TIDMTGA

RNS Number : 3224C

Thungela Resources Limited

12 June 2023

Thungela Resources Limited

(Incorporated in the Republic of South Africa)

Registration number: 2021/303811/06

JSE share code: TGA

LSE share code: TGA

ISIN: ZAE000296554

('Thungela' or the 'Company' and together with its affiliates,

the 'Group')

Chief Financial Officer's Pre-Close and Trading Statement

for the six-months ending 30 June 2023

Dear Stakeholder

On the basis of the first five months of 2023, Thungela expects

to deliver positive earnings and cash generation for the six-month

period ending 30 June 2023, notwithstanding a sharp decline in coal

prices and continued rail underperformance by Transnet Freight Rail

(TFR).

Seaborne coal prices have receded from record highs in 2022 and

have fallen sharply since the start of the year. Following a milder

winter in Europe, coupled with softer gas prices, European coal and

gas stocks continued to be elevated, resulting in the redirection

of coal volumes to Asia. This added significant supply to Asian

markets which also showed signs of weaker demand, especially from

China. Russian coal also continued to flow into the region at

discounts. However, LNG prices are now starting to find support,

which could make coal more competitive as a fuel source towards the

end of the year as the European winter approaches. Other short term

price support factors include the impact of coal supply cuts,

including lower volumes of low grade South African export coal and

reduced export volumes from western Russia.

By early May 2023, TFR performance had stabilised at

approximately 48Mtpa for the industry following a very weak start

to the year. This stability was interrupted by two derailments in

May which resulted in the loss of approximately 300kt in railed

volumes for Thungela. For Thungela to achieve the upper end of our

export saleable production guidance range (i.e. 12.5Mt) we require

an industry run rate of 53Mtpa in the second half of the year.

Thungela and the industry continue to work closely with TFR on a

series of on-going interventions aimed at improving rail

performance.

Thungela is currently not materially affected by the challenges

relating to Eskom's inability to provide a consistent supply of

electricity, however this could become an area of concern in the

event that we see further deterioration in the supply of

electricity.

The following are the key insights into our performance for the

year to date(1) and our expectations for the six-months ending 30

June 2023 (H1 2023):

-- The Benchmark coal price(2) has averaged USD135.47 per tonne

for the year to date, compared to USD270.87 per tonne for FY

2022.

-- Discount to the Benchmark coal price has been approximately

17% for the year to date, compared to 15% for FY 2022. The average

realised export price for the year to date is USD112.40 per tonne,

compared to USD229.21 per tonne for FY 2022.

-- Export saleable production for H1 2023 is expected to be

5.8Mt, in line with the guidance range of 10.5Mt to 12.5Mt for the

full year issued in March 2023, and 5% lower than H1 2022 export

saleable production of 6.1Mt.

-- FOB cost per export tonne is expected to be R1,230 in H1

2023, compared to R1,093 per tonne in H1 2022. FOB cost per export

tonne excluding royalties for H1 2023 is expected to be R1,155, in

line with the full year guidance range of R1,047 to R1,180 per

tonne. This compares to R927 per tonne for H1 2022. The increase is

primarily attributable to lower production coupled with energy

input price escalation.

-- Export equity sales for H1 2023 are expected to be 6.2Mt,

compared to 6.5Mt in H1 2022, a decrease of 5%. This is a result of

the forecast rail performance of 6.0Mt in the first half of 2023

coupled with a draw down in port stocks.

-- Capital expenditure for H1 2023 is expected to be R0.7

billion . This consists of R0.4 billion in sustaining capital and

R0.3 billion in expansionary capital. Capital expenditure has

historically been weighted towards the second half of the year.

-- The Group had a net cash position of R14.0 billion on 31 May

2023. The Group expects to pay taxes and royalties of approximately

R1.0 billion relating to H1 2023 in June 2023.

-- Earnings per share ("EPS") (3) for H1 2023 is expected to be

between R17.00 and R23.00, thus between R44.23 and R50.23 lower

than the H1 2022 EPS of R67.23 per share - a decrease of between

66% and 75%.

-- Headline earnings per share ("HEPS") (3) for H1 2023 is

expected to be between R17.00 and R23.00, thus between R44.23 and

R50.23 lower than the H1 2022 HEPS of R67.23 per share - a decrease

of between 66% and 75%.

Thungela has continued to advance its strategic priorities. The

board has approved the Zibulo North Shaft life extension project at

a capital cost of R2.4 billion which, together with the investment

in the Elders production replacement project, will underpin the

cost competitiveness of our business into the future. The Group

also continues to make progress on fulfilling the conditions

precedent relating to the Ensham acquisition and we are confident

that the transaction will complete within the next three months.

The Ensham operation will further enhance the resilience of our

portfolio.

We are focused on controlling the controllables and we are

working to eliminate costs where we have curtailed production as a

result of rail underperformance, coupled with driving productivity

where production has not been curtailed. We will also continue to

closely monitor the thermal coal prices and rail performance, the

likely trajectory of improvements and the impact this may have on

our future portfolio.

