TIDMKBT

RNS Number : 7219K

K3 Business Technology Group PLC

30 August 2023

AIM: KBT

K3 BUSINESS TECHNOLOGY GROUP PLC

("K3" or "the Group" or "the Company")

Provider of business-critical software solutions focused on

fashion and apparel brands.

Interim results for the six months to 31 May 2023

Key Points

Six months to 31 May 2023 2022

Revenue from continuing operations GBP20.3m GBP19.9m

---------- ----------

Gross profit GBP12.4m GBP11.9m

---------- ----------

_ gross margin 61% 60%

-------------------------------------- ---------- ----------

Adjusted operating loss (see note (GBP0.8m) (GBP1.0m)

10)

---------- ----------

Loss before tax from continuing operations (GBP2.9m) (GBP2.8m)

---------- ----------

Adjusted net cash GBP2.9m GBP1.4m

---------- ----------

Reported loss per share (6.6p) (5.6p)

---------- ----------

Adjusted loss per share for continuing

operations (3.2p) (2.6p)

---------- ----------

Financial

-- Overall performance ahead of management expectations

-- K3 strategic fashion and apparel products annualised recurring revenue up 20% to GBP5.4m

-- Revenue ahead. Approx GBP1.1m of income was not recognised in H1, in line with new policy

o income from new contracts secured by strategic fashion and

apparel products is now recognised over the term of the contract,

instead of upfront

-- Reflecting focus on adjusted net cash, adjusted operating

profit/loss(10) metric has replaced adjusted EBITDA as key

performance indicator

o adjusted operating loss was GBP0.8m (2022: GBP1.0m)

-- Group generated adjusted net cash in the last 12 months;

adjusted net cash at GBP2.9m at 31 May 2023 (31 May 2022:

GBP1.4m)

-- Group earnings and adjusted net cash generation remain

strongly weighted to H2, reflecting the significant H2 weighting of

annual software licence and maintenance and support contract

renewals

Operational

-- K3 Products division - continued strong sales growth from

fashion and apparel offering (strategic products), although

divisional performance still impacted by legacy products in managed

run-off

o Divisional revenue of GBP6.5m (2022: GBP6.5m); gross profit of

GBP5.0m (2022: GBP5.2m)

o Gross profit margin of 77% (2022: 80%)

o Strategic fashion products annualised recurring revenue up 20%

in H1 to GBP5.4m at period-end, driven by new customer wins and

existing customers increasing software licences

o Legacy products performed in line with management

expectations

o Further investment in Sustainability offering to align

functionality with forthcoming legislation from Europe and USA

-- Third-party Solutions division - higher profitability and strongly cash generative

o Divisional revenue of GBP13.8m (2022: GBP13.4m) and gross

profit of GBP7.4m (2022: GBP6.7m)

o Gross profit margin of 53% (2022: 50%) - reflected revenue mix

and reduced overheads

o Global Accounts; lower level of store openings following 2-3

years of high activity

o NexSys (formerly known as SYSPRO); average deal size

increased; strong H2 expected with very healthy services back-log

and high volume of software licence and maintenance and support

contract renewals due; renewals typically c.98%

Prospects

-- Current trading and free cash flow; both in line with

management expectations. Encouraging new business pipeline for

H2

o strategic fashion products - targeting growth of 30% p.a. in

recurring revenue in FY23 and beyond

-- Board is focused on further simplifying operations, reducing

central cost, adjusted net cash generation and continued transition

to higher margin growth activities

Marco Vergani, Chief Executive Officer of K3 Business Technology

Group plc, said:

"We made encouraging progress in key strategic areas of the

business in the first half. We are especially pleased with the

performance of our strategic products for the fashion and apparel

market in the K3 Products division. Our flagship K3 Fashion product

has the potential to maintain its high growth trajectory and has

strong endorsement from Microsoft. Third-party Solutions remains a

cash engine for the Group, and the division will generate high cash

inflows in the second half of the financial year as software

licence and maintenance and support renewals come through.

" Our healthy balance sheet underpins the improvements that we

are making to the business. We remain focused on our high-margin

growth opportunities, cost discipline and adjusted net cash as we

continue to move to higher quality earnings."

Enquiries:

K3 Business Technology Marco Vergani (CEO)

Group plc

www.k3btg.com Tom Crawford (Chairman) T: 0161 876 4498

finnCap Limited Julian Blunt/ Milesh Hindocha T: 020 7220 0500

(NOMAD & Broker) (Corporate Finance)

Sunila De Silva (Corporate

Broking)

KTZ Communications Katie Tzouliadis/ Robert T: 020 3178 6378

Morton

Interim Report

Overview

We have made excellent progress in some key strategic areas, in

particular in our fashion and apparel segment in K3 Products, which

continues to grow very strongly. Overall, the Group's performance

over the first half of the current financial year was ahead

management expectations, with the attrition rate of legacy

products, which are in managed run-off, in line with budgets.

In the six months ended 31 May 2023, Group revenue from

continuing operations was GBP20.3m (2022: GBP19.9m), gross profit

increased to GBP12.4m (2022: GBP11.9m), and gross margin was up to

61% (2022: 60%). Importantly, the Group generated adjusted net cash

in the last 12 months, with net cash at GBP2.9m at the period end

(31 May 2022: GBP1.4m). Group cash generation is typically strongly

weighted to the second half of the financial year. This reflects

the significant cash inflows from NexSys annual software licence

and maintenance and support contract renewals, which fall due in

the second half, with renewal rates historically at c.98%.

