TIDMTHS

RNS Number : 6928F

Tharisa PLC

12 July 2023

Tharisa plc

(Incorporated in the Republic of Cyprus with limited

liability)

(Registration number HE223412)

JSE share code: THA

LSE share code: THS

A2X share code: THA

ISIN: CY0103562118

LEI: 213800WW4YWMVVZIJM90

('Tharisa' or the 'Company')

PRODUCTION REPORT FOR THE THIRD QUARTERED 30 JUNE 2023

Tharisa, the platinum group metals (PGMs) and chrome co-producer

dual-listed on the Johannesburg and London stock exchanges,

announces its production results for Q3 FY2023 [1] and cash balance

as at the quarter end.

Quarter highlights

-- Lost Time Injury Frequency Rate ('LTIFR') of 0.06 per 200 000-man hours worked

-- Processing capacity maintained

-- PGM output increased to 37.0 koz (Q2 FY2023: 34.3 koz) with

yield maintained and recoveries improving

-- Chrome output marginally lower at 378.8 kt (Q2 FY2023: 404.8

kt) on steady grades, yield, and recoveries

-- Mining volumes remain constrained

-- Metallurgical grade chrome concentrate prices up 7.8% quarter

on quarter averaging US$290/t (Q2 FY2023: US$269/t)

-- Karo Platinum Project remains on track with major milestones

of first concrete pour and pilot mining commenced

-- Cash on hand increased by US$36.8 million to US$242.6 million

(31 March 2023: US$205.8 million), resulting in a net cash position

of US$141.5 million (31 March 2023: US$101.1 million

-- Strong balance sheet to support the growth of the business

whilst providing returns to shareholders

Key Operating Numbers

Quarter Quarter Quarter Quarter Nine Nine

ended ended on quarter ended months months

30 June 31 March movement 30 June ended ended

2023 2023 % 2022 30 June 30 June

2023 2022

6E PGMs produced koz 37.0 34.3 7.9 42.1 114.0 133.9

-------- --------- ---------- ------------ --------- --------- ---------

Chrome concentrates

produced (excluding

third party) kt 378.8 404.8 (6.4) 389.7 1 166.7 1 166.4

-------- --------- ---------- ------------ --------- --------- ---------

Average PGM contained

metal basket price US$/oz 1 695 2 032 (16.6) 2 677 2 049 2 619

-------- --------- ---------- ------------ --------- --------- ---------

Metallurgical grade US$/t

chrome concentrate CIF

contract price China 290 269 7.8 247 258 201

-------- --------- ---------- ------------ --------- --------- ---------

Phoevos Pouroulis, CEO of Tharisa, commented:

"The unique co-product model was again highlighted with the

Company benefitting from continued favourable chrome pricing while

dealing with PGM pricing pressures, resulting in strong free cash

generation - ending the period with a further strengthened balance

sheet with net cash of over US$140m.

The quarter also allowed us to review our in-pit mining plan

with the appointment of a waste material contractor helping to

ensure sustainable access to the required reef horizons. Our output

will, however, remain subdued for the remainder of the year as we

focus on mining flexibility for sustainable reef operations.

At Karo, we remain on track with project construction,

completing our first concrete pour in June, with pilot mining

having commenced. The equity contribution by Tharisa of US$135

million is being drawn down to match capital requirements with cash

flow as we finalise the senior debt portion for this globally

strategic mine.

Domestic headwinds coupled with macro events and commodity price

uncertainty have pressured the business and led to a material

disconnect between equity valuations and intrinsic valuation

underpinned by cash generation. However, as we have shown in more

complex historical times, the nature of Tharisa with modern,

low-cost structures leaves us well positioned to weather the

environment and continue to provide returns to shareholders while

actively and sustainably growing the business."

