Form SC 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

06 Agosto 2024 - 5:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 9)*

DIRTT Environmental Solutions Ltd.

(Name of Issuer)

Common Shares, no par value

(Title of Class of Securities)

25490H106

(CUSIP Number)

Shaun Noll

2494 Sand Hill Rd.,

Menlo Park, CA, 94025

(415) 284-7486)

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

August 2, 2024

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is

filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. [X]

Note: Schedules filed in paper format shall include a

signed original and five copies of the schedule, including all exhibits. See Rule.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of

securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities

Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

CUSIP No. 25490H106

|

Page 2

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

|

|

|

|

|

CUSIP No. 25490H106

|

Page 3

|

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

None

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

|

|

|

|

This Amendment No. 9 (this “Amendment No. 9”) to the Statement on Schedule 13D in respect of the Common Shares of the Issuer (as previously hereby amended, the

“Statement”) is being filed by the Reporting Persons with the SEC to report the events described herein. This Amendment No. 9 amends and supplements the Statement as originally filed with the SEC by Shaun Noll on November 17, 2021 and previously

amended by him on January 14, 2022, June 24, 2022, December 2, 2022, December 12, 2022 and November 27, 2023, and by the Reporting Persons on December 11, 2023, December 28, 2023 and January 18, 2024. Except as otherwise defined herein, capitalized

terms used herein shall have the meanings ascribed thereto in the Statement prior to amendment hereby.

|

ITEM 4.

|

PURPOSE OF TRANSACTION.

|

Item 4 is hereby amended by incorporating the disclosure set forth in Item 6 of this Amendment No. 9.

|

ITEM 5.

|

INTEREST IN SECURITIES OF THE ISSUER.

|

Item 5(a)-(b) is hereby amended and restated in its entirety as follows:

The information contained in rows 7, 8, 9, 10, 11 and 13 on the cover pages of this Amendment No. 9 is incorporated by reference in its entirety into this Item 5.

The percentages of the outstanding Common Shares reported herein as beneficially owned by the Reporting Persons are based upon 191,880,226 Common Shares outstanding

on April 30, 2024, as announced by the Issuer in a Periodic Report on Form 8-K filed with the SEC on May 8, 2024.

|

ITEM 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER.

|

On August 2, 2024, the Issuer announced events including its entry that day into a Support and Standstill Agreement (the “Support Agreement”) with certain Issuer

shareholders including WWT1. See the Current Report on Form 8-K filed by the Issuer with the Securities and Exchange Commission on August 2, 2024.

Pursuant to the Support Agreement, WWT1 has agreed to certain voting obligations in respect of itself and its affiliates, including voting in favor of the management

director nominees at each of the Issuer’s next two annual general meetings and voting in favor of the ratification of the amended and restated shareholder rights plan (the “A&R SRP”) adopted by the Issuer’s board of directors on August 2, 2024.

WWT1 also agreed in the Support Agreement that until the date 90 days following the Issuer’s 2026 annual general meeting (such date, or such earlier date on which the Support Agreement shall terminate as provided therein, including upon the failure

of certain specified events to timely occur, the “Support Agreement Termination Date”), WWT1 and its affiliates shall not beneficially own or exercise control or direction over, more than 57,447,988 Common Shares (subject to adjustment for stock

splits, reclassifications, combinations and similar adjustments). Further, until the Termination Date, WWT1 shall not make any unsolicited takeover bid for the Issuer, except upon the occurrence of certain events.

In the Support Agreement, the Issuer agreed that its board of directors and any applicable committee will nominate Shaun Noll (or a qualifying replacement selected

by WWT1) for election to the Issuer’s board of directors at the Issuer’s 2025 and 2026 annual general meetings (and at any other meeting of Issuer shareholders held prior to the Termination Date at which directors are to be elected), provided that

WWT1 and its affiliates continue to own at least the lesser of (i) not less than 20% of the then issued and outstanding Shares and (ii) 38,592,529 Shares (subject in each case to adjustment for stock splits, reclassifications, combinations and

similar adjustments).

The preceding summary of the Support Agreement is not complete and is subject to, and qualified by reference to the full text of the Support Agreement set forth as

Exhibit 95.5 to this Amendment No. 9.

|

ITEM 7.

|

MATERIAL TO BE FILED AS EXHIBITS.

|

99.5 Support and Standstill Agreement, dated the 2nd day of August, 2024, made by and among 22NW Fund, LP, WWT Opportunity #1 LLC and DIRTT Environmental Solutions Ltd. (incorporated by

reference to Exhibit 10.2 to the Current Report on Form 8-K filed by the Issuer with the Securities and Exchange Commission on August 2, 2024)

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is

true, complete and correct.

Dated: August 6, 2024

|

|

SHAUN NOLL

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaun Noll

|

|

|

|

|

Name: Shaun Noll

|

|

|

|

WWT OPPORTUNITY #1 LLC

|

|

|

|

|

|

|

|

|

By:

|

/s/ Shaun Noll

|

|

|

|

|

Name: Shaun Noll

Title: Managing Member

|

|

| |

|

|

|

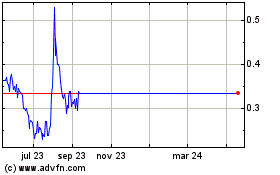

Dirtt Environmental Solu... (NASDAQ:DRTT)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

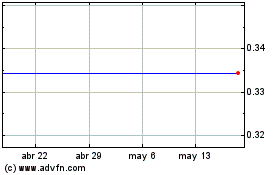

Dirtt Environmental Solu... (NASDAQ:DRTT)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024