UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended: June 30, 2023

or

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ________________

to ________________

Commission file number: 000-12536

SMART POWERR CORP.

(Exact name of registrant as specified in its charter)

| Nevada | | 90-0093373 |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer Identification No.) |

4/F, Tower C

Rong Cheng Yun Gu Building Keji 3rd Road, Yanta

District

Xi An City, Shaan Xi Province

China 710075

(Address of principal executive offices)

(011) 86-29-8765-1098

(Registrant’s telephone number, including

area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | CREG | | Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter

period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒

No ☐

Indicate by check mark whether the

registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☒ |

| | | Emerging Growth Company | ☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as

defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of August 11, 2023, there were

7,788,006 shares of the registrant’s common stock outstanding.

SMART POWERR CORP.

FORM 10-Q

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

SMART POWERR CORP

CONSOLIDATED BALANCE SHEETS

| | |

JUNE 30,

2023 | | |

DECEMBER 31,

2022 | |

| | |

(UNAUDITED) | | |

| |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS | |

| | |

| |

| Cash | |

$ | 456,155 | | |

$ | 138,813,673 | |

| VAT receivable | |

| 167,314 | | |

| 173,589 | |

| Advance to supplier | |

| 66,111,614 | | |

| 31,923 | |

| Operating lease right-of-use assets, net | |

| 30,334 | | |

| 62,177 | |

| Short term loan receivables | |

| 67,120,596 | | |

| - | |

| Other receivables | |

| 53,872 | | |

| 49,690 | |

| | |

| | | |

| | |

| Total current assets | |

| 133,939,885 | | |

| 139,131,052 | |

| | |

| | | |

| | |

| NON-CURRENT ASSET | |

| | | |

| | |

| Fixed assets, net | |

| 4,484 | | |

| 4,653 | |

| | |

| | | |

| | |

| Total non-current assets | |

| 4,484 | | |

| 4,653 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 133,944,369 | | |

$ | 139,135,705 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable | |

$ | 68,695 | | |

$ | 71,271 | |

| Taxes payable | |

| 3,724,312 | | |

| 3,681,352 | |

| Accrued interest on notes | |

| 59,188 | | |

| 261,035 | |

| Notes payable, net of unamortized OID of $0 and $31,250, respectively | |

| 5,400,906 | | |

| 5,697,727 | |

| Accrued liabilities and other payables | |

| 2,587,975 | | |

| 2,776,414 | |

| Operating lease liability | |

| 30,334 | | |

| 62,178 | |

| Payable for purchase of 10% equity interest of Zhonghong | |

| 415,179 | | |

| 430,750 | |

| Interest payable on entrusted loans | |

| 334,697 | | |

| 347,249 | |

| Entrusted loan payable | |

| 10,656,260 | | |

| 11,055,911 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 23,277,546 | | |

| 24,383,887 | |

| | |

| | | |

| | |

| NONCURRENT LIABILITY | |

| | | |

| | |

| Income tax payable | |

| 3,958,625 | | |

| 3,958,625 | |

| | |

| | | |

| | |

| Total noncurrent liability | |

| 3,958,625 | | |

| 3,958,625 | |

| | |

| | | |

| | |

| Total liabilities | |

| 27,236,171 | | |

| 28,342,512 | |

| | |

| | | |

| | |

| CONTINGENCIES AND COMMITMENTS | |

| | | |

| | |

| | |

| | | |

| | |

| STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Common stock, $0.001 par value; 100,000,000 shares authorized, 7,788,006 and 7,391,996 shares issued and outstanding | |

| 7,788 | | |

| 7,392 | |

| Additional paid in capital | |

| 164,407,308 | | |

| 163,663,305 | |

| Statutory reserve | |

| 15,185,889 | | |

| 15,168,003 | |

| Accumulated other comprehensive loss | |

| (12,810,612 | ) | |

| (8,318,564 | ) |

| Accumulated deficit | |

| (60,082,175 | ) | |

| (59,726,943 | ) |

| | |

| | | |

| | |

| Total Company stockholders’ equity | |

| 106,708,198 | | |

| 110,793,193 | |

| TOTAL LIABILITIES AND EQUITY | |

$ | 133,944,369 | | |

$ | 139,135,705 | |

The accompanying notes are an integral part of

these consolidated financial statements

SMART POWERR CORP

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE

INCOME

(UNAUDITED)

| | |

SIX MONTHS ENDED

JUNE 30, | | |

THREE MONTHS ENDED

JUNE 30, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| | |

| | |

| | |

| | |

| |

| Revenue | |

| | |

| | |

| | |

| |

| Contingent rental income | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest income on sales-type leases | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating income | |

| - | | |

| - | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | | |

| | |

| General and administrative | |

| 459,235 | | |

| 383,506 | | |

| 374,407 | | |

| 187,726 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total operating expenses | |

| 459,235 | | |

| 383,506 | | |

| 374,407 | | |

| 187,726 | |

| | |

| | | |

| | | |

| | | |

| | |

| Loss from operations | |

| (459,235 | ) | |

| (383,506 | ) | |

| (374,407 | ) | |

| (187,726 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Non-operating income (expenses) | |

| | | |

| | | |

| | | |

| | |

| Gain (loss) on note conversion | |

| 5,602 | | |

| (121,121 | ) | |

| (4,880 | ) | |

| - | |

| Interest income | |

| 170,441 | | |

| 223,915 | | |

| 82,246 | | |

| 109,585 | |

| Interest expense | |

| (220,280 | ) | |

| (230,318 | ) | |

| (109,176 | ) | |

| (109,742 | ) |

| Other income (expenses), net | |

| 228,618 | | |

| (131,682 | ) | |

| 216,333 | | |

| (31,077 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total non-operating income (expenses), net | |

| 184,381 | | |

| (259,206 | ) | |

| 184,523 | | |

| (31,234 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Loss before income tax | |

| (274,854 | ) | |

| (642,712 | ) | |

| (189,884 | ) | |

| (218,960 | ) |

| Income tax expense | |

| 62,492 | | |

| 23,557 | | |

| 57,958 | | |

| 5,850 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net loss | |

| (337,346 | ) | |

| (666,269 | ) | |

| (247,842 | ) | |

| (224,810 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Other comprehensive items | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation loss | |

| (4,492,048 | ) | |

| (6,930,315 | ) | |

| (6,173,768 | ) | |

| (7,530,496 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Comprehensive loss | |

$ | (4,829,394 | ) | |

$ | (7,596,584 | ) | |

$ | (6,421,610 | ) | |

$ | (7,755,306 | ) |

| | |

| | | |

| | | |

| | | |

| | |

Weighted average shares used for computing basic and diluted loss per share | |

| 7,643,072 | | |

| 7,301,194 | | |

| 7,803,991 | | |

| 7,277,194 | |

| | |

| | | |

| | | |

| | | |

| | |

Basic and diluted net loss per share | |

$ | (0.04 | ) | |

$ | (0.09 | ) | |

$ | (0.03 | ) | |

$ | (0.03 | ) |

The accompanying notes are an integral part of

these consolidated financial statements

SMART POWERR CORP

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’

EQUITY

SIX MONTHS ENDED JUNE 30, 2023 AND 2022

(UNAUDITED)

| | |

Common Stock | | |

Paid in | | |

Statutory | | |

Other

Comprehensive | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Reserves | | |

