Arogo Capital Acquisition Corp. Announces Receipt of and Appeals Nasdaq Delisting Determination

06 Agosto 2024 - 3:05PM

Arogo Capital Acquisition Corp. (“Arogo” or the “Company”) (Nasdaq:

AOGO/AOGOU/AOGOW), a special purpose acquisition company, today

announced that it received a notice (the “Notice”) from the Listing

Qualifications Department of the Nasdaq Stock Market LLC (“Nasdaq”)

on July 31, 2024, notifying the Company has not regained compliance

with Nasdaq Listing Rule 5450(b)(2)(A), requiring the Company to

maintain a Market Value of Listed Securities of at least $50

million, and cited the Company’s failure to comply with Nasdaq’s

Listing Rule 5450(a)(2), which requires the Company to have at

least 400 total holders, as additional basis for delisting the

Company’s securities from Nasdaq. The Notice provides that the

Company has until 4:00 p.m. Eastern Time on August 7, 2024 (the

“Appeal Deadline”), to appeal the Listing Qualification

Department’s determination.

Pursuant to the Notice, unless the Company timely requests a

hearing from the Nasdaq Hearing Panel (the “Panel”), the Company’s

securities will be subject to suspension and delisting from the

Nasdaq Global Market at the opening of business on August 7, 2024

and a Form 25-NSE will be filed with the Securities and Exchange

Commission, which will remove the Company’s securities from listing

on Nasdaq. The Company paid the required $20,000 fee and on August

6, 2024, submitted its timely request for a hearing before the

Panel to appeal the Listing Qualification Department’s

determination, as well as a request to stay the suspension of its

securities pending the hearing date, under the procedures set forth

in the Nasdaq Listing Rule 5800 Series. The appeal and request for

hearing were filed before the Appeal Deadline, and accordingly the

Company expects that the suspension of the Company’s securities

will automatically be stayed until the Panel makes a determination.

No assurances can be provided that the Company will obtain a

favorable decision from the Panel, and/or that the Company will be

able to regain or maintain compliance with the Nasdaq listing rules

and continue the listing of its securities on Nasdaq.

About Arogo Capital Acquisition Corp.

Arogo Capital Acquisition Corp. is a blank check company. The

Company aims to acquire one and more businesses and assets, via a

merger, capital stock exchange, asset acquisition, stock purchase,

and reorganization. For more information, visit

www.arogocapital.com.

Forward-Looking Statements

This Press Release contains “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Forward-looking statements include those that express a

belief, expectation or intention, as well as those that are not

statements of historical fact. Forward-looking statements include

information regarding our future plans and goals, as well as our

expectations with respect to, without limitation: our ability to

consummate the proposed business combination; availability and

terms of capital; our ability to regain compliance with Nasdaq’s

listing requirements; and our success in appealing any delisting

determination.

Forward-looking statements may be accompanied by words such as

“outlook,” “aim,” “anticipate,” “assume,” “believe,” “budget,”

“contemplate,” “continue,” “could,” “due,” “estimate,” “expect,”

“future,” “goal,” “intend,” “may,” “objective,” “plan,” “predict,”

“potential,” “positioned,” “pursue,” “seek,” “should,” “target,”

“will,” “would” and other similar expressions that are predictions

of or indicate future events and future trends, or the negative of

these terms or other comparable terminology, although not all

forward-looking statements contain these words. Forward-looking

statements are not assurances of future performance and involve

risks, uncertainties and assumptions which may cause actual results

to differ materially from any results expressed or implied by any

forward-looking statement, including, but not limited to, the

Company’s ability to regain compliance with the Nasdaq listing

requirements; and the other important factors outlined under the

caption “Risk Factors” in the Company’s Annual Report on Form 10-K

for the year ended December 31, 2023, as such factors may be

updated from time to time in the Company’s other filings with the

SEC, which are available on the SEC’s website at www.sec.gov.

Although the Company believes that the expectations and assumptions

reflected in its forward-looking statements are reasonable, it

cannot guarantee future results. These forward-looking statements

speak only as of the date they were made and, except as otherwise

required by law, the Company undertakes no obligation to update,

amend or ratify any forward-looking statements because of new

information, future events or other factors.

Contact

Suradech TaweesaengsakulthaiChief Executive

Officersuradech@cho.co.th(786) 442-1482

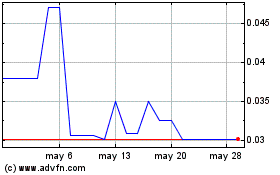

Arogo Capital Acquisition (NASDAQ:AOGOW)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Arogo Capital Acquisition (NASDAQ:AOGOW)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024