false

0000021535

0000021535

2024-07-31

2024-07-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of Earliest Event Reported):

|

|

July 31, 2024

|

Cohu, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-04298

|

95-1934119

|

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

12367 Crosthwaite Circle, Poway, California

|

|

92064

|

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

Registrant’s telephone number, including area code:

|

858-848-8100

|

Not Applicable

Former name or former address, if changed since last report

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, $1.00 par value

|

COHU

|

The NASDAQ Stock Market LLC

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On July 31, 2024, the Company issued a press release regarding its financial results for the second fiscal quarter ended June 29, 2024. The Company’s press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

The information in this Item 2.02 of this Current Report on Form 8-K and the Exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, regardless of any general incorporation language in such filing.

Use of Non-GAAP Financial Information:

Included within this current report are non-GAAP financial measures, including non-GAAP Gross Margin/Profit, Income and Income (adjusted earnings) per share, Operating Income, Operating Expense, effective tax rate, free cash flow, net cash per share and Adjusted EBITDA that supplement the Company’s Condensed Consolidated Statements of Operations prepared under generally accepted accounting principles (GAAP). These non-GAAP financial measures adjust the Company’s actual results prepared under GAAP to exclude charges and the related income tax effect for: share-based compensation, the amortization of purchased intangible assets, manufacturing transition and severance costs, acquisition-related costs and associated professional fees, restructuring costs, impairments, inventory step-up, depreciation of purchase accounting adjustments to property, plant and equipment, amortization of cloud-based software implementation costs (Adjusted EBITDA only) and loss on extinguishment of debt (Adjusted EBITDA only). Reconciliations of GAAP to non-GAAP amounts for the periods presented herein are provided in schedules accompanying this release and should be considered together with the Condensed Consolidated Statements of Operations. With respect to any forward-looking non-GAAP figures, we are unable to provide without unreasonable efforts, at this time, a GAAP to non-GAAP reconciliation of any forward-looking figures due to their inherent uncertainty.

These non-GAAP measures are not meant as a substitute for GAAP, but are included solely for informational and comparative purposes. The Company’s management believes that this information can assist investors in evaluating the Company’s operational trends, financial performance, and cash generating capacity. Management uses non-GAAP measures for a variety of reasons, including to make operational decisions, to determine executive compensation in part, to forecast future operational results, and for comparison to our annual operating plan. However, the non-GAAP financial measures should not be regarded as a replacement for (or superior to) corresponding, similarly captioned, GAAP measures.

Forward Looking Statements:

Certain statements contained in this current report may be considered forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding new product introductions or customer adoptions and corresponding financial impacts; expectations related to our FY2024 outlook, including quarterly projections; effects of test cell utilization on future business; and any other statements that are predictive in nature and depend upon or refer to future events or conditions; and/or include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend;” and/or other similar expressions among others. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Any third-party industry analyst forecasts quoted are for reference only and Cohu does not adopt or affirm any such forecasts.

Actual results and future business conditions could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: new product investments and product enhancements which may not be commercially successful; the semiconductor industry is seasonal, cyclical, volatile and unpredictable; recent erosion in mobile, automotive and industrial market sales; our ability to manage and deliver high quality products and services; failure of sole source contract manufacturer or our ability to manage third-party raw material, component and/or service providers; ongoing inflationary pressures on material and operational costs coupled with rising interest rates; economic recession; the semiconductor industry is intensely competitive, subject to rapid technological changes, and experiences consolidation of key customers for semiconductor test equipment; a limited number of customers account for a substantial percentage of net sales; significant exports to foreign countries with economic and political instability and competition from a number of Asia-based manufacturers; our relationships with customers may deteriorate; loss of key personnel; risks of using artificial intelligence within Cohu’s product developments and business; reliance on foreign locations and geopolitical instability in such locations critical to Cohu and its customers; natural disasters, war and climate-related changes, including related economic impacts; levels of debt; access to sufficient capital on reasonable or favorable terms; foreign operations and related currency fluctuations; required or desired accounting charges and the cost or effectiveness of accounting controls; instability of financial institutions where we maintain cash deposits and potential loss of uninsured cash deposits; significant goodwill and other intangibles as percentage of our total assets; increasingly restrictive trade and export regulations impacting our ability to sell products, specifically within China; risks associated with acquisitions, investments and divestitures such as integration and synergies; constraints related to corporate governance structures; share repurchases and related impacts; financial or operating results that are below forecast or credit rating changes impacting our stock price or financing ability; law/regulatory changes and including environmental or tax law changes; significant volatility in our stock price; the risk of cybersecurity breaches; enforcing or defending intellectual property claims or other litigation.

These and other risks and uncertainties are discussed more fully in Cohu’s filings with the SEC, including our most recent Form 10-K and Form 10-Q, and the other filings made by Cohu with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. Except as required by applicable law, Cohu does not undertake any obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

Item 9.01 Financial Statements and Exhibits.

The Exhibit listed below is being furnished with this Current Report on Form 8-K.