Loss | | |

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at December 31, 2022 | |

| 7,391,996 | | |

$ | 7,392 | | |

$ | 163,663,305 | | |

$ | 15,168,003 | | |

$ | (8,318,564 | ) | |

$ | (59,726,943 | ) | |

$ | 110,793,193 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (89,504 | ) | |

| (89,504 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of long-term notes into common shares | |

| 241,537 | | |

| 242 | | |

| 489,276 | | |

| - | | |

| - | | |

| - | | |

| 489,518 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Transfer to statutory reserves | |

| - | | |

| - | | |

| - | | |

| 2,590 | | |

| - | | |

| (2,590 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation gain | |

| - | | |

| - | | |

| - | | |

| - | | |

| 1,681,720 | | |

| - | | |

| 1,681,720 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at March 31, 2023 | |

| 7,633,533 | | |

| 7,634 | | |

| 164,152,581 | | |

| 15,170,593 | | |

| (6,636,844 | ) | |

| (59,819,037 | ) | |

| 112,874,927 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (247,842 | ) | |

| (247,842 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of long-term notes into common shares | |

| 154,473 | | |

| 154 | | |

| 254,727 | | |

| - | | |

| - | | |

| - | | |

| 254,881 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Transfer to statutory reserves | |

| - | | |

| - | | |

| - | | |

| 15,296 | | |

| - | | |

| (15,296 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (6,173,768 | ) | |

| - | | |

| (6,173,768 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2023 | |

| 7,788,006 | | |

$ | 7,788 | | |

$ | 164,407,308 | | |

$ | 15,185,889 | | |

$ | (12,810,612 | ) | |

$ | (60,082,175 | ) | |

$ | 106,708,198 | |

| | |

Common Stock | | |

Paid in | | |

Statutory | | |

Other

Comprehensive

(Loss) | | |

Accumulated | | |

| |

| | |

Shares | | |

Amount | | |

Capital | | |

Reserves | | |

/ Income | | |

Deficit | | |

Total | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| |

| Balance at December 31, 2021 | |

| 7,044,408 | | |

$ | 7,044 | | |

$ | 161,531,565 | | |

$ | 15,180,067 | | |

$ | 3,321,189.0 | | |

$ | (55,281,680 | ) | |

$ | 124,758,185 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (441,459 | ) | |

| (441,459 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Conversion of long-term notes into common shares | |

| 313,644 | | |

| 314 | | |

| 2,017,793 | | |

| - | | |

| - | | |

| - | | |

| 2,018,107 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Transfer to statutory reserves | |

| - | | |

| - | | |

| - | | |

| (22,277 | ) | |

| - | | |

| 22,277 | | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation gain | |

| - | | |

| - | | |

| - | | |

| - | | |

| 600,181 | | |

| - | | |

| 600,181 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at March 31, 2022 | |

| 7,358,052 | | |

| 7,358 | | |

| 163,549,358 | | |

| 15,157,790 | | |

| 3,921,370 | | |

| (55,700,862 | ) | |

| 126,935,014 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net loss for the period | |

| - | | |

| - | | |

| - | | |

| - | | |

| - | | |

| (224,810 | ) | |

| (224,810 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Transfer to statutory reserves | |

| - | | |

| - | | |

| - | | |

| 4,443 | | |

| - | | |

| (4,443 | ) | |

| - | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Foreign currency translation loss | |

| - | | |

| - | | |

| - | | |

| - | | |

| (7,530,496 | ) | |

| - | | |

| (7,530,496 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Balance at June 30, 2022 | |

| 7,358,052 | | |

$ | 7,358 | | |

$ | 163,549,358 | | |

$ | 15,162,233 | | |

$ | (3,609,126 | ) | |

$ | (55,930,115 | ) | |

$ | 119,179,708 | |

The accompanying notes are an integral part of

these consolidated financial statements

SMART POWERR CORP

CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

| | |

SIX MONTHS ENDED

JUNE 30, | |

| | |

2023 | | |

2022 | |

| | |

| | |

| |

| CASH FLOWS FROM OPERATING ACTIVITIES: | |

| | |

| |

| Net loss | |

$ | (337,346 | ) | |

$ | (666,269 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Amortization of OID and debt issuing costs of notes | |

| 31,250 | | |

| 131,855 | |

| Operating lease expenses | |

| 31,637 | | |

| 33,812 | |

| Loss (gain) on note conversion | |

| (5,602 | ) | |

| 121,121 | |

| Changes in assets and liabilities: | |

| | | |

| | |

| Advance to supplier | |

| (68,898,980 | ) | |

| - | |

| Other receivables | |

| (4,290 | ) | |

| 1,689 | |

| Taxes payable | |

| 46,034 | | |

| (27,748 | ) |

| Payment of lease liability | |

| (31,637 | ) | |

| (33,812 | ) |

| Accrued liabilities and other payables | |

| 126,642 | | |

| 271,753 | |

| | |

| | | |

| | |

| Net cash used in operating activities | |

| (69,042,292 | ) | |

| (167,599 | ) |

| | |

| | | |

| | |

| CASH FLOWS FROM INVESTING ACTIVITY: | |

| | | |

| | |

| Short term loan receivable | |

| (69,994,412 | ) | |

| - | |

| | |

| | | |

| | |

| Net cash used in investing activity | |

| (69,994,412 | ) | |

| - | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| EFFECT OF EXCHANGE RATE CHANGE ON CASH | |

| 679,186 | | |

| (7,598,080 | ) |

| | |

| | | |

| | |

| NET DECREASE IN CASH | |

| (138,357,518 | ) | |

| (7,765,679 | ) |

| CASH, BEGINNING OF PERIOD | |

| 138,813,673 | | |

| 152,011,887 | |

| | |

| | | |

| | |

| CASH, END OF PERIOD | |

$ | 456,155 | | |

$ | 144,246,208 | |

| | |

| | | |

| | |

| Supplemental cash flow data: | |

| | | |

| | |

| Income tax paid | |

$ | 37,279 | | |

$ | 51,356 | |

| Interest paid | |

$ | - | | |

$ | - | |

| | |

| | | |

| | |

| Supplemental disclosure of non-cash financing activities | |

| | | |

| | |

| Conversion of notes into common shares | |

$ | 750,000 | | |

$ | 1,896,986 | |

The accompanying notes are an integral part of

these consolidated financial statements

SMART POWERR CORP. AND SUBSIDIARIES

NOTES TO CONSOLIDATED

FINANCIAL STATEMENTS

JUNE 30, 2023 (UNAUDITED)

AND DECEMBER 31, 2022

1. ORGANIZATION AND DESCRIPTION

OF BUSINESS

Smart Powerr Corp. (the “Company”

or “SPC”) was incorporated in Nevada, and was formerly known as China Recycling Entergy Corporation. The Company, through

its subsidiaries, provides energy saving solutions and services, including selling and leasing energy saving systems and equipment to

customers, and project investment in the Peoples Republic of China (“PRC”).

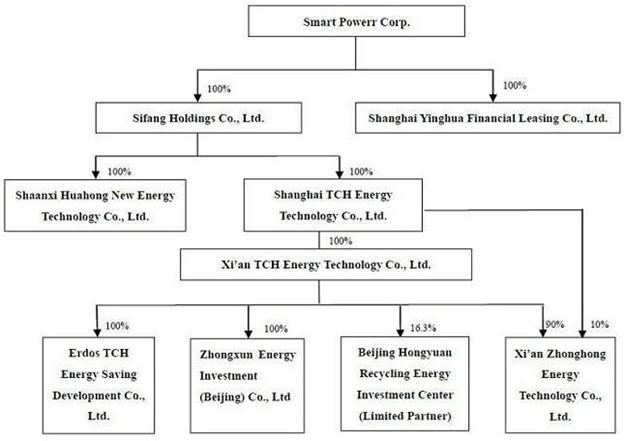

The Company’s

organizational chart as of June 30, 2023 is as follows:

Erdos

TCH – Joint Venture

On April 14, 2009, the Company

formed a joint venture (the “JV”) with Erdos Metallurgy Co., Ltd. (“Erdos”) to recycle waste heat from Erdos’

metal refining plants to generate power and steam to be sold back to Erdos. The name of the JV was Inner Mongolia Erdos TCH Energy Saving

