Aquestive Therapeutics, Inc. (NASDAQ:AQST) ("Aquestive" or the

"Company"), a pharmaceutical company advancing medicines to bring

meaningful improvement to patients' lives through innovative

science and delivery technologies, reported financial results for

the third quarter, which ended September 30, 2024, and provided an

update on recent developments in its business.

"Our innovative epinephrine prodrug platform

remains the cornerstone of our development strategy," said Daniel

Barber, President and Chief Executive Officer of Aquestive. "We've

reached a significant milestone with the clinical development

program for Anaphylm, our groundbreaking oral epinephrine treatment

for severe allergic reactions, including anaphylaxis. With our

adult supportive studies now complete, we are preparing for our

pre-NDA meeting for Anaphylm with the FDA scheduled for this

quarter. Moreover, AQST-108, our promising pipeline candidate, is

progressing towards a pre-IND meeting this quarter, setting the

stage for a potential Phase 2a study in alopecia areata next year,

subject to FDA alignment. On the commercial front, we successfully

expanded Libervant's market presence, deploying a dedicated sales

force and securing nationwide reimbursement coverage, positioning

us for continued growth."

Anaphylm™ (epinephrine) Sublingual

FilmAquestive is advancing the development of Anaphylm™

(epinephrine) Sublingual Film, the first and only orally delivered

epinephrine product candidate, as an easy to remember, easy to

carry, and easy to use alternative to EpiPen® and other epinephrine

medical devices for the treatment of severe life-threatening

allergic reactions, including anaphylaxis.

In October 2024, Aquestive reported positive

topline data from the oral allergy syndrome challenge study (now

referred to as the "OASIS" study), meeting both primary and

secondary endpoints. The two-part study demonstrated that Anaphylm

maintained its pharmacokinetics (PK) and pharmacodynamics (PD)

profile during allergen-induced oral physiological changes. In

addition, following allergen exposure where 94% of subjects

exhibited moderate to severe symptoms per the pre-defined oral

severity score, rapid symptom resolution was observed beginning as

early as two minutes after administration of Anaphylm. The median

time to complete symptom resolution was twelve minutes compared to

seventy-four minutes at screening baseline, with 50% of all

symptoms across all subjects resolving by five minutes. The mean

time of symptom resolution for edema, which affected approximately

25% of subjects, was five minutes after Anaphylm administration.

The PK profile remained consistent, with median time to peak drug

concentration (Tmax) maintained at twelve minutes and comparable

geometric mean maximum concentration (Cmax) values between

allergen-exposed and non-exposed cohorts. The safety profile was

favorable, with all adverse events classified as mild to moderate

and resolving without medical intervention.

Also in October 2024, at the American College of

Allergy Asthma and Immunology (ACAAI) 2024 Annual Meeting in

Boston, the Company presented results from a subsequent analysis of

its pivotal study data demonstrating Anaphylm's consistent PK and

PD profile regardless of variable placement or intraoral movement.

The analysis showed that 87.5% of subjects maintained consistent

film placement during disintegration. In the 12.5% of subjects

where movement was noted, there were no significant differences in

Cmax and Tmax. These findings further demonstrate that initial

placement or subsequent movement of the sublingual film had no

impact on epinephrine PK or PD comparability to epinephrine

autoinjectors.

The Company recently received positive pre-New

Drug Application (NDA) written response feedback from the U.S. Food

and Drug Administration (FDA) to the Company's proposed Chemistry,

Manufacturing, Controls (CMC) submission for Anaphylm. In addition,

a clinically focused pre-NDA meeting with the FDA is scheduled for

the fourth quarter of 2024. The Company is maintaining its guidance

of initiating a full product launch of Anaphylm, if approved by the

FDA, in the first quarter of 2026. This is based on commencing the

pediatric study in subjects weighing 30 kgs and above in the fourth

quarter of 2024 and completing an NDA submission with the FDA in

the first quarter of 2025.

AQST-108 (epinephrine) Topical

GelAquestive is advancing the development of AQST-108, a

topically delivered adrenergic agonist prodrug. At the Company's

virtual investor day in September 2024, Aquestive outlined its

development strategy for AQST-108, the second product candidate

from the Company's Adrenaverse prodrug platform. The Company

outlined the design of its planned Phase 2a study to assess the

safety and efficacy of AQST-108 in alopecia areata patients. The

Company has scheduled a pre-IND meeting with the FDA in the fourth

quarter of 2024 to align on the Phase 2a study design and plans to

commence a Phase 2a study in the second quarter of 2025.

An estimated 6.7 million people in the United

States have been affected by alopecia areata. Of those affected,

43% are considered severe. The existing therapies for alopecia

areata are janus kinase (or JAK) inhibitors. These systemic

treatments with known side effects come with a "black box" warning

and are expensive for patients. Even with these limitations, the

estimated market opportunity for JAK inhibitors is over one billion

dollars. In the first in human Phase 1 clinical study, AQST-108

demonstrated no serious adverse events or topical adverse events.

Since AQST-108 is topical and there is evidence that it acts at the

application site, it may not have systemic side effects. As a

result of these conditions, AQST-108, if approved by the FDA as a

treatment for severe alopecia areata, has the potential to capture

significant market share.

Libervant® (diazepam) Buccal

FilmLibervant® (diazepam) Buccal Film is the first and

only FDA approved orally administered rescue product for the

treatment of seizure clusters in patients between the ages of two

and five years.

