TIDMWHI

RNS Number : 9114J

W.H. Ireland Group PLC

16 December 2022

16 December 2022

WH Ireland Group plc

("WH Ireland" or the "Company")

Interim Results for the Six Months ended 30 September 2022

Financial Highlights

-- Revenue of GBP14.3m (H12021: GBP17.0m(*) )

o Wealth Management division revenue GBP7.3m (H12021:

GBP7.8m)

o Capital Markets division revenue GBP7.0m (H12021: GBP9.2m)

-- Administrative expenses reduced by GBP2.2m year on year

-- Underlying loss before tax of (GBP0.9)m (H12021: profit of

GBP1.1m)(+)

-- Statutory loss before tax of GBP(0.38)m (H12021: GBP0.3m)

-- Basic loss per share (0.59)p (H12021: earnings of

0.55p)(+)

-- Cash balances at GBP6.3m (31 March 2022: GBP6.4m; 30

September 2021: GBP8.4m)

Divisional Highlights

-- Wealth Management (including Harpsden):

o Total group AUM of GBP2.1bn (H12021: GBP2.4bn)

o WM AUM held on SEI (UK) platform of GBP1.4bn (H12021:

GBP1.6bn)

o Discretionary assets under management of GBP1.0bn (H12021:

GBP1.2bn)

-- Capital Markets:

o Increase in number of corporate clients to 92 (H12021: 86)

o Won 13 new quoted corporate client retained mandates

o 19 transactions completed in H1 raising GBP37m (H12021:

GBP193m)

Current trading and outlook

-- Challenging market environment has continued

-- With further tight control over costs, we expect to report a

small loss for the year as a whole

-- Net cash as at 9 December stood at GBP6.75m

-- Progressing development opportunities and recruitment (see

separate announcement issued today) in both divisions

Commenting, Phillip Wale, Chief Executive Officer said:

"Our first half was impacted as expected by the fall in markets

and drop off in transactions on AIM. In the circumstances, we

reported a relatively resilient performance and continued to

develop the Group through selective recruitment and complementary

new services, such as our debt capital markets team who completed

another transaction this week. With a continued focus on

operational efficiencies, and the further development of our new

and existing o fferings, I believe we are well placed to take

advantage of a mark et recovery. "

For further information please contact:

WH Ireland Group plc www.whirelandplc.com

Phillip Wale, Chief Executive

Officer +44(0) 20 7220 1666

Canaccord Genuity Limited www.canaccordgenuity.com

Emma Gabriel / Harry

Rees +44(0) 20 7523 8000

MHP Communications whireland@mhpc.com

Reg Hoare / James Bavister +44 (0) 20 3128 8793

*The comparative information for the period end 30 September

2021 has been reclassified to reflect the correct loss on

discontinued operations, together with a reclassification of

investment gains to revenue as laid out in the report and accounts

year ending 31 March 2021. See note 1 for further information.

(+) A reconciliation from underlying profits to statutory

profits is shown within the Chief Executive's statement below

Notes to Editors :

About WH Ireland Group plc

Wealth Management Division

WH Ireland provides independent financial planning advice and

discretionary investment management. Our goal is to build long

term, mutually beneficial, working relationships with our clients

so that they can make informed and effective choices about their

money and how it can support their lifestyle ambitions. By building

a financial plan and investment strategy with us, our clients are

free to focus on the important things, like life.

Capital Markets Division

Our Capital Markets Division is specifically focused on the

public and private growth company marketplace. The team's

significant experience in this exciting segment means that we are

able to provide a specialist service to each of its respective

participants. For companies, we raise public and private growth

capital, as well as providing both day-to-day and strategic

corporate advice. Our tailored approach means that our teams engage

with all of the key investor groups active in our market - High Net

Worth Individuals, Family Offices, Wealth Managers and Funds. Our

broking, trading and research teams provide the link between growth

companies and this broad investor base.

Chair's opening paragraph

P hillip Wale, our CEO, wrote in his last Annual Report that

"the economic and global environment is probably as testing as any

I have experienced in my career" and "we therefore remain cautious

of the very short term". As many of our peers have already

reported, the very challenging market environment has indeed

continued. This has led to a loss for the period.