Development Co., Ltd. (“Erdos TCH”) with a term of 20 years. Erdos contributed 7% of the total investment of

the project, and Xi’an TCH Energy Technology Co., Ltd. (“Xi’an TCH”) contributed 93%. On June 15, 2013, Xi’an

TCH and Erdos entered into a share transfer agreement, pursuant to which Erdos sold its 7% ownership interest in the JV to Xi’an

TCH for $1.29 million (RMB 8 million), plus certain accumulated profits. Xi’an TCH paid the $1.29 million in

July 2013 and, as a result, became the sole stockholder of the JV. Erdos TCH currently has two power generation systems in Phase I with

a total 18 MW power capacity, and three power generation systems in Phase II with a total 27 MW power capacity. On April 28, 2016, Erdos

TCH and Erdos entered into a supplemental agreement, effective May 1, 2016, whereby Erdos TCH cancelled monthly minimum lease payments

from Erdos, and started to charge Erdos based on actual electricity sold at RMB 0.30 / KWH. The selling price of each KWH is

determined annually based on prevailing market conditions. In May 2019, Erdos TCH ceased operations due to renovations and furnace safety

upgrades of Erdos, and the Company initially expected the resumption of operations in July 2020, but the resumption of operations was

further delayed due to the government’s mandate for Erdos to significantly lower its energy consumption per unit of GDP by implementing

a comprehensive technical upgrade of its ferrosilicon production line to meet the City’s energy-saving targets. Erdos

is currently researching the technical rectification scheme. Once the scheme is determined, Erdos TCH will carry out technical transformation

for its waste heat power station project. During this period, Erdos will compensate Erdos TCH RMB 1 million ($145,524)

per month, until operations resume. The Company has not recognized any income due to the uncertainty of collection. In addition,

Erdos TCH has 30% ownership in DaTangShiDai (BinZhou) Energy Savings Technology Co., Ltd. (“BinZhou Energy Savings”), 30%

ownership in DaTangShiDai DaTong Recycling Energy Technology Co., Ltd. (“DaTong Recycling Energy”), and 40% ownership

in DaTang ShiDai TianYu XuZhou Recycling Energy Technology Co, Ltd. (“TianYu XuZhou Recycling Energy”). These companies were

incorporated in 2012 but had no operations since then nor has any registered capital contribution been made.

Chengli Waste Heat Power Generation

Projects

On July 19, 2013, Xi’an

TCH formed a new company, “Xi’an Zhonghong New Energy Technology Co., Ltd.” (“Zhonghong”), of which it owns 90%,

with HYREF owning the other 10%. Zhonghong provides energy saving solution and services, including constructing, selling and

leasing energy saving systems and equipment to customers. On December 29, 2018, Shanghai TCH entered into a Share Transfer Agreement with

HYREF, pursuant to which HYREF transferred its 10% ownership in Zhonghong to Shanghai TCH for RMB 3 million ($0.44 million).

The transfer was completed January 22, 2019. The Company owns 100% of Xi’an Zhonghong after the transaction.

On July 24, 2013, Zhonghong entered

into a Cooperative Agreement of CDQ and CDQ WHPG Project (Coke Dry Quenching Waste Heat Power Generation Project) with Boxing County Chengli

Gas Supply Co., Ltd. (“Chengli”). The parties entered into a supplement agreement on July 26, 2013. Pursuant to these agreements,

Zhonghong will design, build and maintain a 25 MW CDQ system and a CDQ WHPG system to supply power to Chengli, and Chengli will pay energy

saving fees (the “Chengli Project”).

On December 29, 2018, Xi’an

Zhonghong, Xi’an TCH, HYREF, Guohua Ku, and Mr. Chonggong Bai entered into a CDQ WHPG Station Fixed Assets Transfer Agreement, pursuant

to which Xi’an Zhonghong transferred Chengli CDQ WHPG station (‘the Station”) as the repayment for the loan of RMB 188,639,400 ($27.54 million)

to HYREF. Xi’an Zhonghong, Xi’an TCH, Guohua Ku and Chonggong Bai also agreed to a Buy Back Agreement for the Station when

certain conditions are met (see Note 10). The transfer of the Station was completed January 22, 2019, when the Company recorded a $624,133 loss

from this transfer. However, because the loan was not deemed repaid due to the buyback provision (See Note 10 for detail), the Company

kept the loan and the Chengli project in its consolidated financial statements (“CFS”) until April 9, 2021.

The Buy Back Agreement was terminated April 9, 2021, HYREF did not execute the buy-back option and did not ask for any additional

payment from the buyers other than keeping the CDQ WHPG station.

Formation of Zhongxun

On March 24, 2014, Xi’an

TCH incorporated a subsidiary, Zhongxun Energy Investment (Beijing) Co., Ltd. (“Zhongxun”) with registered capital of $5,695,502 (RMB 35,000,000),

which must be contributed before October 1, 2028. Zhongxun is 100% owned by Xi’an TCH and will be mainly engaged in project

investment, investment management, economic information consulting, and technical services. Zhongxun has not commenced operations nor

has any capital contribution been made as of the date of this report.

Formation

of Yinghua

On February 11, 2015, the Company

incorporated a subsidiary, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) with registered capital of $30,000,000,

to be paid within 10 years from the date the business license is issued. Yinghua is 100% owned by the Company and will

be mainly engaged in financial leasing, purchase of financial leasing assets, disposal and repair of financial leasing assets, consulting

and ensuring of financial leasing transactions, and related factoring business. Yinghua has not commenced operations nor has any capital

contribution been made as of the date of this report.

Other Events

In December 2019, a novel strain

of coronavirus (COVID-19) was reported, and the World Health Organization declared the outbreak to constitute a “Public Health Emergency

of International Concern.” This contagious disease outbreak, which continues to spread to additional countries, and disrupts supply

chains and affecting production and sales across a range of industries as a result of quarantines, facility closures, and travel and logistics

restrictions in connection with the outbreak. The COVID-19 outbreak impacted the Company’s operations for the first quarter of 2020.

However, as a result of PRC government’s effort on disease control, most cities in China were reopened in April 2020, the outbreak

in China is under the control. From April 2020 to the end of 2021, there were some new COVID-19 cases discovered in a few provinces of

China, however, the number of new cases are not significant due to PRC government’s strict control. In 2022, COVID-19 cases fluctuated

and increased in many cities of China including Xi’an Province where the Company is located; as a result of such increases, there

have been periodic short-term lockdowns and restrictions on travel in Xi’an Province and other areas of China, the Company’s

operations have been adversely impacted by the travel and work restrictions imposed on a temporary basis in China to limit the spread

of COVID-19. In January 2023, China dropped all COVID restrictions, and the Company actively resumed its business transformation task

to transform and expand into an energy storage integrated solution provider sector.

On July 27, 2021, the Company

filed a certificate of change to the Company’s Articles of Incorporation with the Secretary of State of the State of Nevada to increase

the total number of the Company’s authorized shares of common stock from 10,000,000 to 100,000,000, par value $0.001 per

share.

On March 3, 2022, the Company

filed with the Secretary of State of the State of Nevada a Certificate of Amendment to the Company’s Amended and Restated Certificate

of Incorporation to change our corporate name from China Recycling Energy Corporation to Smart Powerr Corp, effective March 3, 2022.

2. SUMMARY OF SIGNIFICANT

ACCOUNTING POLICIES

Basis of Presentation

The accompanying unaudited financial

information as of and for the six and three months ended June 30, 2023 and 2022 was prepared in accordance with accounting principles

generally accepted in the U.S. (“US GAAP”) for interim financial information and with the instructions to Quarterly Report

on Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, such financial information includes all adjustments (consisting

only of normal recurring adjustments, unless otherwise indicated) considered necessary for a fair presentation of our financial position

at such date and the operating results and cash flows for such periods. Operating results for the six months ended June 30, 2023 are not

necessarily indicative of the results that may be expected for the entire year or for any other subsequent interim period. The interim

consolidated financial information should be read in conjunction with the Financial Statements and the notes thereto, included in the

Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, previously filed with the Securities Exchange

Commission (“SEC”) on May 8, 2023.