(d) Exhibits

Exhibit No. - 99.1

Exhibit No. - 104

Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Cohu, Inc.

|

|

|

|

|

|

July 31, 2024

|

By:

|

/s/ Jeffrey D. Jones

|

|

|

|

|

|

|

|

Name: Jeffrey D. Jones

|

|

|

|

Title: Senior VP Finance and Chief Financial Officer

|

Exhibit Index

|

Exhibit No.

|

|

Description

|

| |

|

|

|

99.1

|

|

Second Quarter 2024 Earnings Release, dated July 31, 2024, of Cohu, Inc.

|

| |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Exhibit 99.1

Cohu Reports Second Quarter 2024 Results

| |

●

|

Second quarter revenue $104.7 million, approximately 66% recurring

|

| |

●

|

Gross margin of 44.8%; non-GAAP gross margin of 45.1%

|

| |

●

|

Launched two new products: Krypton inspection metrology system and cStrider MEMS probe card

|

| |

●

|

Announced multi-year estimated $100 million win for test automation and inspection systems

|

POWAY, Calif., July 31, 2024 – Cohu, Inc. (NASDAQ: COHU), a global supplier of equipment and services optimizing semiconductor manufacturing yield and productivity, today reported fiscal 2024 second quarter net sales of $104.7 million and GAAP loss of $15.8 million or $0.34 per share. Net sales for the first six months of 2024 were $212.3 million and GAAP loss was $30.4 million or $0.65 per share.

Cohu also reported non-GAAP results, with second quarter 2024 loss of $0.6 million or $0.01 per share and income of $0.0 million or $0.00 per share for the first six months of 2024.

|

GAAP Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except per share amounts)

|

|

Q2 FY

2024

|

|

|

Q1 FY

2024

|

|

|

Q2 FY

2023

|

|

|

6 Months

2024

|

|

|

6 Months

2023

|

|

|

Net sales

|

|

$ |

104.7 |

|

|

$ |

107.6 |

|

|

$ |

168.9 |

|

|

$ |

212.3 |

|

|

$ |

348.3 |

|

|

Net income (loss)

|

|

$ |

(15.8 |

) |

|

$ |

(14.6 |

) |

|

$ |

10.6 |

|

|

$ |

(30.4 |

) |

|

$ |

26.3 |

|

|

Net income (loss) per share

|

|

$ |

(0.34 |

) |

|

$ |

(0.31 |

) |

|

$ |

0.22 |

|

|

$ |

(0.65 |

) |

|

$ |

0.55 |

|

|

Non-GAAP Results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions, except per share amounts)

|

|

Q2 FY

2024

|

|

|

Q1 FY

2024

|

|

|

Q2 FY

2023

|

|

|

6 Months

2024

|

|

|

6 Months

2023

|

|

|

Net income (loss)

|

|

$ |

(0.6 |

) |

|

$ |

0.6 |

|

|

$ |

22.9 |

|

|

$ |

0.0 |

|

|

$ |

49.9 |

|

|

Net income (loss) per share

|

|

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.48 |

|

|

$ |

0.00 |

|

|

$ |

1.04 |

|

Total cash and investments at the end of second quarter 2024 were $262.4 million. Cohu repurchased 267,000 shares of its common stock in the second quarter for an aggregate amount of approximately $8.2 million.

“Cohu continued to execute well on new product development initiatives and delivered several design-wins to expand customer and addressable markets. We secured two customer awards for the new Krypton inspection metrology system, two Taiwanese OSATs adopted the Diamondx tester, and we landed a leading silicon carbide customer with our new cStrider power probe card,” said Cohu President and CEO Luis Müller. “Estimated test cell utilization improved for the second quarter in a row to 74%, a 2 point sequential increase from the March quarter. It is encouraging to see utilization improvements, particularly in computing and mobile segments.”

Cohu expects third quarter 2024 sales to be in a range of $95 million +/- $5 million.

Conference Call Information:

The Company will host a live conference call and webcast with slides to discuss second quarter 2024 results at 1:30 p.m. Pacific Time/4:30 p.m. Eastern Time on July 31, 2024. Interested parties may listen live via webcast on Cohu’s investor relations website at https://edge.media-server.com/mmc/p/c4ojba35.

To participate via telephone and join the call live, please register in advance at https://register.vevent.com/register/BI7136d97fb78049e0a84cc55da2f543aa to receive the dial-in number along with a unique PIN number that can be used to access the call.

About Cohu:

Cohu (NASDAQ: COHU) is a global technology leader supplying test, automation, inspection and metrology products and services to the semiconductor industry. Cohu’s differentiated and broad product portfolio enables optimized yield and productivity, accelerating customers’ manufacturing time-to-market. Additional information can be found at www.cohu.com.