We remain committed to continuing to focus on our operational

efficiencies across the Group to ensure that the company is well

positioned for market recovery. We also remain committed to further

alignment of shareholder and employee interests.

Chief Executive's statement

Although our results are well down on last year's, we were close

to financial breakeven despite the very testing market conditions,

reflecting the benefit of lower costs and a significant VAT refund.

Positively, we made good operational progress during the period,

including winning 13 new brokerships, and launching our new Debt

Capital business to complement our existing Equity Capital Markets

and Private Growth Capital businesses. Wealth Management also made

good progress enhancing its customer proposition and refining its

business model.

Group revenue of GBP14.2m for the six months to 30 September

2022 fell by 15.9% against the comparative period last year, driven

both by the fall in markets, which impacted revenue for both

divisions, and by the widely reported drop off in transactions on

AIM, which particularly affected Capital Markets.

Administration expenses fell by GBP2.2m, or 13.0%, reflecting

both the continuing efficiency measures undertaken and a reduction

in variable employee compensation. This resulted in an underlying

loss for the period of GBP0.9m (six months to 30 September 2021

GBP1.1m profit) and a statutory loss before tax of GBP0.4m (six

months to 30 September 2021 GBP0.3m profit). Net cash at period end

stood at GBP6.3m (31 March 2022 GBP6.4m, 30 September 2021

GBP8.4m).

Capital Markets

Despite the backdrop of a 23% fall in AIM index over the six

months to 30 September 2022 and a 75% decline in total money raised

over the same period, we successfully delivered a number of Equity

Capital Markets fundraises during the period and won 13 new quoted

corporate client retained mandates, taking our total number of

clients to 92 (2021: 86). This increase not only means an immediate

increase in revenue from retainers but should also position us to

benefit from increased transaction fees when market activity

increases. Success fees generated from fundraising are an important

element of our Capital Markets Division revenue and the significant

drop in total funds raised across the market during the period has

correspondingly impacted our own income

Our new Debt Capital Markets team, who joined the company in May

2022, completed their first transaction during the period, and we

remain confident that they will significantly enhance the business

once market conditions improve. The team complements our existing

Capital Markets and Private Growth Capital expertise and creates a

full Capital Markets offering enabling our clients to undertake a

variety of strategic fundraising options to ensure the best

possible outcome for their businesses.

The Private Growth Capital business continues to see an exciting

pipeline of opportunities, with two fundraises being completed in

the period.

We have been proactive in selectively reducing certain costs,

while at the same time investing in other areas where we see

commercial opportunities.

Wealth Management

The present market backdrop has also impacted our Wealth

Management (WM) revenues, through the impact of market falls on

Assets Under Management (AUM) and through a consequent reduction in

new business opportunities. Despite this there were some

encouraging new business wins, good relative investment performance

and progress in enhancing our client proposition. Total WM AUM fell

12.5% to GBP1.4bn. Discretionary AUM (our main focus) fell 9.1% to

GBP1bn. Net new discretionary AUM totalled GBP15.7m.

We have continued to make progress in improving the efficiency

of the business, focussing around our four offices in London,

Manchester, Henley and Poole. We have been encouraged by the rise

in Financial Planning income as we put added emphasis on this area

of the business.

The Wealth Management business benefitted significantly during

the period from a refund from HMRC in respect of our VAT arising on

services during earlier periods, as set out further in the

accounts.

Employees

As stated above we have continued to look for efficiencies and

cost savings across the group which has seen the total number of

employees reduced to 156 from 163 a year ago whilst at the same

time enhancing our capital market division with the recruitment of

an established debt capital team and private growth capital

expertise.

We remain grateful for the loyalty of employees and shareholders

during this challenging period.

Outlook

Market conditions have continued to be very challenging since

the half year end and are expected to continue to be so for the

remainder of our financial year. As a result, and with further

tight control over costs, we expect to report a small loss for the

year as a whole. Cash & cash equivalents as at 9 December stood

at GBP6.75m in line with the half year end.

With a continued focus on operational efficiencies and the

further development of our new and existing offerings, I believe we

are well placed to take advantage of a market recovery.