Principle of

Consolidation

The Consolidated Financial Statements (“CFS”)

include the accounts of SPC and its subsidiaries, Shanghai Yinghua Financial Leasing Co., Ltd. (“Yinghua”) and Sifang

Holdings; Sifang Holdings’ wholly owned subsidiaries, Huahong New Energy Technology Co., Ltd. (“Huahong”) and Shanghai

TCH Energy Tech Co., Ltd. (“Shanghai TCH”); Shanghai TCH’s wholly-owned subsidiary, Xi’an TCH Energy Tech Co.,

Ltd. (“Xi’an TCH”); and Xi’an TCH’s subsidiaries, 1) Erdos TCH Energy Saving Development Co., Ltd (“Erdos

TCH”), 100% owned by Xi’an TCH, 2) Zhonghong, 90% owned by Xi’an TCH and 10% owned by Shanghai TCH, and 3) Zhongxun,

100% owned by Xi’an TCH. Substantially all the Company’s revenues are derived from the operations of Shanghai TCH and its

subsidiaries, which represent substantially all the Company’s consolidated assets and liabilities as of June 30, 2023. However,

there was no revenue for the Company for the six and three months ended June 30, 2023 or 2022. All significant inter-company accounts

and transactions were eliminated in consolidation.

Uses and Sources of Liquidity

For the six months ended June

30, 2023 and 2022, the Company had a net loss of $337,346 and $666,269, respectively. For the three months ended June 30, 2023 and

2022, the Company had a net loss of $247,842 and $224,810, respectively. The Company had an accumulated deficit of $60.08 million

as of June 30, 2023. The Company disposed all of its systems and currently holds five power generating systems through Erdos TCH, the

five power generating systems are currently not producing any electricity. The Company is in the process of transforming and expanding

into an energy storage integrated solution provider business. The Company plans to pursue disciplined and targeted expansion strategies

for market areas the Company currently does not serve. The Company actively seeks and explores opportunities to apply energy storage technologies

to new industries or segments with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV)

and wind power stations, remote islands without electricity, and smart energy cities with multi-energy supplies. The Company’s

cash flow forecast indicates it will have sufficient cash to fund its operations for the next 12 months from the date of issuance of these

CFS.

Use of Estimates

In preparing these CFS in accordance

with US GAAP, management makes estimates and assumptions that affect the reported amounts of assets and liabilities in the balance sheets

as well as revenues and expenses during the period reported. Actual results may differ from these estimates. On an on-going basis,

management evaluates its estimates, including those allowances for bad debt, impairment loss on fixed assets

and construction in progress, income taxes, and contingencies and litigation. Management bases its estimates on historical experience

and on various other assumptions that are believed to be reasonable under the circumstances, the results of which form the basis for making

judgments about the carrying values of assets and liabilities that are not readily apparent from other resources.

Revenue Recognition

A) Sales-type

Leasing and Related Revenue Recognition

The Company follows Financial

Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 842. The Company’s sales

type lease contracts for revenue recognition fall under ASC 842. During the six and three months ended June 30, 2023 and 2022, the Company

did not sell any new power generating projects.

The Company constructs and leases

waste energy recycling power generating projects to its customers. The Company typically transfers legal ownership of the waste energy

recycling power generating projects to its customers at the end of the lease.

The Company finances construction

of waste energy recycling power generating projects. The sales and cost of sales are recognized at the inception of the lease, which is

when control is transferred to the lessee. The Company accounts for the transfer of control as a sales type lease in accordance with ASC

842-10-25-2. The underlying asset is derecognized, and revenue is recorded when collection of payments is probable. This is in accordance

with the revenue recognition principle in ASC 606 - Revenue from contracts with customers. The investment in sales-type leases consists

of the sum of the minimum lease payments receivable less unearned interest income and estimated executory cost. Minimum lease payments

are part of the lease agreement between the Company (as the lessor) and the customer (as the lessee). The discount rate implicit in the

lease is used to calculate the present value of minimum lease payments. The minimum lease payments consist of the gross lease payments

net of executory costs and contingent rentals, if any. Unearned interest is amortized to income over the lease term to produce a constant

periodic rate of return on net investment in the lease. While revenue is recognized at the inception of the lease, the cash flow from

the sales-type lease occurs over the course of the lease, which results in interest income and reduction of receivables. Revenue is recognized

net of value-added tax.

B) Contingent

Rental Income

The Company records income from

actual electricity generated of each project in the period the income is earned, which is when the electricity is generated. Contingent

rent is not part of minimum lease payments.

Operating Leases

The Company determines if an

arrangement is a lease or contains a lease at inception. Operating lease liabilities are recognized based on the present value of the

remaining lease payments, discounted using the discount rate for the lease at the commencement date. As the rate implicit in the lease

is not readily determinable for an operating lease, the Company generally uses an incremental borrowing rate based on information available

at the commencement date to determine the present value of future lease payments. Operating lease right-of-use (“ROU assets”)

assets represent the Company’s right to control the use of an identified asset for the lease term and lease liabilities represent

the Company’s obligation to make lease payments arising from the lease. ROU assets are generally recognized based on the amount

of the initial measurement of the lease liability. Lease expense is recognized on a straight-line basis over the lease term.

ROU assets are reviewed for impairment

when indicators of impairment are present. ROU assets from operating and finance leases are subject to the impairment guidance in ASC

360, Property, Plant, and Equipment, as ROU assets are long-lived nonfinancial assets.

ROU assets are tested for impairment

individually or as part of an asset group if the cash flows related to the ROU asset are not independent from the cash flows of other

assets and liabilities. An asset group is the unit of accounting for long-lived assets to be held and used, which represents the lowest

level for which identifiable cash flows are largely independent of the cash flows of other groups of assets and liabilities. The Company

recognized no impairment of ROU assets as of June 30, 2023 or December 31, 2022.

Operating leases are included

in operating lease ROU and operating lease liabilities (current and non-current), on the consolidated balance sheets.

Cash

Cash includes cash on hand, demand

deposits placed with banks or other financial institutions and all highly liquid investments with an original maturity of three months

or less as of the purchase date.

Accounts Receivable

The Company’s policy is

to maintain an allowance for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable

and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer

payment patterns to evaluate the adequacy of these reserves. As of June 30, 2023 and December 31, 2022, the Company had no accounts

receivable.

Advance to suppliers

Advance to suppliers consist of balances paid to suppliers for materials

that have not been received. The Company reviews its advances to suppliers on a periodic basis and makes general and specific allowances

when there is doubt as to the ability of a supplier to provide supplies to the Company or refund an advance.

Short term loan receivables

The Company provided loans to certain third parties for the purpose of

making use of its cash.

The Company monitors all loans receivable for delinquency and provides

for estimated losses for specific receivables that are not likely to be collected. Management periodically assesses the collectability

of these loans receivable. Delinquent account balances are written-off against the allowance for doubtful accounts after management has

determined that the likelihood of collection is not probable. As of June 30, 2023 and 2022, the Company did not accrue allowance against

short term loan receivables.

Concentration of Credit Risk

Cash includes cash on hand and

demand deposits in accounts maintained within China. Balances at financial institutions and state-owned banks within the PRC

are covered by insurance up to RMB 500,000 ($71,792) per bank. Any balance over RMB 500,000 ($71,792) per bank in

PRC is not covered. The Company has not experienced any losses in such accounts.

Certain other financial instruments,

which subject the Company to concentration of credit risk, consist of accounts and other receivables. The Company does not require collateral

or other security to support these receivables. The Company conducts periodic reviews of its customers’ financial condition and

customer payment practices to minimize collection risk on accounts receivable.

The operations of the Company

are in the PRC. Accordingly, the Company’s business, financial condition and results of operations may be influenced by the political,

economic and legal environments in the PRC.

