false

0001847986

0001847986

2024-08-14

2024-08-14

0001847986

DFLI:CommonStockParValue0.0001PerShareMember

2024-08-14

2024-08-14

0001847986

DFLI:RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember

2024-08-14

2024-08-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August

14, 2024

DRAGONFLY

ENERGY HOLDINGS CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-40730 |

|

85-1873463 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

1190

Trademark Drive,

#108

Reno,

Nevada |

|

89521 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(775)

622-3448

Registrant’s

telephone number, including area code

N/A

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.0001 per share |

|

DFLI |

|

The

Nasdaq Capital Market |

| Redeemable

warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

DFLIW |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

2.02. Results of Operations and Financial Condition.

On

August 14, 2024, Dragonfly Energy Holdings Corp. (the “Company”) issued an earnings release disclosing certain information

regarding its results of operations for the second quarter ended June 30, 2024. As previously announced, following the publication of

the press release, the Company will host an earnings call at 5:00 p.m. (Eastern Time) on August 14, 2024, via a webcast. During the webcast,

the Company’s financial results for the second quarter ended June 30, 2024 will be discussed. A copy of the press release is attached

as Exhibit 99.1 hereto and incorporated in this Item 2.02 by reference.

Item

7.01. Regulation FD Disclosure.

On

August 14, 2024, the Company posted presentation materials (the “Investor Presentation”) on the Investor Relations

section of its website, which is located at https://investors.dragonflyenergy.com/events-and-presentations/default.aspx. A copy

of the Investor Presentation is attached as Exhibit 99.2 hereto.

See

“Item 2.02 Results of Operation and Financial Condition” above.

The

information in this Current Report on Form 8-K under Items 2.02 and 7.01, including the information contained in Exhibits 99.1 and 99.2,

is being furnished to the Securities and Exchange Commission (the “SEC”), and shall not be deemed to be “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities

Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by a specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

Signature

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

DRAGONFLY

ENERGY HOLDINGS CORP. |

| |

|

|

| Dated:

August 14, 2024 |

By: |

/s/

Denis Phares |

| |

Name:

|

Denis

Phares |

| |

Title: |

Chief

Executive Officer, Interim Chief Financial Officer and President |

Exhibit

99.1

Dragonfly

Energy Reports Second Quarter 2024 Financial and Operational Results

| ● | Dragonfly

Energy entered into a $30 million licensing agreement with Stryten Energy, a leading North

American battery manufacturer, to allow for expansion of Battle Born Batteries®

products into new markets |

| ● | The

Company announced progress in bringing its lithium battery technology to the trucking sector,

including a new partnership with Highway Transport to integrate Dragonfly Energy’s

all-electric auxiliary power units (“APUs”) into Highway Transport’s fleet

of over 500 trucks |

| ● | The

Company achieved continued market share growth in the recreational vehicle (“RV”)

segment through partnership with Fraserway RV, Canada’s largest nationwide RV dealer,

as well as Meyer Distributing, a leading North American specialty products distributor, both

of which extended Dragonfly Energy’s reach and presence across North America |

RENO,

NEVADA (August 14, 2024) — Dragonfly Energy Holdings Corp. (“Dragonfly Energy” or the “Company”) (Nasdaq:

DFLI), maker of Battle Born Batteries® and an industry leader in energy storage, today reported its financial and operational

results for the second quarter ended June 30, 2024.