In line with our focus on cash generation, we are no longer

using adjusted earnings before interest, tax, depreciation and

amortisation ("EBITDA") as a key performance indicator ("KPI"). We

have instead adopted adjusted operating profit/loss, which in the

period was a loss of GBP0.8m (2022: GBP1.0m). We have also made a

second important change, and have updated our revenue recognition

policy relating to our strategic fashion and apparel products.

Previously, we recognised income from sales of fashion and apparel

products upfront, at the start of a contract. We are now

recognising income over the term of the contract, which will also

align with payment inflows and provide better visibility of

revenues as we pursue our ambitious growth target in this segment.

The effect of the change is that c. GBP1.1m of fashion software

revenue was not recognised in this period, but will be in future

periods.

Our primary focus remains on the development and growth of our

strategic products for the fashion and apparel markets, and related

large retail brands, where we see a very high growth opportunity.

At the same time, we are continuing to realise the growth

opportunities in other parts of the Group.

The requirement for digital transformation continues to be a key

priority for companies in our target sectors. Retail businesses,

especially in fashion, are needing to adapt their models and

systems to engage with customers and suppliers in new and more

varied and efficient ways. Our expertise in the retail sector,

particularly in fashion and apparel, and Microsoft's endorsement of

our K3 Fashion product as its preferred solution for this vertical,

place us in a strong position to continue to drive the growth of

our strategic products. We are targeting growth in annualised

recurring revenue of c. 30% per annum from strategic fashion and

apparel products this year and beyond.

The Third-party Solutions division generates predictable and

strong cash flows from its large customer base, and we are pleased

to see the NexSys unit adding to this base of recurring income,

with some excellent wins in the period.

Our major programme to upgrade and unify our IT systems, which

started over a year ago, has largely completed. It covered Finance,

Sales, Customer Support, and Project Management processes, and has

driven insights and efficiencies. We will continue to seek further

efficiencies and have identified additional areas for cost saving

initiatives in our operations. As part of our approach to greater

cost control, we will be allocating certain Central costs to

relevant business units.

Financial Results

Results from continuing operations

In the six months ended 31 May 2023, the Group generated total

revenue from continuing operations of GBP20.3m (2022: GBP19.9m)

despite the change in revenue recognition policy, and gross profit

increased to GBP12.4m (2022: GBP11.9m). Gross margin was higher at

approximately 61% (2022: 60%), which mainly reflected improved

gross margin in the Third-party Solutions Division.

It is important to note that our decision to change our revenue

recognition policy for fashion and apparel software product sales,

recognising revenue over the term of the contract rather than at

the start of the contract, has shifted approximately GBP1.1m of

fashion software revenue into the future. This change has also

impacted reported gross profit in the period.

As previously mentioned, we have also introduced adjusted

operating profit/(loss) as a key performance metric for the Group.

It now replaces adjusted EBITDA and has resulted in revised

administration expenses being shown in the comparatives for H1 2023

and in FY2022 data, including both depreciation and capitalised

development costs to provide a better alignment with the actual

cash requirements of the business. The adjusted operating loss for

the period was GBP0.8m (2022: GBP1.0m).

Capitalised development costs are then added back in the income

statement in arriving at the reported loss from operations, though

we would expect the level of capitalised development costs to

reduce in future reflecting a more prudent treatment.

The table below provides the reconciliation between adjusted

operating loss in the first half of the financial year under review

and adjusted EBITDA in the comparable period last year.

H1 2023 H1 2022 Change FY 2022

GBP'000 GBP'000 % GBP'000

--------------------------------------- --------- --------- ------- ---------

Adjusted EBITDA (as previously

reported for H1 2022 and FY 2022) 347 994 (65%) 5,064

- depreciation (784) (964) 19% (1,817)

- capitalised development costs (354) (1,013) 65% (1,699)

---- --------- --------- ------- ---------

Adjusted operating profit/(loss) (791) (983) 20% 1,748

--------------------------------------- --------- --------- ------- ---------

Reported adjusted administrative expenses increased slightly to

GBP13.1m (2022: GBP12.9m), which is in-line with revenue growth,

and expenses are expected to reduce next year and beyond.

Adjusted operating loss from continuing activities reduced to

GBP0.8m (2022: GBP1.0m). This encouraging improvement resulted from

higher gross margin and revenue growth and, as previously stated,

is after the change to our revenue recognition policy for fashion

and apparel software sales.

The reported loss before tax from continuing activities was

GBP2.9m (2022: GBP2.8m). This is stated after depreciation and

amortisation of GBP2.1m (2022: GBP3.0m), exceptional reorganisation

costs of GBP0.4m (2022: GBP0.1m), acquisition costs of GBPnil

(2022: GBP0.1m), share-based charges of GBP0.5m (2022: GBP0.3m) and

net finance expense of GBP0.3m (2022: GBP0.2m).

The adjusted loss per share from continuing operations was 3.2p

(2022: 2.6p), and excludes amortisation of development costs,

capitalised development costs, exceptional reorganisation costs,

acquisition costs and share-based charges, and is net of the

related tax charge of GBP0.1m (2022: GBP0.1m). The reported loss

per share from continuing operations, which includes profit from

discontinued activities, increased to 7.2p (2022: 5.9p) .