Property and Equipment

Property and equipment are stated

at cost, net of accumulated depreciation. Expenditures for maintenance and repairs are expensed as incurred; additions, renewals and betterments

are capitalized. When property and equipment are retired or otherwise disposed of, the related cost and accumulated depreciation are removed

from the respective accounts, and any gain or loss is included in operations. Depreciation of property and equipment is provided using

the straight-line method over the estimated lives as follows:

| Vehicles |

|

2 - 5 years |

| Office and Other Equipment |

|

2 - 5 years |

| Software |

|

2 - 3 years |

Impairment

of Long-lived Assets

In accordance with FASB ASC Topic

360, “Property, Plant, and Equipment,” the Company reviews its long-lived assets, including property and equipment,

for impairment whenever events or changes in circumstances indicate that the carrying amounts of the assets may not be fully recoverable.

If the total expected undiscounted future net cash flows are less than the carrying amount of the asset, a loss is recognized for the

difference between the fair value (“FV”) and carrying amount of the asset. The Company did not record any impairment for the

six and three months ended June 30, 2023 and 2022.

Account and other payables

Accounts and other payables represent liabilities for goods and services

provided to the Company prior to the end of the financial year which are unpaid. They are classified as current liabilities if payment

is due within one year or less (or in the normal operating cycle of the business if longer). Otherwise, they are presented as non-current

liabilities.

Accounts and other payables are initially recognized as fair value, and

subsequently carried at amortized cost using the effective interest method.

Borrowings

Borrowings are presented as current liabilities unless the Company has

an unconditional right to defer settlement for at least 12 months after the financial year end date, in which case they are presented

as non-current liabilities.

Borrowings are initially recognized at fair value (net of transaction costs)

and subsequently carried at amortized cost. Any difference between the proceeds (net of transaction costs) and the redemption value is

recognized in profit or loss over the period of the borrowings using an effective interest method.

Borrowing costs are recognized in profit or loss using the effective interest

method.

Cost of Sales

Cost of sales consists primarily

of the direct material of the power generating system and expenses incurred directly for project construction for sales-type leasing and

sales tax and additions for contingent rental income.

Income Taxes

Income taxes are accounted for

using an asset and liability method. Under this method, deferred income taxes are recognized for the tax consequences in future years

of differences between the tax bases of assets and liabilities and their financial reporting amounts at each period end based on enacted

tax laws and statutory tax rates, applicable to the periods in which the differences are expected to affect taxable income. Valuation

allowances are established, when necessary, to reduce deferred tax assets to the amount expected to be realized.

The Company follows FASB ASC

Topic 740, which prescribes a more-likely-than-not threshold for financial statement recognition and measurement of a tax position taken

or expected to be taken in a tax return. ASC Topic 740 also provides guidance on recognition of income tax assets and liabilities, classification

of current and deferred income tax assets and liabilities, accounting for interest and penalties associated with tax positions, accounting

for income taxes in interim periods, and income tax disclosures.

Under FASB ASC Topic 740, when

tax returns are filed, it is likely that some positions taken would be sustained upon examination by the taxing authorities, while others

are subject to uncertainty about the merits of the position taken or the amount of the position that would be ultimately sustained. The

benefit of a tax position is recognized in the CFS in the period during which, based on all available evidence, management believes it

is more likely than not that the position will be sustained upon examination, including the resolution of appeals or litigation processes,

if any. Tax positions taken are not offset or aggregated with other positions. Tax positions that meet the more-likely-than-not recognition

threshold are measured as the largest amount of tax benefit that is more than 50% likely of being realized upon settlement with the

applicable taxing authority. The portion of the benefits associated with tax positions taken that exceeds the amount measured as described

above is reflected as a liability for unrecognized tax benefits in the accompanying balance sheets along with any associated interest

and penalties that would be payable to the taxing authorities upon examination. Interest associated with unrecognized tax benefits is

classified as interest expense and penalties are classified in selling, general and administrative expenses in the statement of income. At

June 30, 2023 and December 31, 2022, the Company did not take any uncertain positions that would necessitate recording a tax related liability.

Statement of Cash Flows

In accordance with FASB ASC Topic

230, “Statement of Cash Flows,” cash flows from the Company’s operations are calculated based upon

the local currencies. As a result, amounts related to assets and liabilities reported on the statement of cash flows may not necessarily

agree with changes in the corresponding balances on the balance sheet.

Fair Value of Financial Instruments

For certain of the Company’s

financial instruments, including cash and equivalents, restricted cash, accounts receivable, other receivables, accounts payable, accrued

liabilities and short-term debts, the carrying amounts approximate their FVs due to their short maturities. Receivables on sales-type

leases are based on interest rates implicit in the lease.

FASB ASC Topic 820, “Fair

Value Measurements and Disclosures,” requires disclosure of the FV of financial instruments held by the Company. FASB ASC

Topic 825, “Financial Instruments,” defines FV, and establishes a three-level valuation hierarchy for disclosures

of FV measurement that enhances disclosure requirements for FV measures. The carrying amounts reported in the consolidated balance sheets

for receivables and current liabilities each qualify as financial instruments and are a reasonable estimate of their FV because of the

short period of time between the origination of such instruments and their expected realization and their current market rate of interest.

The three levels of valuation hierarchy are defined as follows:

| |

● |

Level 1 inputs to the valuation methodology are quoted prices (unadjusted) for identical assets or liabilities in active markets. |

| |

● |

Level 2 inputs to the valuation methodology include quoted prices for similar assets and liabilities in active markets, and inputs that are observable for the asset or liability, either directly or indirectly, for substantially the full term of the financial instrument. |

| |

● |

Level 3 inputs to the valuation methodology are unobservable and significant to FV measurement. |

The

Company analyzes all financial instruments with features of both liabilities and equity under FASB ASC 480, “Distinguishing

Liabilities from Equity,” and ASC 815, “Derivatives and Hedging.”

As of June 30, 2023 and December

31, 2022, the Company did not have any long-term debt; and the Company did not identify any assets or liabilities that are required to

be presented on the balance sheet at FV.

Stock-Based Compensation

The Company accounts for share-based

compensation awards to employees in accordance with FASB ASC Topic 718, “Compensation – Stock Compensation”, which requires

that share-based payment transactions with employees be measured based on the grant-date FV of the equity instrument issued and recognized

as compensation expense over the requisite service period.

The Company accounts for share-based

compensation awards to non-employees in accordance with FASB ASC Topic 718 and FASB ASC Subtopic 505-50, “Equity-Based Payments

to Non-employees”. Share-based compensation associated with the issuance of equity instruments to non-employees is measured at the

FV of the equity instrument issued or committed to be issued, as this is more reliable than the FV of the services received. The FV is

measured at the date that the commitment for performance by the counterparty has been reached or the counterparty’s performance

is complete.

The Company follows ASU 2018-07,

“Compensation — Stock Compensation (Topic 718): Improvements to Nonemployee Share-Based Payment Accounting,” which expands

the scope of ASC 718 to include share-based payment transactions for acquiring goods and services from non-employees. An entity should

apply the requirements of ASC 718 to non-employee awards except for specific guidance on inputs to an option pricing model and the attribution

of cost. ASC 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used or consumed

in a grantor’s own operations by issuing share-based payment awards.

Basic and Diluted Earnings

per Share

The Company presents net income

(loss) per share (“EPS”) in accordance with FASB ASC Topic 260, “Earning Per Share.” Accordingly,

basic income (loss) per share is computed by dividing income (loss) available to common stockholders by the weighted average number of

shares outstanding, without consideration for common stock equivalents. Diluted EPS is computed by dividing the net income by the weighted-average

number of common shares outstanding as well as common share equivalents outstanding for the period determined using the treasury-stock

method for stock options and warrants and the if-converted method for convertible notes. The Company made an accounting policy election

to use the if-converted method for convertible securities that are eligible to receive common stock dividends, if declared. Diluted EPS

reflect the potential dilution that could occur based on the exercise of stock options or warrants or conversion of convertible securities

using the if-converted method.