In April 2024, the FDA approved Libervant for

the acute treatment of intermittent, stereotypic episodes of

frequent seizure activity (i.e., seizure clusters, acute repetitive

seizures) that are distinct from a patient's usual seizure pattern

in patients with epilepsy between the ages of two to five

years.

Aquestive has continued to expand the launch of

Libervant for patients between the ages of two and five years and

currently has a twelve person national sales team in place. Market

access activities have broadened coverage. Libervant for patients

between the ages of two and five years is available nationwide with

retail distribution capabilities in place, is available for

Medicaid patients in this age group in all states, and commercial

access for patients in this age group continues to expand based on

health plan reviews and Pharmacy Benefit Manager agreements.

The NDA for Libervant for the acute treatment of

intermittent, stereotypic episodes of frequent seizure activity

(i.e., seizure clusters, acute repetitive seizures) in patients

twelve years of age and older was tentatively approved by the FDA

in August 2022 and is currently subject to an orphan drug market

exclusivity block until January 2027 based on an FDA approved nasal

spray product of another company. The Company expects to file for

approval of Libervant for the treatment of these epilepsy patients

between six to twelve years of age prior to the expiration of the

orphan drug market exclusivity block.

Commercial

CollaborationsAquestive continues to manufacture products

for the licensing and supply collaborations that it has

established. The Company manufactured approximately 44 million

doses in the third quarter of 2024, compared to approximately 46

million doses in the third quarter of 2023. The Company continues

to support the manufacturing of Indivior's Suboxone® Sublingual

Film product and its other global collaborations, including

Sympazan® (clobazam) Oral Film product for Assertio Holdings, Inc.,

Ondif® (Ondansetron) Oral Film product for Hypera in Brazil, and

Emylif® (Riluzole) Oral Film product for Zambon in Europe.

Sales of royalty-based products, inclusive of

Sympazan® (clobazam) Oral Film for the treatment of seizures

associated with Lennox-Gastaut Syndrome in patients two years of

age and older, and Azstarys® (serdexmethylphenidate and

dexmethylphenidate) for the treatment of Attention Deficit

Hyperactivity Disorder (ADHD) in patients six years of age and

older, continued to contribute to the Company's revenue in the

third quarter of 2024.

Third Quarter 2024

FinancialsTotal revenues increased to $13.5 million in the

third quarter 2024 from $13.0 million in the third quarter 2023.

This 4% increase in revenue was primarily driven by increases in

license and royalty revenue due to the recognition of deferred

revenue from the termination of a licensing and supply agreement,

partially offset by decreases in manufacture and supply

revenue.

Manufacture and supply revenue decreased to

$10.7 million in the third quarter 2024 from $11.4 million in the

third quarter 2023, primarily due to decreases in Suboxone and

Sympazan revenues, partially offset by an increase in Ondif

revenue, which was attributable to an increase in volume.

Manufacture and supply revenue decreased to $29.3 million for the

nine months ended September 30, 2024 from $32.8 million for

the nine months ended September 30, 2023. On a September

year-to-date basis and excluding the one-time retroactive price

increase of $1.7 million recognized in the three months ended

March 31, 2023, manufacture and supply revenue decreased to $29.3

million from $31.1 million.

Research and development expenses increased to

$5.3 million in the third quarter 2024 from $3.2 million in the

third quarter 2023. The increase in research and development

expenses was primarily due to clinical trial costs and product

research expenses associated with the continued advancement of the

Anaphylm development program.

Selling, general and administrative expenses

increased to $12.1 million in the third quarter 2024 from $7.4

million in the third quarter 2023. This increase was partially

driven by a $1.5 million year-over-year change in the

allocation of expenses of manufacturing and supply costs. Given

this year-over-year change, the Company expects to continue to see

a positive benefit in gross margin offset by somewhat higher

selling, general and administrative expenses. Excluding this item,

increases in expenses were driven by increased commercial spending

and regulatory fees related to the approval of Libervant and the

commercial preparations for Anaphylm.

Aquestive's net loss for the third quarter 2024

was $11.5 million, or $0.13 for both basic and diluted loss per

share, compared to the net loss for the third quarter 2023 of $2.0

million, or $0.03 for both basic and diluted loss per share. The

increase in net loss was primarily driven by increases in selling,

general and administrative expenses, research and development

expenses, non-cash interest expense related to amortization of the

debt and royalty obligation discounts, and decreases in interest

income and other income, net partially offset by increases in

revenues.

Non-GAAP adjusted EBITDA loss was $6.6 million

in the third quarter 2024, compared to non-GAAP adjusted EBITDA

loss of $1.3 million in the third quarter 2023. Non-GAAP adjusted

EBITDA loss excluding adjusted research and development expenses

was $1.6 million in the third quarter 2024, compared to non-GAAP

adjusted EBITDA income excluding adjusted research and development

expenses of $1.7 million in the third quarter 2023.

Cash and cash equivalents were $77.9 million as

of September 30, 2024.

OutlookAquestive's full-year

2024 financial guidance is below.

The Company expects:

| |

Guidance |

| Total revenue (in

millions) |

$57 to $60 |

| Non-GAAP adjusted EBITDA loss

(in millions) |

$20 to $23 |

| |

|

Tomorrow’s Conference Call and Webcast

ReminderThe Company will host a conference call at 8:00

a.m. ET on Tuesday, November 5, 2024.

In order to participate, please register in

advance here to obtain a local or toll-free phone number and your

personal pin.