Balance sheet and cash flows

The Group balance sheet remains strong with cash and cash

equivalents of GBP4.7m (2022: GBP4.3m) and net cash of GBP2.9m

(2022: GBP1.4m). K3 has a bank facility with Barclays, its

long-standing banking relationship, which provides for the draw

down of up to GBP3.5m to support seasonal cash movements. In

February 2023, this facility agreement was extended for a further

year until March 2024. At 31 May 2023, GBP1.8m was drawn down

(2022: GBP1.6m).

As in prior years, Group cash flow remains heavily weighted

towards the second half of the financial year. This reflects the

significant cash inflows from annual software licence and

maintenance and support renewals. The largest element of this is

NexSys renewals, where the renewal rate is typically c.98%.

Cash outflow from operations reduced significantly to GBP2.8m

(2022: GBP5.2m). Net cash used in investing activities amounted to

GBP0.8m (2022: GBP1.6m). This included spend on property, plant and

equipment of GBP0.4m (2022: GBP0.4m), less development expenditure

capitalised at GBP0.3m (2022: GBP1.0m) and ViJi acquisition costs

of GBPnil (2022: GBP0.2m).

Operational Review

The Group's results for the six months ended 31 May 2023,

together with comparatives for the same period in 2022, are

summarised in the tables below. The segmental analysis provides

further information on the key areas of activity, K3 Products

(which includes strategic fashion and apparel products) and

Third-party Solutions.

H1 Revenue (GBPm) Gross profit Gross margin

(GBPm)

2023 2022 2023 2022 2023 2022

------------- -------- ------- ------- ------ ------- ------

K3 Products 6.5 6.5 5.0 5.2 77% 80%

Third-party

solutions 13.8 13.4 7.4 6.7 53% 50%

------------- -------- ------- ------- ------ ------- ------

Total 20.3 19.9 12.4 11.9 61% 60%

------------- -------- ------- ------- ------ ------- ------

K3 Products - K3 strategic 2023 Y/Y Change

products

----------------------------- --------- -----------

Recurring revenue

(SaaS, maintenance, annual

contracts and support) GBP5.4m +20%

----------------------------- --------- -----------

K3 Products

The division provides software products and solutions that are

powered by our own IP. They comprise:

-- strategic products focused on fashion and apparel markets,

principally K3 Fashion and K3 Pebblestone, as well as K3

ViJi and K3 imagine;

-- solutions for the visitor attraction market; and other

stand-alone point solutions and apps, which are mainly

our legacy point-of-sale ("POS") products.

Revenue from strategic products, which are focused on the

fashion and apparel markets and include our flagship product, K3

Fashion, continued to increase strongly and the growth opportunity

remains very exciting. Overall results from the division however

were affected by legacy products, which are in managed run-off, and

by traction with K3 Imagine. We are taking action to ensure that K3

Imagine is cash neutral by the end of the financial year.

In total, revenue generated by the division was GBP6.5m (2022:

GBP6.5m). This figure does not include around GBP1.1m of revenues

from new fashion and apparel software contracts won in the first

half. In line with our new revenue recognition policy, this income

will be recognised over the term of the contracts, rather than

upfront. Gross profit was GBP5.0m (2022: GBP5.2m) although, as with

revenue, it was reduced by the application of the new revenue

recognition policy. Gross margin was 77% (2022: 80%), which

reflected the revenue mix.

Our flagship K3 Fashion product performed very strongly. We

gained a number of major new customers in the period and continued

to expand software licence sales with existing customers. It led

the increase in total annualised recurring revenue from strategic

fashion and apparel products, which rose to GBP5.4m by the end of

the first half, a 20% uplift in just the first half. As well as

securing a major contract with a Swedish outdoor sports fashion

brand, worth c.GBP1.0m over three years, we secured the largest

global deployment of K3 Fashion. This was with a major global

jewellery/watches retailer, and is worth c.GBP1.4m over three

years. We also won a large contract with a major Swiss outdoor

brand, worth c.GBP0.5m over five years, and a five-year contract

worth GBP0.2m with a European golf brand. Alongside these new

contracts, we added a number of smaller value contracts for K3

Fashion, which we expect to expand over time. These new customers

included a German fashion brand, an Italian fabrics and furnishings

manufacturer, a UK ski-wear and accessories company and an Italian

fashion brand.

K3 Fashion remains Microsoft's recommended 'add-on' solution for

the fashion and apparel vertical globally, and our wins continue to

come through our business partner network, with K3 providing

thought leadership and sales support through its domain expertise.

The trend for new customers to buy an initial number of software

licences, mainly for centralised functions such as purchasing, and

catalogue and pricing management, and then to increase their

licence numbers, as they extend the use of the software across

their operations, remains a typical pathway for software adoption.

This is the pattern of we expect to see over the next year and

beyond with the smaller contracts we have gained in the period.

We achieved a good level of new signings for K3 Pebblestone, our

solution based on Microsoft 365 Business Central. We also have a

large base of established clients operating with an 'on-premises'

suite. This offers us the medium-term potential to migrate

customers to a new cloud-based version, sold on a subscription

basis. We are adding functionality to the cloud version to enhance

the proposition. In the current environment, the pace of conversion

is likely to be dictated by customer investment sentiment.