For the six months ended June

30, 2023 and 2022, the basic and diluted income (loss) per share were the same due to the anti-dilutive features of the warrants and options.

For the three months ended June 30, 2023 and 2022, the basic and diluted income (loss) per share were the same due to the anti-dilutive

features of the warrants and options. For the six months ended June 30, 2023 and 2022, 30,911 shares purchasable under warrants

and options were excluded from the EPS calculation as these were not dilutive due to the exercise price was more than the stock market

price. For the three months ended June 30, 2023 and 2022, 30,911 shares purchasable under warrants and options were excluded from the

EPS calculation as these were not dilutive due to the exercise price was more than the stock market price.

Foreign Currency Translation

and Comprehensive Income (Loss)

The Company’s functional

currency is the Renminbi (“RMB”). For financial reporting purposes, RMB were translated into U.S. Dollars (“USD”

or “$”) as the reporting currency. Assets and liabilities are translated at the exchange rate in effect at the balance sheet

date. Revenues and expenses are translated at the average rate of exchange prevailing during the reporting period. Translation adjustments

arising from the use of different exchange rates from period to period are included as a component of stockholders’ equity as “Accumulated

other comprehensive income.” Gains and losses resulting from foreign currency transactions are included in income.

The Company follows FASB ASC

Topic 220, “Comprehensive Income.” Comprehensive income is comprised of net income and all changes to the

statements of stockholders’ equity, except those due to investments by stockholders, changes in paid-in capital and distributions

to stockholders.

Segment Reporting

FASB ASC Topic 280, “Segment

Reporting,” requires use of the “management approach” model for segment reporting. The management approach

model is based on the way a company’s management organizes segments within the company for making operating decisions and assessing

performance. Reportable segments are based on products and services, geography, legal structure, management structure, or any other manner

in which management disaggregates a company. FASB ASC Topic 280 has no effect on the Company’s CFS as substantially all of the Company’s

operations are conducted in one industry segment. All of the Company’s assets are located in the PRC.

New Accounting Pronouncements

In June 2016, the FASB issued

ASU 2016-13, Financial Instruments - Credit Losses (Topic 326): Measurement of Credit Losses on Financial Instruments, which requires

entities to measure all expected credit losses for financial assets held at the reporting date based on historical experience, current

conditions, and reasonable and supportable forecasts. ASU 2016-13 replaces the probable, incurred loss model and is applicable to the

measurement of credit losses on financial assets measured at amortized cost basis. An entity should apply ASU 2016-13 on a modified-retrospective

transition approach that would require a cumulative-effect adjustment to the opening retained earnings in the balance sheets as of the

date of adoption. In March 2022, the FASB issued ASU 2022-02, Financial Instruments – Credit Losses (Topic 326): Troubled Debt Restructurings

and Vintage Disclosures, which eliminates the accounting guidance for trouble debt restructurings by creditors and enhances the disclosure

requirements for modifications of loans to borrowers experiencing financial difficulty. Additionally, ASU 2022-02 requires disclosure

of gross write-offs by year of origination for receivables within the scope of Subtopic 326-20, Financial Instruments - Credit Losses

- Measured at Amortized Cost, which should be applied prospectively. Both ASU 2016-13 and ASU 2022-02 are effective for smaller reporting

companies for fiscal years beginning after December 15, 2022, including interim periods within those fiscal years. The Company adopted

ASU 2016-13 and ASU 2022-02 on January 1, 2023. The adoption of ASU 2016-13 and ASU 2022-02 did not have any impact on the Company’s

CFS.

In January 2017, the FASB issued

ASU No. 2017-04, Simplifying the Test for Goodwill Impairment. The guidance removes Step 2 of the goodwill impairment test, which requires

a hypothetical purchase price allocation. A goodwill impairment will now be the amount by which a reporting unit’s carrying value

exceeds its FV, not to exceed the carrying amount of goodwill. The guidance should be adopted on a prospective basis. As a smaller reporting

company, the standard was effective for the Company for interim and annual reporting periods beginning after December 15, 2022, with early

adoption permitted. The Company adopted ASU 2017-04 for its interim and annual goodwill impairment tests on January 1, 2023. The adoption

of ASU 2017-04 did not have any impact on the Company’s CFS.

Other recent accounting pronouncements

issued by the FASB, including its Emerging Issues Task Force, the American Institute of Certified Public Accountants, and the SEC did

not or are not believed by management to have a material impact on the Company’s present or future CFS.

3. OTHER

RECEIVABLES

As of June 30, 2023, other

receivables mainly consisted of (i) advance to third parties of $6,920, bearing no interest, payable upon demand, and ii) others of $46,952.

As of December 31, 2022, other

receivables mainly consisted of (i) advance to third parties of $7,179, bearing no interest, payable upon demand, ii) advance to suppliers

of $2,583 and (iii) others of $19,579.

4. SHORT-TERM LOAN RECEIVABLE

As of March 31, 2023, the Company

had $140,576,568 (RMB 966.0 million) short term loan to Jinan Youkai Engineering Consulting Co., Ltd (“Youkai”),

an unrelated party of the Company. The short-term loan was for five days with a capital utilization fee of $43,657 (RMB 300,000)

per day for total of $218,287 (RMB 1.5 million). To ensure the safety of the funds, before money was transferred to Youkai,

Youkai handed over the official seal, financial seal and bank account UK to the Company for custody and management until repayment of

the loan. The Company received the repayment of $140.6 million in full plus capital utilization fee on April 3, 2023.

As of June 30, 2023, the Company

had $67,120,596 (RMB 485.0 million) short term loan to Jinan Youkai Engineering Consulting Co., Ltd (“Youkai”),

an unrelated party of the Company. The short-term loan was for five days with a capital utilization fee of $13,839 (RMB 100,000)

per day for total of $69,196 (RMB 500,000). To ensure the safety of the funds, before money was transferred to Youkai, Youkai

handed over the official seal, financial seal and bank account UK to the Company for custody and management until repayment of the loan.

The Company received the repayment of $67.2 million in full plus capital utilization fee on July 3, 2023.

5. ADVANCE TO SUPPLIERS

On June 19, 2023, the Company

entered a purchase agreement with Hubei Bangyu New Energy Technology Co., Ltd. (“Bangyu”). The total contract amount was $82.3

million (RMB 595.0 million) for purchasing the energy storage battery systems. As of June 30, 2023, the Company made a prepayment to Bangyu

of $65.9 million (RMB 476.0 million). The Company is in the process of transforming and expanding into energy storage integrated solution

provider business. The Company actively seeks and explores opportunities to apply energy storage technologies to new industries or segments

with high growth potential, including industrial and commercial complexes, large scale photovoltaic (PV) and wind power stations, remote

islands without electricity, and smart energy cities with multi-energy supplies.

On August 2, 2021, the Company

entered a Research and Development (“R&D”) Cooperation Agreement with a software development company to design, establish,

upgrade and maintenance of Smart Energy Management Cloud Platform for energy storage and remote-site monitoring; upon completion, the

Company will provide such platform to its customers at a fee. Total contracted R&D cost is $1,000,000, as of December 31, 2022, the

Company paid $200,000 as R&D expense, and was committed to pay remaining $800,000 after trial operation. During the year

ended December 31, 2022, the Company expensed $200,000 in R&D.

On August 23, 2021, the

Company entered a Market Research and Project Development Service Agreement with a consulting company in Xi’an for a service period

of 12 months. The consulting company will perform market research for new energy industry including photovoltaic and energy storage, develop

potential new customers and due diligence check, assisting the Company for business cooperation negotiation and relevant agreements preparation.