Use of Non-GAAP Financial Information:

Included within this press release and accompanying materials are non-GAAP financial measures, including non-GAAP Gross Margin/Profit, Income and Income (adjusted earnings) per share, Operating Income, Operating Expense, effective tax rate, free cash flow, net cash per share and Adjusted EBITDA that supplement the Company’s Condensed Consolidated Statements of Operations prepared under generally accepted accounting principles (GAAP). These non-GAAP financial measures adjust the Company’s actual results prepared under GAAP to exclude charges and the related income tax effect for: share-based compensation, the amortization of purchased intangible assets, manufacturing transition and severance costs, acquisition-related costs and associated professional fees, restructuring costs, impairments, inventory step-up, depreciation of purchase accounting adjustments to property, plant and equipment, amortization of cloud-based software implementation costs (Adjusted EBITDA only) and loss on extinguishment of debt (Adjusted EBITDA only). Reconciliations of GAAP to non-GAAP amounts for the periods presented herein are provided in schedules accompanying this release and should be considered together with the Condensed Consolidated Statements of Operations. With respect to any forward-looking non-GAAP figures, we are unable to provide without unreasonable efforts, at this time, a GAAP to non-GAAP reconciliation of any forward-looking figures due to their inherent uncertainty.

These non-GAAP measures are not meant as a substitute for GAAP, but are included solely for informational and comparative purposes. The Company’s management believes that this information can assist investors in evaluating the Company’s operational trends, financial performance, and cash generating capacity. Management uses non-GAAP measures for a variety of reasons, including to make operational decisions, to determine executive compensation in part, to forecast future operational results, and for comparison to our annual operating plan. However, the non-GAAP financial measures should not be regarded as a replacement for (or superior to) corresponding, similarly captioned, GAAP measures.

Forward Looking Statements:

Certain statements contained in this release and accompanying materials may be considered forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, including statements regarding new product introductions or customer adoptions and corresponding financial impacts; expectations related to our FY2024 outlook, including quarterly projections; effects of test cell utilization on future business; and any other statements that are predictive in nature and depend upon or refer to future events or conditions; and/or include words such as “may,” “will,” “should,” “would,” “expect,” “anticipate,” “plan,” “likely,” “believe,” “estimate,” “project,” “intend;” and/or other similar expressions among others. Statements that are not historical facts are forward-looking statements. Forward-looking statements are based on current beliefs and assumptions that are subject to risks and uncertainties and are not guarantees of future performance. Any third-party industry analyst forecasts quoted are for reference only and Cohu does not adopt or affirm any such forecasts.

Actual results and future business conditions could differ materially from those contained in any forward-looking statement as a result of various factors, including, without limitation: new product investments and product enhancements which may not be commercially successful; the semiconductor industry is seasonal, cyclical, volatile and unpredictable; recent erosion in mobile, automotive and industrial market sales; our ability to manage and deliver high quality products and services; failure of sole source contract manufacturer or our ability to manage third-party raw material, component and/or service providers; ongoing inflationary pressures on material and operational costs coupled with rising interest rates; economic recession; the semiconductor industry is intensely competitive, subject to rapid technological changes, and experiences consolidation of key customers for semiconductor test equipment; a limited number of customers account for a substantial percentage of net sales; significant exports to foreign countries with economic and political instability and competition from a number of Asia-based manufacturers; our relationships with customers may deteriorate; loss of key personnel; risks of using artificial intelligence within Cohu’s product developments and business; reliance on foreign locations and geopolitical instability in such locations critical to Cohu and its customers; natural disasters, war and climate-related changes, including related economic impacts; levels of debt; access to sufficient capital on reasonable or favorable terms; foreign operations and related currency fluctuations; required or desired accounting charges and the cost or effectiveness of accounting controls; instability of financial institutions where we maintain cash deposits and potential loss of uninsured cash deposits; significant goodwill and other intangibles as percentage of our total assets; increasingly restrictive trade and export regulations impacting our ability to sell products, specifically within China; risks associated with acquisitions, investments and divestitures such as integration and synergies; constraints related to corporate governance structures; share repurchases and related impacts; financial or operating results that are below forecast or credit rating changes impacting our stock price or financing ability; law/regulatory changes and including environmental or tax law changes; significant volatility in our stock price; the risk of cybersecurity breaches; enforcing or defending intellectual property claims or other litigation.

These and other risks and uncertainties are discussed more fully in Cohu’s filings with the SEC, including our most recent Form 10-K and Form 10-Q, and the other filings made by Cohu with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. Except as required by applicable law, Cohu does not undertake any obligation to revise or update any forward-looking statement, or to make any other forward-looking statements, whether as a result of new information, future events or otherwise.

For press releases and other information of interest to investors, please visit Cohu’s website at www.cohu.com.

Contact:

Cohu, Inc.