We are seeing an encouraging level of interest in K3 ViJi, our

sustainability software product, which reflects emerging

legislation, targeted at 2025 and beyond, from the European Union

and the USA. This new legislation is designed to reduce waste,

promote a circular economy, and to preserve biodiversity and

natural resources. We are reacting to the still forming legislation

and invested further in ViJi's solution suite during the period in

order to strengthen its regulatory support. We continue to assess

market reaction and approaches on how to leverage our corporate

social responsibility functionalities in both K3 Fashion and K3

ViJi.

Our solutions for the visitor attractions market performed well,

helped by our previous investment to update and enhance our

offering. Legacy products performed as expected and remain in

managed run-off.

Third-party Solutions

Third-party Solutions comprises:

-- NexSys, a value-added reseller (with additional own IP

and modules) of SYSPRO ERP to the UK manufacturers and

distributors; and

-- Global Accounts, which provides specialist services, predominantly

to the Inter IKEA Concept overseas franchisee network.

The Third-party solutions division generated total revenue of

GBP13.8m, consistent with the same period last year (2022:

GBP13.4m) while gross profit increased to GBP7.4m (2022: GBP6.7m).

Gross margin increased by around three percentage points to 53%

(2022: 50%). This rise reflected the revenue mix, which was made up

of a higher proportion of software licence and maintenance and

support income, and reduced overheads.

The NexSys business (formerly known as SYSPRO) delivered an

encouraging performance and secured a number of new projects, with

larger deal sizes. Major new wins were signed with a manufacturer

of automotive plastic components, worth c. GBP0.56m, a bicycle

manufacturer, worth c. GBP0.35m and a manufacturer of products for

the farming industry, worth c.GBP0.31m. These initial order values

include the first year's software licence, the first year's

support, and initial services.

We believe that this encouraging performance is partly due to

pent-up demand, following the suspension of purchasing decisions in

2022 when energy costs soared, but more importantly, reflects the

trend to 're-platform' manufacturing ERP, improve operational

connectivity and drive data-led efficiencies. NexSys's performance

also benefited from the selective investment we made previously in

sales, delivery resource and software development to enhance

functionality, as well as from disciplined cost control. The

business enters the second half with a very healthy services

back-log and encouraging new business pipeline.

Global Accounts saw a period of significant store expansion over

the last two to three years, by Inter IKEA Concept overseas

franchisees, in the Far East, Central America and South America.

During the first half, we continued to support franchisees,

including with K3 Product roll-out such as 'Mobile Goods Flow'.

There were more limited new store openings though, and we are

anticipating more subdued expansion activity from IKEA. Our focus

continues on supporting our relationships, delivered from an

appropriately-sized resource base.

Central Costs

Administration expenses include sales, marketing and central IT,

finance, legal, HR, insurance and PLC costs. They amounted to

GBP13.1m in the period (2022: GBP12.9m). As previously stated, we

will now allocate costs previously included in central support to

the relevant business units. We believe that this will provide

greater accountability, responsibility and cost control.

The Board

In early April 2023, Eric Dodd joined the Company as Chief

Financial Officer, with Rob Price stepping down from this role

after six years with K3, as previously reported. We take this

opportunity to thank Rob for his contribution during his

tenure.

Eric has significant experience of the technology sector and was

previously Chief Financial Officer of ATTRAQT Group Plc, which

specialises in omnichannel search, merchandising and personalised

product discovery technology for online retailers and brands,

mainly in the fashion sector. Prior to this, he was Chief Financial

Officer of Iptor Supply Chain Systems UK Limited, a private equity

backed software and services business, and before that, Chief

Financial Officer of KBC Advanced Technology plc, the software and

consultancy provider to the hydrocarbon industry.

Summary and Outlook

The Group generated adjusted net cash over the last 12 months,

and we expect its adjusted net cash position to strengthen in the

second half. This mainly reflects the strong weighting of earnings

and cash flows to this period, predominantly from NexSys.

Our focus remains on the transition we are making to higher

quality recurring earnings while, at the same time, continuing with

cost discipline and operational simplification. While challenges

remain in the current economic environment, and we anticipate more

subdued activity in Global Accounts, we have taken action to reduce

costs and are very encouraged with the uptake of our flagship K3

Fashion product, which has a significant global growth opportunity.

We are targeting growth in annualised recurring revenue of around

30% per annum in FY23 from our strategic products for the fashion

and apparel market, and believe this rate of growth can be

maintained in the near term. We have achieved a lot in the year to

date and remain confident in the Group's prospects.

