Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

08 Agosto 2023 - 3:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2023

Commission File Number: 001-38309

AGM

GROUP HOLDINGS INC.

(Translation

of registrant’s name into English)

c/o Creative Consultants (Hong Kong) Limited

Room 1502-3 15/F., Connuaght Commercial Building,

185 Wanchai Road

Wanchai, Hong Kong

+86-010-65020507 – telephone

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

On May 19, 2023, AGM

Group Holdings Inc. (the “Company”) filed a report on Form 6-K disclosing that on May 17, 2023, the Company received a letter

(the “Notice”) from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”) indicating

that, because the Company has not yet filed its Annual Report on Form 20-F for the fiscal year ended December 31, 2022 (the “Form

20-F”), the Company does not comply with Nasdaq Listing Rule 5250(c)(1) for continued listing.

Pursuant to the Nasdaq Listing Rules, the Company had 60 calendar days

from the date of the Notice to submit a plan of compliance to Nasdaq. The Company timely submitted a plan of compliance to Nasdaq and

on July 17, 2023, the Company received a letter from Nasdaq notifying it that Nasdaq granted the Company an exception to enable

it to regain compliance with the Rule (the “Exception”). Pursuant to the Exception, the Company must file its Form 20-F for

the period ended December 31, 2022 on or before November 13, 2023. In the event the Company does not satisfy these terms, Nasdaq will

provide written notification that the securities of the Company will be delisted. At that time, the Company may appeal Nasdaq’s

determination to a Hearings Panel.

The statements contained

in this Current Report on Form 6-K, and oral statements made regarding the subjects of this Current Report on Form 6-K, contains “forward-looking

statements” within the meaning of the Securities Litigation Reform Act of 1995, or the Reform Act, which may include, but are not

limited to, statements regarding the Company’s estimates, plans, objectives, expectations

and intentions and other statements contained in this press release that are not historical facts, including statements identified by

words such as “believe,” “plan,” “seek,” “expect,” “intend,” “estimate,”

“anticipate,” “will,” and similar expressions. All statements addressing the Company’s ability to regain

compliance with the Nasdaq listing requirements or to develop a plan acceptable to Nasdaq for an extension of the 60 day grace period,

as well as statements expressing optimism or pessimism about future operating results are forward-looking statements within the meaning

of the Reform Act. The forward-looking statements are based on management’s current views and assumptions regarding future events

and operating performance, and are inherently subject to significant uncertainties and contingencies and changes in circumstances, many

of which are beyond the Company’s control. The statements in this press release are made as of the date of this press release, even

if subsequently made available by the Company on its website or otherwise. The Company does not undertake any obligation to update or

revise these statements to reflect events or circumstances occurring after the date of this Current Report on Form 6-K.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| Date: August 8, 2023 |

AGM GROUP HOLDINGS INC. |

| |

|

|

| |

By: |

/s/ Wenjie Tang |

| |

Name: |

Wenjie Tang |

| |

Title: |

Co-Chief Executive Officer and Director |

2

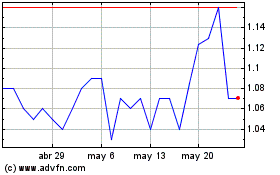

AGM (NASDAQ:AGMH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

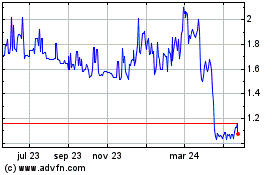

AGM (NASDAQ:AGMH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024