (21) 5 39

Cash and cash equivalents

at end of year 2,697 5,295 3,922

============== ============== =============

Consolidated Statement of Changes in Equity

as at 30 June 2023

Share Share Share Capital Foreign Retained Total

capital Premium option Redemption exchange Earnings Equity

reserve Reserve reserve

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2023 1,561 7,398 513 1,103 150 1,752 12,477

Comprehensive income

for the year - - - - - (941) (941)

Foreign exchange

movement - - - - (77) - (77)

--------- --------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - - - - (77) (941) (1,018)

At 30 June 2023

(unaudited) 1,561 7,398 513 1,103 73 811 11,459

At 1 January 2022 1,561 7,398 455 1,103 26 2,438 12,981

Comprehensive income

for the year - - - - (375) (375)

Foreign exchange

movement - - - 51 - 51

--------- --------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - - - 51 (375) (324)

Share option charge - - 45 - - - 45

--------- --------- --------- ------------ ---------- ---------- ---------

At 30 June 2022

(unaudited) 1,561 7,398 500 1,103 77 2,063 12,702

At 1 January 2022 1,561 7,398 455 1,103 26 2,438 12,981

Comprehensive income

for the year - - - - - (686) (686)

Foreign exchange

movement - - - - 124 - 124

--------- --------- --------- ------------ ---------- ---------- ---------

Total comprehensive

income - - - 124 (686) (562)

Share option charge - - 58 - - - 58

At 31 December

2022 (audited) 1,561 7,398 513 1,103 150 1,752 12,477

========= ========= ========= ============ ========== ========== =========

Notes to the Financial Information

1. General information

itim Group plc is a public limited Company ("Company")

incorporated in the United Kingdom under the Companies Act 2006

(registration number 03486926). The Company is domiciled in the

United Kingdom and its registered address is 2(nd) Floor, Atlas

House, 173 Victoria Street, London SW1E 5NH. The Company's ordinary

shares are admitted to trading on the AIM market of the London

Stock Exchange ("AIM").

The Group's principal activities have been the provision of

technology solutions to help clients drive improvements in

efficiency and effectiveness.

The Group's interim report and accounts for the six months ended

30 June 2023 have been prepared using the recognition and

measurement principles of International Financial Reporting

Standards and Interpretations as endorsed by the European Union

(collectively "Adopted IFRS").

These interim financial statements for the six months ended 30

June 2023 have been prepared in accordance with the AIM Rules for

Companies and should be read in conjunction with the financial

statements for the year ended 31 December 2022, which have been

prepared in accordance with IFRS as adopted by the European Union.

The interim report and accounts do not include all the information

and disclosures required in the annual financial statements.

The interim report and accounts have been prepared on the basis

of the accounting policies, presentation and methods of computation

as set out in the Group's December 2022 Annual Report and Accounts,

except for those that relate to new standards and interpretations

effective for the first time for periods beginning on (or after) 1

January 2023, and will be adopted in the 2023 annual financial

statements.

The interim report and accounts do not comprise statutory

accounts within the meaning of section 434 of the Companies Act

2006. These interim financial statements were approved by the Board

of Directors on 22 September 2023. The results for the six months

to 30 June 2023 and the comparative results for the six months to

30 June 2022 are unaudited. The figures for the period ended 31

December 2022 are extracted from the audited statutory accounts of

the Group for that period.

The Directors believe that a combination of the Group's current

cash, projected revenues from existing and future contracts will

enable the Group to meet its obligations and to implement its

business plan in full. Inherently, there can be no certainty in

these matters, but the Directors believe that the Group's internal

trading forecasts are realistic and that the going concern basis of

preparation continues to be appropriate.

2. Earnings per share

Basic and diluted (loss)/earning per share is calculated by

dividing the (loss)/profit attributable to owners of the parent by

the weighted average number of ordinary shares in issue during the

period. For the avoidance of doubt the deferred shares have been

excluded as they have no rights to profits or capital. The

Company's share options have a dilutive effect over the two year

period.

6 months 6 months Year ended

ended 30 ended 30 31 December

June 2023 June 2022 2022

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Loss after tax for the year (941) (375) (686)

------------------------------------------ ------------ ------------ --------------

Exceptional items - - -

Share option charge - 45 58

------------------------------------------ ------------ ------------ --------------

Adjusted loss after tax for the year (941) (330) (628)

Weighted average number of shares

------------------------------------------ ------------ ------------ --------------

Basic - 000 31,211 31,211 31,211

Potentially dilutive share options -

000 3,657 3,657 3,657

Diluted average number of shares - 000 34,868 34,868 34,868

Earnings per share:

------------------------------------------ ------------ ------------ --------------

Basic - pence on continuing operations (3.02) (1.20) (2.20)

Diluted - pence on continuing operations (3.02) (1.20) (2.20)

Adjusted earnings - Basic - pence on

continuing operations (3.02) (1.06) (2.01)

Adjusted earnings - Diluted - pence

on continuing operations (3.02) (1.06) (2.01)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LRMFTMTMTBFJ

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

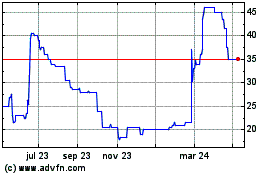

Itim (LSE:ITIM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

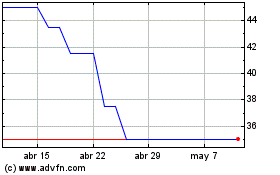

Itim (LSE:ITIM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024