Health & Safety

-- The health and safety of our stakeholders remains a core

value to the Group and Tharisa continues to strive for zero harm at

its operations

-- LTIFR of 0.06 per 200 000-man hours worked

Market Update

-- The pressure seen in the PGM market manifested itself in some

unusual and often aggressive selling patterns, with renewed fears

of a macro economic slowdown, driven by China and the United

States, compounding price pressures. This despite car sales being

set to surpass production last year, which should underpin a demand

for all PGM metals. However, pipeline destocking meant that this

increased demand was satisfied by pipeline inventories. We maintain

that while prices are trading near 52-week lows, in the medium to

long-term, prices should rise, driven by supply complexities in the

major producing regions, with current pricing pressures leading to

increased challenges faced by some higher cost producers. While

most commentators have pulled back price forecasts in line with

recent events, the long-term outlook for even the most conservative

forecasts are indicating higher averages for PGMs than current spot

prices

-- The chrome market showed its ongoing resilience as solid

demand meant prices averaged well above those achieved in the

previous quarters. While port stocks, which were sitting at

multi-year lows have increased, the supply pipeline remains tight,

particularly as inland logistics in South Africa remain

challenging. In addition, there have been no major primary output

increases in the local market due to the lack of available

resources and power constraints for smaller producers unable to

access standby power. The chrome market looks set to continue its

strong performance for the remainder of the calendar year 2023,

particularly as new furnace commissioning continues to draw on

material demand

Operational Update

-- Total reef mined of 908.8 kt (Q2 FY2023: 1 028.0 kt) limited

by constrained in pit flexibility notwithstanding the increased

waste stripping at 14.2 m(3) : m(3) (Q2 FY2023: 12.6 m(3) : m(3)

)

-- Total reef tonnes milled for the quarter at 1 302.2 kt (Q2

FY2023: 1 370.0 kt), supplemented by strategic ROM ore

purchases

-- Quarterly PGM production at 37.0 koz (Q2 FY2023: 34.3 koz)

-- Rougher feed grade of 1.67 g/t (Q2 FY2023: 1.66 g/t)

-- Recovery of 69.0% (Q2 FY2023: 61.9%) as the plants processed more fresh material

-- Quarterly chrome production at 378.8 kt (Q2 FY2023: 404.8 kt)

-- Grade of 17.8% Cr(2) O(3) (Q2 FY2023: 18.4%)

-- Recovery at 67.9% (Q2 FY2023: 66.6%)

-- Speciality chrome production improving as spiral replacement program has been completed

Karo Platinum Update

-- No LTI recorded on the project to date

-- 540 people on site, of which 99 are Karo employees with the balance contractor employees

-- Concrete foundation pouring progressing well with earthworks nearing completion

-- Pilot mining commenced with contractor and staff onsite to commence operational tests

-- Long-lead items manufacturing progressing as planned with

first major deliveries schedule for Q4 calendar 2023

-- Powerline construction to commence this quarter

Cash Balance and Debt Position

Tharisa had a cash balance of US$242.6 million (31 March 2023:

US$205.8 million) at the end of the quarter, and debt of US$101.1

million (31 March 2023: US$99.0 million), resulting in a net cash

position of US$141.5 million (31 March 2023: US$101.1million).

These cash and debt numbers continue to exclude the recently

concluded US$130 million facilities which are undrawn at the

reporting period.

Production Numbers

Quarter Quarter Quarter Quarter Nine Nine

ended ended on quarter ended months months

30 June 31 March movement 30 June ended ended

2023 2023 % 2022 30 June 30 June

2023 2022

Reef mined kt 908.8 1 028.0 (11.6) 1 357.1 3 018.4 4 190.7

--------- --------- ---------- ------------ --------- --------- ---------

m(3)