A live webcast of the call will be available on Aquestive’s

website at: Third Quarter 2024 Earnings Call.

About

Anaphylm™Anaphylm™ (epinephrine) Sublingual Film

is a polymer matrix-based epinephrine prodrug product. Anaphylm is

similar in size to a postage stamp, weighs less than an ounce, and

begins to dissolve on contact. No water or swallowing is required

for administration. The primary packaging for Anaphylm is thinner

and smaller than an average credit card, can be carried in a

pocket, and is designed to withstand weather excursions such as

exposure to rain and/or sunlight. The Anaphylm trade name for

AQST-109 has been conditionally approved by the FDA. Final approval

of the Anaphylm proprietary name is conditioned on FDA approval of

the product candidate.

About Libervant®Libervant®

(diazepam) Buccal Film is a buccally, or inside of the cheek,

administered film formulation of diazepam, a benzodiazepine

intended for the acute treatment of intermittent, stereotypic

episodes of frequent seizure activity (i.e., seizure clusters,

acute repetitive seizures) that are distinct from a patient's usual

seizure pattern in patients with epilepsy between two and five

years of age. Aquestive developed Libervant as an alternative to

the device-based products currently available for patients with

refractory epilepsy, including a rectal gel and nasal spray

products. The FDA approval for U.S. market access received in April

2024 for Libervant is for these epilepsy patients between two and

five years of age. The FDA granted tentative approval in August

2022 for Libervant for treatment of these epilepsy patients twelve

years of age and older, with U.S. market access for Libervant for

this age group of patients subject to the expiration of the

existing orphan drug market exclusivity of a previously FDA

approved drug scheduled to expire in January 2027.

About AQST-108AQST-108

(epinephrine) Topical Gel is a topically delivered adrenergic

agonist prodrug gel product candidate. Aquestive completed a first

in human study for AQST-108 that measured the amount of epinephrine

that remained on the skin or was found in circulation over time

after the application of the gel and without any serious or topical

adverse events. AQST-108 is based on Aquestive's Adrenaverse™

platform that contains a library of over twenty epinephrine prodrug

product candidates intended to control absorption and conversion

rates across a variety of possible dosage forms and delivery

sites.

Important Safety InformationDo

not give Libervant to your child between the ages of two and five

if your child is allergic to diazepam or any of the ingredients in

Libervant or has an eye problem called acute narrow angle

glaucoma.

What is the most important information I

should know about Libervant?

- Libervant is a

benzodiazepine medicine. Taking benzodiazepines with opioid

medicines, alcohol, or other central nervous system (CNS)

depressants (including street drugs) can cause severe drowsiness,

breathing problems (respiratory depression), coma, and

death. Get emergency help right away if any of the

following happens:

- shallow or slowed

breathing,

- breathing stops (which may

lead to the heart stopping),

- excessive sleepiness

(sedation).

Do not allow your child to drive a motor

vehicle, operate heavy machinery, or ride a bicycle until you know

how taking Libervant with opioids affects your child.

- Risk of abuse, misuse, and

addiction. Libervant is used in children 2 to 5 years of

age. The unapproved use of Libervant has a risk for abuse, misuse,

and addiction, which can lead to overdose and serious side effects

including coma and death.

- Serious side effects

including coma and death have happened in people who have abused or

misused benzodiazepines, including diazepam (the active ingredient

in Libervant). These serious side effects may also include

delirium, paranoia, suicidal thoughts or actions, seizures, and

difficulty breathing. Call your child's healthcare provider

or go to the nearest hospital emergency room right away if you get

any of these serious side effects.

- Your child can develop an

addiction even if your child takes Libervant as prescribed by your

child's healthcare provider.

- Give Libervant exactly as

your child's healthcare provider prescribed.

- Do not share Libervant with other

people.

- Keep Libervant in a safe place and

away from children.

- Physical dependence and

withdrawal reactions. Libervant is intended for use if needed in

order to treat higher than usual seizure activity.

Benzodiazepines, including Libervant, can cause physical

dependence and withdrawal reactions, especially if used daily.

Libervant is not intended for daily use.

- Do not suddenly stop giving

Libervant to your child without talking to your child's healthcare

provider. Stopping Libervant suddenly can cause serious

and life-threatening side effects, including, unusual movements,

responses, or expressions, seizures that will not stop (status

epilepticus), sudden and severe mental or nervous system changes,

depression, seeing or hearing things that others do not see or

hear, homicidal thoughts, an extreme increase in activity or

talking, losing touch with reality, and suicidal thoughts or

actions. Call your child's healthcare provider or go to the nearest

hospital emergency room right away if your child gets any of these

symptoms.

- Some people who suddenly

stop benzodiazepines have symptoms that can last for several weeks

to more than 12 months including, anxiety, trouble

remembering, learning, or concentrating, depression, problems

sleeping, feeling like insects are crawling under your skin,

weakness, shaking, muscle twitching, burning, or prickling feeling

in your hands, arms, legs or feet, and ringing in your ears.

- Physical dependence is not the same

as drug addiction. Your child's healthcare provider can tell you

more about the differences between physical dependence and drug

addiction.

- Do not give your child more

Libervant than prescribed or give Libervant more often than

prescribed.

Libervant can make your child sleepy or

dizzy and can slow your child's thinking and motor

skills.

- Do not allow your child to drive a

motor vehicle, operate machinery, or ride a bicycle until you know

how Libervant affects your child.