Tom Crawford Marco Vergani

Chairman Chief Executive Officer

Co nsolidated Income Statement

for the six months ended 31 May 2023

Restated Restated

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Revenue 20,267 19,939 47,532

Cost of sales (7,917) (8,047) (19,382)

--------------------------------------- ---------- ---------- ------------

Gross profit 12,350 11,892 28,150

Administrative expenses (13,034) (12,710) (26,300)

Impairment losses on financial assets (107) (165) (102)

Adjusted operating profit/(loss) (791) (983) 1,748

--------------------------------------- ---------- ---------- ------------

Amortisation of development cost (1,331) (2,060) (3,766)

Capitalised development costs 354 1,013 1,699

Amortisation of acquired intangibles - - -

Exceptional impairment - - (1,603)

Exceptional reorganisation costs (374) (118) (595)

Acquisition costs - (98) (98)

Share-based payment charge (532) (322) (855)

--------------------------------------- ---------- ---------- ------------

Loss from operations (2,674) (2,568) (3,470)

Finance expense (266) (219) (338)

Loss before taxation from continuing

operations (2,940) (2,787) (3,808)

Tax credit/(expense) (245) 156 (278)

Loss after taxation from continuing

operations (3,185) (2,631) (4,086)

(Loss)/profit after taxation

from discontinued operations 317 (130) 108

Loss for the period/year (2,868) (2,761) (3,978)

--------------------------------------- ---------- ---------- ------------

All the loss for the year is attributable to equity shareholders

of the parent.

Restated Restated

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

(Loss)/profit per share

Basic and diluted loss per

share (6.5)p (5.6)p (9.0)p

Basic and diluted loss per

share from continuing operations (7.2)p (5.9)p (9.3)p

Adjusted earnings/(loss) per

share (3.2)p (2.6)p 2.1p

Consolidated Statement of Comprehensive Income

for the six months ended 31 May 2023

Restated Restated

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Loss for the period/year (2,868) (2,761) (3,978)

--------------------------------------- ---------- ---------- ------------

Other comprehensive income

Exchange differences on translation

of foreign operations 212 7 69

--------------------------------------- ---------- ---------- ------------

Total comprehensive income/(expense)

for the period/year (2,656) (2,754) (3,909)

--------------------------------------- ---------- ---------- ------------

All the total comprehensive income/(expense) is attributable to

equity holders of the parent. All the other comprehensive

income/(expense) will be reclassified subsequently to profit or

loss when specific conditions are met. None of the items within

other comprehensive income/(expense) had a tax impact.

Consolidated Statement of Financial

Position

as at 31 May 2023 Restated

Restated Audited

Unaudited Unaudited as at 30

as at 31 as at 31 November

Notes May 2023 May 2022 2022

GBP'000 GBP'000 GBP'000

ASSETS

Non-current assets

Property, plant and equipment 1,866 1,661 1,766

Right-of-use assets 738 1,098 801

Goodwill 25,000 25,475 25,022

Other intangible assets 2,422 5,902 3,394

Deferred tax assets 890 1,010 855

Total non-current assets 30,916 35,146 31,838

----------------------- ------------ -----------

Current assets

Stock 489 448 484

Trade and other receivables 11,136 11,742 13,549

Forward currency contracts 110 - 110

Cash and short-term deposits 4,672 4,322 7,113

Total current assets 16,407 16,512 21,256

----------------------- ------------ -----------

Total assets 47,323 51,658 53,094

----------------------- ------------ -----------

LIABILITIES

Non-current liabilities

Lease liabilities 33 223 79

Provisions - 783 179

Deferred tax liabilities 1,079 1,288 1,119

----------------------- ------------ -----------

Total non-current liabilities 1,112 2,294 1,377

----------------------- ------------ -----------

Current liabilities

Trade and other payables 12,143 10,610 16,882

Current tax liabilities 300 632 372

Lease liabilities 769 951 802

Borrowings 1,768 2,949 50

Provisions 798 854 968

Total current liabilities 15,778 15,996 19,074

----------------------- ------------ -----------

Total liabilities 16,890 18,290 20,451

----------------------- ------------ -----------

EQUITY

Share capital 11,183 11,183 11,183

Share premium account 31,451 31,451 31,451

Other reserves 11,151 11,151 11,151

Translation reserve 1,819 1,545 1,607

Accumulated losses (25,171) (21,962) (22,749)

----------------------- ------------ -----------

Total equity attributable to equity

holders of the parent 30,433 33,368 32,643

----------------------- ------------ -----------

Total equity and liabilities 47,323 51,658 53,094

----------------------- ------------ -----------

Consolidated Cash Flow Statement

for the six months ended 31 May 2023

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

Notes GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss for the period (2,868) (2,761) (3,978)

Adjustments for:

Finance expense 266 219 336

Tax (income)/expense 245 (156) 90

Depreciation of property, plant and equipment 344 300 636

Depreciation of right-of-use assets 440 678 981

Amortisation of intangible assets and development expenditure 1,331 2,060 3,767

Impairment of intangible assets - - 1,603

Loss on sale of property, plant and equipment - - 10

Share-based payments charge 446 322 751

Net cash flow from provisions (359) (346) (717)

Net cash flow from trade and other receivables (1,669) (1,087) (3,037)

Net cash flow from trade and other payables (843) (4,658) 2,380

------------------------------------------------------------------------ ---------- ---------- ------------

Cash generated from operations (2,667) (5,429) 2,822

Income taxes paid (150) 279 (395)

------------------------------------------------------------------------ ---------- ---------- ------------

Net cash from operating activities (2,817) (5,150) 2,427

Cash flows from investing activities

Acquisition of a subsidiary, net of cash acquired - (180) (178)

Development expenditure capitalised (352) (1,013) (1,725)

Purchase of property, plant and equipment (445) (410) (845)

------------------------------------------------------------------------ ---------- ---------- ------------

Net cash from investing activities (797) (1,603) (2,748)

------------------------------------------------------------------------ ---------- ---------- ------------