Second

Quarter 2024 Financial Highlights

| ● | Net

Sales were $13.2 million, compared to $19.3 million in Q2 2023 |

| ● | Gross

Profit was $3.2 million, compared to $3.9 million in Q2 2023 |

| ● | Operating

expenses were $(9.9) million, compared to $(12.5) million in Q2 2023 |

| ● | Net

Loss of $(13.6) million, compared to Net Loss of $(11.9) million in Q2 2023 |

| ● | Diluted

Net Loss per share was $(0.22), compared to Net Loss of $(0.25) per share in Q2 2023 |

| ● | EBITDA

was $(8.4) million, compared to $(7.5) million in Q2 2023 |

| ● | Adjusted

EBITDA was $(6.2) million, compared to $(5.7) million in Q2 2023 |

Operational

and Business Highlights

| ● | Entered

into $30 million licensing agreement for Battle Born Batteries Brand with Stryten Energy,

a leading North American battery manufacturer (link) |

| ● | Announced

partnership with Highway Transport, a North American leader in liquid chemical transportation,

to begin integrating Dragonfly Energy’s all-electric APUs into Highway Transport’s

fleet of over 500 trucks (link) |

| ● | Partnered

with Refreshment Services Pepsi, an independent distributor of Pepsi-Cola products, to provide

new liftgate battery systems (link) |

| ● | Partnered

with Fraserway RV, Canada’s largest coast-to-coast RV dealership group, to strengthen

Dragonfly Energy’s presence in the Canadian RV market (link) |

| ● | Announced

partnership with Meyer Distributing, leveraging Meyer Distributing’s extensive network

of over 100 locations across North America to deliver Battle Born Batteries to new business-to-business

customers in the RV and surrounding industries (link) |

| ● | Announced

development of next-generation power charging solutions under the Company’s Wakespeed®

Product Line: Wakespeed 500 Pro Bluetooth Alternator Regulator and 48V/12V Bi-Directional

DC-DC Converter (link) |

| ● | Hosted

Secretary of Commerce Gina Raimondo and Nevada Senator Jacky Rosen, at an event at the Company’s

Reno, Nevada headquarters to promote American innovation and workforce development within

the state’s burgeoning lithium industry (link) |

“I

am incredibly proud of the significant strides Dragonfly Energy has made this quarter, despite the challenging economic environment.

Our ability to expand into new verticals and secure strategic partnerships is a testament to the strength of our technology and the dedication

of our team,” said Dr. Denis Phares, chief executive officer of Dragonfly Energy. “In particular, we believe the Stryten

Energy agreement has the ability to expose our Battle Born Batteries brand to a broader audience and position us for mass market adoption.

Moreover, Highway Transport’s decision to adopt our all-electric APUs across their large truck fleet marks a pivotal moment for

Dragonfly Energy in the industry, and we anticipate this may inspire others to follow suit. We believe we are laying a solid foundation

for future growth of Dragonfly Energy and are excited about the opportunities ahead.”

Second

Quarter 2024 Financial and Operating Results

Second

quarter 2024 Net Sales were $13.2 million, compared to $19.3 million in the second quarter of 2023. This decrease was primarily due to

lower battery and accessory sales offset by a higher average sales price. For the second quarter 2024, direct-to-consumers (“DTC”)

net sales decreased by $3.5 million to $6.5 million, compared to $10.0 million in the second quarter of 2023 due to decreased customer

demand for the Company’s products, rising interest rates, and inflation. Original equipment manufacturers (“OEM”) revenue

decreased by $2.6 million to $6.7 million, compared to $9.3 million in the second quarter of 2023 primarily due to the Company’s

largest RV customer changing the Company’s product from a standard offering to an option, in addition to lower order volumes by

key customers, primarily due to a weather event at the Company’s largest customer’s production facility, combined with persisting

weakness in the motorized RV market.

Second

quarter 2024 Gross Profit was $3.2 million, compared to $3.9 million in the second quarter of 2023. The decrease in the Company’s

gross profit was primarily due to a lower unit volume of sales.

Operating

Expenses in the second quarter of 2024 were $(9.9) million, compared to $(12.5) million in the second quarter of 2023. The decrease was

primarily driven by lower employee-related costs and stock-based compensation in the prior year. Professional services, legal, insurance

expenses and travel are also lower by $0.6 million, which is in part due to the Company’s June 2023 public offering.

Total

Other Expense in the second quarter of 2024 was $(6.9) million, compared to $(3.3) million in the second quarter of 2023. Other expense

of $(6.9) million in the quarter ended June 30, 2024 is comprised primarily of interest expense of $(4.9) million related to the Company’s

debt securities and a change in fair market value of warrant liability in the amount of $(2.0) million.