- Do not give other drugs that may

make your child sleepy or dizzy while taking Libervant without

first talking to your child's healthcare provider. When taken with

drugs that cause sleepiness or dizziness, Libervant may make your

child's sleepiness or dizziness much worse.

Like other antiepileptic medicines,

Libervant may cause suicidal thoughts or actions in a small number

of people, about 1 in 500.

- Call a healthcare provider

right away if your child has any of these symptoms, especially if

they are new, worse, or worry you:

- thoughts about suicide or

dying

- new or worse depression

- feeling agitated or restless

- trouble sleeping (insomnia)

- acting aggressive, being angry or

violent

- other unusual changes in behavior

or mood

- attempts to commit suicide

- new or worse anxiety or

irritability

- an extreme increase in activity and

talking (mania)

- new or worse panic attacks

- acting on dangerous impulses

- Pay attention to any changes,

especially sudden changes in mood, behaviors, thoughts, or

feelings.

- Keep all follow-up visits with your

child's healthcare provider as scheduled.

- Call your child's

healthcare provider between visits as needed, especially if you are

worried about symptoms. Suicidal thoughts or actions can

be caused by things other than medicines. If your child has

suicidal thoughts or actions, your child's healthcare provider may

check for other causes.

What are the possible side effects of

Libervant?

- The most common side effects of

Libervant are sleepiness and headache.

- These are not all the possible side

effects of Libervant.

- Call your doctor for medical advice

about side effects. You may report side effects to FDA at 1 800

FDA-1088.

For more information about Libervant, talk to

your doctor, and see Product Information: Medication Guide and

Instructions For Use.

About Aquestive Therapeutics,

Inc.Aquestive is pharmaceutical company advancing

medicines to bring meaningful improvement to patients' lives

through innovative science and delivery technologies. We are

developing orally administered products to deliver complex

molecules, providing novel alternatives to invasive and

inconvenient standard of care therapies. Aquestive has five

commercialized products marketed by the Company and its licensees

in the U.S. and around the world and is the exclusive manufacturer

of these licensed products. The Company also collaborates with

pharmaceutical companies to bring new molecules to market using

proprietary, best-in-class technologies, like PharmFilm®, and has

proven drug development and commercialization capabilities.

Aquestive is advancing a late-stage proprietary product candidate

for the treatment of severe allergic reactions, including

anaphylaxis, and an early-stage epinephrine prodrug topical gel

product candidate for various possible dermatology conditions. For

more information, visit Aquestive.com and follow us on

LinkedIn.

Non-GAAP Financial

InformationThis press release and our webcast earnings

call regarding our quarterly financial results contains financial

measures that do not comply with U.S. generally accepted accounting

principles (GAAP), such as non-GAAP adjusted EBITDA loss, non-GAAP

adjusted gross margins, non-GAAP adjusted costs and expenses and

other adjusted expense measures, because such measures exclude, as

applicable, share-based compensation expense, interest expense,

interest expense related to the sale of future revenue, interest

income, depreciation, amortization, and income taxes.

Specifically, the Company adjusts net income

(loss) for loss on the extinguishment of debt; certain non-cash

expenses, including share-based compensation expenses; depreciation

and amortization; and interest expense related to the sale of

future revenue, interest income and other income (expense), net and

income taxes, with a result of non-GAAP adjusted EBITDA loss.

Similarly, manufacture and supply expense, research and development

expense, and selling, general and administrative expense were

adjusted for certain non-cash expenses of share-based compensation

expense and depreciation and amortization. Non-GAAP adjusted EBITDA

loss and these non-GAAP expense categories are used as a supplement

to the corresponding GAAP measures to provide additional insight

regarding the Company's ongoing operating performance.

These measures supplement the Company's

financial results prepared in accordance with GAAP. Aquestive

management uses these measures to analyze its financial results,

and its future manufacture and supply expenses, gross margins,

research and development expense and selling, general and

administrative expense and to help make managerial decisions. In

management's opinion, these non-GAAP measures provide added

transparency into the operating performance of Aquestive and added

insight into the effectiveness of our operating strategies and

actions. The Company may provide one or more revenue measures

adjusted for certain discrete items, such as fees collected on

certain licensed products, in order to provide investors added

insight into our revenue stream and breakdown, along with providing

our GAAP revenue. Such measures are intended to supplement, not act

as substitutes for, comparable GAAP measures and should not be read

as a measure of liquidity for Aquestive. Non-GAAP adjusted EBITDA

loss and the other non-GAAP measures are also likely calculated in

a way that is not comparable to similarly titled measures reported

by other companies.

Non-GAAP OutlookIn providing

the outlook for non-GAAP adjusted EBITDA and non-GAAP gross margin,

we exclude certain items which are otherwise included in

determining the comparable GAAP financial measures. In order to

inform our outlook measures of non-GAAP adjusted EBITDA and

non-GAAP gross margin, a description of the 2024 and 2023

adjustments which have been applicable in determining non-GAAP

Adjusted EBITDA and non-GAAP gross margin for these periods are

reflected in the tables below. In providing outlook for non-GAAP

gross margin, the Company adjusts for non-cash share-based

compensation expense and depreciation and amortization. The Company

is providing such outlook only on a non-GAAP basis because the

Company is unable to predict with reasonable certainty the totality

or ultimate outcome or occurrence of these adjustments for the

forward-looking period such as share-based compensation expense,

income tax, amortization, and certain other adjusted items, which

can be dependent on future events that may not be reliably

predicted. Based on past reported results, where one or more of

these items have been applicable, such excluded items could be

material, individually or in the aggregate, to reported

results.