Cash flows from financing activities

Proceeds from loans and borrowings 1,783 1,500 -

Issue of shares - - (111)

Repayment of loans and borrowings - (83) -

Repayment of lease liabilities (541) (584) (1,073)

Interest paid on lease liabilities (84) (96) (132)

Finance expense paid (30) (26) (150)

Net cash from financing activities 1,128 711 (1,466)

------------------------------------------------------------------------ ---------- ---------- ------------

Net change in cash and cash equivalents (2,486) (6,042) (1,787)

------------------------------------------------------------------------ ---------- ---------- ------------

Cash and cash equivalents at start of period/year 7,000 9,033 9,033

Exchange losses on cash and cash equivalents 158 (64) (133)

------------------------------------------------------------------------ ---------- ---------- ------------

Cash and cash equivalents at end of period/year 4,672 2,927 7,113

------------------------------------------------------------------------ ---------- ---------- ------------

Consolidated Statement of Changes in Equity

for the period ended 31 May 2023

Translation Accumulated

Share capital Share premium Other reserves reserve losses Total equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 30 November

2021 11,183 31,451 11,151 1,538 (19,523) 35,800

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

Changes in

equity for six

months ended 31

May 2022

Loss for the

period - - - - (2,761) (2,761)

Other

comprehensive

income for the

period - - - 7 - 7

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

Total

comprehensive

expense - - - 7 (2,761) (2,754)

Share based

payment - - - - 322 322

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

At 31 May 2022 11,183 31,451 11,151 1,545 (21,962) 33,368

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

Changes in

equity for six

months ended 30

November 2022

Loss for the

period - - - - (1,216) (1,216)

Other

comprehensive

income for the

period - - - 62 - 62

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

Total

comprehensive

expense - - - 62 (1,216) (1,154)

Share based

payment - - - - 429 429

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

At 30 November

2022 11,183 31,451 11,151 1,607 (22,749) 32,643

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

Changes in

equity for six

months ended 31

May 2023

Loss for the

period - - - - (2,868) (2,868)

Other

comprehensive

income for the

period - - - 212 - 212

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

Total

comprehensive

expense - - - 212 (2,723) (2,511)

Share based

payment - - - - 446 446

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

At 31 May 2023 11,183 31,451 11,151 1,819 (25,171) 30,433

----------------- -------------- -------------- --------------- --------------- ---------------- -------------

1 Segment information

For the six months ended 31 May 2023

K3 Products Third-party Solutions Central Costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Software licence revenue 1,958 1,156 - 3,113

Services revenue 400 8,709 - 9,109

Maintenance & support 3,858 3,917 - 7,775

Hardware and other revenue 254 15 - 269

External revenue 6,470 13,797 - 20,267

Cost of sales (1,476) (6,441) - (7,917)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Gross profit 4,994 7,356 - 12,350

Gross margin 77.1% 53.3% 0.0% 60.9%

Adjusted administrative expenses (5,787) (2,367) (4,987) (13,141)

Allocation of Central Costs (1,512) (2,225) 3,737 -

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Adjusted operating profit/(loss) (2,305) 2,764 (1,250) (791)

Amortisation of development cost - - (1,331) (1,331)

Capitalised development costs - - 354 354

Exceptional impairment - - - -

Exceptional reorganisation costs - - (374) (374)

Acquisition costs - - - -

Share-based payment charge - - (532) (532)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

(Loss)/profit from operations (619) 4,816 (6,870) (2,674)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Finance expense - - (266) (266)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

(Loss)/profit before tax and discontinued

operations (619) 4,816 (7,136) (2,940)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Tax expense - - (245) (245)

Profit from discontinued operations - - 317 317

--------------------------------------------------- ------------ ------------------------ -------------- ---------

(Loss)/profit for the year (619) 4,816 (7,064) (2,868)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

For the six months ended 31 May 2022 (restated)

K3 Products Third-party solutions Central Costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Software licence revenue 836 1,801 - 2,637

Services revenue 415 8,019 - 8,434

Maintenance & support 4,834 3,614 - 8,448

Hardware and other revenue 406 14 - 420

External revenue 6,491 13,448 - 19,939

Cost of sales (1,287) (6,760) - (8,047)

----------------------------------------------------- ------------ ---------------------- -------------- ---------

Gross profit 5,204 6,688 - 11,892

Gross margin 80.2% 49.7% - 59.6%

Adjusted administrative expenses (6,326) (3,658) (2,891) (12,875)

Allocation of Central Costs (680) (961) 1,641 -

----------------------------------------------------- ------------ ---------------------- -------------- ---------

Adjusted operating profit/(loss) from continuing

operations (1,802) 2,069 (1,250) (983)

Amortisation of development cost - - (2,060) (2,060)

Capitalised development costs - - 1,013 1,013

Exceptional impairment - - - -

Exceptional reorganisation costs - - (118) (118)

Acquisition costs - - (98) (98)

Share-based payment charge - - (322) (322)

----------------------------------------------------- ------------ ---------------------- -------------- ---------

Loss from operations (1,122) 3,030 (4,476) (2,568)

----------------------------------------------------- ------------ ---------------------- -------------- ---------

Finance expense - - (219) (219)

----------------------------------------------------- ------------ ---------------------- -------------- ---------