Net

Loss in the second quarter of 2024 was $(13.6) million, or $(0.22) cent loss per share, compared to Net Loss of $(11.9) million, or $(0.25)

cent loss per share in the second quarter of 2023.

EBITDA

in the second quarter of 2024 was $(8.4) million, compared to $(7.5) million in the second quarter of 2023.

In

the second quarter of 2024, Adjusted EBITDA excluding stock-based compensation, changes in the fair market value of the Company’s

warrants, and other one-time expenses, was a $(6.2) million, compared to a $(5.7) million for the second quarter of 2023.

The

Company ended the second quarter with $4.7 million in cash, down from $8.5 million at the end of the first quarter of 2024. Although

the Company continues to use its inventory as a source of working capital and expects this to continue into the second half of 2024,

it has also accelerated accounts payable payments and moved some cash into other assets.

As

such, the Company believes that its available cash management tools, including the $5 million upfront fee which was part of the Stryten

Energy licensing deal (expected to be received in Q3 2024), combined with continued access to its largely untapped $150 million equity

line of credit, provide the necessary liquidity and resources to execute on its operational plans and continue research and development

efforts.

Battle

Born Batteries Licensing Agreement with Stryten Energy

On

July 30, 2024, the Company announced a strategic partnership with Stryten Energy, a leading North American battery manufacturer, for

the licensing of the Dragonfly Energy’s Battle Born Batteries® brand of lithium-ion batteries. The licensing agreement,

with a potential value of up to $30 million, granted Stryten Energy a license to market and distribute Dragonfly Energy’s Battle

Born Batteries globally. Additional revenue above the initial contract value is expected from contract manufacturing, battery design,

and technical support fees associated with the deal.

The

agreement, which includes an upfront payment from Stryten Energy to Dragonfly Energy of $5 million, will see Stryten Energy leverage

its vast distributor and customer network to introduce Battle Born Batteries branded products to new business-to-business markets, including

military, automotive, marine, power sports, lawn & garden and golf carts.

Continued

Progress and Major Milestone within Trucking Market

The

Company has made significant progress in developing its distribution channels. The Company’s batteries have now received approval

for installation at Daimler Truck CTS, Rush Enterprises CVS, and Fontaine Modification, all of which are PDI or modification and upfit

centers. This development ensures the ready availability of batteries for shipment on new trucks and allows for their inclusion in the

tractor’s purchase price.

On

August 12, 2024, the Company announced that it would be partnering with Highway Transport, a leader in North American liquid chemical

transportation, to transition Highway Transport’s entire fleet of over 500 trucks to Dragonfly Energy’s Battle Born all-electric

APUs. As part of the partnership, Highway Transport is expected to install the Battle Born all-electric APUs on new tractors in addition

to retrofitting current models in Highway Transport’s fleet. This partnership with Highway Transport marks a major step forward

for Dragonfly Energy’s reach in the commercial trucking sector. The Company believes the planned integration of the Battle Born

all-electric APU into Highway Transport’s fleet paves the way for wider adoption of the Company’s clean energy solutions,

accelerating the transition towards a more sustainable transportation landscape.

On

July 1, 2024, the Company announced it is now a provider of lithium based liftgate power solutions for Refreshment Services Pepsi, a

privately-held independent bottler and distributor for Pepsi-Cola® products. With distribution centers across the U.S., Refreshment

Services Pepsi will begin integrating the Company’s Battle Born Batteries products into their fleet to power liftgate operations.

The expansion of the Company’s lithium-based power solutions to liftgate applications broadens sales opportunities within the trucking

market.

Q3

2024 Outlook

The

Company believes that the RV market continues to show signs of recovery. In addition, the Company believes that its entry into the heavy-duty

trucking market and oil and gas market, as well as its licensing and contract manufacturing deal with Stryten Energy, has the potential

to contribute more meaningful revenue in the second half of 2024.