Forward-Looking

StatementCertain statements in this press release

include "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995. Words such as

"believe," "anticipate," "plan," "expect," "estimate," "intend,"

"may," "will," or the negative of those terms, and similar

expressions, are intended to identify forward-looking statements.

These forward-looking statements include, but are not limited to,

statements regarding the advancement and related timing of our

product candidate Anaphylm™ (epinephrine) Sublingual Film through

clinical development and approval by the U.S. Food and Drug

Administration (FDA), including the timing of submission of

supporting and pediatric clinical studies, holding a pre-New Drug

Application (NDA) meeting with the FDA and filing the NDA for

Anaphylm with the FDA, and the following launch of Anaphylm, if

approved by the FDA; that the results of the Company's clinical

studies for Anaphylm are sufficient to support submission of the

NDA for approval of Anaphylm by the FDA; that Anaphylm will be the

first and only oral administration of epinephrine and accepted as

an alternative to existing standards of care, if Anaphylm is

approved by the FDA; the advancement and related timing of our

Adrenaverse pipeline epinephrine prodrug product candidates,

including AQST-108, through clinical development and FDA regulatory

approval process, including holding a pre-IND meeting with the FDA

for AQST-108; the advancement and related timing of our product

candidate Libervant® (diazepam) Buccal Film for the indicated

epilepsy patient population aged between six and eleven years

through clinical development and FDA regulatory approval and the

following launch of Libervant for this patient population if

approved by the FDA; the approval for U.S. market access of

Libervant for this patient population aged six years, and older and

overcoming the orphan drug market exclusivity of an FDA approved

nasal spray product of another company extending to January 2027

for Libervant for these epilepsy patients six years of age and

older; the advancement, growth and related timing of our

Adrenaverse™ pipeline of epinephrine prodrug product candidates,

including AQST-108 (epinephrine) Topical Gel, through clinical

development including design and timing of clinical studies

including those necessary to support the targeted indication of

alopecia areata for AQST-108, and holding a pre-investigational new

drug application meeting (IND) with the FDA; the commercial

opportunity of Libervant, Anaphylm, AQST-108 and our other product

candidates, including potential revenues (including projected peak

annual sales) generated from commercialization of these products

and product candidates should these product candidates be approved

by the FDA; the potential benefits our products and product

candidates could bring to patients; our cash and financial

position, including with respect to our 2024 financial outlook; and

business strategies, market opportunities, and other statements

that are not historical facts.

These forward-looking statements are based on

our current expectations and beliefs and are subject to a number of

risks and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements.

Such risks and uncertainties include, but are not limited to, risks

associated with our development work, including any delays or

changes to the timing, cost and success of our product development

activities and clinical trials and plans, including those relating

to Anaphylm (including for pediatric patients), AQST-108, and the

Company's other product candidates; risks associated with the

Company's distribution work for Libervant, including any delays or

changes to the timing, cost and success of Company's distribution

activities and expansion of market access to patients aged two to

five for Libervant; risk of delays in advancement of the regulatory

approval process through the FDA of our product candidates,

including the filing of the respective NDAs, including for

Anaphylm, AQST-108, Libervant for patients aged between six and

eleven and other product candidates, or failure to receive FDA

approval at all of any of these product candidates; risk of the

Company's ability to generate sufficient clinical data for approval

of our product candidates, including with respect to our PK/PD

comparability submission for FDA approval of Anaphylm; risk of the

Company's ability to address the FDA's comments on the Company's

future clinical trials and other concerns identified in the FDA

Type C meeting minutes for Anaphylm, including the risk that the

FDA may require additional clinical studies for approval of

Anaphylm; risk of the success of any competing products; risk that

we may not overcome the seven year orphan drug market exclusivity

granted by the FDA for the approved nasal spray product of another

company in the U.S. in order for Libervant to be granted U.S.

market access for patients aged six years and older until the

expiration of the orphan drug market exclusivity period of the

nasal spray product due to expire in January 2027, or for other

reasons; risk of loss of U.S. market approval of Libervant for

patients aged between two and five resulting from a legal challenge

relating to U.S. orphan drug market exclusivity by the owner of the

approved nasal spray product with respect to the FDA's approval for

U.S. market access of Libervant for this pediatric patient

population, or for other reasons; risks and uncertainties inherent

in commercializing a new product (including technology risks,

financial risks, market risks and implementation risks and

regulatory limitations); risk of development of a sales and

marketing capability for commercialization of our product Libervant

and other product candidates, including Anaphylm and AQST-108; the

potential impact on the value of the Company of the sale or

outlicensing of our product and product candidates, including

Libervant and Anaphylm and other product candidates; risk of

sufficient capital and cash resources, including sufficient access

to available debt and equity financing, including under our ATM

facility, and revenues from operations, to satisfy all of our

short-term and longer-term liquidity and cash requirements and

other cash needs, at the times and in the amounts needed, including

to fund commercialization activities relating to Libervant for

patients between two and five years of age and to fund future

clinical development and commercial activities for our product

candidates, including Anaphylm, AQST-108 and Libervant for patients

aged between six and eleven, should these product candidates be

approved by the FDA, and for Libervant patients of six years and

older upon expiration of the orphan drug marketing exclusivity

period of the nasal spray product; risk that our manufacturing

capabilities will be sufficient to support demand for Libervant for

patients between two and five years of age and for older patients,

should Libervant receive U.S. market access for these older

patients, and for demand for our licensed products in the U.S. and

abroad; risk of eroding market share for Suboxone® and risk as a

sunsetting product, which accounts for the substantial part of our

current operating revenue; risk of default of our debt instruments;