Independent Auditor's review

Conclusion

We have been engaged by WH Ireland Group plc ('the Company') to

review the condensed set of financial statements of the Company and

its subsidiaries (the 'Group') in the interim financial report for

the six months ended 30 September 2022 which comprises the

consolidated statement of comprehensive income, consolidated

statement of financial position, consolidated statement of cash

flows, consolidated statement of changes in equity and the related

explanatory notes that have been reviewed. We have read the other

information contained in the interim financial report and

considered whether it contains any apparent material misstatements

of fact or material inconsistencies with the information in the

condensed set of financial statements.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the interim financial report for the six months ended 30

September 2022 is not prepared, in all material respects, in

accordance with International Accounting Standard 34, "Interim

Financial Reporting" as contained in UK-adopted International

Accounting Standards, and the AIM Rules for Companies.

Basis for Conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410, "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity" ('ISRE (UK) 2410') issued for use in the United Kingdom. A

review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

As disclosed in note 1, the annual financial statements of the

Group are prepared in accordance with UK-adopted International

Accounting Standards. The condensed set of financial statements

included in this interim financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting" as contained in UK-adopted International

Accounting Standards.

Conclusions Relating to Going Concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis for

Conclusion section of this report, nothing has come to our

attention to suggest that management have inappropriately adopted

the going concern basis of accounting or that management have

identified material uncertainties relating to going concern that

are not appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the Group and the Company to cease to continue as a going

concern.

Responsibilities of Directors

The interim financial report, is the responsibility of, and has

been approved by, the directors. The directors are responsible for

preparing the interim financial report in accordance with

International Accounting Standard 34, "Interim Financial Reporting"

as contained in UK-adopted International Accounting Standards and

the AIM Rules for Companies.

In preparing the interim financial report, the directors are

responsible for assessing the Group's and the Company's ability to

continue as a going concern, disclosing, as applicable, matters

related to going concern and using the going concern basis of

accounting unless the directors either intend to liquidate the

Group or the Company or to cease operations, or have no realistic

alternative but to do so.

Auditor's Responsibilities for the Review of the Financial

Information

In reviewing the interim financial report, we are responsible

for expressing to the Company a conclusion on the condensed set of

financial statements in the interim financial report. Our

conclusion, including our Conclusions Relating to Going Concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for Conclusion paragraph of

this report.

Use of our report

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK) 2410 "Review of

Interim Financial Information performed by the Independent Auditor

of the Entity". Our review work has been undertaken so that we

might state to the Company those matters we are required to state

to them in an independent review report and for no other purpose.

To the fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the Company, for our review

work, for this report, or for the conclusions we have formed.

RSM UK Audit LLP

Chartered Accountants

25 Farringdon Street

London

EC4A 4AB

15 December 2022

Consolidated statement of comprehensive income

6 months 6 months ended 12 months

ended ended

30 Sep 30 Sep 2021* 31 Mar

2022 2022

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Revenue 14,289 16,999 32,035

Administrative expenses (14,637) (16,823) (33,143)

---------------------------------------------- ----- ---------------------- ----------------- --------------------

Operating (loss)/ profit (348) 176 (1,108)

---------------------------------------------- ----- ---------------------- -----------------

Other income 1 1,673 - -

Net (losses)/ gains on investments 1 (1,534) 503 1,626

Finance income 1 - 1

Finance expense 1 (176) (354) (511)

---------------------------------------------- ----- ----------------- --------------------

(Loss)/ profit before tax (384) 325 8

Taxation 33 - 67

---------------------------------------------- ----- ----------------- --------------------

(Loss)/ profit and total comprehensive income

for the year (351) 325 75

---------------------------------------------- ----- ---------------------- ----------------- --------------------

Earnings per share 8

-------------------- -------- ------ ------

Basic (0.59p) 0.55p 0.13p

Diluted - 0.49p 0.12p

-------------------- -------- ------ ------

* The comparative revenue and net gains on investments have been

restated. Further details can be found in note 1.