Q3

2024 Guidance

| ● | Net

Sales are expected to range between $13.5 - $15.0 million |

| ● | Gross

Margin is expected in the range of 24% - 26% |

| ● | Operating

Expenses are expected to be in a range of $(10.0) - $(10.5) million |

Since

other income and net income are impacted by the fair market revaluation of outstanding warrants each quarter, which is dependent on the

Company’s future stock price on a given date and not reflective of operating results, the Company does not believe it is prudent

to continue to provide guidance on other income and net income.

Webcast

Information

The

Dragonfly Energy management team will host a conference call to discuss its second quarter 2024 financial and operational results this

afternoon, Wednesday, August 14, 2024, at 5:00 pm E.T. The call can be accessed live via webcast by clicking here, or through the Events and Presentations page within the Investor Relations section of Dragonfly Energy’s website at

https://investors.dragonflyenergy.com/events-and-presentations/default.aspx. The call can also be accessed live via telephone

by dialing (800) 549-8228 toll-free in North America, or for international callers +1 (289) 819-1520, and referencing conference ID:

70028. Please log in to the webcast or dial in to the call at least 10 minutes prior to the start of the event.

An

archive of the webcast will be available for a period of time shortly after the call on the Events and Presentations page on the Investor

Relations section of Dragonfly Energy’s website, along with the earnings press release.

About

Dragonfly Energy

Dragonfly

Energy Holdings Corp. (Nasdaq: DFLI) is a comprehensive lithium battery technology company, specializing in cell manufacturing, battery

pack assembly, and full system integration. Through its renowned Battle Born Batteries® brand, Dragonfly Energy has established itself

as a frontrunner in the lithium battery industry, with hundreds of thousands of reliable battery packs deployed in the field through

top-tier OEMs and a diverse retail customer base. At the forefront of domestic lithium battery cell production, Dragonfly Energy’s

patented dry electrode manufacturing process can deliver chemistry-agnostic power solutions for a broad spectrum of applications, including

energy storage systems, electric vehicles, and consumer electronics. The Company’s overarching mission is the future deployment

of its proprietary, nonflammable, all-solid-state battery cells.

To

learn more about Dragonfly Energy and its commitment to clean energy advancements, visit www.dragonflyenergy.com/investors.

Forward-Looking

Statements

This

press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of

1995. Forward-looking statements include all statements that are not historical statements of fact and statements regarding the Company’s

intent, belief or expectations, including, but not limited to, statements regarding the Company’s guidance for 2024, results of

operations and financial position, planned products and services, the Company’s partnerships, including its partnership with Stryten

Energy and the potential value of the license agreement, business strategy and plans, market size and growth opportunities, competitive

position and technological and market trends. Some of these forward-looking statements can be identified by the use of forward-looking

words, including “may,” “should,” “expect,” “intend,” “will,” “estimate,”

“anticipate,” “believe,” “predict,” “plan,” “targets,” “projects,”

“could,” “would,” “continue,” “forecast” or the negatives of these terms or variations

of them or similar expressions.

These

forward-looking statements are subject to risks, uncertainties, and other factors (some of which are beyond the Company’s control)

which could cause actual results to differ materially from those expressed or implied by such forward-looking statements. Factors that

may impact such forward-looking statements include, but are not limited to: improved recovery in the Company’s core markets, including

the RV market; the Company’s ability to successfully increase market penetration into target markets; the Company’s ability

to penetrate the heavy-duty trucking and other new markets; the growth of the addressable markets that the Company intends to target;

the Company’s ability to generate revenue from future product sales and its ability to achieve and maintain profitability; the