Jeffrey D. Jones - Investor Relations

858-848-8106

COHU, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except per share amounts)

| |

|

Three Months Ended (1)

|

|

|

Six Months Ended (1)

|

|

| |

|

June 29,

|

|

|

July 1,

|

|

|

June 29,

|

|

|

July 1,

|

|

| |

|

2024 (2)

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Net sales

|

|

$ |

104,701 |

|

|

$ |

168,921 |

|

|

$ |

212,315 |

|

|

$ |

348,292 |

|

|

Cost and expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (excluding amortization)

|

|

|

57,779 |

|

|

|

88,576 |

|

|

|

116,144 |

|

|

|

181,729 |

|

|

Research and development

|

|

|

21,342 |

|

|

|

22,466 |

|

|

|

43,678 |

|

|

|

44,976 |

|

|

Selling, general and administrative

|

|

|

32,118 |

|

|

|

32,798 |

|

|

|

67,200 |

|

|

|

66,987 |

|

|

Amortization of purchased intangible assets

|

|

|

9,748 |

|

|

|

9,006 |

|

|

|

19,543 |

|

|

|

17,760 |

|

|

Restructuring charges

|

|

|

13 |

|

|

|

416 |

|

|

|

22 |

|

|

|

1,304 |

|

| |

|

|

121,000 |

|

|

|

153,262 |

|

|

|

246,587 |

|

|

|

312,756 |

|

|

Income (loss) from operations

|

|

|

(16,299 |

) |

|

|

15,659 |

|

|

|

(34,272 |

) |

|

|

35,536 |

|

|

Other (expense) income:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(144 |

) |

|

|

(727 |

) |

|

|

(433 |

) |

|

|

(1,855 |

) |

|

Interest income

|

|

|

2,333 |

|

|

|

2,732 |

|

|

|

5,042 |

|

|

|

5,450 |

|

|

Foreign transaction loss

|

|

|

(373 |

) |

|

|

(645 |

) |

|

|

(914 |

) |

|

|

(1,085 |

) |

|

Loss on extinguishment of debt

|

|

|

- |

|

|

|

- |

|

|

|

(241 |

) |

|

|

(369 |

) |

|

Income (loss) from operations before taxes

|

|

|

(14,483 |

) |

|

|

17,019 |

|

|

|

(30,818 |

) |

|

|

37,677 |

|

|

Income tax provision (benefit)

|

|

|

1,286 |

|

|

|

6,435 |

|

|

|

(414 |

) |

|

|

11,408 |

|

|

Net income (loss)

|

|

$ |

(15,769 |

) |

|

$ |

10,584 |

|

|

$ |

(30,404 |

) |

|

$ |

26,269 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic:

|

|

$ |

(0.34 |

) |

|

$ |

0.22 |

|

|

$ |

(0.65 |

) |

|

$ |

0.55 |

|

|

Diluted:

|

|

$ |

(0.34 |

) |

|

$ |

0.22 |

|

|

$ |

(0.65 |

) |

|

$ |

0.55 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in computing income (loss) per share: (3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

46,965 |

|

|

|

47,618 |

|

|

|

47,049 |

|

|

|

47,481 |

|

|

Diluted

|

|

|

46,965 |

|

|

|

48,028 |

|

|

|

47,049 |

|

|

|

48,099 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(1)

|

The three- and six-month periods ended June 29, 2024 and July 1, 2023 were both comprised of 13 weeks and 26 weeks, respectively.

|

| |

(2)

|

On January 30, 2023 the Company completed the acquisition of MCT Worldwide, LLC (“MCT”) and on October 2, 2023 the Company completed the acquisition of Equiptest Engineering Pte. Ltd. (“EQT”). The results of MCT’s and EQT’s operations have been included since those dates.

|

| |

(3)

|

For the three- and six-month periods ended June 29, 2024, potentially dilutive securities were excluded from the per share computations due to their antidilutive effect.

|

COHU, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(in thousands)

| |

|

June 29,

|

|

|

December 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Assets:

|

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and investments (1)

|

|

$ |

262,397 |

|

|

$ |

335,698 |

|

|

Accounts receivable

|

|

|

103,025 |

|

|

|

124,624 |

|

|

Inventories

|

|

|

146,074 |

|

|

|

155,793 |

|

|

Other current assets

|

|

|

34,629 |

|

|

|

22,703 |

|

|

Total current assets

|

|

|

546,125 |

|

|

|

638,818 |

|

|

Property, plant & equipment, net

|

|

|

74,907 |

|

|

|

69,085 |

|

|

Goodwill

|

|

|

237,476 |

|

|

|

241,658 |

|

|

Intangible assets, net

|

|

|

130,922 |

|

|

|

151,770 |

|

|

Operating lease right of use assets

|

|

|

14,896 |

|

|

|

16,778 |

|

|

Other assets

|

|

|

34,706 |

|

|

|

32,243 |

|

|

Total assets

|

|

$ |

1,039,032 |

|

|

$ |

1,150,352 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities & Stockholders’ Equity:

|

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Short-term borrowings

|

|

$ |

1,243 |

|

|

$ |

1,773 |

|

|

Current installments of long-term debt

|

|

|

1,135 |

|

|

|

4,551 |

|

|

Deferred profit

|

|

|

3,327 |

|

|

|

3,586 |

|

|

Other current liabilities

|

|

|

72,858 |

|

|

|

93,511 |

|

|

Total current liabilities

|

|

|

78,563 |

|

|

|

103,421 |

|

|

Long-term debt (1)

|

|

|

7,592 |

|

|

|

34,303 |

|

|

Non-current operating lease liabilities

|

|

|

11,408 |

|

|

|

13,175 |

|

|

Other noncurrent liabilities

|

|

|

45,259 |

|

|

|

49,283 |

|

|

Cohu stockholders’ equity

|

|

|

896,210 |

|

|

|

950,170 |

|

|

Total liabilities & stockholders’ equity

|

|

$ |

1,039,032 |

|

|

$ |

1,150,352 |

|

| |

|

|

|

|

|

|

|

|

| |

(1)

|

On February 9, 2024, the Company made a cash payment of $29.3 million to repay the remaining outstanding amounts owed under our Term Loan B.

|

COHU, INC.