Stripping ratio : m(3) 14.2 12.6 12.7 14.2 12.3 12.6

--------- --------- ---------- ------------ --------- --------- ---------

Reef milled kt 1 302.2 1 370.0 (4.9) 1 367.1 4 099.5 4 161.4

--------- --------- ---------- ------------ --------- --------- ---------

PGM flotation feed kt 996.5 1 039.6 (4.1) 1 051.4 3 151.4 3 166.4

--------- --------- ---------- ------------ --------- --------- ---------

PGM rougher feed

grade g/t 1.67 1.66 0.6 1.65 1.66 1.71

--------- --------- ---------- ------------ --------- --------- ---------

PGM recovery % 69.0 61.9 11.5 75.6 67.6 76.8

--------- --------- ---------- ------------ --------- --------- ---------

6E PGMs produced koz 37.0 34.3 7.9 42.1 114.0 133.9

--------- --------- ---------- ------------ --------- --------- ---------

Platinum produced koz 20.9 19.7 6.1 23.1 63.8 73.9

--------- --------- ---------- ------------ --------- --------- ---------

Palladium produced koz 6.6 6.1 8.2 7.2 20.1 22.1

--------- --------- ---------- ------------ --------- --------- ---------

Rhodium produced koz 3.4 3.0 13.3 4.0 10.6 12.8

--------- --------- ---------- ------------ --------- --------- ---------

Average PGM contained

metal basket price US$/oz 1 695 2 032 (16.6) 2 677 2 049 2 619

--------- --------- ---------- ------------ --------- --------- ---------

Platinum price US$/oz 1 034 1 004 3.0 958 994 994

--------- --------- ---------- ------------ --------- --------- ---------

Palladium price US$/oz 1 441 1 563 (7.8) 2 100 1 664 2 117

--------- --------- ---------- ------------ --------- --------- ---------

Rhodium price US$/oz 6 959 10 812 (35.6) 15 755 10 467 15 370

--------- --------- ---------- ------------ --------- --------- ---------

Average PGM contained

metal basket price ZAR/oz 31 544 35 801 (11.9) 41 531 36 671 40 299

--------- --------- ---------- ------------ --------- --------- ---------

Cr(2) O(3) ROM grade % 17.8 18.4 (3.3) 17.0 17.7 17.4

--------- --------- ---------- ------------ --------- --------- ---------

Chrome recovery % 67.9 66.6 2.0 70.2 66.7 67.8

--------- --------- ---------- ------------ --------- --------- ---------

Chrome yield % 29.1 29.5 (1.4) 28.5 28.5 28.0

--------- --------- ---------- ------------ --------- --------- ---------

Chrome concentrates

produced (excluding

third party) kt 378.8 404.8 (6.4) 389.7 1 166.7 1 166.4

--------- --------- ---------- ------------ --------- --------- ---------

Metallurgical grade kt 306.0 365.3 (16.2) 307.0 1 018.5 907.3

--------- --------- ---------- ------------ --------- --------- ---------

Specialty grades kt 72.8 39.5 84.3 82.7 148.2 259.1

--------- --------- ---------- ------------ --------- --------- ---------

Third party chrome

production kt 56.2 45.8 22.7 47.4 143.0 150.0

--------- --------- ---------- ------------ --------- --------- ---------

Metallurgical grade US$/t

chrome concentrate CIF

contract price China 290 269 7.8 247 258 201

--------- --------- ---------- ------------ --------- --------- ---------

Metallurgical grade ZAR/t

chrome concentrate CIF

contract price China 5 519 4 827 14.3 3 900 4 680 3 112

--------- --------- ---------- ------------ --------- --------- ---------

Average exchange

rate ZAR:US$ 18.7 17.8 5.1 15.6 18.0 15.4

--------- --------- ---------- ------------ --------- --------- ---------

Paphos, Cyprus

12 July 2023

JSE Sponsor

Investec Bank Limited

Connect with us on LinkedIn and Twitter to get further news and

updates about our business.

Investor Relations Contacts:

Ilja Graulich (Head of Investor Relations and

Communications)

+27 11 996 3500

+27 83 604 0820

igraulich@tharisa.com

Financial PR Contacts:

Bobby Morse / Oonagh Reidy

+44 207 466 5000

tharisa@buchanan.uk.com

Broker Contacts:

Peel Hunt LLP (UK Joint Broker)

Ross Allister / Georgia Langoulant

+44 207 7418 8900

BMO Capital Markets Limited (UK Joint Broker)

Thomas Rider / Nick Macann

+44 207 236 1010

Berenberg (UK Joint Broker)

Matthew Armitt / Jennifer Lee / Detlir Elezi

+44 203 207 7800

Nedbank Limited (acting through its Corporate and Investment

Banking division) (RSA Broker)

Carlyle Whittaker

+27 11 294 0061

About Tharisa

Tharisa is an integrated resource group critical to the energy

transition and decarbonisation of economies. It incorporates

exploration, mining, processing and the beneficiation, marketing,

sales, and logistics of PGMs and chrome concentrates, using

innovation and technology as enablers. Its principal operating

asset is the Tharisa Mine, located in the south-western limb of the

Bushveld Complex, South Africa. The mechanised mine has an 18 year

pit life and can extend operations underground by at least 40

years. Tharisa also owns Karo Platinum, a low-cost, open-pit PGM

asset under construction and located on the Great Dyke in Zimbabwe.

The Company is committed to reducing its carbon emissions by 30% by

2030 and the development of a roadmap is continuing to be net

carbon neutral by 2050. Tharisa plc is listed on the Johannesburg

Stock Exchange (JSE: THA) and the Main Board of the London Stock

Exchange (LSE: THS).

[1] Tharisa's financial year is from 01 October to 30

September

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DRLNKDBDQBKDAOD

(END) Dow Jones Newswires

July 12, 2023 02:00 ET (06:00 GMT)

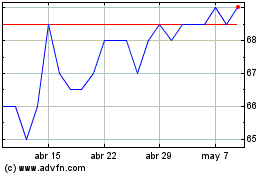

Tharisa (LSE:THS)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Tharisa (LSE:THS)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024