Loss before tax and discontinued operations (1,122) 3,030 (4,695) (2,787)

----------------------------------------------------- ------------ ---------------------- -------------- ---------

Tax credit - - 156 156

Loss from discontinued operations - - (130) (130)

----------------------------------------------------- ------------ ---------------------- -------------- ---------

Profit/(loss) for the year (1,122) 3,030 (4,669) (2,761)

----------------------------------------------------- ------------ ---------------------- -------------- ---------

For the twelve months ended 30 November 2022 (restated)

K3 Products Third-party Solutions Central Costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Software licence revenue 2,174 3,468 - 5,642

Services revenue 738 17,377 - 18,115

Maintenance & support 9,620 13,196 - 22,816

Hardware and other revenue 925 34 - 959

External revenue 13,457 34,075 - 47,532

Cost of sales (2,920) (16,462) - (19,382)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Gross profit 10,537 17,613 - 28,150

Gross margin 78.3% 51.7% - 59.2%

Adjusted administrative expenses (12,127) (5,099) (9,176) (26,402)

Allocation of Central Costs (1,904) (4,762) 6,666 -

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Adjusted operating profit/(loss) (3,494) 7,752 (2,510) 1,748

Amortisation of development cost - - (3,766) (3,766)

Capitalised development costs - - 1,699 1,699

Exceptional impairment - - (1,603) (1,603)

Exceptional reorganisation costs - - (595) (595)

Acquisition costs - - (98) (98)

Share-based payment charge - - (855) (855)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

(Loss)/profit from operations (1,590) 12,514 (14,394) (3,470)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Finance expense - - (338) (338)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

(Loss)/profit before tax and discontinued

operations (1,590) 12,514 (14,732) (3,808)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

Tax expense - - (278) (278)

Profit from discontinued operations - - 108 108

--------------------------------------------------- ------------ ------------------------ -------------- ---------

(Loss)/profit for the year (1,590) 12,514 (14,902) (3,978)

--------------------------------------------------- ------------ ------------------------ -------------- ---------

2 General information

K3 Business Technology Group Plc is incorporated in England and

Wales under the Companies Act (listed on AIM, a market operated by

the London Stock Exchange Plc) with the registered number 2641001.

The address of the registered office is Baltimore House, 50 Kansas

Avenue, Manchester M50 2GL.

The interim condensed consolidated financial statements comprise

the company and its subsidiaries, "the Group".

Basis of preparation and Going Concern

The financial information set out in this Interim Report does

not constitute statutory accounts as defined in Section 434 of the

Companies Act 2006. The Group's statutory financial statements for

the year ended 30 November 2022, prepared in accordance with the

international accounting standards in conformity with the

requirements of the Companies Act 2006, have been filed with the

Registrar of Companies. The auditor's report on those financial

statements was unqualified and did not contain a statement under

Section 498 (2) or (3) of the Companies Act 2006. The interim

financial information has been prepared in accordance with the

recognition and measurement principles of International Financial

Reporting Standards ("IFRS") and on the same basis and using the

same accounting policies as used in the financial statements for

the year ended 30 November 2022, except for change in revenue

policy discussion in the front half.

The financial information has not been prepared (and is not

required to be prepared) in accordance with IAS 34. The accounting

policies have been applied consistently throughout the Group for

the purposes of preparation of this financial information.

The Interim Report has not been audited or reviewed in

accordance with the International Standard on Review Engagement

2410 issued by the Auditing Practices Board.

The Directors have a reasonable expectation that the Group has

adequate resources to continue in operational existence for the

foreseeable future. For these reasons, they continue to adopt the

going concern basis of accounting in preparing this financial

information.

3 Significant events

During H1 2023, Robert Price (Chief Finance Officer) left the

business and is replaced by Eric Dodd.

As disclosed in our Annual Report and Accounts for FY2022, on 24

February 2023, the Group agreed an extension to its Current

Revolving Credit Facility with Barclays for GBP3.5m until 31 March

2024.

4 (Loss)/earnings per share

The calculations of (loss)/earnings per share (EPS) are based on

the profit/(loss) for the period and the following numbers of

shares:

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

No. of Shares No. of Shares No. of Shares

Denominator

Weighted average number of

shares used in basic and diluted

EPS 44,090,074 44,705,570 44,090,074

Certain employee options and warrants have not been included in

the calculation of diluted EPS because their exercise is contingent

on the satisfaction of certain criteria that had not been met at

the end of the period/year.

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Loss after tax from continuing operations (3,185) (2,631) (4,086)

Profit after tax from discontinued

operations 317 130 108

---------- -------- --------

(Loss)/profit attributable to ordinary

equity holders of the parent for

basic and diluted earnings per share (2,868) (2,501) (3,978)

---------- -------- --------

4 (Loss)/earnings per share (continued)

The alternative earnings per share calculations have been

computed because the directors consider that they are useful to

shareholders and investors. These are based on the following

profits/(losses) and the above number of shares.