Thungela remains focused on disciplined capital allocation and

committed to our stated dividend policy, which is to target a

minimum payout of 30% of adjusted operating free cash flow(4) . In

this context, the Group's balance sheet remains robust and together

with the actions we are taking to further bolster the resilience of

our business, we are confident that we will be able to navigate the

current headwinds and to continue delivering superior returns for

our shareholders over the long-term.

Deon Smith

Chief Financial Officer

Annexure A: Operational Performance

Table 1: Export saleable production by operation

Export saleable H1 2022 H1 2023 % change

production Actual Forecast(5)

Mt (a) (b)

(b-a)/a

Underground 4.5 4.3 -4%

------------------------- -------- ------------

Zibulo 2.3 2.0 -13%

------------------------- -------- ------------

Greenside 1.2 0.9 -25%

------------------------- -------- ------------

Goedehoop(6) 1.0 1.4 40%

------------------------- -------- ------------

Opencast 1.6 1.5 -6%

------------------------- -------- ------------

Khwezela 0.6 0.8 33%

------------------------- -------- ------------

Mafube 1.0 0.7 -30%

------------------------- -------- ------------

TOTAL 6.1 5.8 -5%

------------------------- -------- ------------

Table 2: Export sales by segment

Export sales H1 2022 H1 2023 % change

Mt Actual Forecast(5)

Equity sales 6.5 6.2 -5%

------------------ ------- ------------

Underground 4.8 4.7 -2%

------------------ ------- ------------

Opencast 1.7 1.5 -12%

------------------ ------- ------------

Third party sales 0.0 0.0 -

------------------ ------- ------------

TOTAL 6.5 6.2 -5%

------------------ ------- ------------

Footnotes

1. All references in this document to "year to date" refer to

the period from 1 January 2023 to 31 May 2023.

2. Benchmark price reference for 6,000kcal/kg thermal coal

exported from the Richards Bay Coal Terminal.

3. Expected EPS and HEPS for H1 2023 is based on a WANOS of

approximately 137.2 million shares. EPS and HEPS for H1 2022 is

based on a WANOS of approximately 133.3 million shares. The lower

end of the forecast EPS and HEPS ranges are calculated at an

average exchange rate of USD:ZAR R18.00 for the month of June

2023.

4. Adjusted operating free cash flow is net cash flows from

operating activities less sustaining capex.

5. Based on the latest available management forecasts. Final figures may differ by +/- 5%.

6. Export saleable production for Goedehoop includes

approximately 300kt attributable to the Nasonti operation.

Review of Pre-Close and Trading Statement

The information in this Pre-Close and Trading Statement is the

responsibility of the directors of Thungela and has not been

reviewed or reported on by the Group's independent external

auditors.

The Group expects to release its interim results on or about 21

August 2023.

Investor Call Details

A conference call and audio webinar relating to the details of

this announcement will be held at 11:00 SAST on Monday 12 June

2023. A recording of the audio webinar will be made available on

the Thungela website from 15:00 SAST on the same date.

Conference Call registration:

https://services.choruscall.za.com/DiamondPassRegistration/register?confirmationNumber=8399487&linkSecurityString=1556933ae1

Audio webinar registration:

https://services.themediaframe.com/links/thungela10044564.html

Disclaimer

This document includes forward-looking statements. All

statements other than statements of historical facts included in

this document, including, without limitation, those regarding

Thungela's financial position, business, acquisition and divestment

strategy, dividend policy, plans and objectives of management for

future operations (including development plans and objectives

relating to Thungela's products, production forecasts and Reserve

and Resource positions), are, or may be deemed to be,

forward-looking statements. By their nature, such forward-looking

statements involve known and unknown risks, uncertainties and other

factors which may cause the actual results, performance or

achievements of Thungela or industry results to be materially

different from any future results, performance or achievements

expressed or implied by such forward-looking statements. The Group

assumes no responsibility to update forward-looking statements in

this announcement except as may be required by law.

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the market abuse regulation (EU) no. 596/2014 as amended by the

market abuse (amendment) (UK mar) regulations 2019. Upon the

publication of this announcement via the regulatory information

service, this inside information is now considered to be in the

public domain.

Investor Relations

Ryan Africa

Email: ryan.africa@thungela.com

Media Contacts

Tarryn Genis

Email: tarryn.genis@thungela.com

UK Financial adviser and corporate broker

Liberum Capital Limited

Tel: +44 20 3100 2000

Sponsor

Rand Merchant Bank

(a division of FirstRand Bank Limited)

Rosebank

12 June 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAFKFFSKDEFA

(END) Dow Jones Newswires

June 12, 2023 02:00 ET (06:00 GMT)

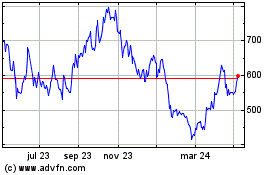

Thungela Resources (LSE:TGA)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Thungela Resources (LSE:TGA)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024