Company’s ability to retain members of its senior management team and other key personnel; the Company’s ability to maintain

relationships with key suppliers including suppliers in China; the Company’s ability to maintain relationships with key customers;

the Company’s ability to access capital as and when needed under its $150 million ChEF Equity Facility; the Company’s ability

to protect its patents and other intellectual property; the Company’s ability to successfully utilize its patented dry electrode

battery manufacturing process and optimize solid state cells as well as to produce commercially viable solid state cells in a timely

manner or at all, and to scale to mass production; the Company’s failure to timely achieve the anticipated benefits of its licensing

arrangement with Stryten Energy; the Company’s ability to achieve the anticipated benefits of its customer arrangements with THOR

Industries and THOR Industries’ affiliated brands (including Keystone RV Company); the impact of geopolitical events, including

the Russian/Ukrainian conflict and Hamas’ attack on Israel; and the Company’s ability to compete with other manufacturers

in the industry and its ability to engage target customers and successfully convert these customers into meaningful orders in the future.

These and other risks and uncertainties are described more fully in the sections entitled “Risk Factors” and “Cautionary

Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023

filed with the SEC and in the Company’s subsequent filings with the SEC available at www.sec.gov.

If

any of these risks materialize or any of the Company’s assumptions prove incorrect, actual results could differ materially from

the results implied by these forward-looking statements. There may be additional risks that the Company presently does not know or that

it currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements.

All forward-looking statements contained in this press release speak only as of the date they were made. Except to the extent required

by law, the Company undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after

the date on which they were made.

Investor

Relations:

Caldwell

Bailey

ICR,

Inc.

DragonflyIR@icrinc.com

Dragonfly

Energy Holdings Corp.

Unaudited

Condensed Consolidated Balance Sheets

(in

thousands, except share and per share data)

| | |

As of | |

| | |

June 30, 2024 | | |

December 31, 2023 | |

| Current Assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 4,699 | | |

$ | 12,713 | |

| Accounts receivable, net of allowance for credit losses | |

| 2,866 | | |

| 1,639 | |

| Inventory | |

| 28,653 | | |

| 38,778 | |

| Prepaid expenses | |

| 776 | | |

| 772 | |

| Prepaid inventory | |

| 1,976 | | |

| 1,381 | |

| Prepaid income tax | |

| 345 | | |

| 519 | |

| Other current assets | |

| 750 | | |

| 118 | |

| Total Current Assets | |

| 40,065 | | |

| 55,920 | |

| Property and Equipment | |

| | | |

| | |

| Property and Equipment, Net | |

| 23,496 | | |

| 15,969 | |

| Operating lease right of use asset | |

| 20,949 | | |

| 3,315 | |

| Other assets | |

| 445 | | |

| - | |

| Total Assets | |

$ | 84,955 | | |

$ | 75,204 | |

| | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 10,339 | | |

$ | 10,258 | |

| Accrued payroll and other liabilities | |

| 7,359 | | |

| 7,107 | |

| Accrued tariffs | |

| 1,863 | | |

| 1,713 | |

| Customer deposits | |

| 250 | | |

| 201 | |

| Uncertain tax position liability | |

| 91 | | |

| 91 | |

| Notes payable, current portion, net of debt issuance costs | |

| 21,903 | | |

| 19,683 | |

| Operating lease liability, current portion | |

| 2,807 | | |

| 1,288 | |

| Financing lease liability, current portion | |

| 37 | | |

| 36 | |

| Total Current Liabilities | |

| 44,649 | | |

| 40,377 | |

| Long-Term Liabilities | |

| | | |

| | |

| Warrant liabilities | |

| 11,004 | | |

| 4,463 | |

| Accrued expenses, long-term | |

| - | | |

| 152 | |

| Operating lease liability, net of current portion | |

| 23,990 | | |

| 2,234 | |

| Financing lease liability, net of current portion | |

| 46 | | |

| 66 | |

| Total Long-Term Liabilities | |

| 35,040 | | |

| 6,915 | |

| Total Liabilities | |

| 79,689 | | |

| 47,292 | |

| | |

| | | |

| | |

| Equity | |

| | | |

| | |

| Preferred stock, 5,000,000 shares at $0.0001 par value, authorized, no shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| - | | |