Consolidated statement of financial position

30 Sep 2022 30 Sep 2021 31 Mar 2022

Note (unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------- ----- ------------ ------------ ------------

ASSETS

Non-current assets

Intangible assets 4,006 4,512 4,259

Goodwill 6 3,539 3,539 3,539

Property, plant and equipment 679 376 325

Investments 3 1,402 1,783 3,013

Right of use asset 783 1,377 1,168

Deferred tax asset 190 190 190

10,599 11,777 12,494

------------------------------- ----- ------------ ------------ ------------

Current assets

Trade and other receivables 5,833 5,652 5,758

Other investments 3 1,692 1,675 1,912

Cash and cash equivalents 4 6,303 8,377 6,446

13,828 15,704 14,116

------------------------------- ----- ------------ ------------ ------------

Total assets 24,427 27,481 26,610

------------------------------- ----- ------------ ------------ ------------

LIABILITIES

Current liabilities

Trade and other payables (5,159) (7,001) (6,681)

Lease liability (328) (516) (376)

Deferred consideration 5 (2,541) (1,291) (2,412)

Deferred tax liability (699) (772) (732)

(8,727) (9,580) (10,201)

------------------------------- ----- ------------ ------------ ------------

Non-current liabilities

Lease liability (516) (1,224) (999)

Deferred consideration 5 - (1,011) -

(516) (2,235) (999)

------------------------------- ----- ------------ ------------ ------------

Total liabilities (9,243) (11,815) (11,200)

------------------------------- ----- ------------ ------------ ------------

Total net assets 15,184 15,666 15,410

------------------------------- ----- ------------ ------------ ------------

Capital and reserves

Share capital 7 3,104 3,101 3,104

Share premium 19,014 18,983 19,014

Other reserves 981 981 981

Retained earnings (6,899) (6,755) (6,789)

Treasury shares (1,016) (644) (900)

------------------------------- ----- ------------ ------------ ------------

Shareholders' funds 15,184 15,666 15,410

------------------------------- ----- ------------ ------------ ------------

Signed on behalf of the board

P A Wale

15 December 2022

Consolidated statement of cash flows

6 months ended 6 months ended 12 months ended

30 Sep 2022 30 Sep 2021* 31 Mar 2022

(unaudited) (unaudited) (audited)

Note GBP'000 GBP'000 GBP'000

Operating activities:

(Loss)/profit for the period: (351) 325 75

(351) 325 75

Adjustments for:

Depreciation and amortisation 468 611 1,229

Finance income - - (1)

Finance expense 176 354 511

Tax (33) - (67)

Non-cash adjustment for share option charge 241 254 470

Non-cash adjustment for investment losses/(gains) 1,552 (336) (1,626)

Non-cash adjustment for revenue (161) (503) (1,651)

Increase in trade and other receivables (183) (951) (601)

Decrease in trade and other payables (1,842) (55) (942)

Net cash used in operations (133) (301) (2,603)

Net cash outflows from operating activities (133) (301) (2,603)

-------------------------------------------------------------- --------------- --------------- ----------------

Investing activities:

Acquisition of property, plant and equipment (202) (4) (103)

Movement in current asset investments 550 815 1,933

Net cash gained from investing activities 348 811 1,830

-------------------------------------------------------------- --------------- --------------- ----------------

Finance activities:

Proceeds from issue of share capital - - 34

Purchase of own shares by Employee Benefit Trust (116) - (256)

Interest paid - - (2)

Lease liability payments (242) (344) (768)

Net cash used in financing activities (358) (344) (992)

-------------------------------------------------------------- --------------- --------------- ----------------

Net (decrease)/increase in cash and cash equivalents (143) 166 (1,765)

Cash and cash equivalents at beginning of period 6,446 8,211 8,211

Cash and cash equivalents at end of period 6,303 8,377 6,446

-------------------------------------------------------------- --------------- --------------- ----------------

Consolidated statement of changes in equity

Share Share Other Retained Treasury Total

capital premium reserves earnings shares equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------------- -------- -------- --------- --------- --------- --------

Balance at 1 April 2021 3,101 18,983 981 (7,334) (644) 15,087

Profit and total comprehensive income for the period - - - 325 - 325

----------------------------------------------------- -------- -------- --------- --------- --------- --------

Employee share option scheme - - - 254 - 254

Balance at 30 September 2021 3,101 18,983 981 (6,755) (644) 15,666

Profit and total comprehensive income for the period (250) (250)

Employee share option scheme - - - 216 - 216

New share capital issued 3 31 - - - 34

Purchase of own shares by Employee Benefit Trust - - - - (256) (256)