Total contract amount is $1,150,000, and the Company paid $650,000 at commencement of the service and recorded as R&D expense

during the year ended December 31, 2022; the Company prepaid $200,000 during the quarter ended June 30, 2023, and will pay the remaining

of $300,000 upon completion all the services.

6. ASSET SUBJECT TO BUYBACK

The Chengli project finished

construction, and was transferred to the Company’s fixed assets at a cost of $35.24 million (without impairment loss) and was

ready to be put into operation as of December 31, 2018. On January 22, 2019, Xi’an Zhonghong completed the transfer of

Chengli CDQ WHPG project as partial repayment for the loan and accrued interest of RMB 188,639,400 ($27.54 million) to HYREF (see Note

10).

On April 9, 2021, Xi’an

TCH, Xi’an Zhonghong, Guohua Ku, Chonggong Bai and HYREF entered a Termination of Fulfillment Agreement (termination agreement).

Under the termination agreement, the original buyback agreement entered on December 19, 2019 was terminated upon signing of the termination

agreement. HYREF will not execute the buy-back option and will not ask for any additional payment from the buyers other than keeping the

CDQ WHPG station. As a result of the termination of the buy-back agreement, the Company recorded a gain of approximately $3.1 million

from transferring the CDP WHPG station to HYREF as partial repayment of the entrusted loan, which is the difference between the carrying

value of the assets and loan and interest payable on the loan.

7. ACCRUED LIABILITIES AND

OTHER PAYABLES

Accrued liabilities and other

payables consisted of the following as of June 30, 2023 and December 31, 2022:

| | |

2023 | | |

2022 | |

| Education and union fund and social insurance payable | |

$ | 244,255 | | |

$ | 270,116 | |

| Accrued payroll and welfare | |

| 232,193 | | |

| 251,021 | |

| Accrued litigation | |

| 2,082,022 | | |

| 2,203,149 | |

| Other | |

| 29,505 | | |

| 52,128 | |

| Total | |

$ | 2,587,975 | | |

$ | 2,776,414 | |

Accrued

litigation was mainly for court enforcement fee, fee to lawyer, penalty and other fees (see Note 16).

8. TAXES

PAYABLE

Taxes payable

consisted of the following as of June 30, 2023 and December 31, 2022:

| | |

2023 | | |

2022 | |

| Income tax | |

$ | 7,682,757 | | |

$ | 7,639,832 | |

| Other | |

| 180 | | |

| 145 | |

| Total | |

| 7,682,937 | | |

| 7,639,977 | |

| Current | |

| 3,724,312 | | |

| 3,681,352 | |

| Noncurrent | |

$ | 3,958,625 | | |

$ | 3,958,625 | |

As of

June 30, 2023, income tax payable included $7.61 million from recording the estimated one-time transition tax on post-1986

foreign unremitted earnings under the Tax Cut and Jobs Act signed on December 22, 2017 ($3.65 million included in current tax

payable and $3.96 million noncurrent). An election was available for the U.S. shareholders of a foreign company to pay the

tax liability in installments over a period of eight years (until year 2026) with 8% of net tax liability in each of the first five

years, 15% in the sixth year, 20% in the seventh year, and 25% in the eighth year. The Company made such an

election.

9. DEFERRED TAX, NET

Deferred tax assets resulted

from asset impairment loss which was temporarily non-tax deductible for tax purposes but expensed in accordance with US GAAP; interest

income in sales-type leases which was recognized as income for tax purposes but not for book purpose as it did not meet revenue recognition

in accordance with US GAAP; accrued employee social insurance that can be deducted for tax purposes in the future, and the difference

between tax and accounting basis of cost of fixed assets which was capitalized for tax purposes and expensed as part of cost of systems

in accordance with US GAAP. Deferred tax liability arose from the difference between tax and accounting basis of net investment in sales-type

leases.

As of June

30, 2023 and December 31, 2022, deferred tax assets consisted of the following:

| | |

2023 | | |

2022 | |

| Accrued expenses | |

$ | 52,614 | | |

$ | 57,611 | |

| Write-off Erdos TCH net investment in sales-type leases * | |

| 4,271,168 | | |

| 4,579,725 | |

| Impairment loss of Xi’an TCH’s investment into the HYREF fund | |

| 2,594,868 | | |

| 2,692,186 | |

| US NOL | |

| 889,941 | | |

| 730,855 | |

| PRC NOL | |

| 9,257,662 | | |

| 9,118,123 | |

| Total deferred tax assets | |

| 17,066,253 | | |

| 17,178,500 | |

| Less: valuation allowance for deferred tax assets | |

| (17,066,253 | ) | |

| (17,178,500 | ) |

| Deferred tax assets, net | |

$ | - | | |

$ | - | |

10. LOAN

PAYABLE

Entrusted Loan Payable

(HYREF Loan)

The HYREF Fund was established

in July 2013 with a total fund of RMB 460 million ($77 million) invested in Xi’an Zhonghong for Zhonghong’s

three new CDQ WHPG projects. The HYREF Fund invested RMB 3 million ($0.5 million) as an equity investment and RMB 457 million

($74.5 million) as a debt investment in Xi’an Zhonghong; in return for such investments, the HYREF Fund was to receive interest

from Zhonghong for the HYREF Fund’s debt investment. The loan was collateralized by the accounts receivable and the fixed assets

of Shenqiu Phase I and II power generation systems; the accounts receivable and fixed assets of Zhonghong’s three CDQ WHPG systems;

and a 27 million RMB ($4.39 million) capital contribution made by Xi’an TCH in Zhonghong. Repayment of the loan (principal

and interest) was also jointly and severally guaranteed by Xi’an TCH and the Chairman and CEO of the Company. In the fourth quarter

of 2015, three power stations of Erdos TCH were pledged to Industrial Bank as an additional guarantee for the loan to Zhonghong’s

three CDQ WHPG systems. In 2016, two additional power stations of Erdos TCH and Pucheng Phase I and II systems were pledged to Industrial

Bank as an additional guarantee along with Xi’an TCH’s equity in Zhonghong.

The term of this loan was for

60 months from July 31, 2013 to July 30, 2018, with interest of 12.5%. The Company paid RMB 50 million ($7.54 million) of the

RMB 280 million ($42.22 million), and on August 5, 2016, the Company entered into a supplemental agreement with the lender to extend the

due date of the remaining RMB 230 million ($34.68 million) of the original RMB 280 million ($45.54 million) to August 6, 2017. During

the year ended December 31, 2017, the Company negotiated with the lender again to further extend the remaining loan balance of RMB 230

million ($34.68 million), RMB 100 million ($16.27 million), and RMB 77 million ($12.08 million) The lender had tentatively agreed to extend

the remaining loan balance until August 2019 with interest of 9%, subject to the final approval from its headquarters. The headquarters

did not approve the extension proposal with interest of 9%; however, on December 29, 2018, the Company and the lender agreed to an alternative

repayment proposal as described below.

Repayment of HYREF loan

1. Transfer of Chengli project

as partial repayment

On December 29, 2018, Xi’an

Zhonghong, Xi’an TCH, HYREF, Guohua Ku, and Chonggong Bai entered into a CDQ WHPG Station Fixed Assets Transfer Agreement, pursuant

to which Xi’an Zhonghong transferred Chengli CDQ WHPG station as the repayment for the loan of RMB 188,639,400 ($27.54 million)

to HYREF, the transfer of which was completed on January 22, 2019.

Xi’an TCH is a secondary

limited partner of HYREF. The FV of the CDQ WHPG station applied in the transfer was determined by the parties based upon the appraisal

report issued by Zhonglian Assets Appraisal Group (Shaanxi) Co., Ltd. as of August 15, 2018. However, per the discussion below, Xi’an

Zhonghong, Xi’an TCH, Guohua Ku and Chonggong Bai (the “Buyers”) entered into a Buy Back Agreement, also agreed to buy

back the Station when conditions under the Buy Back Agreement are met. Due to the Buy Back agreement, the loan was not deemed repaid,

and therefore the Company recognized Chengli project as assets subject to buyback and kept the loan payable remained recognized under

ASC 405-20-40-1 as of December 31, 2020. The Buy Back agreement was terminated in April 2021 (see 2 below for detail).