| - | |

| Common stock, 250,000,000 shares at $0.0001 par value, authorized, 61,367,633 and 60,260,282 shares issued and outstanding as of June 30, 2024 and December 31, 2023, respectively | |

| 6 | | |

| 6 | |

| Additional paid in capital | |

| 70,793 | | |

| 69,445 | |

| Retained deficit | |

| (65,533 | ) | |

| (41,539 | ) |

| Total Equity | |

| 5,266 | | |

| 27,912 | |

| Total Liabilities and Shareholders’ Equity | |

$ | 84,955 | | |

$ | 75,204 | |

Dragonfly

Energy Holdings Corp.

Unaudited

Condensed Interim Consolidated Statement of Operations

For

the Three Months Ended June 30, 2024

(in

thousands, except share and per share data)

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Net Sales | |

$ | 13,208 | | |

$ | 19,274 | |

| | |

| | | |

| | |

| Cost of Goods Sold | |

| 10,041 | | |

| 15,350 | |

| | |

| | | |

| | |

| Gross Profit | |

| 3,167 | | |

| 3,924 | |

| | |

| | | |

| | |

| Operating Expenses | |

| | | |

| | |

| Research and development | |

| 1,531 | | |

| 1,067 | |

| General and administrative | |

| 5,704 | | |

| 7,614 | |

| Selling and marketing | |

| 2,681 | | |

| 3,808 | |

| | |

| | | |

| | |

| Total Operating Expenses | |

| 9,916 | | |

| 12,489 | |

| | |

| | | |

| | |

| Loss From Operations | |

| (6,749 | ) | |

| (8,565 | ) |

| | |

| | | |

| | |

| Other Income (Expense) | |

| | | |

| | |

| Interest expense | |

| (4,878 | ) | |

| (4,138 | ) |

| Other Expense | |

| (19 | ) | |

| - | |

| Change in fair market value of warrant liability | |

| (1,981 | ) | |

| 804 | |

| Total Other Expense | |

| (6,878 | ) | |

| (3,334 | ) |

| | |

| | | |

| | |

| Net Loss Before Taxes | |

| (13,627 | ) | |

| (11,899 | ) |

| | |

| | | |

| | |

| Income Tax (Benefit) Expense | |

| - | | |

| - | |

| | |

| | | |

| | |

| Net Loss | |

$ | (13,627 | ) | |

$ | (11,899 | ) |

| | |

| | | |

| | |

| Net Loss Per Share- Basic & Diluted | |

$ | (0.22 | ) | |

$ | (0.25 | ) |

| Weighted Average Number of Shares- Basic & Diluted | |

| 60,673,835 | | |

| 47,418,269 | |

Dragonfly

Energy Holdings Corp.

Unaudited

Condensed Consolidated Statement of Cash Flows

For

the Six Months Ended June 30, 2024

(in

thousands)