Restated Restated

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Loss after tax from continuing operations (3,185) (2,631) (4,086)

Add back Other Items:

Amortisation of development cost 1,331 2,060 3,766

Capitalised development costs (354) (1,013) (1,699)

Amortisation of acquired intangibles - - -

Exceptional reorganisation costs 374 118 595

Exceptional impairment costs - - 1,603

Acquisition costs - 98 98

Shared-based payment charge 532 322 855

Tax (credit)/charge related to Other

Items (112) (102) (202)

---------- ---------- ------------

(Loss)/profit attributable to ordinary

equity holders of the parent for basic

and diluted earnings per share from

continuing operations before other items (1,414) (1,148) 930

---------- ---------- ------------

Restated Restated

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

Pence Pence Pence

(Loss)/profit per share

Basic and diluted loss per share (6.5) (5.6) (9.0)

Basic and diluted (loss)/profit per

share from continuing operations (7.2) (5.9) (9.3)

Adjusted loss per share

Basic and diluted loss per share from

continuing operations before other items (3.2) (2.6) 2.1

-------------------------------------------- ------ ---------- ------------

5 Loans and borrowings

Unaudited Unaudited Audited

as at as at as at

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current

Bank overdrafts (secured) - 1,395 -

Bank loans (secured) 1,768 1,555 50

1,768 2,950 50

---------- ---------- ------------

6 Net cash

Unaudited Unaudited Audited

as at as at as at

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Cash 4,672 4,322 7,113

Bank overdrafts (secured) - (1,395) -

Cash and cash equivalents 4,672 2,927 7,113

---------- ---------- ------------

Loans and borrowings (1,768) (1,555) (50)

Net adjusted cash (before leases) 2,904 1,372 7,063

---------- ---------- ------------

Non-current leases liabilities (33) (223) (79)

Current lease liabilities (769) (951) (802)

---------- ---------- ------------

Net Cash 2,102 198 6,182

---------- ---------- ------------

7 Trade and other payables

Unaudited Unaudited Audited

as at as at as at

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Trade payables 1,974 2,432 2,823

Other payables 1,128 1,437 2,202

Accruals 2,942 2,539 4,041

---------- ---------- ------------

Total financial Liabilities, excluding

loans and borrowings, classified as

financial liabilities measures at amortised

cost 6,044 6,408 9,066

Other tax and social security tax 1,311 1,181 2,504

Contract liabilities 4,788 3,021 5,312

12,143 10,610 16,882

---------- ---------- ------------

8 Trade and other receivables

Unaudited Unaudited Audited

as at as at as at

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Trade receivables 6,883 7,797 8,079

Loss allowance (1,099) (726) (784)

---------- ---------- ------------

Trade receivables - net 5,784 7,071 7,295

Other receivables 341 172 138

Contract assets 4,153 3,423 5,512

Prepayments 858 1,076 604

11,136 11,742 13,549

---------- ---------- ------------

9 Tax

Unaudited Unaudited Audited

6 months 6 months 12 months

31 May 31 May 30 November

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current tax (credit)/expense

Income tax of overseas operations

on (losses)/profits for the period/year (245) (156) 203

Adjustment in respect of prior periods - - (100)

--------------------- ---------- ------------

Total current tax (credit)/expense (245) (156) 103

--------------------- ---------- ------------

Deferred tax (income)/expense

Origination and reversal of temporary

differences - - 19

Adjustment in respect of prior periods - - (32)

--------------------- ---------- ------------

Total deferred tax expense - - (13)

--------------------- ---------- ------------

Total tax (credit)/expense (245) (156) 90

--------------------- ---------- ------------

Income tax (credit)/expense attributable

to continuing operations (245) (156) 278

Income tax credit attributable to

discontinued operations - - (188)

--------------------- ---------- ------------

(245) (156) 90

--------------------- ---------- ------------

10 Non-statutory information

The Group uses a variety of alternative performance measures,

which are non-IFRS, to assess the performance of its operations.

The Group considers these performance measures to provide useful

historical financial information to help investors evaluate the

underlying performance of the business.

These measures, as described below, are used to improve the

comparability of information between reporting periods and

geographical units, to adjust for exceptional items or to adjust

for businesses identified as discontinued to provide information on

the ongoing activities of the Group. This also reflects how the

business is managed and measured on a day-to-day basis.

1 Adjusted administrative expenses and Adjusted operating profit

or loss are, as appropriate, stated before: exceptional and other

adjusting items including gains or losses on business acquisitions

and disposals, amortisation of acquired intangibles, costs relating

to share-based payments, exceptional impairment, exceptional

re-organisation costs, amortisation of development cost,

capitalised development costs and the related tax effect of these

exceptional and other adjusting items, as Management do not

consider these items when reviewing the underlying performance of

the Segment or the Group as a whole.

2 Recurring or predictable revenue - Contracted support,

maintenance and services revenues with a frame agreement of 2 years

or more, as % of total revenue.

3 Cash outflow - speed at which business spends the money that

is available to it. Calculated as delta between cash and cash

equivalents balances between two periods.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFLATEIAFIV

(END) Dow Jones Newswires

August 30, 2023 02:00 ET (06:00 GMT)

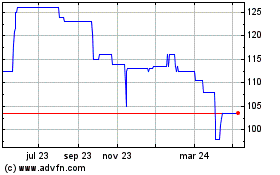

K3 Business Technology (LSE:KBT)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

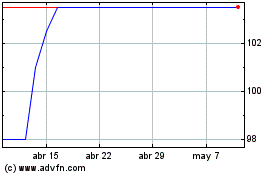

K3 Business Technology (LSE:KBT)

Gráfica de Acción Histórica

De May 2023 a May 2024