Supplemental Reconciliation of GAAP Results to Non-GAAP Financial Measures (Unaudited)

(in thousands, except per share amounts)

| |

|

Three Months Ended

|

|

| |

|

June 29,

|

|

|

March 30,

|

|

|

July 1,

|

|

| |

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

Income (loss) from operations - GAAP basis (a)

|

|

$ |

(16,299 |

) |

|

$ |

(17,973 |

) |

|

$ |

15,659 |

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Share-based compensation included in (b):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (COS)

|

|

|

262 |

|

|

|

227 |

|

|

|

216 |

|

|

Research and development (R&D)

|

|

|

1,001 |

|

|

|

834 |

|

|

|

819 |

|

|

Selling, general and administrative (SG&A)

|

|

|

4,320 |

|

|

|

3,567 |

|

|

|

3,397 |

|

| |

|

|

5,583 |

|

|

|

4,628 |

|

|

|

4,432 |

|

|

Amortization of purchased intangible assets (c)

|

|

|

9,748 |

|

|

|

9,795 |

|

|

|

9,006 |

|

|

Restructuring charges related to inventory adjustments in COS (d)

|

|

|

(12 |

) |

|

|

(4 |

) |

|

|

(13 |

) |

|

Restructuring charges (d)

|

|

|

13 |

|

|

|

9 |

|

|

|

416 |

|

|

Manufacturing and sales transition costs included in (e):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COS

|

|

|

2 |

|

|

|

- |

|

|

|

- |

|

|

R&D

|

|

|

44 |

|

|

|

14 |

|

|

|

22 |

|

|

SG&A

|

|

|

1,196 |

|

|

|

1,640 |

|

|

|

166 |

|

| |

|

|

1,242 |

|

|

|

1,654 |

|

|

|

188 |

|

|

Impairment charge included in SG&A (f)

|

|

|

- |

|

|

|

966 |

|

|

|

- |

|

|

Inventory step-up included in COS (g)

|

|

|

- |

|

|

|

- |

|

|

|

149 |

|

|

Acquisition costs included in SG&A (h)

|

|

|

1 |

|

|

|

174 |

|

|

|

140 |

|

|

Depreciation of PP&E step-up included in SG&A (i)

|

|

|

12 |

|

|

|

12 |

|

|

|

14 |

|

|

Income (loss) from operations - non-GAAP basis (j)

|

|

$ |

288 |

|

|

$ |

(739 |

) |

|

$ |

29,991 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) - GAAP basis

|

|

$ |

(15,769 |

) |

|

$ |

(14,635 |

) |

|

$ |

10,584 |

|

|

Non-GAAP adjustments (as scheduled above)

|

|

|

16,587 |

|

|

|

17,234 |

|

|

|

14,332 |

|

|

Tax effect of non-GAAP adjustments (k)

|

|

|

(1,400 |

) |

|

|

(1,999 |

) |

|

|

(2,004 |

) |

|

Net income (loss) - non-GAAP basis

|

|

$ |

(582 |

) |

|

$ |

600 |

|

|

$ |

22,912 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net income (loss) per share - diluted

|

|

$ |

(0.34 |

) |

|

$ |

(0.31 |

) |

|

$ |

0.22 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP net income (loss) per share - diluted (l)

|

|

$ |

(0.01 |

) |

|

$ |

0.01 |

|

|

$ |

0.48 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

Management believes the presentation of these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provides meaningful supplemental information regarding the Company’s operating performance. Our management uses these non-GAAP financial measures in assessing the Company's operating results, as well as when planning, forecasting and analyzing future periods and these non-GAAP measures allow investors to evaluate the Company’s financial performance using some of the same measures as management. Management views share-based compensation as an expense that is unrelated to the Company’s operational performance as it does not require cash payments and can vary in amount from period to period and the elimination of amortization charges provides better comparability of pre- and post-acquisition operating results and to results of businesses utilizing internally developed intangible assets. Management initiated certain restructuring and manufacturing transition activities including employee headcount reductions and other organizational changes to align our business strategies in light of the acquisitions of MCT and EQT. Restructuring and manufacturing transition costs have been excluded because such expense is not used by Management to assess the core profitability of Cohu’s business operations. Impairment charges have been excluded as these amounts are infrequent and are unrelated to the operational performance of Cohu. PP&E and inventory step-up costs have been excluded by management as they are unrelated to the core operating activities of the Company. Acquisition costs have been excluded by management as they are unrelated to the core operating activities of the Company and the frequency and variability in the nature of the charges can vary significantly from period to period. Excluding this data provides investors with a basis to compare Cohu’s performance against the performance of other companies without this variability. However, the non-GAAP financial measures should not be regarded as a replacement for (or superior to) corresponding, similarly captioned, GAAP measures. The presentation of non-GAAP financial measures above may not be comparable to similarly titled measures reported by other companies and investors should be careful when comparing our non-GAAP financial measures to those of other companies.