| | |

2024 | | |

2023 | |

| Cash flows from Operating Activities | |

| | | |

| | |

| Net Loss | |

$ | (23,994 | ) | |

$ | (7,124 | ) |

| Adjustments to Reconcile Net Income (Loss) to Net Cash | |

| | | |

| | |

| Used in Operating Activities | |

| | | |

| | |

| Stock based compensation | |

| 503 | | |

| 5,441 | |

| Amortization of debt discount | |

| 2,428 | | |

| 620 | |

| Change in fair market value of warrant liability | |

| 1,745 | | |

| (19,327 | ) |

| Non-cash interest expense (paid-in-kind) | |

| 4,582 | | |

| 2,510 | |

| Provision for credit losses | |

| 18 | | |

| 93 | |

| Depreciation and amortization | |

| 663 | | |

| 593 | |

| Amortization of right of use assets | |

| 1,019 | | |

| 601 | |

| Loss on disposal of property and equipment | |

| - | | |

| 116 | |

| Changes in Assets and Liabilities | |

| | | |

| | |

| Accounts receivable | |

| (1,246 | ) | |

| (821 | ) |

| Inventories | |

| 10,125 | | |

| 5,648 | |

| Prepaid expenses | |

| (4 | ) | |

| 425 | |

| Prepaid inventory | |

| (595 | ) | |

| (940 | ) |

| Other current assets | |

| (632 | ) | |

| 28 | |

| Other assets | |

| (445 | ) | |

| - | |

| Income taxes payable | |

| 174 | | |

| (4 | ) |

| Accounts payable and accrued expenses | |

| (1,970 | ) | |

| 6,272 | |

| Accrued tariffs | |

| 150 | | |

| 316 | |

| Customer deposits | |

| 49 | | |

| (86 | ) |

| Total Adjustments | |

| 16,564 | | |

| 1,485 | |

| Net Cash Used in Operating Activities | |

| (7,430 | ) | |

| (5,639 | ) |

| | |

| | | |

| | |

| Cash Flows From Investing Activities | |

| | | |

| | |

| Purchase of property and equipment | |

| (1,324 | ) | |

| (2,571 | ) |

| Net Cash Used in Investing Activities | |

| (1,324 | ) | |

| (2,571 | ) |

| | |

| | | |

| | |

| Cash Flows From Financing Activities | |

| | | |

| | |

| Proceeds from public offering | |

| 788 | | |

| 23,527 | |

| Payment of public offering costs | |

| (51 | ) | |

| (1,216 | ) |

| Proceeds from note payable, related party | |

| 2,700 | | |

| 1,000 | |

| Repayment of note payable, related party | |

| (2,700 | ) | |

| (1,000 | ) |

| Proceeds from exercise of public warrants | |

| - | | |

| 747 | |

| Proceeds from exercise of options | |

| 3 | | |

| 323 | |

| Net Cash Provided by Financing Activities | |

| 740 | | |

| 23,381 | |

| | |

| | | |

| | |

| Net (Decrease) Increase in Cash and cash equivalents | |

| (8,014 | ) | |

| 15,171 | |

| Cash and cash equivalents - beginning of period | |

| 12,713 | | |

| 17,781 | |

| Cash and cash equivalents - end of period | |

$ | 4,699 | | |

$ | 32,952 | |

| | |

| | | |

| | |

| Supplemental Disclosures of Cash Flow Information: | |

| | | |

| | |

| Cash paid for income taxes | |

| | | |

| 237 | |

| Cash paid for interest | |

$ | 4,780 | | |

$ | 4,361 | |

| Supplemental Non-Cash Items | |

| | | |

| | |

| Purchases of property and equipment, not yet paid | |

$ | 2,278 | | |

$ | 3,583 | |

| Recognition of right of use asset obtained in exchange for operating lease liability | |

$ | 18,653 | | |

$ | - | |

| Recognition of warrant liability | |

$ | 4,796 | | |

$ | - | |

| Settlement of accrued liability for employee liability for employee stock purchase plan | |

$ | 112 | | |

$ | - | |

| Cashless exercise of liability classified warrants | |

$ | - | | |

$ | 12,628 | |

Use

of Non-GAAP Financial Measures

The

Company provides non-GAAP financial measures including EBITDA and Adjusted EBITDA as a supplement to GAAP financial information to enhance

the overall understanding of the Company’s financial performance and to assist investors in evaluating the Company’s results

of operations, period over period. Adjusted non-GAAP measures exclude significant unusual items. Investors should consider these non-GAAP

measures as a supplement to, and not a substitute for financial information prepared on a GAAP basis.

Adjusted

EBITDA

Adjusted

EBITDA is considered a non-GAAP financial measure under the rules of the SEC because it excludes certain amounts included in net loss

calculated in accordance with GAAP. Specifically, the Company calculates Adjusted EBITDA by GAAP net loss adjusted to exclude stock-based

compensation expense, business combination related expenses and other one-time, non-recurring items.

The

Company has included Adjusted EBITDA because it is a key measure used by Dragonfly’s management team to evaluate its operating

performance, generate future operating plans, and make strategic decisions, including those relating to operating expenses. As such,

the Company believes Adjusted EBITDA is helpful in highlighting trends in the ongoing core operating results of the business.