Balance at 31 March 2022 3,104 19,014 981 (6,789) (900) 15,410

Balance at 1 April 2022 3,104 19,014 981 (6,789) (900) 15,410

Profit and total comprehensive income for the period (351) (351)

----------------------------------------------------- -------- -------- --------- --------- --------- --------

Employee share option scheme - - - 241 - 241

Purchase of own shares by Employee Benefit Trust - - - - (116) (116)

Balance at 30 September 2022 3,104 19,014 981 (6,899) (1,016) 15,184

----------------------------------------------------- -------- -------- --------- --------- --------- --------

Notes to the financial statements

1. General information

WH Ireland Group plc is a public company incorporated in the

United Kingdom. The shares of the Company are traded on AIM, a

market operated by the London Stock Exchange Group plc. The address

of its registered office is 24 Martin Lane, London, EC4R 0DR.

Basis of preparation

The condensed financial statements in this interim report for

the six months to 30 September 2022 has been prepared in accordance

with IAS 34 Interim Financial Reporting. This report has been

prepared on a going concern basis and should be read together with

the Group's annual consolidated financial statements as at and

prepared to 31 March 2022 in accordance with UK-adopted

International Accounting Standards.

The accounting policies, presentation and methods of computation

adopted by the Group in the preparation of its 2022 interim report

are those which the Group currently expects to adopt in its annual

financial statements for the year ending 31 March 2023 which will

be prepared in accordance with UK-adopted International Accounting

Standards and are consistent with those adopted in the audited

annual Report and Accounts for the period ended 31 March 2022.

The financial information in this report does not constitute the

Company's statutory accounts. The statutory accounts for the period

ended 31 March 2022 have been delivered to the Registrar of

Companies in England and Wales. The auditor has reported on those

accounts. Its report was unqualified, did not draw attention to any

matters by way of emphasis, and did not contain a statement under

Section 498(2) or 498(3) of the Companies Act 2006. The financial

information for the six months to 30 September 2022 is unaudited

(six months to 30 September 2021: unaudited).

Going concern

The condensed financial statements of the Group have been

prepared on a going concern basis. In making this assessment, the

Directors have prepared detailed financial forecasts for the period

to March 2024 which consider the funding and capital position of

the Group. Those forecasts make assumptions in respect of future

trading conditions, notably the economic environment and its impact

on the Group's revenues and costs. In addition to this, the nature

of the Group's business is such that there can be considerable

variation in the timing of cash inflows. The forecasts take into

account foreseeable downside risks, based on the information that

is available to the Directors at the time of the approval of these

financial statements.

The Directors have conducted full and thorough assessments of

the Group's business and the past financial year has provided a

thorough test of those assessments and the resilience of the

business. The significant market turbulence particularly in the

preceding 12 months resulting from the Russian invasion of Ukraine

presented a range of challenges to the business.

An analysis of the potential downside impacts was conducted as

part of the going concern assessment to assess the potential impact

on revenue and asset values with a particular focus on the variable

component parts of our overall revenue, such as corporate finance

fees and commission. Furthermore, reverse stress tests were

modelled to assess what level the Group's business would need to be

driven down to before resulting in a liquidity crisis or a breach

of regulatory capital. That modelling concluded that transactional,

non-contractual revenue would need to decline by more than 20% from

management's forecasts to create such a crisis situation within

eighteen months' time.

Based on all the aforementioned, the Directors believe that the

Group has sufficient liquidity to meet its liabilities for the next

twelve months and that the preparation of the financial statements

on a going concern basis remains appropriate. The Directors,

conscious of the continuing, challenging external market

environment, will continue to prudently manage the capital and

liquidity position of the firm.

Net (losses)/ gains on investments

Warrants and investments may be received during the course of

business and are designated as fair value through profit or loss.

At each reporting date the warrants and investments are revalued

and any gain or loss is recognised in net (losses)/ gains on

investments. On exercise of warrants and sale of investments the

gain or loss is also recognised in net (losses)/ gains on

investments.

Other income

During the period, the Group received confirmation from HMRC

that the supply of certain Group services was exempt from VAT. As a

result, the Group received a refund from HMRC in respect of VAT

arising on those services during the period from 1 April 2017 to 31

March 2021 of GBP1.7m (net GBP1.5m after advisory costs). This has

been treated as an adjusting item to the underlying profit in view

of its non-recurring nature.