| |

(a)

|

(15.6)%, (16.7)% and 9.3% of net sales, respectively.

|

| |

(b)

|

To eliminate compensation expense for employee stock options, stock units and our employee stock purchase plan.

|

| |

(c)

|

To eliminate the amortization of acquired intangible assets.

|

| |

(d)

|

To eliminate restructuring costs incurred related to the integration of MCT.

|

| |

(e)

|

To eliminate the manufacturing transition and severance costs.

|

| |

(f)

|

To eliminate the impairment of the Company’s investment in Fraes-und Technologiezentrum GmbH Frasdorf.

|

| |

(g)

|

To eliminate amortization of inventory step up charges related to acquisitions.

|

| |

(h)

|

To eliminate professional fees and other direct incremental expenses incurred related to acquisitions.

|

| |

(i)

|

To eliminate depreciation of PP&E step up charges related to the acquisition of MCT and EQT.

|

| |

(j)

|

0.3%, (0.7)% and 17.8% of net sales, respectively.

|

| |

(k)

|

To adjust the provision for income taxes related to the adjustments described above based on applicable tax rates.

|

| |

(l)

|

The three months ended March 30, 2024 was computed using 47,606 shares outstanding as the effect of dilutive securities was excluded from GAAP diluted common shares due to the reported net loss under GAAP, but are included for non-GAAP diluted common shares since the Company has non-GAAP net income. All other periods presented were calculated using the number of GAAP diluted shares outstanding.

|

COHU, INC.

Supplemental Reconciliation of GAAP Results to Non-GAAP Financial Measures (Unaudited)

(in thousands, except per share amounts)

| |

|

Six Months Ended

|

|

| |

|

June 29,

|

|

|

July 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Income (loss) from operations - GAAP basis (a)

|

|

$ |

(34,272 |

) |

|

$ |

35,536 |

|

|

Non-GAAP adjustments:

|

|

|

|

|

|

|

|

|

|

Share-based compensation included in (b):

|

|

|

|

|

|

|

|

|

|

Cost of sales (COS)

|

|

|

489 |

|

|

|

396 |

|

|

Research and development (R&D)

|

|

|

1,835 |

|

|

|

1,685 |

|

|

Selling, general and administrative (SG&A)

|

|

|

7,887 |

|

|

|

6,265 |

|

| |

|

|

10,211 |

|

|

|

8,346 |

|

|

Amortization of purchased intangible assets (c)

|

|

|

19,543 |

|

|

|

17,760 |

|

|

Restructuring charges related to inventory adjustments in COS (d)

|

|

|

(16 |

) |

|

|

(41 |

) |

|

Restructuring charges (d)

|

|

|

22 |

|

|

|

1,304 |

|

|

Manufacturing and sales transition costs included in (e):

|

|

|

|

|

|

|

|

|

|

COS

|

|

|

2 |

|

|

|

18 |

|

|

R&D

|

|

|

58 |

|

|

|

22 |

|

|

SG&A

|

|

|

2,836 |

|

|

|

419 |

|

| |

|

|

2,896 |

|

|

|

459 |

|

| |

|

|

|

|

|

|

|

|

|

Impairment charge included in SG&A (f)

|

|

|

966 |

|

|

|

- |

|

|

Inventory step-up included in COS (g)

|

|

|

- |

|

|

|

273 |

|

|

Acquisition costs included in SG&A (h)

|

|

|

175 |

|

|

|

525 |

|

|

Depreciation of PP&E step-up included in SG&A (i)

|

|

|

24 |

|

|

|

23 |

|

|

Income (loss) from operations - non-GAAP basis (j)

|

|

$ |

(451 |

) |

|

$ |

64,185 |

|

| |

|

|

|

|

|

|

|

|

|

Net income (loss) - GAAP basis

|

|

$ |

(30,404 |

) |

|

$ |

26,269 |

|

|

Non-GAAP adjustments (as scheduled above)

|

|

|

33,821 |

|

|

|

28,649 |

|

|

Tax effect of non-GAAP adjustments (k)

|

|

|

(3,399 |

) |

|

|

(5,061 |

) |

|

Net income - non-GAAP basis

|

|

$ |

18 |

|

|

$ |

49,857 |

|

| |

|

|

|

|

|

|

|

|

|

GAAP net income (loss) per share - diluted

|

|

$ |

(0.65 |

) |

|

$ |

0.55 |

|

| |

|

|

|

|

|

|

|

|

|

Non-GAAP income per share - diluted (l)