Adjusted

EBITDA has limitations as an analytical tool, and it should not be considered in isolation or as a substitute for analysis of net loss

or other results as reported under GAAP. Some of these limitations are:

| |

● |

Adjusted

EBITDA does not reflect the Company’s cash expenditures, future requirements for capital expenditures, or contractual commitments; |

| |

|

|

| |

● |

Adjusted

EBITDA does not reflect changes in, or cash requirements for, the Company’s working capital needs; |

| |

|

|

| |

● |

Adjusted

EBITDA does not reflect the Company’s tax expense or the cash requirements to pay taxes; |

| |

|

|

| |

● |

although

amortization and depreciation are non-cash charges, the assets being amortized and depreciated will often have to be replaced in

the future and Adjusted EBITDA does not reflect any cash requirements for such replacements; |

| |

|

|

| |

● |

Adjusted

EBITDA should not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring

items for which the Company may adjust in historical periods; and |

| |

|

|

| |

● |

other

companies in the industry may calculate Adjusted EBITDA differently than the Company does, limiting its usefulness as a comparative

measure. |

Reconciliations

of Non-GAAP Financial Measures

EBITDA

and Adjusted EBITDA

The

following table presents reconciliations of EBITDA and Adjusted EBITDA to the most directly comparable GAAP financial measure for each

of the periods indicated.

Dragonfly

Energy Holdings Corp.

For

the Three Months Ended June 30, 2024, and 2023

(in

thousands, except share and per share data)

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| EBITDA Calculation | |

| | | |

| | |

| Net Loss Before Taxes | |

$ | (13,627 | ) | |

$ | (11,899 | ) |

| Interest Expense | |

| 4,878 | | |

| 4,138 | |

| Depreciation and Amortization | |

| 331 | | |

| 296 | |

| EBITDA | |

$ | (8,418 | ) | |

$ | (7,465 | ) |

| | |

| | | |

| | |

| Adjustments to EBITDA | |

| | | |

| | |

| Stock Based Compensation | |

| 237 | | |

| 954 | |

| Separation Agreement | |

| | | |

| 720 | |

| June Offering Costs | |

| | | |

| 904 | |

| Change in fair market value of warrant liability | |

| 1,981 | | |

| (804 | ) |

| Adjusted EBITDA | |

$ | (6,200 | ) | |

$ | (5,691 | ) |

Source:

Dragonfly Energy Holdings Corp.

Exhibit

99.2

v3.24.2.u1

Cover

|

Aug. 14, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 14, 2024

|

| Entity File Number |

001-40730

|

| Entity Registrant Name |

DRAGONFLY

ENERGY HOLDINGS CORP.

|

| Entity Central Index Key |

0001847986

|

| Entity Tax Identification Number |

85-1873463

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

1190

Trademark Drive

|

| Entity Address, Address Line Two |

#108

|

| Entity Address, City or Town |

Reno

|

| Entity Address, State or Province |

NV

|

| Entity Address, Postal Zip Code |

89521

|

| City Area Code |

(775)

|

| Local Phone Number |

622-3448

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Common stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Common

stock, par value $0.0001 per share

|

| Trading Symbol |

DFLI

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment |

|

| Title of 12(b) Security |

Redeemable

warrants, exercisable for common stock at an exercise price of $11.50 per share, subject to adjustment

|

| Trading Symbol |

DFLIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DFLI_CommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=DFLI_RedeemableWarrantsExercisableForCommonStockAtExercisePriceOf11.50PerShareSubjectToAdjustmentMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

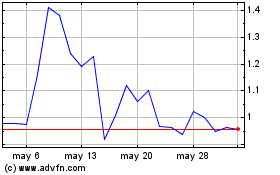

Dragonfly Energy (NASDAQ:DFLI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Dragonfly Energy (NASDAQ:DFLI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024