Finance expense

Included within finance expenses is the fair value measurement

arising on deferred consideration payments from the acquisition of

Harpsden together with the associated net finance costs.

Prior period restatement

The income statement and cash flow statement for the six months

ended 30 September 2021 have been restated to reflect the following

errors which were identified by management and corrected during the

previous financial year:

-- Net fair value gains of GBP503,000 arising on movements in

non-cash consideration after initial recognition and sales of

investments were incorrectly recorded within Revenue rather than

within Net gains on investments.

-- Movements in current asset investments have been represented

in the cash flow statements as investing activities in accordance

with IAS 7. Movements in current asset investments have been

restated to exclude non-cash movements identified which were

incorrectly included in calculating the cash flow.

There was no impact upon the profit and total comprehensive

income and net increase in cash and cash equivalents as reported at

31 March 2021 and the net assets as reported at 1 April 2020.

As originally Effect of Group restated

reported restatement amounts

30 September 2021 GBP'000 GBP'000 GBP'000

Statement of

Comprehensive Income

Revenue 17,502 (503) 16,999

Net gains on investments - 503 503

Consolidated and Company statement of cash flows

Operating activities

(extract)

Non-cash adjustment for

revenue - (503) (503)

Non-cash adjustment for

investment

gains - (336) (336)

Decrease/ (increase) in

current asset

investments 815 (815) -

(Increase)/ decrease in

non-current

asset investments (839) 839 -

Net cash (used

in)/generated from

operations 514 (815) (301)

Investing activities

(extract)

Cash on investing

activities - 815 815

Net cash (used in)/

generated

from investing

activities (4) 815 811

There was no impact upon the profit and total comprehensive

income and net increase in cash and cash equivalents as reported at

30 September 2021 and the net assets as reported at 30 September

2021.

2. Segment information

The Group has two principal operating segments, Wealth

Management (WM) and Capital Markets (CM) and a number of minor

operating segments that have been aggregated into one operating

segment.

WM offers investment management advice and services to

individuals and contains our Wealth Planning business, giving

advice on and acting as intermediary for a range of financial

products. CM provides corporate finance and corporate broking

advice and services to companies and acts as Nominated Adviser

(Nomad) to clients traded on the AIM and contains our Institutional

Sales and Research business, which carries out stockbroking

activities on behalf of companies as well as conducting research

into markets of interest to its clients.

Both divisions are located in the UK. Each reportable segment

has a segment manager who is directly accountable to, and maintains

regular contact with, the Chief Executive Officer.

No customer represents more than ten percent of the Group's

revenue (FY21: nil).

The majority of the Group's revenue originates within the

UK.

Wealth Management Capital Group and Group

Markets consolidation

6 months ended 30 Sep 2022 adjustments

(unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- ------------------ --------- ----------------------- -----------

Revenue 7,262 7,027 - 14,289

Direct costs (6,075) (6,243) - (12,318)

------------------ --------- ----------------------- -----------

Contribution 1,187 784 - 1,971

Indirect costs (1,663) (1,171) - (2,834)

Underlying (loss) before tax (476) (387) - (863)

Amortisation (252) - - (252)

Changes in fair value and finance

cost of deferred consideration (129) - - (129)

Net changes in the value of non-current

investment assets - (645) - (645)

Other income 1,505 - - 1,505

Profit/ (loss) before tax 648 (1,032) - (384)

Taxation 33 - - 33

------------------------------------------- ------------------ --------- ----------------------- -----------

Profit/ (loss) for the period 681 (1,032) - (351)

------------------------------------------- ------------------ --------- ----------------------- -----------

Wealth Management Capital Group Group

Markets and consolidation

6 months ended 30 Sep 2021* adjustments

(unaudited) GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------- ------------------ --------- ------------------- -------------

Revenue 7,800 9,199 - 16,999

Direct costs (6,352) (6,622) - (12,974)

------------------ --------- -------------------

Contribution 1,448 2,577 - 4,025

Indirect costs (1,614) (795) (374) (2,783)

Underlying profit/(loss) before

tax (166) 1,782 (374) 1,242

Acquisition related costs (405) - - (405)

Amortisation of acquired client

relationships (218) - - (218)

Changes in fair value and finance

cost of deferred consideration (306) - (306)

Restructuring costs (194) (102) - (296)

Net changes in the value of non-current

investment assets - 308 - 308

Loss/ (profit) before tax (1,289) 1,988 (374) 325

Taxation - - - -

Loss/ (profit) for the period (1,289) 1,988 (374) 325

------------------------------------ ------------------------- --------- ------------------- -------------

* The comparative revenue and net gains on investments have been

restated. Further details can be found in note 1.