risks related to the outsourcing of certain sales, marketing and

other operational and staff functions to third parties; risk of the

rate and degree of market acceptance in the U.S. and abroad of

Libervant for epilepsy patients between two and five years of age,

and for older epilepsy patients, if approved for U.S. market access

and after the expiration of the orphan drug market exclusivity

period in January 2027; risk of the rate and degree of market

acceptance in the U.S. and abroad of Libervant and Anaphylm,

AQST-108 and our other product candidates, should these product

candidates be approved by the FDA, and for our licensed products in

the U.S. and abroad; risk of the success of any competing products

including generics; risk of the size and growth of our product

markets; risk of compliance with all FDA and other governmental and

customer requirements for our manufacturing facilities; risks

associated with intellectual property rights and infringement

claims relating to our products; risk that our patent applications

for our product candidates, including for Anaphylm, will not be

timely issued, or issued at all, by the PTO; risk of unexpected

patent developments; risk of legislation and regulatory actions and

changes in laws or regulations affecting our business including

relating to our products and products candidates and product

pricing, reimbursement or access therefor; risk of loss of

significant customers; risks related to claims and legal

proceedings against Aquestive including patent infringement,

securities, business torts, investigative, product safety or

efficacy and antitrust litigation matters; risk of product recalls

and withdrawals; risks related to any disruptions in our

information technology networks and systems, including the impact

of cybersecurity attacks; risk of increased cybersecurity attacks

and data accessibility disruptions due to remote working

arrangements; risk of adverse developments affecting the financial

services industry; risks related to inflation and rising interest

rates; risks related to the impact of the COVID-19 global pandemic

and other pandemic diseases on our business, including with respect

to our clinical trials and the site initiation, patient enrollment

and timing and adequacy of those clinical trials, regulatory

submissions and regulatory reviews and approvals of our product

candidates, availability of pharmaceutical ingredients and other

raw materials used in our products and product candidates, supply

chain, manufacture and distribution of our products and product

candidates; risks and uncertainties related to general economic,

political (including the Ukraine and Israel wars and other acts of

war and terrorism), business, industry, regulatory, financial and

market conditions and other unusual items. These forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause our actual results, levels of activity,

performance or achievements to differ materially from those

expressed or implied by these statements. These factors include the

matters discussed and referenced in the risk factors of the

Company's 2023 Annual Report on Form 10-K and our other Quarterly

Reports on Form 10-Q and in our Current Reports on Form 8-K and our

other filings with the U.S. Securities and Exchange Commission.

Given these uncertainties, you should not place undue reliance on

these forward-looking statements, which speak only as the date

made. All subsequent forward-looking statements attributable to the

Company or any person acting on its behalf are expressly qualified

in their entirety by this cautionary statement. The Company assumes

no obligation to update forward-looking statements or outlook or

guidance after the date of this press release whether as a result

of new information, future events or otherwise, except as may be

required by applicable law.

Libervant®, PharmFilm®, Sympazan® and the

Aquestive logo are registered trademarks of Aquestive Therapeutics,

Inc. All other registered trademarks referenced herein are the

property of their respective owners.

Investor inquiries:ICR WestwickeStephanie

CarringtonStephanie.Carrington@icrhealthcare.com646-277-1282

| |

|

AQUESTIVE THERAPEUTICS, INC. |

|

Condensed Balance Sheets |

|

(In thousands, except share and per share

amounts) |

|

(Unaudited) |

| |

| |

|

September 30,2024 |

|

December 31,2023 |

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

77,893 |

|

|

$ |

23,872 |

|

|

Trade and other receivables, net |

|

|

9,684 |

|

|

|

8,471 |

|

|

Inventories |

|

|

7,021 |

|

|

|

6,769 |

|

|

Prepaid expenses and other current assets |

|

|

1,972 |

|

|

|

1,854 |

|

|

Total current assets |

|

|

96,570 |

|

|

|

40,966 |

|

|

Property and equipment, net |

|

|

3,848 |

|

|

|

4,179 |

|

|

Right-of-use assets, net |

|

|

5,310 |

|

|

|

5,557 |

|

|

Intangible assets, net |

|

|

— |

|

|

|

1,278 |

|

|

Other non-current assets |

|

|

4,230 |

|

|

|

5,438 |

|

|

Total assets |

|

$ |

109,958 |

|

|

$ |

57,418 |

|

| |

|

|

|

|

| Liabilities and

stockholders' deficit |

|

|

|

|

| Current liabilities: |

|

|

|

|

|

Accounts payable |

|

$ |

7,572 |

|

|

$ |

8,926 |

|

|

Accrued expenses |

|

|

5,025 |

|

|

|

6,497 |

|

|

Lease liabilities, current |

|

|

482 |

|

|

|

390 |

|

|

Deferred revenue, current |

|

|

1,048 |

|

|

|

1,551 |

|

|

Liability related to the sale of future revenue, current |

|

|

1,000 |

|

|

|

922 |

|

|

Loans payable, current |

|

|

25 |

|

|

|

22 |

|

|

Total current liabilities |

|

|

15,152 |

|

|

|

18,308 |

|

|

Notes payable, net |

|

|

31,253 |

|

|

|

27,508 |

|

|

Royalty obligations, net |

|

|

18,835 |

|

|

|

14,761 |

|

|

Liability related to the sale of future revenue, net |

|

|

62,730 |

|

|

|

63,568 |

|

|

Lease liabilities |

|

|

5,109 |

|

|

|

5,399 |

|

|

Deferred revenue, net of current portion |

|

|

20,266 |

|

|

|

32,345 |

|

|

Other non-current liabilities |

|

|

2,033 |

|

|

|

2,016 |

|

|

Total liabilities |

|

|

155,378 |

|

|

|

163,905 |

|

|

Contingencies |

|

|

|

|

| |

|

|

|

|

| Stockholders' deficit: |

|

|

|

|

|

Common stock, $0.001 par value. Authorized 250,000,000 shares;

