Sequoia Economic Infra Inc Fd Ld Notice of Results

28 Noviembre 2024 - 3:55AM

RNS Regulatory News

RNS Number : 0351O

Sequoia Economic Infra Inc Fd Ld

28 November 2024

28 November 2024

Sequoia Economic

Infrastructure Income Fund Limited

(The "Company" or

"SEQI")

Notice of Interim Results and

Investor and Analyst Conference Call

SEQI, the specialist investor in

economic infrastructure debt, will publish its interim results for

the six months ended 30 September 2024 on Thursday, 5 December

2024.

The Investment Adviser will host a

conference call for investors and analysts on the results at

09:00am GMT on Thursday, 5 December 2024. There will be the

opportunity for participants to ask questions at the end of the

call.

Those wishing to attend should

register via the following link:

https://stream.brrmedia.co.uk/broadcast/672399a2c86085b1bff5df3f

For further information, please

contact:

|

Sequoia Investment Management Company

|

+44 (0) 20

7079 0480

|

|

Steve Cook

|

|

|

Dolf Kohnhorst

|

|

|

Randall Sandstrom

|

|

|

Anurag Gupta

|

|

|

|

|

|

Jefferies International Limited (Corporate Broker &

Financial Adviser)

|

+44 (0) 20

7029 8000

|

|

Gaudi Le Roux

|

|

|

Harry Randall

|

|

|

|

|

|

Teneo (Financial PR)

|

+44 (0) 20

7353 4200

|

|

Martin Pengelley

|

|

|

Elizabeth Snow

|

|

|

Faye Calow

|

|

|

|

|

|

Sanne Fund Services (Guernsey) Limited (Company

Secretary)

|

+44 (0) 20

3530 3107

|

|

Matt Falla

|

|

|

Devon Jenkins

|

|

|

|

|

About Sequoia Economic Infrastructure Income Fund

Limited

|

·

|

SEQI is the UK's largest listed debt

investor, investing in economic infrastructure private loans and

bonds across a range of industries in stable, low-risk

jurisdictions, creating equity-like returns with the protections of

debt.

|

|

·

|

It seeks to provide investors with

regular, sustained, long-term income with opportunity for NAV

upside from its well-diversified portfolio. Investments are

typically non-cyclical, in industries that provide essential public

services or in evolving sectors such as energy transition,

digitalisation or healthcare.

|

|

·

|

Since its launch in 2015, SEQI has

provided investors with over nine years of quarterly income,

consistently meeting its annual dividend per share target, which

has grown from 5p in 2015 to 6.875p per share in 2023.

|

|

·

|

The fund has a comprehensive ESG

programme combining proprietary ESG goals, processes and metrics

with alignment to key global initiatives.

|

|

·

|

SEQI is advised by Sequoia

Investment Management Company Limited (SIMCo), a long-standing

investment advisory team with extensive infrastructure debt

origination, analysis, structuring and execution

experience.

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NORKVLBLZFLEFBL

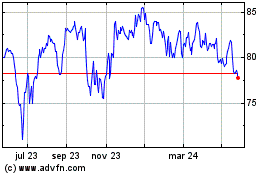

Sequoia Economic Infrast... (LSE:SEQI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

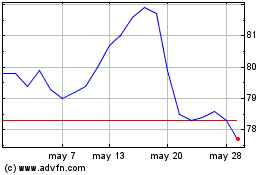

Sequoia Economic Infrast... (LSE:SEQI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024