|

|

$ |

0.00 |

|

|

$ |

1.04 |

|

| |

|

|

|

|

|

|

|

|

Management believes the presentation of these non-GAAP financial measures, when taken together with the corresponding GAAP financial measures, provides meaningful supplemental information regarding the Company’s operating performance. Our management uses these non-GAAP financial measures in assessing the Company's operating results, as well as when planning, forecasting and analyzing future periods and these non-GAAP measures allow investors to evaluate the Company’s financial performance using some of the same measures as management. Management views share-based compensation as an expense that is unrelated to the Company’s operational performance as it does not require cash payments and can vary in amount from period to period and the elimination of amortization charges provides better comparability of pre- and post-acquisition operating results and to results of businesses utilizing internally developed intangible assets. Management initiated certain restructuring and manufacturing transition activities including employee headcount reductions and other organizational changes to align our business strategies in light of the acquisitions of MCT and EQT. Restructuring and manufacturing transition costs have been excluded because such expense is not used by Management to assess the core profitability of Cohu’s business operations. Impairment charges have been excluded as these amounts are infrequent and are unrelated to the operational performance of Cohu. PP&E and inventory step-up costs have been excluded by management as they are unrelated to the core operating activities of the Company. Acquisition costs have been excluded by management as they are unrelated to the core operating activities of the Company and the frequency and variability in the nature of the charges can vary significantly from period to period. Excluding this data provides investors with a basis to compare Cohu’s performance against the performance of other companies without this variability. However, the non-GAAP financial measures should not be regarded as a replacement for (or superior to) corresponding, similarly captioned, GAAP measures. The presentation of non-GAAP financial measures above may not be comparable to similarly titled measures reported by other companies and investors should be careful when comparing our non-GAAP financial measures to those of other companies.

| |

(a)

|

(16.1)% and 10.2% of net sales, respectively.

|

| |

(b)

|

To eliminate compensation expense for employee stock options, stock units and our employee stock purchase plan.

|

| |

(c)

|

To eliminate the amortization of acquired intangible assets.

|

| |

(d)

|

To eliminate restructuring costs incurred related to the integration of MCT.

|

| |

(e)

|

To eliminate the manufacturing transition and severance costs.

|

| |

(f)

|

To eliminate the impairment of the Company’s investment in Fraes-und Technologiezentrum GmbH Frasdorf.

|

| |

(g)

|

To eliminate amortization of inventory step up charges related to acquisitions.

|

| |

(h)

|

To eliminate professional fees and other direct incremental expenses incurred related to acquisitions.

|

| |

(i)

|

To eliminate the property, plant & equipment step-up depreciation accelerated related to the acquisition of MCT and EQT.

|

| |

(j)

|

(0.2)% and 18.4% of net sales, respectively.

|

| |

(k)

|

To adjust the provision for income taxes related to the adjustments described above based on applicable tax rates.

|

| |

(l)

|

The six months ended June 29, 2024 was computed using 47,390 shares outstanding as the effect of dilutive securities was excluded from GAAP diluted common shares due to the reported net loss under GAAP, but are included for non-GAAP diluted common shares since the Company has non-GAAP net income. The six months ended July 1, 2023 was calculated using the number of GAAP diluted shares outstanding.

|

COHU, INC.

Supplemental Reconciliation of GAAP Results to Non-GAAP Financial Measures (Unaudited)

(in thousands)

| |

|

Three Months Ended

|

|

| |

|

June 29,

|

|

|

March 30,

|

|

|

July 1,

|

|

| |

|

2024

|

|

|

2024

|

|

|

2023

|

|

|

Gross Profit Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit - GAAP basis (excluding amortization) (1)

|

|

$ |

46,922 |

|

|

$ |

49,249 |

|

|

$ |

80,345 |

|

| Non-GAAP adjustments to cost of sales (as scheduled above) |

|

|

252 |

|

|

|

223 |

|

|

|

352 |

|

|

Gross profit - Non-GAAP basis

|

|

$ |

47,174 |

|

|

$ |

49,472 |

|

|

$ |

80,697 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

As a percentage of net sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP gross profit |

|

|

44.8 |

% |

|

|

45.8 |

% |

|

|

47.6 |

% |

| Non-GAAP gross profit |

|

|

45.1 |

% |

|

|

46.0 |

% |

|

|

47.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income - GAAP Basis

|

|

$ |

(15,769 |

) |

|

$ |

(14,635 |

) |

|

$ |

10,584 |

|

| Income tax provision (benefit) |

|

|

1,286 |

|

|

|

(1,700 |

) |

|

|

6,435 |

|

| Interest expense |

|

|

144 |

|

|

|

289 |

|

|

|

727 |

|

| Interest income |

|

|

(2,333 |

) |

|

|

(2,709 |

) |

|

|

(2,732 |

) |

| Amortization of purchased intangible assets |

|

|

9,748 |

|

|

|

9,795 |

|

|

|

9,006 |

|

| Depreciation |

|

|

3,413 |

|

|

|

3,429 |

|

|

|

3,361 |

|

| Amortization of cloud-based software implementation costs (2) |

|

|

709 |

|

|

|

709 |

|

|

|

700 |

|

| Loss on extinguishment of debt |

|

|

- |

|

|

|

241 |

|

|

|

- |

|

| Other non-GAAP adjustments (as scheduled above) |

|

|

6,827 |

|

|

|

7,427 |

|

|

|

5,312 |

|

|

Adjusted EBITDA

|

|

$ |

4,025 |

|

|

$ |

2,846 |

|

|

$ |

33,393 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

As a percentage of net sales:

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income - GAAP Basis |

|

|

(15.1 |

)% |

|

|

(13.6 |

)% |

|

|

6.3 |

% |

| Adjusted EBITDA |

|

|

3.8 |

% |

|

|

2.6 |

% |

|

|

19.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expense Reconciliation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expense - GAAP basis

|

|

$ |

63,221 |

|

|

$ |

67,222 |

|

|

$ |

64,686 |

|

| Non-GAAP adjustments to operating expenses (as scheduled above) |

|

|

(16,335 |

) |

|

|

(17,011 |

) |

|

|

(13,980 |

) |

|

Operating Expenses - Non-GAAP basis

|

|

$ |

46,886 |

|

|

$ |

50,211 |

|

|

$ |

50,706 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Excludes amortization of $7,486, $7,522 and $7,102 for the three months ending June 29, 2024, March 30, 2024 and July 01, 2023, respectively.

|

|

(2)

|

Represents amortization of capitalized implementation costs related to cloud-based software arrangements that are included within SG&A.

|

| |

|

Six Months Ended

|

|

| |

|

June 29,

|

|

|

July 1,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Gross Profit Reconciliation

|

|

|

|

|

|

|

|

|

|

Gross profit - GAAP basis (excluding amortization) (1)

|

|

$ |

96,171 |

|

|

$ |

166,563 |

|

|

Non-GAAP adjustments to cost of sales (as scheduled above)

|

|

|

475 |

|

|

|

646 |

|

|

Gross profit - Non-GAAP basis

|

|

$ |

96,646 |

|

|

$ |

167,209 |

|

| |

|

|

|

|

|

|

|

|

|

As a percentage of net sales:

|

|

|

|

|

|

|

|

|

|

GAAP gross profit

|

|

|

45.3 |

% |

|

|

47.8 |

% |

|

Non-GAAP gross profit

|

|

|

45.5 |

% |

|

|

48.0 |

% |

| |

|

|

|

|

|

|

|

|

|

Adjusted EBITDA Reconciliation

|

|

|

|

|

|

|

|

|

|

Net income (loss) - GAAP Basis

|

|

$ |

(30,404 |

) |

|

$ |

26,269 |

|

|

Income tax provision

|

|

|

(414 |

) |

|

|

11,408 |

|

|

Interest expense

|

|

|

433 |

|

|

|

1,855 |

|

|

Interest income

|

|

|

(5,042 |

) |

|

|

(5,450 |

) |

|

Amortization of purchased intangible assets

|

|

|

19,543 |

|

|

|

17,760 |

|

|

Depreciation

|

|

|

6,842 |

|

|

|

6,698 |

|

|

Amortization of cloud-based software implementation costs (2)

|

|

|

1,418 |

|

|

|

1,400 |

|

|

Loss on extinguishment of debt

|

|

|

241 |

|

|

|

369 |

|

|

Other non-GAAP adjustments (as scheduled above)

|

|

|

14,254 |

|

|

|

10,866 |

|

|

Adjusted EBITDA

|

|

$ |

6,871 |

|

|

$ |

71,175 |

|

| |

|

|

|

|

|

|

|

|

|

As a percentage of net sales:

|

|

|

|

|

|

|

|

|

|

Net income (loss) - GAAP Basis

|

|

|

-14.3 |

% |

|

|

7.5 |

% |

|

Adjusted EBITDA

|

|

|

3.2 |

% |

|

|

20.4 |

% |

| |

|

|

|

|

|

|

|

|

|

Operating Expense Reconciliation

|

|

|

|

|

|

|

|

|

|

Operating Expense - GAAP basis

|

|

$ |

130,443 |

|

|

$ |

131,027 |

|

|

Non-GAAP adjustments to operating expenses (as scheduled above)

|

|

|

(33,346 |

) |

|

|

(28,003 |

) |

|

Operating Expenses - Non-GAAP basis

|

|

$ |

97,097 |

|

|

$ |

103,024 |

|

| |

|

|

|

|

|

|

|

|

|

(1)

|

Excludes amortization of $15,008 and $13,993 for the six months ending June 29, 2024 and July 01, 2023, respectively.

|

|

(2)

|

Represents amortization of capitalized implementation costs related to cloud-based software arrangements that are included within SG&A.

|

v3.24.2

Document And Entity Information

|

Jul. 31, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Cohu, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jul. 31, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-04298

|

| Entity, Tax Identification Number |

95-1934119

|

| Entity, Address, Address Line One |

12367 Crosthwaite Circle

|

| Entity, Address, City or Town |

Poway

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

92064

|

| City Area Code |

858

|

| Local Phone Number |

848-8100

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

COHU

|

| Security Exchange Name |

NASDAQ

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000021535

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

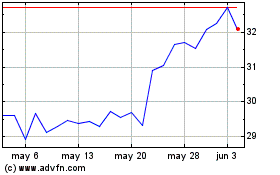

Cohu (NASDAQ:COHU)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Cohu (NASDAQ:COHU)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024