91,178,193 and 68,533,085 shares issued and outstanding at

September 30, 2024 and December 31, 2023, respectively |

|

|

91 |

|

|

|

69 |

|

|

Additional paid-in capital |

|

|

300,648 |

|

|

|

212,521 |

|

|

Accumulated deficit |

|

|

(346,159 |

) |

|

|

(319,077 |

) |

|

Total stockholders' deficit |

|

|

(45,420 |

) |

|

|

(106,487 |

) |

|

Total liabilities and stockholders' deficit |

|

$ |

109,958 |

|

|

$ |

57,418 |

|

|

AQUESTIVE THERAPEUTICS, INC. |

|

Condensed Statements of Operations and Comprehensive (Loss)

Income |

|

(In thousands, except share and per share data

amounts) |

|

(Unaudited) |

| |

| |

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

|

$ |

13,542 |

|

|

$ |

13,002 |

|

|

$ |

45,694 |

|

|

$ |

37,377 |

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

Manufacture and supply |

|

|

4,437 |

|

|

|

4,798 |

|

|

|

13,352 |

|

|

|

16,152 |

|

|

Research and development |

|

|

5,269 |

|

|

|

3,196 |

|

|

|

15,363 |

|

|

|

10,216 |

|

|

Selling, general and administrative |

|

|

12,126 |

|

|

|

7,385 |

|

|

|

34,171 |

|

|

|

22,200 |

|

|

Total costs and expenses |

|

|

21,832 |

|

|

|

15,379 |

|

|

|

62,886 |

|

|

|

48,568 |

|

|

Income (Loss) from operations |

|

|

(8,290 |

) |

|

|

(2,377 |

) |

|

|

(17,192 |

) |

|

|

(11,191 |

) |

| Other income/(expenses): |

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(2,780 |

) |

|

|

(1,256 |

) |

|

|

(8,343 |

) |

|

|

(4,064 |

) |

|

Interest expense related to royalty obligations |

|

|

(1,359 |

) |

|

|

— |

|

|

|

(4,075 |

) |

|

|

— |

|

|

Interest expense related to the sale of future revenue |

|

|

(59 |

) |

|

|

(56 |

) |

|

|

(175 |

) |

|

|

(163 |

) |

|

Interest income and other income, net |

|

|

979 |

|

|

|

1,514 |

|

|

|

2,703 |

|

|

|

16,156 |

|

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(353 |

) |

| Net (loss) income before

income taxes |

|

|

(11,509 |

) |

|

|

(2,175 |

) |

|

|

(27,082 |

) |

|

|

385 |

|

|

Income taxes (benefit) expense |

|

|

— |

|

|

|

(140 |

) |

|

|

— |

|

|

|

144 |

|

| Net (loss) income |

|

$ |

(11,509 |

) |

|

$ |

(2,035 |

) |

|

$ |

(27,082 |

) |

|

$ |

241 |

|

| Comprehensive (loss)

income |

|

$ |

(11,509 |

) |

|

$ |

(2,035 |

) |

|

$ |

(27,082 |

) |

|

$ |

241 |

|

| |

|

|

|

|

|

|

|

|

| (Loss) earnings per

share attributable to common stockholders: |

|

|

|

|

|

|

|

|

| Basic (in dollars per

share) |

|

$ |

(0.13 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.32 |

) |

|

$ |

— |

|

| Diluted (in dollars per

share) |

|

$ |

(0.13 |

) |

|

$ |

(0.03 |

) |

|

$ |

(0.32 |

) |

|

$ |

— |

|

| Weighted average

common shares outstanding: |

|

|

|

|

|

|

|

|

| Basic (in shares) |

|

|

91,082,081 |

|

|

|

64,678,761 |

|

|

|

85,224,263 |

|

|

|

59,252,768 |

|

| Diluted (in shares) |

|

|

91,082,081 |

|

|

|

64,678,761 |

|

|

|

85,224,263 |

|

|

|

61,513,736 |

|

|

AQUESTIVE THERAPEUTICS, INC. |

|

Reconciliation of Non-GAAP Adjustments – Net (Loss) Income

to Non-GAAP Adjusted EBITDA |

|

(In Thousands) |

|

(Unaudited) |

| |

| |

|

Three Months EndedSeptember 30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| GAAP net (loss) income |

|

$ |

(11,509 |

) |

|

$ |

(2,035 |

) |

|

$ |

(27,082 |

) |

|

$ |

241 |

|

|

Share-based compensation expense |

|

|

1,577 |

|

|

|

774 |

|

|

|

4,696 |

|

|

|

1,766 |

|

|

Interest expense |

|

|

2,780 |

|

|

|

1,256 |

|

|

|

8,343 |

|

|

|

4,064 |

|

|

Interest expense related to royalty obligations |

|

|

1,359 |

|

|

|

— |

|

|

|

4,075 |

|

|

|

— |

|

|

Interest expense related to the sale of future revenue |

|

|

59 |

|

|

|

56 |

|

|

|

175 |

|

|

|

163 |

|

|

Interest income and other income, net |

|

|

(979 |

) |

|

|

(1,514 |

) |

|

|

(2,703 |

) |

|

|

(16,156 |

) |

|

Loss on extinguishment of debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