Wealth Management Capital Group and Group

Markets consolidation

12 months ended 31 Mar 2022 adjustments

(audited) GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------- ------------------ --------- --------------- ---------

Revenue 15,837 16,198 - 32,035

Direct costs (13,072) (12,475) - (25,547)

------------------ --------- ---------------

Contribution 2,765 3,723 - 6,488

Indirect costs (3,013) (1,427) (651) (5,091)

Underlying profit/(loss) before

tax (248) 2,296 (651) 1,397

Acquisition related costs (446) - - (446)

Amortisation of acquired client

relationships (505) - - (505)

Changes in fair value and finance

cost of deferred consideration (416) (416)

Restructuring costs (478) (357) - (835)

Net changes in the value of

non-current investment assets - 813 - 813

Loss/ (profit) before tax (2,093) 2,752 (651) 8

Taxation 67 - - 67

Loss/ (profit) for the year (2,026) 2,752 (651) 75

----------------------------------- ------------------ --------- --------------- ---------

3. Investments

As at As at As at

30 Sep 30 Sep 31 Mar

2022 2021 2022

Investments GBP'000 GBP'000 GBP'000

-------- -------- --------

Fair value: unquoted - 48 48

Fair value: quoted - 1 1

Fair value: warrants 1,402 1,734 2,964

Total investments 1,402 1,783 3,012

---------------------- -------- -------- --------

Quoted and unquoted investments include equity investments other

than those in subsidiary undertakings. Warrants may be received

during the ordinary course of business; there is no cash

consideration associated with the acquisition.

Fair value, in the case of quoted investments, represents the

bid price at the reporting date. In the case of unquoted

investments, the fair value is estimated by reference to recent

arm's length transactions. The fair value of warrants is estimated

using established valuation models. These investments are included

in non-current assets.

As at As at As at

30 Sep 30 Sep 31 Mar

2022 2021 2022

GBP'000 GBP'000 GBP'000

------------------- -------- -------- --------

Other investments 1,692 1,675 1,912

Investments are measured at fair value, which is determined

directly by reference to published prices in an active market where

available. Trading investments are included in current assets.

4. Cash, cash equivalents and bank overdrafts

For the purposes of the statement of cash flows, cash and cash

equivalents comprise cash in hand and deposits with banks and

financial institutions with a maturity of up to three months.

Cash and cash equivalents represent the Group's money and money

held for settlement of outstanding transactions.

Money held on behalf of clients is not included in cash and cash

equivalents. Client money at 30 September 2022 was GBP0.4m (30

September 2021: GBP0.4m; 31 March 2022: GBP0.4m).

5. Deferred consideration

As at As at As at

30 Sep 2022 30 Sep 2021 31 Mar 2022

GBP'000 GBP'000 GBP'000

------------ ------------ ------------

At beginning of period 2,412 1,996 1,996

Finance expense of deferred consideration 66 208 318

Change in fair value 63 98 98

------------------------------------------- ------------ ------------ ------------

Balance at end of period 2,541 2,302 2,412

------------------------------------------- ------------ ------------ ------------

Analysed as:

Included in current liabilities 2,541 1,291 2,412

Included in non-current liabilities - 1,011 -

Balance at end of period 2,541 2,302 2,412

------------------------------------------- ------------ ------------ ------------

Deferred consideration relates to the acquisition of Harpsden

Wealth Management Limited and the maximum amounts payable over a

two year period. The following assumptions were made: revenue

growth of 2%, attrition rate of 3% for larger clients and 10% for

smaller clients, discount rate of 13.5%. The total cash

consideration of GBP2.5m was recognised at its fair value of GBP2m

on acquisition.