2. Buy

Back Agreement

On December 29, 2018, Xi’an

TCH, Xi’an Zhonghong, HYREF, Guohua Ku, Chonggong Bai and Xi’an Hanneng Enterprises Management Consulting Co. Ltd. (“Xi’an

Hanneng”) entered into a Buy Back Agreement.

Pursuant to the Buy Back Agreement,

the Buyers jointly and severally agreed to buy back all outstanding capital equity of Xi’an Hanneng which was transferred to HYREF

by Chonggong Bai (see 3 below), and a CDQ WHPG station in Boxing County which was transferred to HYREF by Xi’an Zhonghong. The buy-back

price for the Xi’an Hanneng’s equity was based on the higher of (i) the market price of the equity shares at the time of buy-back;

or (ii) the original transfer price of the equity shares plus bank interest. The buy-back price for the Station was based on the higher

of (i) the FV of the Station on the date transferred; or (ii) the loan balance at the date of the transfer plus interest accrued through

that date. HYREF could request that the Buyers buy back the equity shares of Xi’an Hanneng and/or the CDQ WHPG station if one of

the following conditions is met: (i) HYREF holds the equity shares of Xi’an Hanneng until December 31, 2021; (ii) Xi’an Huaxin

New Energy Co., Ltd., is delisted from The National Equities Exchange And Quotations Co., Ltd., a Chinese over-the-counter trading system

(the “NEEQ”); (iii) Xi’an Huaxin New Energy, or any of the Buyers or its affiliates has a credit problem, including

not being able to issue an auditor report or standard auditor report or any control person or executive of the Buyers is involved in crimes

and is under prosecution or has other material credit problems, to HYREF’s reasonable belief; (iv) if Xi’an Zhonghong fails

to timely make repayment on principal or interest of the loan agreement, its supplemental agreement or extension agreement; (v) the Buyers

or any party to the Debt Repayment Agreement materially breaches the Debt Repayment Agreement or its related transaction documents, including

but not limited to the Share Transfer Agreement, the Pledged Assets Transfer Agreement, the Entrusted Loan Agreement and their guarantee

agreements and supplemental agreements. Due to halted trading of Huaxin stock by NEEQ for not filing its 2018 annual report, on December

19, 2019, Xi’an TCH, Xi’an Zhonghong, Guohua Ku and Chonggong Bai jointly and severally agreed to buy back all outstanding

capital equity of Xi’an Hanneng which was transferred to HYREF by Chonggong Bai earlier. The total buy back price was RMB 261,727,506 ($37.52 million)

including accrued interest of RMB 14,661,506 ($2.10 million), and was paid in full by Xi’an TCH on December 20, 2019.

On April 9, 2021, Xi’an

TCH, Xi’an Zhonghong, Guohua Ku, Chonggong Bai and HYREF entered a Termination of Fulfillment Agreement (termination agreement).

Under the termination agreement, the original buyback agreement entered on December 19, 2019 was terminated upon signing of the termination

agreement. HYREF will not execute the buy-back option and will not ask for any additional payment from the buyers other than keeping the

CDQ WHPG station. The Company recorded a gain of approximately $3.1 million from transferring the CDP WHPG station to HYREF as partial

repayment of the entrusted loan resulting from the termination of the buy-back agreement.

3. Transfer of Xuzhou Huayu Project

and Shenqiu Phase I & II project to Mr. Bai for partial repayment of HYREF loan

On January 4, 2019, Xi’an

Zhonghong, Xi’an TCH, and Mr. Chonggong Bai entered into a Projects Transfer Agreement, pursuant to which Xi’an Zhonghong

transferred a CDQ WHPG station (under construction) located in Xuzhou City for Xuzhou Huayu Coking Co., Ltd. (“Xuzhou Huayu Project”)

to Mr. Bai for RMB 120,000,000 ($17.52 million) and Xi’an TCH transferred two Biomass Power Generation Projects in

Shenqiu (“Shenqiu Phase I and II Projects”) to Mr. Bai for RMB 127,066,000 ($18.55 million). Mr. Bai agreed

to transfer all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF as repayment for the RMB 247,066,000 ($36.07 million)

loan made by Xi’an Zhonghong to HYREF as consideration for the transfer of the Xuzhou Huayu Project and Shenqiu Phase I and II Projects.

On February 15, 2019, Xi’an

Zhonghong completed the transfer of the Xuzhou Huayu Project and Xi’an TCH completed the transfer of Shenqiu Phase I and II Projects

to Mr. Bai, and on January 10, 2019, Mr. Bai transferred all the equity shares of his wholly owned company, Xi’an Hanneng, to HYREF

as repayment of Xi’an Zhonghong’s loan to HYREF as consideration for the transfer of the Xuzhou Huayu Project and Shenqiu

Phase I and II Projects.

Xi’an Hanneng is a

holding company and was supposed to own 47,150,000 shares of Xi’an Huaxin New Energy Co., Ltd.

(“Huaxin”), so that HYREF will indirectly receive and own such shares of Xi’an Huaxin as the repayment for the

loan of Zhonghong. Xi’an Hanneng already owned 29,948,000 shares of Huaxin; however, Xi’an Hanneng was not able to

obtain the remaining 17,202,000 shares due to halted trading of Huaxin stock by NEEQ for not filing its 2018 annual

report.

On December 19, 2019, Xi’an

TCH, Xi’an Zhonghong, Guohua Ku and Chonggong Bai jointly and severally agreed to buy back all outstanding capital equity of Xi’an

Hanneng which was transferred to HYREF by Chonggong Bai earlier. The total buy back price was RMB 261,727,506 ($37.52 million)

including accrued interest of RMB 14,661,506 ($2.10 million), and was paid in full by Xi’an TCH on December 20, 2019. On

December 20, 2019, Mr. Bai, Xi’an TCH and Xi’an Zhonghong agreed to have Mr. Bai repay the Company in cash for the transfer

price of Xuzhou Huayu and Shenqiu in five installment payments. The 1st payment of RMB 50 million ($7.17 million)

was due January 5, 2020, the 2nd payment of RMB 50 million ($7.17 million) was due February 5, 2020, the

3rd payment of RMB 50 million ($7.17 million) was due April 5, 2020, the 4th payment of

RMB 50 million ($7.17 million) was due on June 30, 2020, and the final payment of RMB 47,066,000 ($6.75 million)

was due September 30, 2020. As of December 31, 2020, the Company received the full payment of RMB 247 million ($36.28 million)

from Mr. Bai.

4. The lender agreed to extend

the repayment of RMB 77.00 million ($12.13 million) to July 8, 2023. However, per court’s judgement on June 28, 2021,

the Company should repay principal $12.13 million and accrued interest of $0.38 million within 10 days from the judgment date.

The Company has not paid it yet as of this report date.

Xi’an TCH had investment

RMB 75.00 million ($11.63 million) into the HYREF fund as a secondary limited partner, and the Company recorded an impairment

loss of $11.63 million for such investment during the year ended December 31, 2021 due to uncertainty of the collection of the investment.

This was impaired as Hongyuan does not have the ability to pay back (see Note 16 – Litigation).

11. NOTE PAYABLE, NET

Promissory Notes in December

2020

On December 4, 2020, the Company

entered into a Note Purchase Agreement with an institutional investor, pursuant to which the Company issued the Purchaser a Promissory

Note of $3,150,000. The Purchaser purchased the Note with an original issue discount (“OID”) of $150,000, which was recognized

as debt discount is amortized using the interest method over the life of the note. The Note bears interest at 8% and has a term of 24