353 |

|

|

Income Taxes |

|

|

— |

|

|

|

(140 |

) |

|

|

— |

|

|

|

144 |

|

|

Depreciation and Amortization |

|

|

159 |

|

|

|

264 |

|

|

|

571 |

|

|

|

878 |

|

| Total non-GAAP

adjustments |

|

$ |

4,955 |

|

|

$ |

696 |

|

|

$ |

15,157 |

|

|

$ |

(8,788 |

) |

| Non-GAAP adjusted EBITDA |

|

$ |

(6,554 |

) |

|

$ |

(1,339 |

) |

|

$ |

(11,925 |

) |

|

$ |

(8,547 |

) |

| Excluding Non-GAAP adjusted

R&D expenses |

|

|

(4,943 |

) |

|

|

(3,069 |

) |

|

|

(14,521 |

) |

|

|

(9,869 |

) |

| Non-GAAP adjusted EBITDA

excluding Non-GAAP adjusted R&D expenses |

|

$ |

(1,611 |

) |

|

$ |

1,730 |

|

|

$ |

2,596 |

|

|

$ |

1,322 |

|

|

AQUESTIVE THERAPEUTICS, INC. |

|

Reconciliation of Non-GAAP Adjustments – GAAP Expenses to

Non-GAAP Adjusted Expenses |

|

(In Thousands, except percentages) |

|

(Unaudited) |

| |

| |

|

Three Months EndedSeptember

30, |

|

Nine Months EndedSeptember

30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Total costs and

expenses |

|

$ |

21,832 |

|

|

$ |

15,379 |

|

|

$ |

62,886 |

|

|

$ |

48,568 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

(1,577 |

) |

|

|

(774 |

) |

|

|

(4,696 |

) |

|

|

(1,766 |

) |

|

Depreciation and amortization |

|

|

(159 |

) |

|

|

(264 |

) |

|

|

(571 |

) |

|

|

(878 |

) |

| Non-GAAP adjusted

costs and expenses |

|

$ |

20,096 |

|

|

$ |

14,341 |

|

|

$ |

57,619 |

|

|

$ |

45,924 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Manufacture and Supply

Expense |

|

$ |

4,437 |

|

|

$ |

4,798 |

|

|

$ |

13,352 |

|

|

$ |

16,152 |

|

|

Gross Margin on total revenue |

|

|

67 |

% |

|

|

63 |

% |

|

|

71 |

% |

|

|

57 |

% |

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

(102 |

) |

|

|

(59 |

) |

|

|

(271 |

) |

|

|

(155 |

) |

|

Depreciation and amortization |

|

|

(130 |

) |

|

|

(214 |

) |

|

|

(482 |

) |

|

|

(746 |

) |

| Non-GAAP adjusted

manufacture and supply expense |

|

$ |

4,205 |

|

|

$ |

4,525 |

|

|

$ |

12,599 |

|

|

$ |

15,251 |

|

|

Non-GAAP Gross Margin on total revenue |

|

|

69 |

% |

|

|

65 |

% |

|

|

72 |

% |

|

|

59 |

% |

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Research and

Development Expense |

|

$ |

5,269 |

|

|

$ |

3,196 |

|

|

$ |

15,363 |

|

|

$ |

10,216 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

(310 |

) |

|

|

(105 |

) |

|

|

(788 |

) |

|

|

(277 |

) |

|

Depreciation and amortization |

|

|

(16 |

) |

|

|

(22 |

) |

|

|

(54 |

) |

|

|

(70 |

) |

| Non-GAAP adjusted

research and development expense |

|

$ |

4,943 |

|

|

$ |

3,069 |

|

|

$ |

14,521 |

|

|

$ |

9,869 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Selling, General and

Administrative Expenses |

|

$ |

12,126 |

|

|

$ |

7,385 |

|

|

$ |

34,171 |

|

|

$ |

22,200 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

Share-based compensation expense |

|

|

(1,165 |

) |

|

|

(610 |

) |

|

|

(3,637 |

) |

|

|

(1,334 |

) |

|

Depreciation and amortization |

|

|

(13 |

) |

|

|

(28 |

) |

|

|

(35 |

) |

|

|

(62 |

) |

| Non-GAAP adjusted

selling, general and administrative expenses |

|

$ |

10,948 |

|

|

$ |

6,747 |

|

|

$ |

30,499 |

|

|

$ |

20,804 |

|

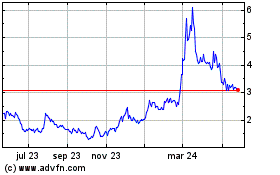

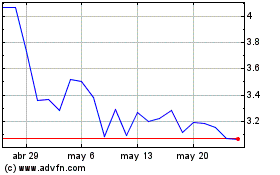

Aquestive Therapeutics (NASDAQ:AQST)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Aquestive Therapeutics (NASDAQ:AQST)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024