During the six months ended 30 September 2022, the fair value of

the estimated deferred consideration for Harpsden Wealth Management

Limited was revalued by GBP63k due to the estimated timing of when

the consideration will fall due. During the six months ended 30

September 2022 the Group also recognised a finance expense of

GBP66k on the deferred consideration. The fair value of the

Harpsden deferred consideration at 30 September 2022 was GBP2.5m.

The first payment has not been paid.

6. Goodwill

Goodwill acquired in a business combination is allocated to a

cash generating unit (CGU) that will benefit from that business

combination.

The carrying amount of goodwill acquired in the acquisition of

Harpsden Wealth Management is set out below:

As at As at As at

30 Sep 2022 30 Sep 2021 31 Mar 2022

Group GBP'000 GBP'000 GBP'000

------------ ------------ ------------

Beginning of year 3,539 3,539 3,539

Acquisition of subsidiaries - - -

End of year 3,539 3,539 3,539

----------------------------- ------------ ------------ ------------

Goodwill is assessed annually for impairment and the

recoverability has been assessed at 31 January 2022 by comparing

the carrying value of the CGU to which the goodwill is allocated,

against its recoverable amount. The Harpsden CGU recoverable amount

was calculated as GBP10.9m and the carrying value of the CGU was

GBP6.4m.

Forecasts have been re-visited due to changes in the economic

environment. Market decline has caused a reduction in revenue

growth and the increase in market interest rates has caused the

discount rate used in the value in use calculation to increase. The

revised pre-tax discount rate is 17.2% (31 Mar 2022: 14.7%) and the

revised recoverable amount of the CGU is GBP7.2m. Compared against

the carrying value at 30 September 2022 of GBP6.3m, indicating no

impairment. Client retention remained unchanged for the six months

to 30 September 2022, indicating the reduction in revenue was due

to the market decline, a factor outside the control of management.

Therefore future changes to the headroom remains subject to market

uncertainty.

7. Share capital

The total number of ordinary shares in issue is 62.09 million

(30 September 2021: 62.05 million; 31 March 2022: 62.09

million).

8. Earnings per share

Basic earnings per share (EPS) is calculated by dividing the

profit attributable to equity holders of the Company by the

weighted average number of ordinary shares in issue during the

year, excluding ordinary shares purchased by the Company and held

as treasury shares.

Diluted EPS is the basic EPS, adjusted for the effect of

conversion into fully paid shares of the weighted average number of

all dilutive employee share options outstanding during the period.

At 30 September 2022: 6.48m (30 September 2021: 6.48m; 31 March

2021: 6.48m) options were excluded from the EPS calculation as they

were anti-dilutive. In a period when the company presents positive

earnings attributable to ordinary shareholders, anti-dilutive

options represent options issued where the exercise price is

greater than the average market price for the period.

Reconciliation of the earnings and weighted average number of

shares used in the calculations are set out below.

As at As at As at

30 Sep 2022 30 Sep 2021 31 Mar 2022

---------------------------------------------- ------------ ------------ ------------

Weighted average number of shares in

issue during the period ('000) 59,409 58,690 59,692

Effect of dilutive share options (thousands) - 7,162 1,190

59,409 65,852 60,882

---------------------------------------------- ------------ ------------ ------------

(Loss)/ profit for the year (351) 325 75

Basic EPS (0.59p) 0.55p 0.13p

Diluted EPS - 0.49p 0.12p

---------------------------------------------- ------------ ------------ ------------

9. Dividends

No interim dividend has been paid or proposed in respect of the

current financial period (30 September 2021: nil; 31 March 2022:

nil ).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFLFWIEESELE

(END) Dow Jones Newswires

December 16, 2022 02:00 ET (07:00 GMT)

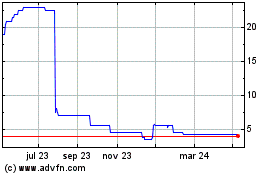

W.h. Ireland (LSE:WHI)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

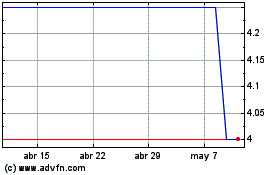

W.h. Ireland (LSE:WHI)

Gráfica de Acción Histórica

De May 2023 a May 2024